Tire Reinforcement Materials Market Report

Published Date: 02 February 2026 | Report Code: tire-reinforcement-materials

Tire Reinforcement Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Tire Reinforcement Materials market, covering market sizes, growth forecasts, and trends from 2023 to 2033. It explores industry dynamics, segmentation, regional insights, and key market players to offer valuable insights for stakeholders.

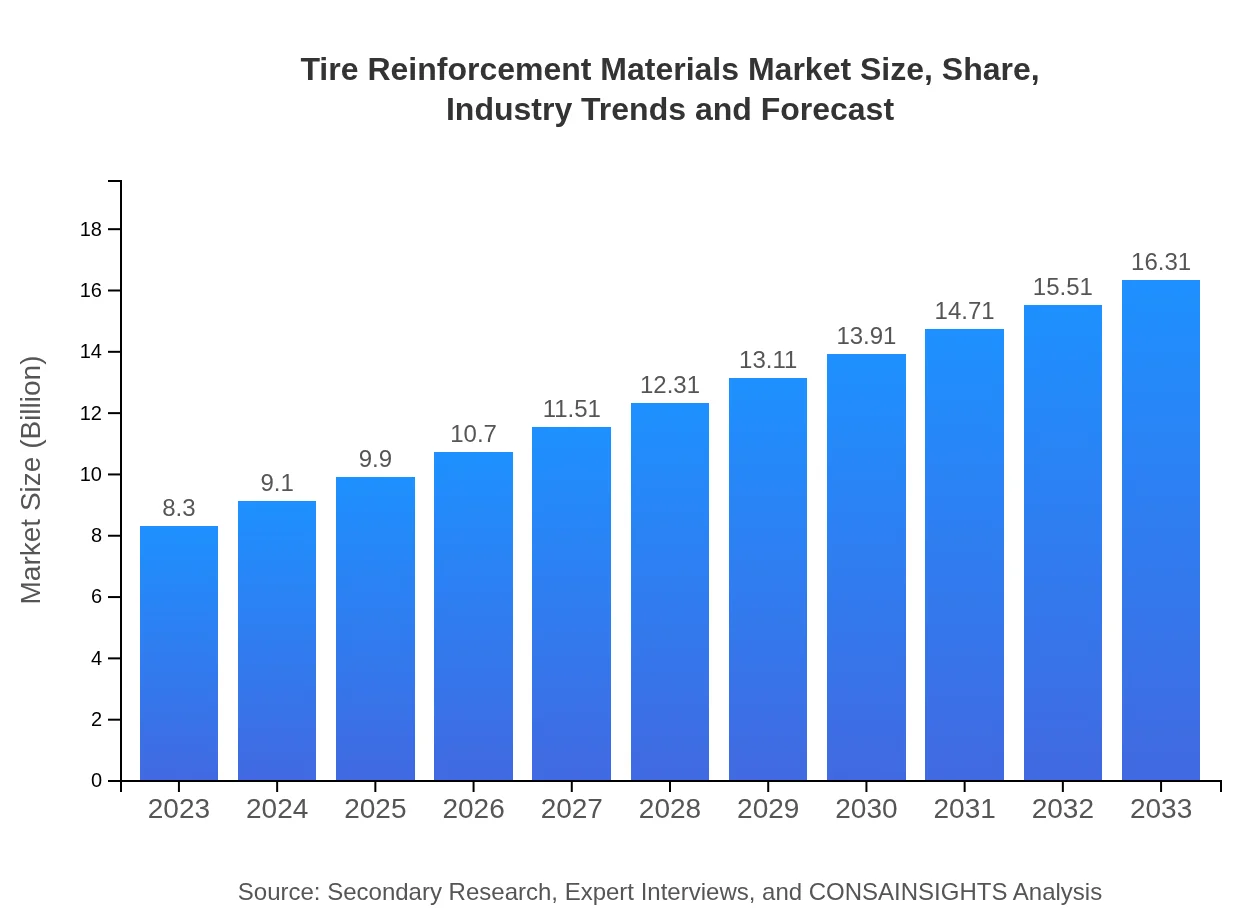

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $16.31 Billion |

| Top Companies | Continental AG, Bridgestone Corporation, Goodyear Tire & Rubber Company, Michelin, Seremban Rubber Export (M) Sdn. Bhd. |

| Last Modified Date | 02 February 2026 |

Tire Reinforcement Materials Market Overview

Customize Tire Reinforcement Materials Market Report market research report

- ✔ Get in-depth analysis of Tire Reinforcement Materials market size, growth, and forecasts.

- ✔ Understand Tire Reinforcement Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Tire Reinforcement Materials

What is the Market Size & CAGR of Tire Reinforcement Materials market in 2023?

Tire Reinforcement Materials Industry Analysis

Tire Reinforcement Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Tire Reinforcement Materials Market Analysis Report by Region

Europe Tire Reinforcement Materials Market Report:

In Europe, the market is significant, starting at $2.43 billion in 2023 with predictions to rise to $4.78 billion by 2033. The region’s stringent regulations on vehicle emissions and road safety standards influence manufacturers to invest in advanced tire technologies with reinforced materials.Asia Pacific Tire Reinforcement Materials Market Report:

In the Asia Pacific region, the Tire Reinforcement Materials market was valued at approximately $1.69 billion in 2023 and is expected to reach $3.32 billion by 2033. The region's rapid urbanization and increasing automotive production are major growth drivers. Countries like China and India are leading in tire manufacturing, leveraging cost-effective materials to meet local demand and export needs.North America Tire Reinforcement Materials Market Report:

The North American Tire Reinforcement Materials market is valued at $2.90 billion in 2023 and is projected to grow to $5.70 billion by 2033. The expansion is driven by strong consumer preferences for performance vehicles and an increase in technological investments in the automotive sector, as manufacturers seek to remain competitive in a rapidly changing market.South America Tire Reinforcement Materials Market Report:

South America reflects a market value of about $0.59 billion in 2023, escalating to $1.16 billion by 2033. The growth in this region is largely attributed to a gradual increase in automotive production coupled with the rising demand for improved safety and performance in tires, influenced by both manufacturers and consumers seeking innovation and robustness.Middle East & Africa Tire Reinforcement Materials Market Report:

The Middle East and Africa show a market starting at $0.69 billion in 2023 and expected to grow to $1.36 billion by 2033. Growth in this region is associated with increased infrastructure investments and rising automotive demand, especially in burgeoning markets like South Africa and the Gulf countries.Tell us your focus area and get a customized research report.

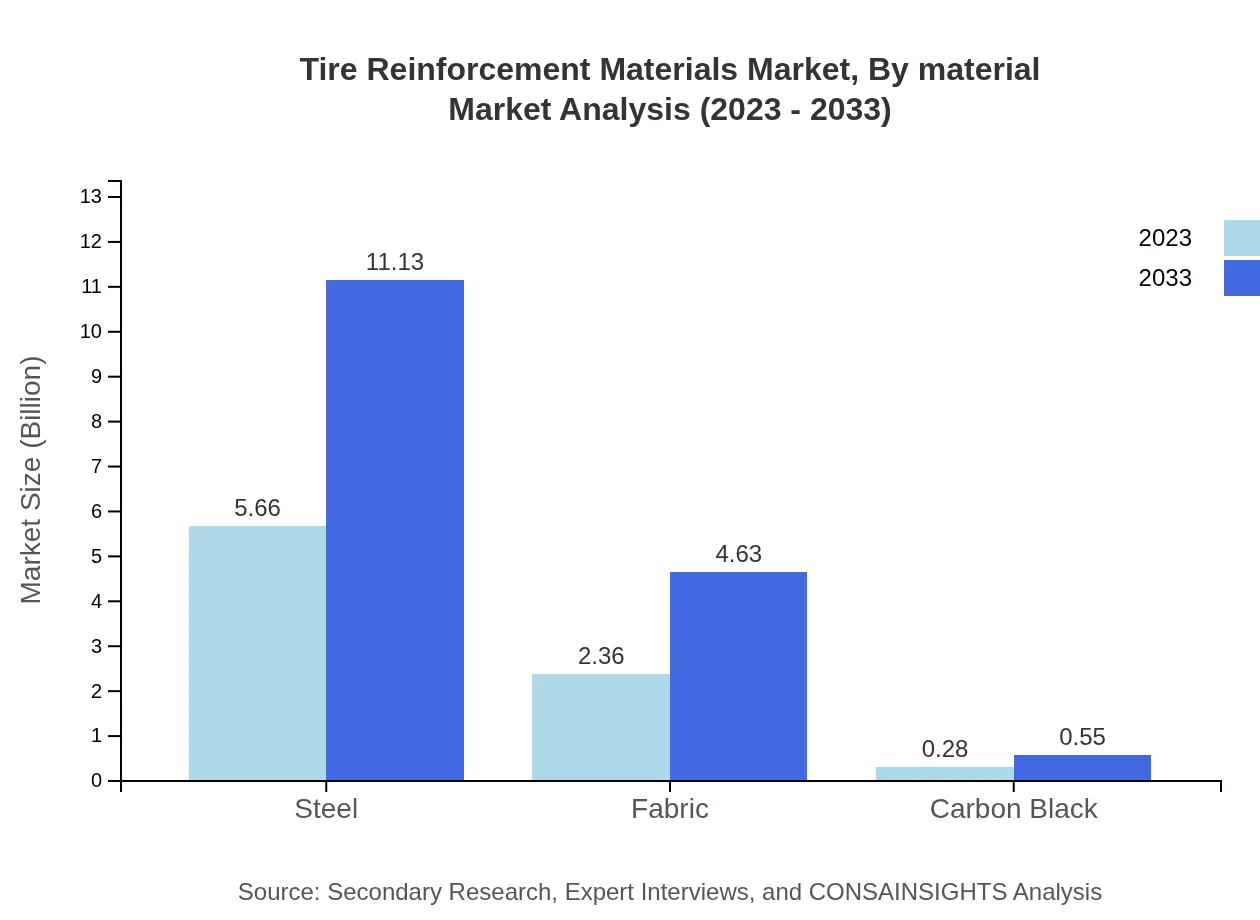

Tire Reinforcement Materials Market Analysis By Material

In the Tire Reinforcement Materials market, steel remains the dominant segment, holding a market size of $5.66 billion in 2023, expected to grow to $11.13 billion by 2033. Fabric materials follow, with $2.36 billion in 2023 and a projected growth to $4.63 billion, while carbon black constitutes a smaller segment at $0.28 billion in 2023, reaching $0.55 billion by 2033, emphasizing its role in enhancing tire durability.

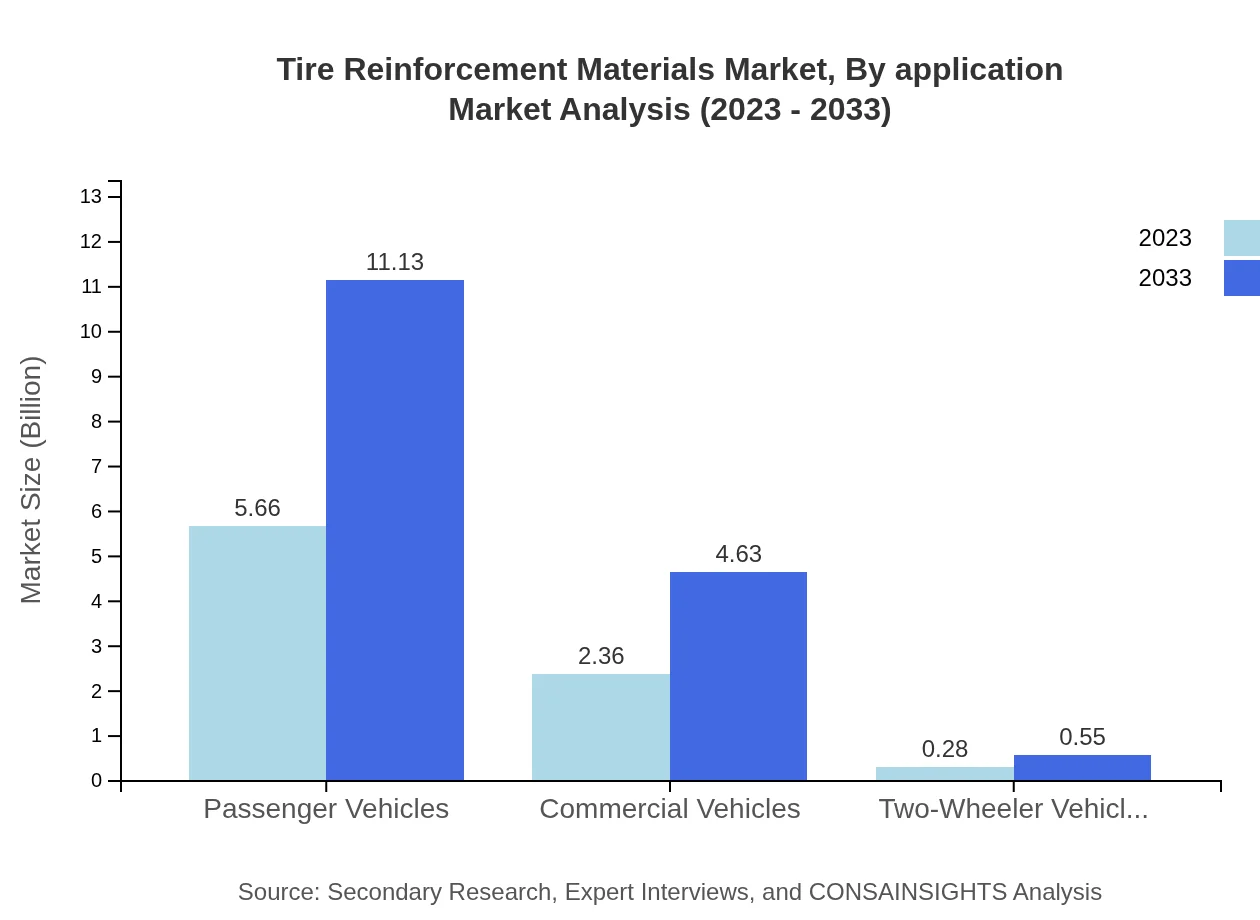

Tire Reinforcement Materials Market Analysis By Application

Passenger vehicles dominate the Tire Reinforcement Materials market with a size of $5.66 billion in 2023 and projected growth to $11.13 billion by 2033, highlighting consumer preference for safety and longevity. Commercial vehicles occupy $2.36 billion in 2023, anticipated to increase to $4.63 billion. Two-wheeler vehicles, while smaller, contribute significantly at $0.28 billion in 2023, forecasted to reach $0.55 billion.

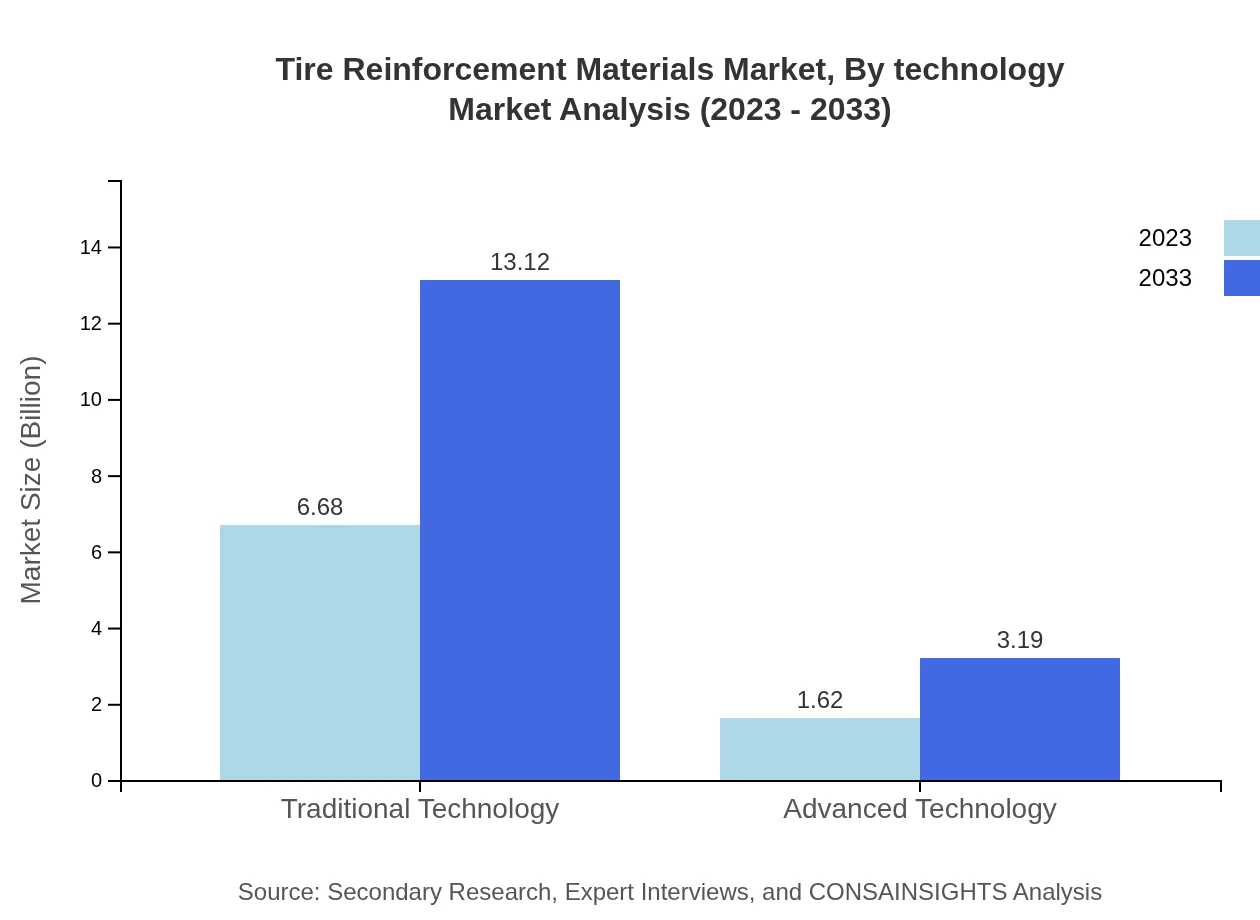

Tire Reinforcement Materials Market Analysis By Technology

The segment for traditional technology leads with a market size of $6.68 billion in 2023 and expected growth to $13.12 billion by 2033, emphasizing its established position in the industry. Advanced technology accounts for $1.62 billion in 2023, poised to almost double to $3.19 billion, reflecting increasing trends towards innovation and performance-driven materials.

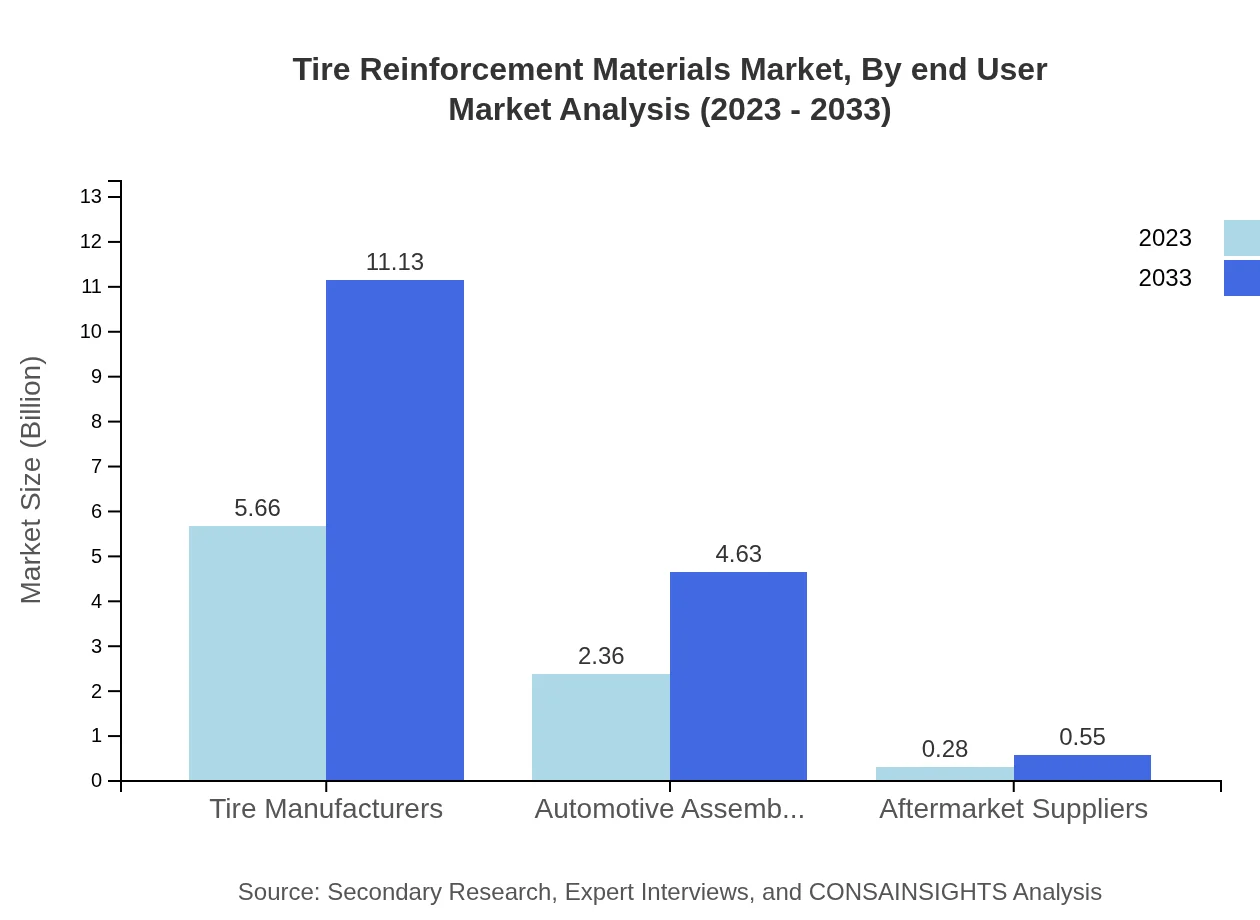

Tire Reinforcement Materials Market Analysis By End User

Tire manufacturers greatly influence the market, holding a size of $5.66 billion in 2023, with expectations of reaching $11.13 billion by 2033, driven by the demand for high-performance tires. Automotive assemblers follow, valued at $2.36 billion, projected growth to $4.63 billion, while aftermarket suppliers contribute $0.28 billion, with growth to approximately $0.55 billion in the upcoming years.

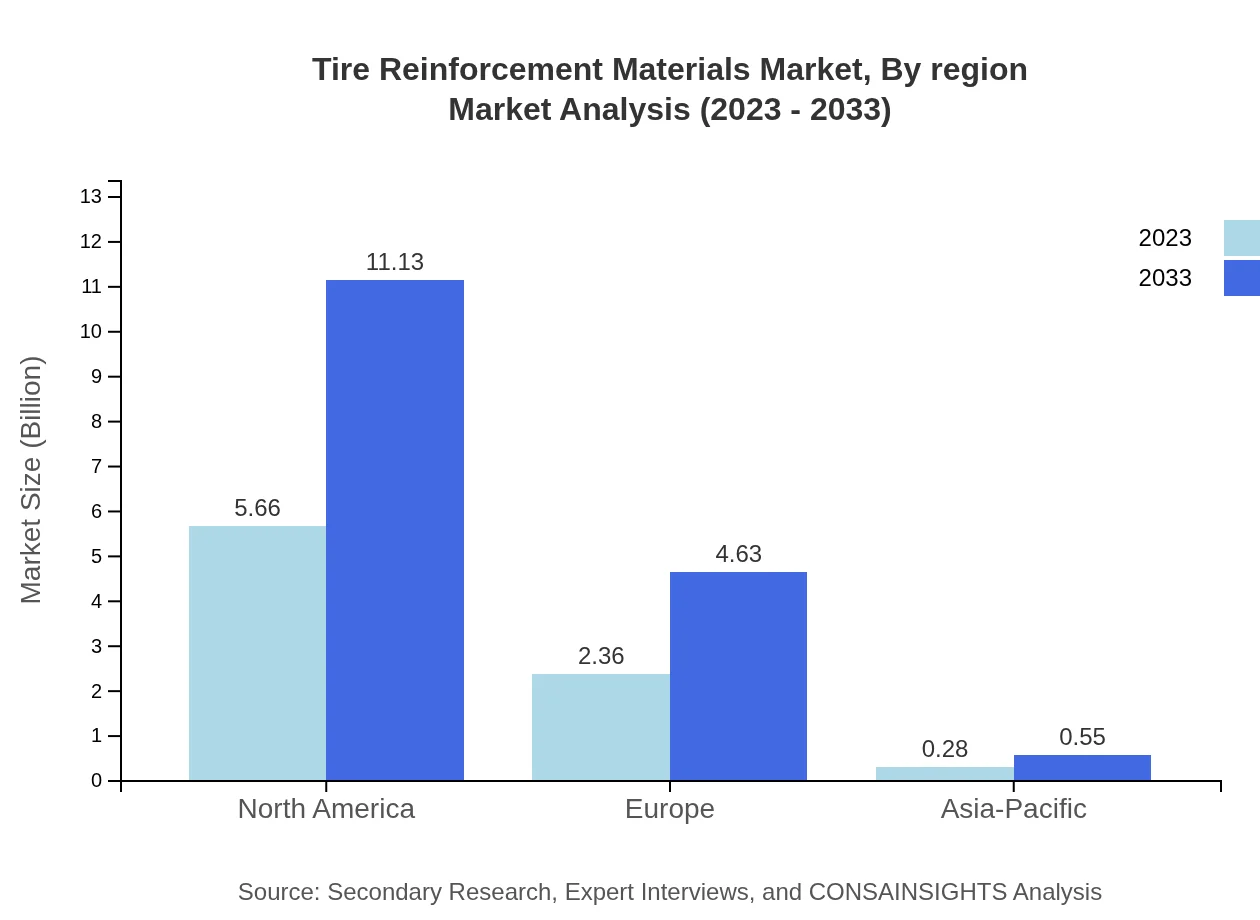

Tire Reinforcement Materials Market Analysis By Region

Regional analysis indicates that North America commands a significant share at 68.22% in 2023, which is expected to remain stable through 2033. Europe and Asia-Pacific also show notable shares at 28.4% and 3.38%, respectively, in 2023, reflecting their strategic importance due to vehicle production and burgeoning consumer markets.

Tire Reinforcement Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Tire Reinforcement Materials Industry

Continental AG:

A leading tire manufacturer known for its innovative tire reinforcement technologies and commitment to sustainability.Bridgestone Corporation:

The world's largest tire manufacturer, Bridgestone focuses on advanced tire materials to enhance performance and safety.Goodyear Tire & Rubber Company:

A major player in the tire market, Goodyear invests in research and development to improve reinforcement material technologies.Michelin:

Recognized for its high-quality tires, Michelin is involved in developing eco-friendly reinforcement materials.Seremban Rubber Export (M) Sdn. Bhd.:

A notable supplier of reinforced tire materials, focusing on sustainable and innovative product solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of tire Reinforcement Materials?

The tire reinforcement materials market is currently valued at approximately $8.3 billion, with a projected compound annual growth rate (CAGR) of 6.8% from 2023 to 2033.

What are the key market players or companies in this tire Reinforcement Materials industry?

Key market players include major tire manufacturers, automotive assemblers, and specialized suppliers of reinforcement materials. Companies at the forefront are investing in research and development to enhance material performance and sustainability.

What are the primary factors driving the growth in the tire Reinforcement Materials industry?

Growth drivers include increasing vehicle production, demand for durable tires, and advancements in reinforcement technologies. Additionally, the push for fuel efficiency and safety standards are influencing market expansion.

Which region is the fastest Growing in the tire Reinforcement Materials?

The Asia Pacific region is the fastest-growing market for tire reinforcement materials, expected to grow from $1.69 billion in 2023 to $3.32 billion by 2033, fueled by rising automotive production and consumption.

Does ConsaInsights provide customized market report data for the tire Reinforcement Materials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the tire reinforcement materials industry, ensuring comprehensive insights that align with client requirements.

What deliverables can I expect from this tire Reinforcement Materials market research project?

Expect detailed reports featuring market size, growth forecasts, segment analysis, competitive landscape, and regional insights, presented in various formats including executive summaries and in-depth analysis.

What are the market trends of tire Reinforcement Materials?

Current trends include the adoption of advanced materials and technologies, an emphasis on sustainability, and increased collaboration among manufacturers to innovate and enhance product offerings.