Travel Insurance

Published Date: 02 February 2026 | Report Code: travel-insurance

Travel Insurance Market Size, Share, Industry Trends and Forecast to 2033

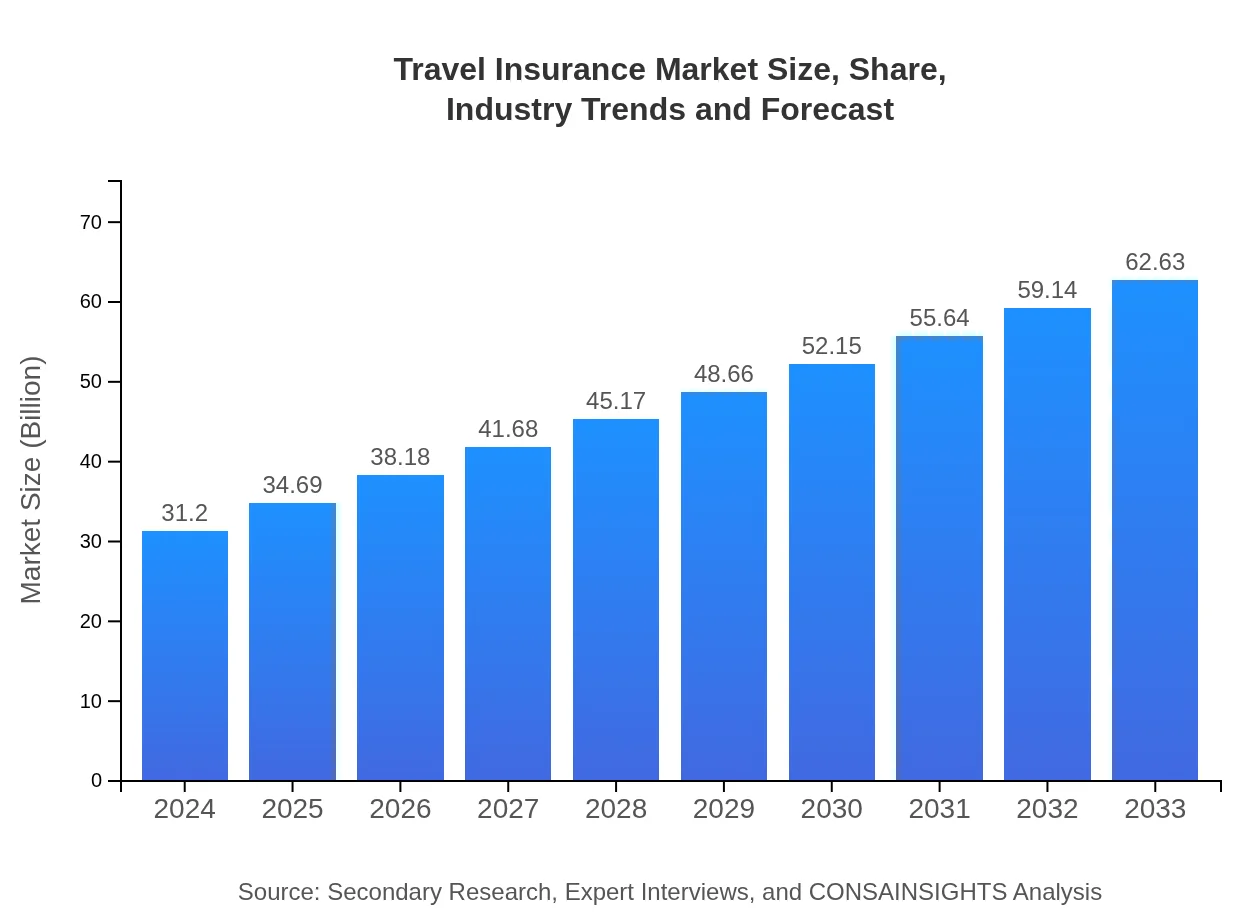

This report examines the global travel insurance market, providing an in‐depth exploration of market dynamics, competitive positioning, segmentation strategies, and technological innovations. Covering the forecast period from 2024 to 2033, the report highlights current market conditions, growth drivers, and challenges. It offers strategic insights into market size, CAGR, regional trends, and future opportunities to guide industry stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $31.20 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $62.63 Billion |

| Top Companies | Global Insurance Corp, TravelSure Ltd. |

| Last Modified Date | 02 February 2026 |

Travel Insurance Market Overview

Customize Travel Insurance market research report

- ✔ Get in-depth analysis of Travel Insurance market size, growth, and forecasts.

- ✔ Understand Travel Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Travel Insurance

What is the Market Size & CAGR of Travel Insurance market in {Year}?

Travel Insurance Industry Analysis

Travel Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Travel Insurance Market Analysis Report by Region

Europe Travel Insurance:

Europe's travel insurance sector is expanding significantly, with market size increasing from 10.32 in 2024 to 20.72 in 2033. Stringent regulatory landscapes, combined with high consumer awareness and sophisticated risk management practices, contribute to a stable growth trajectory in this mature market.Asia Pacific Travel Insurance:

In Asia Pacific, the market is set for considerable growth, expanding from a size of 5.89 in 2024 to approximately 11.82 by 2033. The region benefits from a surge in international travel, an increasing middle class, and rapid digital adoption in financial services. Local insurers are innovating product offerings to suit diverse cultural and regulatory environments, enhancing overall market penetration.North America Travel Insurance:

North America, traditionally a robust market, is witnessing continued growth with market figures rising from 11.23 in 2024 to 22.53 by 2033. The region benefits from high disposable incomes, a mature insurance framework, and innovations in product delivery and claims management, which collectively bolster market expansion.South America Travel Insurance:

South America's travel insurance market is evolving steadily, with market size projected to grow from 1.88 in 2024 to about 3.78 in 2033. Despite regional economic fluctuations, rising outbound tourism and improved consumer awareness regarding travel security are driving steady enrollment in insurance policies.Middle East & Africa Travel Insurance:

The Middle East and Africa region, though smaller in size, is poised for growth with market figures expected to rise from 1.88 in 2024 to approximately 3.77 in 2033. Emerging travel trends, increased international tourism, and innovative digital platforms are key drivers in this region's incremental development.Tell us your focus area and get a customized research report.

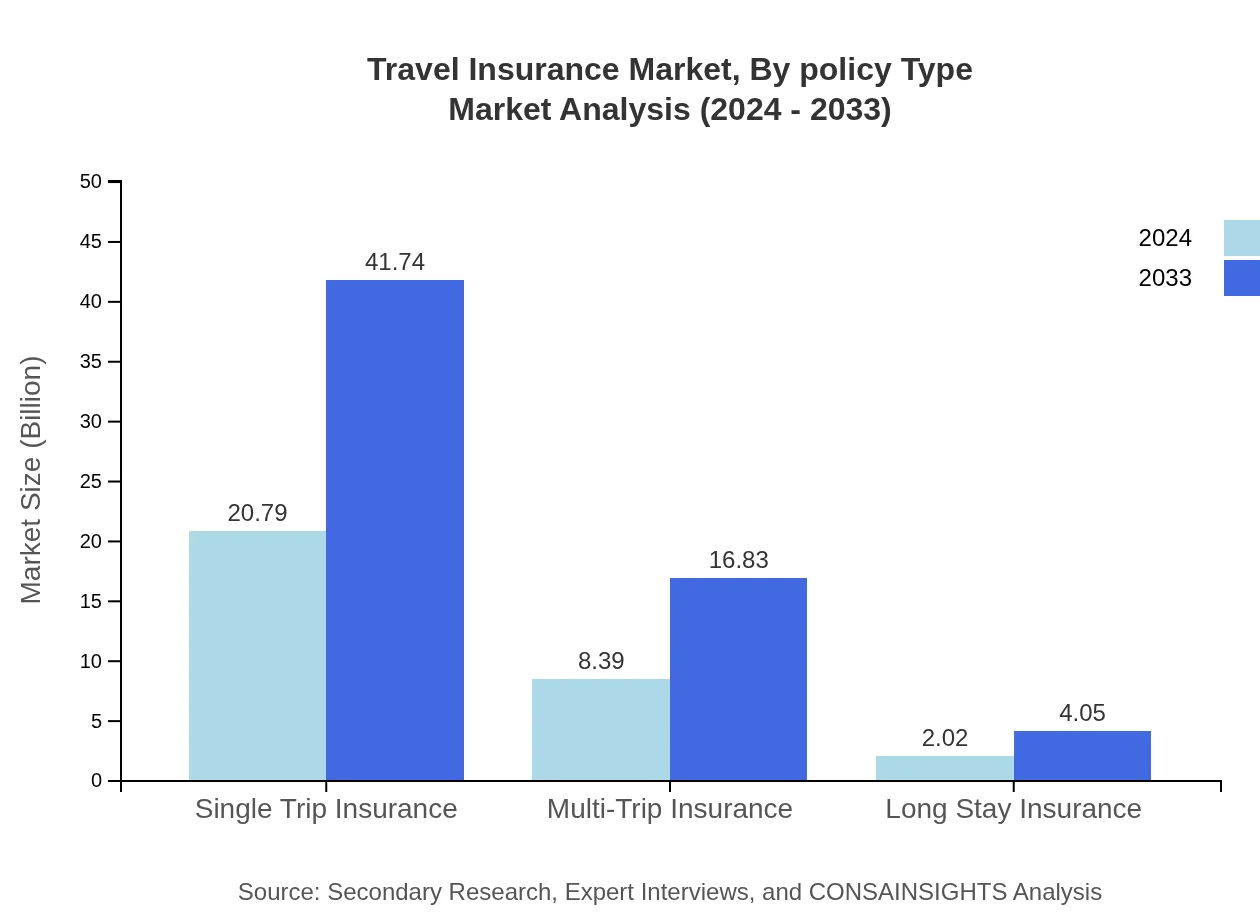

Travel Insurance Market Analysis By Policy Type

Analysis by policy type reveals differentiated performance among single-trip, multi-trip, and long-stay insurance products. Single-trip insurance consistently holds a dominant market share with sizes increasing from 20.79 in 2024 to 41.74 in 2033, underscoring its appeal for one-off travel arrangements. Multi-trip and long-stay policies, although smaller in size, are witnessing proportionate growth as consumer needs diversify. The stable share percentage for single-trip products, reflected at 66.65% for both 2024 and 2033, indicates resilient demand, while niche products cater to specialized travel requirements.

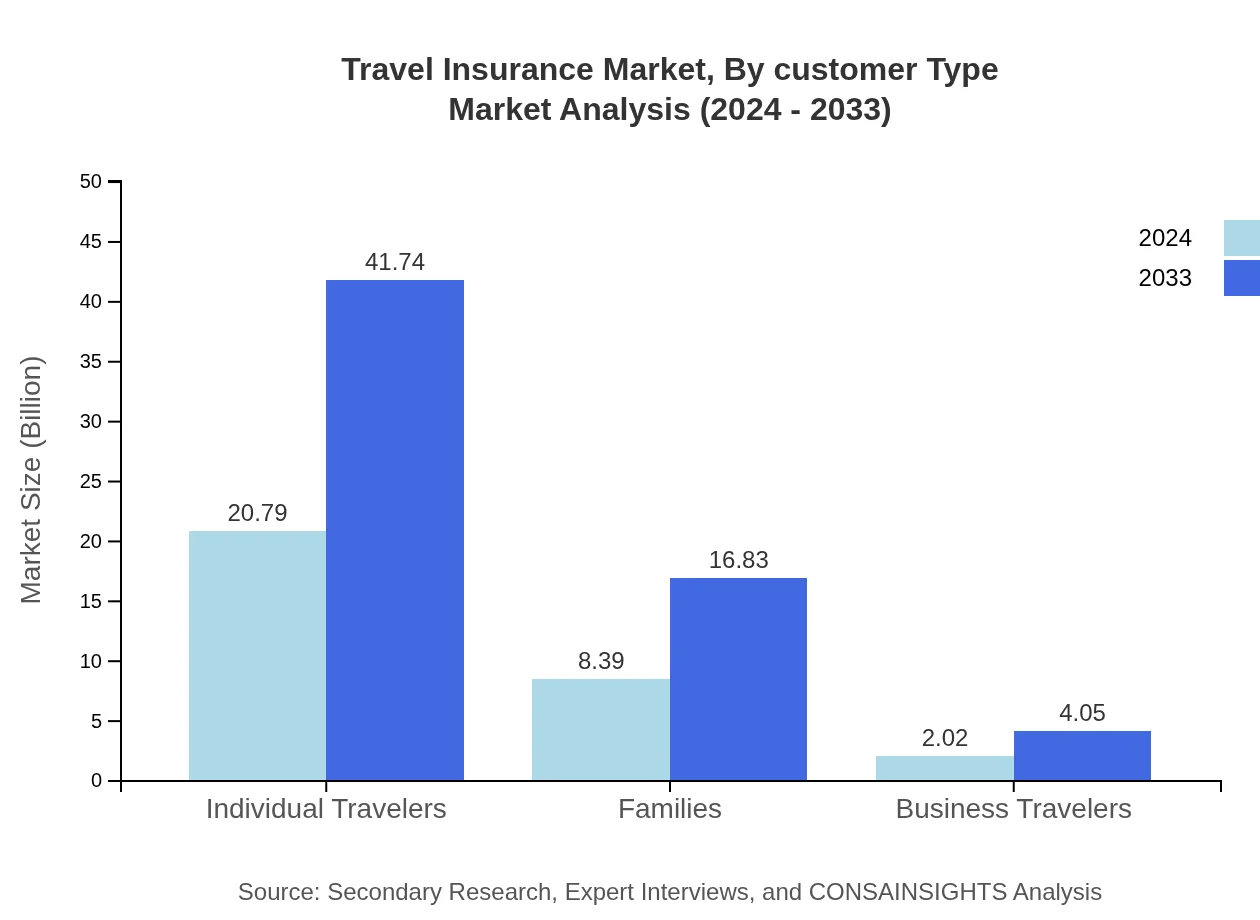

Travel Insurance Market Analysis By Customer Type

Customer segmentation distinguishes varied travel profiles including individual travelers, families, and business travelers. Individual travelers command a significant portion of the market with sizes growing from 20.79 in 2024 to 41.74 in 2033, underscoring a consistent demand for personalized coverage. Families and business travelers, though representing smaller segments, display steady growth and tailored insurance needs. These trends suggest that insurers are increasingly developing products that precisely target distinct customer categories and adapt to evolving lifestyle changes.

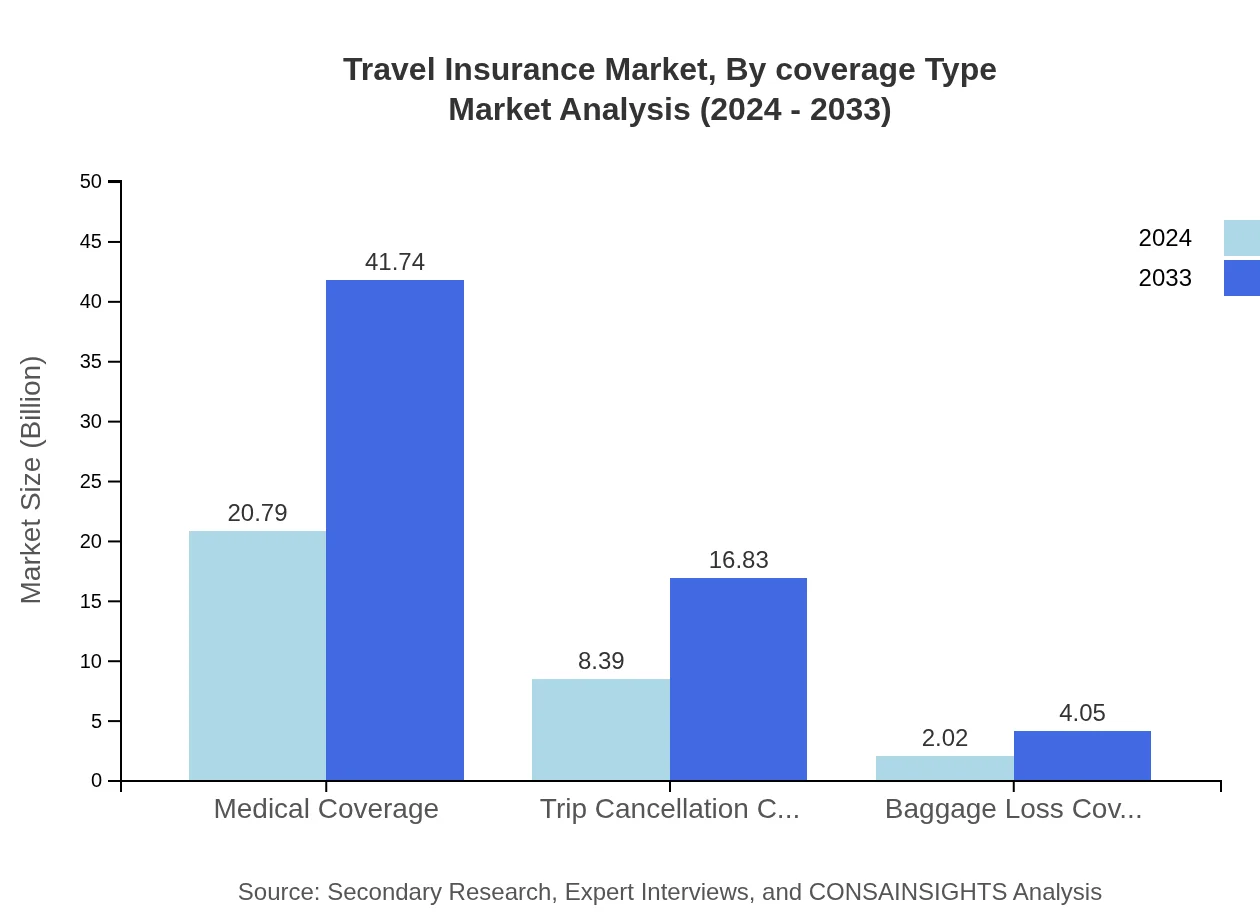

Travel Insurance Market Analysis By Coverage Type

Coverage type analysis encompasses medical coverage, trip cancellation, and baggage loss. Medical coverage is the pillar of travel insurance, with market sizes expanding identically to the single-trip segment. Trip cancellation and baggage loss coverage, while modest in size relative to medical plans, are vital for comprehensive risk management. The proportional share of the coverage types suggests that consumers prioritize precautionary measures against unexpected travel disruptions. The consistent share percentages across these segments further affirm the foundational role of these coverages in policy design.

Travel Insurance Market Analysis By Distribution Channel

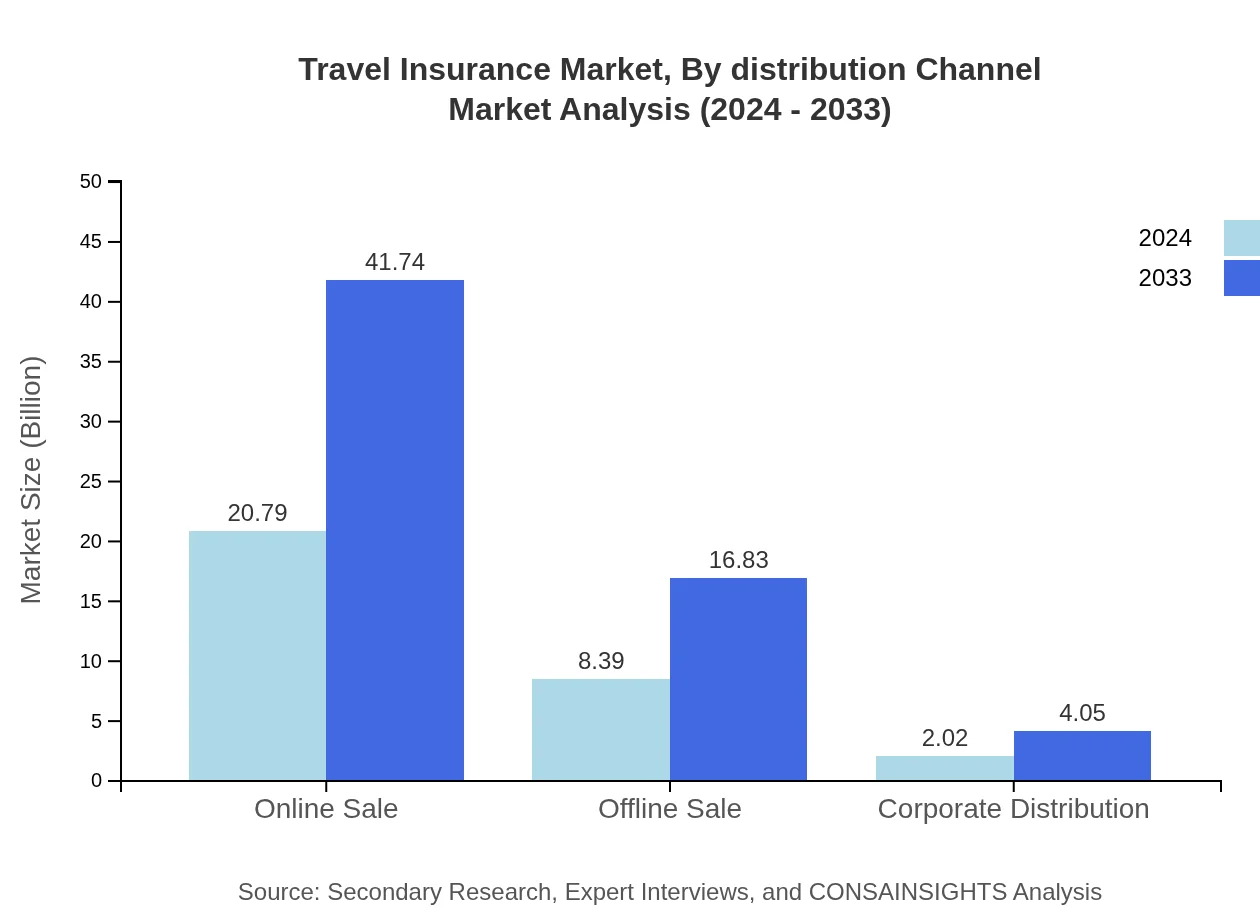

Distribution channels have diversified, with online sales, offline sales, and corporate distribution each contributing to market expansion. Online sales, driven by technological penetration, show robust growth – with market sizes expected to double from 20.79 in 2024 to 41.74 in 2033. Offline sales remain significant for traditional customers, while corporate distribution channels target business travelers and groups. The evolving channel mix is creating opportunities for insurers to optimize customer accessibility and enhance profitability through integrated digital platforms.

Travel Insurance Market Analysis By Claims Process

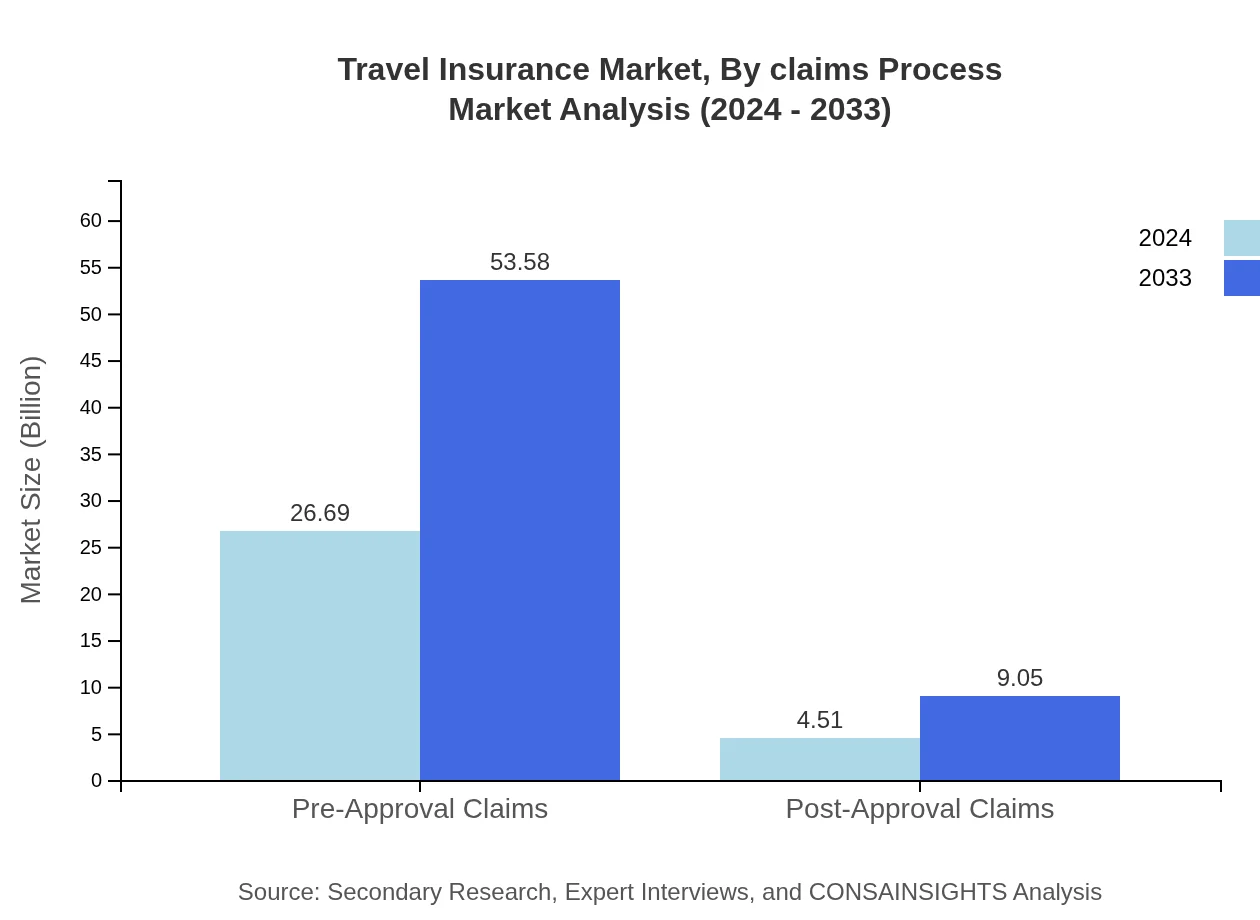

The claims process is segmented into pre-approval and post-approval claims, each reflecting operational efficiency and customer service quality. Pre-approval claims dominate the process with market sizes expanding from 26.69 in 2024 to 53.58 in 2033 and maintaining a high share percentage, indicative of streamlined claim adjudication protocols. Post-approval claims, with modest growth, reinforce the necessity for transparent and efficient claims management. The balanced approach in claims processing solidifies consumer trust and supports overall market robustness.

Travel Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Travel Insurance Industry

Global Insurance Corp:

A pioneering global insurer, Global Insurance Corp leverages innovative technology and comprehensive risk management to offer versatile travel insurance products. Their commitment to digital transformation and customer service excellence has positioned them as a leader in navigating market complexities.TravelSure Ltd.:

TravelSure Ltd. is renowned for its wide range of travel insurance solutions that cater to diverse customer needs. With a robust global presence, the company continuously enhances its product portfolio through technological advancements and strategic partnerships, ensuring high-quality service.We're grateful to work with incredible clients.