Vacuum Mixing Devices Market Report

Published Date: 31 January 2026 | Report Code: vacuum-mixing-devices

Vacuum Mixing Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Vacuum Mixing Devices market, covering market trends, segmentation, technology advancements, and regional insights for the forecast period from 2023 to 2033.

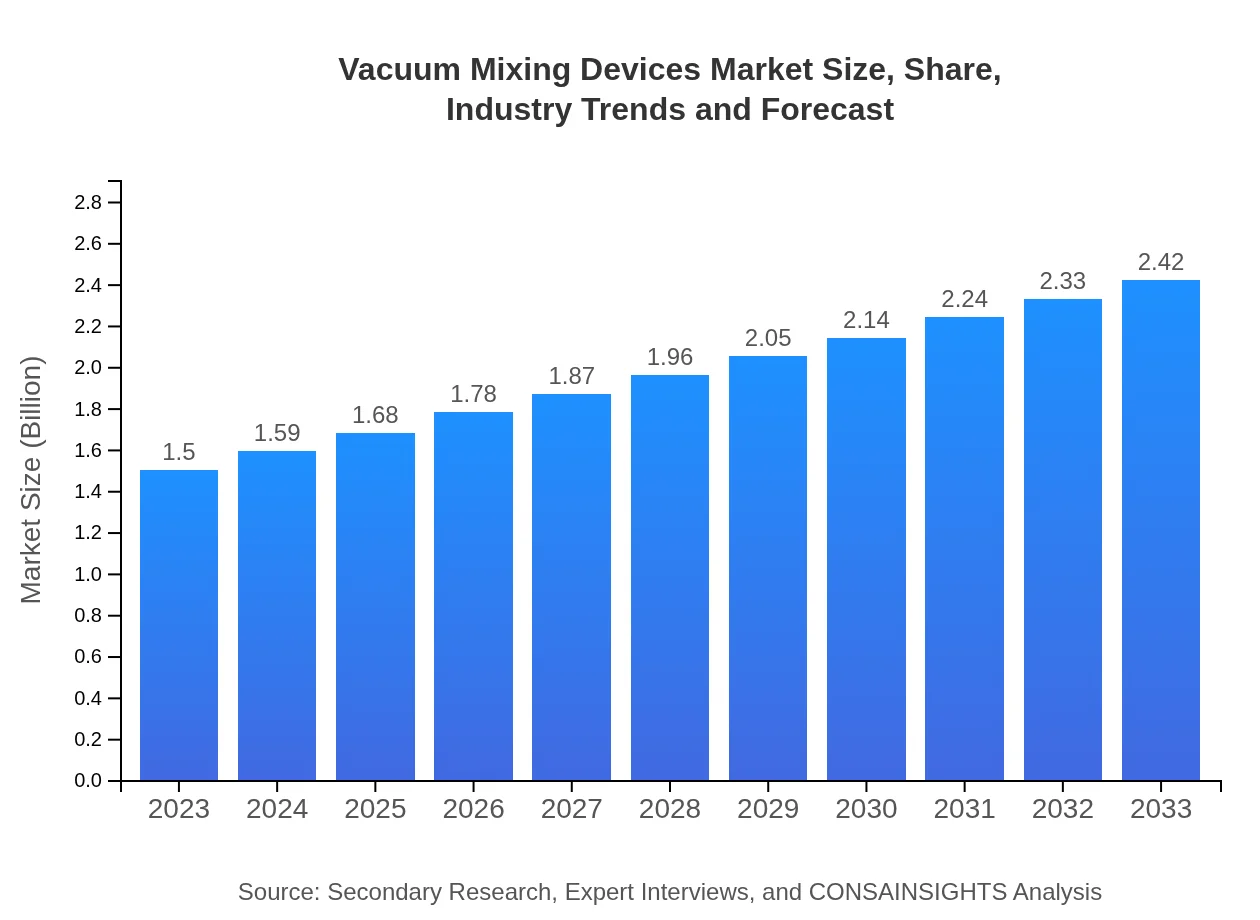

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $2.42 Billion |

| Top Companies | Bertoli, TEKNO Mix, GEMÜ, Glatt, HDDM |

| Last Modified Date | 31 January 2026 |

Vacuum Mixing Devices Market Overview

Customize Vacuum Mixing Devices Market Report market research report

- ✔ Get in-depth analysis of Vacuum Mixing Devices market size, growth, and forecasts.

- ✔ Understand Vacuum Mixing Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Vacuum Mixing Devices

What is the Market Size & CAGR of Vacuum Mixing Devices market in 2023 and 2033?

Vacuum Mixing Devices Industry Analysis

Vacuum Mixing Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Vacuum Mixing Devices Market Analysis Report by Region

Europe Vacuum Mixing Devices Market Report:

Europe holds a market value of $0.46 billion in 2023, with projections of $0.75 billion by 2033. The region's focus on quality standards and regulatory compliance in manufacturing drives demand for advanced mixing technologies.Asia Pacific Vacuum Mixing Devices Market Report:

In 2023, the Asia Pacific market was valued at $0.26 billion, projected to increase to $0.42 billion by 2033. Rapid industrialization, particularly in China and India, alongside expanding pharmaceutical and food sectors, are key growth drivers.North America Vacuum Mixing Devices Market Report:

North America is a significant contributor, with the market size reaching $0.57 billion in 2023 and projected to grow to $0.92 billion by 2033. The growing demand for efficient processes in pharmaceuticals and food production is a major catalyst.South America Vacuum Mixing Devices Market Report:

The South American Vacuum Mixing Devices market, valued at $0.01 billion in 2023, is expected to reach $0.02 billion by 2033. Despite being a smaller market, the region is witnessing growth from biotechnology and food sectors.Middle East & Africa Vacuum Mixing Devices Market Report:

In 2023, the Middle East and Africa market was valued at $0.19 billion and is expected to increase to $0.31 billion by 2033. Increasing investments in healthcare and food production sectors are instrumental to this growth.Tell us your focus area and get a customized research report.

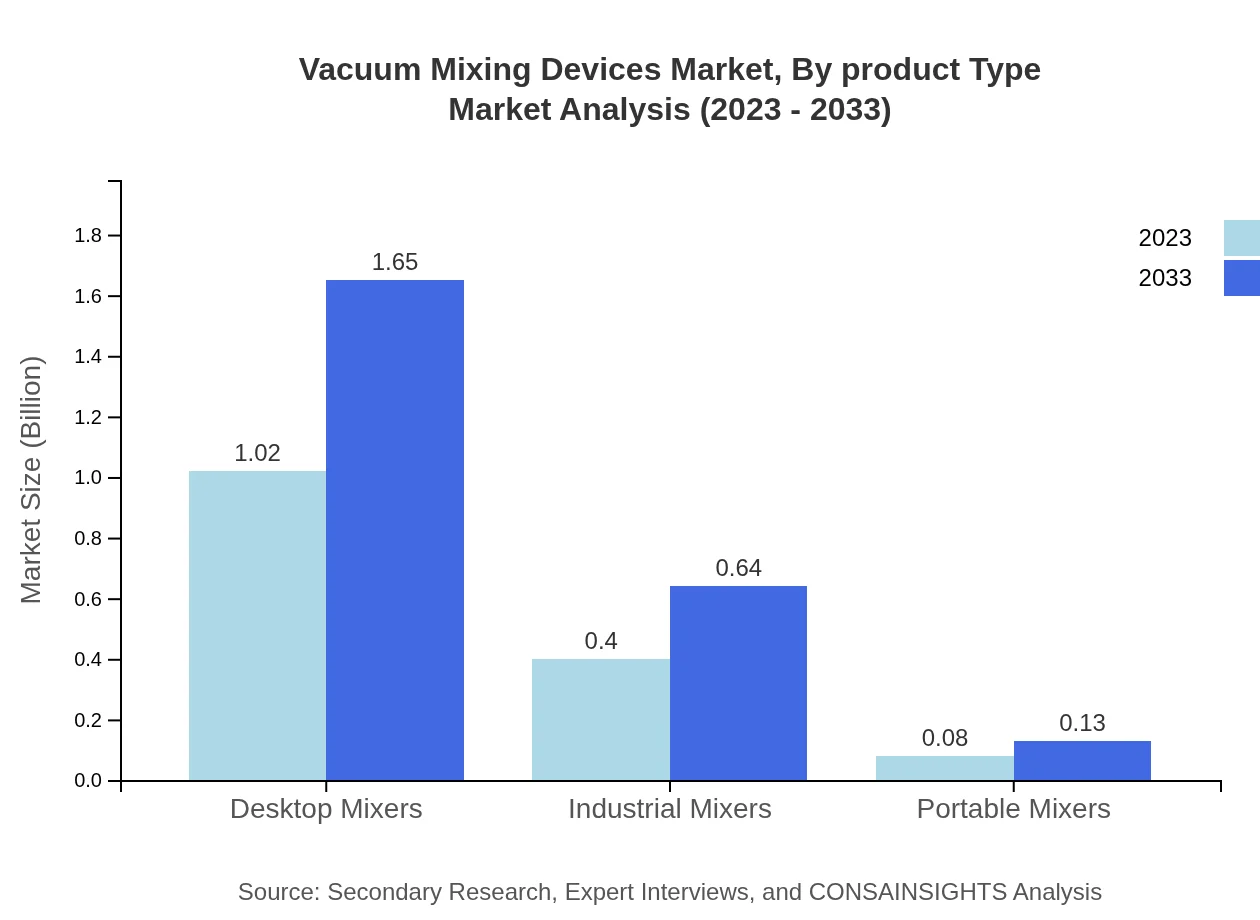

Vacuum Mixing Devices Market Analysis By Product Type

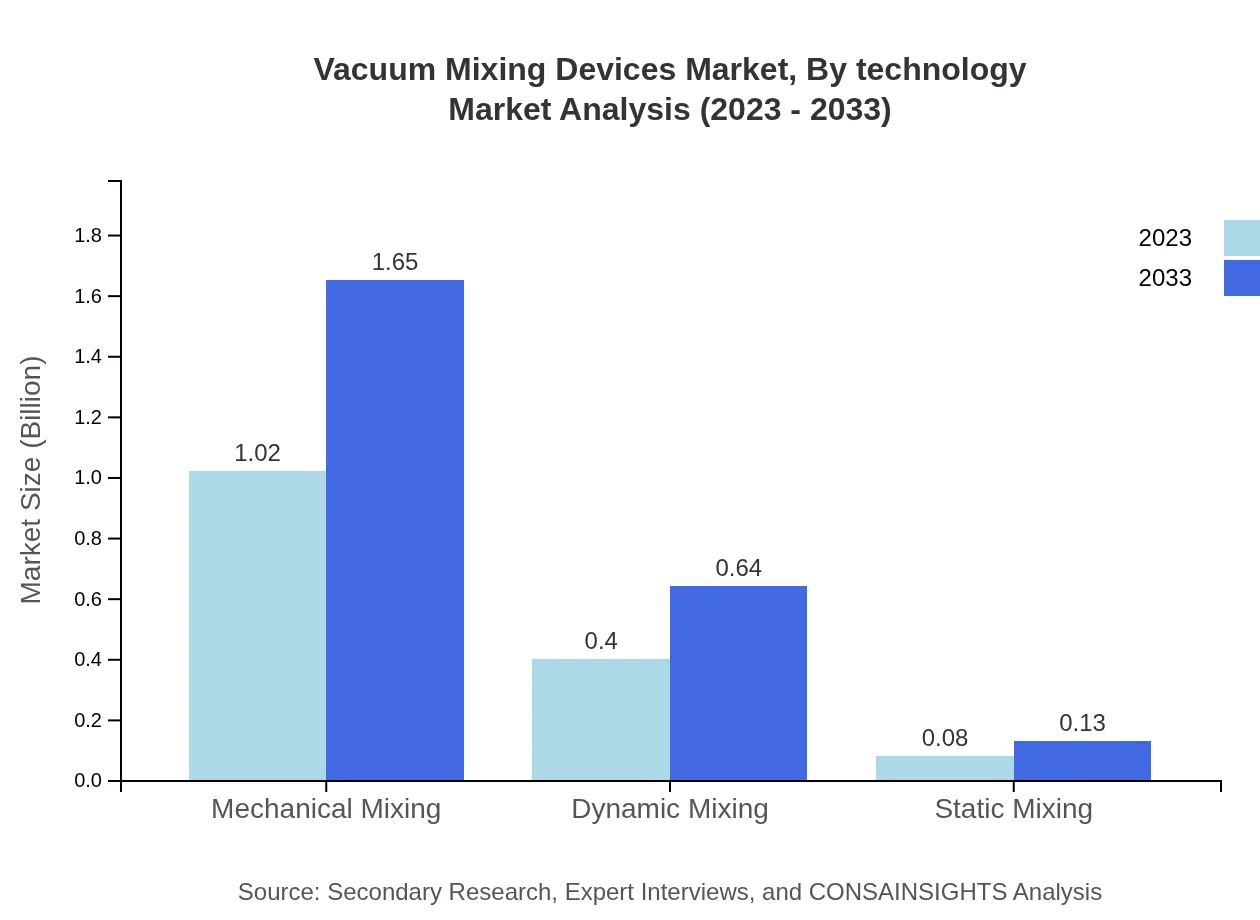

In the product type segment, mechanical mixing leads with a 67.98% share in 2023, valued at $1.02 billion, growing to $1.65 billion by 2033. Dynamic mixing, accounting for 26.58% share, is also seeing significant growth, expected to reach $0.64 billion in 2033.

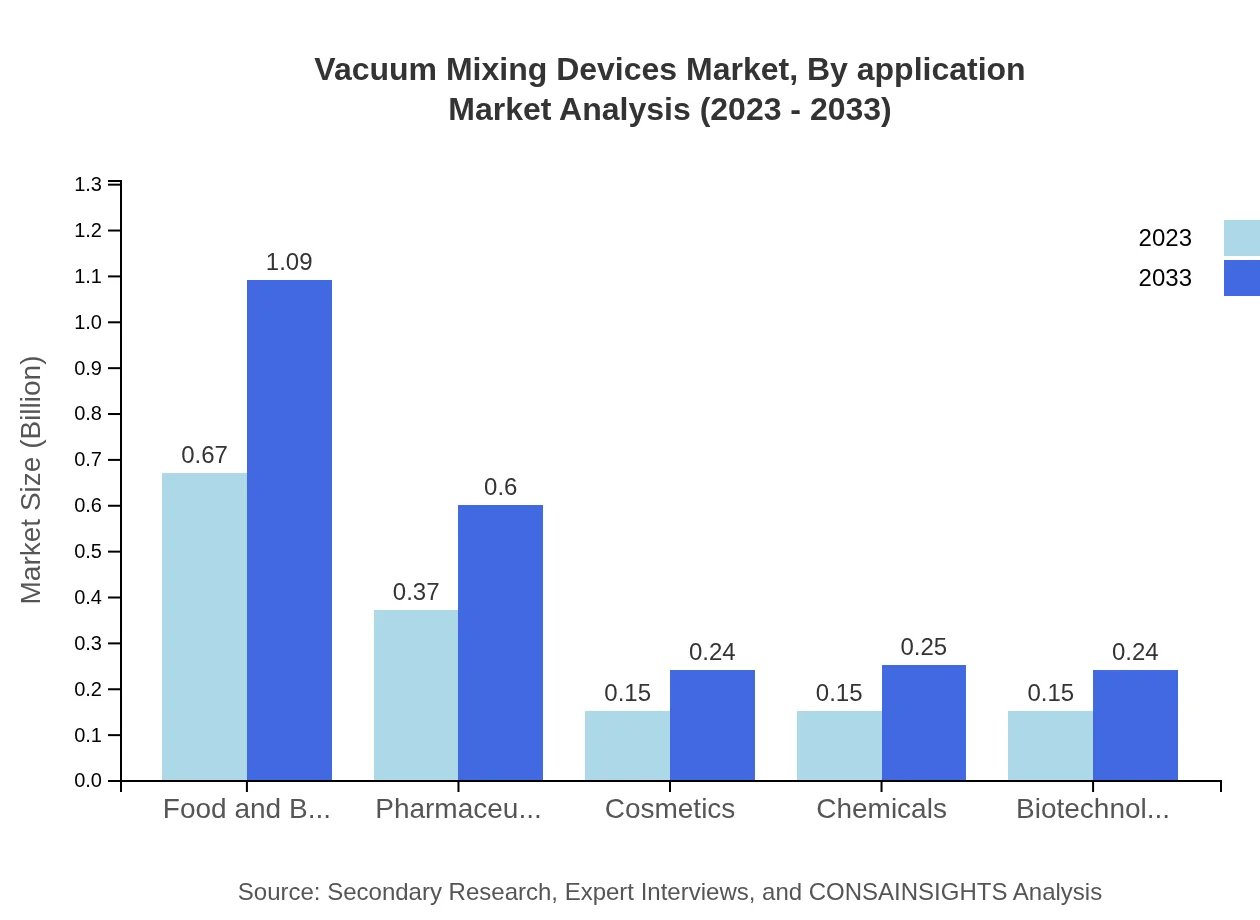

Vacuum Mixing Devices Market Analysis By Application

Food and beverage applications constitute a major part of the market, projecting growth from $0.67 billion in 2023 to $1.09 billion by 2033, driven by increased consumer demand for quality products. The pharmaceutical sector is also critical, with sizes moving from $0.37 to $0.60 in the same timeframe.

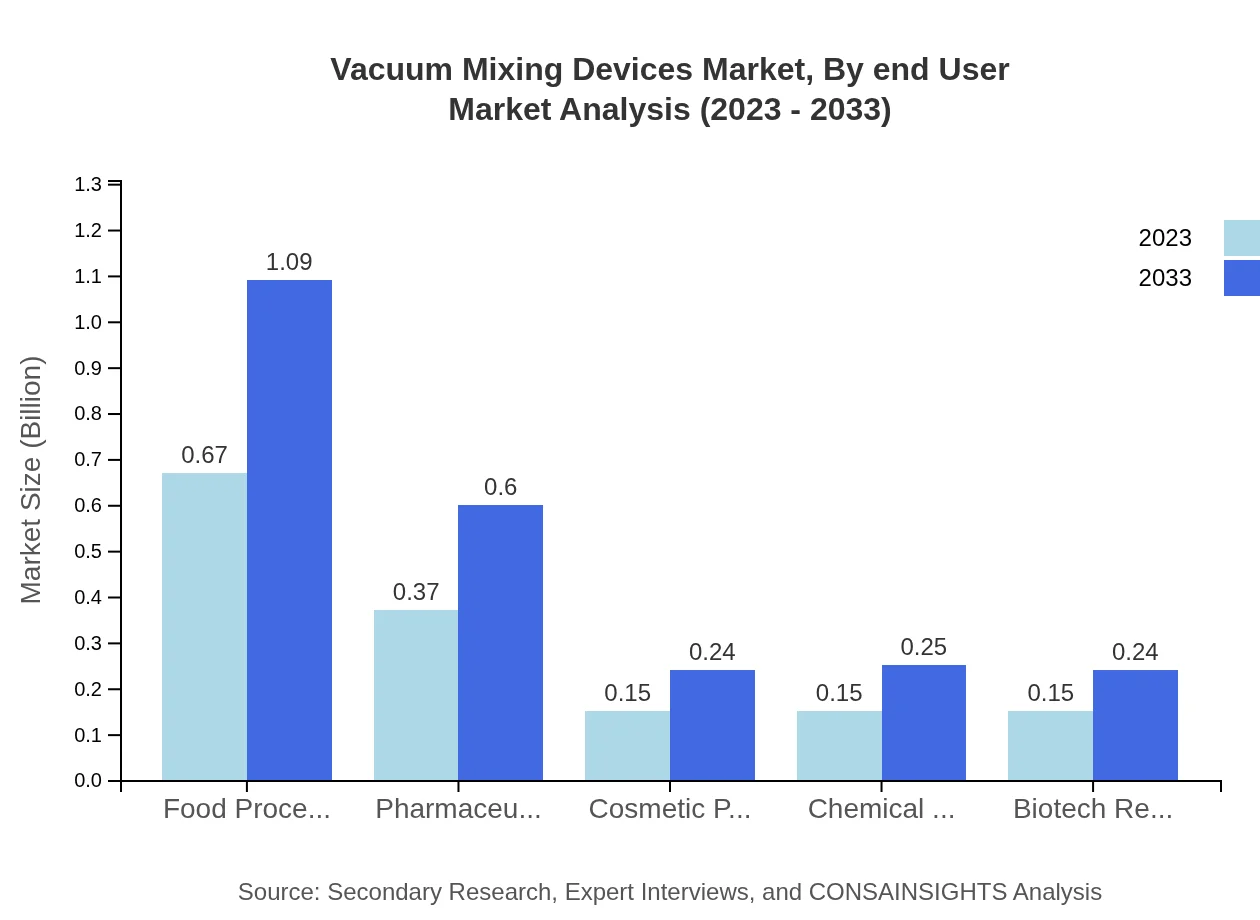

Vacuum Mixing Devices Market Analysis By End User

Major end-users include food processors, pharmaceuticals, and cosmetics. The food processing industry, sharing 44.94% of market share, shows tremendous growth potential, alongside cosmetic producers, which contribute to ongoing innovation in product development.

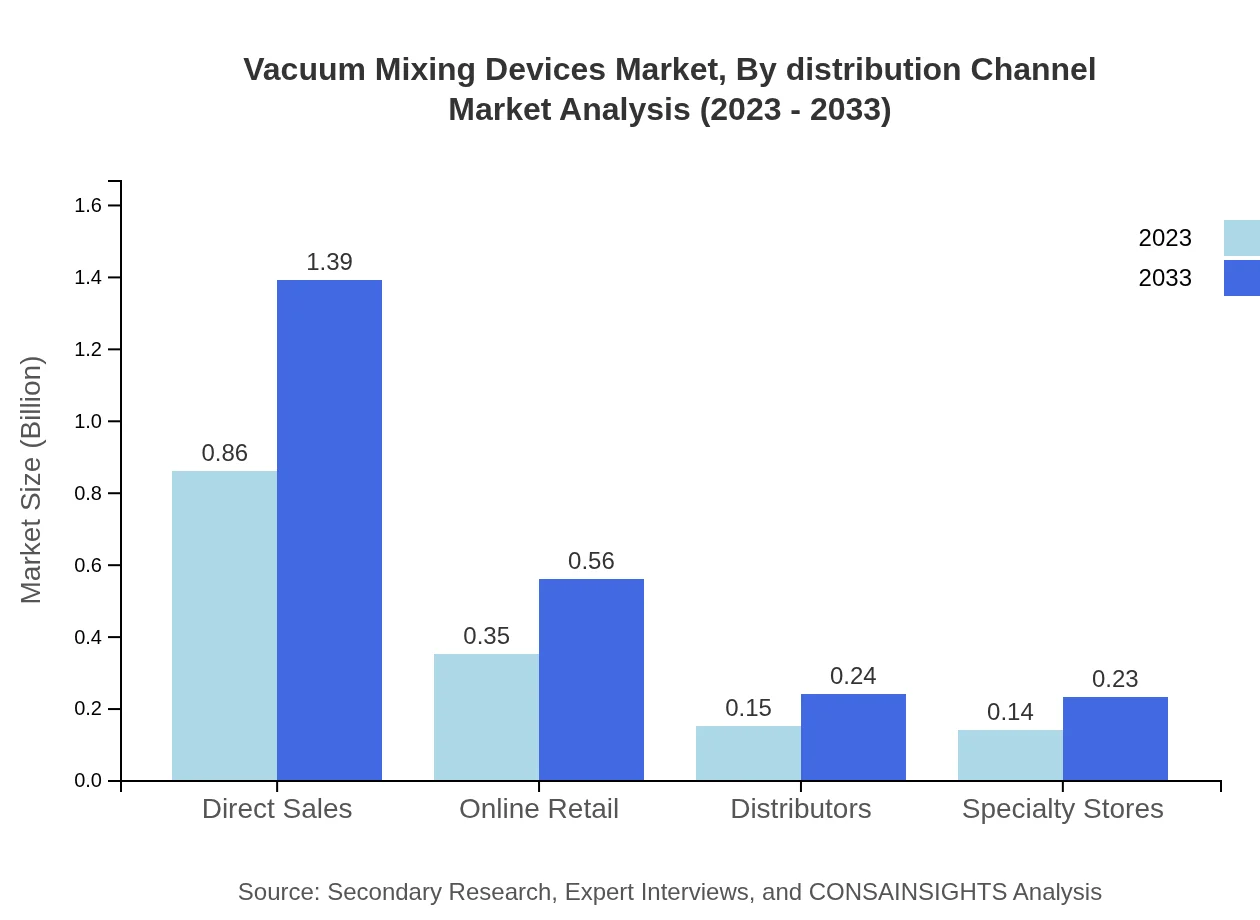

Vacuum Mixing Devices Market Analysis By Distribution Channel

Direct sales account for a majority share at 57.39%, indicating manufacturers’ inclinations to connect directly with end-users, while online retailing is growing steadily as digitalization transforms buying behaviors.

Vacuum Mixing Devices Market Analysis By Technology

Technological advancements are pivotal. Integration of IoT and automation technologies enhances data collection, monitoring, and overall operational efficiency in vacuum mixing processes, which is vital for compliance and quality control.

Vacuum Mixing Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Vacuum Mixing Devices Industry

Bertoli:

Bertoli is known for its innovative vacuum mixing technology and has established a strong presence in both pharmaceutical and cosmetic sectors, delivering high-quality mixing solutions.TEKNO Mix:

A major player in the food processing industry, TEKNO Mix specializes in customized vacuum mixers that enhance food safety and quality. Their focus on R&D keeps them at the forefront of industry trends.GEMÜ:

GEMÜ is recognized for manufacturing high-quality mixing devices catering to the pharmaceutical industry, with an emphasis on precision and compliance with stringent regulations.Glatt:

Glatt specializes in mixing technologies and offers solutions designed for the chemical and pharmaceutical industries. Their products are appreciated for their efficiency and flexibility.HDDM:

HDDM focuses on providing advanced vacuum mixing systems aimed at industries such as cosmetics and pharmaceuticals, enhancing product development processes.We're grateful to work with incredible clients.

FAQs

What is the market size of vacuum Mixing Devices?

The vacuum mixing devices market is valued at approximately $1.5 billion as of 2023, with a projected compound annual growth rate (CAGR) of 4.8% through to 2033. This growth underscores the increasing demand for advanced mixing solutions across industries.

What are the key market players or companies in the vacuum Mixing Devices industry?

Key players in the vacuum mixing devices industry include major manufacturers and suppliers located globally. They provide innovative solutions and capitalize on technological advancements, contributing significantly to market share and competitive landscape within the industry.

What are the primary factors driving the growth in the vacuum Mixing Devices industry?

Key drivers for vacuum mixing devices' growth include the rise in demand for consistent mixing solutions in food, pharmaceuticals, and cosmetics, along with technological advancements. Increased production efficiency and the need for automation are also pivotal for this market expansion.

Which region is the fastest Growing in the vacuum Mixing Devices?

The fastest-growing region in the vacuum mixing devices market is North America, with market size increasing from $0.57 billion in 2023 to $0.92 billion by 2033. This region's growth reflects technological adoption and increasing industrial activities.

Does ConsaInsights provide customized market report data for the vacuum Mixing Devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific requirements of businesses in the vacuum mixing devices industry, ensuring that stakeholders have the most relevant insights for strategic decision-making.

What deliverables can I expect from this vacuum Mixing Devices market research project?

Deliverables from the vacuum mixing devices market research project typically include detailed market analysis, trend identification, competitive landscape assessments, and forecast data segmented by region and application, ensuring comprehensive insights.

What are the market trends of vacuum Mixing Devices?

Current market trends in vacuum mixing devices highlight increasing integration of automation and smart technologies, growing emphasis on energy efficiency, and escalating demand for high-quality and consistent mixing solutions across various sectors.