Valve Positioners Market Report

Published Date: 22 January 2026 | Report Code: valve-positioners

Valve Positioners Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Valve Positioners market, reviewing current trends, market size, and future growth forecasts from 2023 to 2033. Insights include technological advancements, regional developments, and key industry players shaping the market landscape.

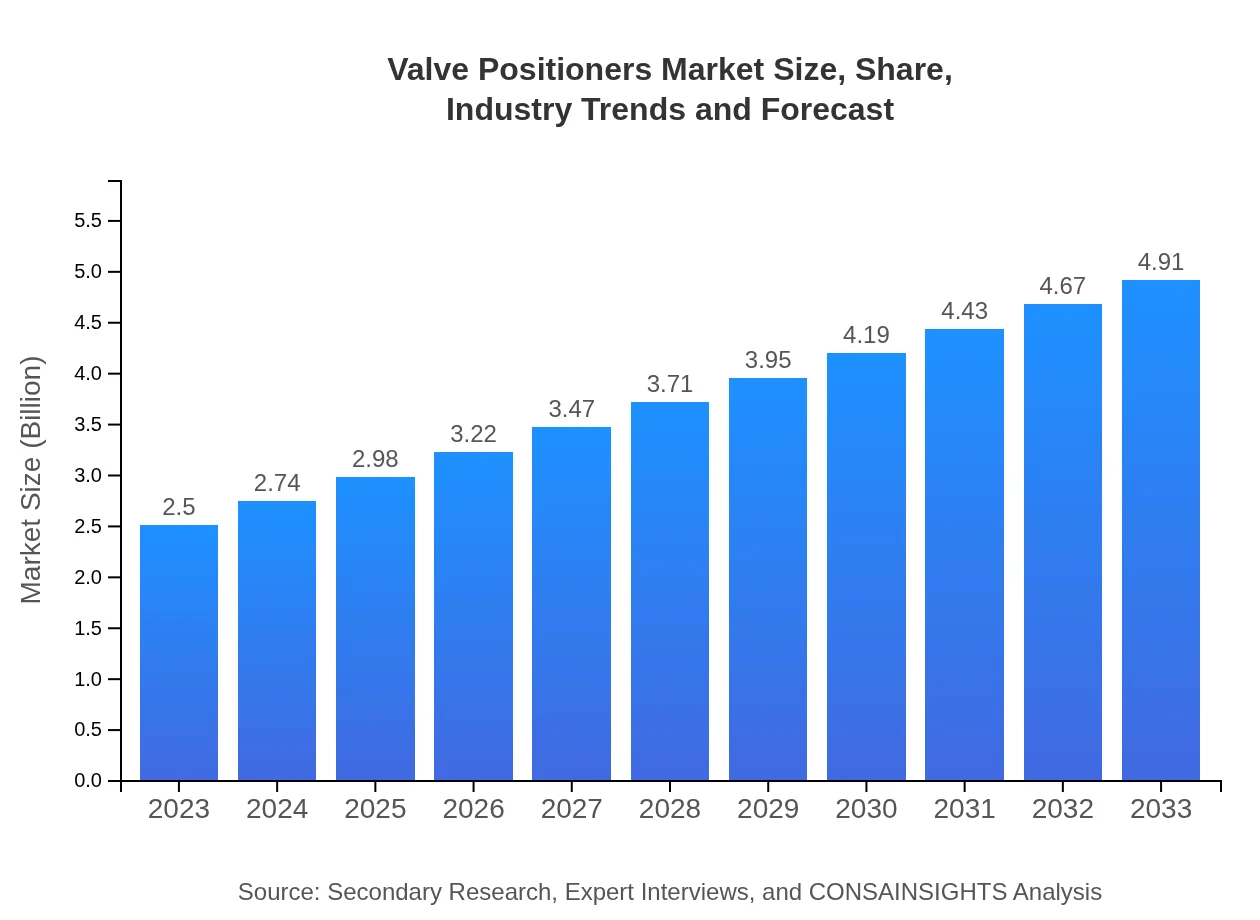

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Emerson Electric Co., Honeywell International Inc., Siemens AG, Fischer & Porter, Yokogawa Electric Corporation |

| Last Modified Date | 22 January 2026 |

Valve Positioners Market Overview

Customize Valve Positioners Market Report market research report

- ✔ Get in-depth analysis of Valve Positioners market size, growth, and forecasts.

- ✔ Understand Valve Positioners's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Valve Positioners

What is the Market Size & CAGR of Valve Positioners market in 2023?

Valve Positioners Industry Analysis

Valve Positioners Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Valve Positioners Market Analysis Report by Region

Europe Valve Positioners Market Report:

Europe's Valve Positioners market is anticipated to grow significantly, with projections showing an increase from $0.71 billion in 2023 to $1.39 billion by 2033. The region is driven by technological innovation in automation, stringent regulations for process control, and a shift towards sustainable energy solutions.Asia Pacific Valve Positioners Market Report:

The Asia Pacific region is expected to witness significant growth in the Valve Positioners market, with the market size rising from $0.47 billion in 2023 to $0.93 billion by 2033. This growth is driven by heightened industrial automation, infrastructure projects, and a burgeoning manufacturing sector. Countries such as China and India are at the forefront due to substantial investments in automation technologies.North America Valve Positioners Market Report:

The North American market is expected to experience robust growth, from $0.94 billion in 2023 to $1.86 billion in 2033, primarily due to technological advancements and the region's push towards smart automation. The presence of major oil and gas exploration activities and power generation projects signifies strong demand for high-quality valve positioners.South America Valve Positioners Market Report:

In South America, the Valve Positioners market is projected to grow from $0.04 billion in 2023 to $0.08 billion in 2033. Increased focus on oil and gas exploration activities, along with investments in water management systems, are key drivers of growth in this region.Middle East & Africa Valve Positioners Market Report:

The Middle East and Africa region is projected to rise from $0.33 billion in 2023 to $0.65 billion by 2033. The ongoing developments in the oil and gas sector, coupled with water management needs due to rising population dynamics, drive the demand for valve positioners.Tell us your focus area and get a customized research report.

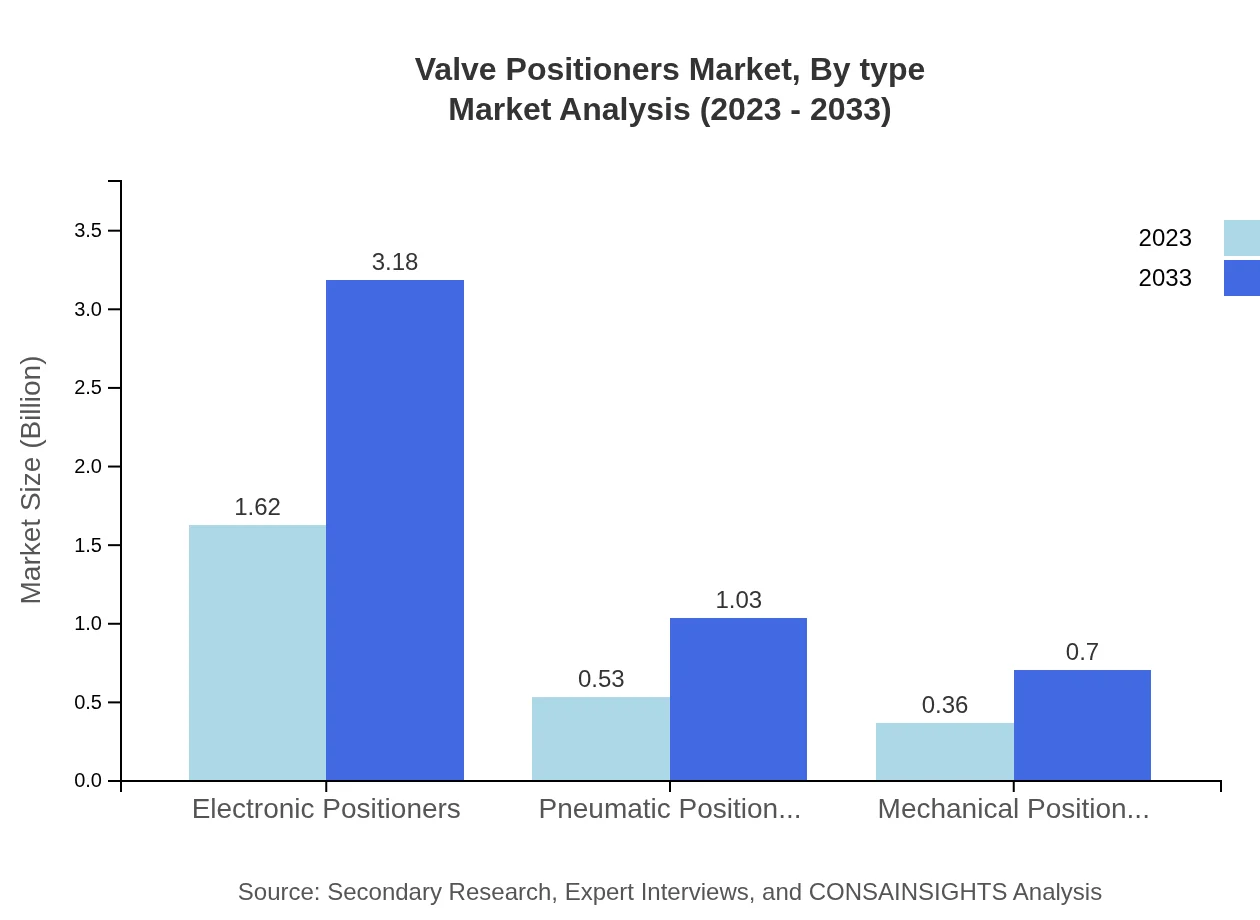

Valve Positioners Market Analysis By Type

In 2023, Electronic Positioners dominate the market with a share of 64.67%, valued at $1.62 billion, and this is projected to grow to $3.18 billion by 2033. Pneumatic Positioners follow with a market size of $0.53 billion (21.04% share) in 2023, expected to reach $1.03 billion by 2033. Mechanical Positioners account for a share of 14.29%, with a market size of $0.36 billion in 2023 rising to $0.70 billion by 2033.

Valve Positioners Market Analysis By Application

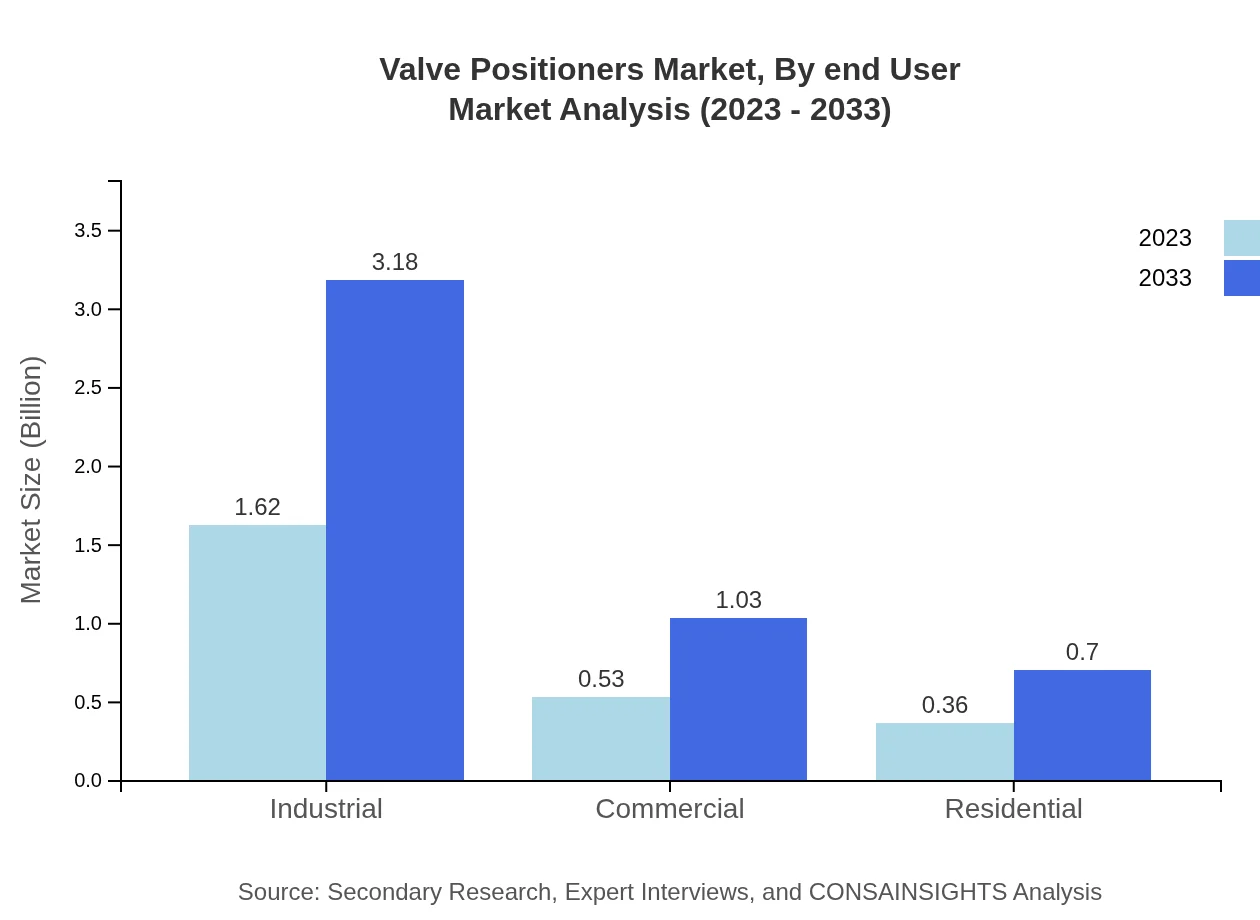

The market is significantly tilted towards Industrial applications which hold a 64.67% share in 2023 at a size of $1.62 billion, projected to double by 2033. Commercial applications represent 21.04%, growing from $0.53 billion to $1.03 billion through 2033. Residential applications currently account for 14.29%, with market size expected to increase from $0.36 billion to $0.70 billion.

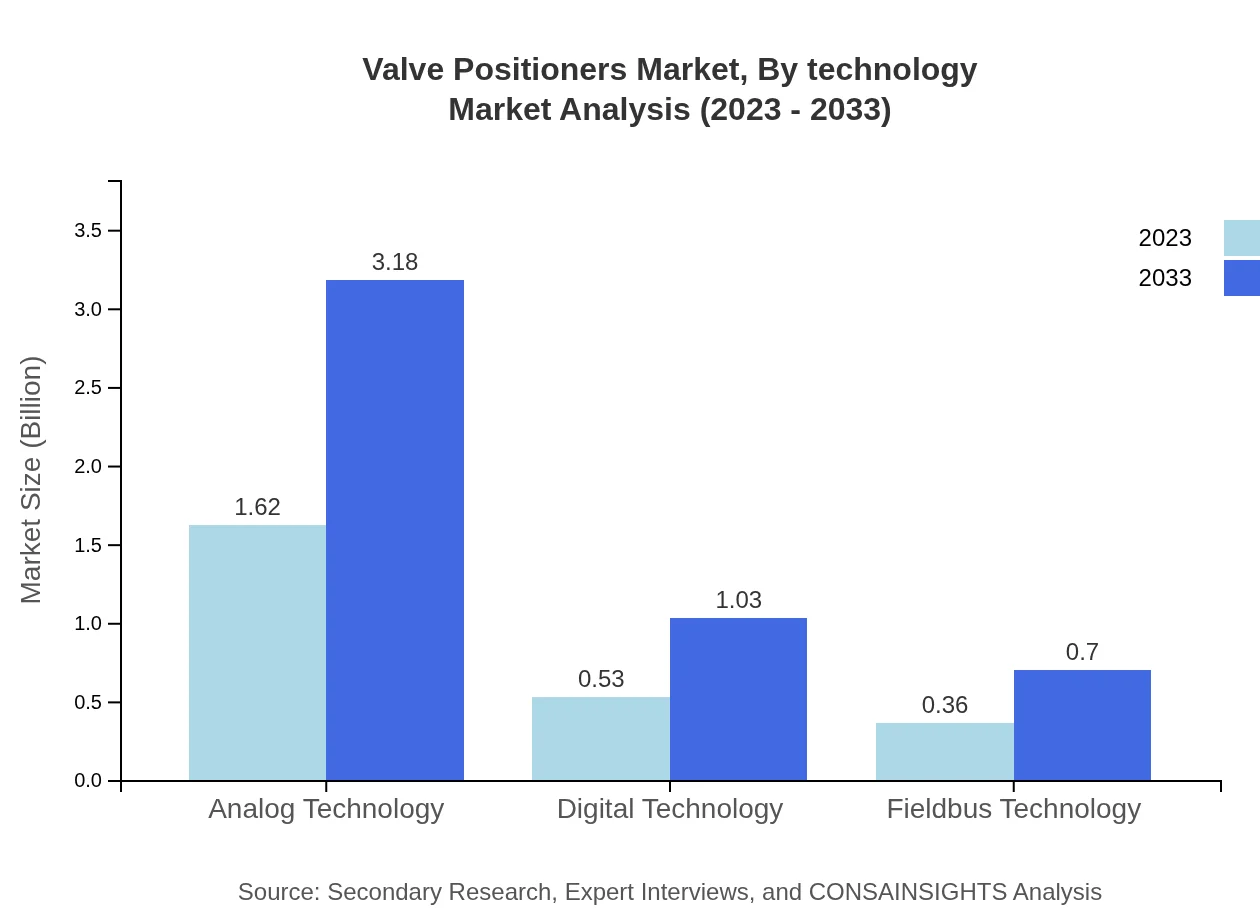

Valve Positioners Market Analysis By Technology

Analog technology leads the technology segment, constituting a market size of $1.62 billion (64.67% share) in 2023, with forecasts reflecting growth to $3.18 billion by 2033. Digital technologies hold a 21.04% share ($0.53 billion), projected to enhance to $1.03 billion. Fieldbus Technology represents 14.29%, with an increase from $0.36 billion to $0.70 billion anticipated through 2033.

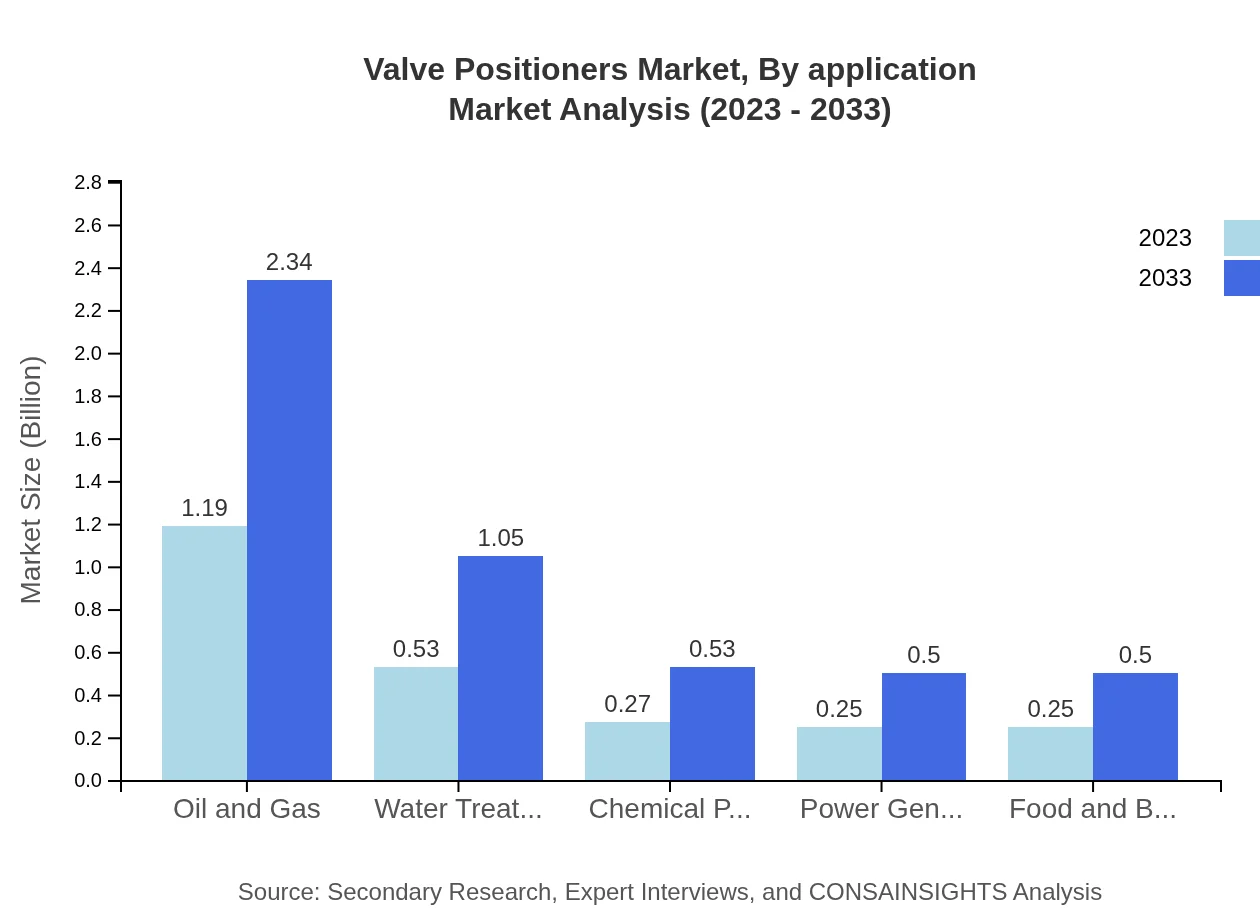

Valve Positioners Market Analysis By End User

The Oil and Gas industry is the largest end-user, representing 47.6% of the market ($1.19 billion) in 2023 and expected to grow to $2.34 billion by 2033. Water Treatment follows with 21.28% share, growing from $0.53 billion to $1.05 billion. Chemical Processing showcases a 10.85% share, forecasted to grow from $0.27 billion to $0.53 billion, while Power Generation and Food and Beverage industries hold a share of 10.13% and 10.14% respectively, each anticipated to grow accordingly.

Valve Positioners Market Analysis By Sales Channel

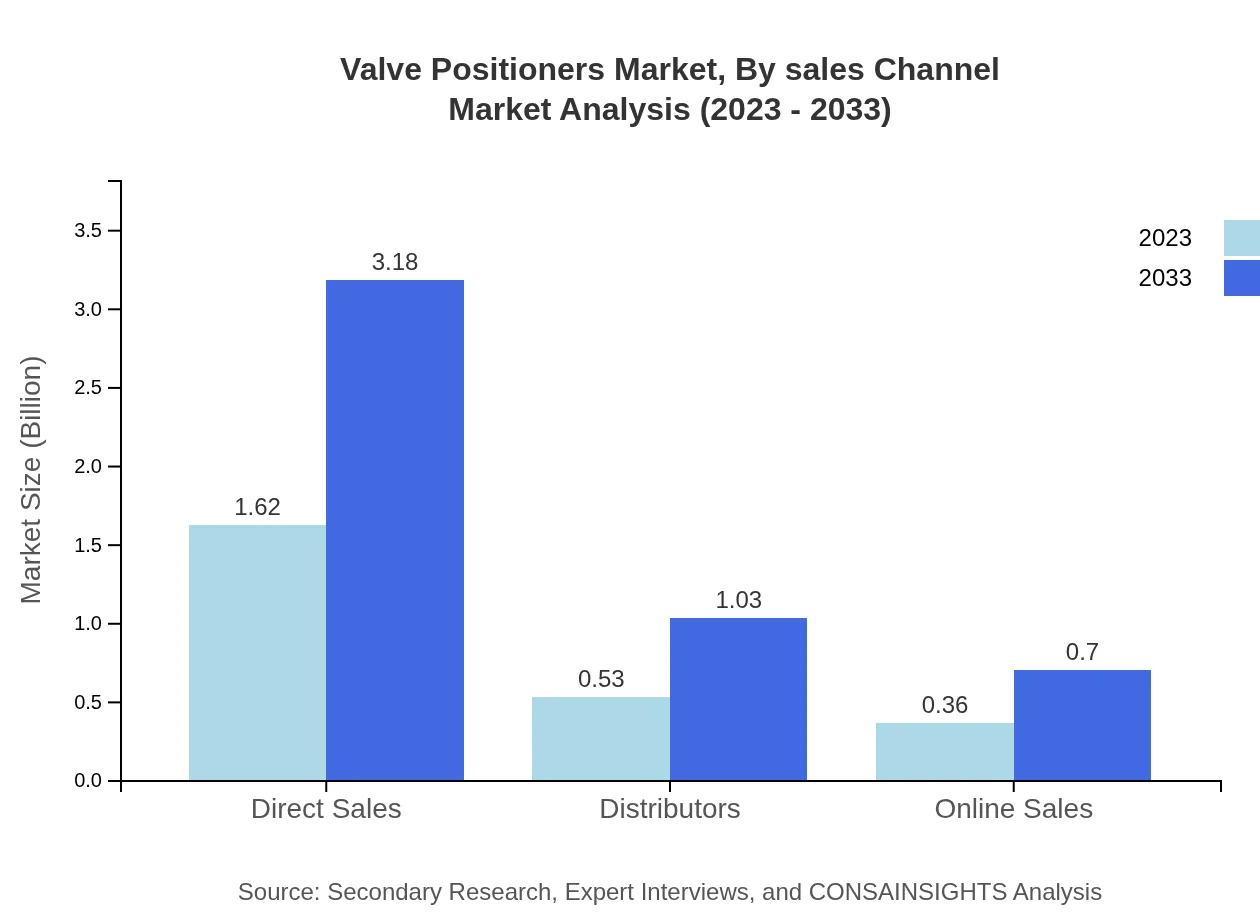

Direct Sales is the leading sales channel, capturing 64.67% of the market with a valuation of $1.62 billion in 2023, expected to double by 2033. Distributors represent a share of 21.04% ($0.53 billion), anticipated to increase to $1.03 billion. Online Sales currently encompass 14.29% of the market, forecasted to rise from $0.36 billion to $0.70 billion.

Valve Positioners Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Valve Positioners Industry

Emerson Electric Co.:

A leading global technology and engineering company providing innovative solutions in automation and control systems across various industries.Honeywell International Inc.:

Specializes in various industrial technologies including automation and process control, providing comprehensive solutions for valve positioning applications.Siemens AG:

A global conglomerate with extensive contributions to automation technologies, renowned for its high-quality valve positioners and related products.Fischer & Porter:

Known for its pioneering work in process automation and control instrumentation, particularly in valve positioner technology.Yokogawa Electric Corporation:

Recognized for its advanced control technology and integrated solutions, primarily in the oil & gas and petrochemical industries.We're grateful to work with incredible clients.

FAQs

What is the market size of valve positioners?

The global valve positioners market size is projected to be approximately $2.5 billion in 2023, with a Compound Annual Growth Rate (CAGR) of 6.8%, indicating significant growth potential through 2033.

What are the key market players or companies in the valve positioners industry?

Key market players in the valve positioners industry include major corporations specializing in industrial automation and control systems. These companies are known for their innovation, reliability, and commitment to quality, contributing to market competitiveness.

What are the primary factors driving the growth in the valve positioners industry?

The growth in the valve positioners industry is primarily driven by the increasing demand for automation across various sectors, enhanced efficiency in industrial processes, and the need for precise control in applications like oil and gas, and water treatment.

Which region is the fastest Growing in the valve positioners market?

The fastest-growing region in the valve positioners market is Europe, projected to grow from $0.71 billion in 2023 to $1.39 billion by 2033. Other rapidly growing regions include North America and Asia Pacific.

Does ConsaInsights provide customized market report data for the valve positioners industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the valve positioners industry, allowing clients to gain targeted insights and data that align with their unique business strategies and goals.

What deliverables can I expect from this valve positioners market research project?

From the valve positioners market research project, you can expect comprehensive reports including market size analysis, segmentation data, growth forecasts, regional breakdowns, and competitive landscape assessments, all tailored to your requirements.

What are the market trends of valve positioners?

Market trends for valve positioners include a shift towards electronic positioning systems, increased adoption of digital technology, and a growing emphasis on automation within critical industries, driving innovation and competition in the sector.