Video Wall Market Report

Published Date: 31 January 2026 | Report Code: video-wall

Video Wall Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Video Wall market from 2023 to 2033, including market size, CAGR, technological advancements, regional insights, and trends shaping the industry's future.

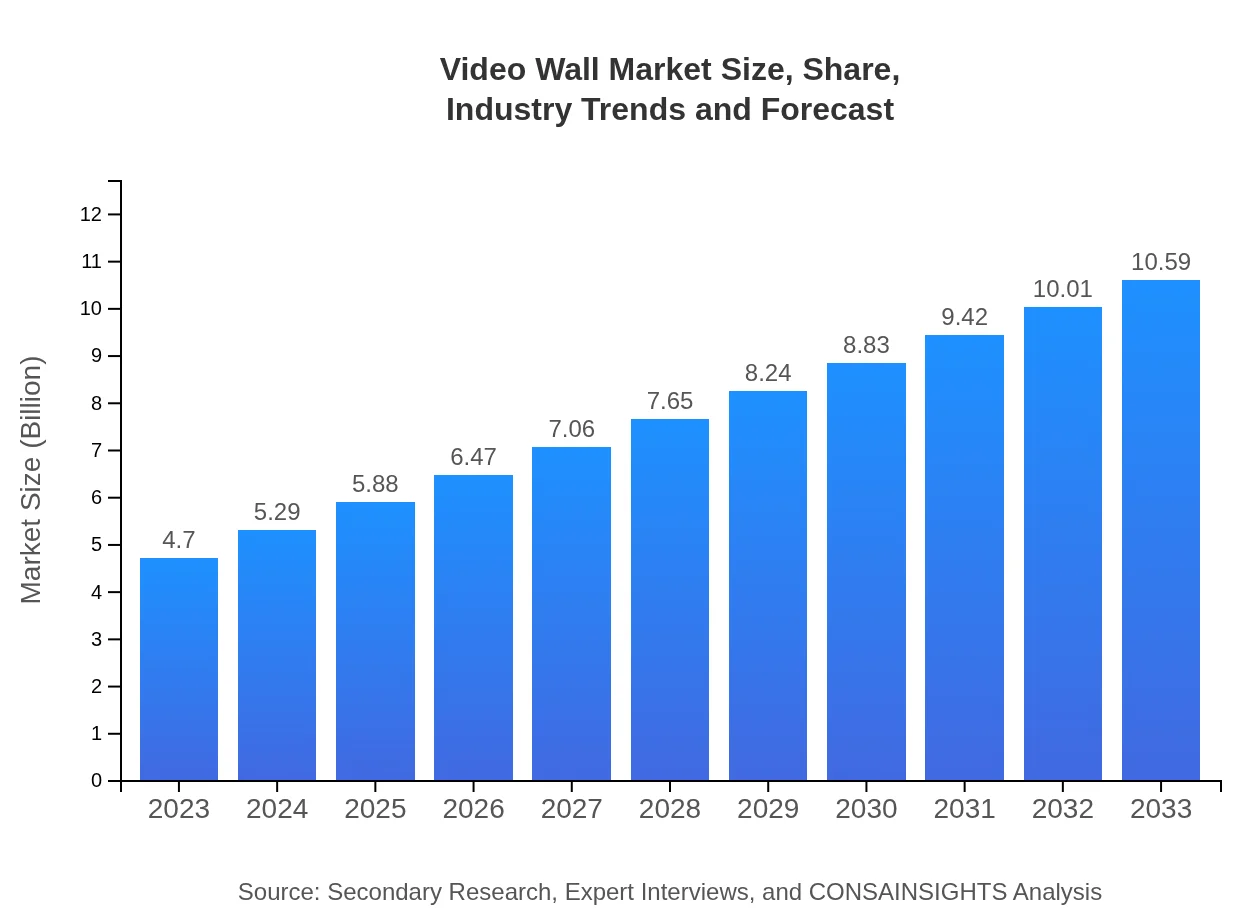

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.70 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $10.59 Billion |

| Top Companies | Samsung Electronics, LG Display, Barco, NEC Corporation, Sony Corporation |

| Last Modified Date | 31 January 2026 |

Video Wall Market Overview

Customize Video Wall Market Report market research report

- ✔ Get in-depth analysis of Video Wall market size, growth, and forecasts.

- ✔ Understand Video Wall's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Video Wall

What is the Market Size & CAGR of Video Wall market in 2023?

Video Wall Industry Analysis

Video Wall Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Video Wall Market Analysis Report by Region

Europe Video Wall Market Report:

The European market is projected to grow from $1.39 billion in 2023 to $3.13 billion by 2033. Increasing awareness of visual communication effectiveness in sectors like retail and events is driving this growth. Additionally, stringent regulations on advertising are prompting businesses to innovate in display formats.Asia Pacific Video Wall Market Report:

The Asia Pacific region is expected to exhibit robust growth, with a market size projected to rise from $0.94 billion in 2023 to $2.13 billion by 2033. The increasing adoption of digital signage in retail and advertising sectors drives demand, alongside enhancements in technology. Countries like China and India are witnessing significant investments in infrastructure, contributing to this growth.North America Video Wall Market Report:

North America remains a dominant player, with the market anticipated to rise from $1.66 billion in 2023 to $3.73 billion by 2033. The presence of major corporations, high spending on advertising technologies, and a focus on enhancing customer experiences support this growth.South America Video Wall Market Report:

In South America, the Video Wall market is anticipated to grow from $0.39 billion in 2023 to $0.88 billion by 2033. Economic growth and a rising middle class drive demand for advanced advertising solutions, although budget constraints may temper growth rates compared to other regions.Middle East & Africa Video Wall Market Report:

The Middle East and Africa exhibit steady growth, with the market size expected to increase from $0.32 billion in 2023 to $0.73 billion by 2033. Rising urbanization and investment in digital infrastructure in the region are strong factors contributing to market expansion.Tell us your focus area and get a customized research report.

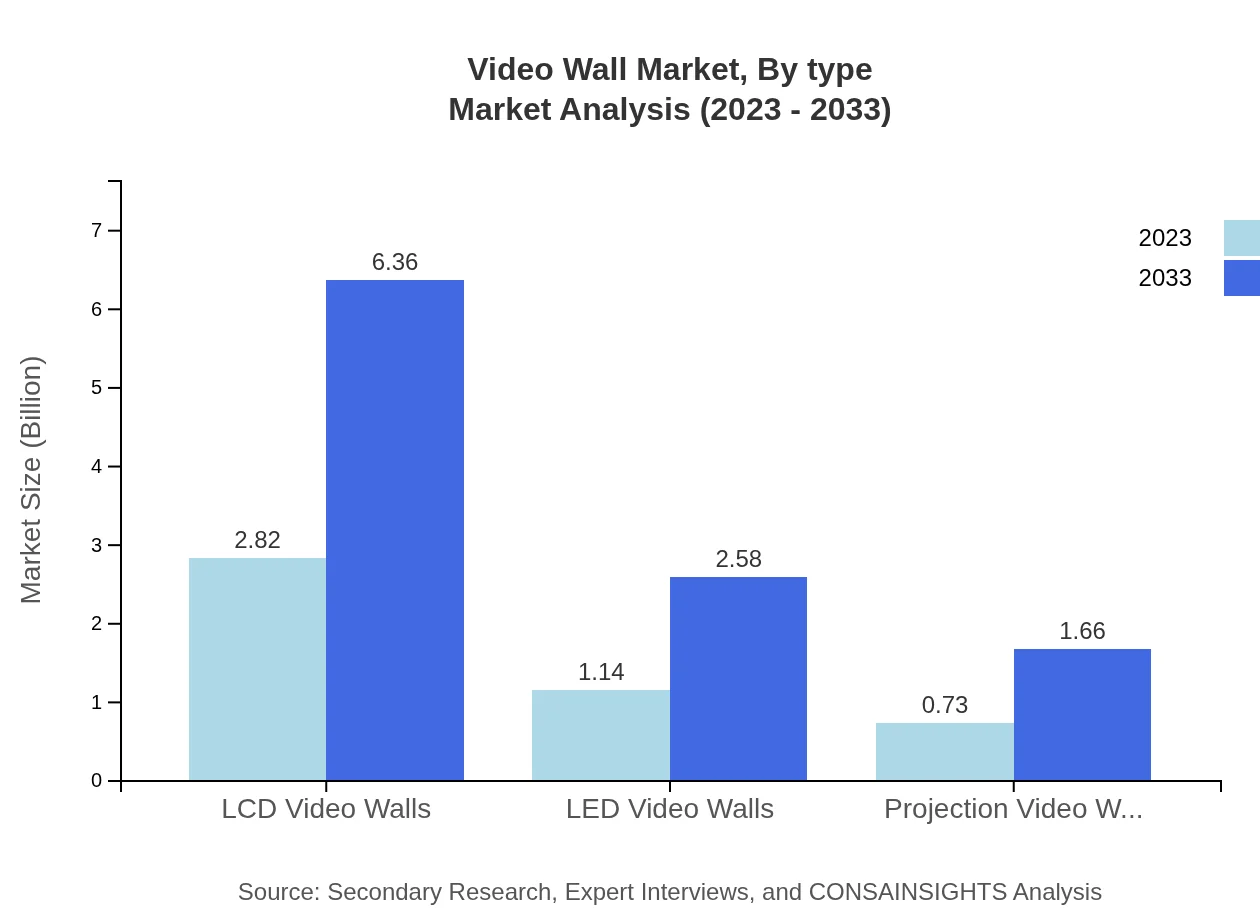

Video Wall Market Analysis By Type

In 2023, the total Video Wall market size by type comprises: - LCD Video Walls: $2.82 billion (60.06% share) - LED Video Walls: $1.14 billion (24.31% share) - Projection Video Walls: $0.73 billion (15.63% share) The sector shows the largest growth potential in LED technology, which is expected to gain further market traction due to its superior brightness and color vibrancy.

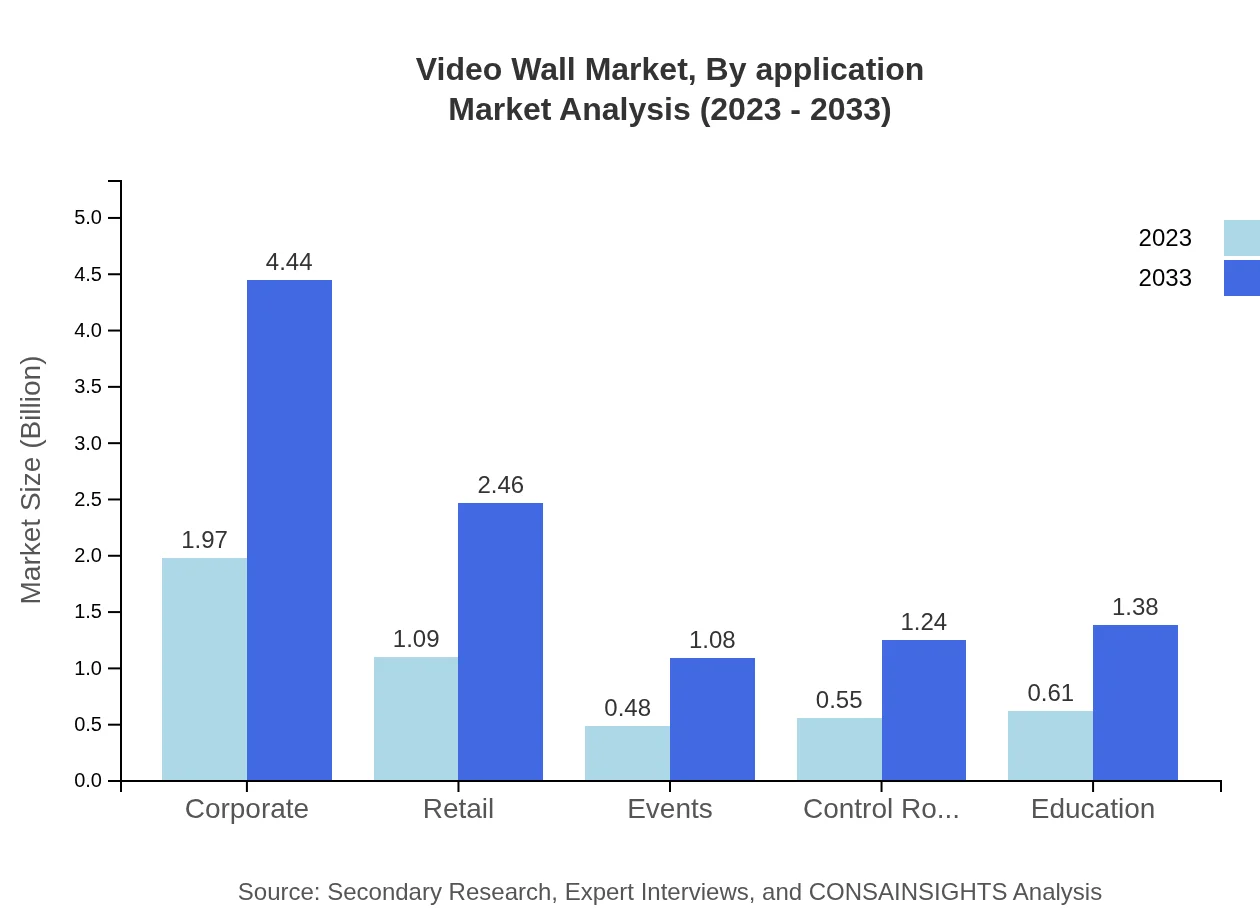

Video Wall Market Analysis By Application

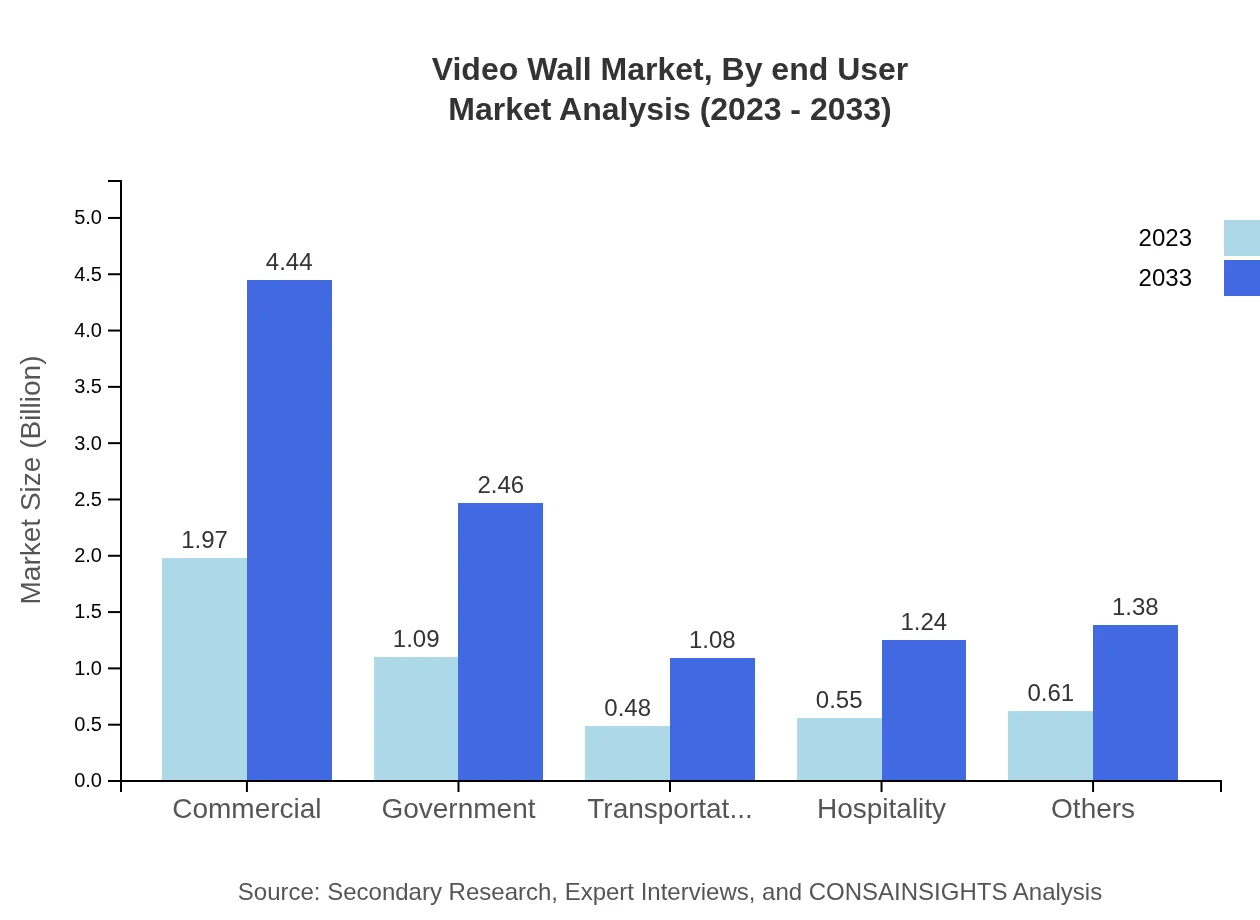

The Video Wall market segmented by application in 2023 includes: - Commercial: $1.97 billion (41.88% share) - Government: $1.09 billion (23.26% share) - Transportation: $0.48 billion (10.21% share) - Hospitality: $0.55 billion (11.67% share) - Others: $0.61 billion (12.98% share) This analysis indicates commercial applications lead the market, driven by retail advertising and branding initiatives.

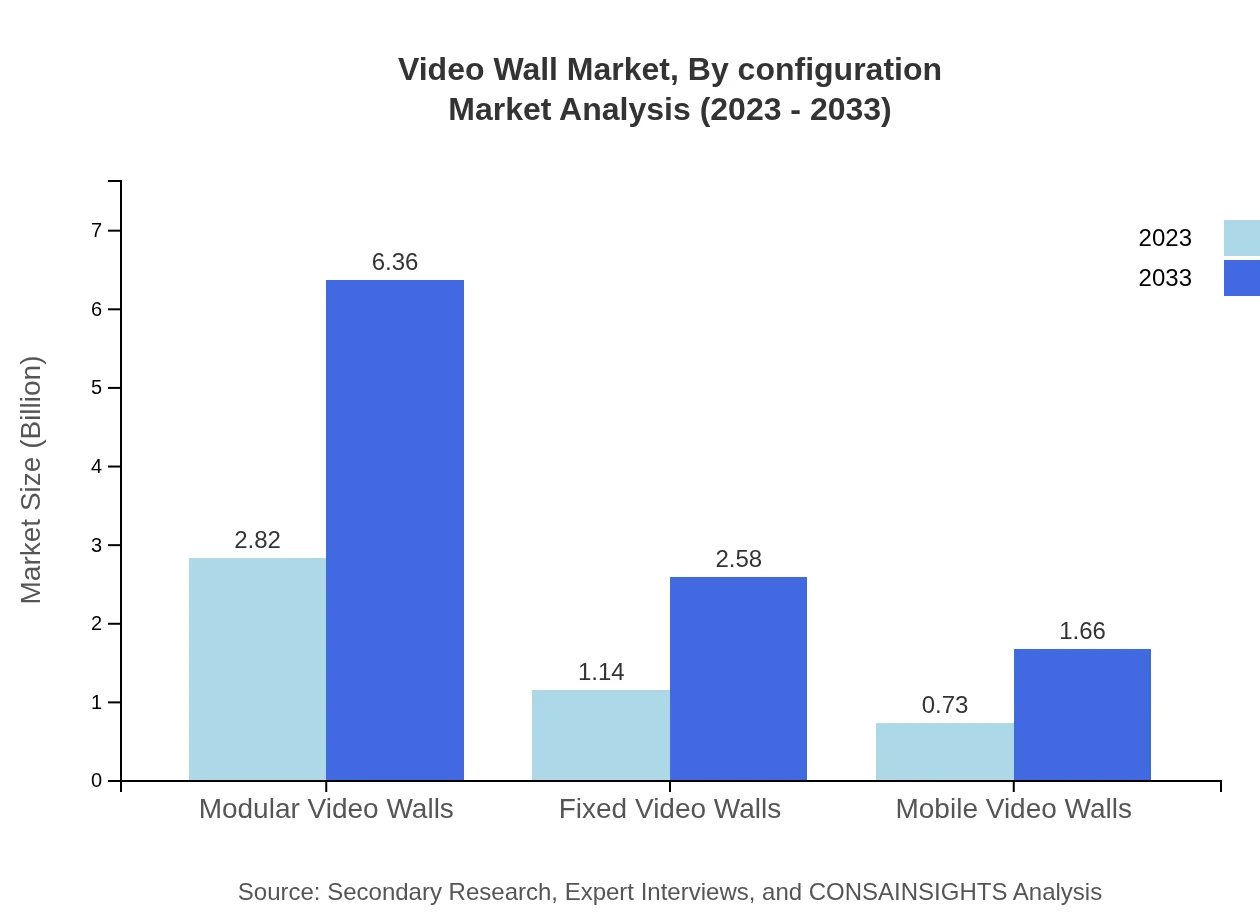

Video Wall Market Analysis By Configuration

The model segmentation reflects: - Modular Video Walls: $2.82 billion (60.06% share) - Fixed Video Walls: $1.14 billion (24.31% share) - Mobile Video Walls: $0.73 billion (15.63% share) Modular configurations are particularly prevalent due to their adaptability and scalability in various environments.

Video Wall Market Analysis By End User

In 2023, end-user segmentation is as follows: - Corporate: $1.97 billion (41.88% share) - Education: $0.61 billion (12.98% share) - Control Rooms: $0.55 billion (11.67% share) - Events: $0.48 billion (10.21% share) - Others: $0.61 billion (12.98% share) Corporate sector shows the most significant demand, reflecting a growing trend of using video walls for presentations and conferences.

Video Wall Market Analysis By Technology

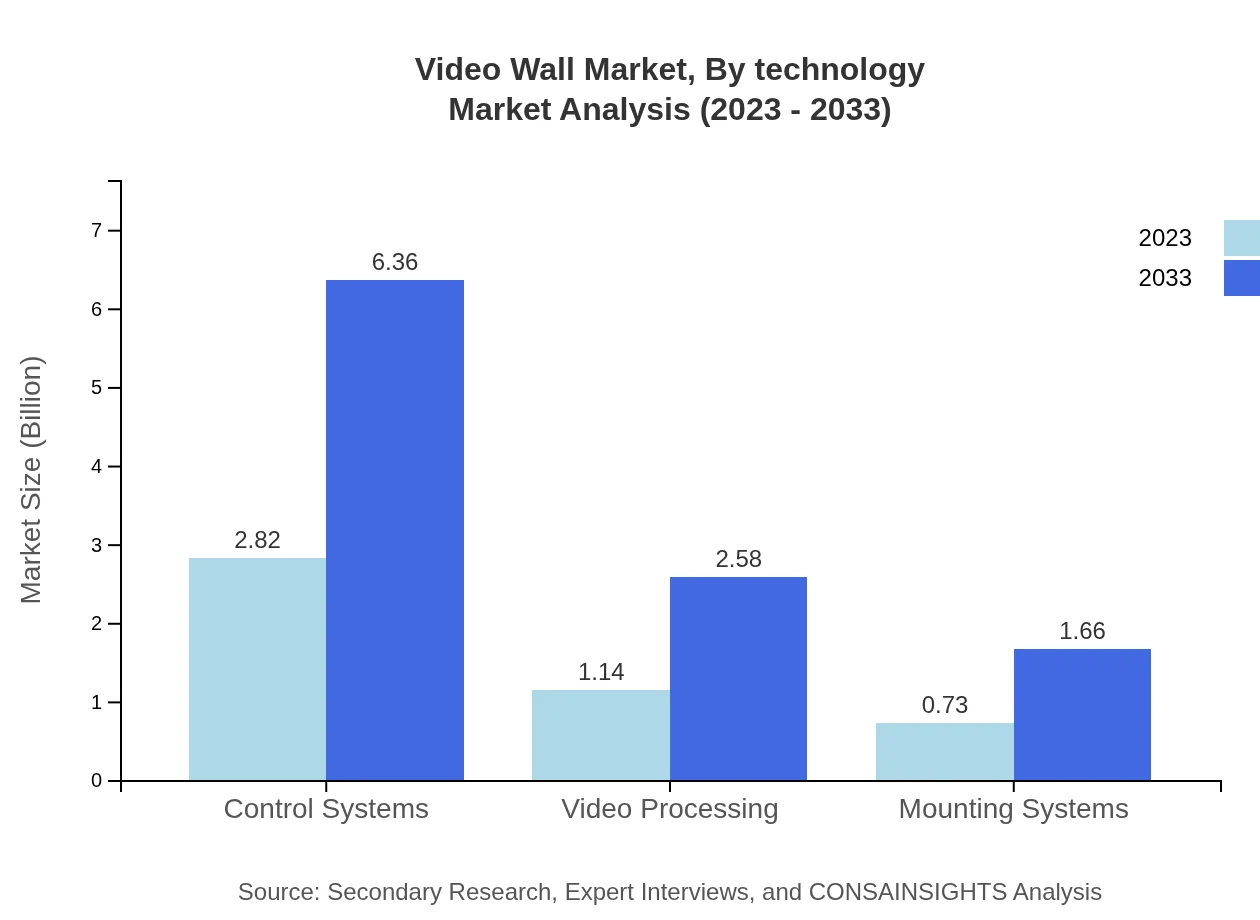

Technological segments in 2023 are as follows: - Control Systems: $2.82 billion (60.06% share) - Video Processing: $1.14 billion (24.31% share) - Mounting Systems: $0.73 billion (15.63% share) Control systems dominate the market, facilitating easy management of content across large displays.

Video Wall Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Video Wall Industry

Samsung Electronics:

Samsung is a pioneering technology company, providing a broad range of video wall solutions that integrate innovative display technology with powerful connectivity options.LG Display:

LG Display specializes in LCD and OLED displays, equipped with advanced video wall technologies designed for high-performance scenarios and diverse applications.Barco:

Barco is a renowned name in visualization and collaboration solutions, offering high-quality video wall solutions for command centers and public venues.NEC Corporation:

NEC has a strong footprint in the display solutions sector, providing reliable and flexible video wall systems tailored for a variety of commercial applications.Sony Corporation:

Sony’s advanced video wall solutions utilize cutting-edge technology to deliver impactful visuals, catering to entertainment and corporate sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of video Wall?

The video wall market is expected to reach $4.7 billion by 2023, growing at a CAGR of 8.2% through 2033. The predicted market size by then will significantly rise, reflecting increased demand in various sectors.

What are the key market players or companies in this video Wall industry?

Key players in the video wall industry include major manufacturers and technology companies that focus on display technology, video processing, and integration services. These companies are pivotal in driving innovation and market expansion.

What are the primary factors driving the growth in the video wall industry?

Growth in the video wall market is driven by advancements in display technology, increasing demand for digital signage, and the expanding use of video walls in corporate, retail, and public spaces for enhanced visibility and audience engagement.

Which region is the fastest Growing in the video wall market?

Asia Pacific is the fastest-growing region in the video wall market, with its size expected to grow from $0.94 billion in 2023 to $2.13 billion by 2033, driven by technological advancements and rising demand in emerging economies.

Does ConsaInsights provide customized market report data for the video wall industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the video wall industry. This includes in-depth analysis, specific regional insights, and segment data to meet clients' unique requirements.

What deliverables can I expect from this video wall market research project?

Deliverables from the video wall market research project typically include detailed market analysis reports, growth forecasts, competitive landscape assessments, and actionable insights specific to market segments and geographical regions.

What are the market trends of video wall?

Current market trends in video walls include the shift towards LED technology, increased integration with IoT devices, growing interest in modular systems, and the expansion of applications in events, education, and control rooms.