Waterborne Polyurethane Market Report

Published Date: 02 February 2026 | Report Code: waterborne-polyurethane

Waterborne Polyurethane Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Waterborne Polyurethane market from 2023 to 2033. It includes market trends, insights into industry dynamics, regional analyses, and key players shaping the market landscape, alongside market size forecasts and growth opportunities.

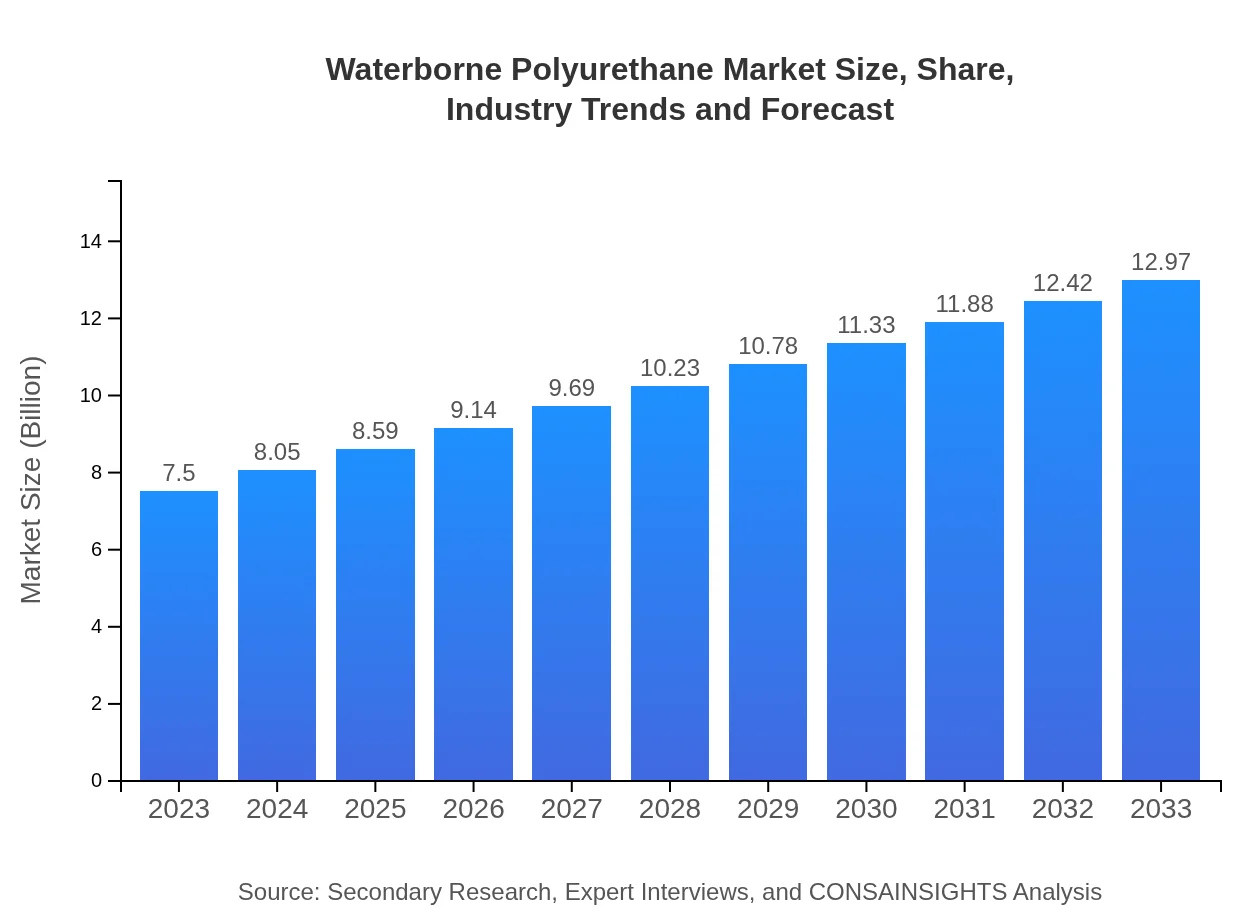

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $12.97 Billion |

| Top Companies | BASF SE, Huntsman Corporation, Covestro AG, Dow Inc., Eastman Chemical Company |

| Last Modified Date | 02 February 2026 |

Waterborne Polyurethane Market Overview

Customize Waterborne Polyurethane Market Report market research report

- ✔ Get in-depth analysis of Waterborne Polyurethane market size, growth, and forecasts.

- ✔ Understand Waterborne Polyurethane's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Waterborne Polyurethane

What is the Market Size & CAGR of Waterborne Polyurethane market in 2023?

Waterborne Polyurethane Industry Analysis

Waterborne Polyurethane Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Waterborne Polyurethane Market Analysis Report by Region

Europe Waterborne Polyurethane Market Report:

Europe is a leading market for Waterborne Polyurethane, valued at USD 2.11 billion in 2023 and projected to grow to USD 3.65 billion by 2033. Countries such as Germany and France lead the charge in product innovation and sustainable practices, with significant investment in R&D aimed at developing higher performing, eco-friendly materials.Asia Pacific Waterborne Polyurethane Market Report:

In the Asia Pacific region, the Waterborne Polyurethane market is valued at USD 1.50 billion in 2023 and is projected to grow to USD 2.60 billion by 2033. The rapid industrialization in countries like China and India, along with rising demand for sustainable building materials, drives this growth. Additionally, the governmental push for eco-friendly products significantly impacts market uptake.North America Waterborne Polyurethane Market Report:

North America represents a robust market, with a size of USD 2.64 billion in 2023, anticipated to rise to USD 4.57 billion by 2033. The stringent environmental laws empower the growth of waterborne technologies, especially in the automotive and construction sectors, coupled with consumer preferences for eco-friendly products.South America Waterborne Polyurethane Market Report:

The South American market is valued at USD 0.55 billion in 2023 and expected to reach USD 0.96 billion by 2033. The region's growth focuses on enhancing sustainable construction techniques and the revival of manufacturing sectors, particularly in Brazil and Argentina, where regulatory frameworks favor greener products.Middle East & Africa Waterborne Polyurethane Market Report:

The Middle East and Africa market is valued at USD 0.69 billion in 2023, with projections reaching USD 1.20 billion by 2033. Increased construction activity and a move towards greener building materials in UAE and South Africa are propelling market growth, alongside infrastructural investments.Tell us your focus area and get a customized research report.

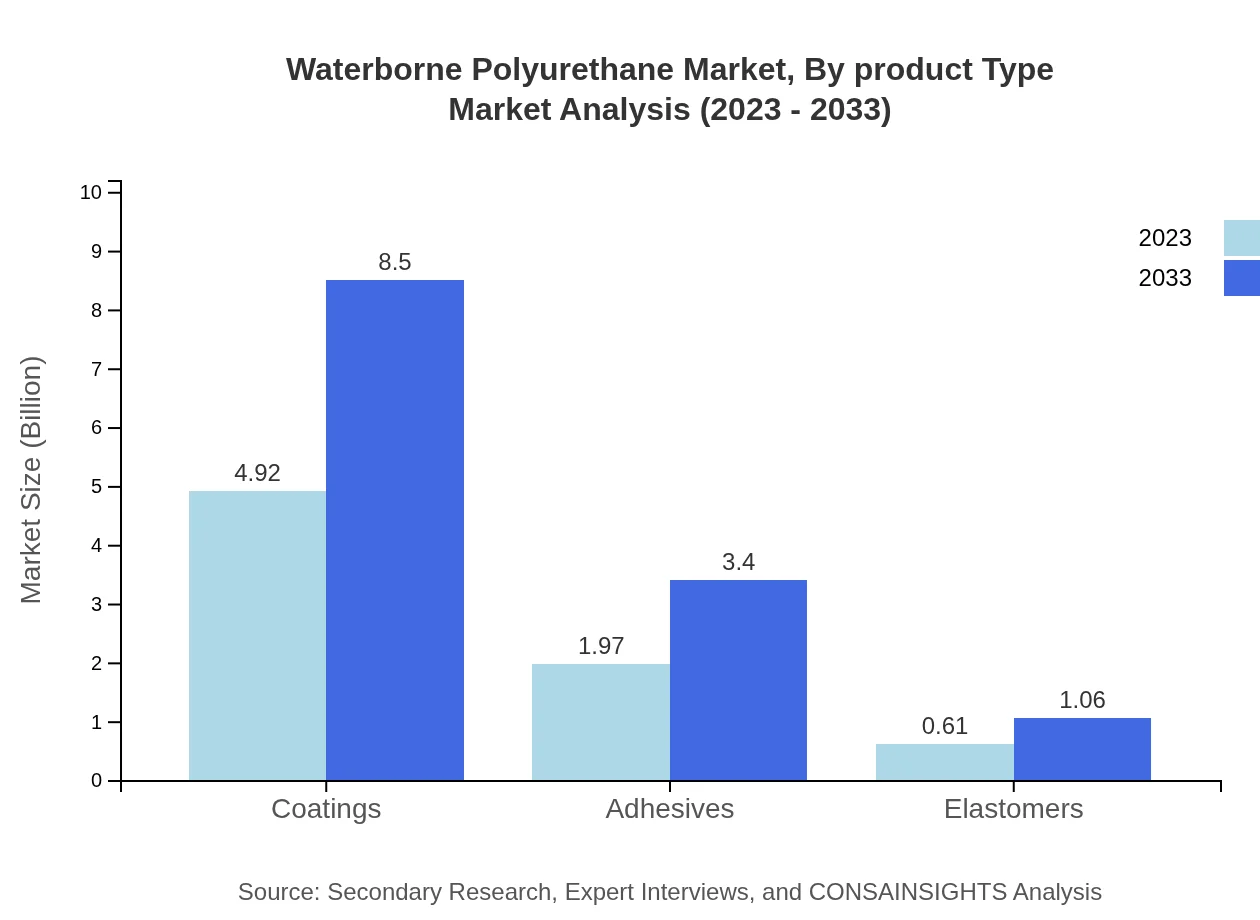

Waterborne Polyurethane Market Analysis By Product Type

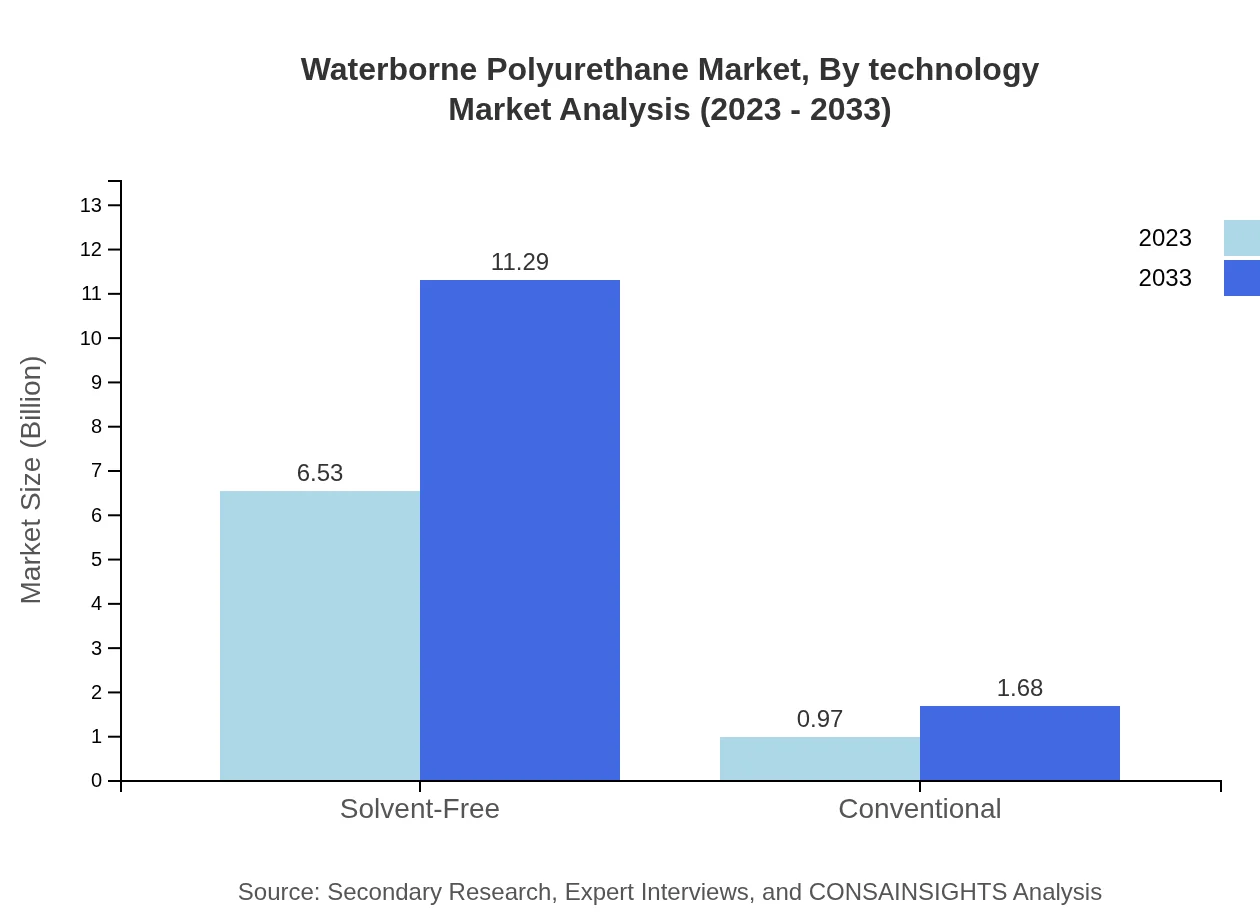

The Waterborne Polyurethane market, by product type, is divided into solvent-free and conventional categories. In 2023, the solvent-free segment dominates with a market size of USD 6.53 billion and is expected to grow to USD 11.29 billion by 2033, capturing a major market share of 87.05%. The conventional segment, while smaller at USD 0.97 billion in 2023, demonstrates a growing trend as companies invest in traditional formulations amid increasing eco-consciousness.

Waterborne Polyurethane Market Analysis By Application

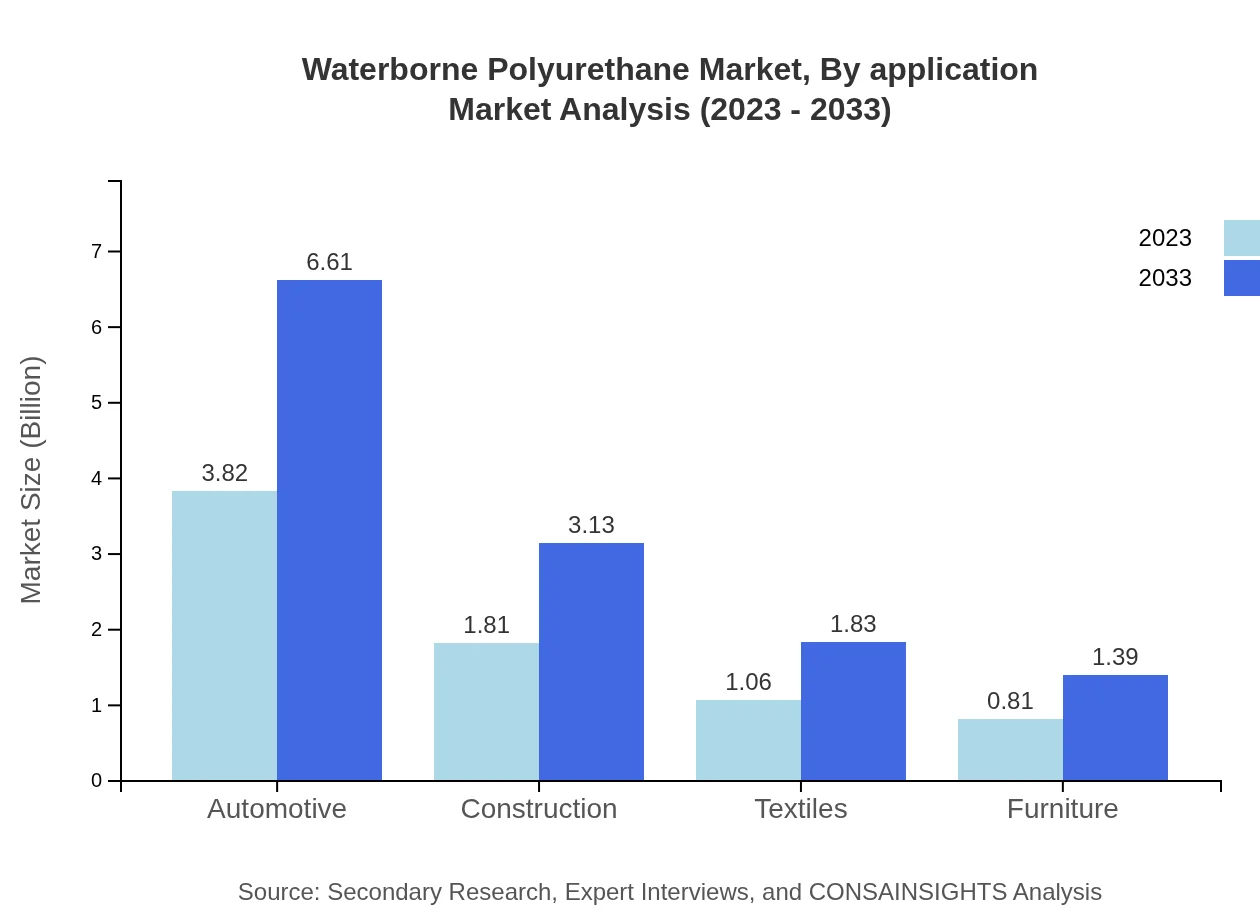

In terms of applications, the Waterborne Polyurethane market segments into automotive, construction, textiles, furniture, coatings, adhesives, elastomers, and more. The automotive sector represents a significant share, with a market size of USD 3.82 billion in 2023, anticipated to reach USD 6.61 billion by 2033. Coatings are the highest-valued application, accounting for USD 4.92 billion in 2023 and expected to grow to USD 8.50 billion. Such trends underscore the versatility and widespread adoption of waterborne polyurethanes across various industries.

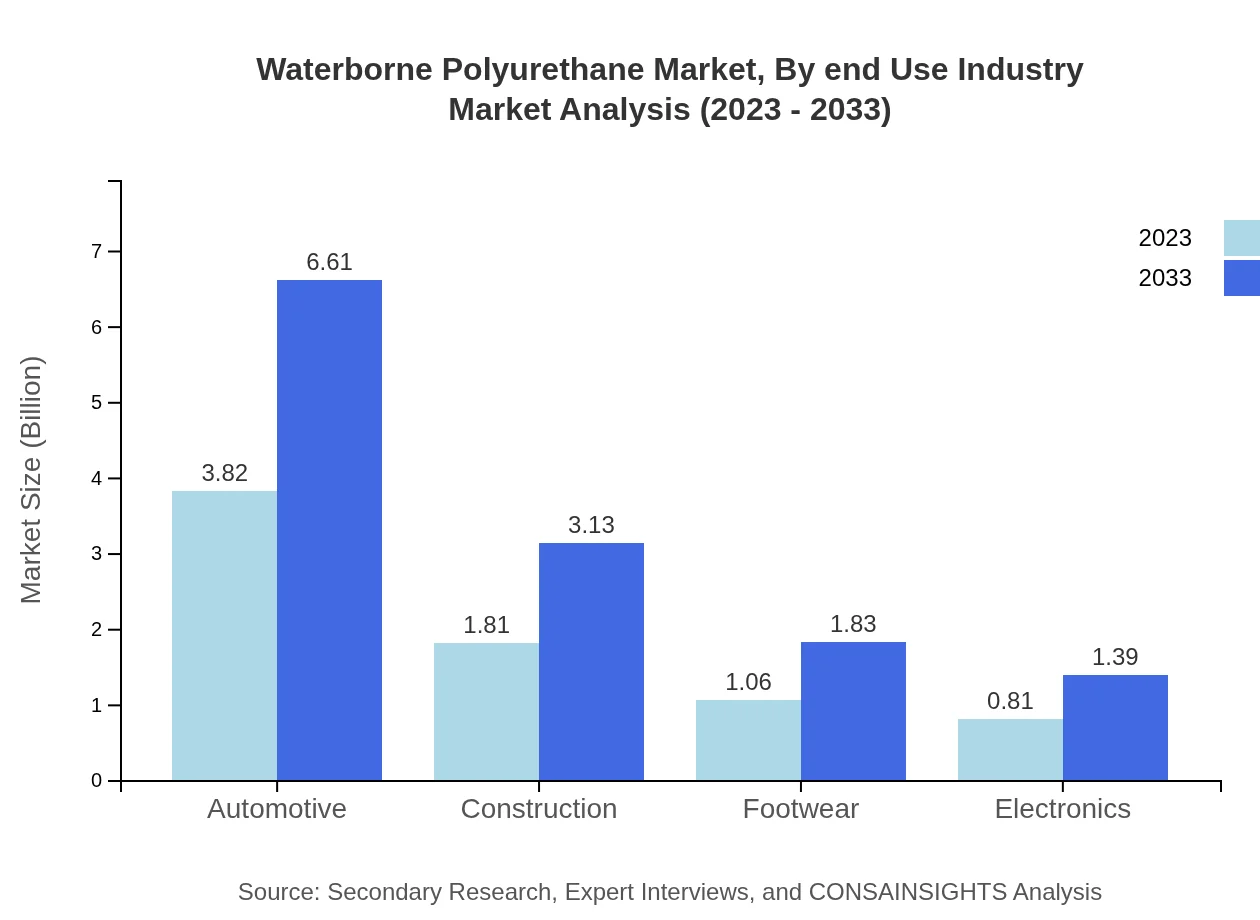

Waterborne Polyurethane Market Analysis By End Use Industry

End-use industries for Waterborne Polyurethane include automotive, construction, footwear, electronics, and textiles. The automotive industry, as noted, holds a significant share at 50.98% in 2023. Construction follows closely with a notable share of 24.15%, signaling the importance of waterborne products in sustainable construction practices, which emphasize low environmental footprints.

Waterborne Polyurethane Market Analysis By Technology

Latest technological advancements in the Waterborne Polyurethane market focus on enhancing product formulations to improve performance and sustainability. Innovations in manufacturing methodologies, such as the adoption of nanotechnology and bio-based raw materials, are prominently shaping the landscape. These technologies aim to produce high-performance waterborne polyurethanes that comply with stringent environmental regulations while offering superior durability and usability.

Waterborne Polyurethane Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Waterborne Polyurethane Industry

BASF SE:

BASF SE, a German chemical company, leads the production of waterborne polyurethanes globally, focusing on sustainability and high-performance solutions for various applications, including coatings and adhesives.Huntsman Corporation:

Huntsman Corporation specializes in chemistry for a diverse range of industries and offers innovative waterborne polyurethane systems, strengthening their position through technological advancements and product variety.Covestro AG:

Covestro AG is committed to developing sustainable materials and is a prominent player in the waterborne polyurethane market, focusing on high-performance solutions in coatings and adhesives.Dow Inc.:

Dow Inc. offers a broad range of waterborne polyurethane technologies catering to various industries, prioritizing innovation and environmental sustainability in their product offerings.Eastman Chemical Company:

Eastman Chemical Company is known for its specialty chemicals, including advanced waterborne polyurethane solutions that meet stringent industry regulations and customer demands for sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of waterborne polyurethane?

The global waterborne polyurethane market was valued at approximately $7.5 billion in 2023 and is projected to grow at a CAGR of 5.5%, reaching around $13 billion by 2033. This growth reflects increasing demand across various sectors.

What are the key market players or companies in the waterborne polyurethane industry?

Key players in the waterborne polyurethane market include BASF, Covestro AG, Wanhua Chemical Group, and Dow Chemical Company. These companies significantly influence market trends through innovations and sustainable product offerings.

What are the primary factors driving the growth in the waterborne polyurethane industry?

Growth in the waterborne polyurethane industry is driven by increased demand in automotive and construction sectors, stringent environmental regulations promoting eco-friendly materials, and rising consumer preference for sustainable and durable products.

Which region is the fastest Growing in the waterborne polyurethane market?

The Asia Pacific region is the fastest-growing market for waterborne polyurethane, projected to grow from $1.50 billion in 2023 to $2.60 billion by 2033. This growth is fueled by rapid industrialization and increasing manufacturing activities.

Does ConsaInsights provide customized market report data for the waterborne polyurethane industry?

Yes, ConsaInsights offers tailored market report data for the waterborne polyurethane industry, allowing clients to request specific information that meets their unique business needs and strategic goals.

What deliverables can I expect from this waterborne polyurethane market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, competitive landscape reports, trend forecasts, regional market data, and segment insights, providing a holistic view of the waterborne polyurethane market.

What are the market trends of waterborne polyurethane?

Current market trends in waterborne polyurethane include a shift towards solvent-free formulations, increased use in high-performance coatings, and rising applications in electronics and automotive, highlighting the material's versatility and sustainability.