Wireless Temperature Sensors Market Report

Published Date: 31 January 2026 | Report Code: wireless-temperature-sensors

Wireless Temperature Sensors Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides valuable insights into the Wireless Temperature Sensors market, including market size, growth rate, technological advancements, and competitive landscape from 2023 to 2033.

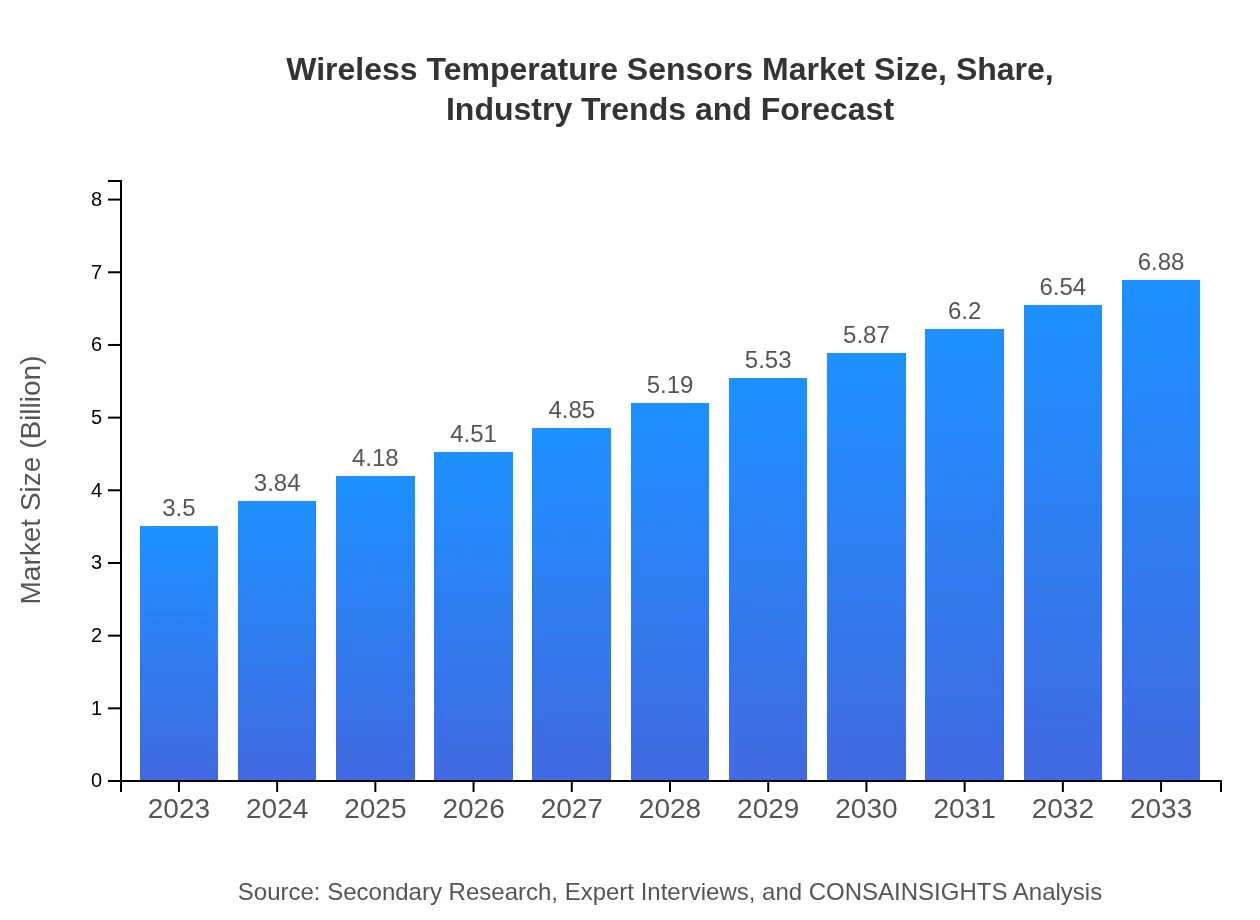

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Honeywell International Inc., Siemens AG, Emerson Electric Co., Thermo Fisher Scientific, Texas Instruments Inc. |

| Last Modified Date | 31 January 2026 |

Wireless Temperature Sensors Market Overview

Customize Wireless Temperature Sensors Market Report market research report

- ✔ Get in-depth analysis of Wireless Temperature Sensors market size, growth, and forecasts.

- ✔ Understand Wireless Temperature Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wireless Temperature Sensors

What is the Market Size & CAGR of Wireless Temperature Sensors market in 2023 and 2033?

Wireless Temperature Sensors Industry Analysis

Wireless Temperature Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wireless Temperature Sensors Market Analysis Report by Region

Europe Wireless Temperature Sensors Market Report:

The European market for Wireless Temperature Sensors is predicted to grow significantly from $0.98 billion in 2023 to $1.94 billion by 2033. Compliance with stringent environmental regulations and a strong focus on sustainability propel the adoption of wireless technologies in this region.Asia Pacific Wireless Temperature Sensors Market Report:

The Asia Pacific region is expected to witness substantial growth, with the market projected to grow from $0.67 billion in 2023 to $1.31 billion in 2033. Key markets in this region include China and India, where the rapid industrialization and growth of the manufacturing sector promote extensive use of wireless temperature sensors for real-time data acquisition.North America Wireless Temperature Sensors Market Report:

North America is anticipated to be the largest market, growing from $1.32 billion in 2023 to $2.60 billion in 2033. The region benefits from a strong presence of key industry players and robust technological infrastructure that supports the widespread deployment of advanced wireless sensing solutions.South America Wireless Temperature Sensors Market Report:

In South America, the Wireless Temperature Sensors market is forecasted to expand from $0.34 billion in 2023 to $0.66 billion by 2033. The increasing focus on agricultural development and environmental management practices is propelling the adoption of wireless sensors across the region.Middle East & Africa Wireless Temperature Sensors Market Report:

In the Middle East and Africa, the market is expected to grow from $0.19 billion in 2023 to $0.38 billion in 2033, driven by improvements in healthcare infrastructures and increasing demands for effective monitoring solutions in various sectors.Tell us your focus area and get a customized research report.

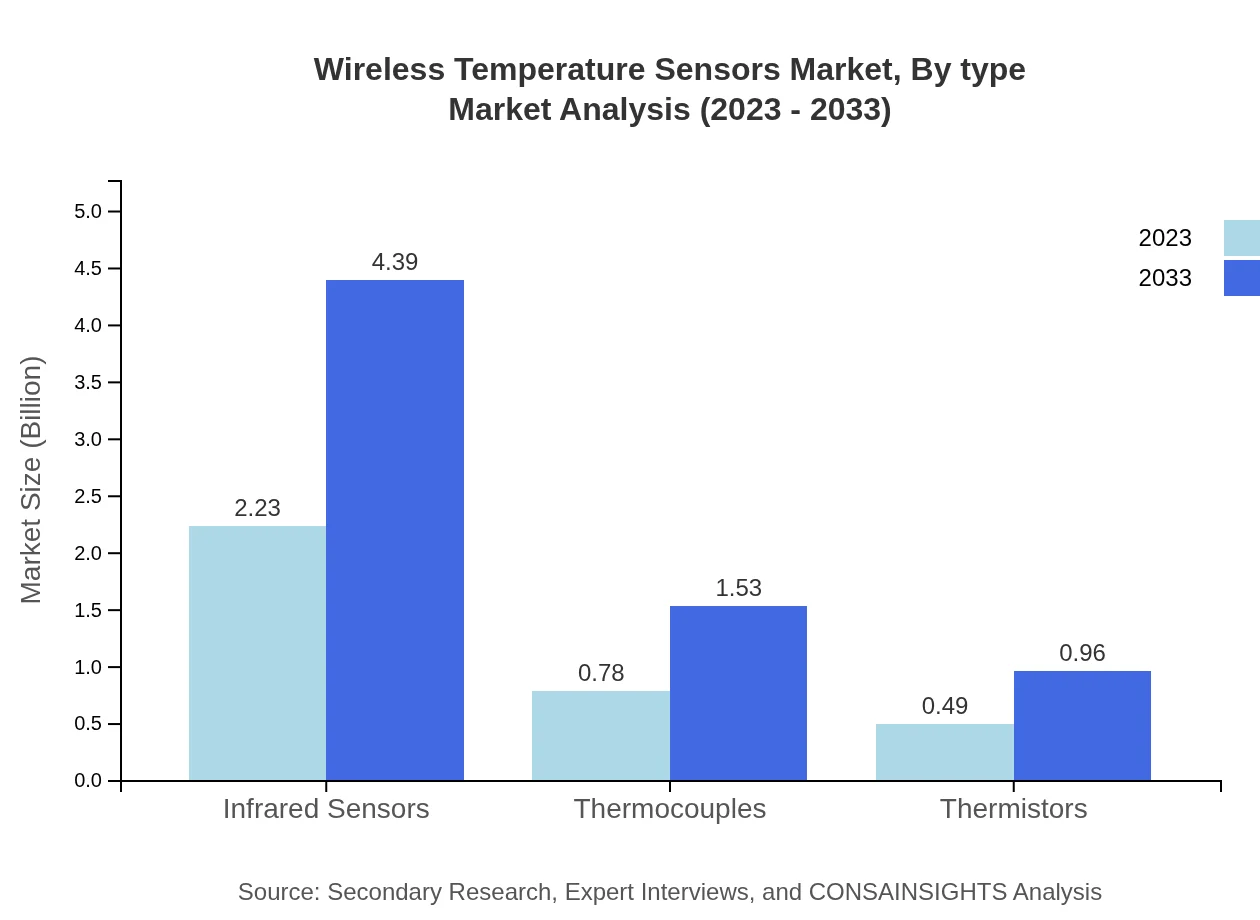

Wireless Temperature Sensors Market Analysis By Type

The performance of different types of wireless temperature sensors reveals market structures that reflect their unique applications. For 2023, infrared sensors dominate with an estimated market size of $2.23 billion, expected to grow to $4.39 billion by 2033, capturing a substantial market share of approximately 63.77%. Thermocouples and thermistors show a solid presence, with expected market sizes of $0.78 billion and $0.49 billion respectively in 2023, both anticipated to see significant growth by 2033.

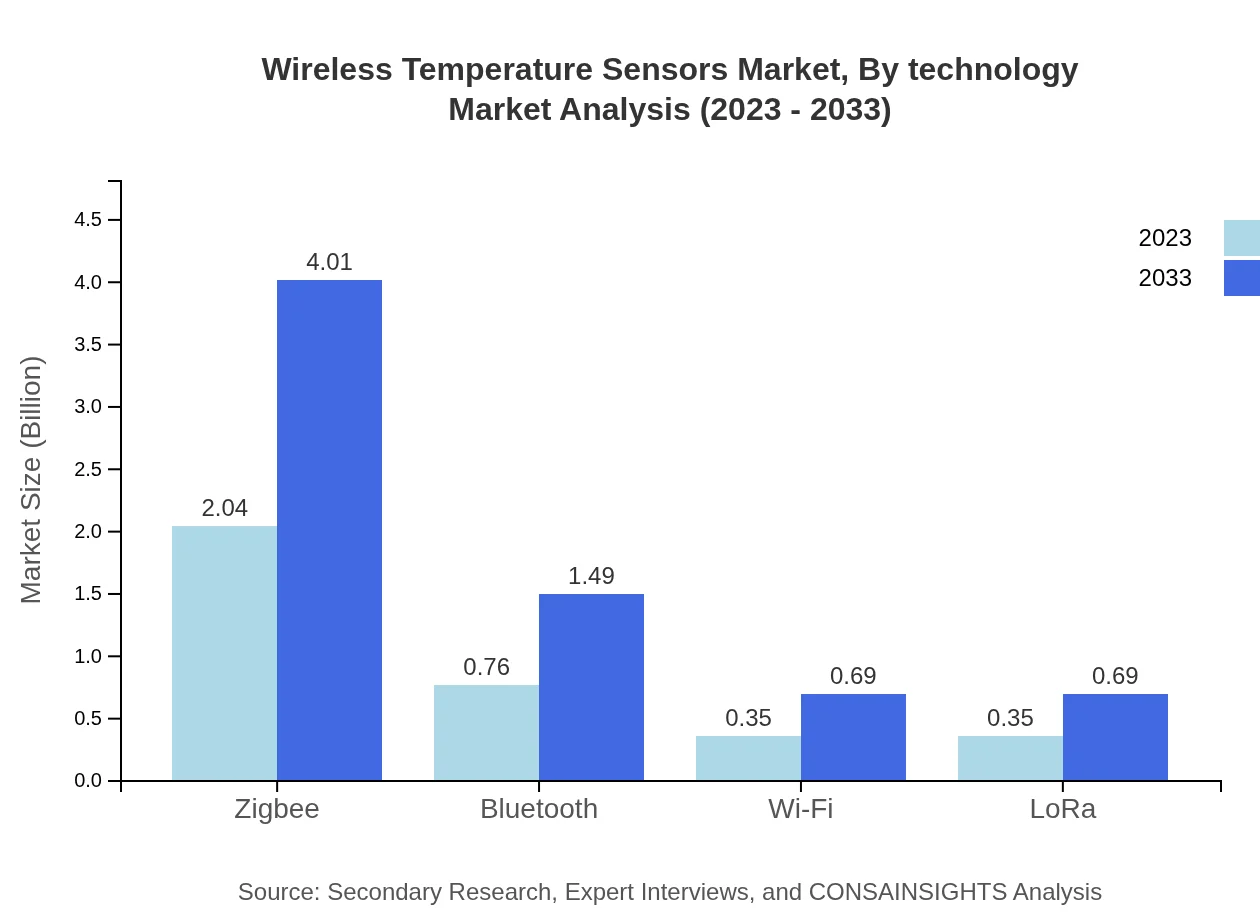

Wireless Temperature Sensors Market Analysis By Technology

The technology segment showcases substantial variation in market performance depending on the deployment setting. Zigbee technology holds a significant position, with a market size of $2.04 billion in 2023, increasing to $4.01 billion by 2033. Bluetooth technology follows closely with a market size of $0.76 billion in 2023, growing to $1.49 billion over the forecast period.

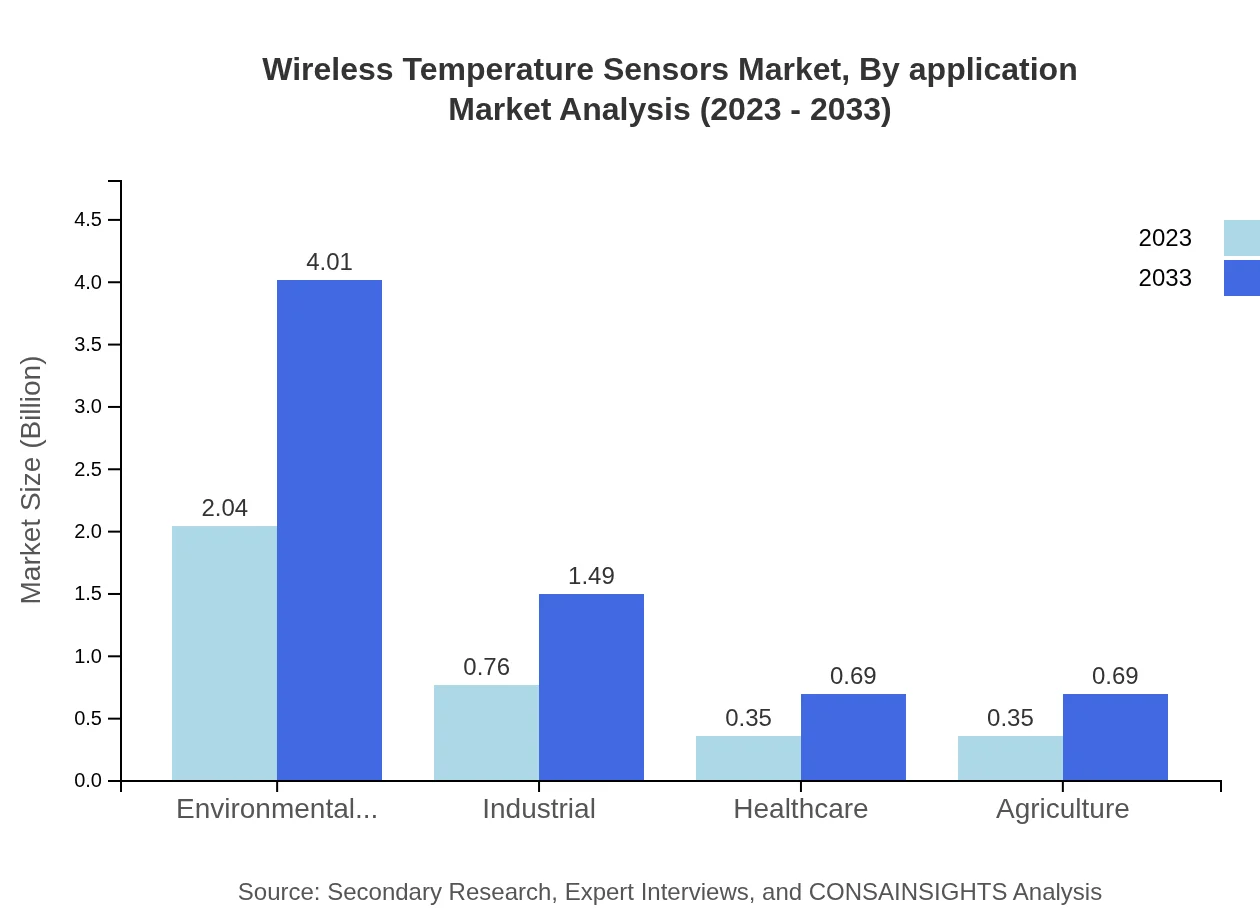

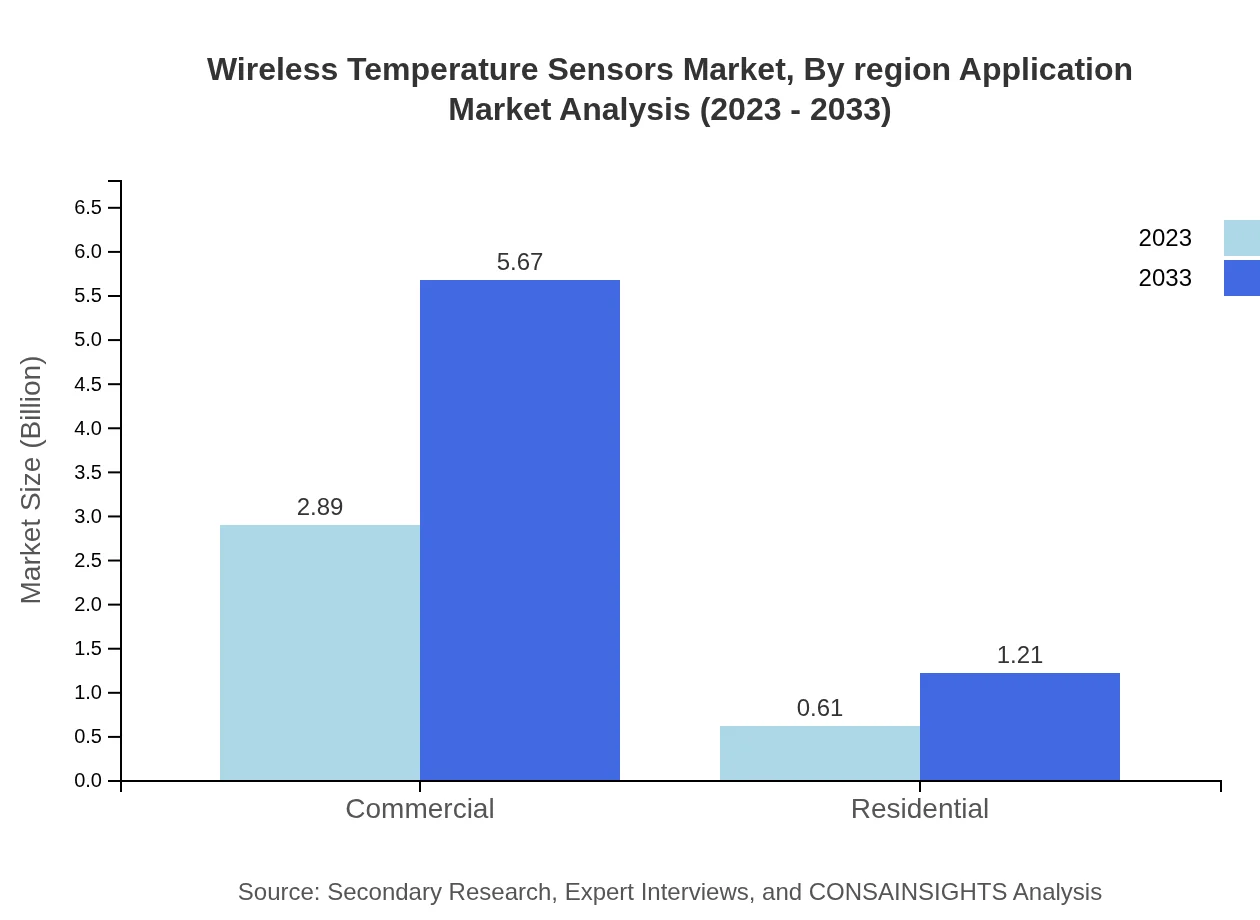

Wireless Temperature Sensors Market Analysis By Application

Applications in the commercial sector lead the market, with a size of $2.89 billion in 2023, set to reach approximately $5.67 billion by 2033. This segment represents a significant share of 82.43%. The healthcare sector also shows promise, with its market size expected to expand from $0.76 billion in 2023 to $1.49 billion by 2033.

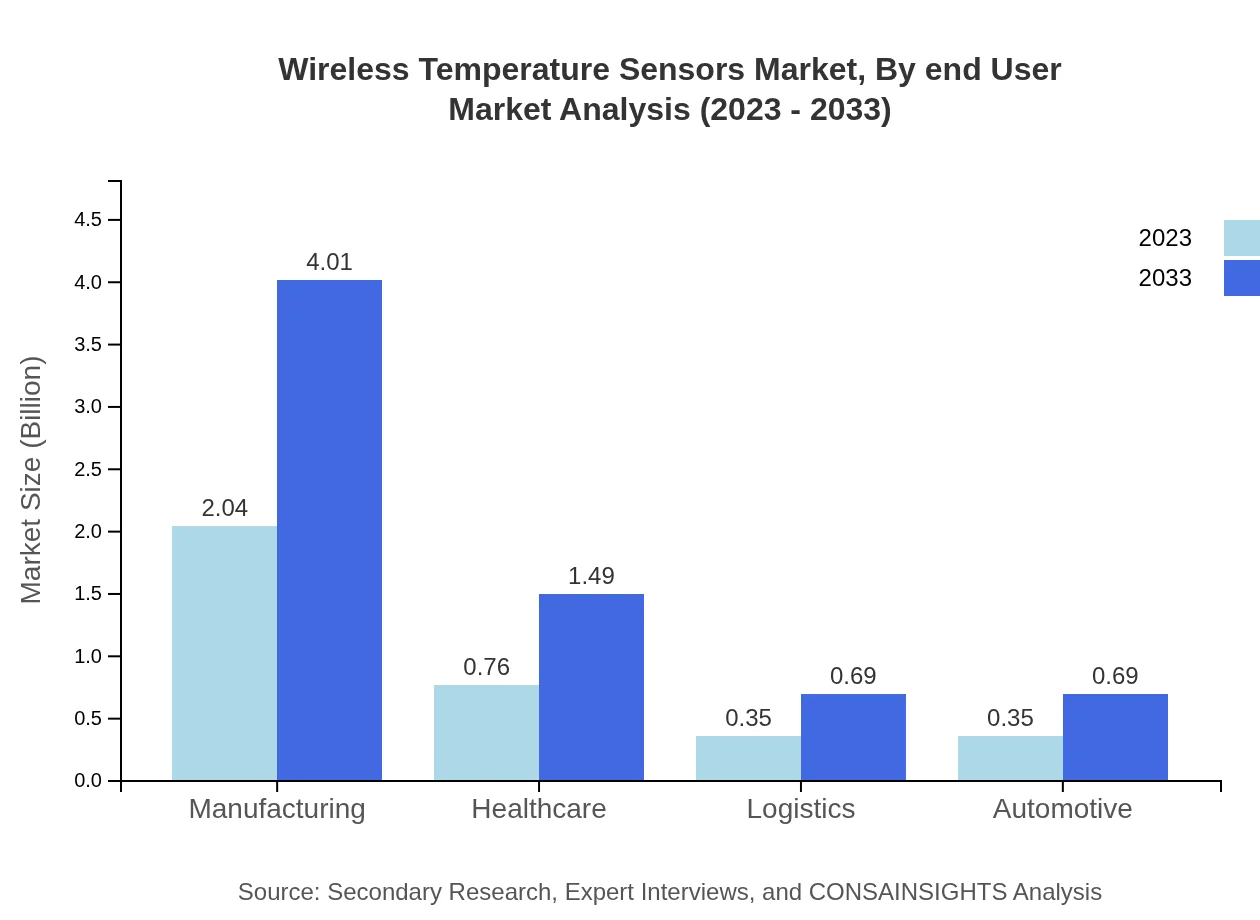

Wireless Temperature Sensors Market Analysis By End User

The industry shows growth across various end-user segments, with manufacturing leading at a size of $2.04 billion in 2023, projected to rise to $4.01 billion by 2033, thus holding an impressive segment share of 58.33%. Other key sectors include logistics, automotive, and agriculture, each experiencing a steady rise in adoption rates.

Wireless Temperature Sensors Market Analysis By Region Application

By region, North America is poised to capture a major share of the Wireless Temperature Sensors market across applications, with the healthcare and manufacturing sectors driving growth. Europe also plays a crucial role, with legislative measures enhancing the need for efficient temperature monitoring solutions, especially in environmental sector applications.

Wireless Temperature Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wireless Temperature Sensors Industry

Honeywell International Inc.:

A renowned leader in automation and connectivity solutions, Honeywell provides advanced wireless temperature sensing solutions tailored to various industrial applications.Siemens AG:

Siemens is a major player in the industrial automation sector, offering reliable wireless temperature sensors integrated with IoT platforms for enhanced operational efficiency.Emerson Electric Co.:

Emerson specializes in automation technologies, providing a wide range of wireless temperature sensors designed for accurate monitoring in demanding environments.Thermo Fisher Scientific:

A global leader in laboratory equipment, Thermo Fisher offers a comprehensive line of wireless temperature sensors for healthcare and environmental monitoring applications.Texas Instruments Inc.:

Texas Instruments develops advanced sensing technologies and contributes significantly to the wireless temperature sensor market through innovative solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of wireless temperature sensors?

The wireless temperature sensors market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching a significant market size over the next decade. This growth reflects the increasing demand for temperature monitoring in various industries.

What are the key market players or companies in this industry?

Key players in the wireless temperature sensors market include renowned companies that specialize in manufacturing sensor technologies. These companies are continuously innovating to enhance product offerings, drive revenue growth, and implement advanced technologies to maintain competitive advantages.

What are the primary factors driving the growth in the wireless temperature sensors industry?

Factors such as the rise in automation, demand for precision in temperature monitoring, and the integration of IoT technologies are driving significant growth in the wireless temperature sensors market. This growth is further fueled by increased applications across various sectors.

Which region is the fastest Growing in the wireless temperature sensors market?

North America is the fastest-growing region for wireless temperature sensors, expected to expand from $1.32 billion in 2023 to $2.60 billion by 2033. Europe and Asia-Pacific also show promising growth, highlighting the global adoption of advanced sensor technologies.

Does ConsaInsights provide customized market report data for the wireless temperature sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the wireless temperature sensors industry. Clients can obtain detailed insights that fit their unique research necessities, ensuring effective decision-making and strategic planning.

What deliverables can I expect from this wireless temperature sensors market research project?

You can expect comprehensive deliverables, including detailed market size analysis, growth projections, competitive landscape assessments, and insights into key market trends and segmentation data, helping professionals make informed decisions in the wireless temperature sensors market.

What are the market trends of wireless temperature sensors?

Current trends in the wireless temperature sensors market include increasing integration of IoT, demand for real-time data monitoring, and advancements in wireless technologies like Bluetooth and Zigbee, which enhance sensor performance and operational efficiency.