3d Printing Medical Devices Market Report

Published Date: 22 January 2026 | Report Code: 3d-printing-medical-devices

3d Printing Medical Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the 3D printing medical devices market from 2023 to 2033, focusing on market size, segmentation, regional insights, technology advancements, and key players shaping the future of this industry.

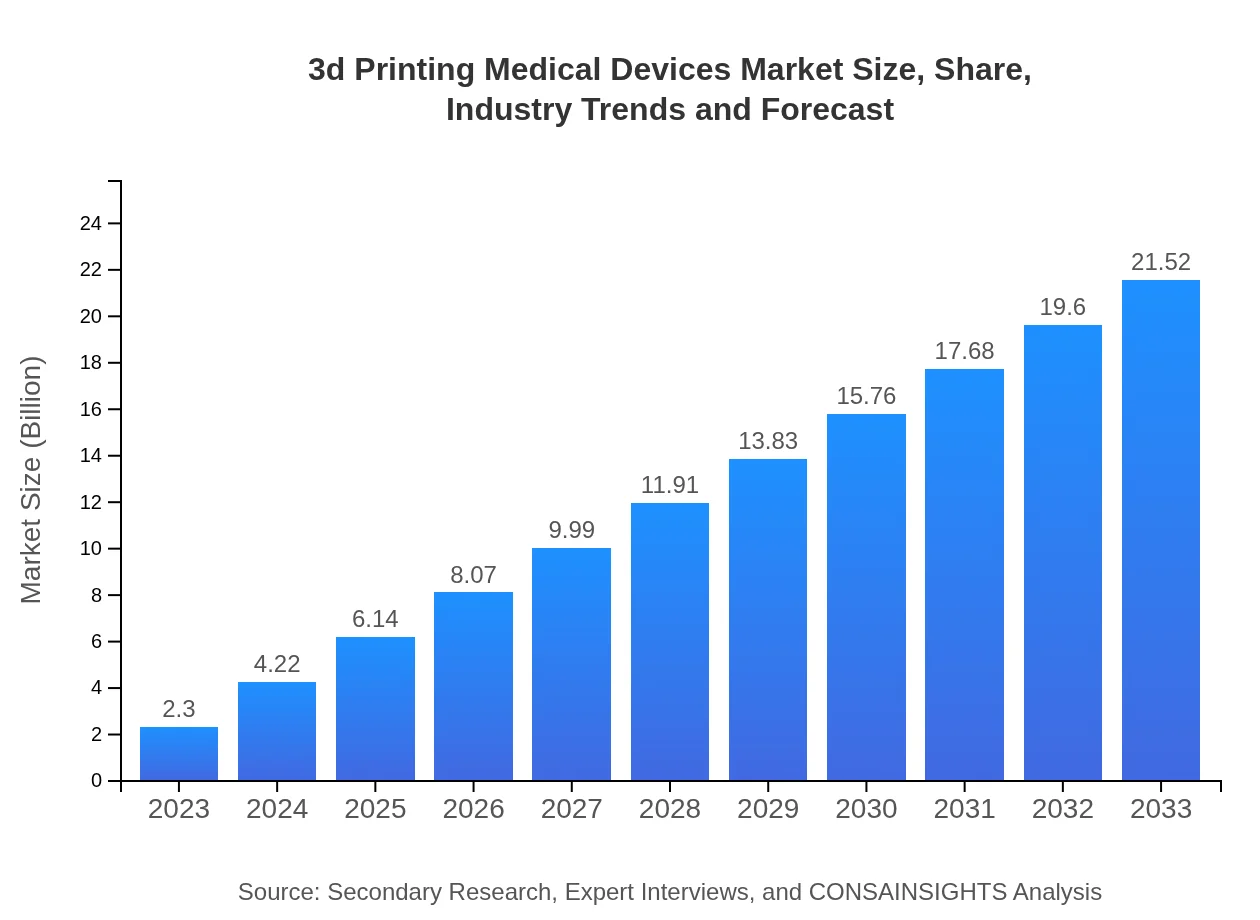

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.30 Billion |

| CAGR (2023-2033) | 23.5% |

| 2033 Market Size | $21.52 Billion |

| Top Companies | Stratasys Ltd., 3D Systems Corporation, Materialise NV, Cerhum, Nanoscribe GmbH |

| Last Modified Date | 22 January 2026 |

3d Printing Medical Devices Market Overview

Customize 3d Printing Medical Devices Market Report market research report

- ✔ Get in-depth analysis of 3d Printing Medical Devices market size, growth, and forecasts.

- ✔ Understand 3d Printing Medical Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 3d Printing Medical Devices

What is the Market Size & CAGR of 3d Printing Medical Devices market in 2023?

3d Printing Medical Devices Industry Analysis

3d Printing Medical Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

3d Printing Medical Devices Market Analysis Report by Region

Europe 3d Printing Medical Devices Market Report:

The European market was valued at $0.73 billion in 2023 and is expected to reach $6.85 billion by 2033. The presence of established players and strong regulatory support drive the market, alongside increasing integration of 3D printing technology in the European Union's healthcare systems.Asia Pacific 3d Printing Medical Devices Market Report:

In the Asia Pacific region, the 3D printing medical devices market was valued at $0.43 billion in 2023 and is projected to reach $4.03 billion by 2033. The growth is driven by advancements in healthcare, the rise of medical tourism, and government initiatives to enhance medical infrastructure, particularly in countries like China and India.North America 3d Printing Medical Devices Market Report:

North America commands the largest share of the market, with a valuation of $0.87 billion in 2023 expected to rise to $8.12 billion by 2033. Key factors driving growth include significant investments by healthcare providers, technological advancements, and robust regulatory frameworks that foster innovation in medical device manufacturing.South America 3d Printing Medical Devices Market Report:

The South American market is relatively smaller, valued at $0.01 billion in 2023, but is expected to grow to $0.11 billion by 2033. Economic developments and increasing healthcare investments are poised to uplift the market in this region, albeit at a slower pace compared to others.Middle East & Africa 3d Printing Medical Devices Market Report:

The market in the Middle East and Africa is growing, with a valuation of $0.26 billion in 2023 projected to increase to $2.41 billion by 2033. The focus on improving healthcare facilities and technology adoption in countries like the UAE and South Africa is contributing to market growth.Tell us your focus area and get a customized research report.

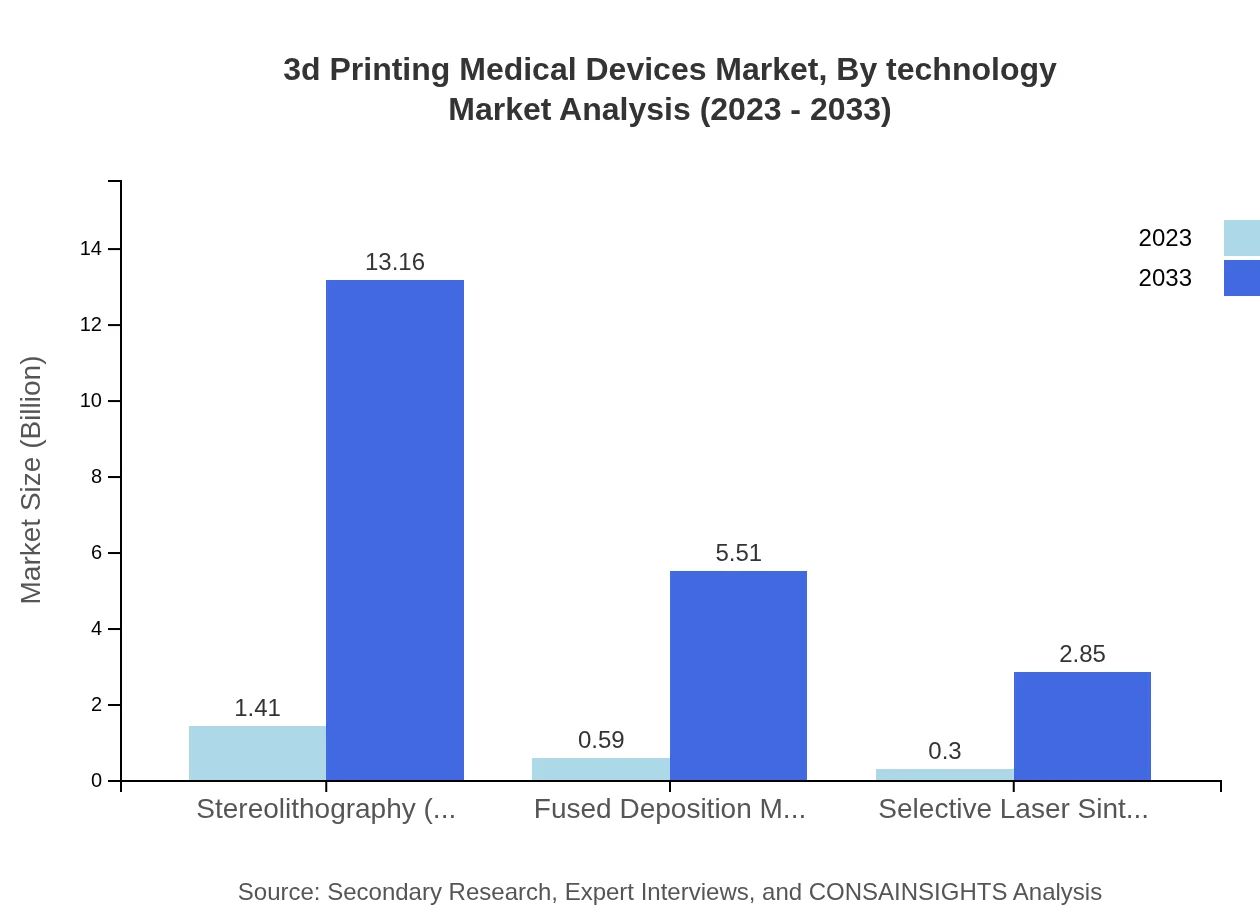

3d Printing Medical Devices Market Analysis By Technology

The most prominent technologies in this market include Stereolithography (SLA), Fused Deposition Modeling (FDM), and Selective Laser Sintering (SLS). In 2023, SLA leads the market with a size of $1.41 billion, while FDM and SLS account for $0.59 billion and $0.30 billion respectively. By 2033, SLA is expected to continue to dominate, reaching $13.16 billion, with FDM at $5.51 billion and SLS at $2.85 billion.

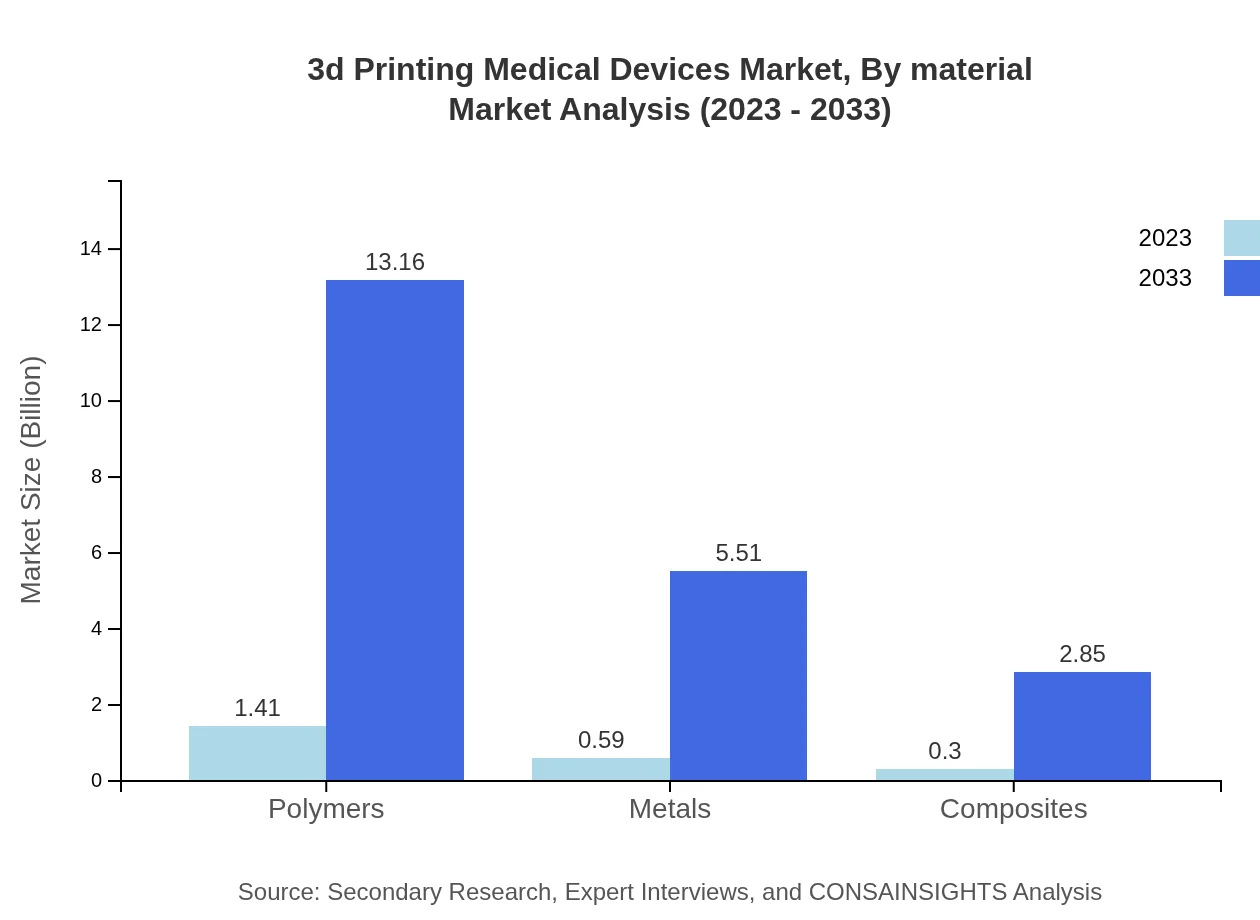

3d Printing Medical Devices Market Analysis By Material

In terms of materials, polymers represent the largest share of the market at $1.41 billion in 2023, growing to $13.16 billion by 2033. Metals come second with a market size of $0.59 billion which will increase to $5.51 billion, whereas composites hold a smaller portion valued at $0.30 billion and forecasted to reach $2.85 billion.

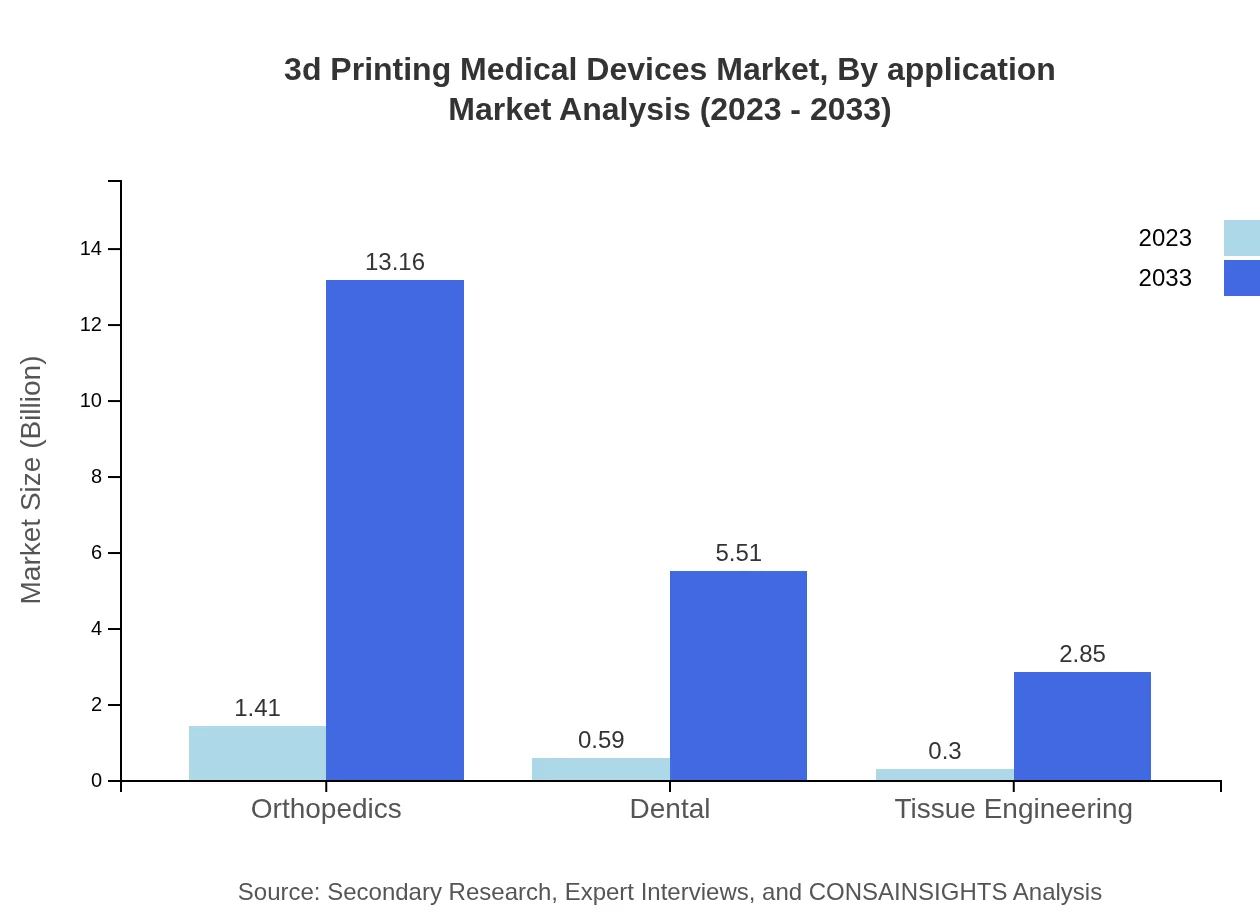

3d Printing Medical Devices Market Analysis By Application

Market segmentation by application showcases orthopedics leading with a 2023 size of $1.41 billion, anticipated to grow to $13.16 billion by 2033. The dental application is valued at $0.59 billion but is also projected to expand to $5.51 billion, highlighting a strong demand for customized dental implants and prosthetics.

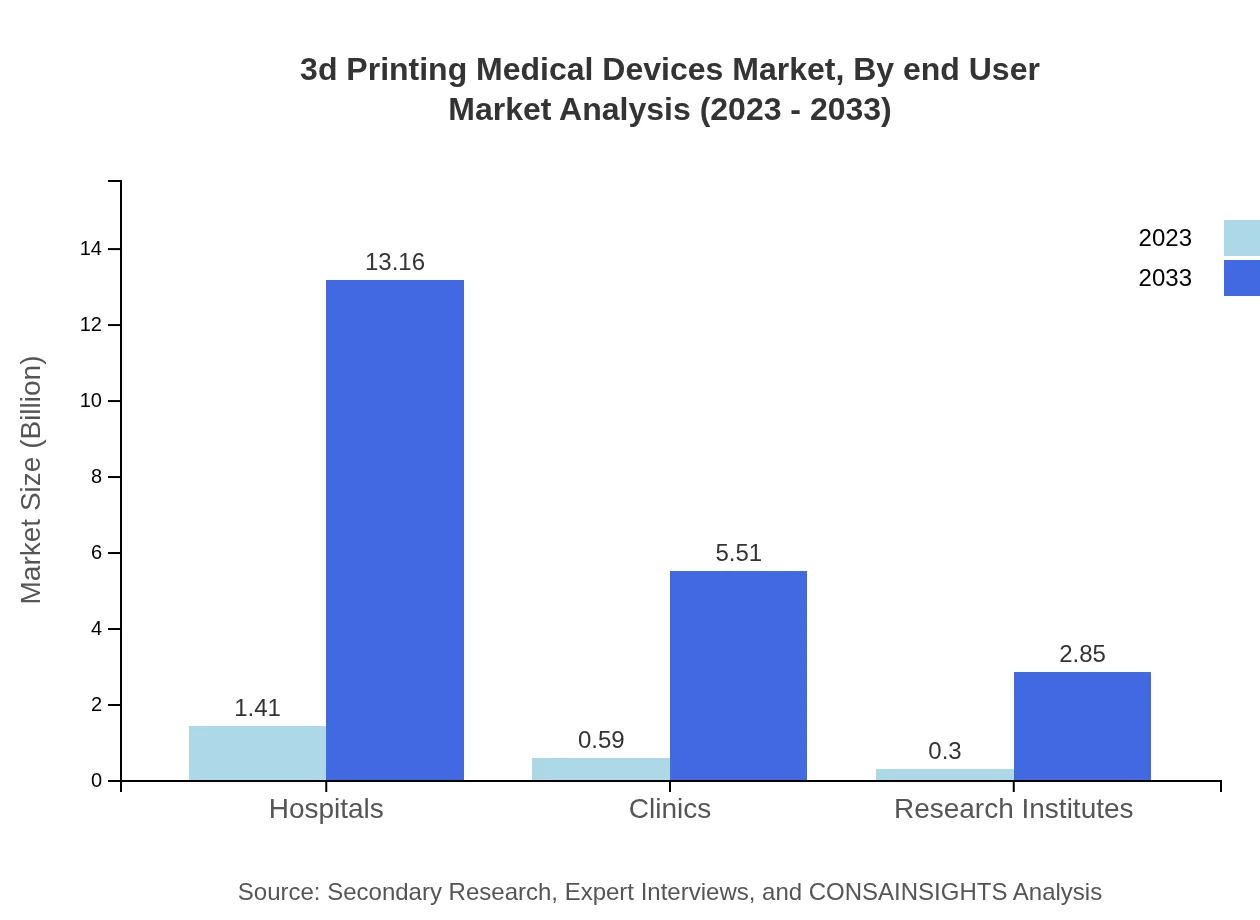

3d Printing Medical Devices Market Analysis By End User

Hospitals dominate the 3D printing medical device market with a size of $1.41 billion in 2023, expected to grow to $13.16 billion by 2033, maintaining a 61.16% market share. Clinics and research institutes follow, accounting for sizes of $0.59 billion and $0.30 billion, projected to expand correspondingly.

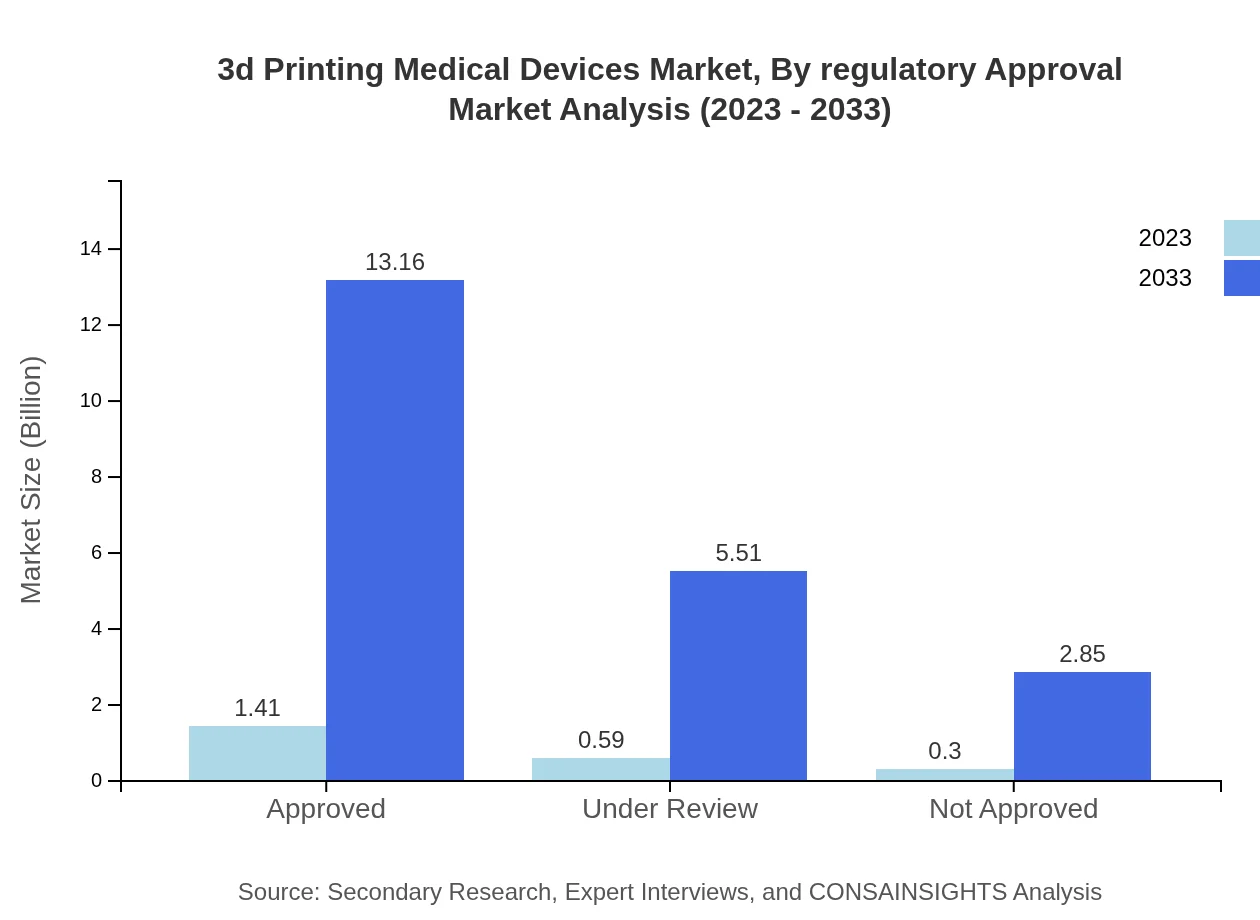

3d Printing Medical Devices Market Analysis By Regulatory Approval

Devices approved by regulatory agencies accounted for $1.41 billion in 2023, representing the majority share at 61.16%. Under review devices are sizeable, reaching $0.59 billion and projected to grow, while not approved devices currently sit at $0.30 billion with substantial growth potential, indicating a shifting landscape in regulatory approval processes.

3d Printing Medical Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 3d Printing Medical Devices Industry

Stratasys Ltd.:

Stratasys is a leading manufacturer of 3D printing solutions, specializing in additive manufacturing technologies used extensively in creating orthopedic and dental devices.3D Systems Corporation:

3D Systems offers a variety of 3D printing solutions for medical devices, focusing on personalized and precision medicine through its advanced printing technologies.Materialise NV:

Materialise is known for its software and services focused on improving 3D printing applications in the healthcare sector, including customized surgical guides and anatomical models.Cerhum:

Cerhum specializes in the production of 3D printed customized implants, particularly in orthopedics, leveraging extensive research and development in biocompatible materials.Nanoscribe GmbH:

Nanoscribe is focused on microfabrication and is making strides in the development of 3D printed medical devices at nano and micro scales, offering innovative solutions for specific medical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of 3d Printing Medical Devices?

The 3D printing medical devices market is projected to reach a size of approximately $2.3 billion by 2033, with a remarkable CAGR of 23.5% from the current year's market assessment.

What are the key market players or companies in the 3d Printing Medical Devices industry?

Key players in the 3D printing medical devices space include Stratasys Ltd., 3D Systems Corporation, Materialise NV, and Siemens Healthineers, each contributing innovative technologies and market competitive strategies.

What are the primary factors driving the growth in the 3d Printing Medical Devices industry?

Growth in this sector is driven by technological advancements, increasing demand for personalized implants, and a rising prevalence of chronic diseases leading to innovative medical solutions.

Which region is the fastest Growing in the 3d Printing Medical Devices?

North America is the fastest-growing region in the 3D printing medical devices market, expected to grow from $0.87 billion in 2023 to $8.12 billion by 2033, reflecting substantial investments in healthcare innovations.

Does ConsaInsights provide customized market report data for the 3d Printing Medical Devices industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, providing insights, forecasts, and detailed analyses for the 3D printing medical devices industry.

What deliverables can I expect from this 3d Printing Medical Devices market research project?

Deliverables typically include comprehensive reports, market forecasts, competitor analysis, segment insights, and actionable strategies tailored for the 3D printing medical devices market.

What are the market trends of 3d Printing Medical Devices?

Current trends include rapid technological advancements, a focus on patient-specific solutions, increasing applications in orthopedics and dental sectors, and higher regulatory approvals for innovative products.