4k Display Resolution Market Report

Published Date: 31 January 2026 | Report Code: 4k-display-resolution

4k Display Resolution Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the 4k Display Resolution market, highlighting critical insights into its growth, segmentation, and regional performance from 2023 to 2033. The report provides valuable data on the market size, trends, and key players within the industry.

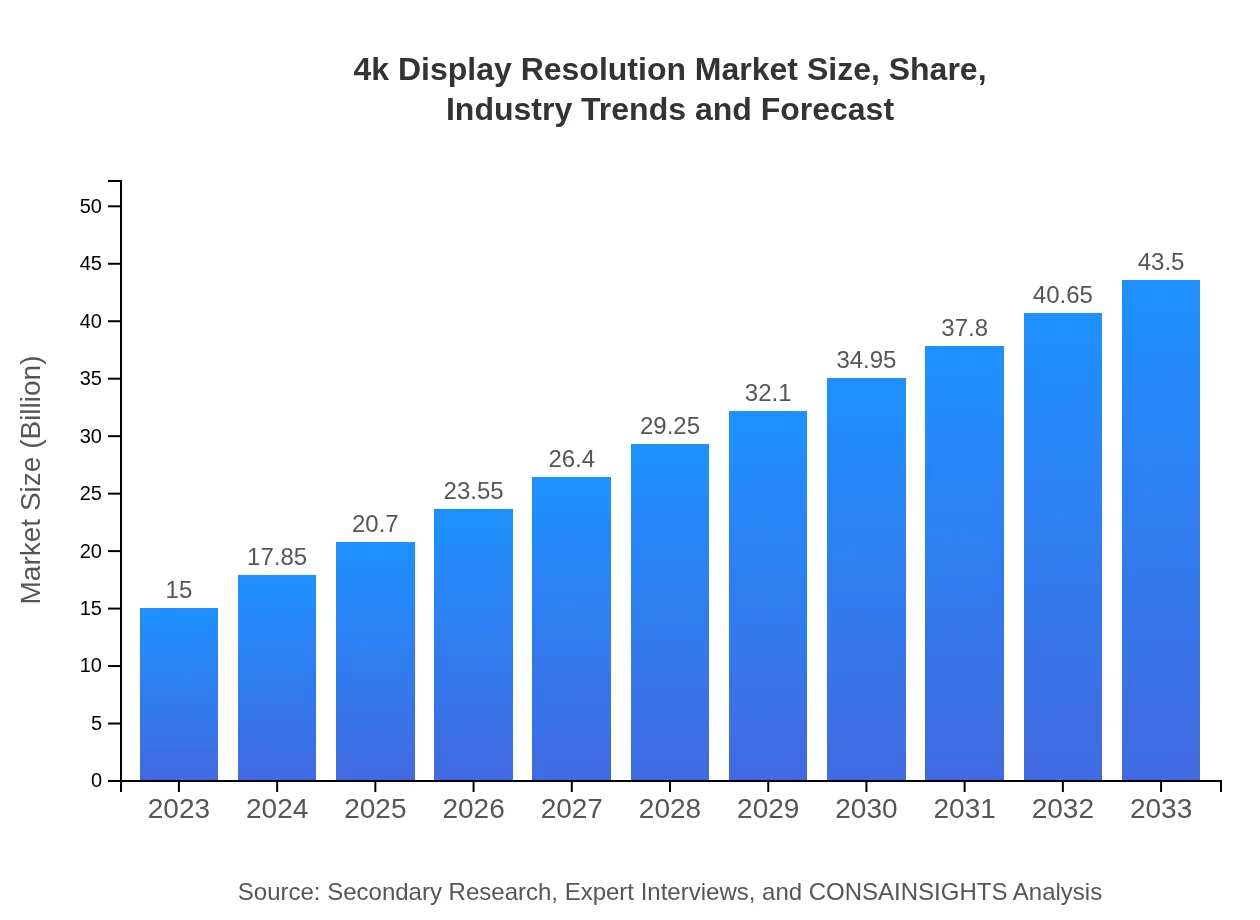

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 10.8% |

| 2033 Market Size | $43.50 Billion |

| Top Companies | Samsung Electronics, LG Electronics, Sony Corporation, TCL Technology |

| Last Modified Date | 31 January 2026 |

4k Display Resolution Market Overview

Customize 4k Display Resolution Market Report market research report

- ✔ Get in-depth analysis of 4k Display Resolution market size, growth, and forecasts.

- ✔ Understand 4k Display Resolution's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in 4k Display Resolution

What is the Market Size & CAGR of 4k Display Resolution market in 2023?

4k Display Resolution Industry Analysis

4k Display Resolution Market Segmentation and Scope

Tell us your focus area and get a customized research report.

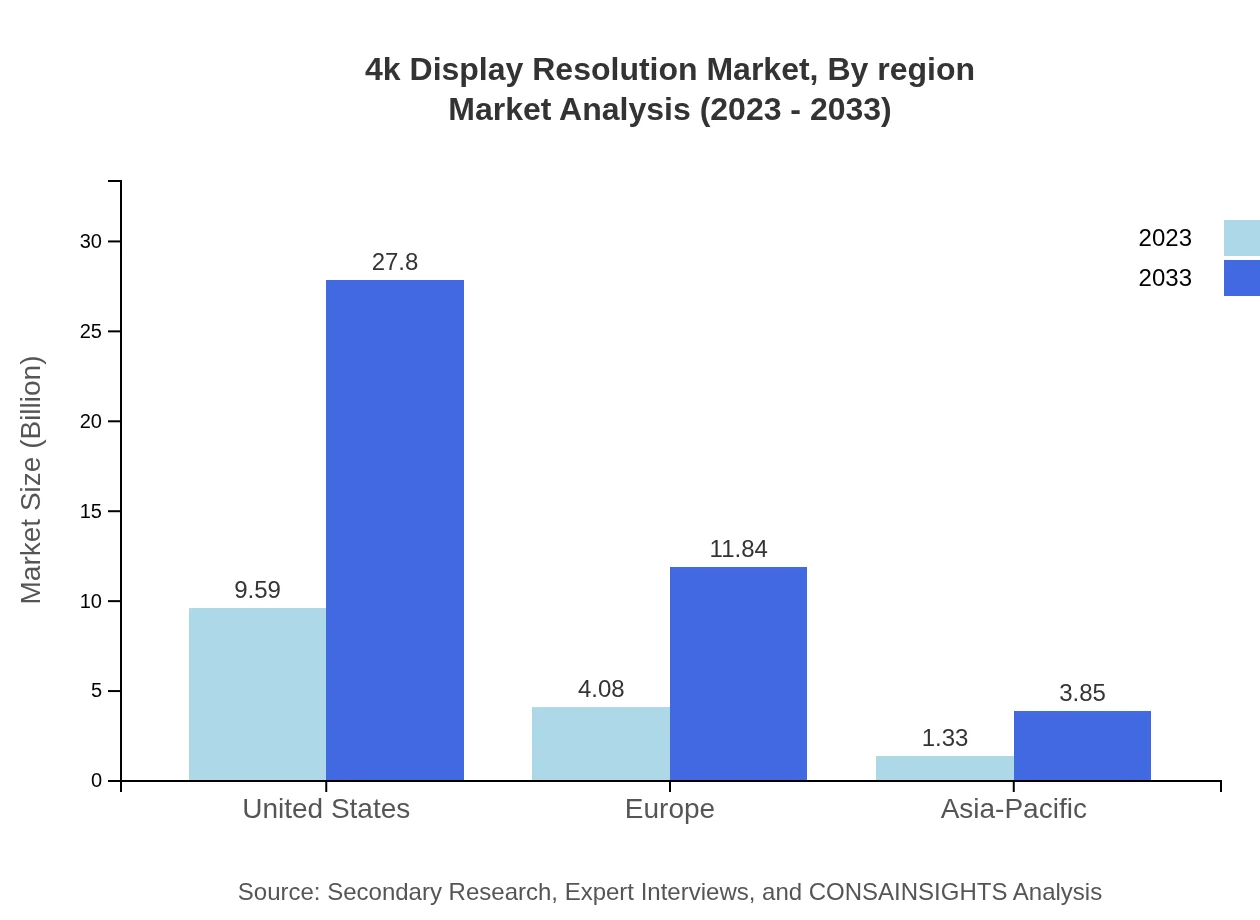

4k Display Resolution Market Analysis Report by Region

Europe 4k Display Resolution Market Report:

Europe's market is expected to grow from USD 4.33 billion in 2023 to USD 12.56 billion in 2033. The increasing adoption of 4k displays in both residential and commercial sectors, coupled with high per capita income, is a significant driver.Asia Pacific 4k Display Resolution Market Report:

The Asia Pacific region is experiencing robust growth in the 4k Display Resolution market, with a projected market size of USD 8.10 billion by 2033, up from USD 2.79 billion in 2023. This growth is primarily driven by increasing consumer electronics penetration, expanding middle class, and the rising demand for 4k content in countries like China, Japan, and South Korea.North America 4k Display Resolution Market Report:

North America holds a significant share of the 4k Display Resolution market, projected to expand from USD 5.81 billion in 2023 to USD 16.84 billion by 2033. The presence of major electronics manufacturers and the strong demand for high-end televisions and devices continue to drive growth in this region.South America 4k Display Resolution Market Report:

In South America, the 4k Display Resolution market is expected to grow from USD 0.99 billion in 2023 to USD 2.88 billion by 2033. Factors contributing to this growth include the improving economic conditions and increased investments in digital infrastructure.Middle East & Africa 4k Display Resolution Market Report:

The Middle East and Africa region is projected to expand from USD 1.07 billion in 2023 to USD 3.11 billion by 2033. Growing urbanization, increasing disposable income, and a growing interest in home entertainment systems are key factors contributing to market growth.Tell us your focus area and get a customized research report.

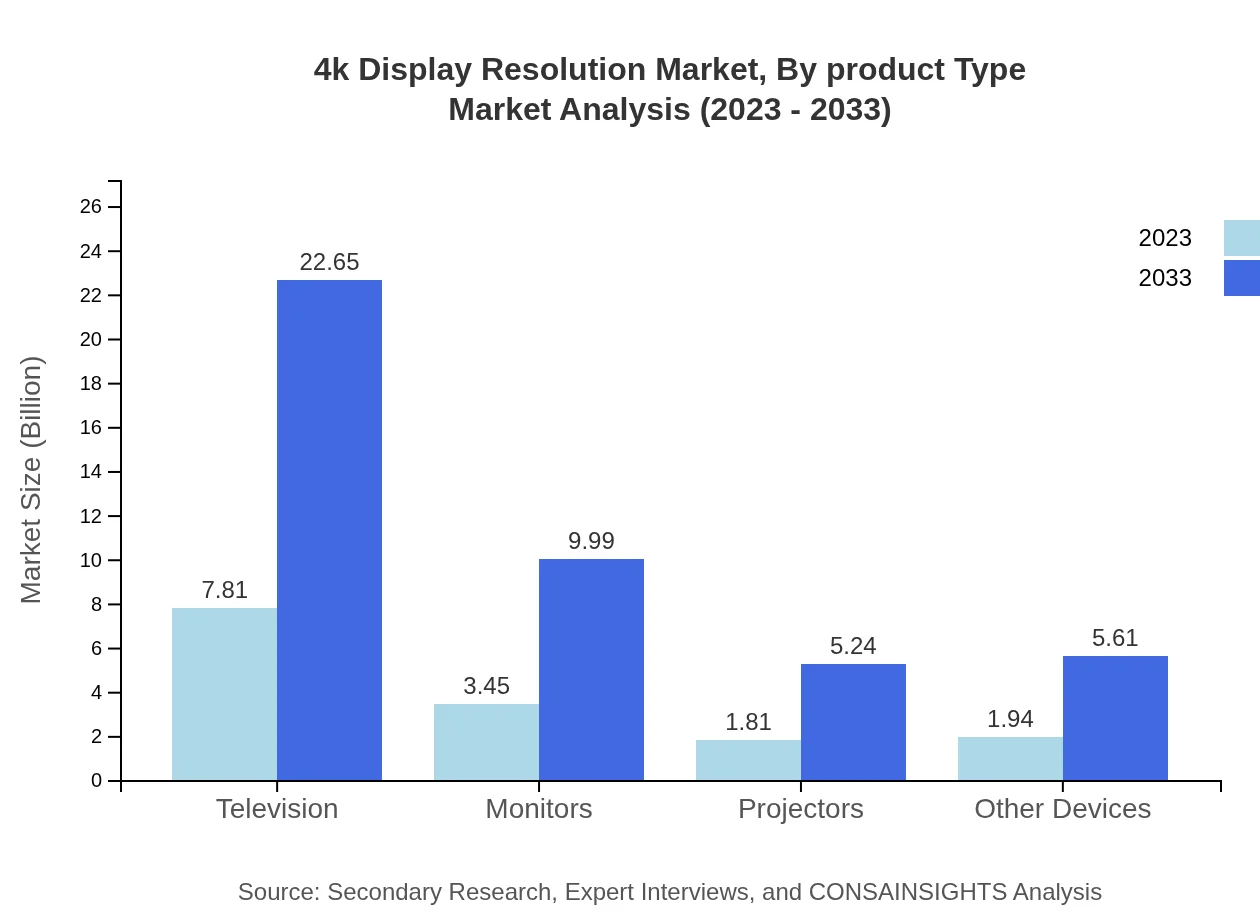

4k Display Resolution Market Analysis By Product Type

The market for 4k displays by product type includes televisions, monitors, projectors, and other devices. Televisions form the dominant product segment, making up approximately 52.08% of the market share in 2023, expected to rise to 53% in 2033. Monitors represent about 22.97% of the market share currently, predicted to maintain similar figures due to the growing demand for 4k displays in professional applications.

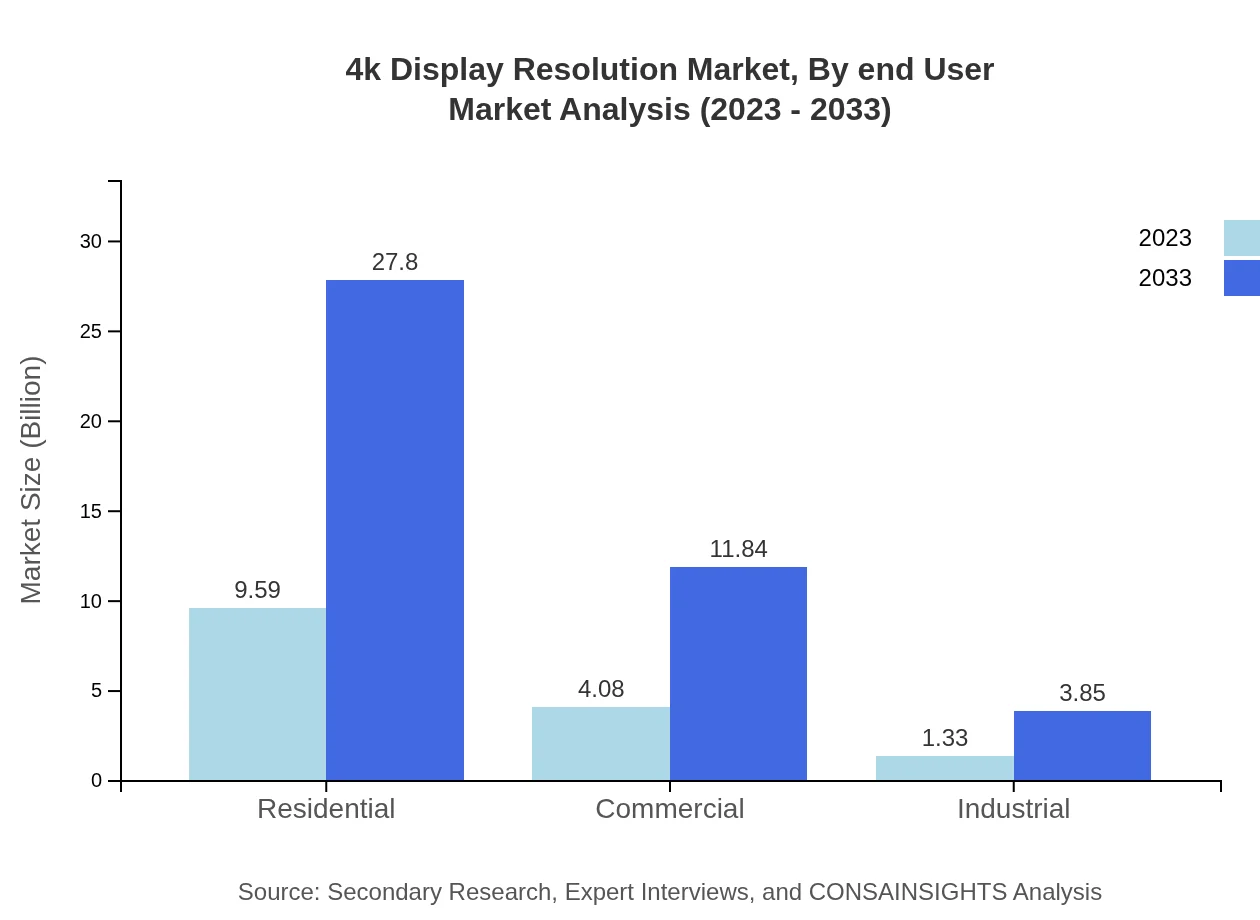

4k Display Resolution Market Analysis By End User

The analysis by end-user illustrates a strong preference for residential usage, accounting for 63.92% of the market share in 2023. Commercial usage, however, exhibits growing adoption trends, currently capturing 27.23% market share and expected to expand accordingly due to businesses upgrading their display technologies.

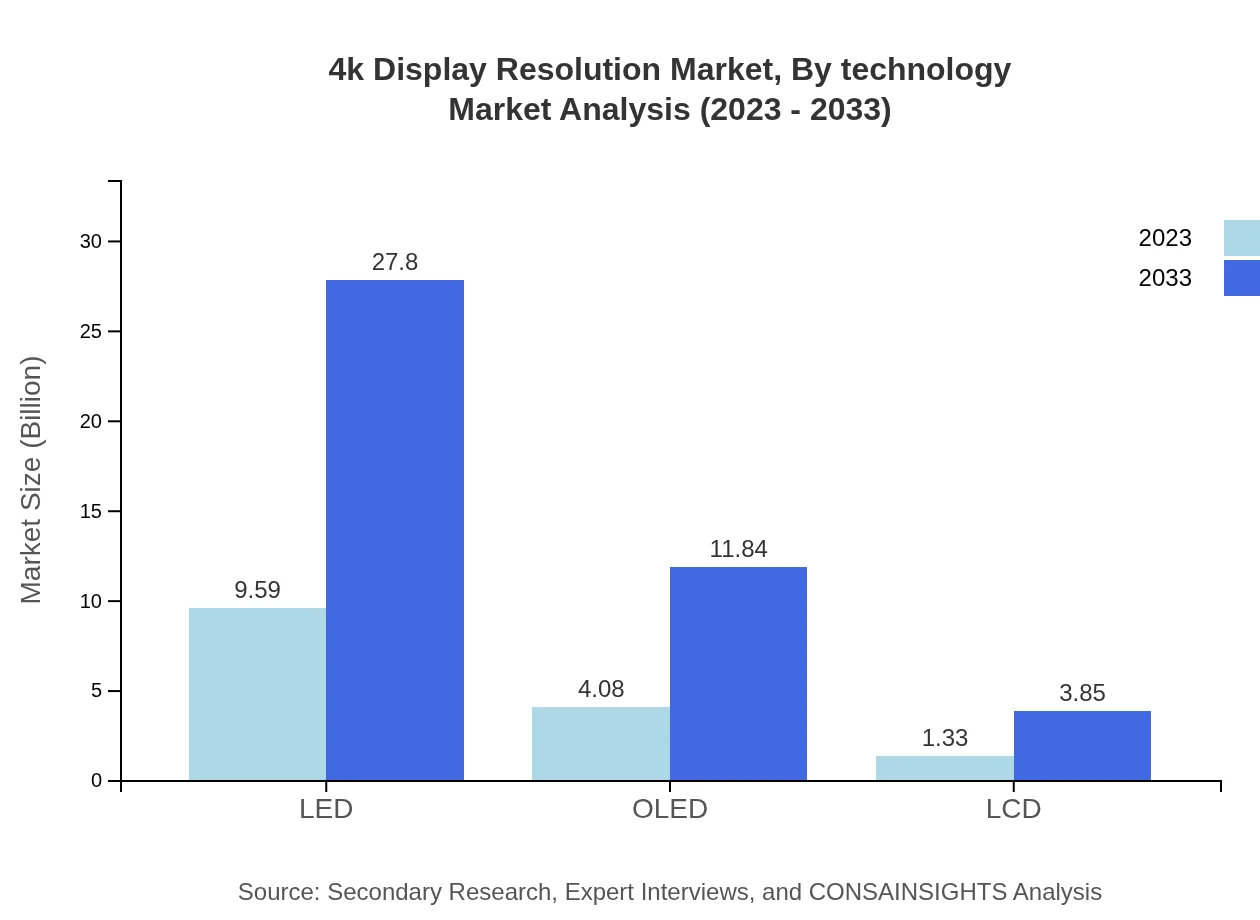

4k Display Resolution Market Analysis By Technology

This segment reveals a substantial dominance of LED technology in the 4k Display market, comprising around 63.92% of the market share in 2023 despite competition from OLED and LCD technologies. OLED's share is projected to remain strong given its performance superiority in contrast and color representation.

4k Display Resolution Market Analysis By Distribution Channel

The distribution channel analysis indicates that online channels contribute significantly to sales, making up 87.71% of the market share in 2023. This is attributed to increasing consumer preference for online shopping and promotional activities, while offline channels still maintain a significant presence.

4k Display Resolution Market Analysis By Region

Regionally, the North America market leads with a significant market size and high growth rate, followed by Europe and Asia Pacific. This segmentation showcases insights into pricing strategy and competitive behaviors among leading manufacturers.

4k Display Resolution Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in 4k Display Resolution Industry

Samsung Electronics:

A leading manufacturer in the electronics space, Samsung is known for its innovative 4k display technologies including QLED and UHD TV offerings that cater to a wide consumer base.LG Electronics:

Known for its OLED technologies, LG has been at the forefront of 4k display technologies, focusing on premium quality and consumer-focused features to enhance entertainment experiences.Sony Corporation:

Sony's expertise in high-definition video content and display technology has positioned it as a significant player in the 4k market. The company's BRAVIA series has gained traction for quality and performance.TCL Technology:

A prominent figure in the consumer electronics market, TCL provides affordable yet high-quality 4k televisions and displays, significantly increasing its market share in recent years.We're grateful to work with incredible clients.

FAQs

What is the market size of 4k Display Resolution?

The 4K display resolution market is projected to reach approximately $15 billion by 2033, growing at a CAGR of 10.8% from 2023 to 2033, indicating a robust demand for high-resolution displays.

What are the key market players or companies in this 4k Display Resolution industry?

The key players in the 4K display resolution market include LG Electronics, Samsung, Sony, Panasonic, and Dell Technologies, among others. These companies are pivotal in driving innovation and enhancing product offerings across segments.

What are the primary factors driving the growth in the 4k Display Resolution industry?

Growth in the 4K display resolution industry is fueled by increasing demand for high-definition content, technological advancements in display technology, growing adoption of 4K TVs and monitors, and an expanding gaming industry with higher resolution capabilities.

Which region is the fastest Growing in the 4k Display Resolution?

North America is anticipated to be the fastest-growing region in the 4K display resolution market, with market size expected to increase from $5.81 billion in 2023 to $16.84 billion by 2033, reflecting strong consumer interest.

Does ConsaInsights provide customized market report data for the 4k Display Resolution industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the 4K display resolution industry, allowing for detailed analysis and insights based on individual requirements.

What deliverables can I expect from this 4k Display Resolution market research project?

From a 4K display resolution market research project, clients can expect comprehensive reports, including market size data, growth forecasts, regional insights, competitive analysis, and segment-wise breakdowns of market trends.

What are the market trends of 4k Display Resolution?

Current trends in the 4K display resolution market include a shift towards OLED and LED technologies, increased integration of smart features in displays, growing interest in gaming-grade monitors, and an overarching trend towards online shopping for electronics.