Africa Mobile Money

Published Date: 31 January 2026 | Report Code: africa-mobile-money

Africa Mobile Money Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report provides an in-depth analysis of the Africa Mobile Money market from 2024 to 2033. It explores market size, growth drivers, technological innovations, and regional dynamics while offering critical insights into industry segments and competitive landscapes. Stakeholders will gain valuable data on trends, challenges, and future opportunities in this transformative digital financial ecosystem.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

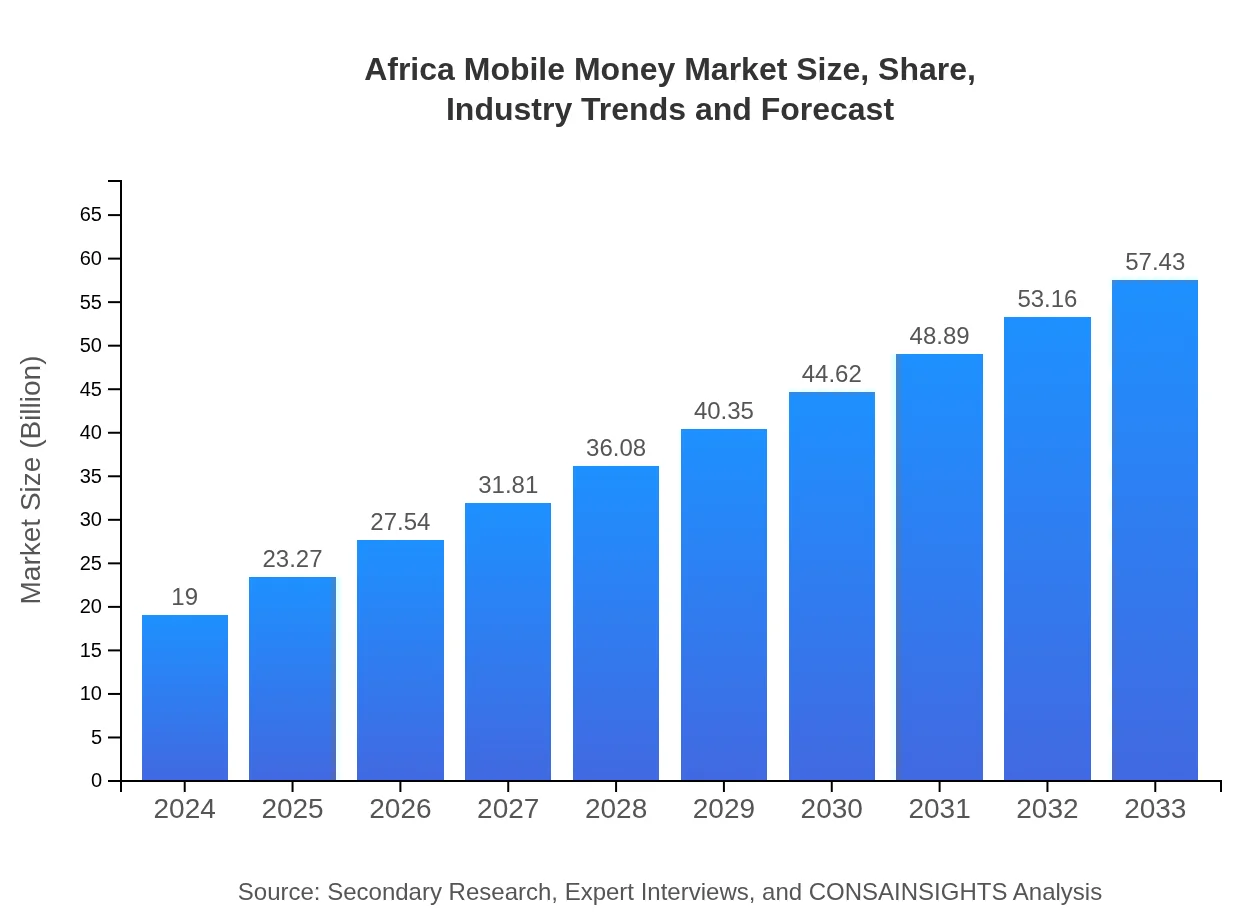

| 2024 Market Size | $19.00 Billion |

| CAGR (2024-2033) | 12.5% |

| 2033 Market Size | $57.43 Billion |

| Top Companies | MTN Group, Vodafone Group, Airtel Africa |

| Last Modified Date | 31 January 2026 |

Africa Mobile Money Market Overview

Customize Africa Mobile Money market research report

- ✔ Get in-depth analysis of Africa Mobile Money market size, growth, and forecasts.

- ✔ Understand Africa Mobile Money's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Africa Mobile Money

What is the Market Size & CAGR of Africa Mobile Money market in 2024?

Africa Mobile Money Industry Analysis

Africa Mobile Money Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Africa Mobile Money Market Analysis Report by Region

Europe Africa Mobile Money:

Europe illustrates a stable yet growing demand for mobile money with market estimates increasing from 4.98 in 2024 to 15.06 in 2033. Consistent regulatory support and heightened consumer security measures have bolstered confidence in digital financial services. The emphasis on innovation and cross-border transfers has further propelled growth in this region.Asia Pacific Africa Mobile Money:

In the Asia Pacific region, mobile money solutions have been rapidly adopted, with market size growing from 3.70 in 2024 to an anticipated 11.17 in 2033. Despite being a smaller segment compared to other regions, innovation and digital banking trends in this region are encouraging steady growth. The focus on technology-driven solutions and government initiatives promoting digital financial inclusion are key drivers in this market.North America Africa Mobile Money:

North America showcases robust engagement with digital payment ecosystems, where the market is projected to rise from 6.26 in 2024 to 18.93 in 2033. Factors such as advanced infrastructure, high consumer awareness, and a competitive technology landscape contribute to the accelerated growth. This region benefits from its mature financial markets and continuous investment in digital innovations.South America Africa Mobile Money:

In South America, represented here as Latin America with markets evolving from 1.46 in 2024 to 4.42 in 2033, there is a gradual but consistent uptake of mobile money services. The market remains in a growth phase, driven by increased smartphone penetration and efforts to extend financial services to unbanked populations. This region demonstrates potential for scaling mobile money as regulatory reforms advance.Middle East & Africa Africa Mobile Money:

In the Middle East and Africa region, market size is expected to grow from 2.60 in 2024 to 7.86 in 2033. This dynamic region is witnessing rapid adoption due to strategic initiatives aimed at enhancing digital infrastructure and fostering financial inclusion. Political and economic reforms, combined with high mobile penetration rates, are catalyzing substantial progress in mobile money adoption.Tell us your focus area and get a customized research report.

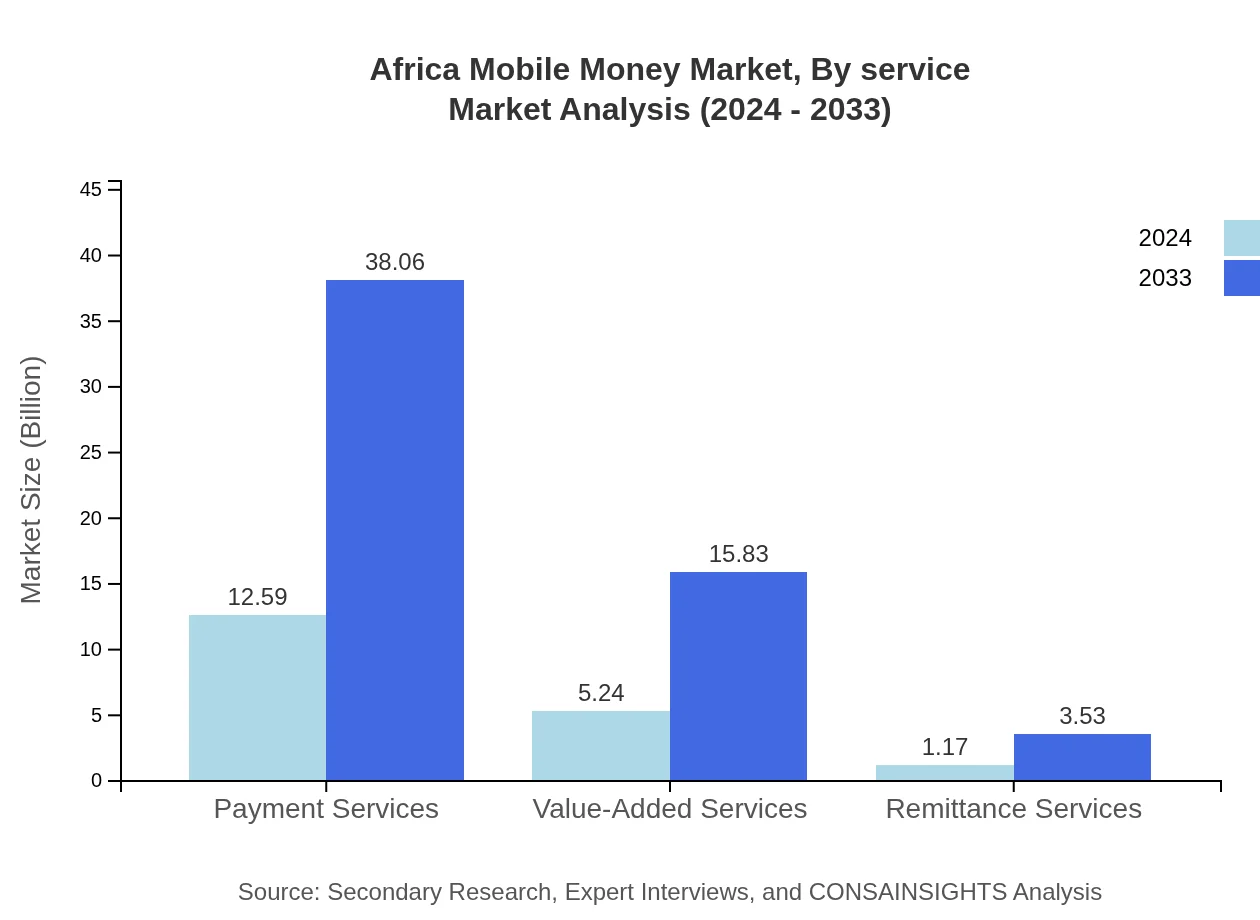

Africa Mobile Money Market Analysis By Service

The service segmentation of the Africa Mobile Money market primarily includes Payment Services and Remittance Services. Payment Services dominate the market, with size estimates rising from 12.59 in 2024 to 38.06 in 2033, maintaining a consistent market share of 66.28%. Remittance Services, though smaller, are vital for cross-border transactions, growing from 1.17 in 2024 to 3.53 in 2033 and holding a market share of 6.15%. This segmentation underscores the importance of seamless digital transactions and a vast network of supporting services that cater to both everyday consumers and businesses.

Africa Mobile Money Market Analysis By Technology

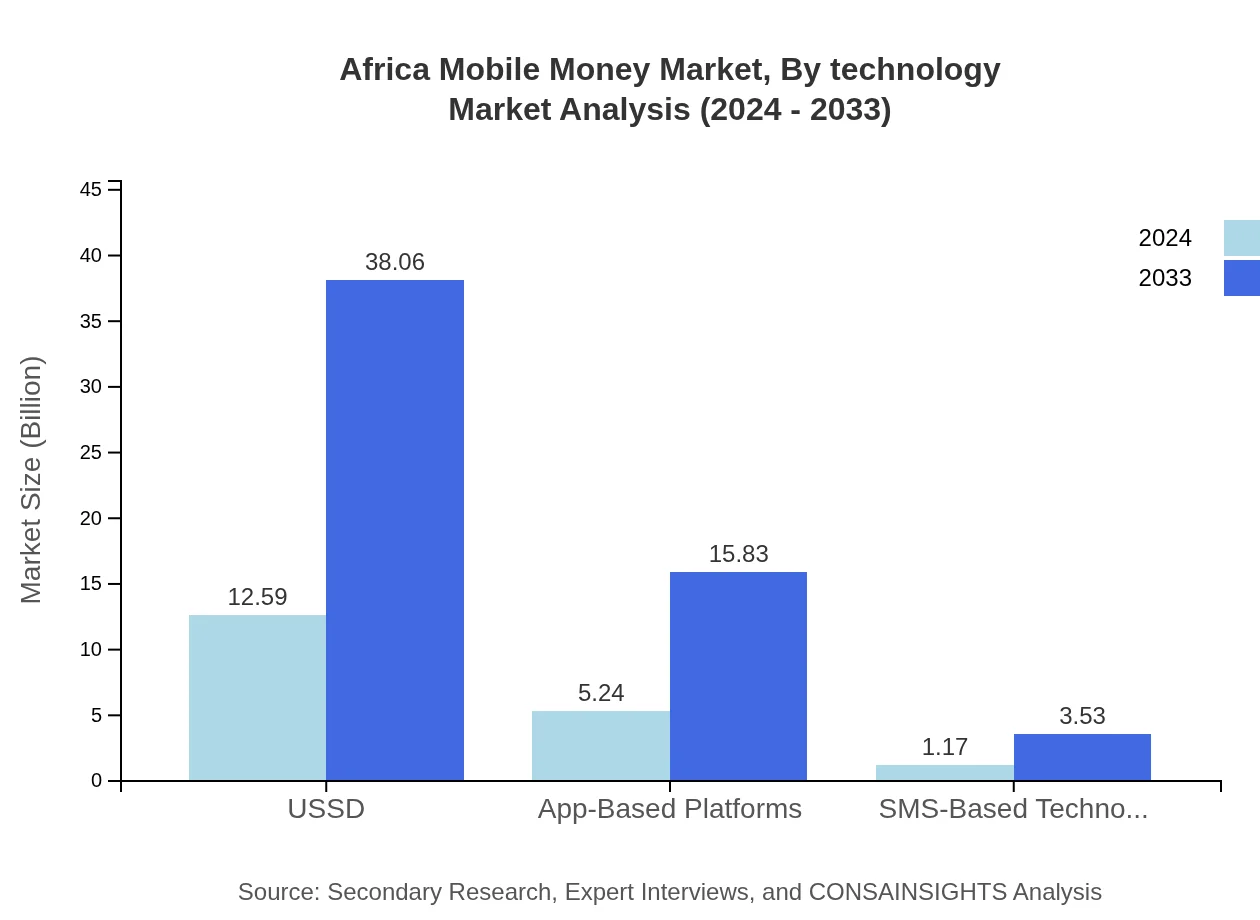

Technology plays a pivotal role in driving the mobile money market. Key technological segments include USSD, SMS-Based Technology, and App-Based Platforms. USSD, noted for its wide accessibility, shares disproportionate importance with a size similar to Payment Services. App-Based Platforms and SMS-Based Technology also contribute significantly, offering intuitive, secure, and real-time transaction capabilities. Together, these technological insights reveal an ecosystem where low-tech accessibility and high-tech innovations coexist, enabling broader financial inclusion and customer satisfaction.

Africa Mobile Money Market Analysis By User Segment

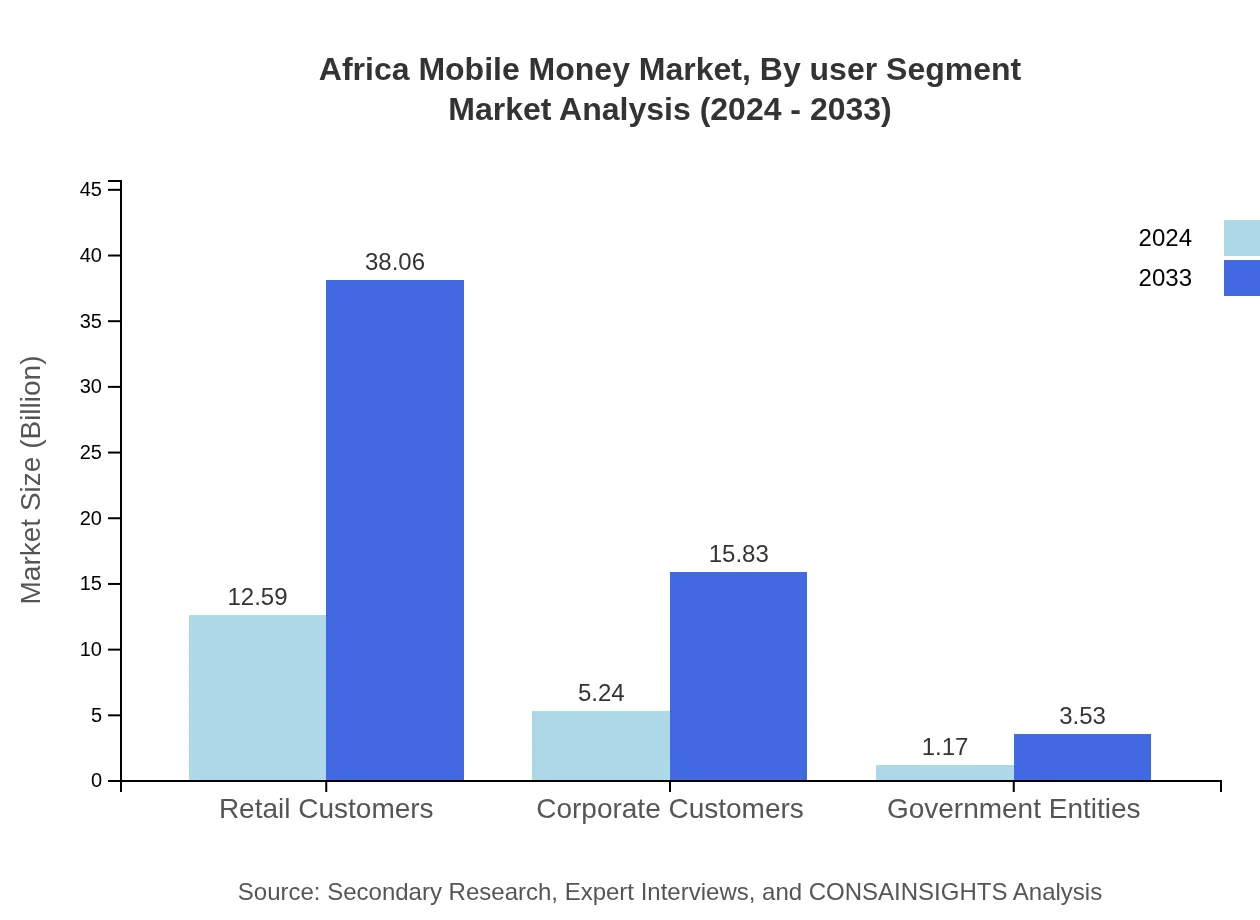

User segmentation in the mobile money landscape divides the market into Retail Customers, Corporate Customers, and Government Entities. Retail Customers form the largest group, similar in size to Payment Services, reflecting everyday transactional needs. Corporate Customers and Government Entities, while representing smaller segments, are crucial for driving high-value transactions and institutional trust. This segmentation highlights the market’s adaptability in catering to diverse financial requirements, ensuring that both individual consumers and large organizations have access to efficient and reliable mobile financial services.

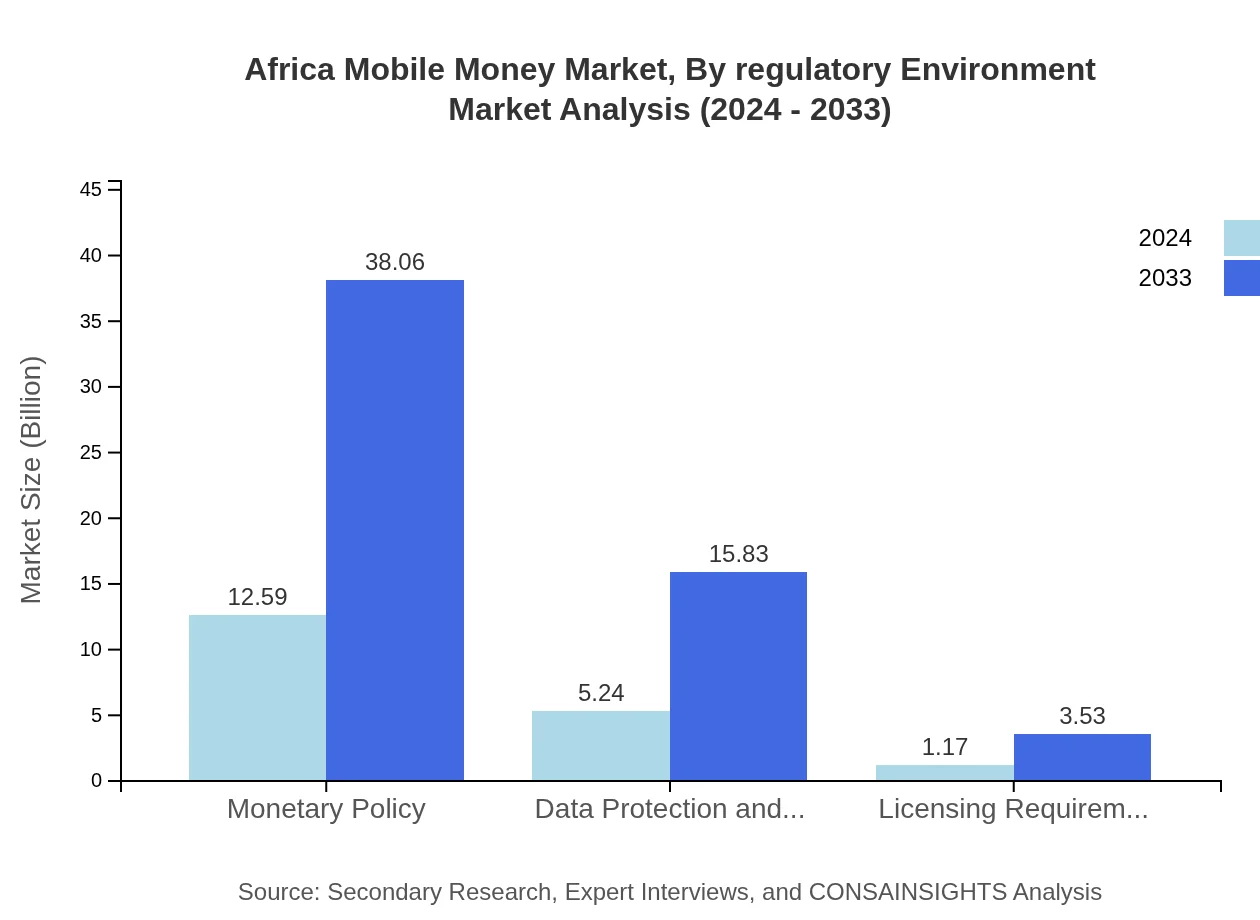

Africa Mobile Money Market Analysis By Regulatory Environment

The regulatory environment is a critical component in shaping the mobile money market. Key elements include Monetary Policy, Data Protection and Privacy, and Licensing Requirements. Monetary Policy influences market strategies, with size and share estimates indicating robust regulatory frameworks. Data Protection and Privacy have become increasingly important with the rise in digital transactions, while Licensing Requirements ensure that providers adhere to essential compliance standards. This segment analysis reflects the delicate balance regulators must maintain between fostering innovation and ensuring consumer protection, which is essential for sustainable market growth.

Africa Mobile Money Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Africa Mobile Money Industry

MTN Group:

MTN Group is a leading telecommunications provider that has significantly expanded its mobile money services across Africa. Their innovative platforms and strategic partnerships have set industry benchmarks in offering secure, efficient, and accessible financial solutions.Vodafone Group:

Vodafone plays a pivotal role in connecting consumers to digital financial services. With extensive mobile infrastructure and a focus on technological excellence, Vodafone has helped drive the adoption of mobile money, making it an indispensable player in the market.Airtel Africa:

Airtel Africa has consistently demonstrated leadership in mobile financial services by offering an integrated suite of payment and financial products. Their commitment to innovation and customer service has established them as a key market influencer.We're grateful to work with incredible clients.