Agriculture Tire Market Report

Published Date: 02 February 2026 | Report Code: agriculture-tire

Agriculture Tire Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Agriculture Tire market from 2023 to 2033, offering insights into market size, trends, segmentation, and forecasts. It evaluates regional dynamics and key players shaping the industry's future.

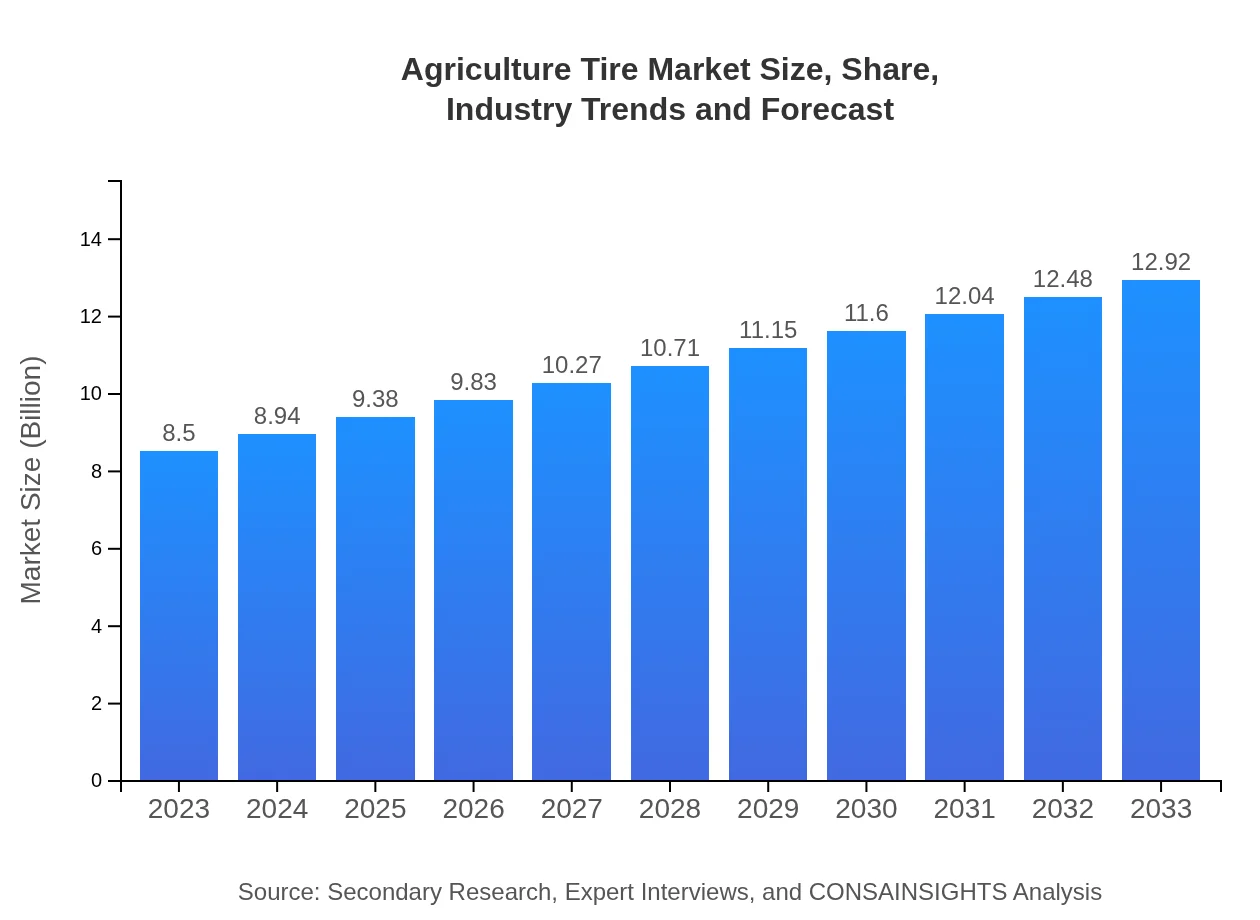

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $12.92 Billion |

| Top Companies | Michelin, Bridgestone, Goodyear, Continental AG, Pirelli |

| Last Modified Date | 02 February 2026 |

Agriculture Tire Market Overview

Customize Agriculture Tire Market Report market research report

- ✔ Get in-depth analysis of Agriculture Tire market size, growth, and forecasts.

- ✔ Understand Agriculture Tire's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Agriculture Tire

What is the Market Size & CAGR of Agriculture Tire market in 2023?

Agriculture Tire Industry Analysis

Agriculture Tire Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Agriculture Tire Market Analysis Report by Region

Europe Agriculture Tire Market Report:

In Europe, the Agriculture Tire market was valued at $2.84 billion in 2023, projected to increase to $4.32 billion by 2033. The focus on sustainable farming and mechanization drives demand in this region.Asia Pacific Agriculture Tire Market Report:

In 2023, the Agriculture Tire market in the Asia Pacific region was valued at $1.49 billion, expected to grow to $2.27 billion by 2033, reflecting a growing demand for agricultural mechanization driven by population growth and urbanization.North America Agriculture Tire Market Report:

The North American market, valued at $2.98 billion in 2023, is expected to grow to $4.53 billion by 2033. This growth is attributed to advancements in technology and the high adoption rate of agricultural machinery.South America Agriculture Tire Market Report:

South America recorded a market size of $0.27 billion in 2023, anticipated to reach $0.40 billion by 2033. The increasing agricultural exports and investments in modern farming equipment contribute to this growth.Middle East & Africa Agriculture Tire Market Report:

The Middle East and Africa region's Agriculture Tire market was valued at $0.92 billion in 2023, with expectations to grow to $1.40 billion by 2033, as the agricultural sector seeks to modernize and improve productivity.Tell us your focus area and get a customized research report.

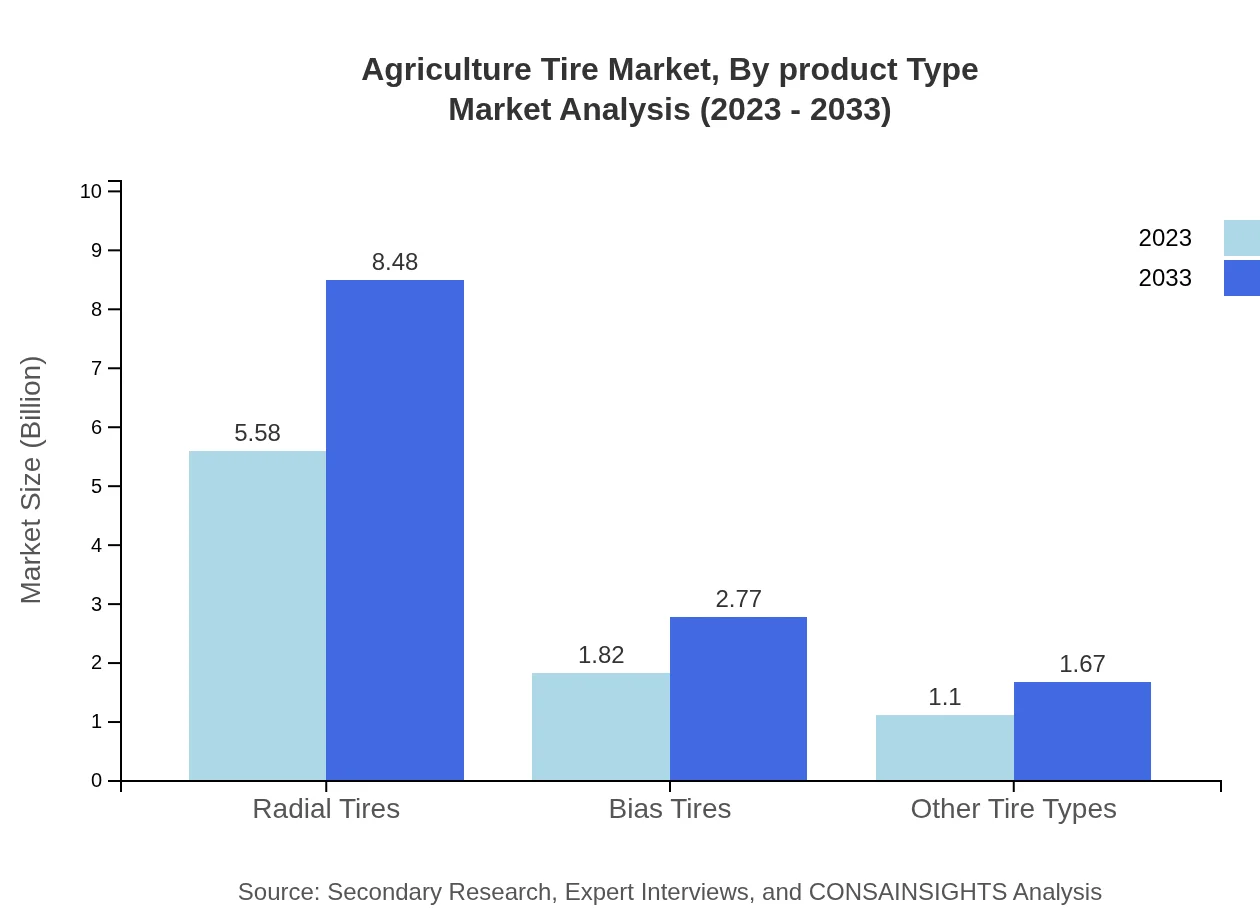

Agriculture Tire Market Analysis By Product Type

In 2023, radial tires dominated the Agriculture Tire market with a size of $5.58 billion, expected to reach $8.48 billion by 2033, maintaining a market share of 65.64%. Bias tires and other tire types follow, with sizes of $1.82 billion and $1.10 billion, respectively.

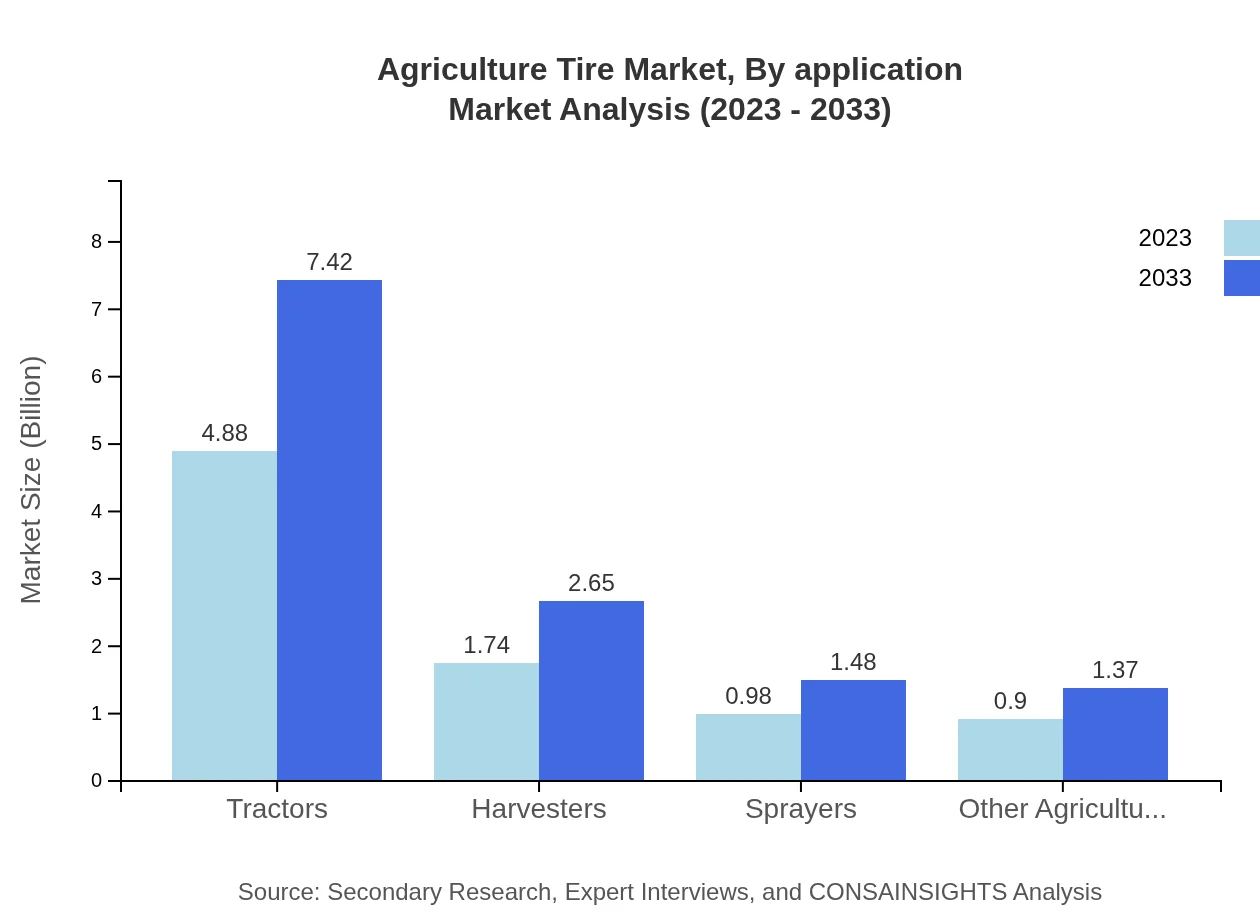

Agriculture Tire Market Analysis By Application

Tractors represent the largest segment, with a size of $4.88 billion in 2023, projected to grow to $7.42 billion by 2033, holding a share of 57.43%. Harvesters and sprayers follow, reflecting significant demand across applications.

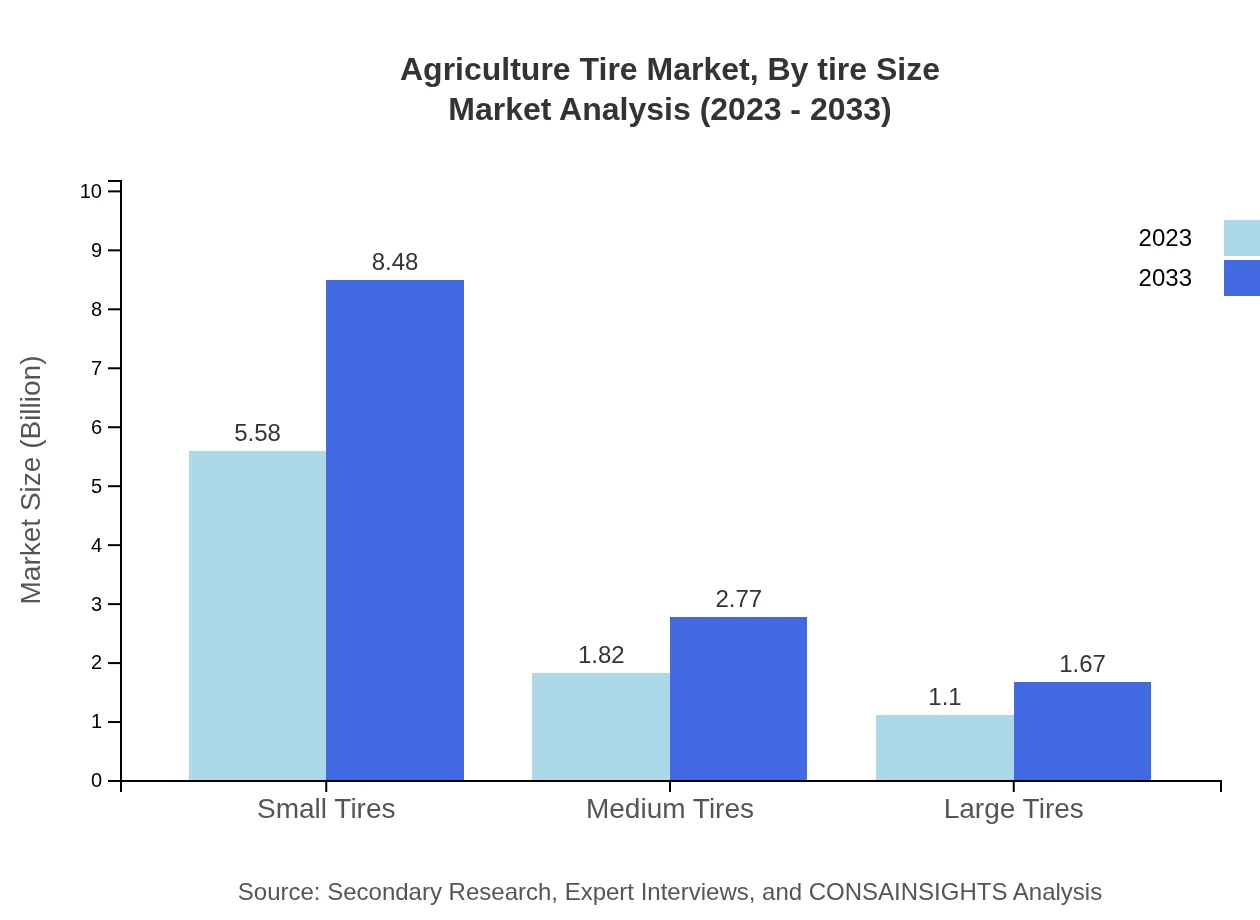

Agriculture Tire Market Analysis By Tire Size

Small tires dominated the market with a size of $5.58 billion in 2023, projected to grow to $8.48 billion by 2033, constituting 65.64% of the market. Medium and large tires accounted for 21.45% and 12.91%, highlighting usage across various agricultural machinery.

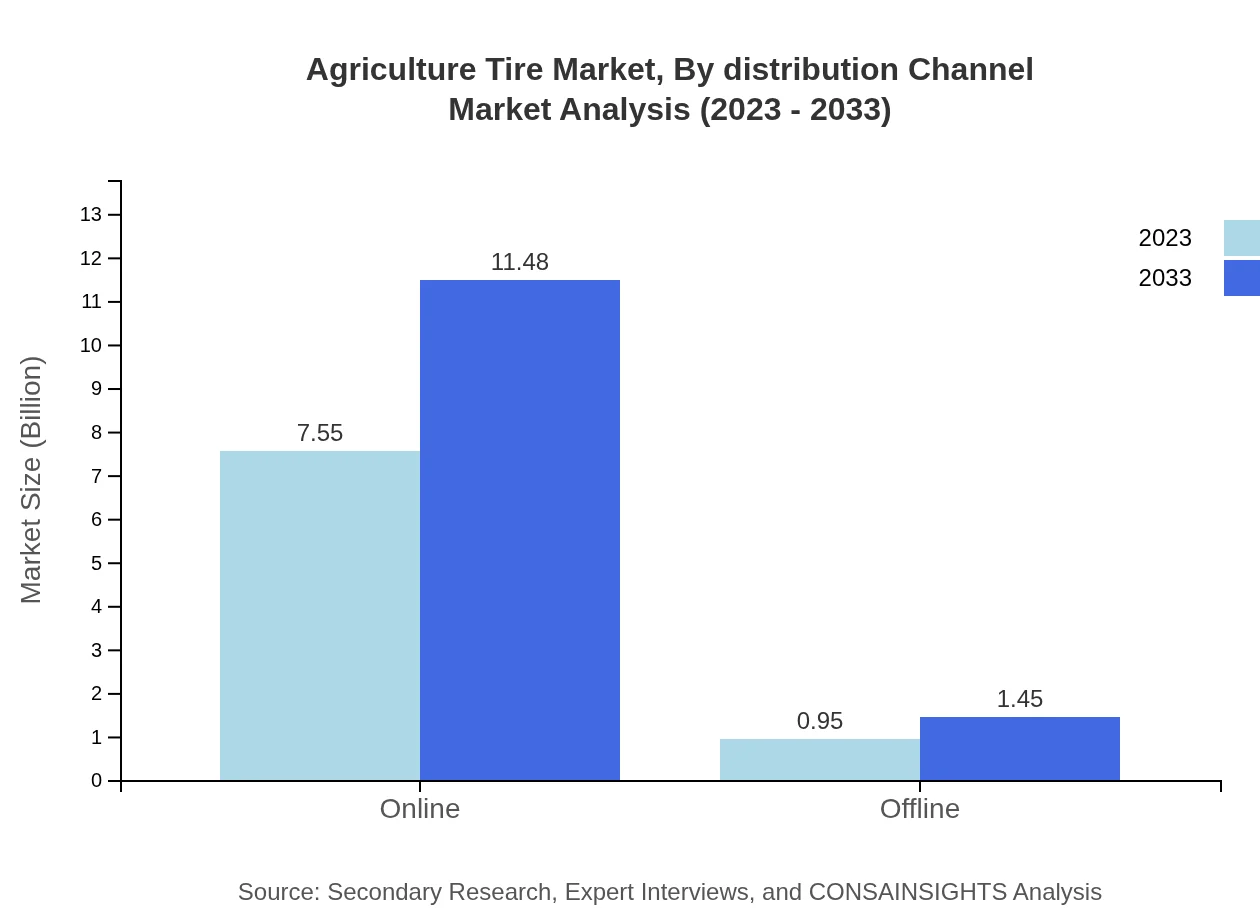

Agriculture Tire Market Analysis By Distribution Channel

The Agriculture Tire market's online segment generated $7.55 billion in 2023, anticipated to reach $11.48 billion by 2033, with a dominant share of 88.81%. Offline channels, while smaller, accounted for $0.95 billion in 2023 and are likely to grow as physical retail evolves.

Agriculture Tire Market Analysis By Technology

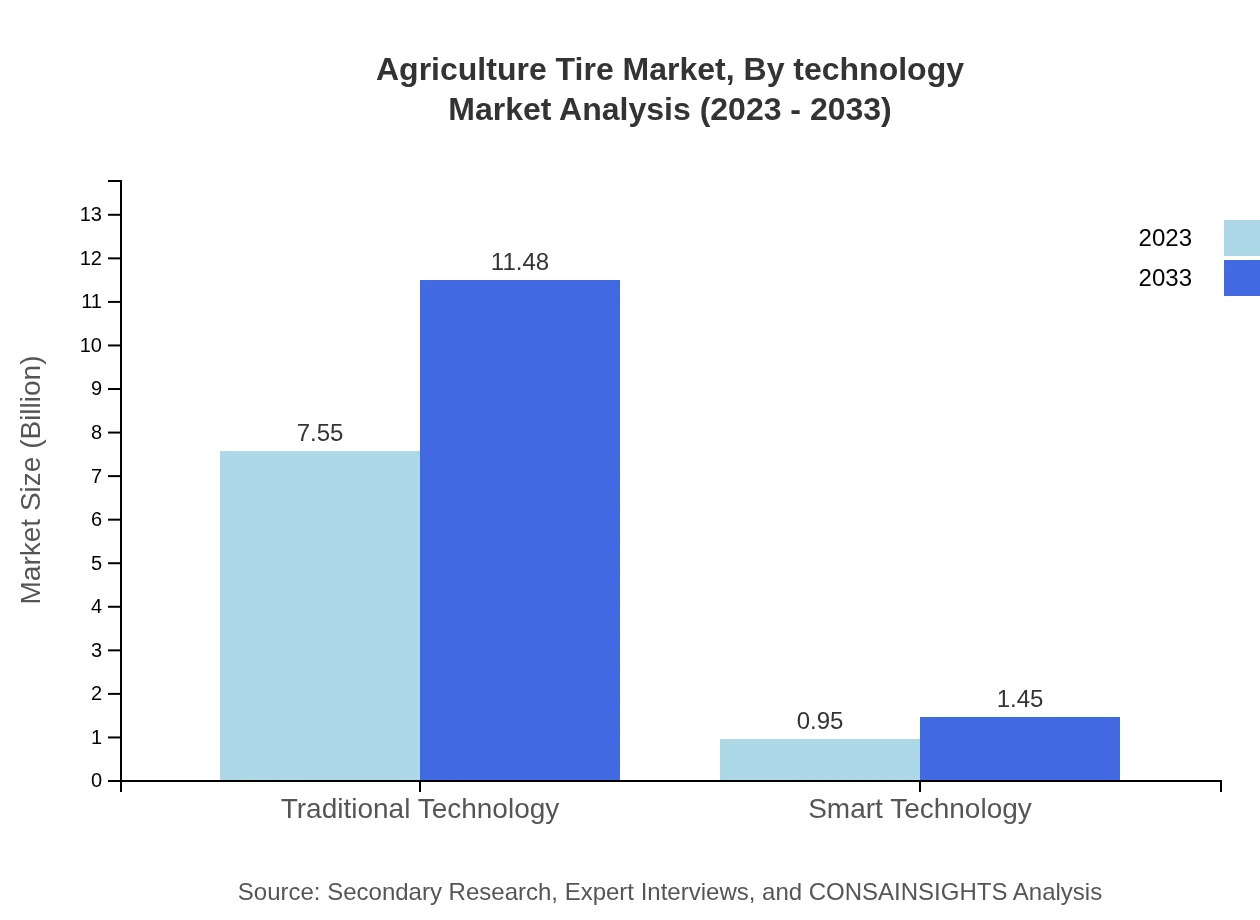

Traditional technology holds the substantial market share of 88.81%, with a size of $7.55 billion in 2023, projected to grow to $11.48 billion by 2033. In contrast, smart technology remains a growing segment, valued at $0.95 billion in 2023, expected to rise to $1.45 billion.

Agriculture Tire Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Agriculture Tire Industry

Michelin:

A leading global tire manufacturer known for its innovative and high-performance agricultural tires, providing solutions for improved traction and durability.Bridgestone:

One of the largest tire manufacturers, involved in the development of advanced agricultural tires aimed at enhancing productivity and efficiency in farming operations.Goodyear:

A major player in the agriculture sector, producing a wide range of tires designed to meet varying agricultural needs and advancing technological specifications.Continental AG:

Specializes in the manufacturing of agricultural tires, focusing on sustainability and efficiency while ensuring high reliability under diverse farm conditions.Pirelli:

Known for its high-performance tires, Pirelli has made significant investments in research to innovate agricultural tires tailored to modern farming requirements.We're grateful to work with incredible clients.

FAQs

What is the market size of agriculture Tire?

The agriculture tire market is valued at approximately $8.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 4.2% over the next decade, demonstrating significant potential for growth.

What are the key market players or companies in this agriculture Tire industry?

The agriculture tire industry features major players such as Michelin, Bridgestone, Goodyear, and Continental, who lead in product innovation, quality, and distribution channels, thereby defining market trends and competition.

What are the primary factors driving the growth in the agriculture Tire industry?

Key growth drivers in the agriculture tire market include increasing mechanization in farming, demand for efficient crop production, and technological advancements in tire manufacturing that enhance durability and performance.

Which region is the fastest Growing in the agriculture Tire market?

The fastest-growing region in the agriculture tire market is Europe, with a projected market size increase from $2.84 billion in 2023 to $4.32 billion by 2033, supported by agricultural mechanization initiatives.

Does ConsaInsights provide customized market report data for the agriculture Tire industry?

Yes, ConsaInsights offers tailored market reports for the agriculture tire industry, allowing clients to access specific data and insights suited to their business needs and strategic planning.

What deliverables can I expect from this agriculture Tire market research project?

Deliverables from the agriculture tire market research project include comprehensive market analysis, forecasts, competitive landscape evaluations, and insights into regional trends and consumer preferences.

What are the market trends of agriculture Tire?

Current market trends in agriculture tires include the rising adoption of smart technology, sustainability in tire manufacturing, and a shift towards online distribution channels, reflecting consumer preferences and market demands.