Ai In Corporate Finance

Published Date: 22 January 2026 | Report Code: ai-in-corporate-finance

Ai In Corporate Finance Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Ai In Corporate Finance market from 2024 to 2033. It covers market overview, size and growth predictions, industry challenges, segmentation details, regional dynamics, evolving technology trends, product performance insights, and profiles of global market leaders. The analysis is backed by detailed quantitative and qualitative insights.

| Metric | Value |

|---|---|

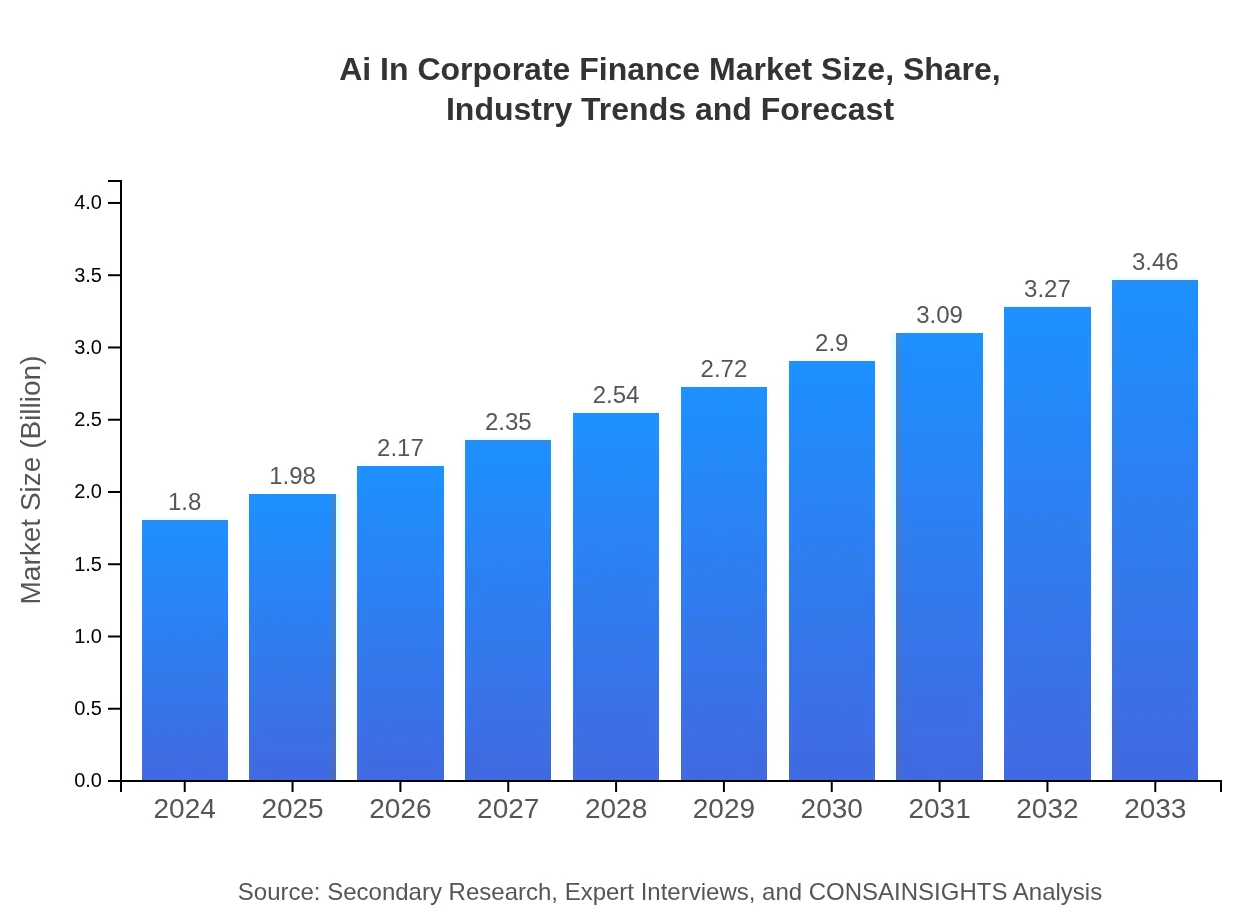

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 7.3% |

| 2033 Market Size | $3.46 Billion |

| Top Companies | IBM, SAS Institute, Accenture, Oracle |

| Last Modified Date | 22 January 2026 |

Ai In Corporate Finance Market Overview

Customize Ai In Corporate Finance market research report

- ✔ Get in-depth analysis of Ai In Corporate Finance market size, growth, and forecasts.

- ✔ Understand Ai In Corporate Finance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Ai In Corporate Finance

What is the Market Size & CAGR of Ai In Corporate Finance market in 2024?

Ai In Corporate Finance Industry Analysis

Ai In Corporate Finance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Ai In Corporate Finance Market Analysis Report by Region

Europe Ai In Corporate Finance:

Europe is witnessing remarkable growth driven by a unique blend of robust regulatory environments and strong innovation ecosystems. The market size is expected to increase from 0.63 in 2024 to 1.20 by 2033. European financial institutions are increasingly adopting AI to enhance efficiency in areas such as risk management, fraud detection, and compliance. Strategic partnerships between tech firms and traditional banks are also fueling this upward trajectory.Asia Pacific Ai In Corporate Finance:

In Asia Pacific, the Ai In Corporate Finance market is projected to double from a market size of approximately 0.31 in 2024 to 0.60 by 2033. Growth in this region is fueled by rapid digitalization, increased government initiatives to promote fintech innovation, and a rising number of startups integrating AI into financial systems. The region remains highly competitive, with both local and international players investing heavily in tech-driven solutions to cater to the burgeoning corporate finance sector.North America Ai In Corporate Finance:

North America is emerging as a significant hub for AI innovations in corporate finance, with market estimates rising from 0.61 in 2024 to 1.18 in 2033. The region benefits from a highly developed technology ecosystem, sophisticated regulatory frameworks and deep financial expertise. Continuous investments in AI research and development, along with a rapid pace of digital transformation within major financial institutions, are key drivers of this dynamic growth.South America Ai In Corporate Finance:

South America, although representing a smaller market segment with an estimated market size growth from 0.01 in 2024 to 0.03 by 2033, displays promising potential. The gradual adoption of AI-driven financial solutions, bolstered by improvements in internet infrastructure and supportive regulatory reforms, is creating a fertile ground for innovation. The market here is expected to grow steadily as economic conditions stabilize and demand for digital financial services increases.Middle East & Africa Ai In Corporate Finance:

The Middle East and Africa region is projected to see growth from 0.23 in 2024 to 0.45 by 2033. This expansion is being driven by accelerated digital adoption and increased investments in fintech. Nations within this region are undertaking significant initiatives to modernize financial infrastructures and integrate advanced AI solutions, laying down a solid foundation for market evolution over the next decade.Tell us your focus area and get a customized research report.

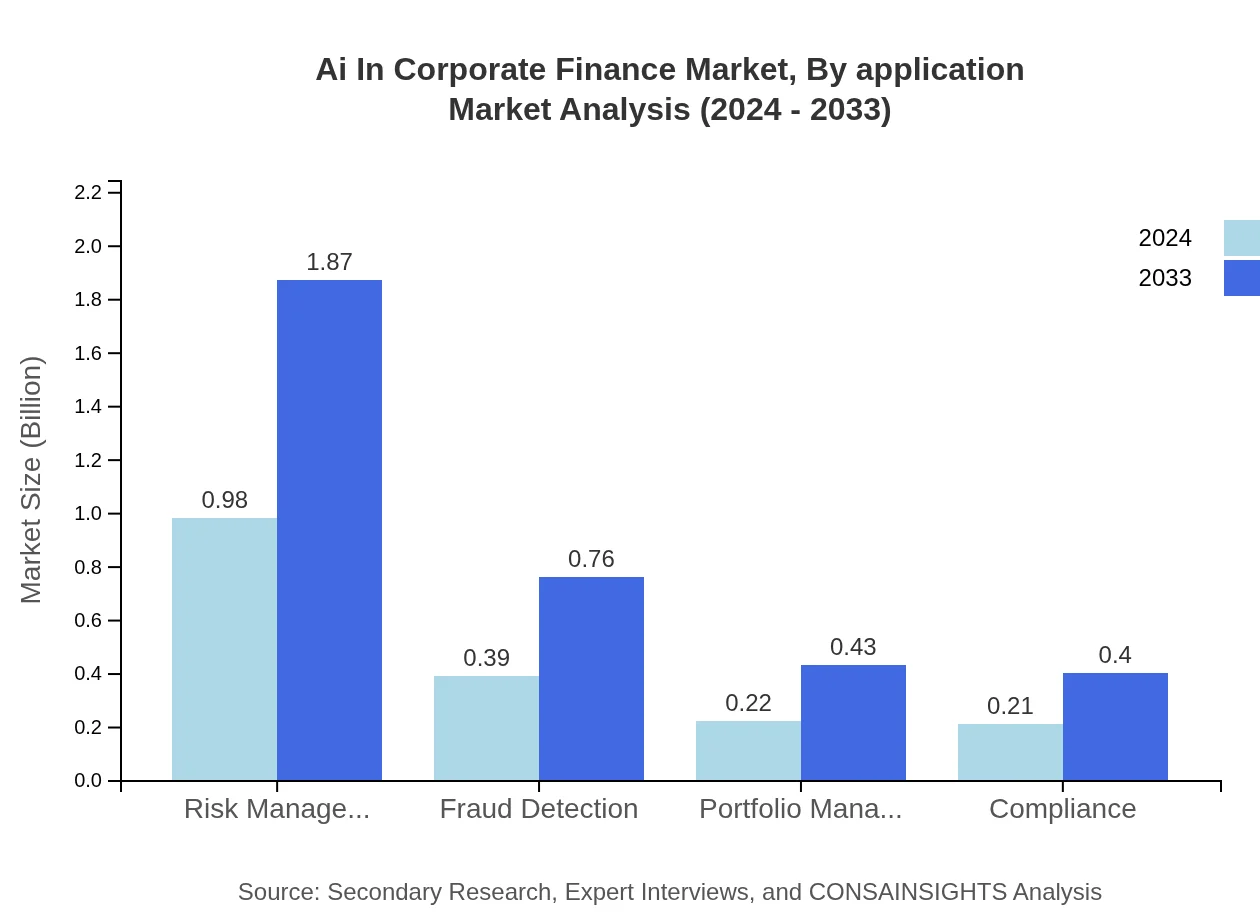

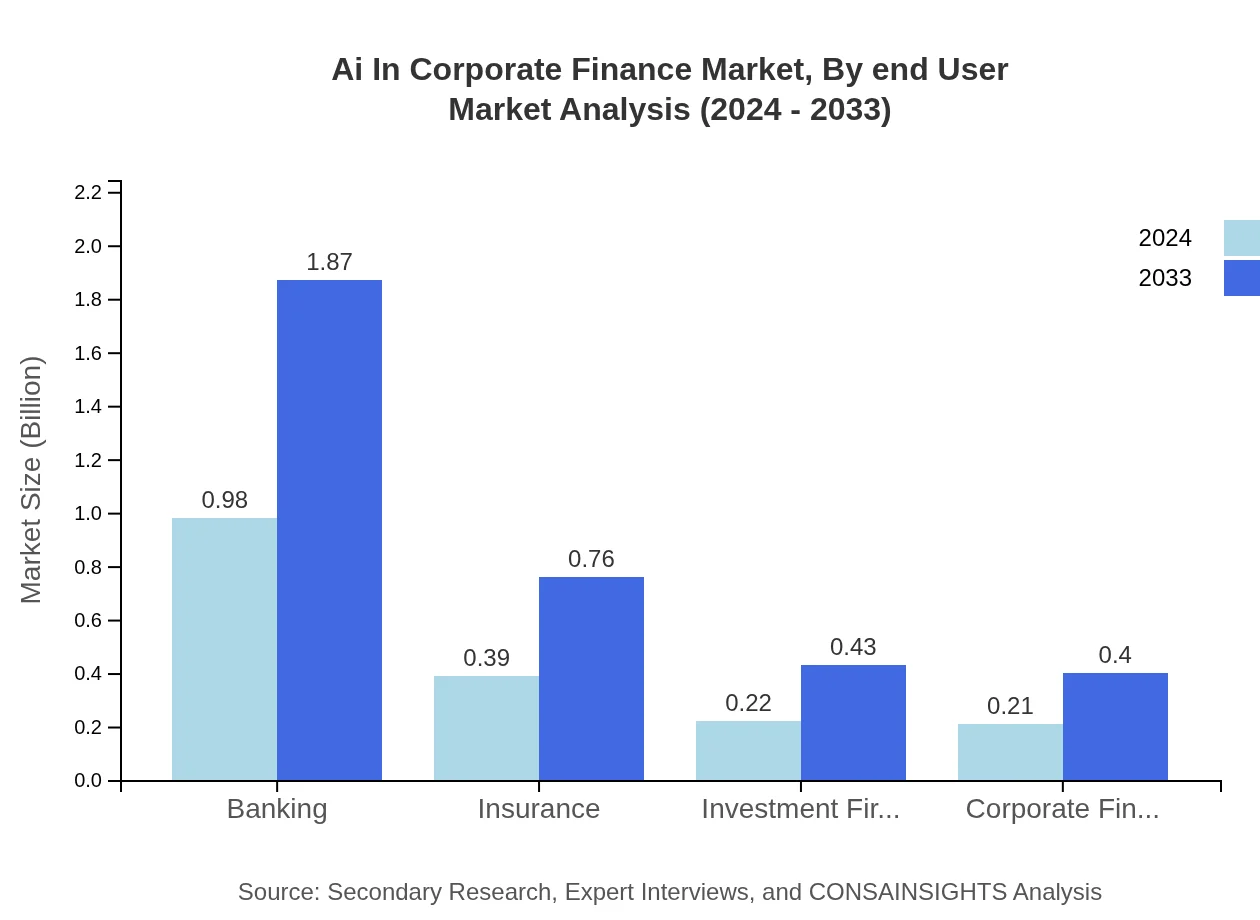

Ai In Corporate Finance Market Analysis By Application

The application segment of the Ai In Corporate Finance market is broadly categorized to encompass financial institutions such as banking, insurance, investment firms, corporate finance departments, risk management, fraud detection, portfolio management, and compliance. Banking remains the dominant segment, with market size growing from approximately 0.98 in 2024 to 1.87 by 2033, representing a substantial share of 54.2%. Insurance, with growth from 0.39 to 0.76, and investment firms growing from 0.22 to 0.43, contribute significantly to the overall financial technology transformation. Additionally, corporate finance departments and specialized applications in risk management, fraud detection, portfolio management, and compliance mirror steady growth trends. The persistence of similar market shares across these subdivisions indicates stability and assurance in the adoption of AI technologies. Strategic investments, improved data analytics, and a focus on regulatory compliance are further propelling this segment forward.

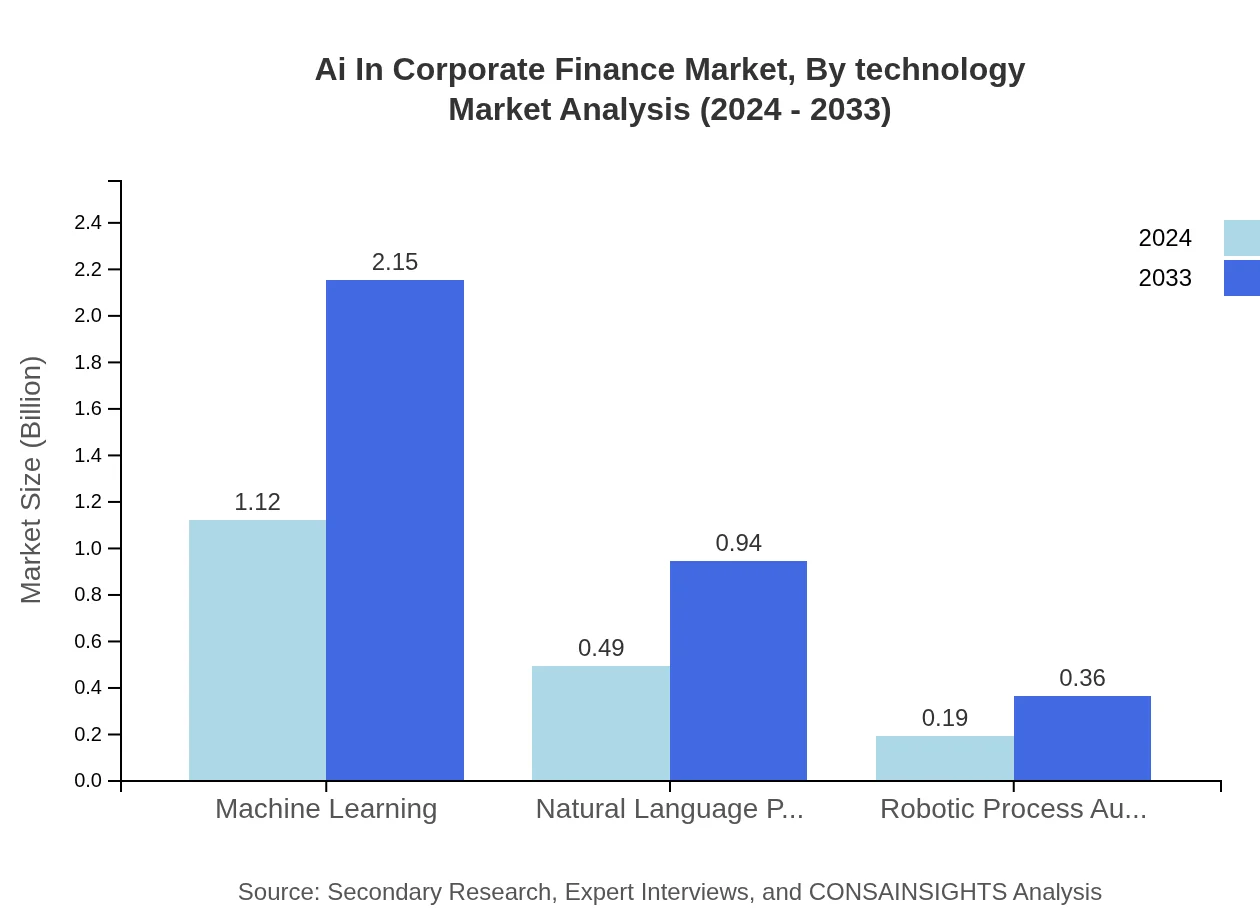

Ai In Corporate Finance Market Analysis By Technology

Technological components have become a foundational element within the corporate finance domain. This segment is primarily divided into machine learning, natural language processing (NLP), and robotic process automation (RPA). Among these, machine learning takes a commanding lead with market size increasing from 1.12 in 2024 to 2.15 by 2033, securing an impressive market share of 62.33%. Natural language processing follows with growth from 0.49 to 0.94 and represents 27.17%, while robotic process automation, with market size progression from 0.19 to 0.36, maintains a share of 10.5%. Advances in these technologies are not only streamlining data analysis and customer service operations but are also revolutionizing decision-making processes within corporate finance departments. The continuous evolution in these technological avenues is fundamental to driving future innovation and maintaining competitive advantages in the industry.

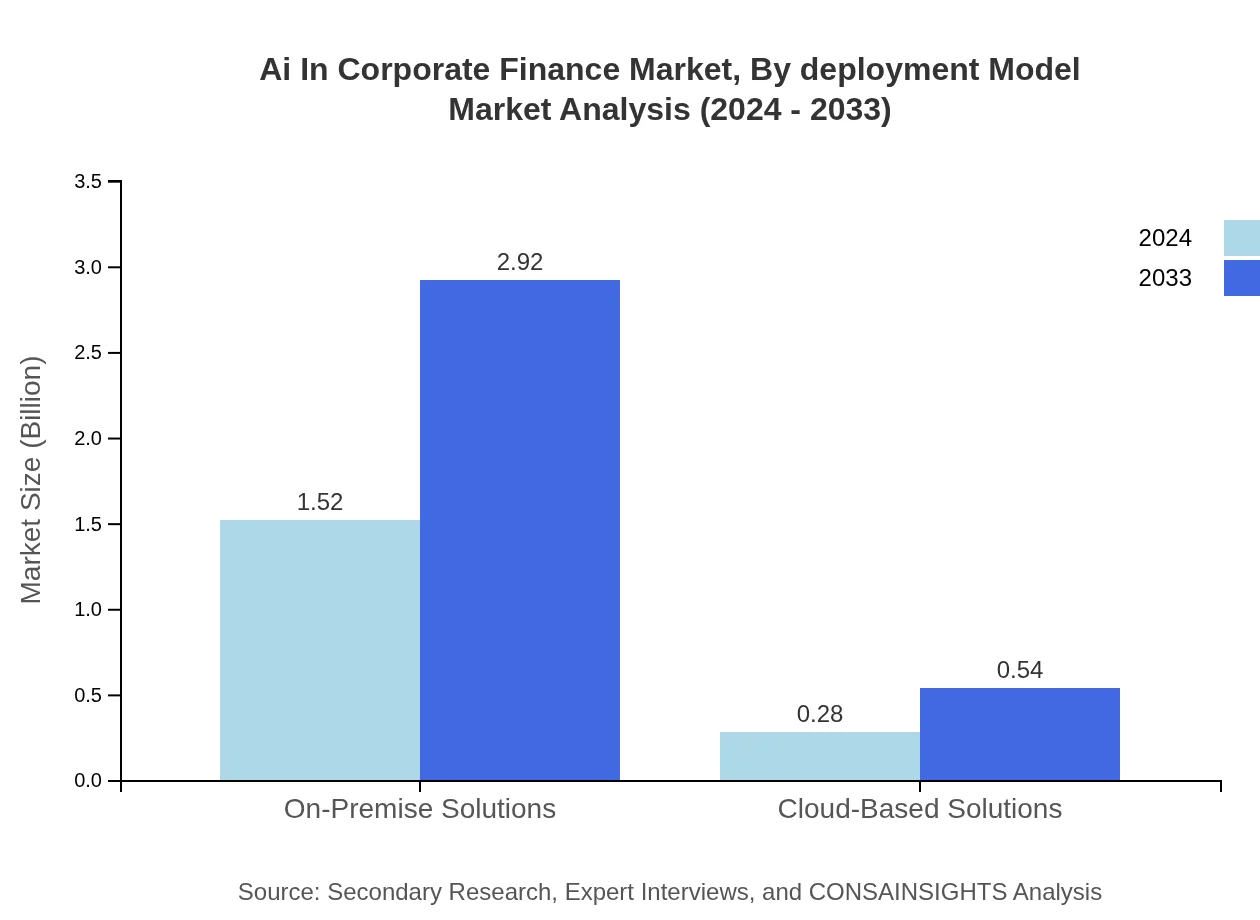

Ai In Corporate Finance Market Analysis By Deployment Model

Deployment models have become critical in determining the success and scalability of AI solutions in corporate finance. The market analysis reveals a clear dichotomy between on-premise and cloud-based solutions. On-premise solutions currently hold a dominant market position, with a size expanding from 1.52 in 2024 to 2.92 by 2033, representing approximately 84.38% of the market. This dominance is attributed to the robust security protocols and customizability these systems offer to large financial corporations. On the other hand, cloud-based solutions, though capturing a smaller market share of 15.62%, are gaining traction due to their flexibility, scalability, and cost efficiency, with market size growing from 0.28 to 0.54 over the same period. The dual-mode deployment strategy enables companies to leverage the benefits of both models according to their specific operational demands and regulatory requirements.

Ai In Corporate Finance Market Analysis By End User

The end-user segment of the Ai In Corporate Finance market emphasizes the diverse beneficiaries of AI technology within the finance sector. End users include not only large-scale financial institutions but also mid-sized companies and specialized corporate finance departments seeking transformative solutions. These users rely on advanced AI tools to enhance decision-making, optimize risk management, and improve operational efficiencies. Customer demands are being met through customized offerings that integrate seamlessly with legacy systems while providing real-time analytics and comprehensive fraud detection capabilities. Additionally, end-user adoption is driven by the need for regulatory compliance and efficient portfolio management, making this segment a critical pillar in the sustained growth of the market. The evolving expectations and strategic adaptability of these end-users are central to shaping future product developments and market dynamics.

Ai In Corporate Finance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Ai In Corporate Finance Industry

IBM:

IBM leverages its extensive experience in artificial intelligence and deep learning to offer state-of-the-art solutions for corporate finance. Its advanced analytics platforms drive risk management and strategic decision-making across global financial institutions.SAS Institute:

SAS Institute is renowned for its robust data analytics and predictive modeling tools. The company provides comprehensive AI-driven financial solutions that enable institutions to optimize portfolio management, regulatory compliance, and fraud detection.Accenture:

Accenture offers a broad portfolio of AI consulting services that support digital transformation in corporate finance. Their innovative solutions integrate machine learning and automation to enhance operational efficiency and drive competitive advantage.Oracle:

Oracle is a key player in developing integrated AI solutions, focusing on cloud-backed financial services. Their technologies streamline complex financial operations and facilitate real-time decision-making for global enterprises.We're grateful to work with incredible clients.

FAQs

What is the market size of ai In Corporate Finance?

The ai-in-corporate-finance market is projected to reach $1.8 billion by 2033, with a CAGR of 7.3%. This growth reflects the increasing adoption of AI technologies in enhancing financial operations and decision-making processes.

What are the key market players or companies in this ai In Corporate Finance industry?

Key players in the ai-in-corporate-finance industry include major tech firms, financial service providers, and startups that specialize in AI solutions. These companies provide innovative tools to optimize financial operations and improve accuracy in forecasting.

What are the primary factors driving the growth in the ai In Corporate Finance industry?

The growth in the ai-in-corporate-finance industry is driven by factors such as the increasing demand for automation in financial processes, the necessity for data-driven insights, and advancements in AI technologies that enable better risk management.

Which region is the fastest Growing in the ai In Corporate Finance?

North America is the fastest-growing region in the ai-in-corporate-finance sector, projected to grow from $0.61 billion in 2024 to $1.18 billion by 2033. Europe follows closely, expanding from $0.63 billion to $1.20 billion in the same period.

Does ConsaInsights provide customized market report data for the ai In Corporate Finance industry?

Yes, ConsaInsights offers customized market report data for the ai-in-corporate-finance industry, allowing clients to gain tailored insights that meet their specific research and strategy needs.

What deliverables can I expect from this ai In Corporate Finance market research project?

Deliverables from the ai-in-corporate-finance market research project typically include comprehensive reports, market trend analyses, competitive landscape evaluations, and forecasts of market growth segmented by region and technology.

What are the market trends of ai In Corporate Finance?

Market trends in the ai-in-corporate-finance sector include a shift towards cloud-based solutions, increased investment in machine learning for financial analysis, and a growing emphasis on compliance and risk management through AI technologies.