Airborne Fire Control Radar Market Report

Published Date: 03 February 2026 | Report Code: airborne-fire-control-radar

Airborne Fire Control Radar Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Airborne Fire Control Radar market from 2023 to 2033, providing insights on current market conditions, segmentation, regional performances, and future forecasts. It aims to deliver a comprehensive understanding of market dynamics and growth opportunities within this specialized industry.

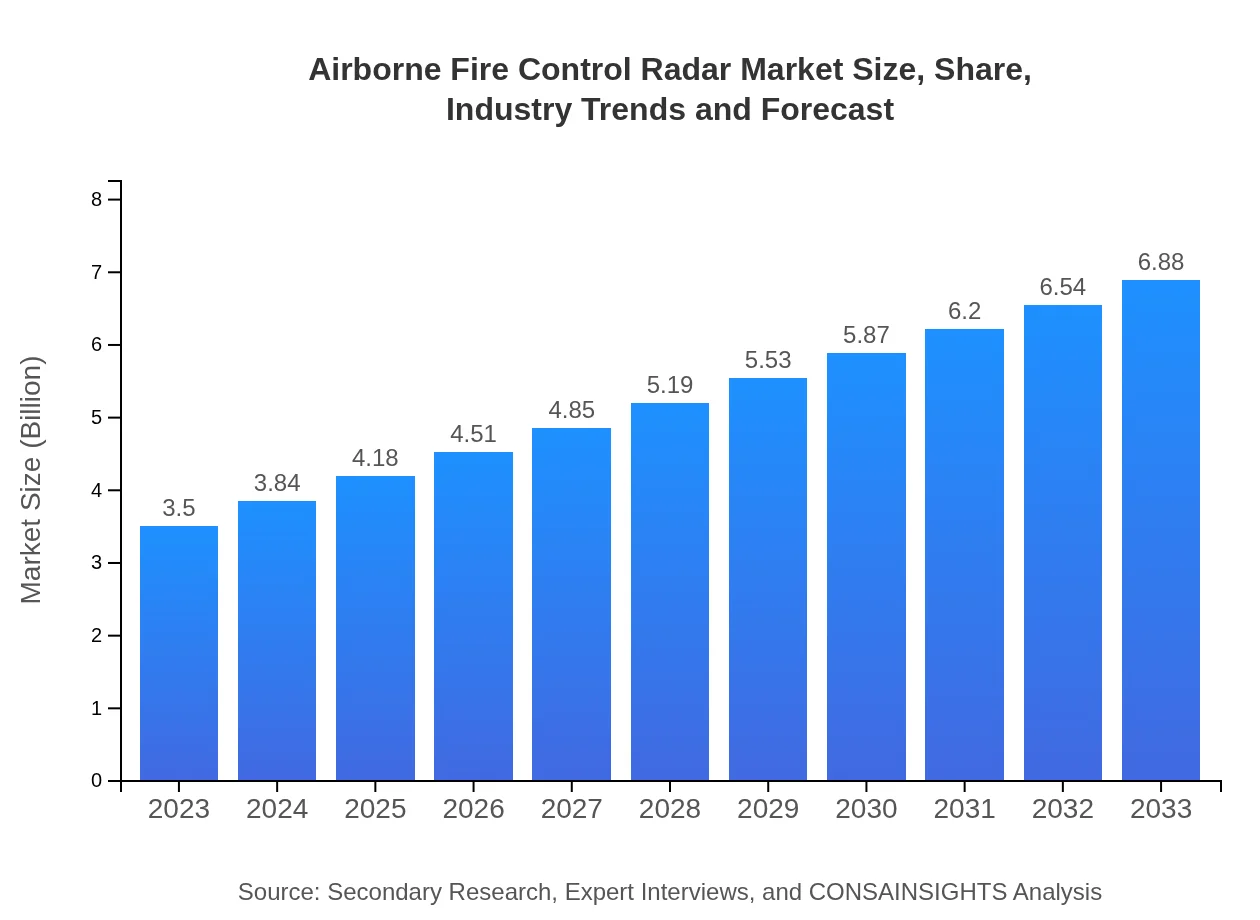

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems |

| Last Modified Date | 03 February 2026 |

Airborne Fire Control Radar Market Overview

Customize Airborne Fire Control Radar Market Report market research report

- ✔ Get in-depth analysis of Airborne Fire Control Radar market size, growth, and forecasts.

- ✔ Understand Airborne Fire Control Radar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Airborne Fire Control Radar

What is the Market Size & CAGR of Airborne Fire Control Radar market in 2023?

Airborne Fire Control Radar Industry Analysis

Airborne Fire Control Radar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Airborne Fire Control Radar Market Analysis Report by Region

Europe Airborne Fire Control Radar Market Report:

The European market is projected to increase from 0.88 billion USD in 2023 to 1.72 billion USD by 2033. The growing focus on enhancing air defense mechanisms and joint military exercises among NATO members promotes the deployment of advanced airborne fire control radars. Additionally, increased investment in technological upgrades across European forces is likely to contribute significantly to market expansion.Asia Pacific Airborne Fire Control Radar Market Report:

The Asia-Pacific region is projected to grow from 0.68 billion USD in 2023 to 1.34 billion USD by 2033. Rapid modernization of military capabilities and increasing defense budgets in countries like India and China are fueling this growth. Moreover, collaborative efforts in defense technology and a rising focus on homeland security are key drivers for the increasing installation of advanced airborne fire control radars in this region.North America Airborne Fire Control Radar Market Report:

North America leads the market with an expected growth from 1.33 billion USD in 2023 to 2.62 billion USD by 2033. The United States continues to invest heavily in advanced radar technologies for its air force and defense operations, thereby maintaining a dominant market position. The presence of major defense contractors further supports innovation and market growth in this region.South America Airborne Fire Control Radar Market Report:

In South America, the market is anticipated to grow from 0.33 billion USD in 2023 to 0.66 billion USD by 2033. Countries like Brazil are enhancing their military capabilities, focusing on improving surveillance and reconnaissance capabilities to address potential threats. The demand for cost-effective and reliable fire control radar systems is anticipated to rise significantly during this period.Middle East & Africa Airborne Fire Control Radar Market Report:

The Middle East and Africa region is set to grow from 0.27 billion USD in 2023 to 0.54 billion USD by 2033, driven by rising defense budgets and concerns regarding regional instability. Countries such as Israel and the UAE are actively enhancing their military capabilities, leading to an upsurge in the demand for sophisticated airborne fire control radar systems to strengthen surveillance capabilities.Tell us your focus area and get a customized research report.

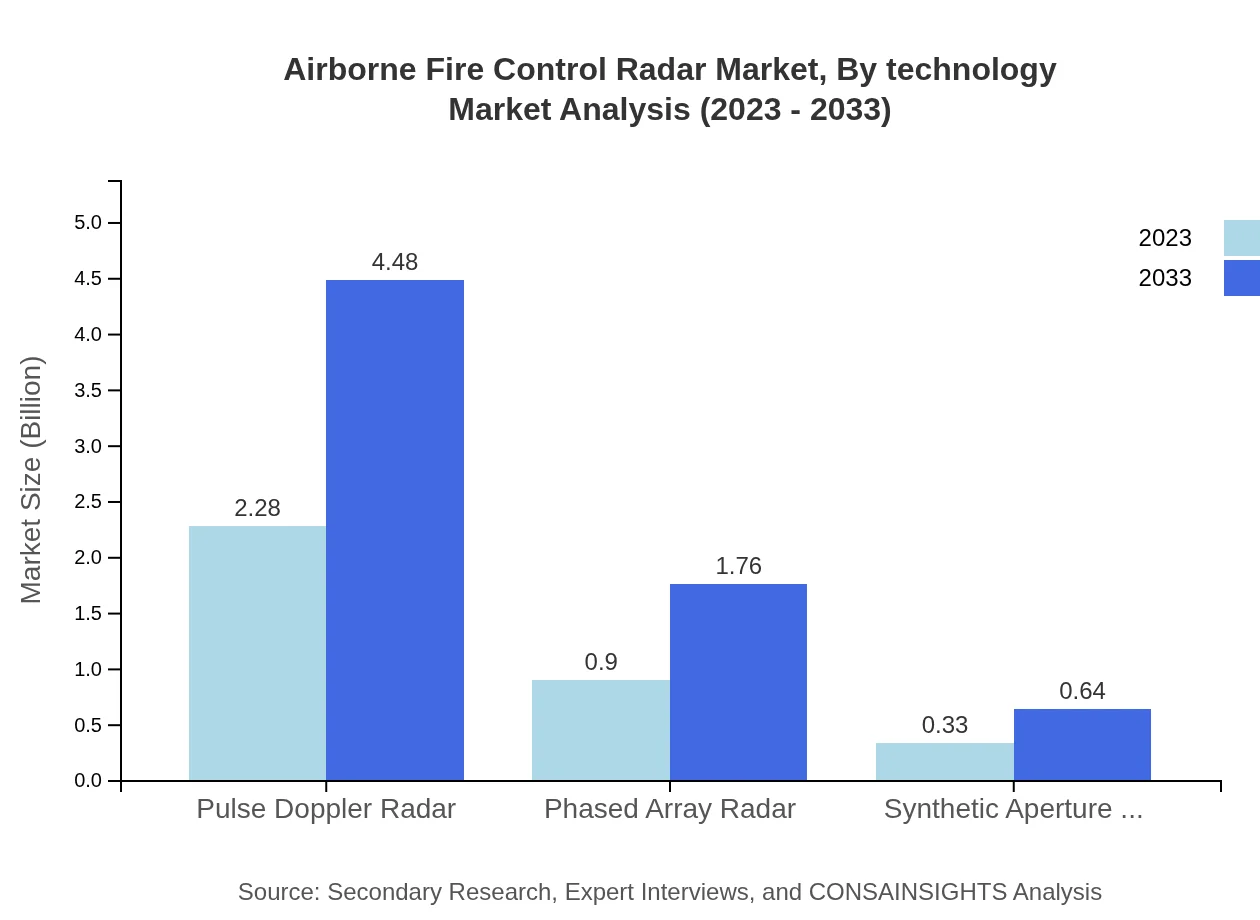

Airborne Fire Control Radar Market Analysis By Technology

The technology segment of the Airborne Fire Control Radar market includes Pulse Doppler Radar, Phased Array Radar, and Synthetic Aperture Radar. Pulse Doppler Radars currently dominate the market with a share of approximately 65.12% in 2023, growing to 65.12% by 2033. Phased Array Radars are gaining traction due to their advantages in tracking multiple targets simultaneously, while Synthetic Aperture Radars facilitate high-resolution imaging capabilities, essential for intelligence, surveillance, and reconnaissance (ISR) missions.

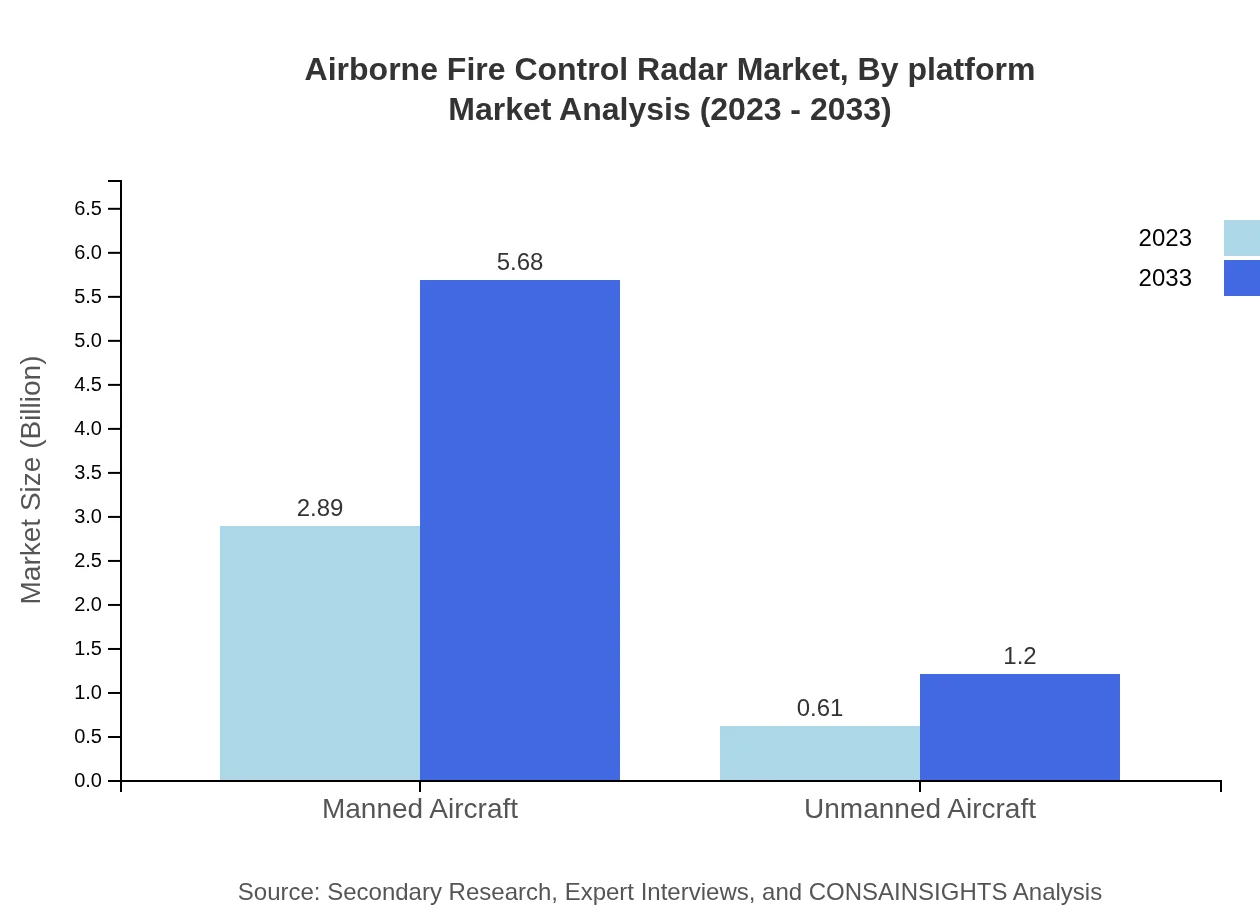

Airborne Fire Control Radar Market Analysis By Platform

The Airborne Fire Control Radar market is segmented based on platform into manned and unmanned aircraft. Manned aircraft are projected to account for approximately 82.61% market share in 2023 and maintain this share by 2033. Unmanned aircraft, on the other hand, are increasingly being adopted due to the flexibility and cost-effectiveness they provide, rising from a market size of 0.61 billion USD in 2023 to 1.20 billion USD by 2033.

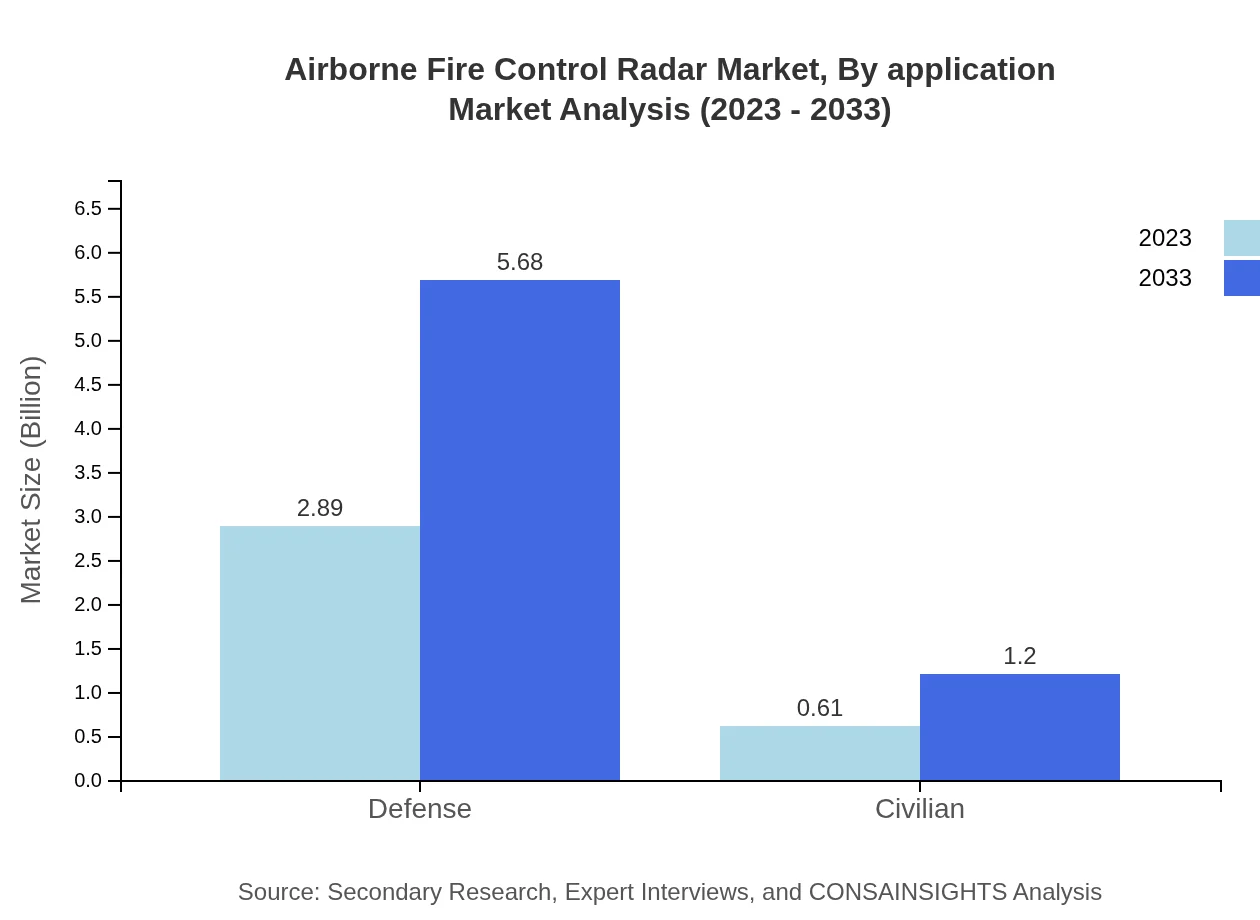

Airborne Fire Control Radar Market Analysis By Application

The application segment of the Airborne Fire Control Radar market is dominated by defense applications, accounting for 82.61% of the market share in 2023, projected to rise accordingly by 2033. The civilian applications are emerging as a significant segment due to increasing uses in search and rescue operations, disaster management, and environmental monitoring.

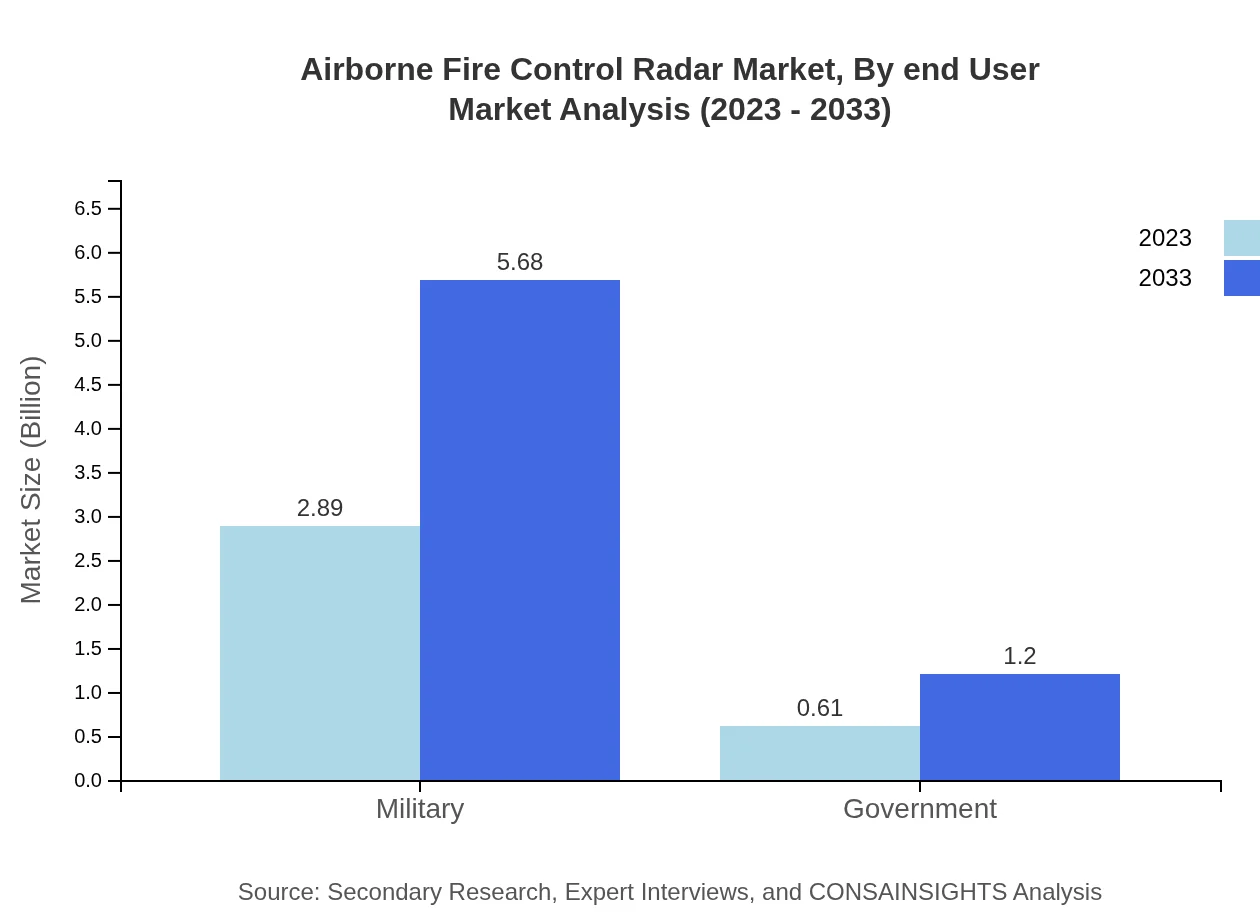

Airborne Fire Control Radar Market Analysis By End User

The end-user segment of the market primarily comprises military and government sectors, with military applications holding a substantial share due to ongoing defense modernization initiatives. Government applications are also increasing, as civilian agencies look to enhance public safety and emergency response capabilities using advanced airborne fire control radars.

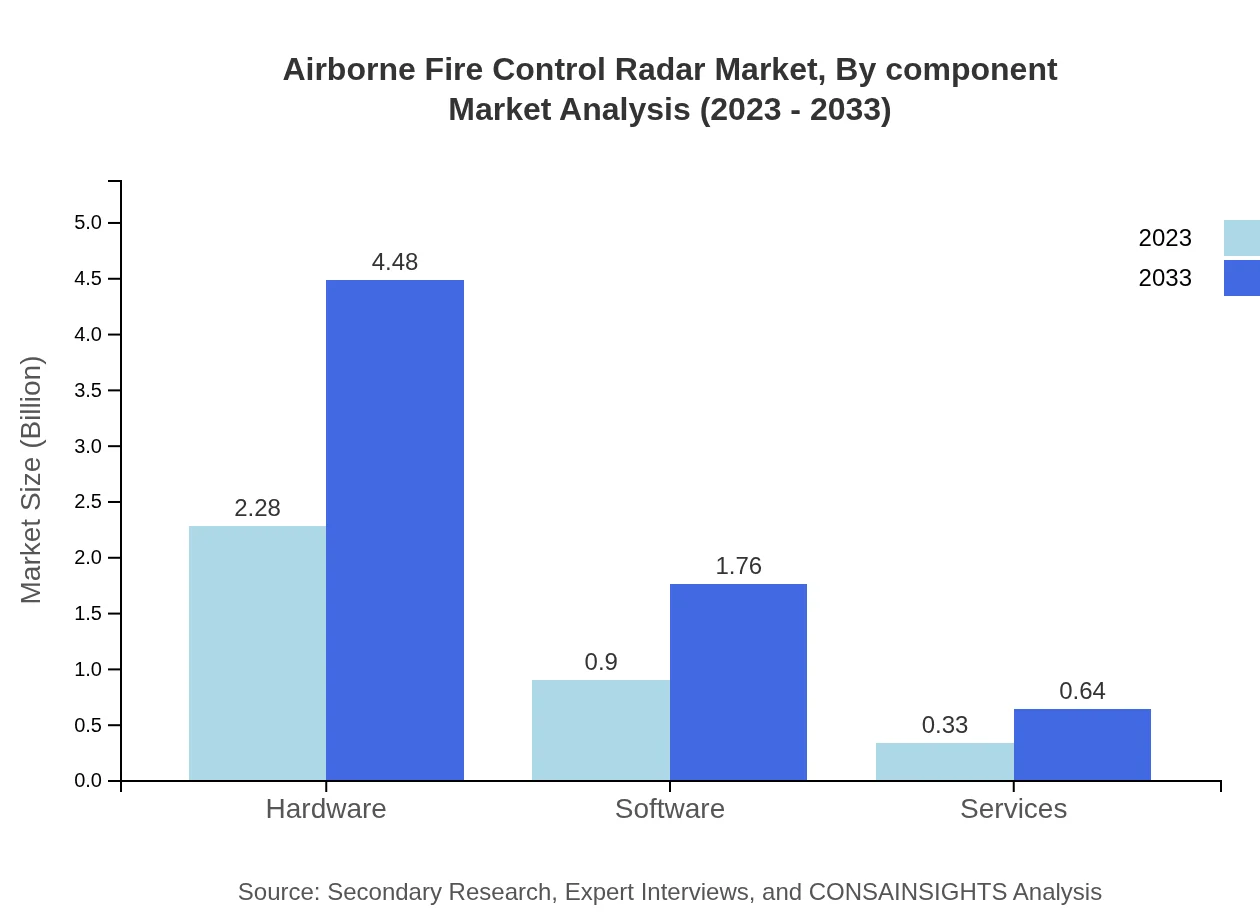

Airborne Fire Control Radar Market Analysis By Component

The Airborne Fire Control Radar market's component segment includes hardware, software, and services. Hardware is projected to dominate the market size, accounting for 65.12% in 2023, with the software segment rapidly growing due to increasing integrations of software advancements such as AI and data analytics that enhance the functionality of existing radar systems.

Airborne Fire Control Radar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Airborne Fire Control Radar Industry

Lockheed Martin Corporation:

Lockheed Martin is a key player in the aerospace, defense, and security market, known for its innovative radar systems, including the F-35 fighter jet's advanced fire control radar capabilities.Northrop Grumman Corporation:

Northrop Grumman specializes in aerospace and defense technologies, producing advanced radar systems that provide critical capabilities for airborne operations, enhancing situational awareness.Raytheon Technologies Corporation:

Raytheon Technologies is a major defense contractor recognized for designing cutting-edge radar systems utilized across various military branches, contributing to enhanced operational effectiveness.Thales Group:

Thales is engaged in providing advanced radar technologies and solutions for defense applications, focusing on enhancing safety and security through innovative systems.BAE Systems:

BAE Systems delivers comprehensive technology solutions, including airborne radar systems, that play a significant role in enhancing defense capabilities across multiple platforms.We're grateful to work with incredible clients.

FAQs

What is the market size of Airborne Fire Control Radar?

The global market size for Airborne Fire Control Radar is projected to reach approximately $3.5 billion in 2023, with an expected CAGR of 6.8% from 2023 to 2033.

What are the key market players or companies in the Airborne Fire Control Radar industry?

Key players in the Airborne Fire Control Radar market include major defense contractors and technology firms specializing in radar systems and military applications, alongside emerging companies focused on unique technological developments.

What are the primary factors driving the growth in the Airborne Fire Control Radar industry?

Factors driving market growth include increasing defense budgets, technological advancements, the rising need for enhanced surveillance, and the growing demand for modern aircraft equipped with advanced radar systems.

Which region is the fastest Growing in the Airborne Fire Control Radar?

The Asia Pacific region is the fastest-growing market for Airborne Fire Control Radar, expected to grow from $0.68 billion in 2023 to $1.34 billion by 2033, reflecting a rising investment in defense capabilities.

Does ConsaInsights provide customized market report data for the Airborne Fire Control Radar industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the Airborne Fire Control Radar sector, providing detailed insights based on client needs.

What deliverables can I expect from this Airborne Fire Control Radar market research project?

Deliverables include comprehensive market analysis reports, forecasts, competitive landscape assessments, and insights into regional trends, helping stakeholders make informed decisions.

What are the market trends of Airborne Fire Control Radar?

Current market trends include the adoption of advanced radar types like Pulse Doppler and Phased Array, increased focus on unmanned aerial systems, and enhanced integration of software solutions for improved operational capabilities.