Aircraft Brakes Market Report

Published Date: 03 February 2026 | Report Code: aircraft-brakes

Aircraft Brakes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Aircraft Brakes market from 2023 to 2033, including insights on market dynamics, trends, size forecasts, and competitive landscape. It aims to inform stakeholders about growth potential and challenges in this essential aerospace component sector.

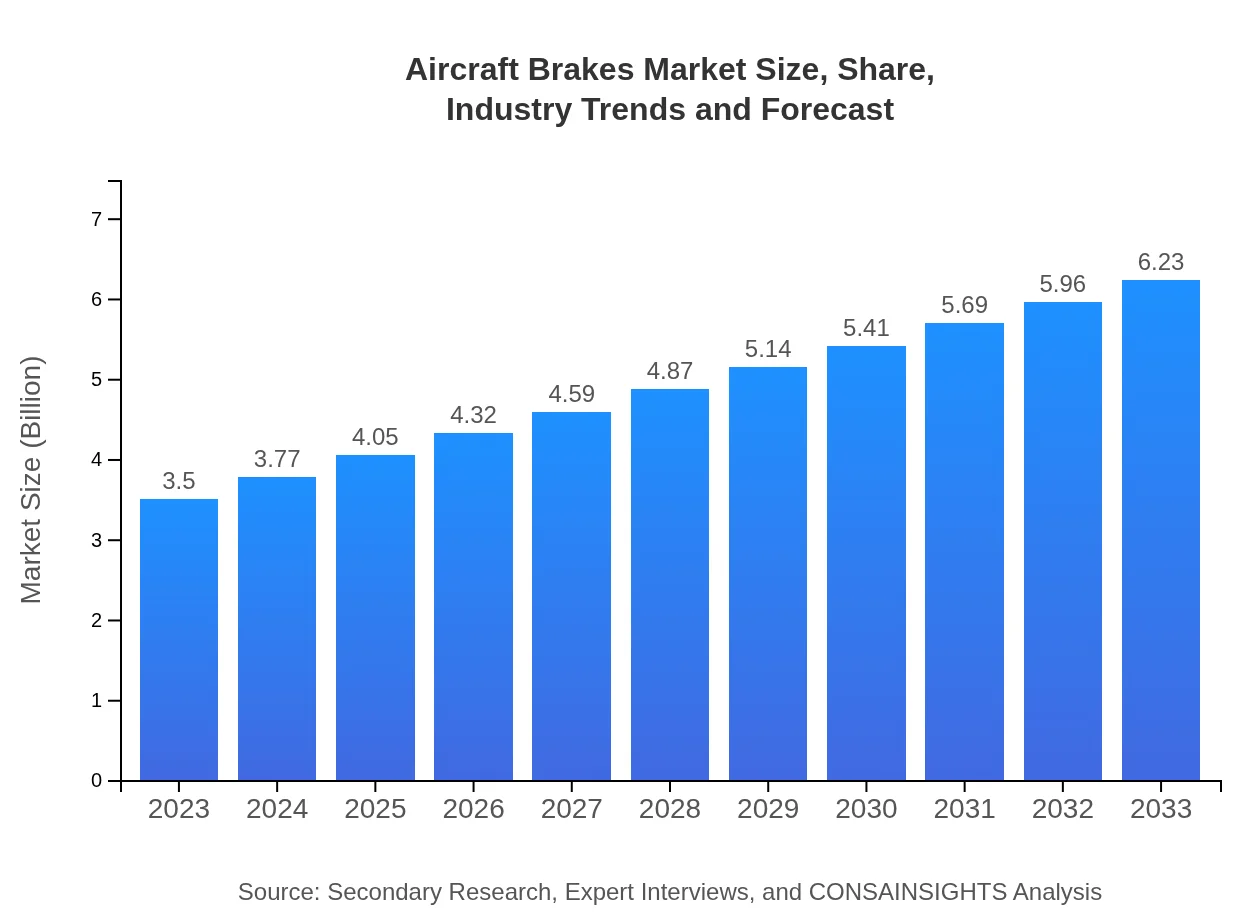

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $6.23 Billion |

| Top Companies | Honeywell International Inc., Boeing Company, Safran S.A., Collins Aerospace, UTC Aerospace Systems |

| Last Modified Date | 03 February 2026 |

Aircraft Brakes Market Overview

Customize Aircraft Brakes Market Report market research report

- ✔ Get in-depth analysis of Aircraft Brakes market size, growth, and forecasts.

- ✔ Understand Aircraft Brakes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Brakes

What is the Market Size & CAGR of Aircraft Brakes market in 2023?

Aircraft Brakes Industry Analysis

Aircraft Brakes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Brakes Market Analysis Report by Region

Europe Aircraft Brakes Market Report:

The European aircraft brakes market stands at $1.05 billion in 2023, projected to grow to $1.87 billion by 2033. Europe’s strong emphasis on aircraft safety and performance leads to continuous advancements in braking technology. The strong presence of established manufacturers and OEMs in the region also contributes to market growth, while regulatory compliance drives innovation.Asia Pacific Aircraft Brakes Market Report:

In the Asia Pacific region, the aircraft brakes market is witnessing growth fueled by rising air traffic and increasing investments in aviation infrastructure. In 2023, the market is valued at approximately $0.62 billion and is expected to reach $1.11 billion by 2033, indicating a robust growth trajectory. Major economies like China and India are leading this growth, thanks to their expanding airline fleets and rising disposable incomes of travelers.North America Aircraft Brakes Market Report:

North America remains a significant market for aircraft brakes, valued at around $1.36 billion in 2023 and projected to grow to $2.42 billion by 2033. The high concentration of major airlines and aircraft manufacturers, along with technological advancements, is propelling the market. Furthermore, the region's stringent safety regulations necessitate the adoption of advanced braking systems.South America Aircraft Brakes Market Report:

The South American market for aircraft brakes is gradually expanding, projecting growth from $0.33 billion in 2023 to $0.58 billion by 2033. Factors including increased tourism and the need for upgrading aging fleets drive this growth. The region's strategic focus on improving air connectivity is expected to increase the demand for reliable and efficient braking systems.Middle East & Africa Aircraft Brakes Market Report:

In the Middle East and Africa, the market is relatively smaller, valued at $0.14 billion in 2023 and expected to reach $0.25 billion by 2033. Growth is driven by increased investments in transportation infrastructure and the development of new airline operators. The region's strategic geographical position serves as a connecting hub for international flights, further boosting the demand for reliable aircraft braking solutions.Tell us your focus area and get a customized research report.

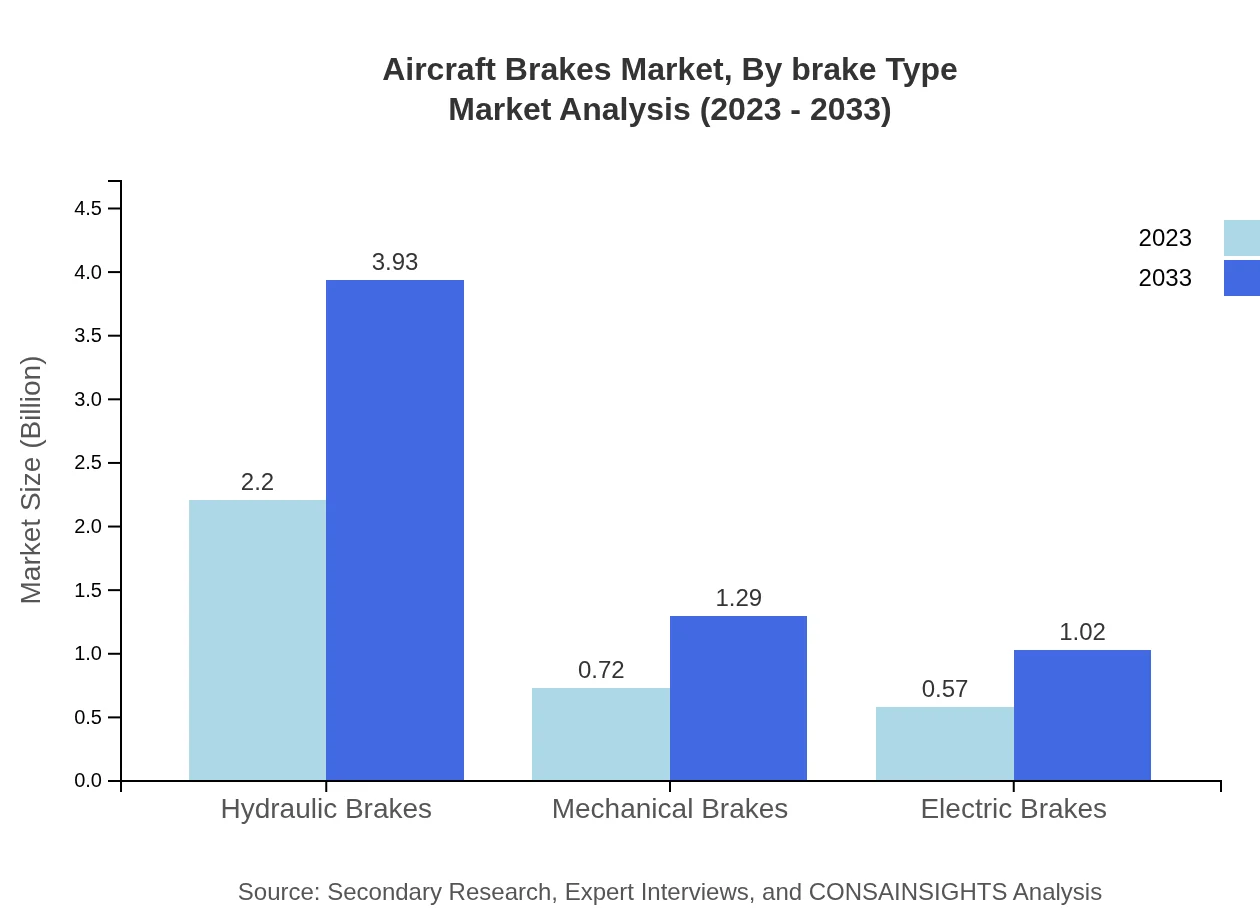

Aircraft Brakes Market Analysis By Brake Type

The Aircraft Brakes Market is categorized by brake type into hydraulic, mechanical, and electric brakes. Hydraulic brakes dominate the segment, representing about 62.99% of the market share in 2023, totaling $2.20 billion and expected to reach $3.93 billion by 2033, owing to their effectiveness in ensuring safety. Mechanical brakes hold a 20.63% share with $0.72 billion in 2023, projected to grow to $1.29 billion by 2033. Electric brakes, though relatively new, are gaining traction, holding about 16.38% share in 2023, and expected to expand from $0.57 billion to $1.02 billion by the end of the forecast period. These dynamics reflect the industry's shift towards innovative and efficient braking solutions.

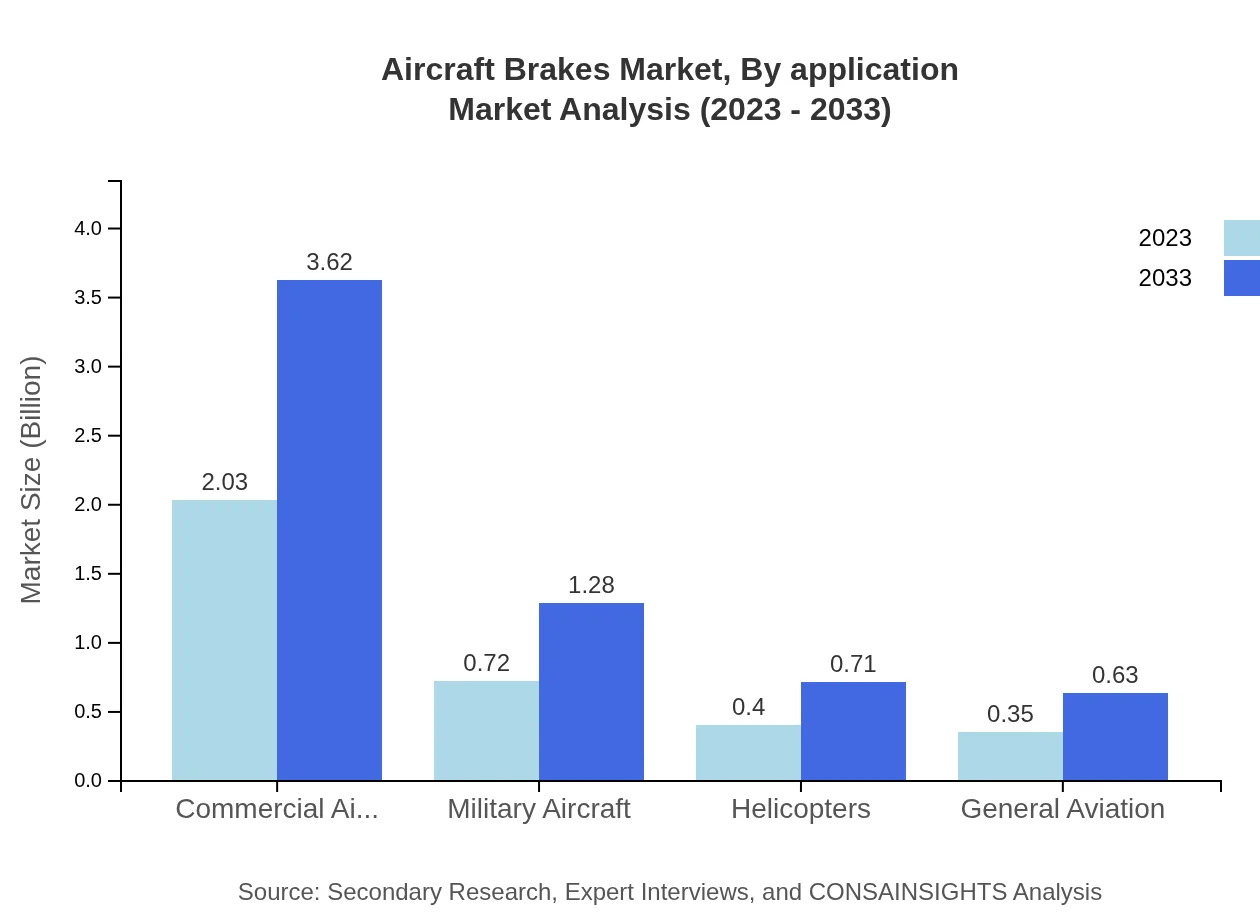

Aircraft Brakes Market Analysis By Application

In terms of application, the aircraft brakes market is segmented into commercial aircraft, military aircraft, helicopters, and general aviation. Commercial aircraft dominate the market, accounting for 58.02% in 2023 with a market size of $2.03 billion; this is expected to grow to $3.62 billion by 2033. Military aircraft represent 20.53% of the market with $0.72 billion in 2023, expected to reach $1.28 billion by 2033. Helicopters and general aviation also show promising growth trajectories, with market shares of 11.38% and 10.07% respectively. The ongoing modernization of fleets and increasing defense budgets are driving the demand for advanced braking systems across these segments.

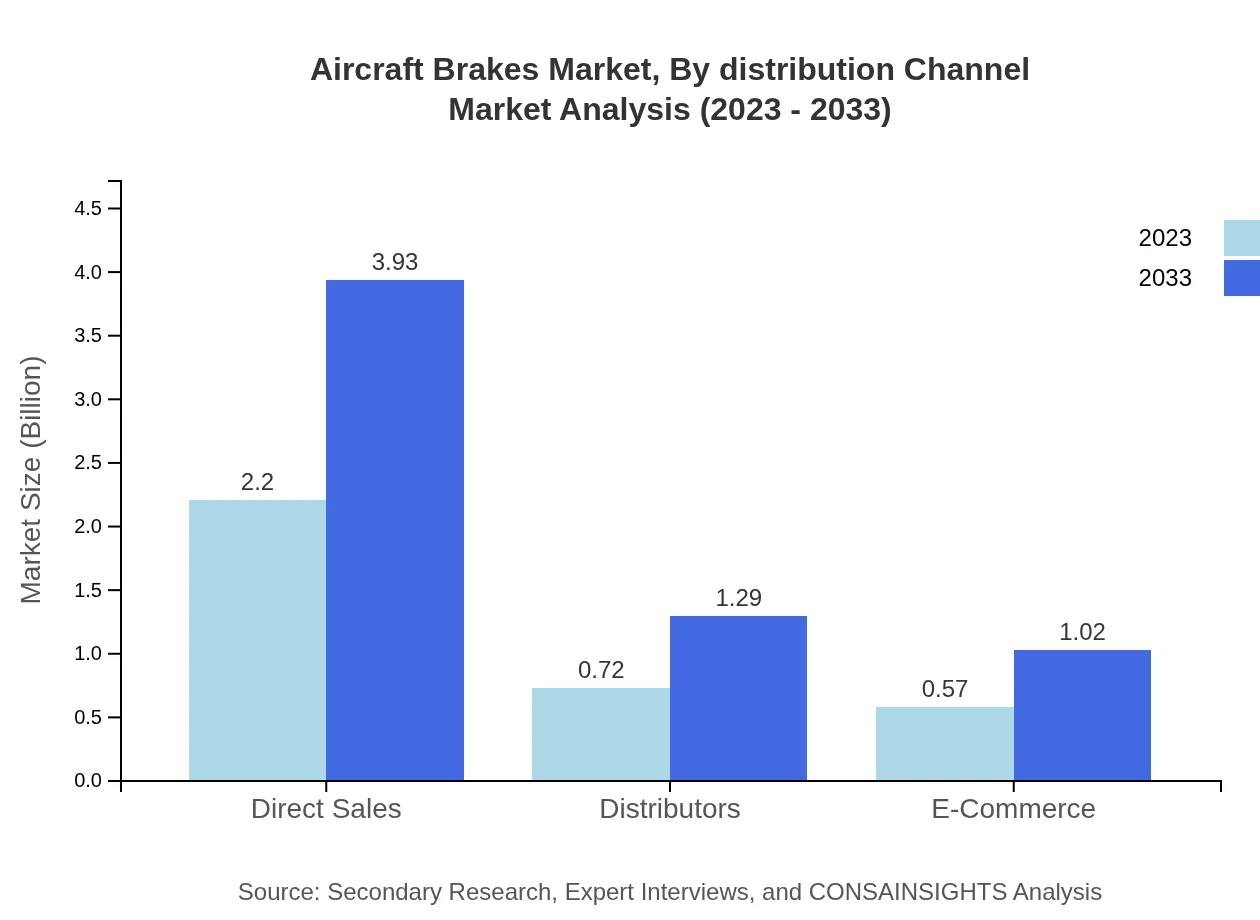

Aircraft Brakes Market Analysis By Distribution Channel

Distribution channels for aircraft brakes include direct sales, distributors, and e-commerce platforms. Direct sales hold the largest share, capturing about 62.99% of the market with $2.20 billion in 2023, projected to expand to $3.93 billion by 2033. Distributors account for 20.63% with $0.72 billion in 2023, expected to grow to $1.29 billion by 2033. E-commerce is emerging as a significant channel, covering 16.38%, increasing the accessibility of aircraft brake products. The evolution of distribution strategies due to digital transformation is greatly influencing market growth.

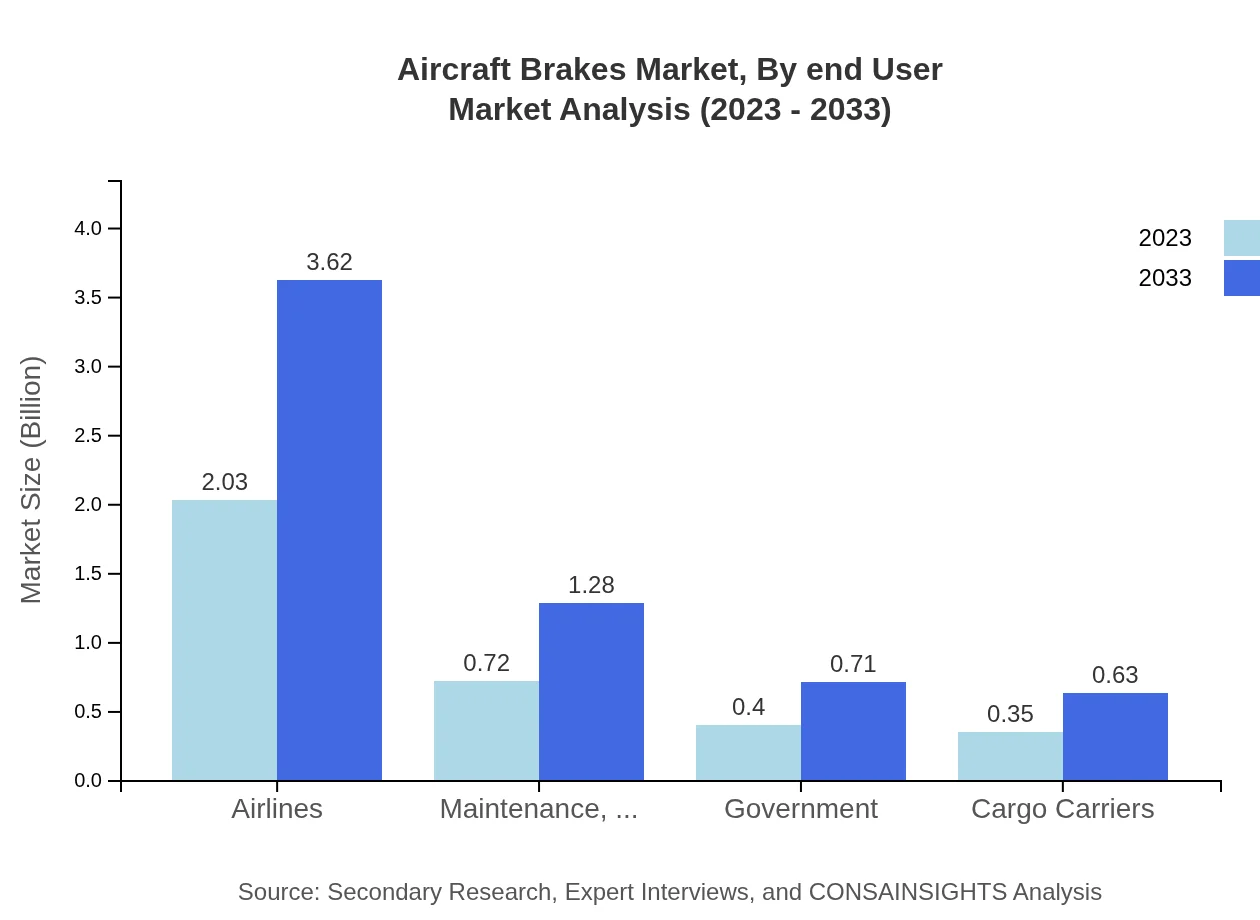

Aircraft Brakes Market Analysis By End User

The end-user segmentation of the aircraft brakes market encompasses airlines, maintenance, repair, and overhaul (MRO) services, government entities, and cargo carriers. Airlines lead the segment with a significant market size of $2.03 billion and a share of 58.02% in 2023, with an expected growth to $3.62 billion by 2033. MRO services contribute $0.72 billion, with a consistent 20.53% share, projected to reach $1.28 billion. Government contracts account for $0.40 billion and are poised for growth, while cargo carriers represent a growing niche. The evolving landscape of air travel and the need for efficient fleet management are driving demand across this segment.

Aircraft Brakes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Brakes Industry

Honeywell International Inc.:

Honeywell is a leading global provider of aerospace products and services, including advanced aircraft braking systems. Their innovative solutions focus on improving performance and safety while minimizing maintenance costs.Boeing Company:

Boeing is a major player in the aerospace industry and offers aircraft brakes as part of its comprehensive aircraft solutions. Their focus on integrating new technologies ensures their brakes meet evolving industry standards.Safran S.A.:

Safran is a key manufacturer of aircraft components, including brakes. They emphasize lightweight materials and advanced manufacturing processes that enhance braking efficiency and reliability.Collins Aerospace:

Collins Aerospace specializes in aerospace and defense solutions, including aircraft braking systems. Their focus on innovation promotes safer and more efficient braking technologies.UTC Aerospace Systems:

UTC Aerospace Systems provides advanced aircraft systems, including braking systems. Their integration of smart technologies represents a significant advancement in the safety and efficiency of braking solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft Brakes?

The global aircraft brakes market is projected to reach approximately $3.5 billion by 2033, growing at a CAGR of 5.8%. This growth indicates a robust demand for innovative braking technologies in the aerospace sector.

What are the key market players or companies in the aircraft Brakes industry?

Key players in the aircraft brakes market include Honeywell International Inc., UTC Aerospace Systems, and Safran S.A. These companies play a significant role in advancing braking technologies and meeting the rising demand for aircraft safety.

What are the primary factors driving the growth in the aircraft Brakes industry?

Growth drivers in the aircraft brakes industry include increasing air travel demand, innovations in braking technologies, and stringent safety regulations. Additionally, the expansion of the aerospace sector fuels investments in advanced braking solutions.

Which region is the fastest Growing in the aircraft Brakes market?

The North American region leads the aircraft brakes market, expected to grow from $1.36 billion in 2023 to $2.42 billion by 2033. Europe follows closely, expanding from $1.05 billion to $1.87 billion over the same period.

Does ConsaInsights provide customized market report data for the aircraft Brakes industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs within the aircraft-brakes industry. This includes detailed analysis, data segmentation, and forecasts based on client-defined parameters.

What deliverables can I expect from this aircraft Brakes market research project?

From the aircraft brakes market research project, you can expect comprehensive reports, detailed regional analyses, segmented data insights, market forecasts, and strategic recommendations to inform business decisions.

What are the market trends of aircraft Brakes?

Current market trends in aircraft brakes include an emphasis on lightweight materials, automation in braking systems, and regulatory shifts towards enhanced safety features. Sustainability initiatives are also becoming more prominent in product development.