Aircraft Engines Market Report

Published Date: 03 February 2026 | Report Code: aircraft-engines

Aircraft Engines Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Aircraft Engines market, presenting insights and data from 2023 to 2033. It covers market size, growth trends, regional analysis, and key players, aiming to assist stakeholders in making informed decisions in this evolving industry.

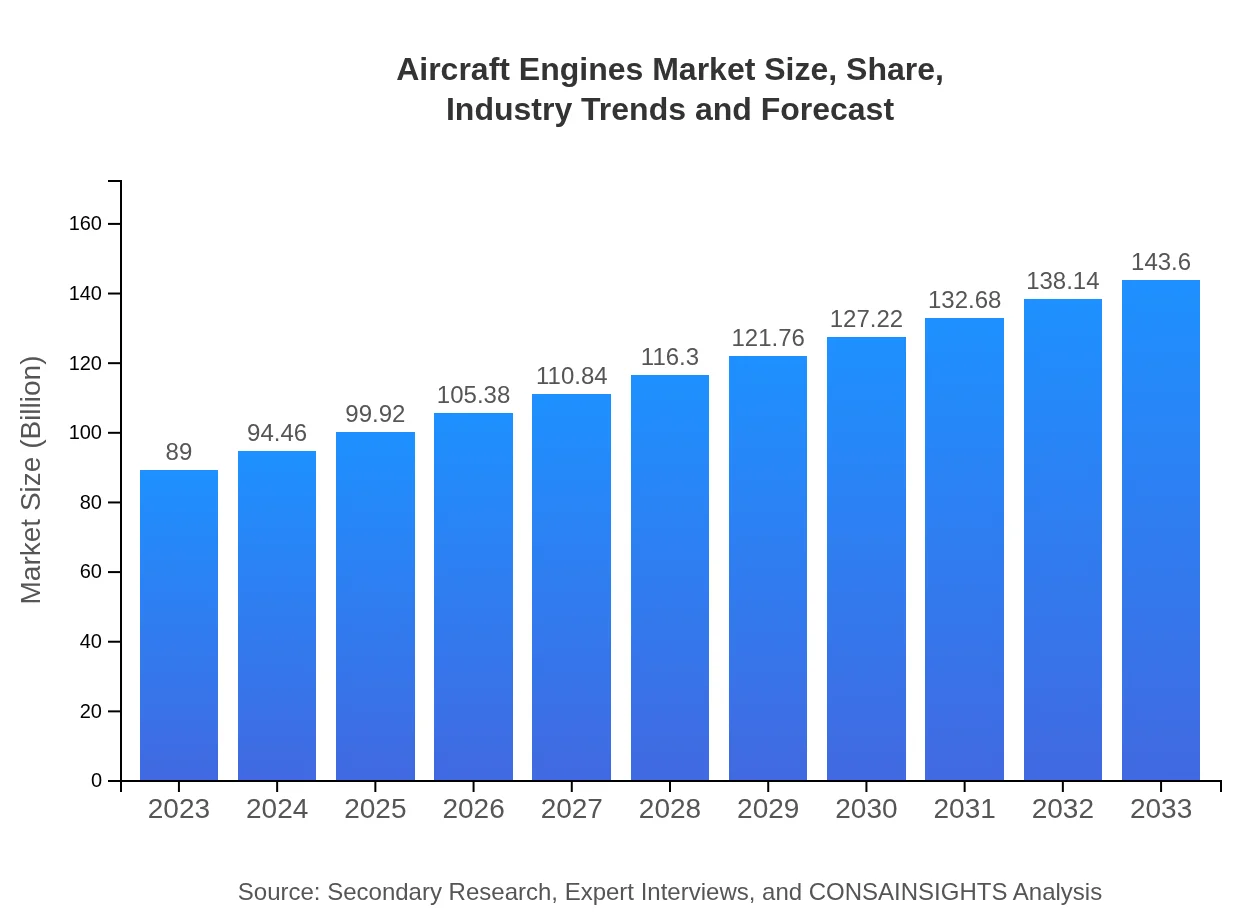

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $89.00 Billion |

| CAGR (2023-2033) | 4.8% |

| 2033 Market Size | $143.60 Billion |

| Top Companies | General Electric Aviation, Rolls Royce Holdings, Pratt & Whitney, Safran |

| Last Modified Date | 03 February 2026 |

Aircraft Engines Market Overview

Customize Aircraft Engines Market Report market research report

- ✔ Get in-depth analysis of Aircraft Engines market size, growth, and forecasts.

- ✔ Understand Aircraft Engines's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Aircraft Engines

What is the Market Size & CAGR of Aircraft Engines market in 2023?

Aircraft Engines Industry Analysis

Aircraft Engines Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Aircraft Engines Market Analysis Report by Region

Europe Aircraft Engines Market Report:

The European market for aircraft engines is expanding, with projections indicating growth from $26.71 billion in 2023 to $43.09 billion in 2033. The region's focus on sustainable aviation practices and strong regulatory frameworks facilitates advancements in eco-friendly technologies, driving demand for innovative engine solutions.Asia Pacific Aircraft Engines Market Report:

The Asia-Pacific region is a burgeoning market for aircraft engines, driven by increasing air travel demand and government investments in aviation infrastructure. The market is projected to grow from $16.93 billion in 2023 to $27.31 billion in 2033. Countries like China and India are at the forefront, with expanding airline fleets and military modernization efforts slated to bolster growth further.North America Aircraft Engines Market Report:

North America remains a dominant force in the aircraft engines market, with a forecasted growth from $32.01 billion in 2023 to $51.65 billion in 2033. The presence of major manufacturers and a robust military sector underpin this market, with a strong push for modernization and advanced technology engines to address strict environmental regulations.South America Aircraft Engines Market Report:

In South America, the aircraft engines market is expected to rise from $5.92 billion in 2023 to $9.55 billion in 2033. Despite economic fluctuations, regional airlines are focusing on fleet upgrades and the adoption of more fuel-efficient engines, supported by rising disposable incomes and tourism demands.Middle East & Africa Aircraft Engines Market Report:

The Middle East and Africa's aircraft engines market, growing from $7.43 billion in 2023 to $11.99 billion in 2033, is heavily influenced by increasing air traffic and strategic investments in aviation infrastructure. Countries are aiming to enhance connectivity and aviation capabilities, presenting significant opportunities for engine manufacturers.Tell us your focus area and get a customized research report.

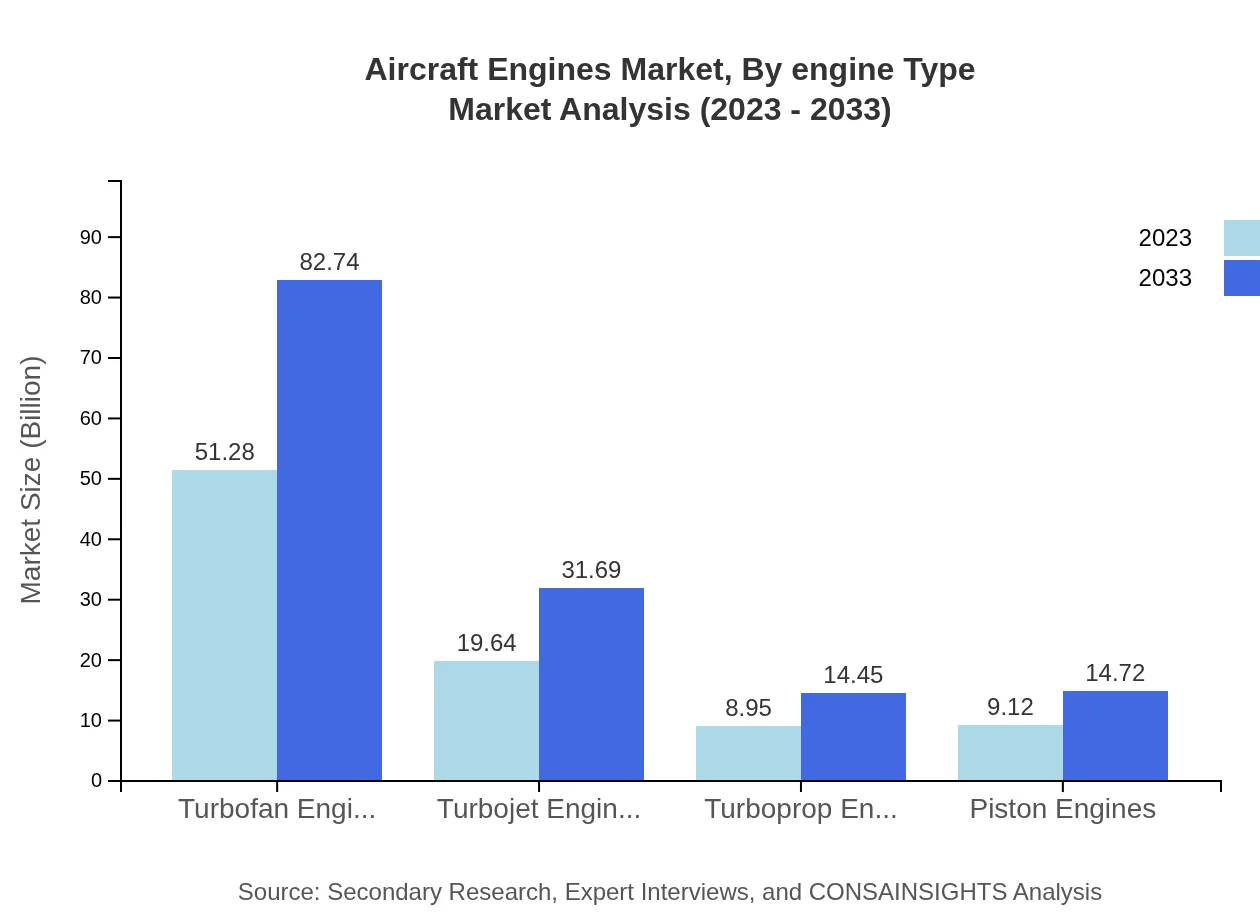

Aircraft Engines Market Analysis By Engine Type

In 2023, Turbofan Engines account for the largest segment, valued at $51.28 billion, projected to reach $82.74 billion by 2033. Turbojet and Turboprop Engines also play significant roles, with Turbojets valued at $19.64 billion and Turboprops at $8.95 billion. The demand for Conventional Engines continues to dominate, while Advanced Technology Engines are gaining traction due to their improved efficiency.

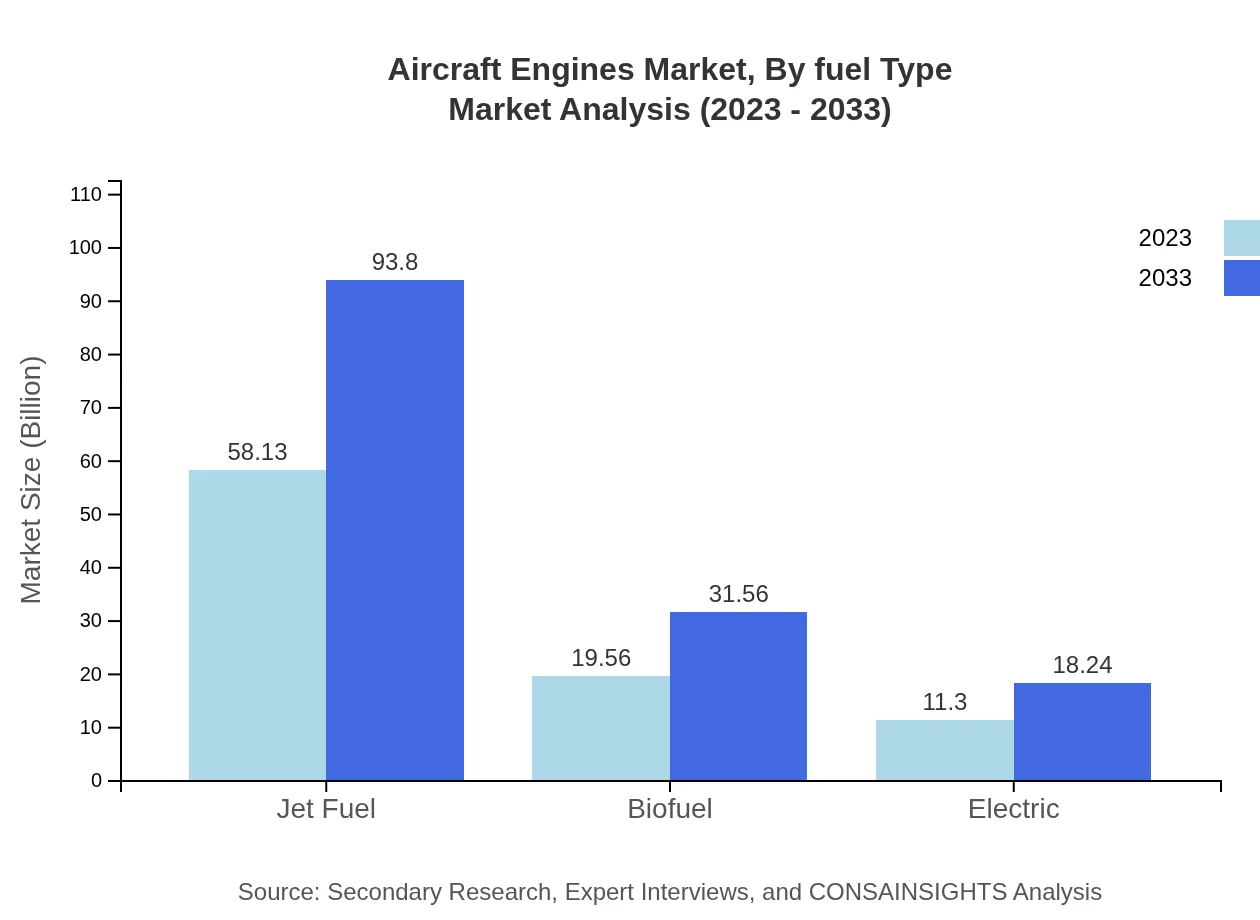

Aircraft Engines Market Analysis By Fuel Type

Jet Fuel holds the largest market share with a value of $58.13 billion in 2023, expected to grow to $93.80 billion by 2033. Biofuel is also an emerging segment, showcasing significant growth due to increasing environmental concerns, growing from $19.56 billion to $31.56 billion. Electric engines, although currently smaller in share, are being explored extensively for future applications.

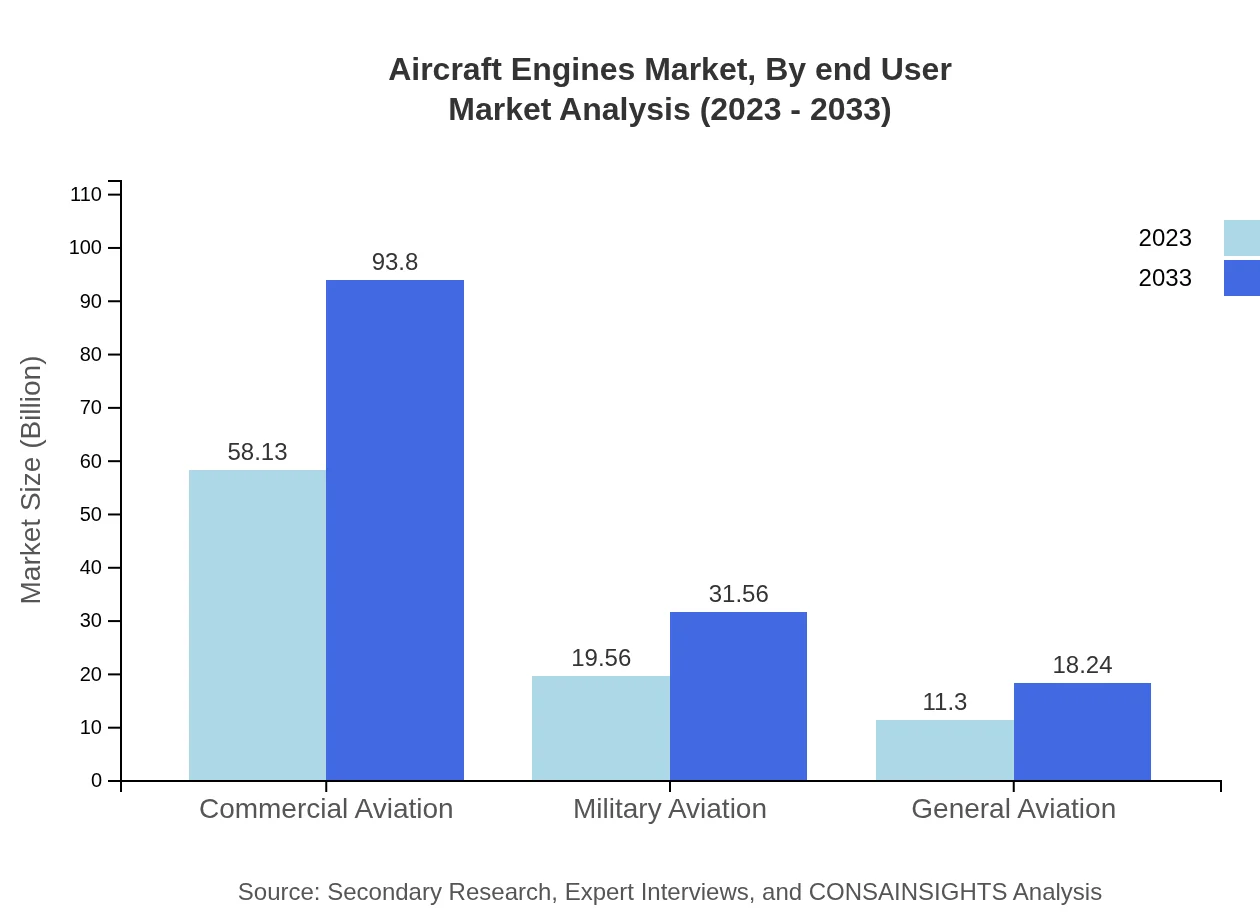

Aircraft Engines Market Analysis By End User

Commercial aviation dominates the market, reaching $58.13 billion in 2023 and projected to grow to $93.80 billion by 2033. Military aviation follows, with substantial investment driving growth from $19.56 billion to $31.56 billion throughout the same period. General aviation also has a stake, albeit smaller, projected to increase steadily.

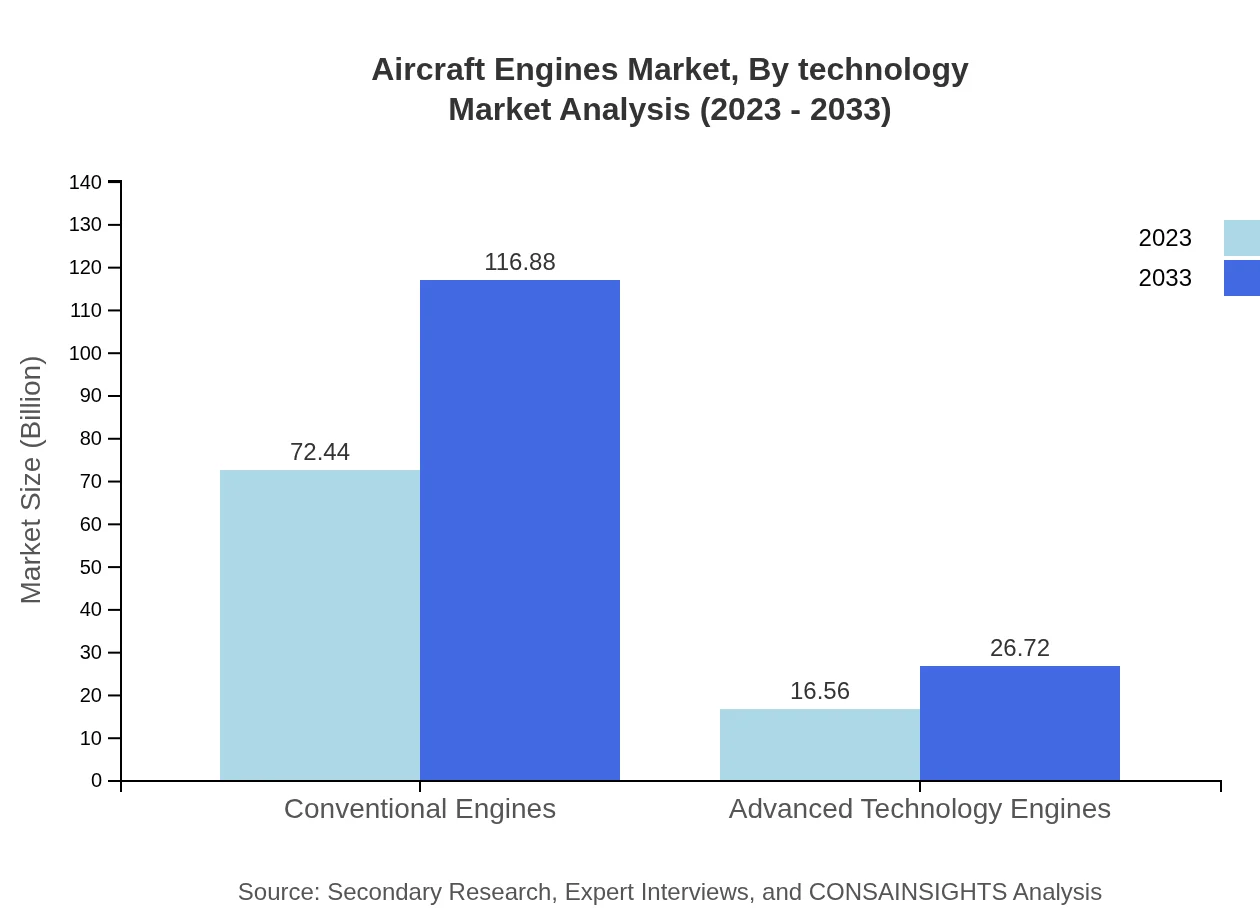

Aircraft Engines Market Analysis By Technology

Conventional Engines, representing a robust $72.44 billion in 2023, are expected to command an increasing share of the market, driven by their reliability. Advanced Technology Engines are emerging rapidly, forecasted to grow from $16.56 billion to $26.72 billion, contributing to the transition towards sustainable aviation practices.

Aircraft Engines Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Aircraft Engines Industry

General Electric Aviation:

A leading player in the aircraft engine industry, GE Aviation specializes in developing high-performance jet engines, known for their efficiency and reliability in both commercial and military applications.Rolls Royce Holdings:

A key competitor in the aerospace space, Rolls Royce is recognized for its cutting-edge technologies in aircraft engines, particularly in the realm of turbofan engines for commercial aircraft.Pratt & Whitney:

Part of Raytheon Technologies, Pratt & Whitney designs, manufactures, and services aircraft engines with a strong focus on innovation and efficiency, catering to both the commercial and military sectors.Safran:

A global leader in aircraft propulsion and equipment, Safran produces high-tech propulsion systems and innovative engine technologies focused on sustainability and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of aircraft engines?

The aircraft engines market is projected to reach $89 billion by 2033, growing at a CAGR of 4.8% from its current size. This growth is attributed to increased air travel and advancements in engine technology.

What are the key market players or companies in the aircraft engines industry?

Key players in the aircraft engines industry include General Electric, Rolls-Royce Holdings, Pratt & Whitney, and Safran, all leading the market in innovation and production capabilities.

What are the primary factors driving the growth in the aircraft engines industry?

Key factors driving growth include rising demand for air travel, technological advancements in engine efficiency, and the increasing shift towards sustainable and biofuel alternatives.

Which region is the fastest Growing in the aircraft engines market?

The Asia-Pacific region is the fastest-growing market, projected to grow from $16.93 billion in 2023 to $27.31 billion by 2033, reflecting significant investments in aviation infrastructure.

Does ConsaInsights provide customized market report data for the aircraft engines industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing businesses to gain insights that align with their strategic objectives in the aircraft engines sector.

What deliverables can I expect from this aircraft engines market research project?

Deliverables include comprehensive market analysis, regional and segment insights, competitive landscape assessments, and actionable recommendations tailored to your business objectives.

What are the market trends of aircraft engines?

Current trends in the aircraft engines market include a focus on fuel efficiency, development of hybrid and electric engines, and increased reliance on digital technologies for engine management and maintenance.