Automotive Artificial Intelligence Market Report

Published Date: 31 January 2026 | Report Code: automotive-artificial-intelligence

Automotive Artificial Intelligence Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Artificial Intelligence market, exploring its size, trends, and forecasts from 2023 to 2033. Key insights into the industry landscape and regional performances are also discussed.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

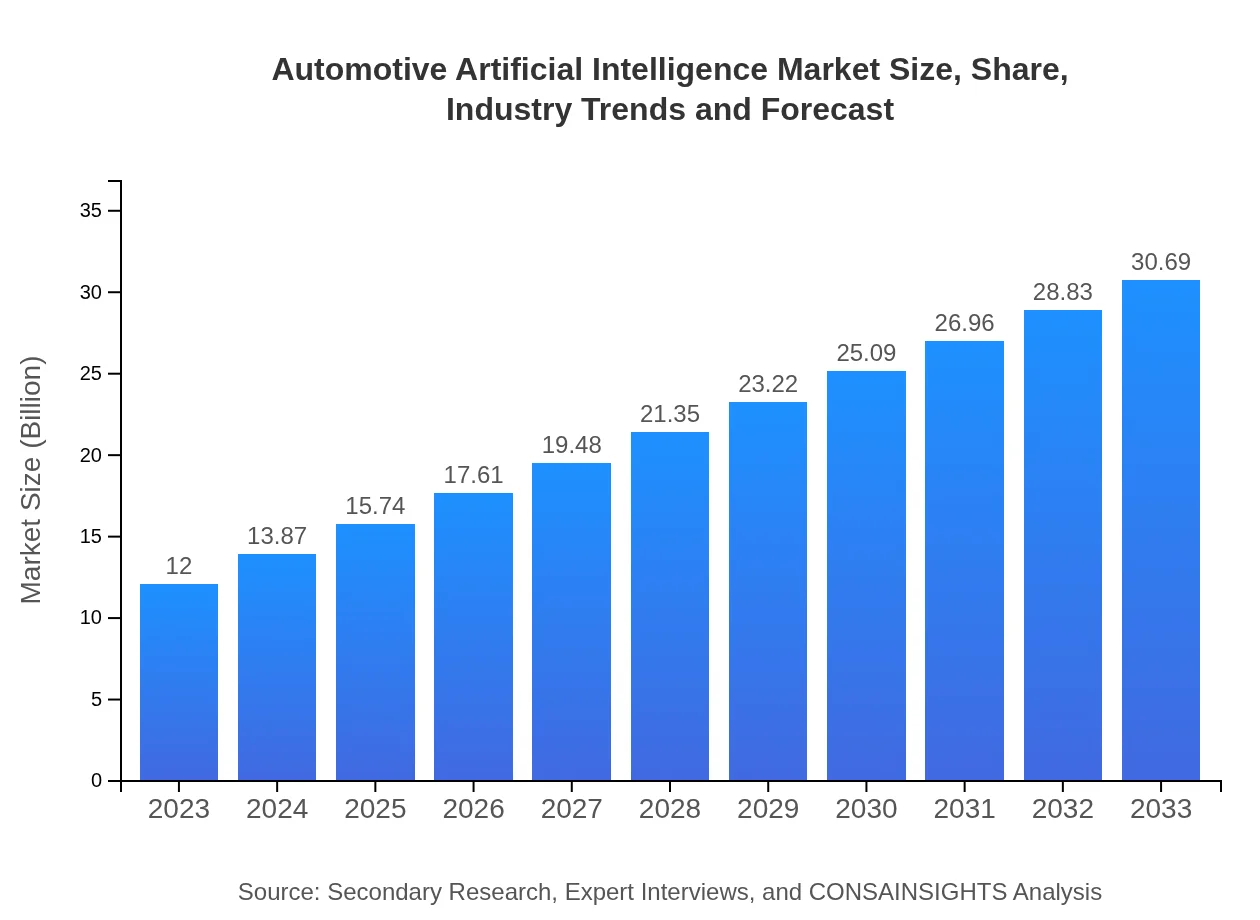

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | NVIDIA Corporation, Intel Corporation, Tesla, Inc., Google LLC, Mobileye |

| Last Modified Date | 31 January 2026 |

Automotive Artificial Intelligence Market Overview

Customize Automotive Artificial Intelligence Market Report market research report

- ✔ Get in-depth analysis of Automotive Artificial Intelligence market size, growth, and forecasts.

- ✔ Understand Automotive Artificial Intelligence's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Artificial Intelligence

What is the Market Size & CAGR of Automotive Artificial Intelligence market in 2023?

Automotive Artificial Intelligence Industry Analysis

Automotive Artificial Intelligence Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Artificial Intelligence Market Analysis Report by Region

Europe Automotive Artificial Intelligence Market Report:

The European Automotive AI market was valued at $3.81 billion in 2023 and is anticipated to reach $9.74 billion by 2033. The region’s strong focus on sustainability and regulatory push for autonomous driving solutions are the main drivers for AI adoption in vehicles.Asia Pacific Automotive Artificial Intelligence Market Report:

The Asia Pacific region accounted for $2.15 billion in 2023, with projections to reach $5.51 billion by 2033. Countries like China, Japan, and India are leading the integration of AI in automotive systems, driven by technological advancements and increasing adoption of electric vehicles enhancing demand for AI technologies.North America Automotive Artificial Intelligence Market Report:

North America stands as a powerhouse in the Automotive AI sector, with a market size of $4.56 billion in 2023, projected to grow to $11.65 billion by 2033. The presence of major automotive manufacturers and suppliers, along with substantial investments in AI-driven technologies, are key factors propelling market growth.South America Automotive Artificial Intelligence Market Report:

In South America, the Automotive AI market was valued at $1.04 billion in 2023 and is expected to grow to $2.65 billion by 2033. The market is influenced by rising consumer interest in advanced vehicle technologies and regional economic improvements, fostering investment in intelligent automotive solutions.Middle East & Africa Automotive Artificial Intelligence Market Report:

In the Middle East and Africa, the Automotive AI market is at $0.45 billion in 2023, expected to grow to $1.14 billion by 2033. The gradual increase in infrastructure development and the rise in consumer demand for innovative technologies are contributing to market growth.Tell us your focus area and get a customized research report.

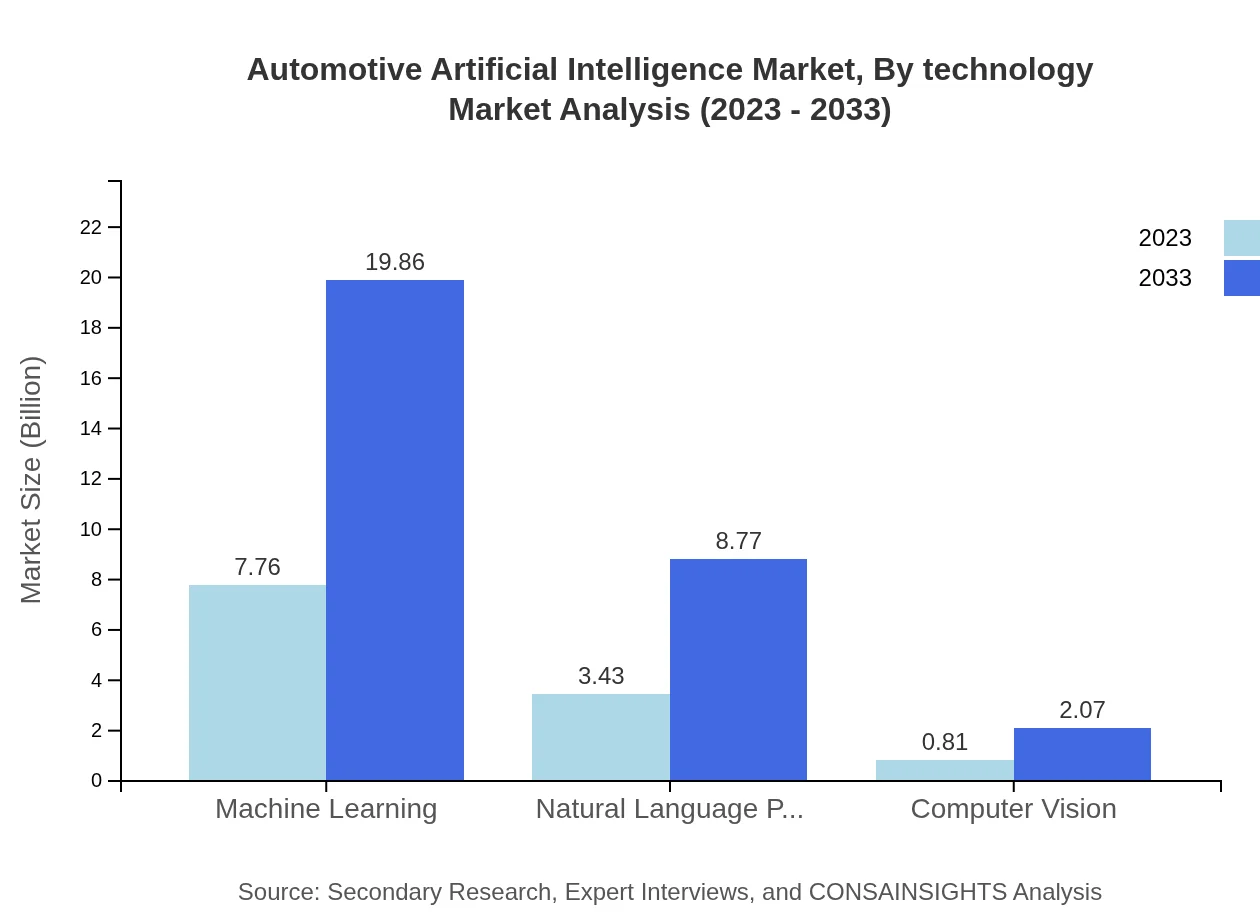

Automotive Artificial Intelligence Market Analysis By Technology

The Automotive AI market is significantly influenced by technology segments, with Machine Learning dominating the space. In 2023, Machine Learning holds a market size of $7.76 billion, anticipated to rise to $19.86 billion by 2033, accounting for a 64.69% market share. Natural Language Processing, valued at $3.43 billion in 2023, is expected to rise to $8.77 billion by 2033, while Computer Vision is projected to grow from $0.81 billion to $2.07 billion in the same period, reflecting increased AI integration across various applications.

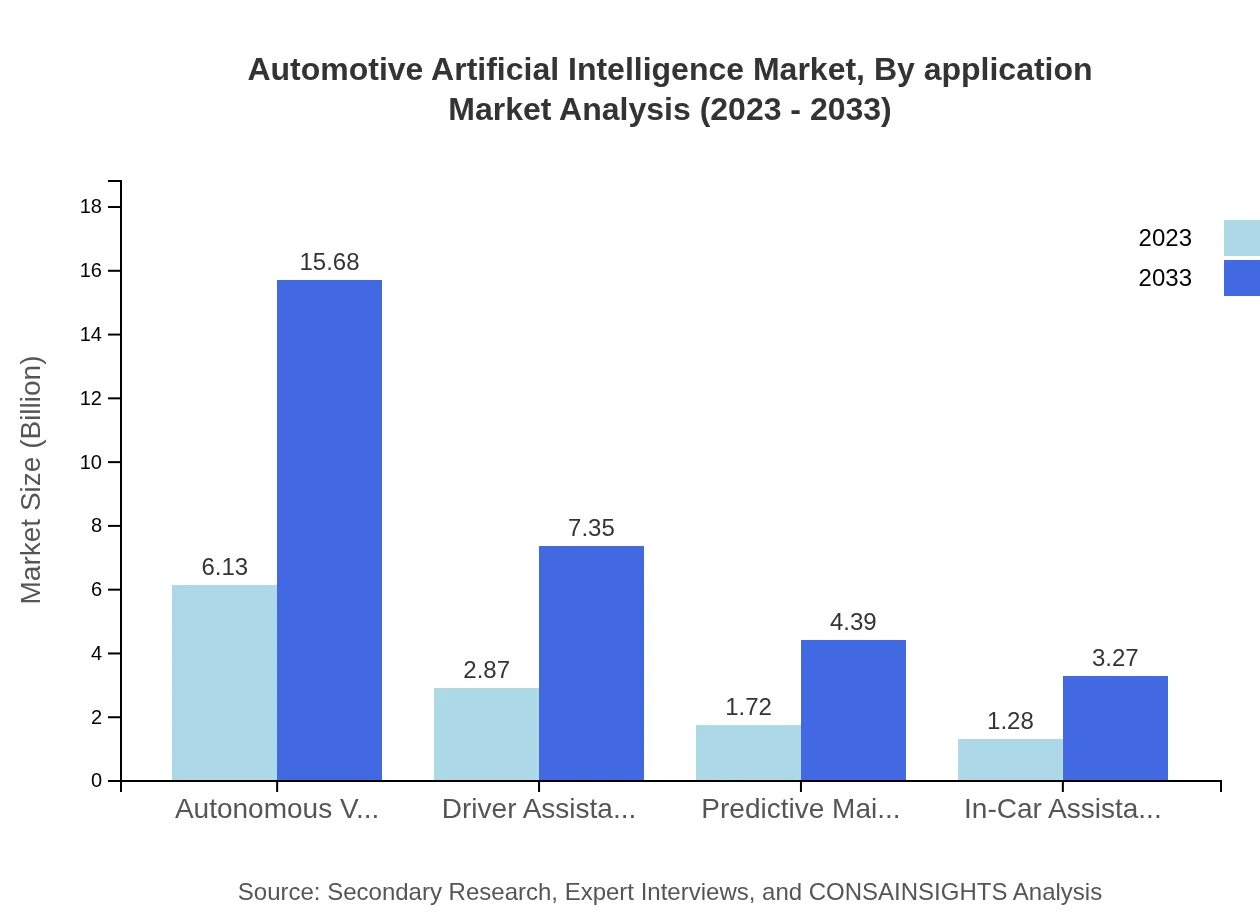

Automotive Artificial Intelligence Market Analysis By Application

Driver Assistance Systems and Autonomous Vehicles are primary application sectors within the Automotive AI market. Driver Assistance Systems generated $2.87 billion in 2023, expected to grow to $7.35 billion by 2033, holding a substantial market share of 23.94%. Meanwhile, Autonomous Vehicles hold a significant position, with a size of $6.13 billion in 2023, expected to increase to $15.68 billion by 2033, achieving a 51.1% market share, underscoring the growing trend toward autonomous mobility solutions.

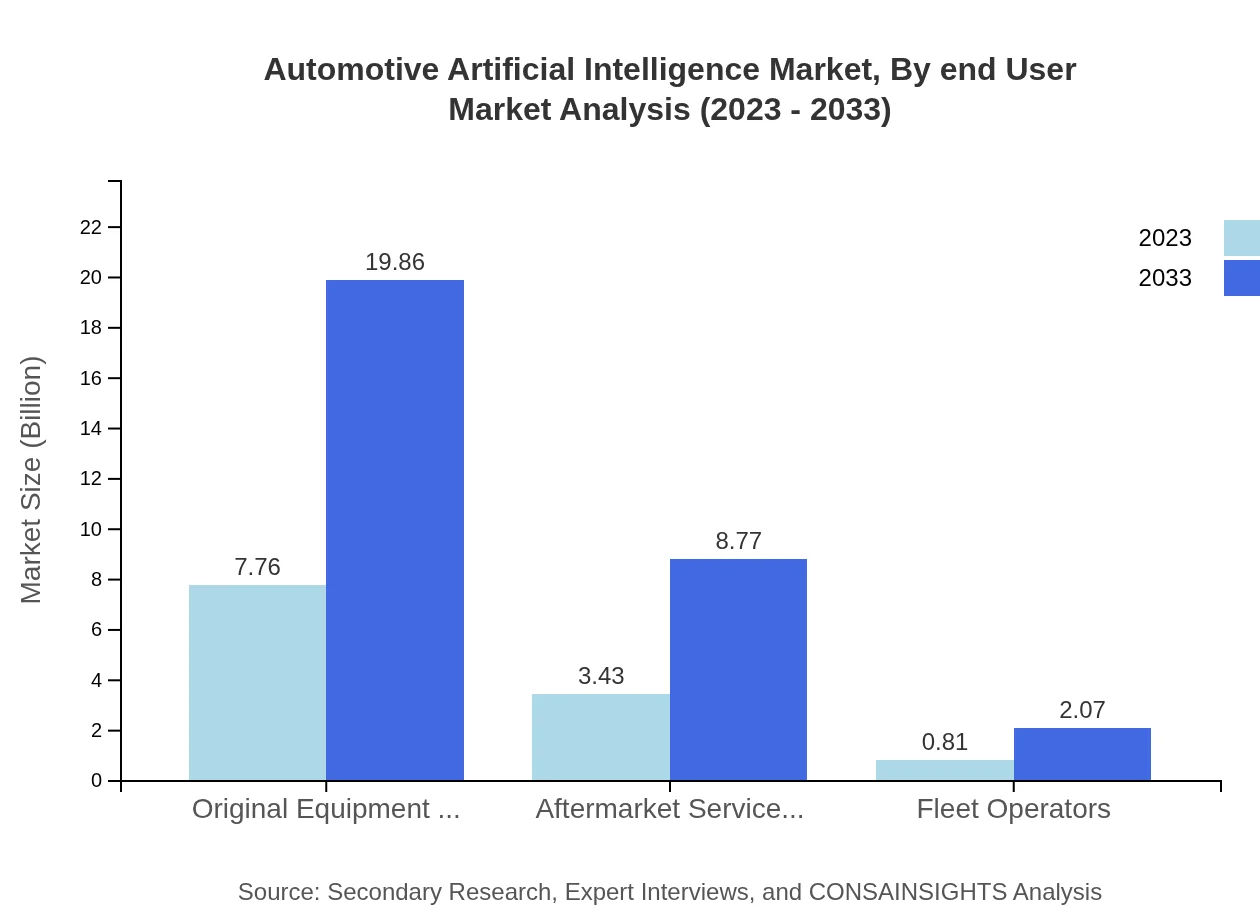

Automotive Artificial Intelligence Market Analysis By End User

Original Equipment Manufacturers (OEMs) dominate the automotive AI sector, accounting for $7.76 billion in 2023 and projected to rise to $19.86 billion by 2033, maintaining a market share of 64.69%. Aftermarket Service Providers, currently at $3.43 billion, are expected to reach $8.77 billion by 2033, holding a market share of 28.58%. Fleet Operators contribute $0.81 billion to the market, forecasted to grow to $2.07 billion, maintaining a 6.73% market share.

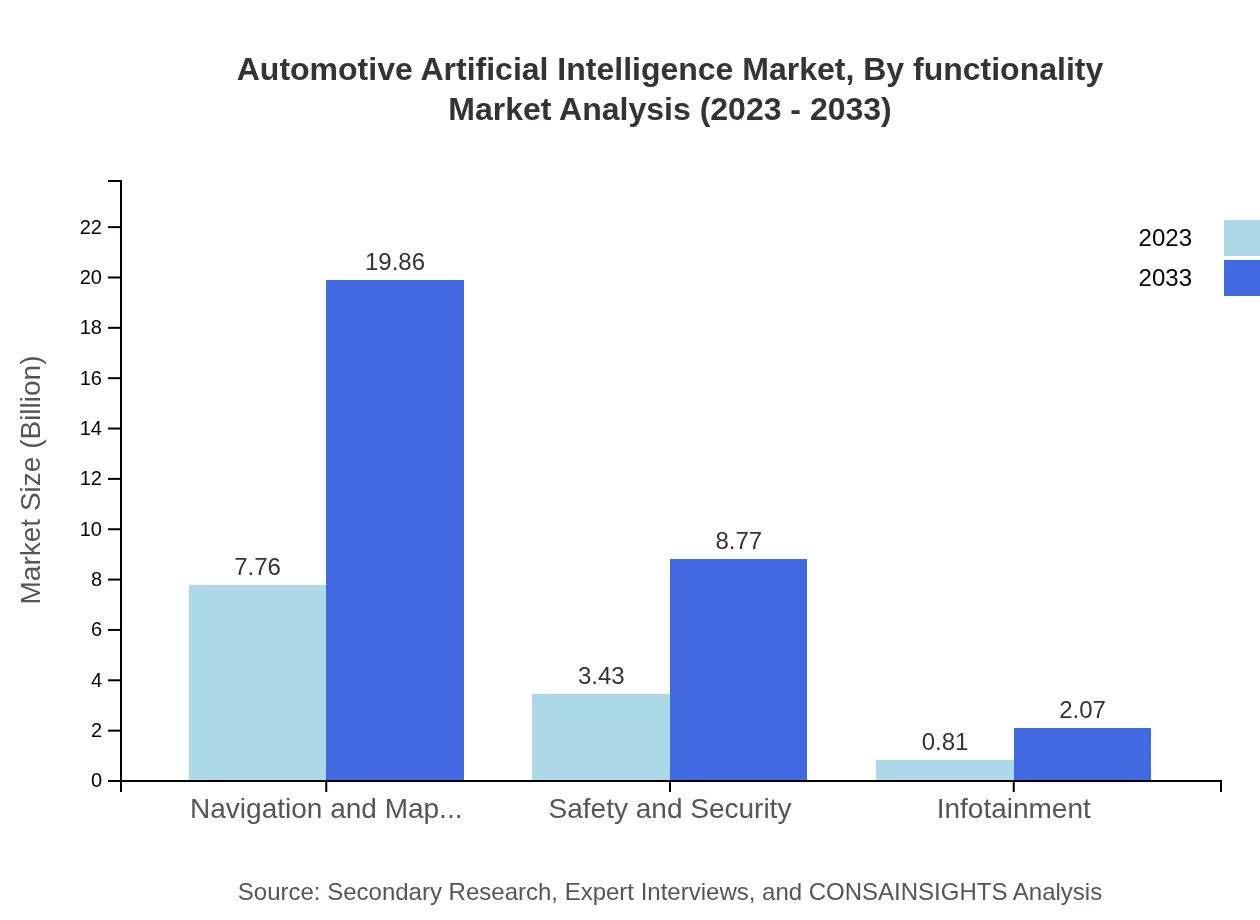

Automotive Artificial Intelligence Market Analysis By Functionality

Various functionalities of AI in automotive applications are expanding. Navigation and Mapping, with a market size of $7.76 billion in 2023, is expected to increase to $19.86 billion by 2033 and maintains a 64.69% market share. Safety and Security functionalities are projected to reach $8.77 billion by 2033 from $3.43 billion, while Infotainment segments are set to grow modestly from $0.81 billion to $2.07 billion, catering to rising consumer demands for on-the-go information and entertainment.

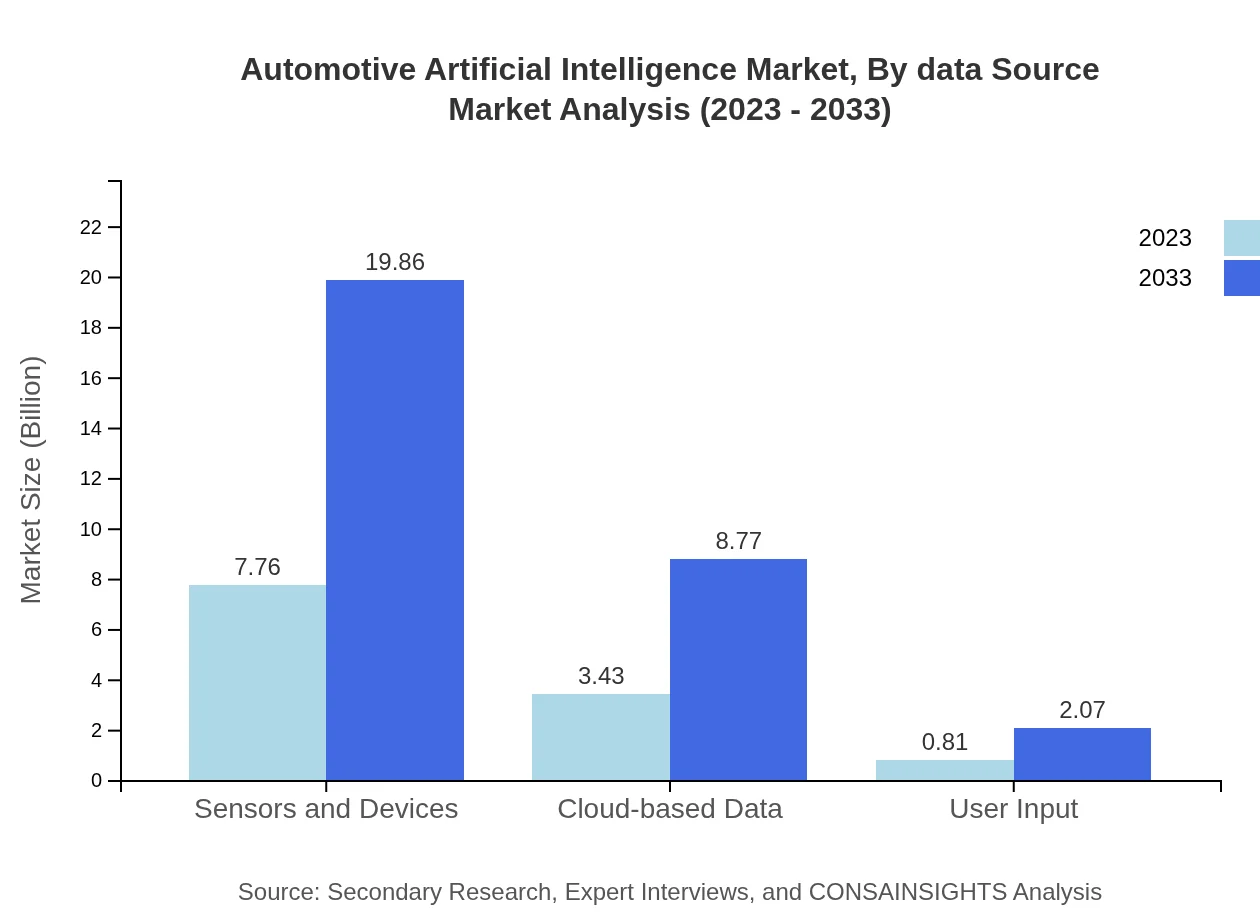

Automotive Artificial Intelligence Market Analysis By Data Source

Data sources such as sensors and cloud-based systems are crucial for AI functionalities. The market for Sensors and Devices is leading with $7.76 billion in 2023, projected to grow to $19.86 billion by 2033, forming 64.69% of the market. Cloud-based Data solutions are also gaining traction, with a market increase forecast from $3.43 billion to $8.77 billion by 2033, capturing a significant share as smart vehicles demand real-time data processing for efficient operations.

Automotive Artificial Intelligence Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Artificial Intelligence Industry

NVIDIA Corporation:

NVIDIA leads in AI computing technology, focusing on automotive applications with their Drive platform that supports autonomous vehicle development.Intel Corporation:

Intel is advancing AI by providing hardware and software solutions that enable vehicle manufacturers to enhance performance and data analysis capabilities.Tesla, Inc.:

Tesla has pioneered autonomous driving and AI integration, setting benchmarks for self-driving technology and smart vehicle systems.Google LLC:

Through its Waymo division, Google is at the forefront of developing full autonomy in vehicles, pushing the automotive AI innovation envelope.Mobileye:

Mobileye specializes in computer vision technology and advanced driver assistance systems, playing a pivotal role in enhancing vehicle safety through AI.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Artificial Intelligence?

The automotive artificial intelligence market is currently valued at approximately $12 billion in 2023, with a projected CAGR of 9.5%. By 2033, the market size is expected to significantly increase, reflecting the robust growth in this sector.

What are the key market players or companies in the automotive Artificial Intelligence industry?

Key players in the automotive artificial intelligence industry include major automotive manufacturers, technology companies specializing in AI, software developers, and data analytics firms. Their contributions significantly influence technological advancements and the direction of the industry.

What are the primary factors driving the growth in the automotive Artificial Intelligence industry?

The growth in the automotive AI industry is primarily driven by increasing demand for autonomous vehicles, advancements in machine learning, and the rising need for in-car technologies. Additionally, regulatory factors and consumer preferences also play pivotal roles.

Which region is the fastest Growing in the automotive Artificial Intelligence?

North America is the fastest-growing region in the automotive artificial intelligence market, projected to grow from $4.56 billion in 2023 to $11.65 billion in 2033. Europe and Asia Pacific also show significant growth potential in the same period.

Does ConsaInsights provide customized market report data for the automotive Artificial Intelligence industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients in the automotive artificial intelligence sector. This includes detailed insights and analyses specific to various market segments.

What deliverables can I expect from this automotive Artificial Intelligence market research project?

Deliverables from the automotive artificial intelligence market research project include comprehensive reports, market analysis, segmentation data, regional insights, and actionable recommendations to support strategic decision-making for stakeholders.

What are the market trends of automotive Artificial Intelligence?

Current trends in automotive artificial intelligence highlight advancements in autonomous driving technology, increased integration of AI in safety systems, and growing public interest in enhanced in-car experiences through AI-driven features.