Automotive Camera Market Report

Published Date: 02 February 2026 | Report Code: automotive-camera

Automotive Camera Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the automotive camera market, highlighting trends, forecasted growth, and segment performance from 2023 to 2033. Insights on regional markets, product types, and key players are also provided for an in-depth understanding of the industry landscape.

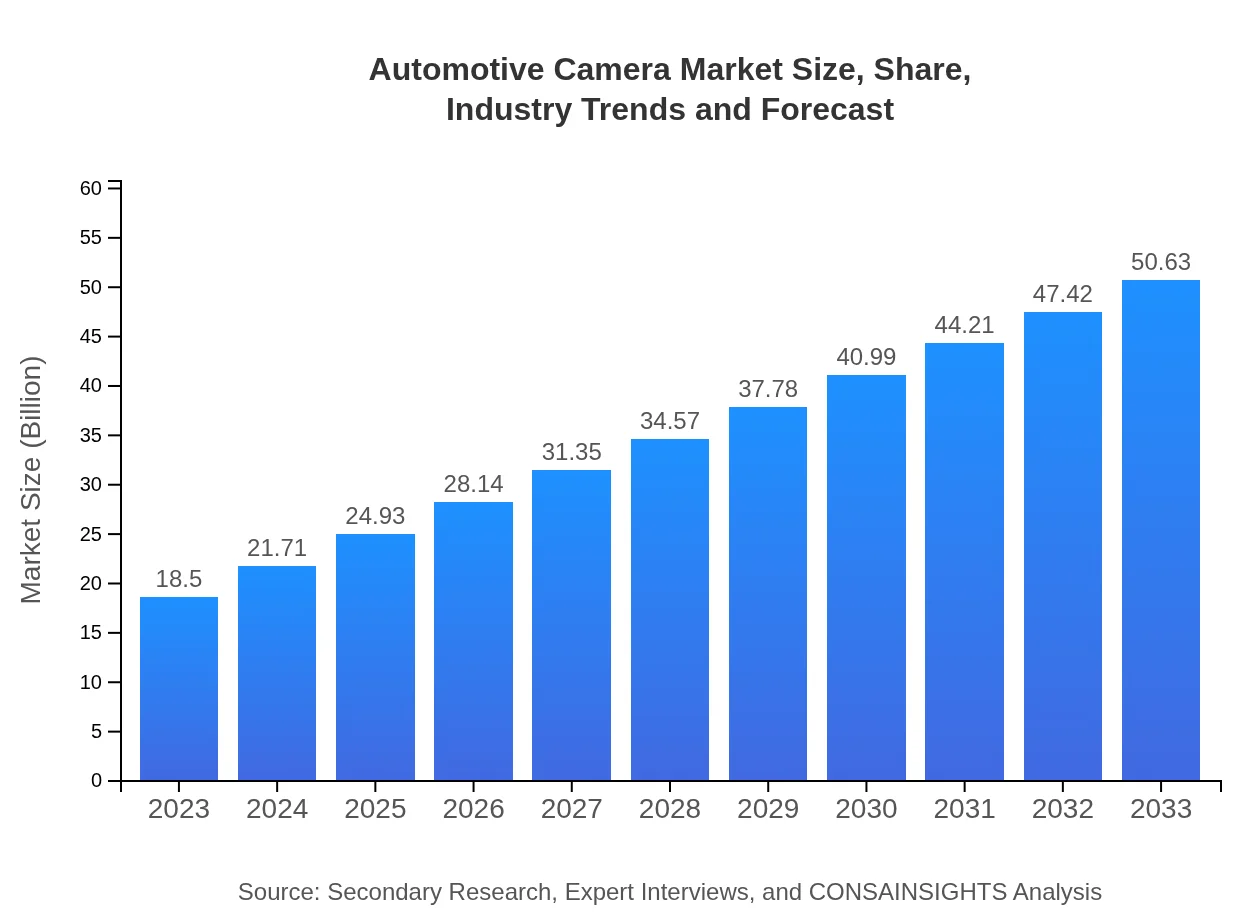

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $50.63 Billion |

| Top Companies | Bosch, FLIR Systems, Inc., Continental AG, Denso Corporation |

| Last Modified Date | 02 February 2026 |

Automotive Camera Market Overview

Customize Automotive Camera Market Report market research report

- ✔ Get in-depth analysis of Automotive Camera market size, growth, and forecasts.

- ✔ Understand Automotive Camera's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Camera

What is the Market Size & CAGR of the Automotive Camera market in 2023?

Automotive Camera Industry Analysis

Automotive Camera Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Camera Market Analysis Report by Region

Europe Automotive Camera Market Report:

The European market is analyzed to rise from $5.56 billion in 2023 to $15.23 billion by 2033, heavily influenced by stringent safety regulations and manufacturers integrating more camera systems for enhanced vehicle functionalities.Asia Pacific Automotive Camera Market Report:

The Asia Pacific automotive camera market is projected to grow from $3.36 billion in 2023 to $9.20 billion by 2033. The region is a hub for automotive manufacturing, with countries like China, Japan, and South Korea leading the charge in adopting advanced camera technologies in vehicles.North America Automotive Camera Market Report:

North America is anticipated to be a major market, expanding from $7.21 billion in 2023 to $19.75 billion by 2033. The US leads in the adoption of advanced driver assistance systems, significantly driving demand for automotive cameras.South America Automotive Camera Market Report:

In South America, the automotive camera market is expected to increase from $0.65 billion in 2023 to $1.79 billion by 2033. Enhancing safety regulations and growing interest in vehicle technology are driving this growth.Middle East & Africa Automotive Camera Market Report:

The Middle East and Africa market is projected to grow from $1.71 billion in 2023 to $4.67 billion by 2033, with increasing investments in automotive technology and growing demand for safety features driving the expansion.Tell us your focus area and get a customized research report.

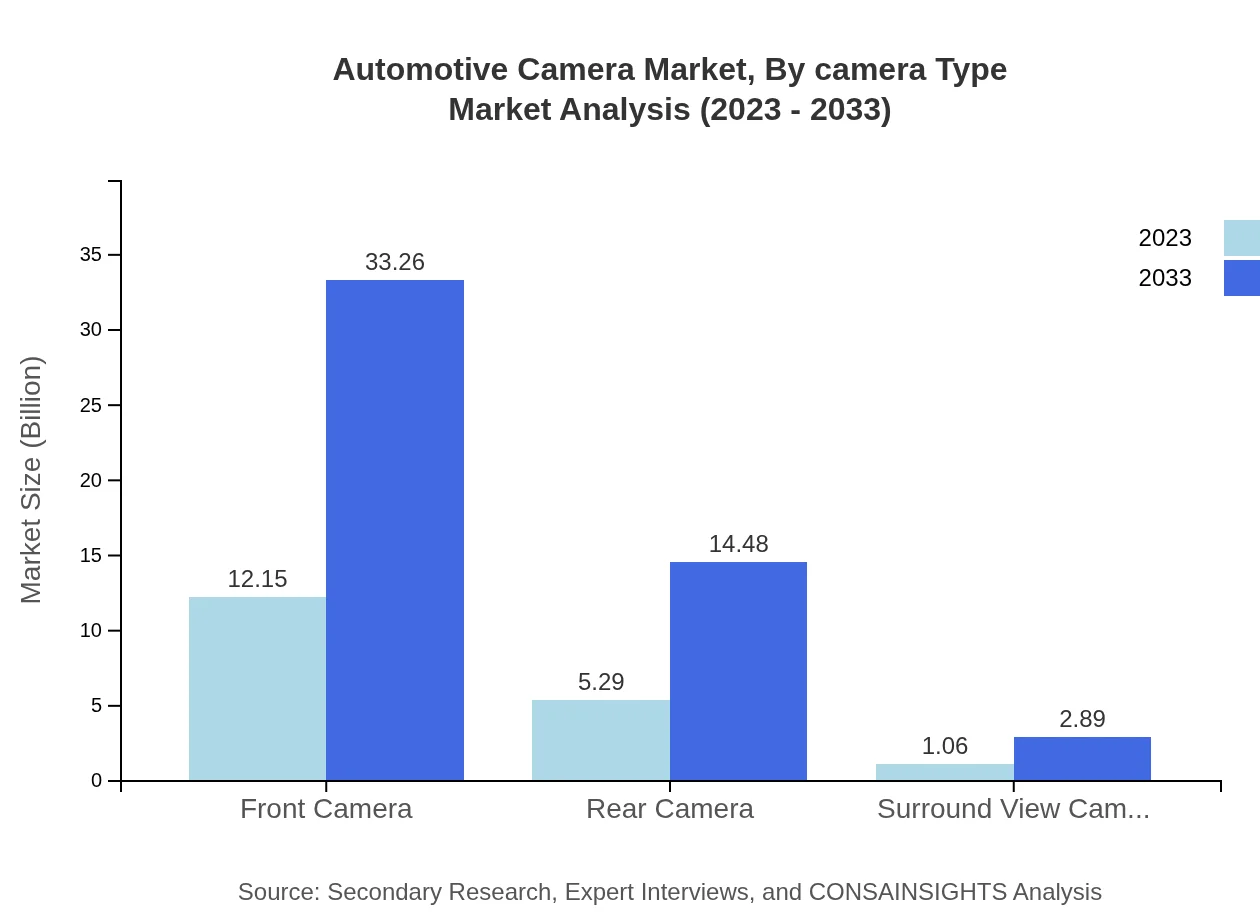

Automotive Camera Market Analysis By Camera Type

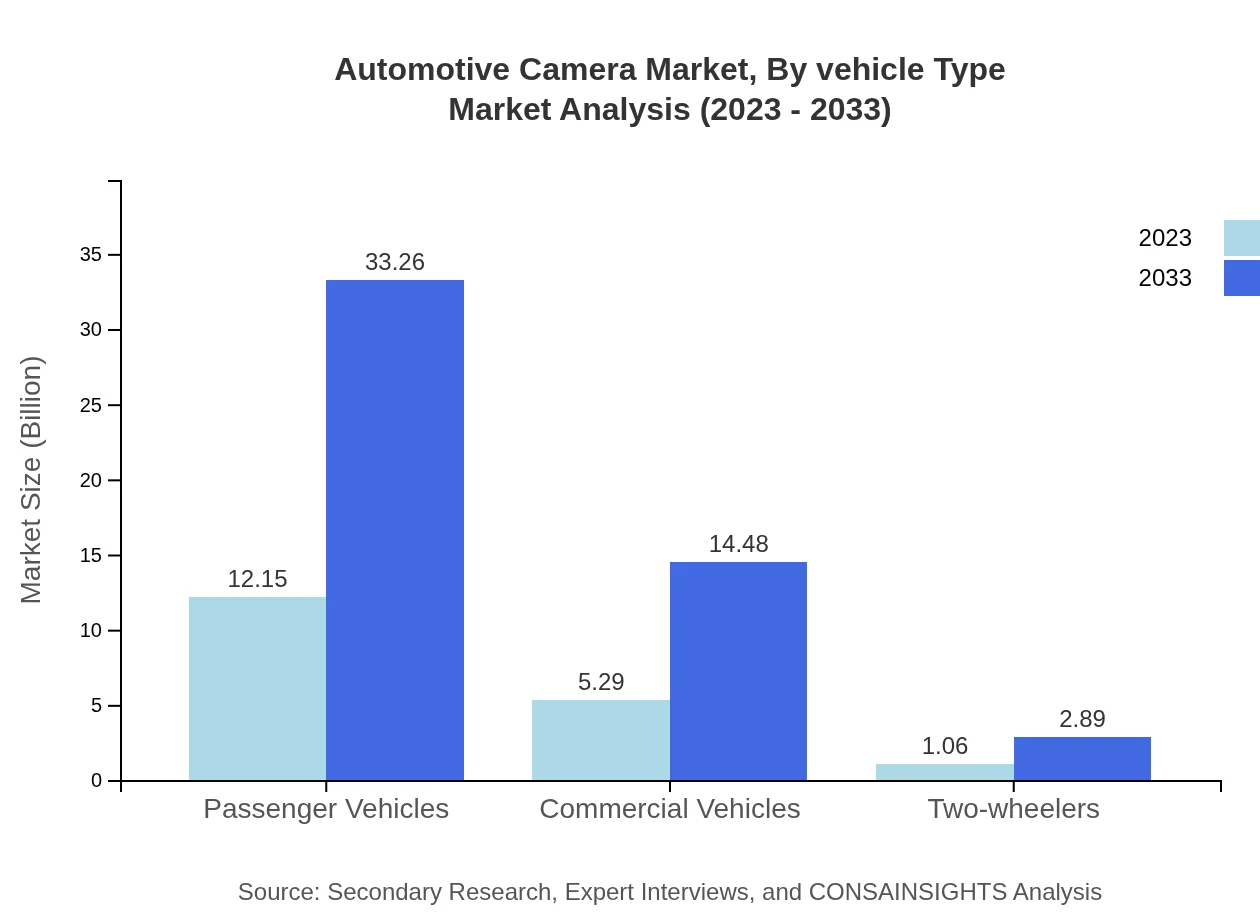

In 2023, the digital camera segment leads with a market size of $12.15 billion. This segment is expected to reach $33.26 billion by 2033, capturing 65.69% share in both years. Analog cameras, while trailing, show growth from $5.29 billion in 2023 to $14.48 billion in 2033, maintaining a 28.6% share. Smart cameras depict steady growth from $1.06 billion to $2.89 billion, marking a 5.71% share across the decade.

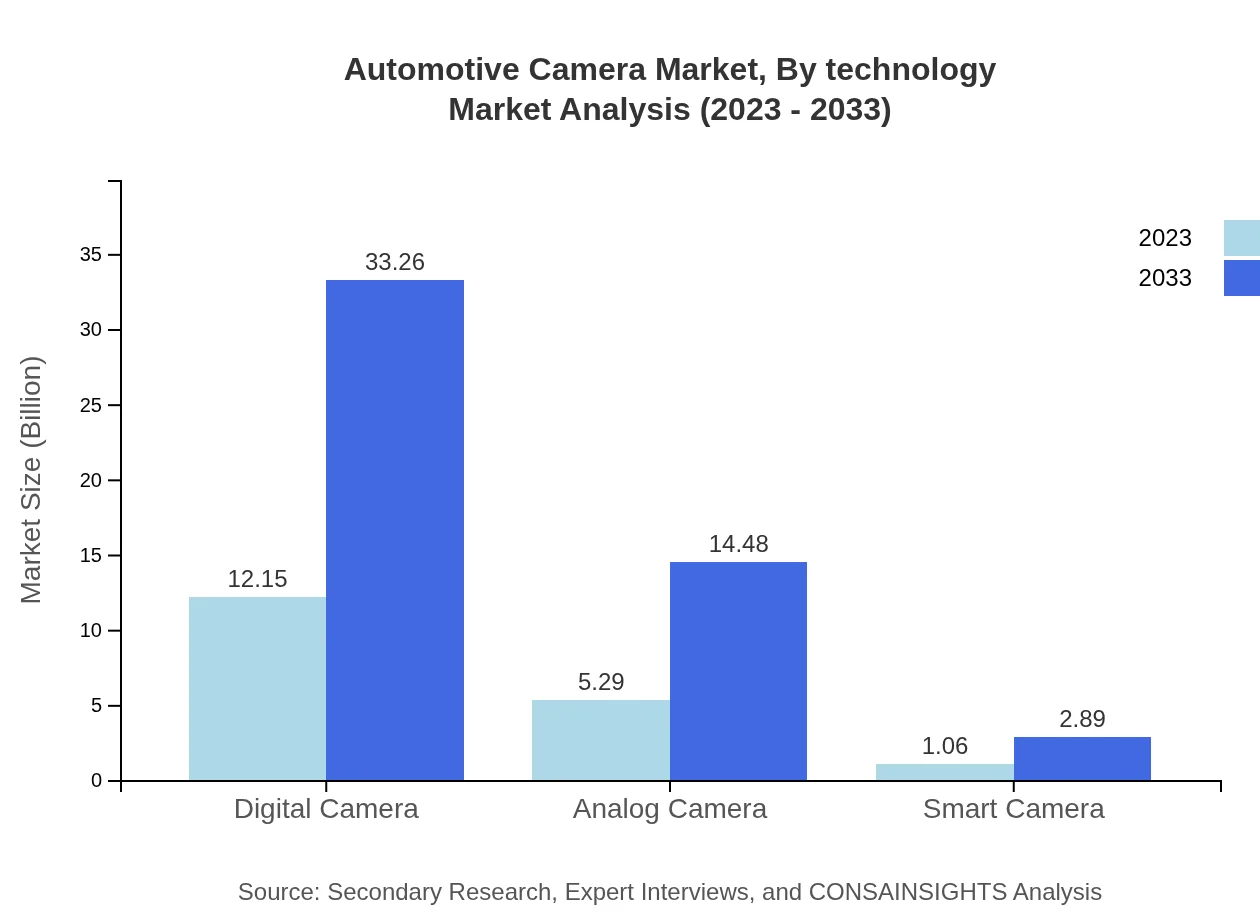

Automotive Camera Market Analysis By Technology

The market, by technology, emphasizes the importance of high-resolution imaging, with potential advancements in AI and machine learning driving innovation. Technologies such as thermal imaging and LiDar integration are predicted to grow alongside traditional camera technologies, expanding the capabilities of automotive cameras significantly.

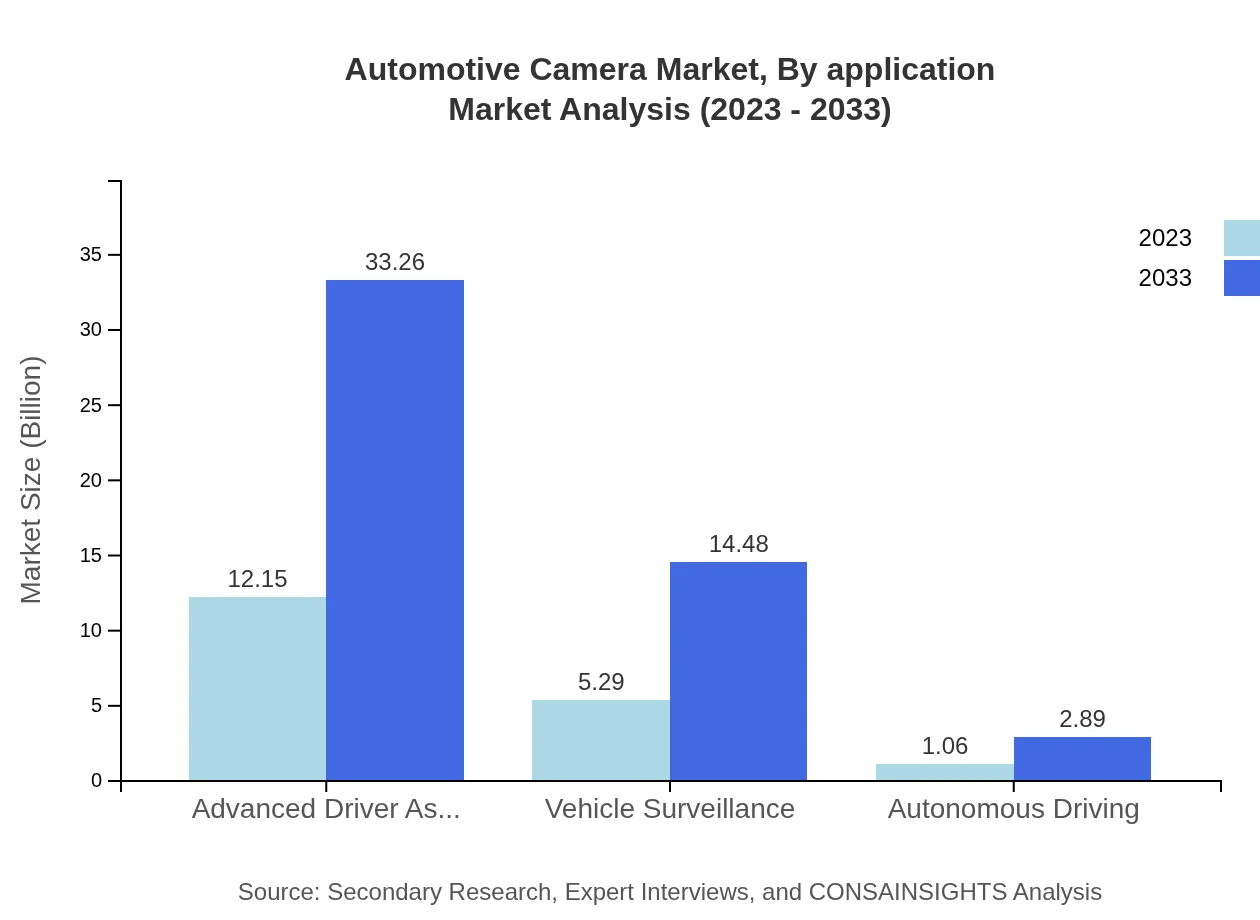

Automotive Camera Market Analysis By Application

Key applications include Advanced Driver Assistance Systems (ADAS) and vehicle safety systems, projected to grow from a combined $12.15 billion in 2023 to $33.26 billion by 2033, reflecting a robust market segment focus on safety enhancement and crash prevention systems.

Automotive Camera Market Analysis By Vehicle Type

Passenger vehicles dominate the sector, expected to rise from $12.15 billion in 2023 to $33.26 billion in 2033. Commercial vehicles and two-wheelers, while smaller segments, are experiencing growth as user demand for safety features increases in all vehicle classes.

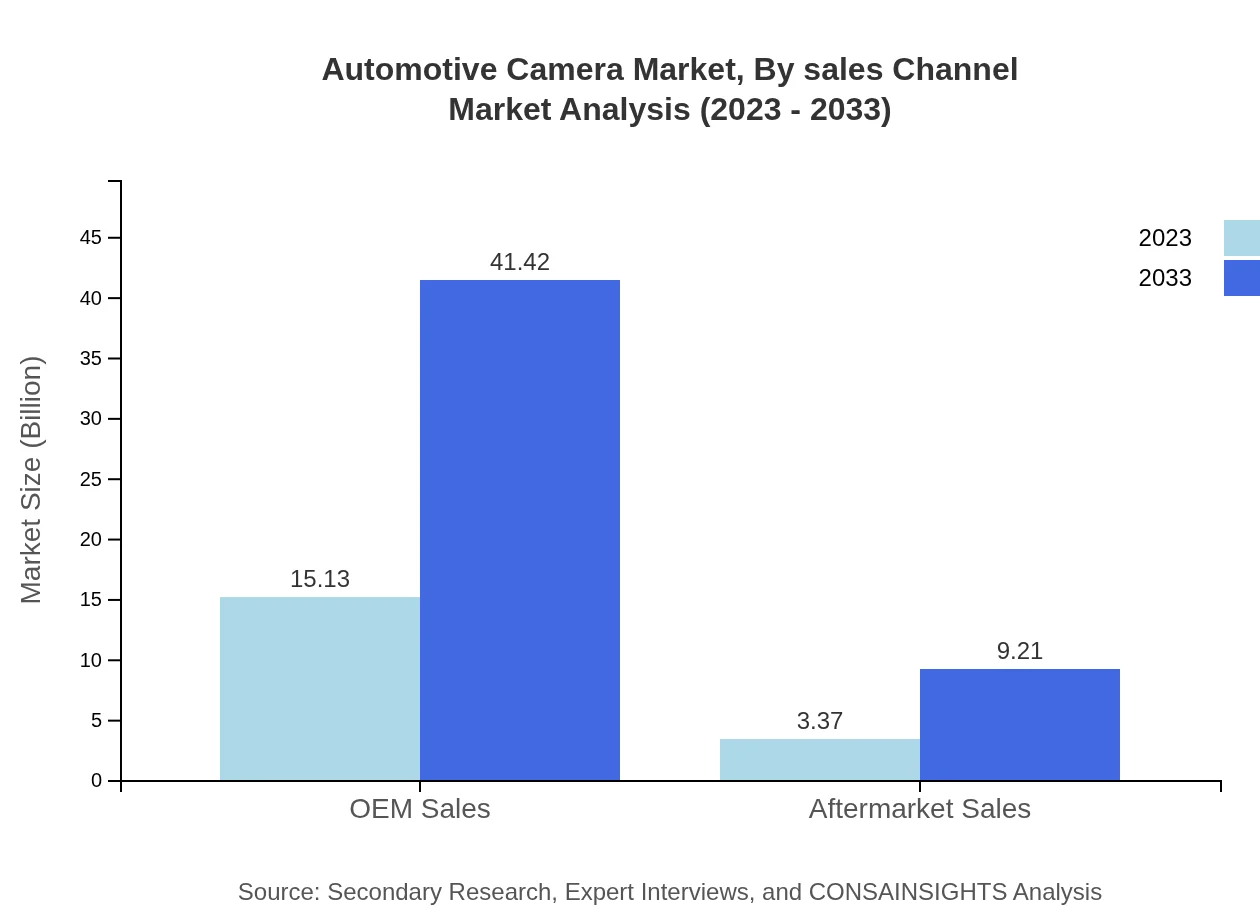

Automotive Camera Market Analysis By Sales Channel

The OEM sales channel is highly significant, set to move from $15.13 billion in 2023 to $41.42 billion by 2033. Aftermarket sales are expanding but remain smaller, projected at $3.37 billion in 2023, growing to $9.21 billion by 2033, showing increasing consumer interest in retrofitting advanced camera systems.

Automotive Camera Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Camera Industry

Bosch:

A leading global supplier of technology and services, Bosch has made significant investments in camera systems for ADAS applications, focusing on safety solutions and sensor technology.FLIR Systems, Inc.:

FLIR develops thermal imaging cameras that enhance vehicle safety through advanced environmental recognition and situational awareness technologies.Continental AG:

Continental is known for its innovative camera systems that cater to safety and autonomous driving applications, enhancing its presence in the global market.Denso Corporation:

Denso is a prominent manufacturer in the automotive sector, focusing on electronics and sensor technologies, including advanced camera systems.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Camera?

The global automotive camera market is projected to grow from $18.5 billion in 2023 to an estimated size by 2033, with a CAGR of 10.2%. This significant growth indicates increased demand for automotive safety technologies and enhanced driver assistance systems.

What are the key market players or companies in the automotive Camera industry?

Key players in the automotive camera market include leading companies like Bosch, Continental AG, and Valeo. These companies focus on technological advancements in camera systems, contributing to the market's growth and innovation in automotive safety features.

What are the primary factors driving the growth in the automotive camera industry?

Factors driving growth include the rising demand for advanced driver assistance systems (ADAS), increased focus on vehicle safety, and stringent government regulations for automotive safety. Consumer preference for smart vehicle technology also significantly fuels this industry's expansion.

Which region is the fastest Growing in the automotive camera market?

North America is poised to be the fastest-growing region, with market size expected to rise from $7.21 billion in 2023 to $19.75 billion by 2033. This growth is driven by technological advancements and rising demand for safety features in vehicles.

Does ConsaInsights provide customized market report data for the automotive camera industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the automotive camera industry. These reports can focus on specific regions, segments, and emerging trends for more accurate insights.

What deliverables can I expect from this automotive camera market research project?

Deliverables include detailed market analyses, trend forecasts, competitive landscape mapping, regional market assessments, and segment breakdowns, allowing stakeholders to make informed business decisions in the automotive camera industry.

What are the market trends of automotive Camera?

Current trends indicate a shift towards the integration of AI in camera systems, growing interest in autonomous vehicles, and increased investment in smart safety features, which are expected to drive growth in the automotive camera market.