Automotive Electronic Logging Device Market Report

Published Date: 02 February 2026 | Report Code: automotive-electronic-logging-device

Automotive Electronic Logging Device Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Automotive Electronic Logging Device market from 2023 to 2033, offering insights into market size, growth trends, regional analysis, and key player strategies.

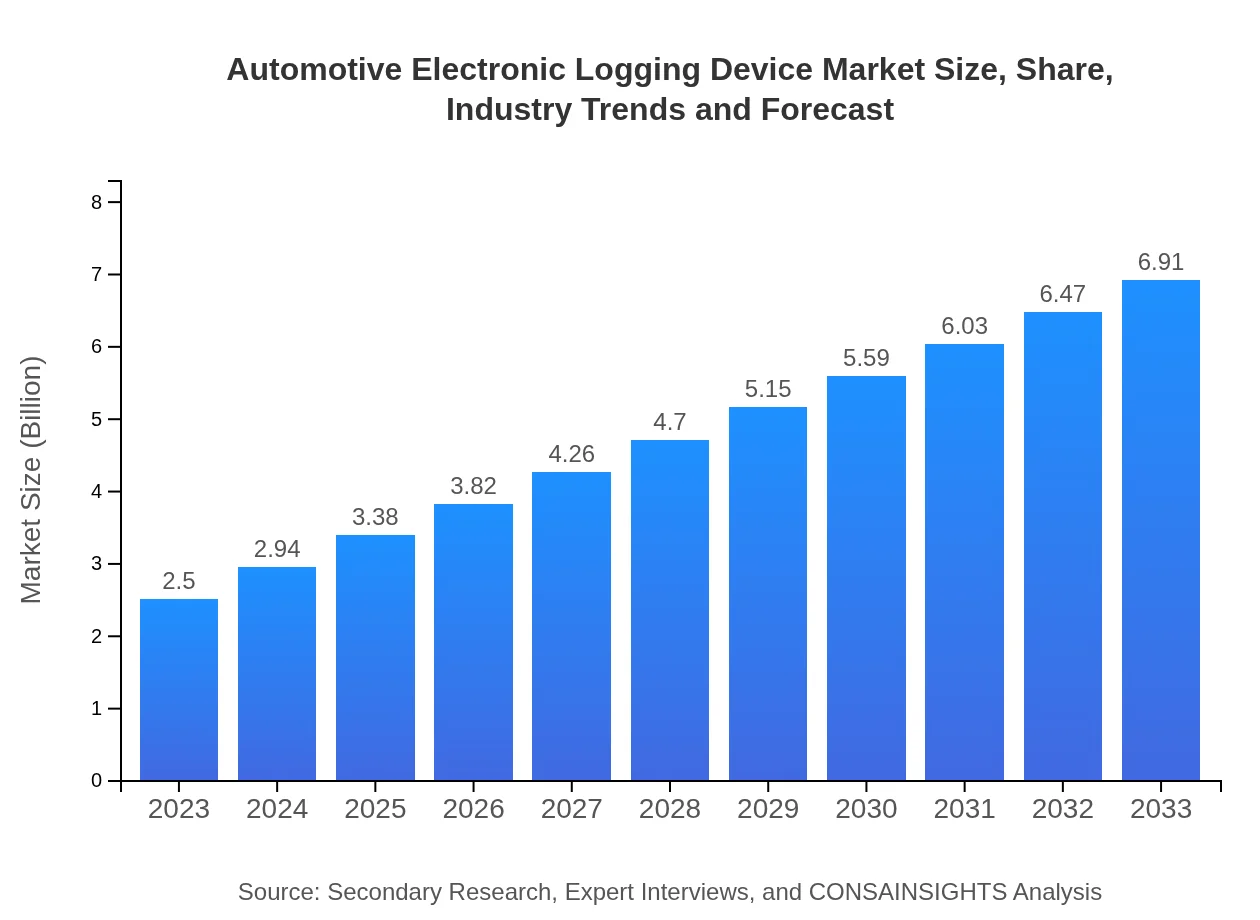

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $6.91 Billion |

| Top Companies | Omnicomm, Samsara , Geotab, KeepTruckin, Teletrac Navman |

| Last Modified Date | 02 February 2026 |

Automotive Electronic Logging Device Market Overview

Customize Automotive Electronic Logging Device Market Report market research report

- ✔ Get in-depth analysis of Automotive Electronic Logging Device market size, growth, and forecasts.

- ✔ Understand Automotive Electronic Logging Device's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Electronic Logging Device

What is the Market Size & CAGR of Automotive Electronic Logging Device market in 2023?

Automotive Electronic Logging Device Industry Analysis

Automotive Electronic Logging Device Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Electronic Logging Device Market Analysis Report by Region

Europe Automotive Electronic Logging Device Market Report:

Europe's ELD market is anticipated to see a rise from $0.73 billion in 2023 to $2.01 billion by 2033, driven by regulatory frameworks promoting the use of logging devices for safety and efficiency.Asia Pacific Automotive Electronic Logging Device Market Report:

The Asia Pacific region is expected to witness significant growth, with the market size projected to increase from $0.51 billion in 2023 to $1.42 billion by 2033. This growth is driven by increasing freight transport activities and regulatory initiatives aimed at improving road safety across countries like China and India.North America Automotive Electronic Logging Device Market Report:

North America remains the largest market for ELDs, estimated to grow from $0.84 billion in 2023 to $2.32 billion by 2033. The dominance is fueled by stringent regulatory requirements and vast adoption of technology in fleet management.South America Automotive Electronic Logging Device Market Report:

In South America, the market is forecasted to grow from $0.12 billion in 2023 to $0.33 billion by 2033. The growth is attributed to the rise in logistics activities and increasing awareness regarding driver safety.Middle East & Africa Automotive Electronic Logging Device Market Report:

In the Middle East and Africa, the ELD market is expected to grow from $0.30 billion in 2023 to $0.83 billion in 2033 due to rising freight demand and regulatory initiatives aimed at enhancing road safety.Tell us your focus area and get a customized research report.

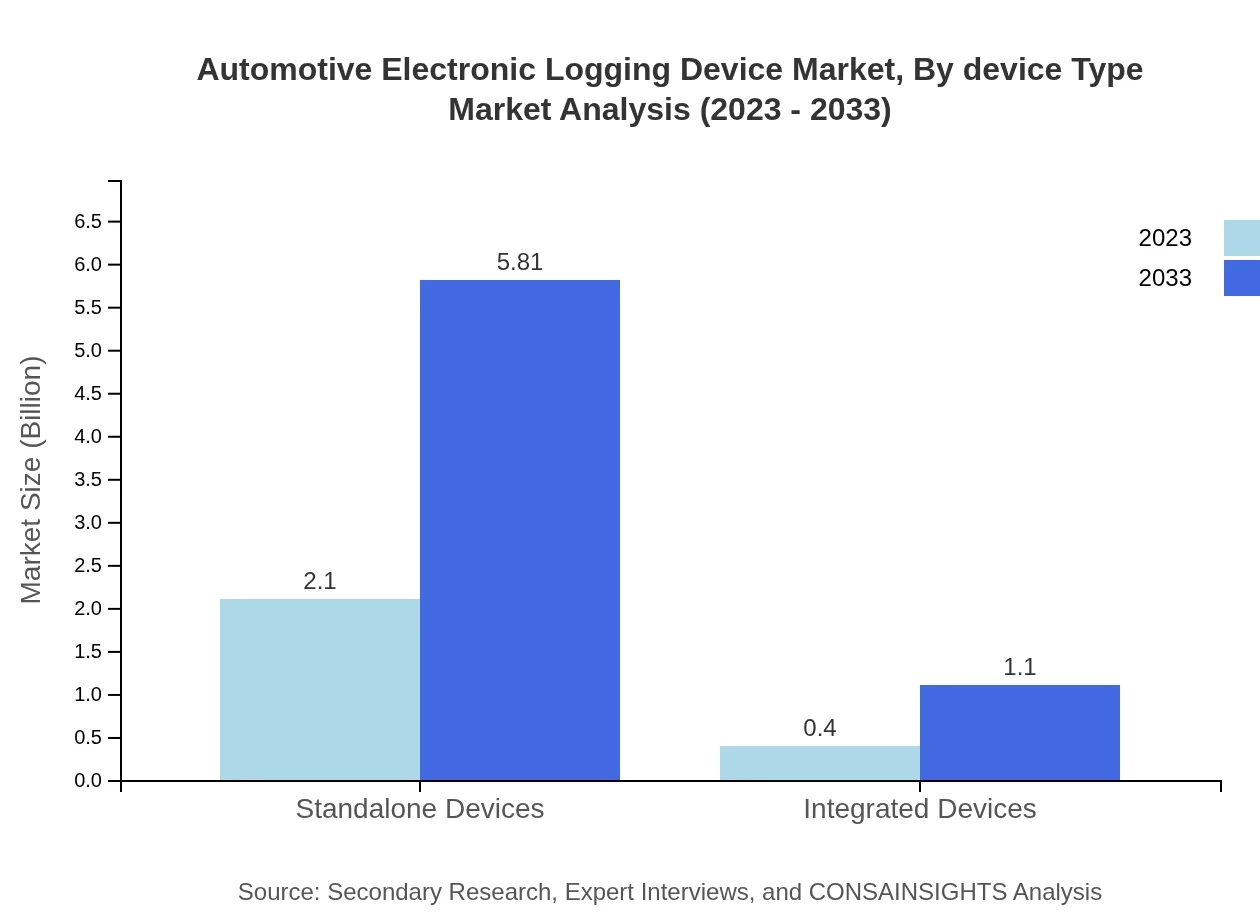

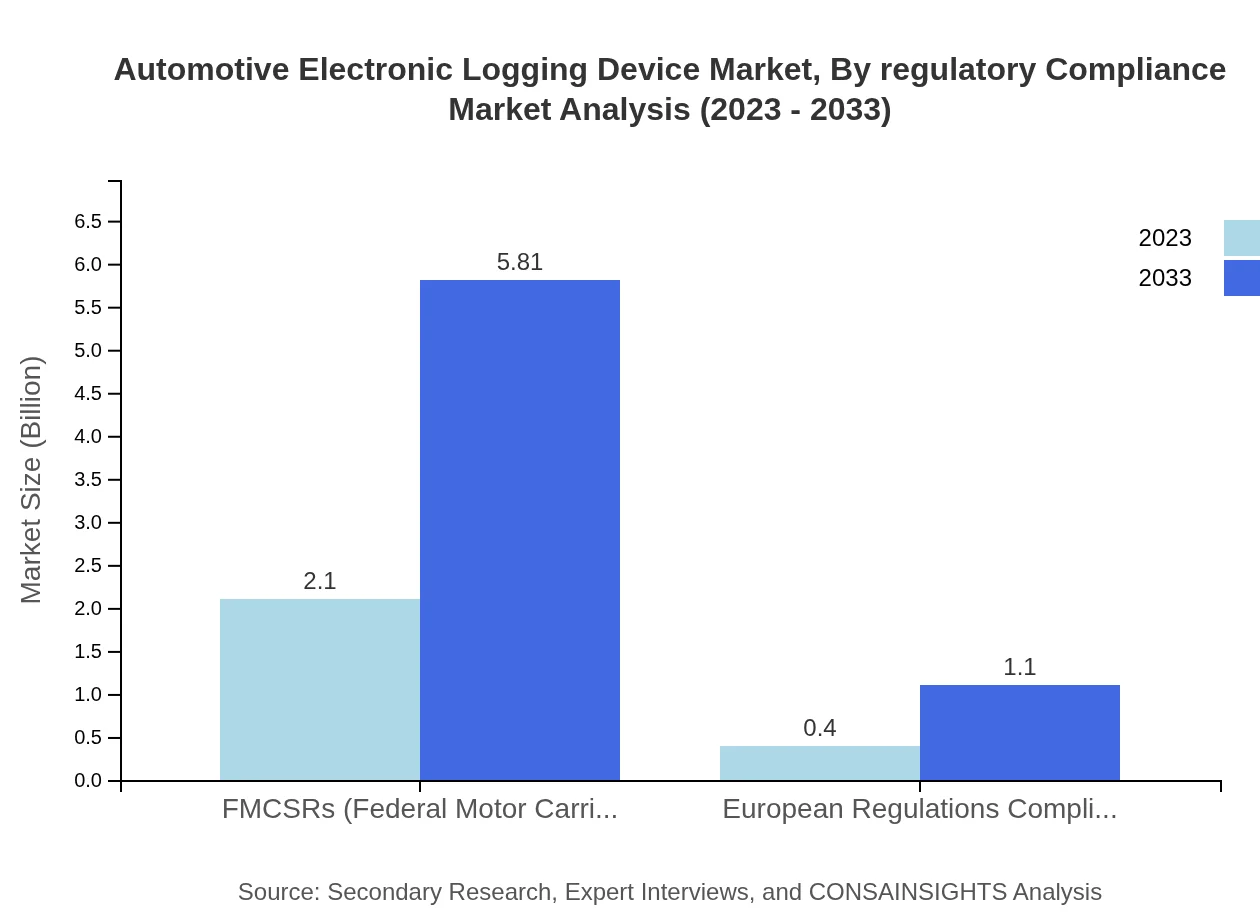

Automotive Electronic Logging Device Market Analysis By Device Type

Standalone devices dominate the ELD market, reflecting a size of $2.10 billion in 2023, with expectations to increase to $5.81 billion by 2033 due to their extensive features and reliability. Integrated devices, while smaller in size at $0.40 billion in 2023, represent a growing market segment increasingly adopted for their comprehensive solutions.

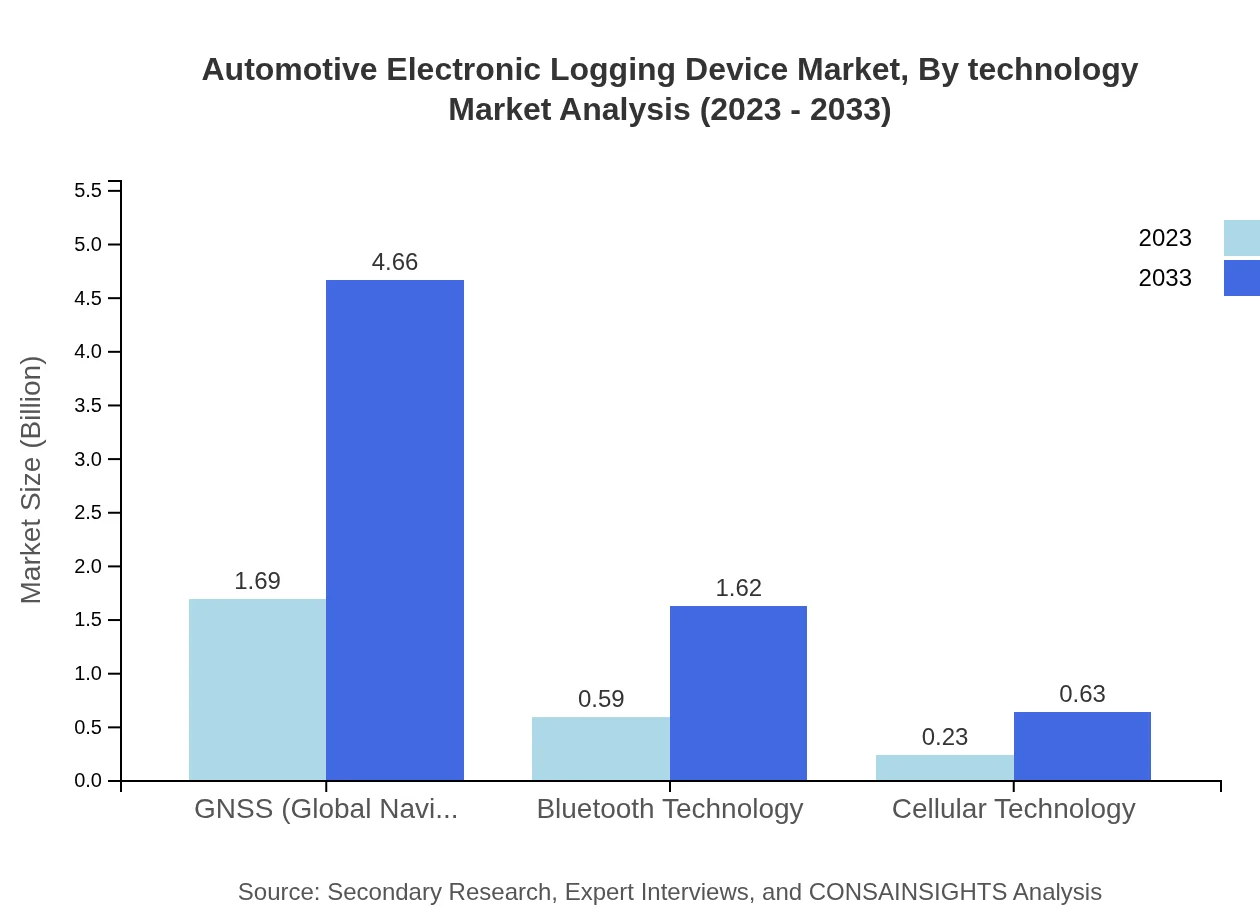

Automotive Electronic Logging Device Market Analysis By Technology

Among technologies, GNSS accounts for a significant share, with a market size of $1.69 billion in 2023. Bluetooth technology and cellular technology also contribute notably, highlighting the diverse technological adoption in ELDs.

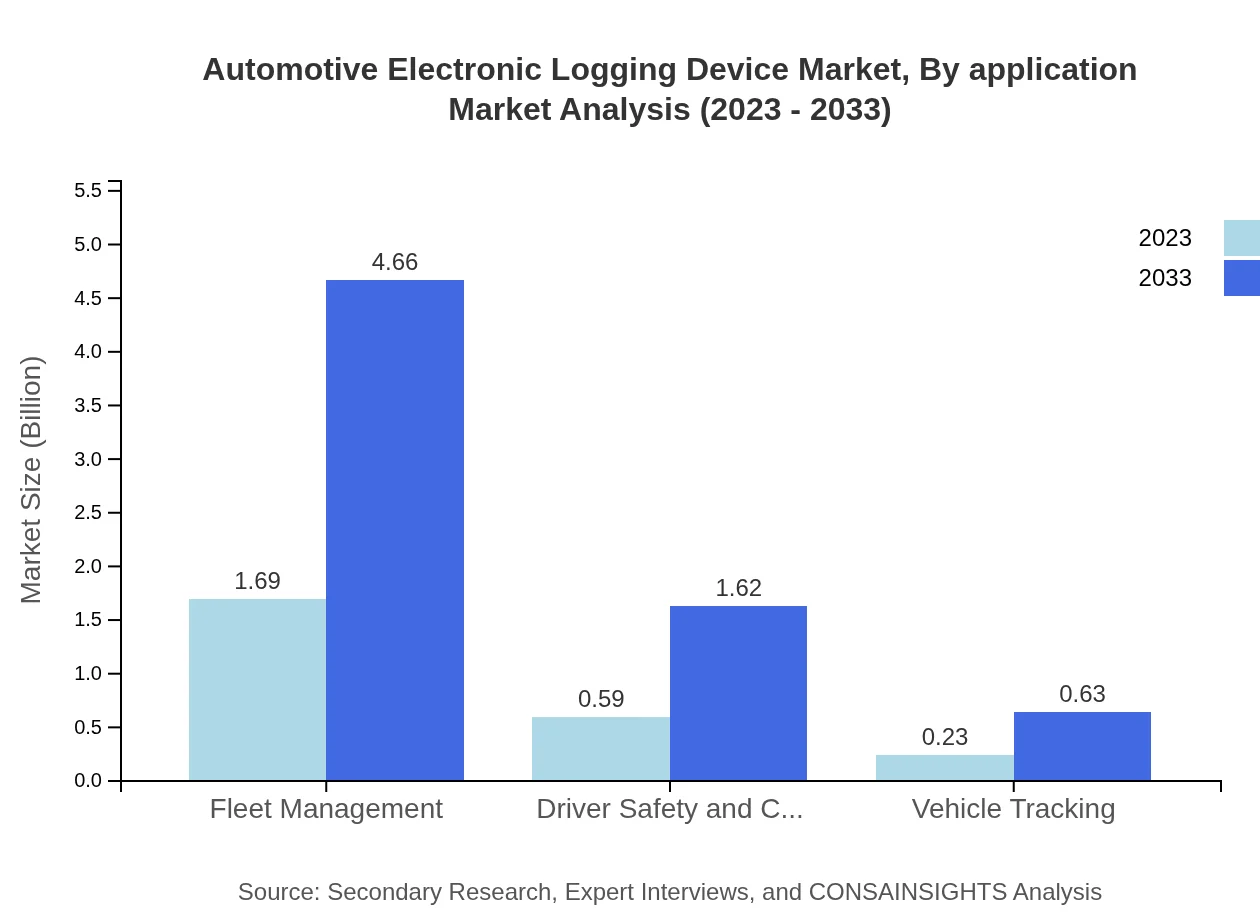

Automotive Electronic Logging Device Market Analysis By Application

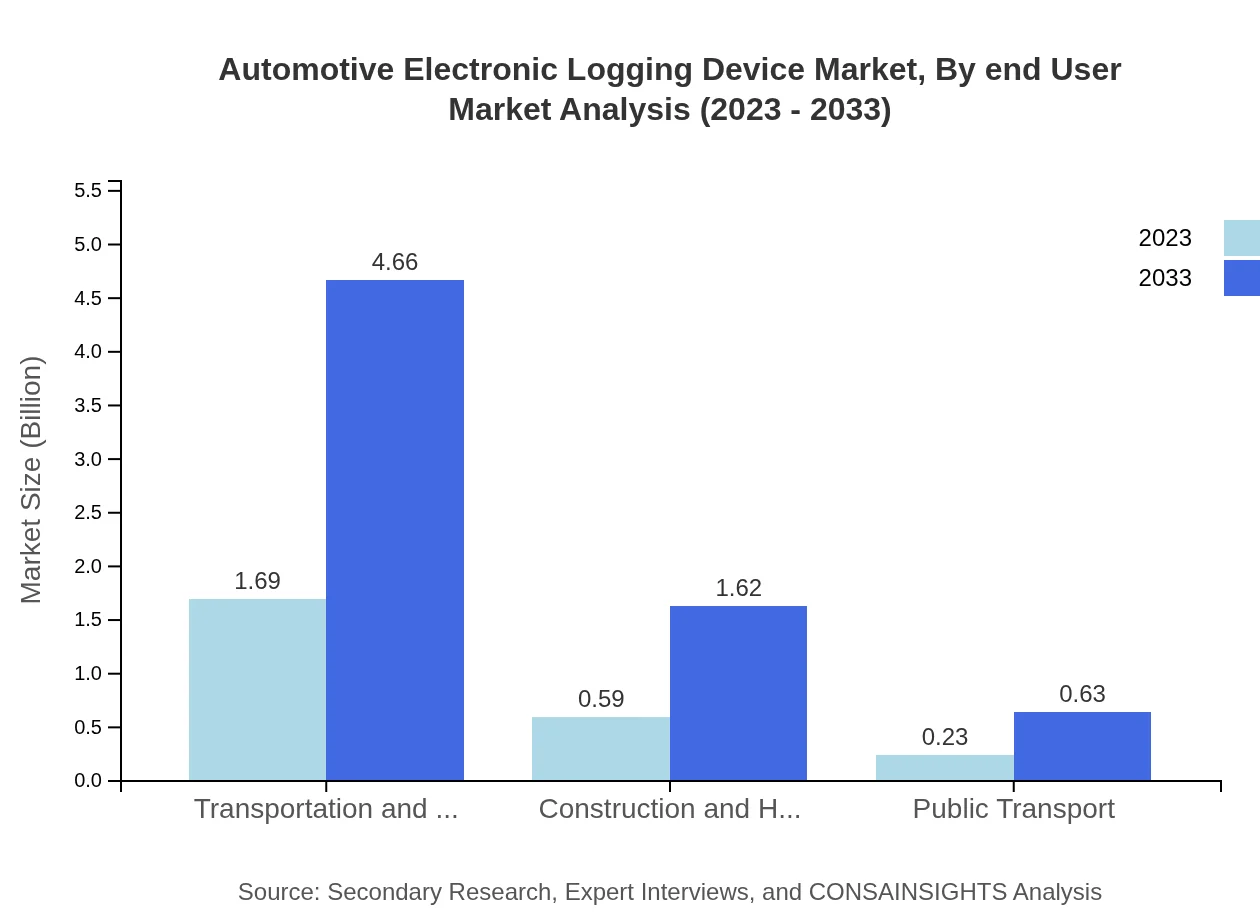

The Transportation and Logistics sector is the primary end user of ELDs, holding a market size of $1.69 billion in 2023, which is projected to rise significantly due to the increasing emphasis on compliance and efficiency.

Automotive Electronic Logging Device Market Analysis By End User

The Transportation and Logistics sector represents the greatest share of ELD usage, aligning with significant growth projections driven by regulatory compliance and the need for efficient fleet management.

Automotive Electronic Logging Device Market Analysis By Regulatory Compliance

Devices compliant with FMCSRs are projected to grow from a market size of $2.10 billion in 2023 to $5.81 billion by 2033, showcasing the necessity of compliance-driven innovations.

Automotive Electronic Logging Device Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Automotive Electronic Logging Device Industry

Omnicomm:

A leader in telematics solutions, Omnicomm offers advanced ELD solutions that enhance fleet management efficiency and ensure compliance with regulations.Samsara :

Samsara provides comprehensive fleet management solutions, integrating ELD functionalities with GPS tracking and driver safety features to improve operational performance.Geotab:

Geotab is a prominent player in the telematics market, offering innovative ELD solutions that help businesses optimize fleet operations and ensure compliance.KeepTruckin:

KeepTruckin specializes in fleet management technology and provides a modern ELD solution focused on ease of use and driver safety.Teletrac Navman:

Teletrac Navman is a global provider of fleet tracking solutions, offering an expansive ELD platform focused on compliance and operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive Electronic Logging Device?

The automotive electronic logging device market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 10.3% through 2033. This growth reflects increasing regulatory compliance and the need for efficient fleet management solutions.

What are the key market players or companies in this automotive Electronic Logging Device industry?

Key players in the automotive electronic logging device industry include leading companies that specialize in telematics and fleet management solutions. Their innovations and competitive strategies play a crucial role in shaping the market dynamics.

What are the primary factors driving the growth in the automotive Electronic Logging Device industry?

Driving factors include stricter regulations for driver safety, rising demand for fleet management solutions, technological advancements such as GPS integration, and the growing trend of digitization in logistics and transportation.

Which region is the fastest Growing in the automotive Electronic Logging Device?

Europe is the fastest-growing region, with market sizes projected to increase from $0.73 billion in 2023 to $2.01 billion by 2033. Following closely are Asia Pacific and North America, indicating strong regional demand.

Does ConsaInsights provide customized market report data for the automotive Electronic Logging Device industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the automotive electronic logging device sector, allowing clients to gain insights relevant to their business strategy and market positioning.

What deliverables can I expect from this automotive Electronic Logging Device market research project?

Deliverables include comprehensive reports outlining market trends, competitive analysis, regulatory insights, and detailed projections segmented by regions and industry verticals, ensuring clients are well-informed for strategic decisions.

What are the market trends of automotive Electronic Logging Device?

Market trends include increasing adoption of cloud-based solutions, integration of advanced telematics features, a shift towards sustainable fleet management practices, and ongoing innovations in data analytics for better compliance management.