Automotive Financing Market Report

Published Date: 02 February 2026 | Report Code: automotive-financing

Automotive Financing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Automotive Financing market, highlighting key trends, segmentation, and growth forecasts for the period 2023 to 2033. It delivers insights into market dynamics, major players, and future growth potential.

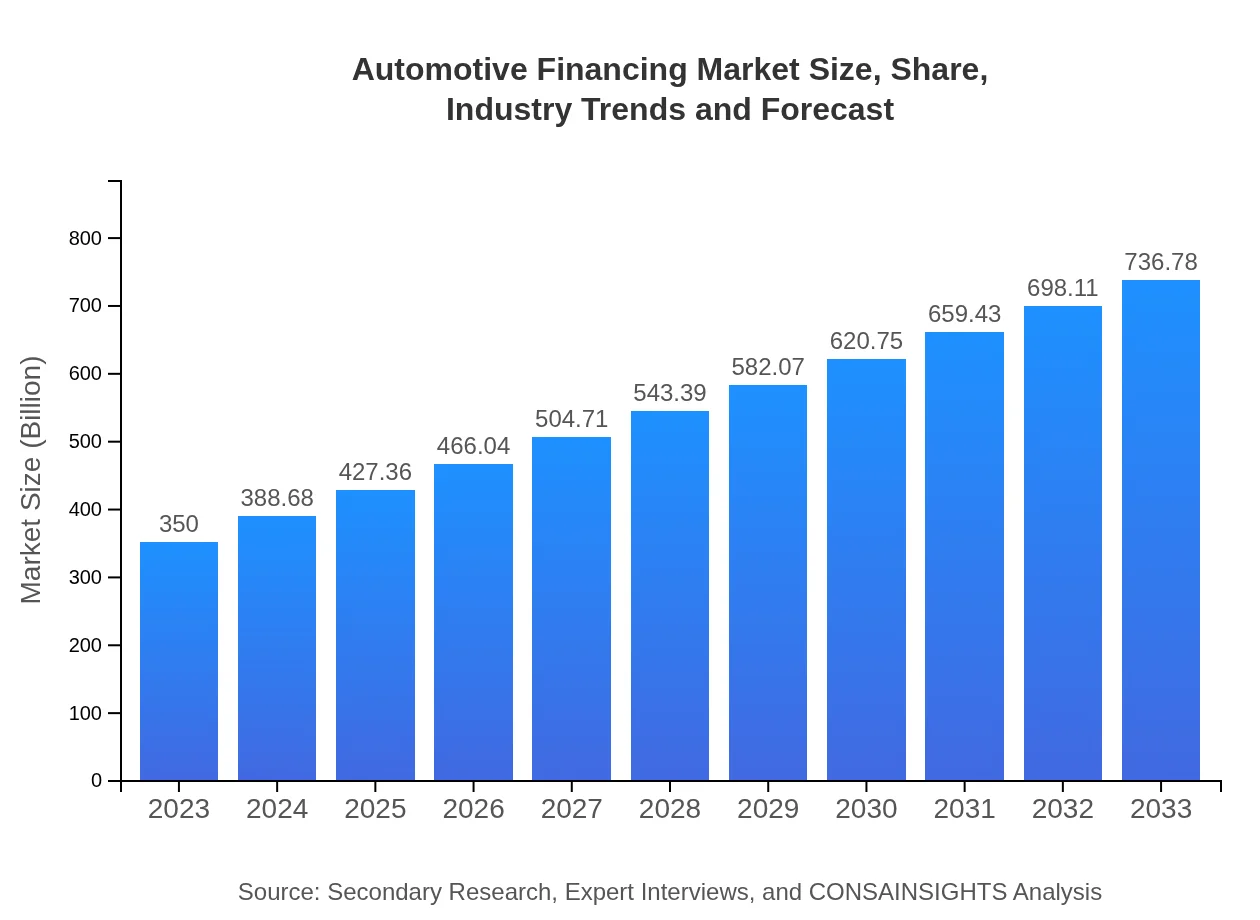

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $350.00 Billion |

| CAGR (2023-2033) | 7.5% |

| 2033 Market Size | $736.78 Billion |

| Top Companies | Ford Motor Credit Company, Toyota Financial Services, General Motors Financial, BMW Financial Services, Ally Financial |

| Last Modified Date | 02 February 2026 |

Automotive Financing Market Overview

Customize Automotive Financing Market Report market research report

- ✔ Get in-depth analysis of Automotive Financing market size, growth, and forecasts.

- ✔ Understand Automotive Financing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Automotive Financing

What is the Market Size & CAGR of the Automotive Financing market in 2023?

Automotive Financing Industry Analysis

Automotive Financing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Automotive Financing Market Analysis Report by Region

Europe Automotive Financing Market Report:

Europe's Automotive Financing market is witnessing notable growth, expected to expand from $86.63 billion in 2023 to $182.35 billion by 2033. Factors influencing this growth include stringent emissions regulations pushing electric vehicle adoption, favorable financing conditions, and a robust demand for innovative mobility solutions. Additionally, the digital transformation in financial services is allowing consumers more flexibility in financing options.Asia Pacific Automotive Financing Market Report:

The Asia Pacific region's Automotive Financing market is characterized by rapid growth, expanding at a rate reflected in an increase from $72.77 billion in 2023 to approximately $153.18 billion by 2033. Enhanced financing options and government incentives for EVs are driving adoption in markets like China and India. Additionally, the increasing integration of technology in financing processes, such as platform-based loan applications, is reshaping the consumer experience in this dynamic market.North America Automotive Financing Market Report:

North America represents a significant market for Automotive Financing, with a size of $119.25 billion in 2023, anticipated to grow to $251.02 billion by 2033. The growth is driven by strong automotive sales, competitive financing products, and increasing consumer access to credit. The region’s well-developed financial ecosystem with a multitude of lenders and technology-driven solutions substantially enhances the financing landscape.South America Automotive Financing Market Report:

In South America, the Automotive Financing market is emerging, with a market size of $24.46 billion in 2023 projected to reach $51.50 billion by 2033. Rapid urbanization and a growing middle class are increasing the demand for automotive purchases, coupled with flexible financing solutions tailored for the region's economic conditions. However, challenges such as fluctuating currencies and economic instability may affect growth.Middle East & Africa Automotive Financing Market Report:

The Automotive Financing market in the Middle East and Africa is projected to grow from $46.90 billion in 2023 to $98.73 billion by 2033. This region is experiencing a gradual shift towards diversified automotive offerings and improved credit availability. Economic diversification efforts in several countries are encouraging investments in infrastructure and mobility, leading to an increased focus on automotive financing options.Tell us your focus area and get a customized research report.

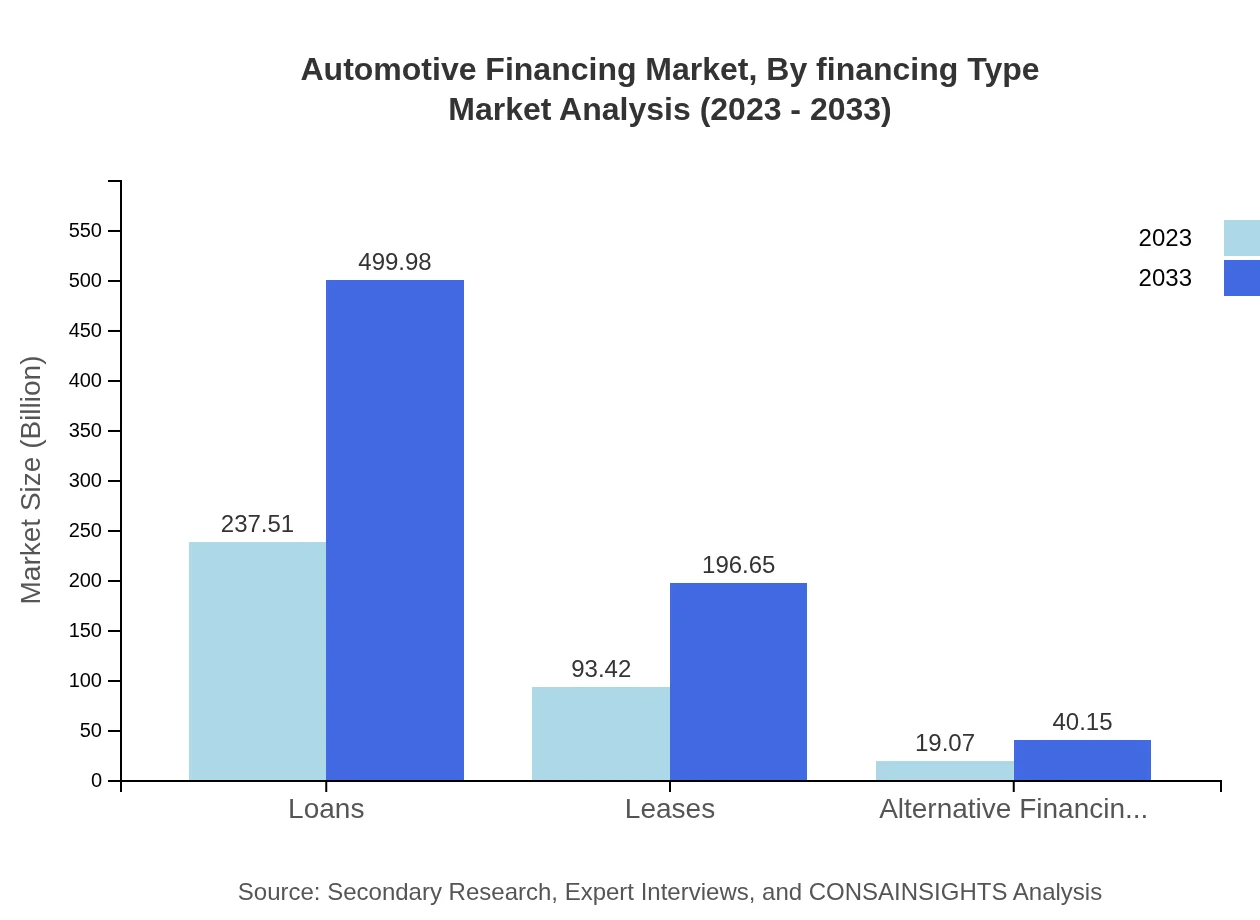

Automotive Financing Market Analysis By Financing Type

The Automotive Financing Market is primarily segmented into loans and leases, representing a significant portion of the market by size. In 2023, the loans segment is valued at $237.51 billion, expected to increase to $499.98 billion by 2033, maintaining a share of 67.86%. The leases segment is valued at $93.42 billion and is projected to reach $196.65 billion, with a 26.69% market share. Alternative financing options, though smaller at $19.07 billion, hold growth potential, anticipated to grow to $40.15 billion by 2033, capturing a 5.45% share.

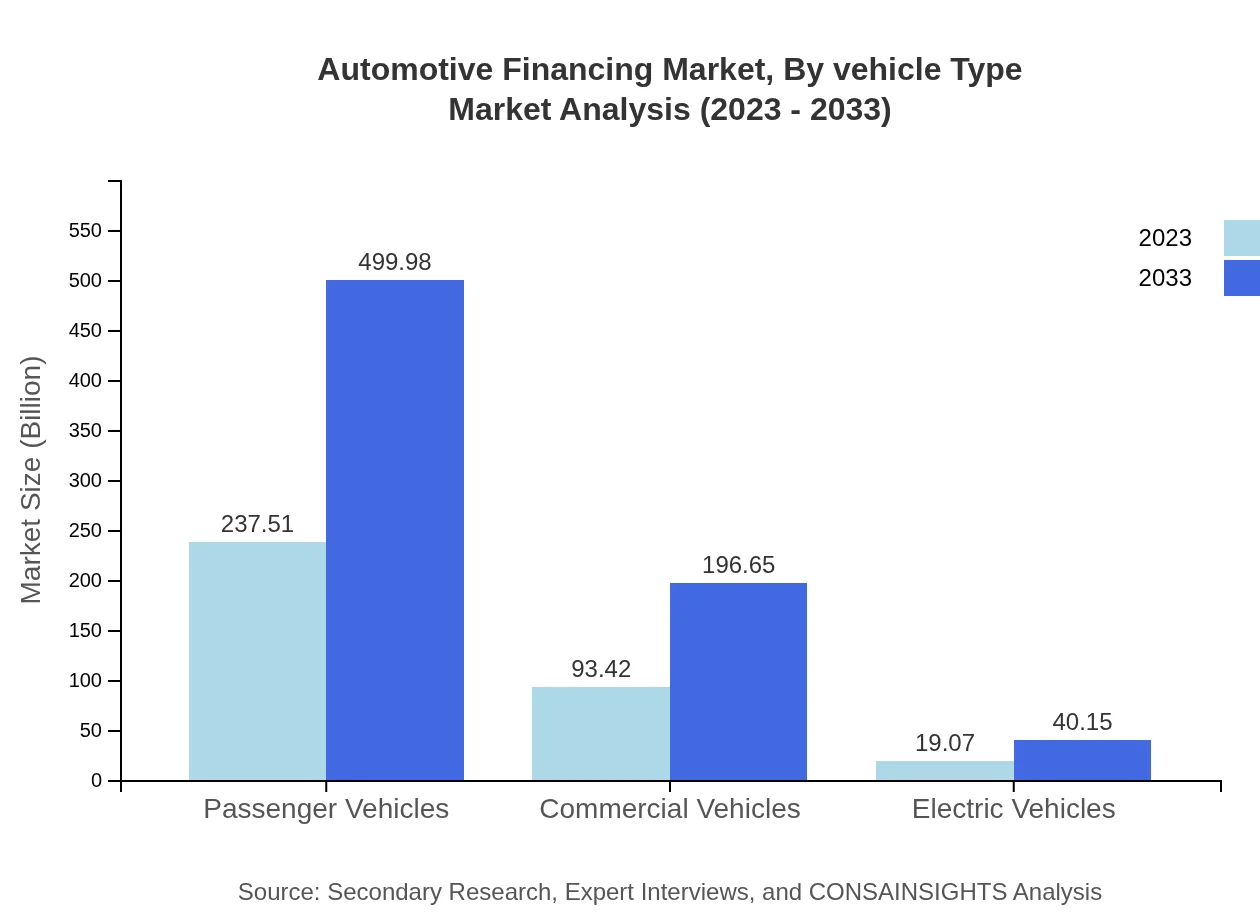

Automotive Financing Market Analysis By Vehicle Type

The Automotive Financing Market by vehicle type shows significant division between passenger and commercial vehicles. Passenger vehicles dominate with a market size of $237.51 billion expanding to $499.98 billion by 2033, holding a steady share of 67.86%. Commercial vehicles, with a market size of $93.42 billion in 2023, are forecasted to grow to $196.65 billion, accounting for 26.69% of the market. Electric vehicles, while the smallest segment currently at $19.07 billion, show a promising growth path to $40.15 billion by 2033, contributing 5.45% to the overall automotive financing landscape.

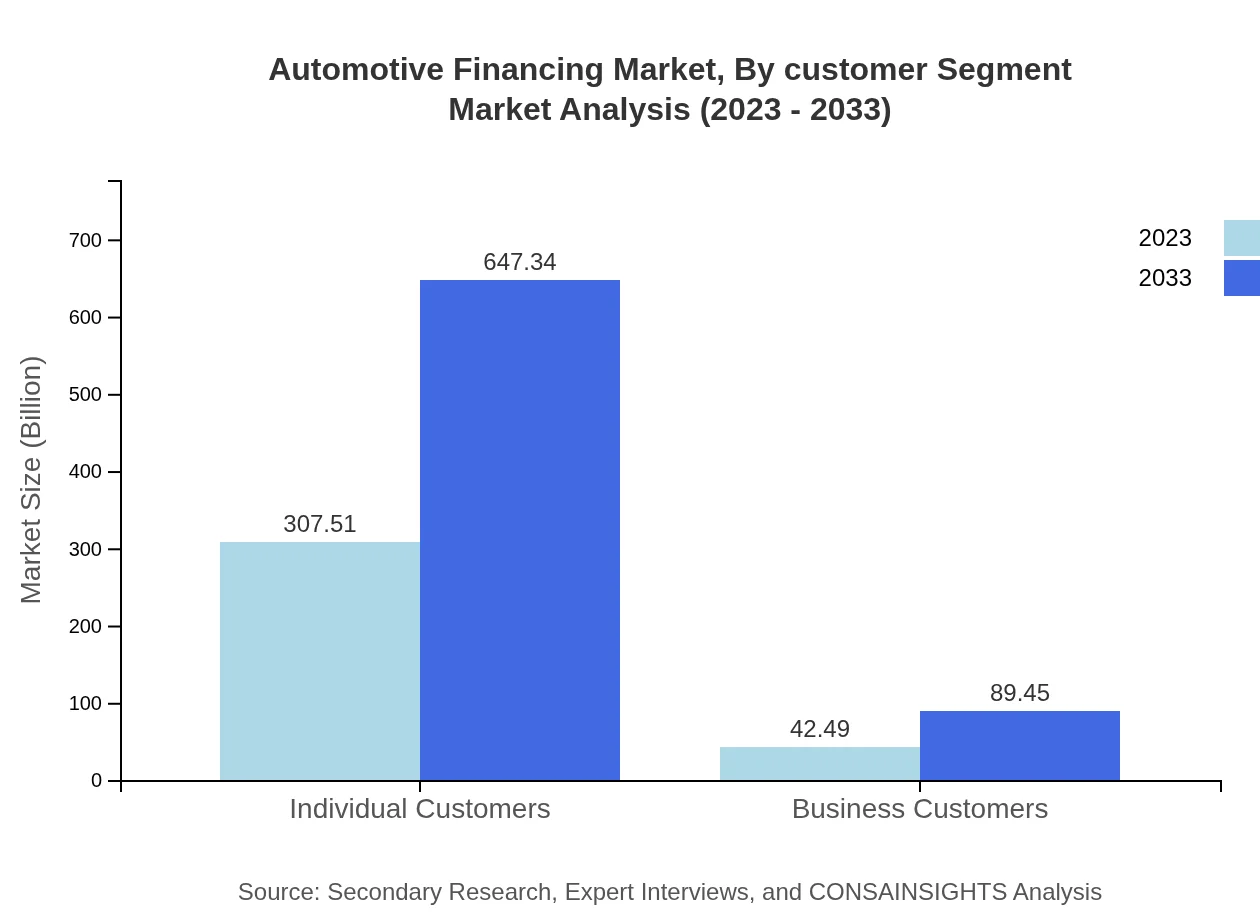

Automotive Financing Market Analysis By Customer Segment

The market can also be segmented by customer base where individual customers represent the dominant share, valued at $307.51 billion in 2023, anticipated to grow to $647.34 billion by 2033, holding an 87.86% share. Business customers, while significantly smaller at $42.49 billion in 2023, project growth to $89.45 billion by the end of 2033, maintaining a 12.14% market share. This highlights the growing trend where businesses increasingly seek financing options for their fleets.

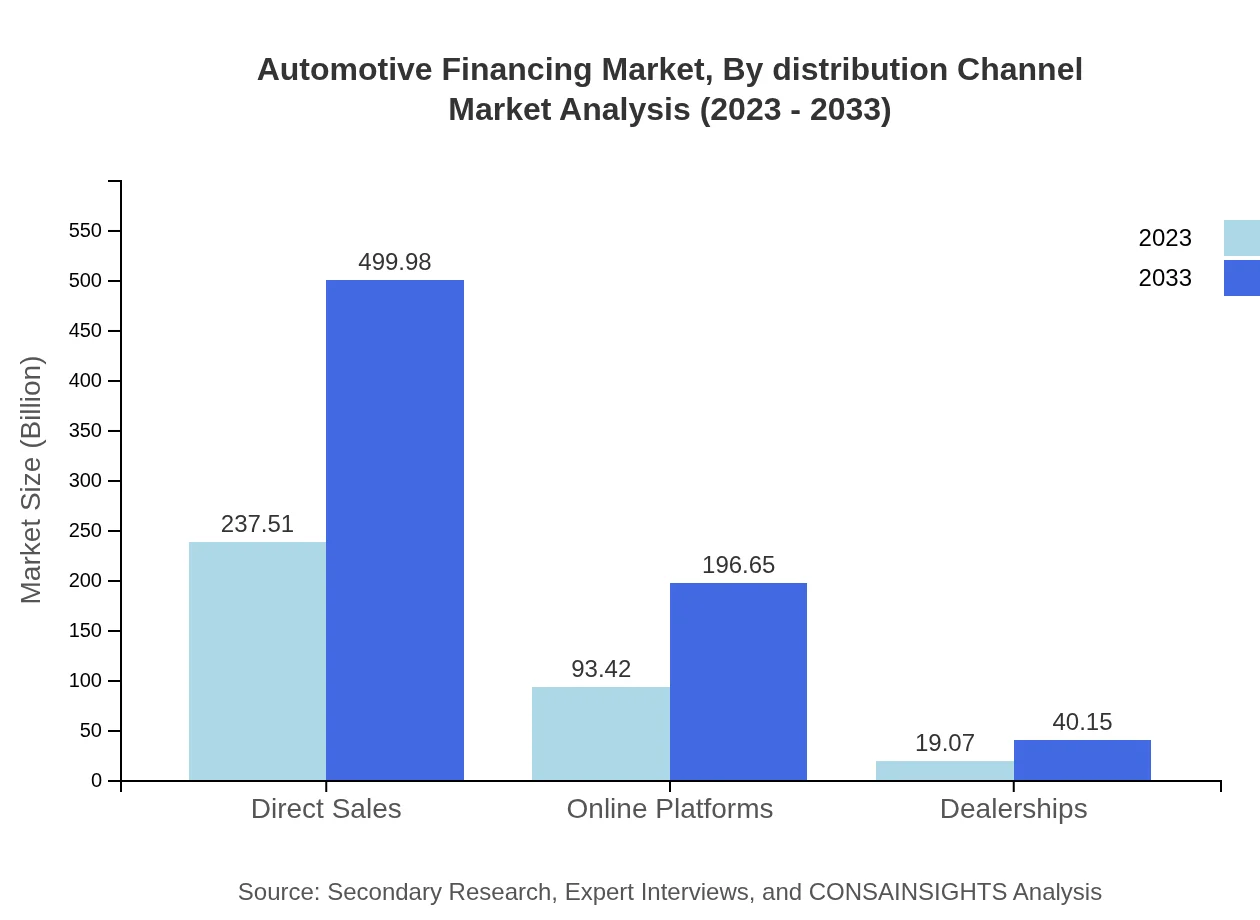

Automotive Financing Market Analysis By Distribution Channel

Distribution channels primarily include direct sales, online platforms, and dealerships. Direct sales are prominent, valued at $237.51 billion in 2023 and projected to reach $499.98 billion by 2033, capturing 67.86% of the market. Online platforms are increasingly influential, starting at $93.42 billion and expected to rise to $196.65 billion, holding a 26.69% share. Dealerships, while smaller at $19.07 billion, are anticipated to expand to $40.15 billion, representing 5.45% of the market share by 2033.

Automotive Financing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in the Automotive Financing Industry

Ford Motor Credit Company:

The financing arm of the Ford Motor Company provides a variety of automotive financing options, including retail loans and leases, catering to both direct and dealer customers across North America and international markets.Toyota Financial Services:

Toyota Financial Services offers comprehensive financing solutions for Toyota customers, facilitating access to loans, leases, and various insurance products, emphasized on customer satisfaction and loyalty.General Motors Financial:

As the wholly-owned financial services subsidiary of General Motors, GM Financial provides a range of automotive financial solutions, including competitively-priced loans and leases, primarily for GM customers.BMW Financial Services:

BMW Financial Services specializes in providing premium financing solutions for BMW and Mini customers, enhancing the purchasing or leasing experience with tailored financial products.Ally Financial:

Ally Financial is a leading automotive financial services provider, offering integrated financing, insurance, and accounting solutions to dealerships and consumers, emphasizing technology-driven solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of automotive financing?

The automotive financing market is projected to reach a size of $350 billion by 2033, growing at a CAGR of 7.5%. This growth signifies robust demand and expansion opportunities within the industry.

What are the key market players or companies in the automotive financing industry?

Key players in the automotive financing industry include major banks, credit unions, and captive finance companies associated with automotive manufacturers. These companies provide essential financing services that contribute to market stability and growth.

What are the primary factors driving the growth in the automotive financing industry?

Key drivers of growth in automotive financing include rising vehicle sales, increasing consumer reliance on financing options, and a shift towards online lending platforms. Additionally, favorable interest rates and innovative loan products enhance accessibility.

Which region is the fastest Growing in automotive financing?

North America is the fastest-growing region in automotive financing, with a market size projected to rise from $119.25 billion in 2023 to $251.02 billion by 2033. This growth is attributed to high vehicle ownership and expanding credit availability.

Does ConsaInsights provide customized market report data for the automotive financing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the automotive financing industry. This service allows clients to gain insights into niche markets and make informed business decisions.

What deliverables can I expect from this automotive financing market research project?

Deliverables from the automotive financing market research project include comprehensive market analysis, detailed segmentation data, growth forecasts, competitor analysis, and strategic recommendations tailored to your business objectives.

What are the market trends of automotive financing?

Current trends in automotive financing include a shift towards digital financing platforms, increased popularity of electric vehicle financing options, and the rise of lease agreements over loans. These trends reflect changing consumer preferences and technological advancements.