Banking Hardware Maintenance Software Support And Helpdesk Support Services

Published Date: 31 January 2026 | Report Code: banking-hardware-maintenance-software-support-and-helpdesk-support-services

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive examination of the Banking Hardware Maintenance Software Support And Helpdesk Support Services market over the forecast period 2024 to 2033. It delivers key insights into market trends, segmentation, regional performance, technological advancements, and the roles of global market leaders, enabling stakeholders to make informed strategic decisions.

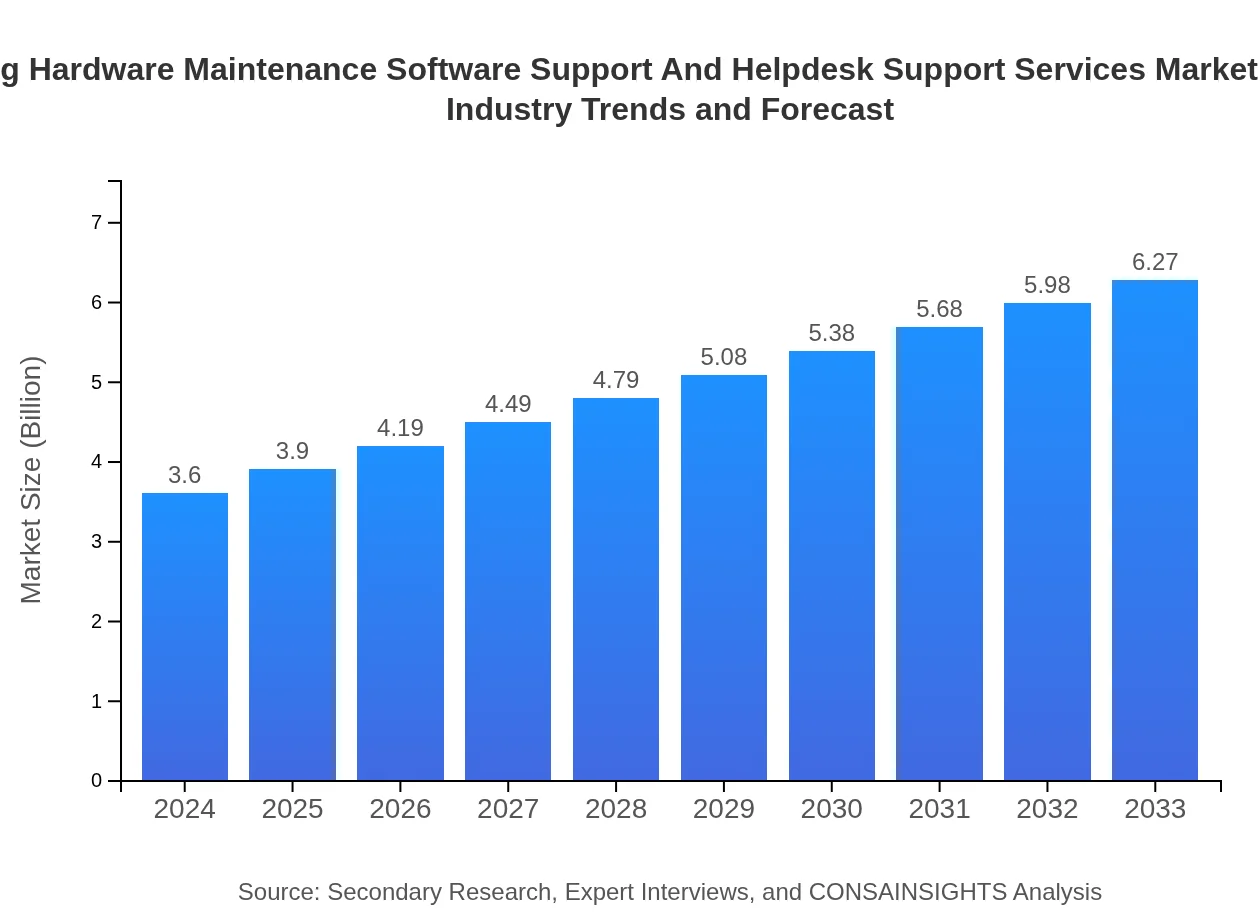

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.60 Billion |

| CAGR (2024-2033) | 6.2% |

| 2033 Market Size | $6.27 Billion |

| Top Companies | TechBank Corp, Innovative Support Solutions, Global IT Services |

| Last Modified Date | 31 January 2026 |

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Overview

Customize Banking Hardware Maintenance Software Support And Helpdesk Support Services market research report

- ✔ Get in-depth analysis of Banking Hardware Maintenance Software Support And Helpdesk Support Services market size, growth, and forecasts.

- ✔ Understand Banking Hardware Maintenance Software Support And Helpdesk Support Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Banking Hardware Maintenance Software Support And Helpdesk Support Services

What is the Market Size & CAGR of Banking Hardware Maintenance Software Support And Helpdesk Support Services market in {Year}?

Banking Hardware Maintenance Software Support And Helpdesk Support Services Industry Analysis

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis Report by Region

Europe Banking Hardware Maintenance Software Support And Helpdesk Support Services:

Europe's market is evolving rapidly as banks invest in hybrid support models to bridge the gap between traditional hardware maintenance and innovative digital solutions. The region’s market size is expected to grow from $0.88 billion in 2024 to $1.53 billion by 2033. Regulatory pressures and the need for enhanced data security have accelerated the adoption of integrated support solutions, positioning the region as a key adopter of new technologies in banking.Asia Pacific Banking Hardware Maintenance Software Support And Helpdesk Support Services:

In the Asia Pacific region, the market is witnessing significant growth due to rapid digitalization and the expansion of banking infrastructure in emerging economies. With projected market growth from $0.70 billion in 2024 to $1.21 billion by 2033, banks are prioritizing integrated hardware maintenance and IT support solutions to overcome infrastructural challenges and enhance service reliability. These technologies are becoming crucial catalysts for operational efficiency in the region.North America Banking Hardware Maintenance Software Support And Helpdesk Support Services:

North America remains one of the leading markets, with its sophisticated banking infrastructure and high demand for cutting-edge support services. Market estimations indicate a growth from $1.39 billion in 2024 to approximately $2.42 billion by 2033. High investments in cybersecurity, rapid IT upgrades, and an emphasis on automated support and remote delivery mechanisms are driving market advancements in this region.South America Banking Hardware Maintenance Software Support And Helpdesk Support Services:

The South American (Latin America) market is expanding at a steady pace, growing from an estimated $0.30 billion in 2024 to around $0.52 billion by 2033. Although the investment scale is moderate compared to global powerhouses, increasing digital transformation initiatives in the region and the rising adoption of modern support services are fueling demand. Regional banks are progressively shifting towards advanced maintenance and support frameworks despite facing budget constraints.Middle East & Africa Banking Hardware Maintenance Software Support And Helpdesk Support Services:

The Middle East and Africa are demonstrating promising market potential with an anticipated market increase from $0.33 billion in 2024 to approximately $0.58 billion by 2033. The drive for modernization, combined with strategic investments in IT infrastructure, has encouraged banks in this region to adopt comprehensive maintenance and helpdesk solutions. Despite economic and infrastructural challenges, these regions are poised for gradual but steady growth.Tell us your focus area and get a customized research report.

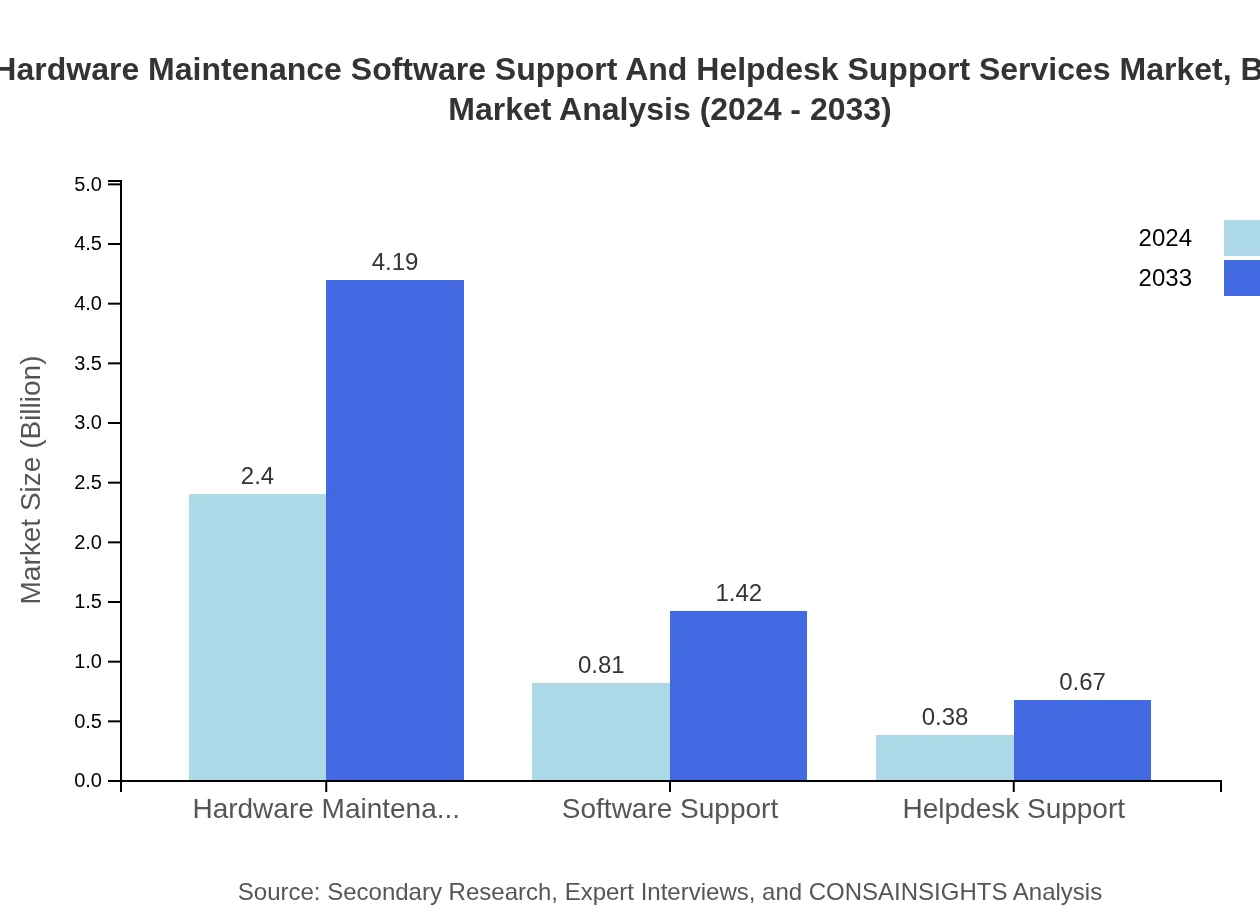

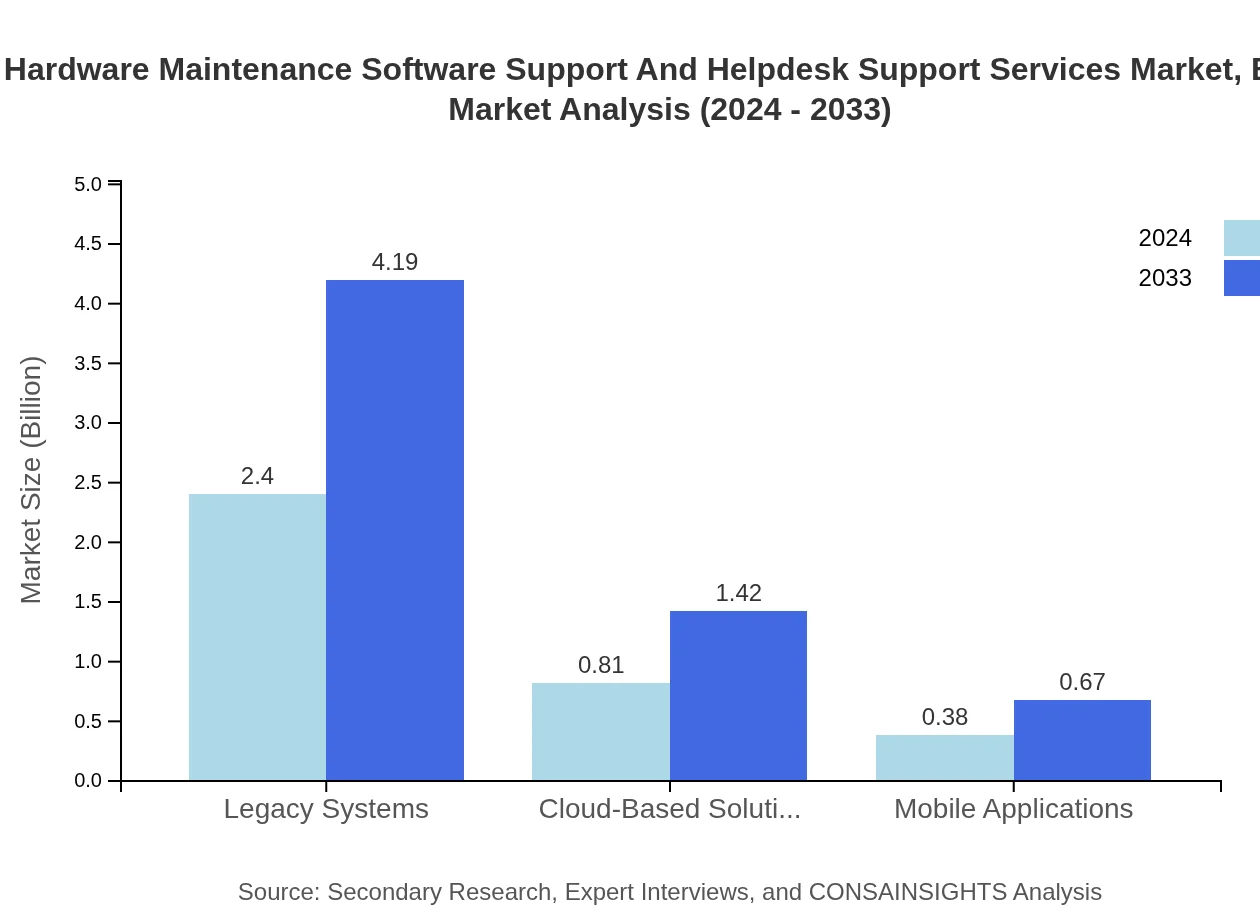

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis By Service Type

The service type segment is subdivided into key technology solutions including legacy systems, cloud-based solutions, mobile applications, hardware maintenance, software support, and helpdesk support. Legacy systems continue to dominate the market with a substantial size reaching $2.40 billion in 2024 and growing to $4.19 billion by 2033, representing a consistent share of 66.79%. Meanwhile, the cloud-based solutions segment, growing from $0.81 billion to $1.42 billion, along with mobile applications, which are anticipated to grow from $0.38 billion to $0.67 billion, highlight the transition towards digital and mobile-optimized service models. Hardware maintenance and software support segments mirror these trends, underscoring the importance of hybrid support models that blend traditional and innovative solutions. Overall, this segmentation provides clarity on service-specific trends, helping stakeholders allocate investments and streamline service delivery frameworks in both emerging and mature markets.

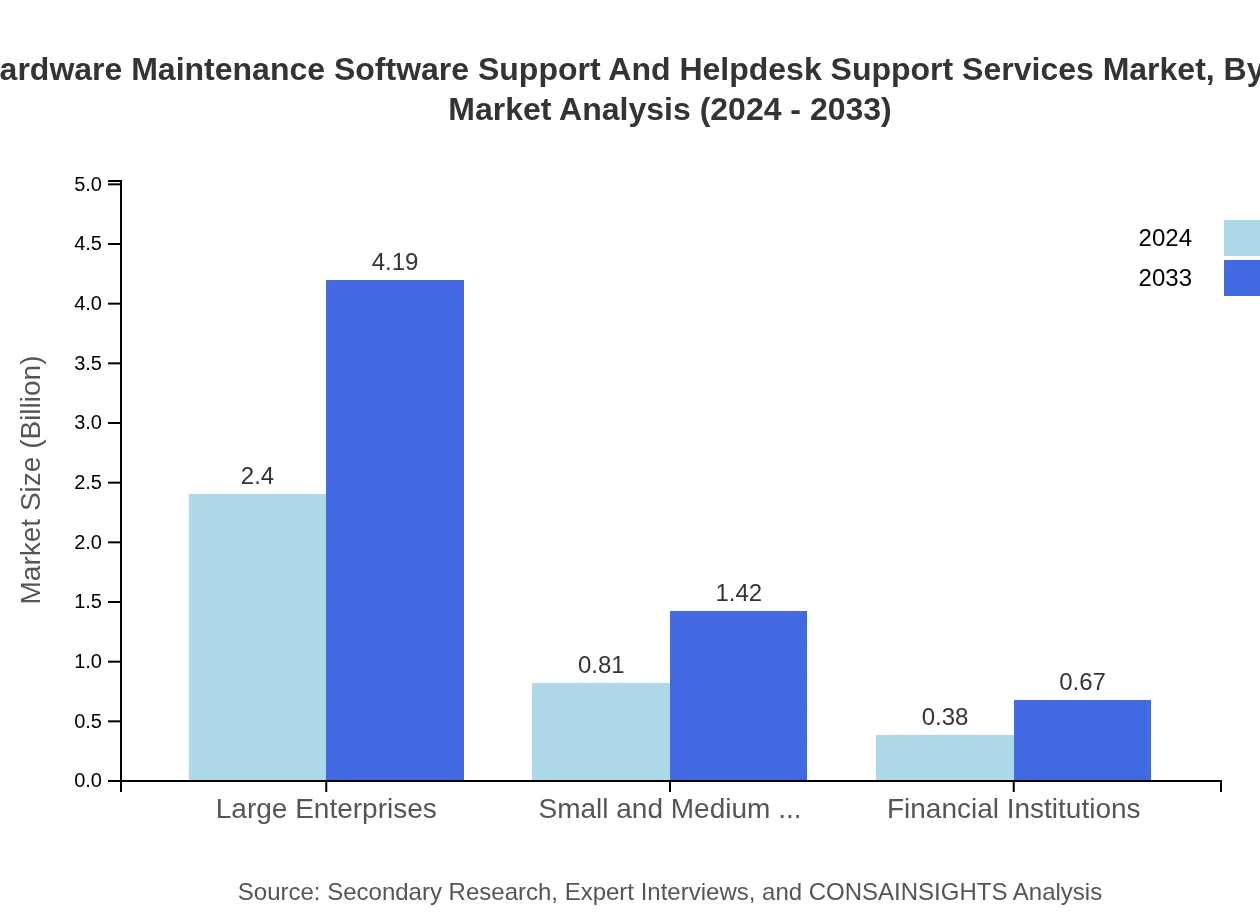

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis By Customer Type

The market by customer type is categorized into large enterprises, small and medium enterprises (SMEs), and financial institutions. Large enterprises originally contribute a dominant market size of $2.40 billion in 2024, growing steadily to $4.19 billion by 2033, while maintaining a strong share of approximately 66.79%. In contrast, SMEs represent a progressively important segment with market sizes growing from $0.81 billion to $1.42 billion, indicative of increasing digital adoption in smaller organizations. Additionally, financial institutions, with market sizes growing from $0.38 billion to $0.67 billion, are particularly sensitive to the need for robust IT support frameworks that ensure operational continuity. The diverse needs across different customer types necessitate tailored service solutions and support models, reflecting the overall maturity and segmentation of the market.

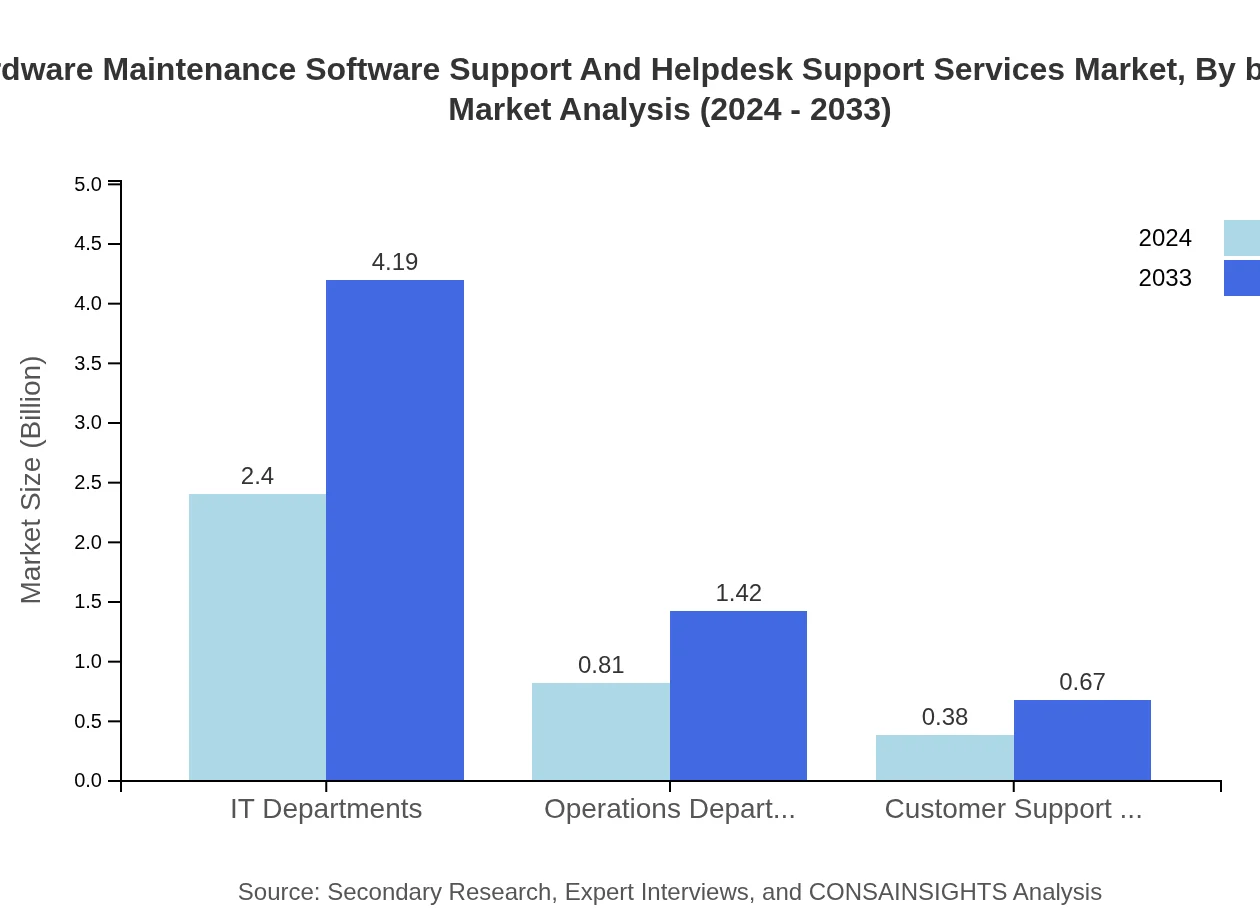

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis By Business Function

Analysis by business function subdivides the market into divisions such as IT departments, operations departments, and customer support departments, each playing a critical role in the operational effectiveness of banking institutions. IT departments, which are at the forefront of technology management, show a market size escalation from $2.40 billion in 2024 to $4.19 billion by 2033, securing a dominant share of 66.79%. Operations departments, growing from $0.81 billion to $1.42 billion, are critical for the efficient functioning of bank processes, while customer support departments, with growth prospects from $0.38 billion to $0.67 billion, reflect the market's focus on enhancing customer service experiences. These detailed insights help organizations pinpoint investment areas, optimize internal functions, and align their service delivery models with broader business objectives.

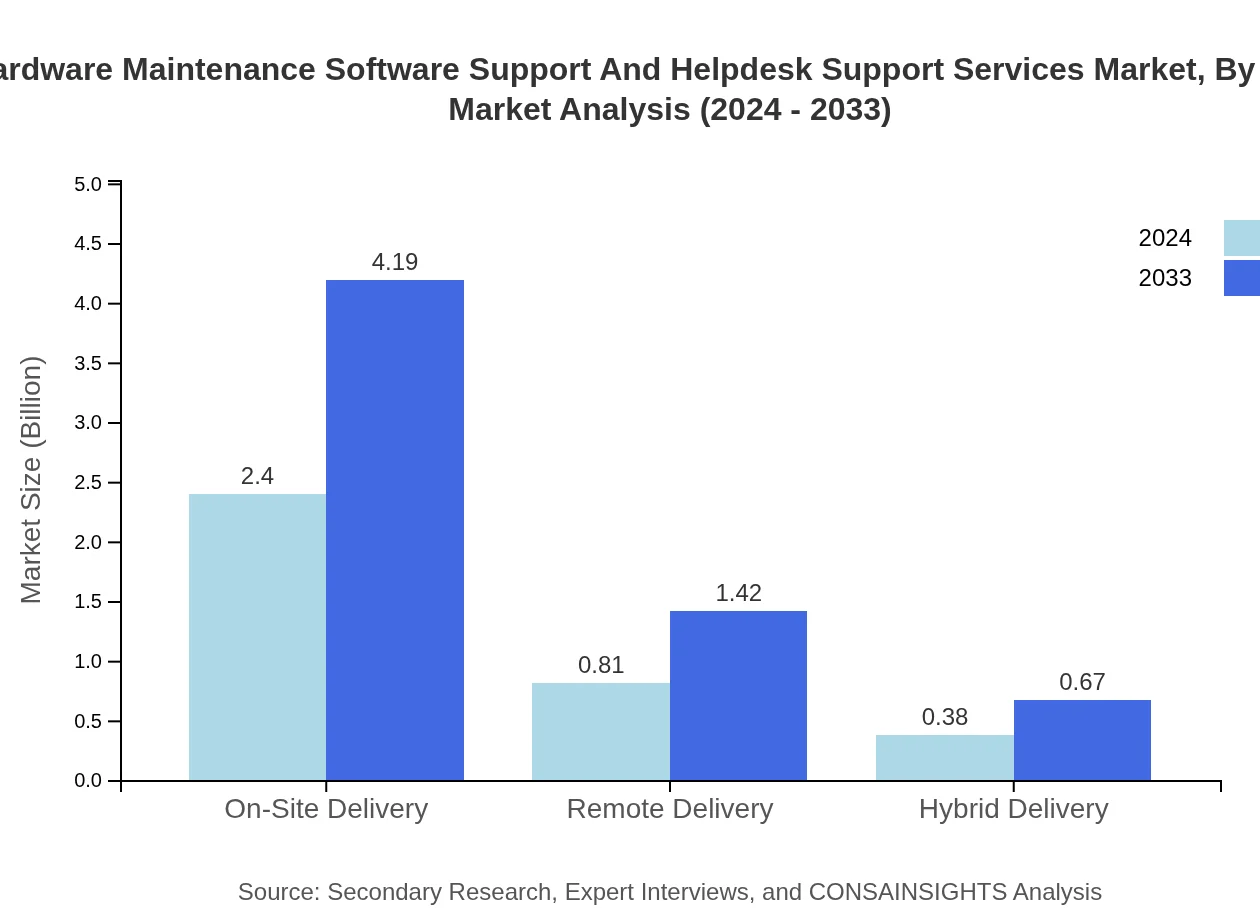

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis By Delivery Method

Delivery method segmentation categorizes the market into on-site delivery, remote delivery, and hybrid delivery. On-site delivery remains a traditional yet critical segment with market values rising from $2.40 billion in 2024 to $4.19 billion by 2033, and maintaining a dominant share of 66.79% due to its reliability in critical service deployments. Remote delivery services, which are gaining popularity due to advancements in digital communication technologies, are projected to grow from $0.81 billion to $1.42 billion. Hybrid delivery models, integrating both on-site and remote support, are emerging to offer flexibility and efficiency, showing growth from $0.38 billion to $0.67 billion. These shifts in delivery methods are reflective of wider digital transformation trends within the banking sector and underscore the need for agile support models.

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Analysis By Technology

The by-technology segment focuses on the impact of technological innovation in the support services domain. This includes the ongoing shift from traditional legacy systems to cloud-based and mobile-driven applications, supported by advancements in automation and artificial intelligence. Legacy systems, despite their age, continue to sustain a major market share due to their deep integration within banking systems. In contrast, cloud-based and mobile applications are steadily gaining traction as banks seek more scalable, flexible, and cost-effective solutions. Furthermore, an increased focus on security protocols and real-time system monitoring is driving the adoption of cutting-edge software support and helpdesk functionalities. These advancements are fundamentally reshaping the technological landscape of banking support services, ensuring higher operational efficiency and improved risk management for financial institutions.

Banking Hardware Maintenance Software Support And Helpdesk Support Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Banking Hardware Maintenance Software Support And Helpdesk Support Services Industry

TechBank Corp:

TechBank Corp is a leading provider renowned for integrating state-of-the-art IT solutions with robust hardware maintenance and helpdesk support services. Their innovative technology platforms and a strong commitment to excellence have set industry standards.Innovative Support Solutions:

Innovative Support Solutions specializes in comprehensive support services, offering a blend of traditional and digital solutions that ensure high reliability and rapid response times. Their customer-centric strategies and strategic global partnerships have positioned them as a market leader.Global IT Services:

Global IT Services delivers a wide range of support and maintenance services to major financial institutions worldwide. With a focus on integrating advanced automation tools and providing seamless helpdesk support, they have consistently driven technological transformation in the banking sector.We're grateful to work with incredible clients.