Bed Monitoring System Baby Monitoring System Market Report

Published Date: 31 January 2026 | Report Code: bed-monitoring-system-baby-monitoring-system

Bed Monitoring System Baby Monitoring System Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Bed Monitoring System Baby Monitoring System market, examining its growth prospects, key drivers, and technology advancements from 2023 to 2033. It includes insights into market size, segmentation, regional dynamics, and future trends essential for stakeholders in the industry.

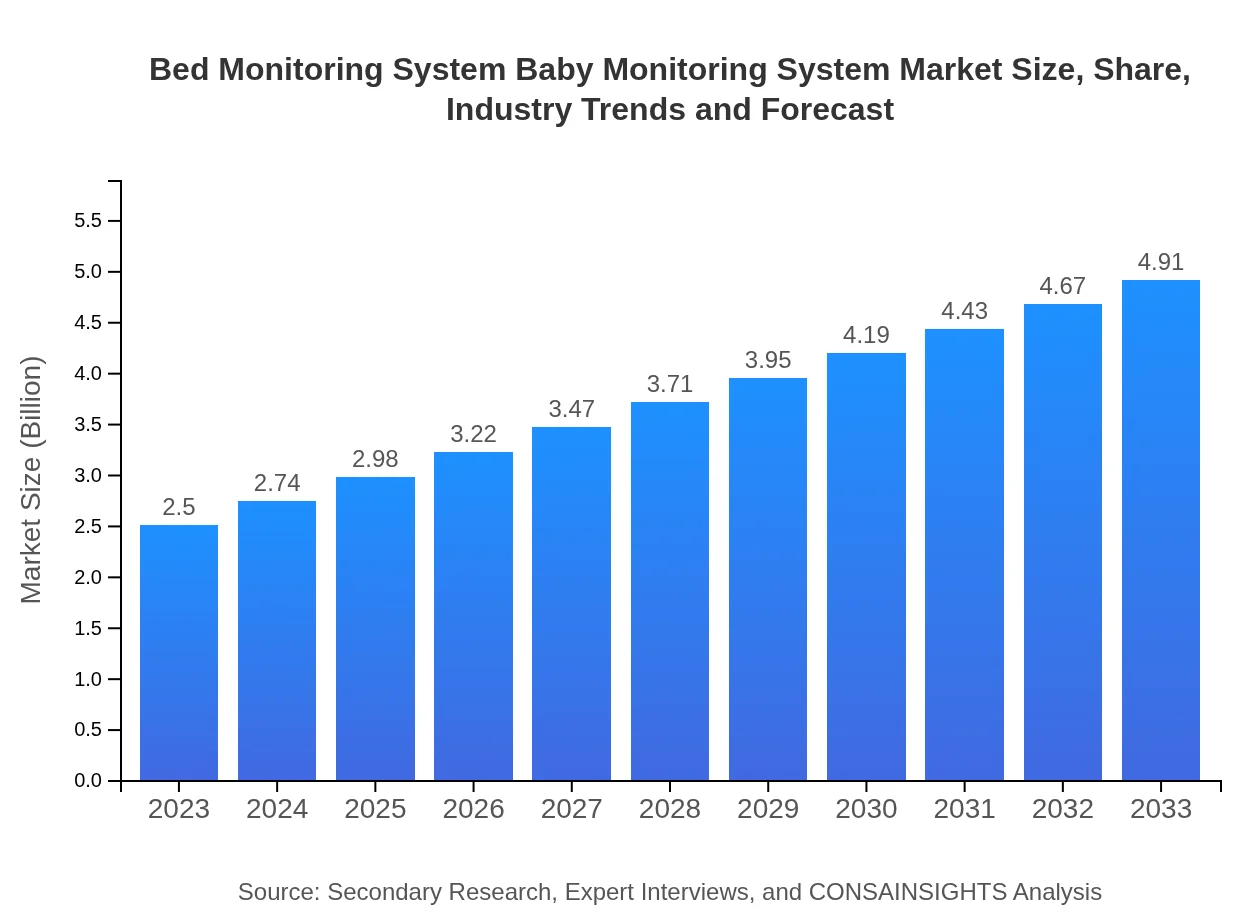

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Nanit, Owlet, Miku |

| Last Modified Date | 31 January 2026 |

Bed Monitoring System Baby Monitoring System Market Overview

Customize Bed Monitoring System Baby Monitoring System Market Report market research report

- ✔ Get in-depth analysis of Bed Monitoring System Baby Monitoring System market size, growth, and forecasts.

- ✔ Understand Bed Monitoring System Baby Monitoring System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bed Monitoring System Baby Monitoring System

What is the Market Size & CAGR of Bed Monitoring System Baby Monitoring System market in 2023?

Bed Monitoring System Baby Monitoring System Industry Analysis

Bed Monitoring System Baby Monitoring System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bed Monitoring System Baby Monitoring System Market Analysis Report by Region

Europe Bed Monitoring System Baby Monitoring System Market Report:

The European market is expected to grow from $0.70 billion in 2023 to $1.38 billion in 2033. The emphasis on product safety regulations, alongside growing consumer awareness about infant health issues, fuels demand for advanced monitoring solutions.Asia Pacific Bed Monitoring System Baby Monitoring System Market Report:

In the Asia Pacific region, the market is expanding rapidly, projected to grow from $0.48 billion in 2023 to $0.94 billion in 2033. The increasing urban population and rising disposable incomes drive the adoption of baby monitoring systems, particularly in urban centers with dual-income families.North America Bed Monitoring System Baby Monitoring System Market Report:

North America holds a substantial market share, estimated to grow from $0.85 billion in 2023 to $1.67 billion in 2033. Factors such as high healthcare spending, advanced technology adoption, and cultural preferences for safety and surveillance contribute to its leading position.South America Bed Monitoring System Baby Monitoring System Market Report:

The South American market, projected to grow from $0.18 billion in 2023 to $0.36 billion in 2033, is witnessing increased demand due to heightened awareness of infant health and safety. This market offers significant growth potential, primarily through e-commerce channels.Middle East & Africa Bed Monitoring System Baby Monitoring System Market Report:

In the Middle East and Africa, the market will likely expand from $0.29 billion in 2023 to $0.57 billion by 2033, driven by improving healthcare infrastructure and rising concerns about child safety in various countries.Tell us your focus area and get a customized research report.

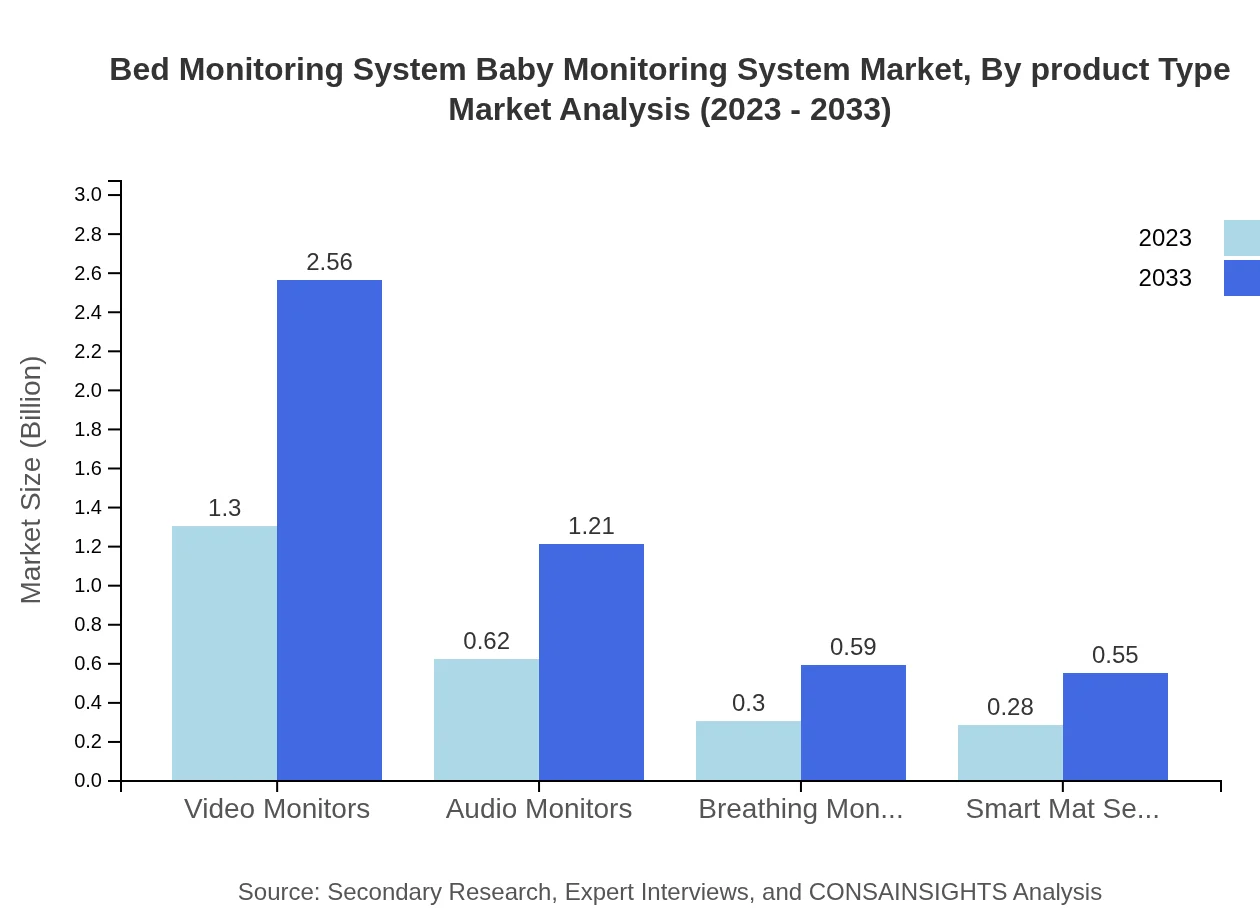

Bed Monitoring System Baby Monitoring System Market Analysis By Product Type

In terms of product type, video monitors dominate the market, expected to increase from $1.30 billion in 2023 to $2.56 billion in 2033. Audio monitors and breathing monitors also hold significant shares, catering to specific safety and monitoring needs for infants. The market for smart mat sensors, while smaller, is gaining traction due to technological innovations.

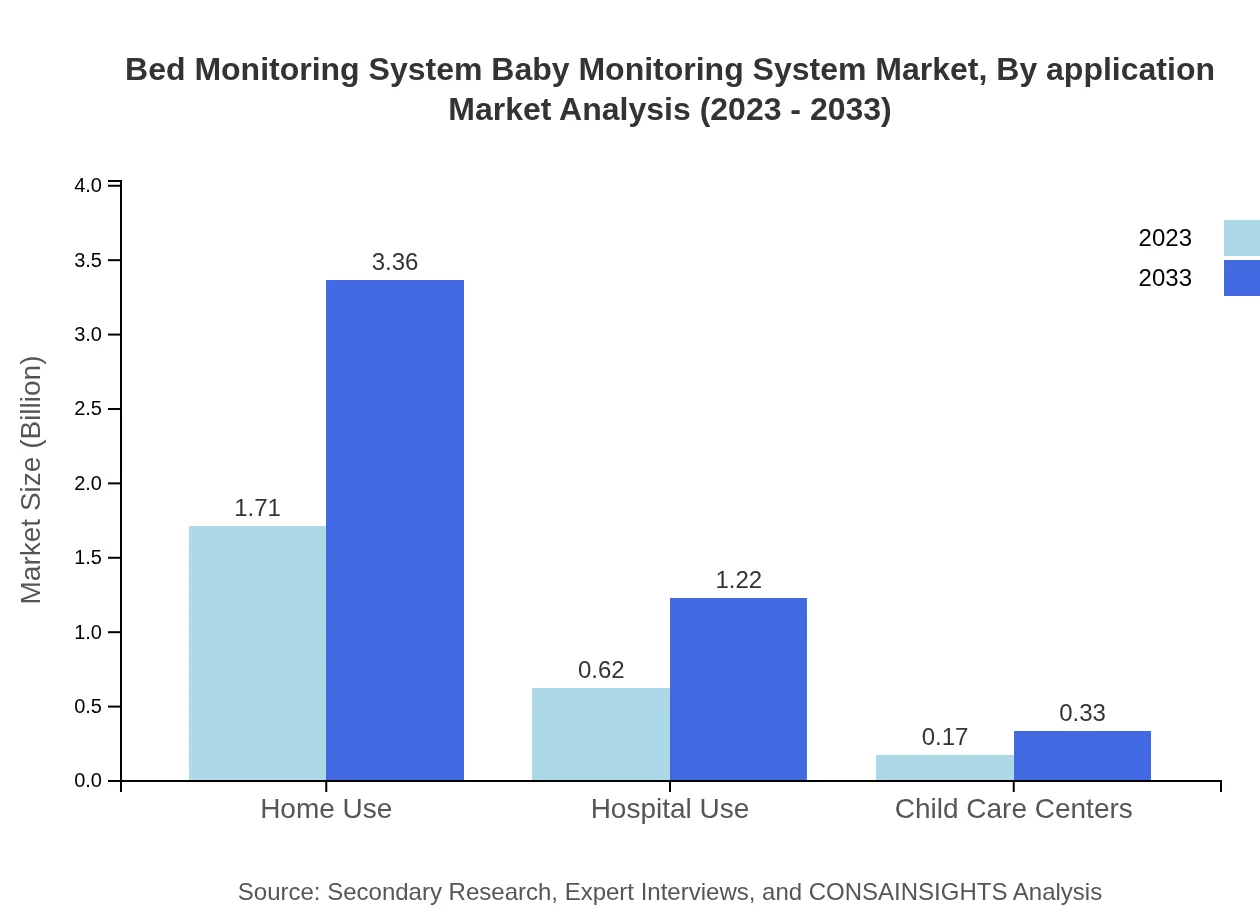

Bed Monitoring System Baby Monitoring System Market Analysis By Application

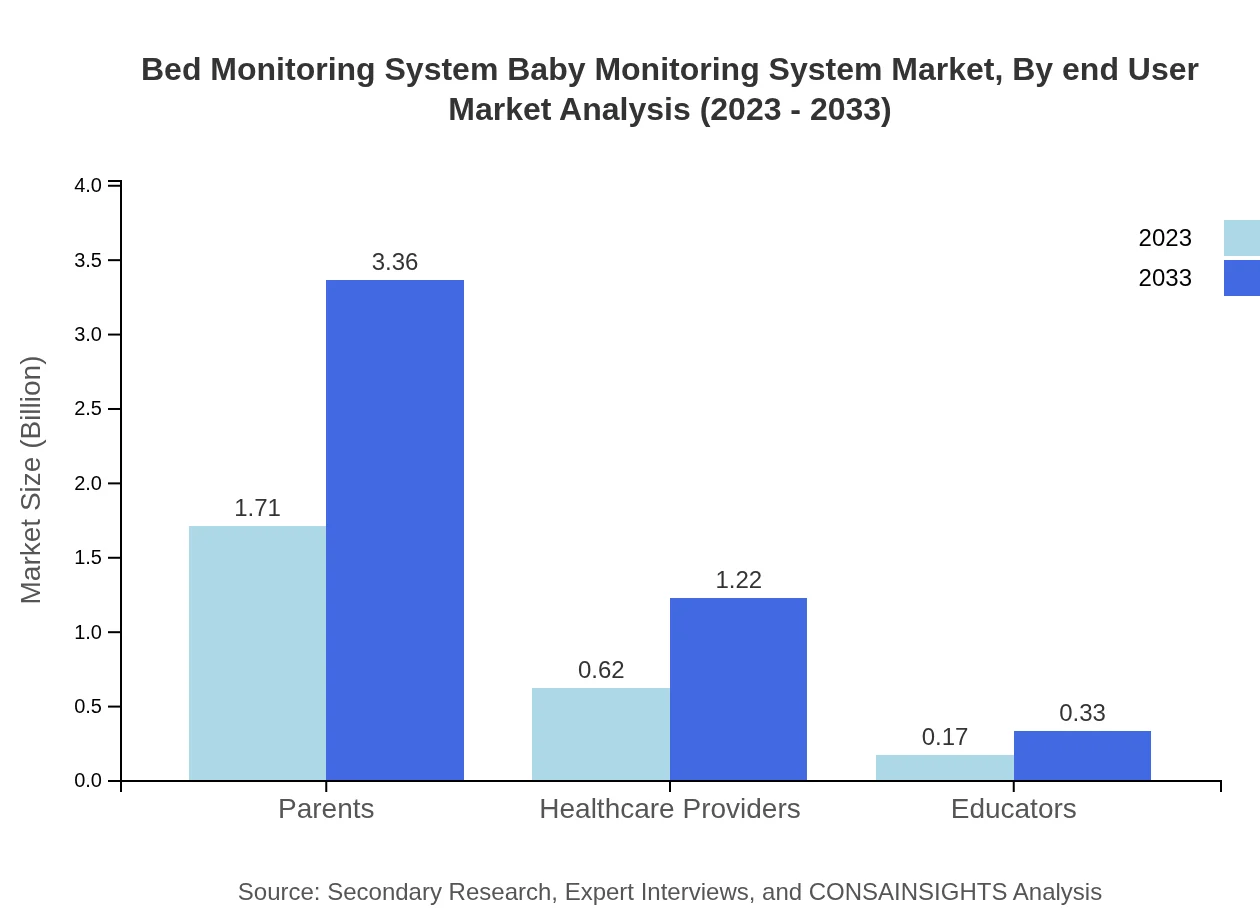

The applications of Bed Monitoring Systems are primarily directed toward parents and healthcare providers. The parent segment is projected to reach $3.36 billion by 2033, showing the highest growth rate as parents seek ways to monitor their children's safety. Healthcare providers are also increasingly adopting these systems, with a projected market size of $1.22 billion by 2033.

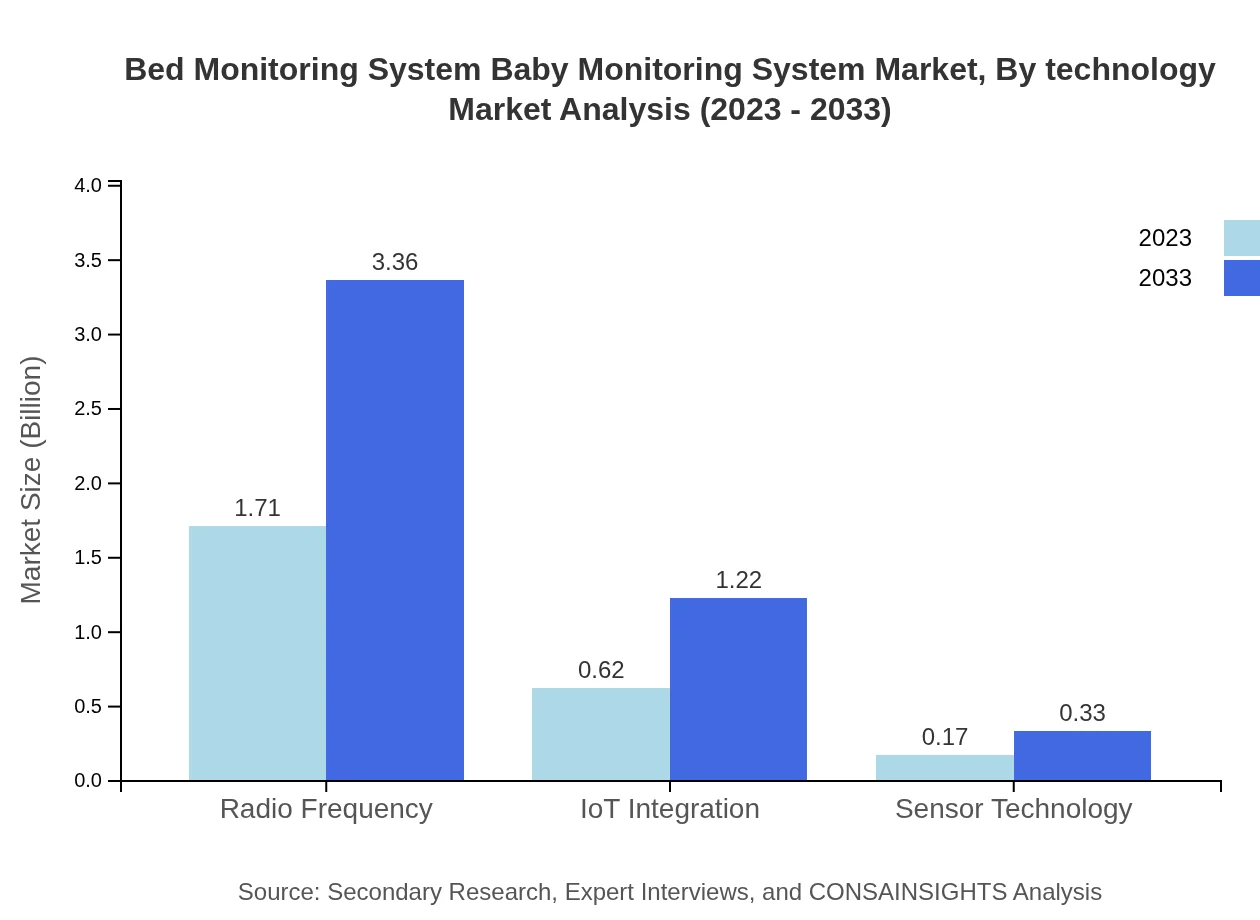

Bed Monitoring System Baby Monitoring System Market Analysis By Technology

Technological advancements lead the market, with a significant shift towards IoT integration. Devices using RF technology are set to remain dominant, ensuring comprehensive monitoring and connectivity. The share of IoT-based technologies in the market will likely grow, enhancing data sharing and analysis capabilities.

Bed Monitoring System Baby Monitoring System Market Analysis By End User

The primary end-users include parents and healthcare facilities. Home use dominates the market, predicted to reach $3.36 billion by 2033, driven by growing preferences for general safety equipment for babies. The hospital segment is also significant, expanding its size due to increased institution-related safety measures.

Bed Monitoring System Baby Monitoring System Market Analysis By Distribution Channel

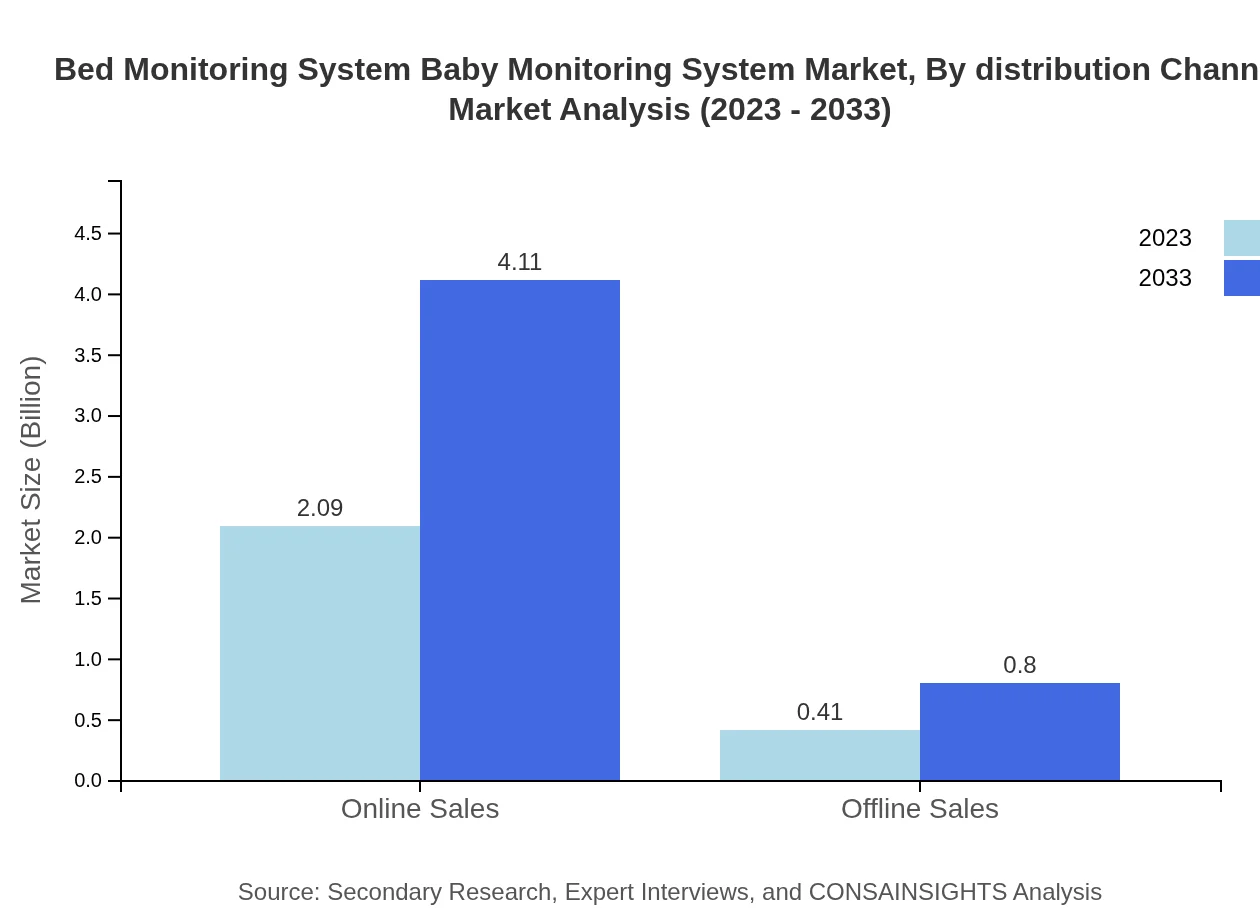

Online sales channels are crucial for market expansion, projected to increase from $2.09 billion in 2023 to $4.11 billion in 2033. The convenience and accessibility of e-commerce platforms significantly enhance product reach. Offline sales are also relevant, catering to consumers who prefer in-store purchases.

Bed Monitoring System Baby Monitoring System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bed Monitoring System Baby Monitoring System Industry

Nanit:

Nanit is a leader in the baby monitoring space that offers smart monitors equipped with advanced technology to provide insights into infant sleep patterns and safety.Owlet:

Owlet designs innovative monitoring systems focusing primarily on infant health, including heart rate and oxygen level monitoring using smart technology.Miku:

Miku specializes in contact-free breathing monitors that deliver real-time analytics and sleep insights directly to parents' smartphones.We're grateful to work with incredible clients.

FAQs

What is the market size of bed Monitoring System Baby Monitoring System?

The global market size of the Bed Monitoring System Baby Monitoring System is projected to reach approximately $2.5 billion in 2023, with a robust compound annual growth rate (CAGR) of 6.8%, indicating significant opportunities for growth in the decade ahead.

What are the key market players or companies in this bed Monitoring System Baby Monitoring System industry?

Key market players include major companies such as Motorola, Philips, and Baby Monitor Inc., which drive innovation and competition. These firms leverage advanced technologies to enhance product offerings in the baby monitoring segment, driving market dynamics and customer preferences.

What are the primary factors driving the growth in the bed Monitoring System Baby Monitoring System industry?

The growth in the bed monitoring system industry is primarily driven by increasing parental concerns for infant safety, technological advancements in monitoring devices, and an uptick in online sales. Additionally, rising disposable incomes further foster the demand for these innovative products.

Which region is the fastest Growing in the bed Monitoring System Baby Monitoring System?

The fastest-growing region in the bed monitoring system market is Europe, where the market is anticipated to grow from $0.70 billion in 2023 to $1.38 billion by 2033. North America also shows strong growth potential, projected to reach $1.67 billion by 2033.

Does ConsaInsights provide customized market report data for the bed Monitoring System Baby Monitoring System industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs. This service allows stakeholders in the bed monitoring industry to receive in-depth insights and detailed market analysis relevant to their operational requirements.

What deliverables can I expect from this bed Monitoring System Baby Monitoring System market research project?

Deliverables from this market research project include comprehensive reports detailing market trends, growth forecasts, competitive analysis, and regional breakdowns. Clients will also receive actionable insights to guide strategic decision-making in product development and market positioning.

What are the market trends of bed Monitoring System Baby Monitoring System?

Current market trends include the increasing demand for IoT-integrated baby monitors, a shift towards online retail channels, and growing interest in advanced sensor technologies. Additionally, there is a significant growth in video and audio monitoring devices as parents seek enhanced safety measures.