Biometric In The Automotive Market Report

Published Date: 31 January 2026 | Report Code: biometric-in-the-automotive

Biometric In The Automotive Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biometric In The Automotive market, detailing market size, growth forecasts, and trends from 2023 to 2033. It includes insights into regional dynamics, industry analysis, and key players in the market.

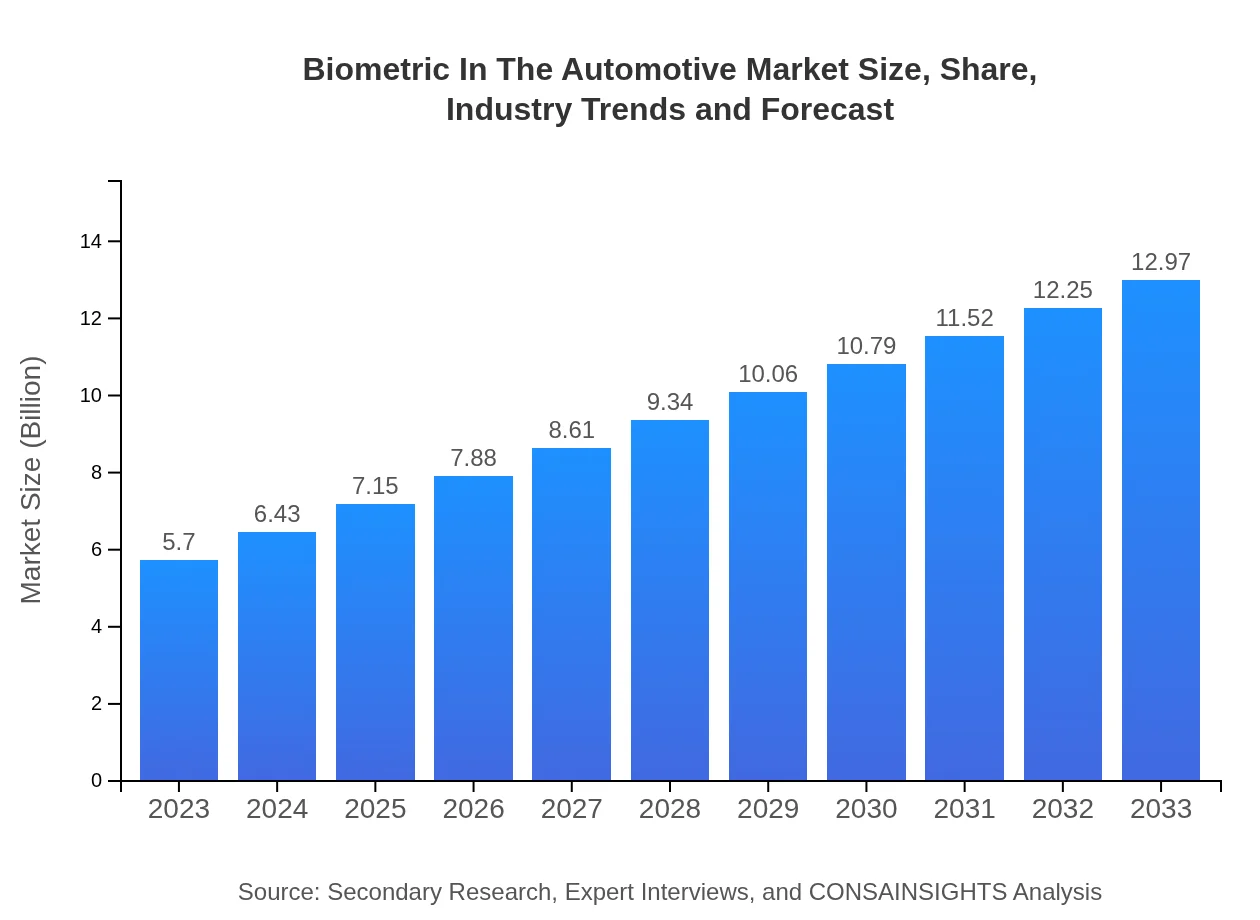

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $12.97 Billion |

| Top Companies | Bosch, Gentex Corporation, Aware, Inc. |

| Last Modified Date | 31 January 2026 |

Biometric In The Automotive Market Overview

Customize Biometric In The Automotive Market Report market research report

- ✔ Get in-depth analysis of Biometric In The Automotive market size, growth, and forecasts.

- ✔ Understand Biometric In The Automotive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric In The Automotive

What is the Market Size & CAGR of Biometric In The Automotive market in 2023?

Biometric In The Automotive Industry Analysis

Biometric In The Automotive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric In The Automotive Market Analysis Report by Region

Europe Biometric In The Automotive Market Report:

In Europe, the biometric market is set to grow from $1.37 billion in 2023 to $3.13 billion by 2033. An increase in stringent safety regulations and consumer demand for cutting-edge features propel the growth of biometric systems in vehicles.Asia Pacific Biometric In The Automotive Market Report:

In the Asia Pacific region, the market size is estimated at $1.13 billion in 2023, growing to $2.56 billion by 2033. The rapid adoption of electric vehicles and a rising middle class contribute significantly to this growth as manufacturers seek to integrate advanced technology into the automotive experience.North America Biometric In The Automotive Market Report:

North America holds a notable market size of $1.85 billion in 2023, predicted to reach $4.22 billion by 2033. Strong regulatory frameworks promoting safety, coupled with the region's advanced automotive sector, emphasize the necessity of integrating biometric systems into vehicles.South America Biometric In The Automotive Market Report:

The South America market is expected to grow from $0.57 billion in 2023 to $1.29 billion by 2033. Growing urbanization and improvements in transportation infrastructure drive demand for innovative automotive solutions, including biometric technologies.Middle East & Africa Biometric In The Automotive Market Report:

The Middle East and Africa market size starts at $0.78 billion in 2023 and is projected to reach $1.77 billion by 2033. The region's investments in smart transportation and growing vehicle service demands highlight the emerging role of biometrics in automotive applications.Tell us your focus area and get a customized research report.

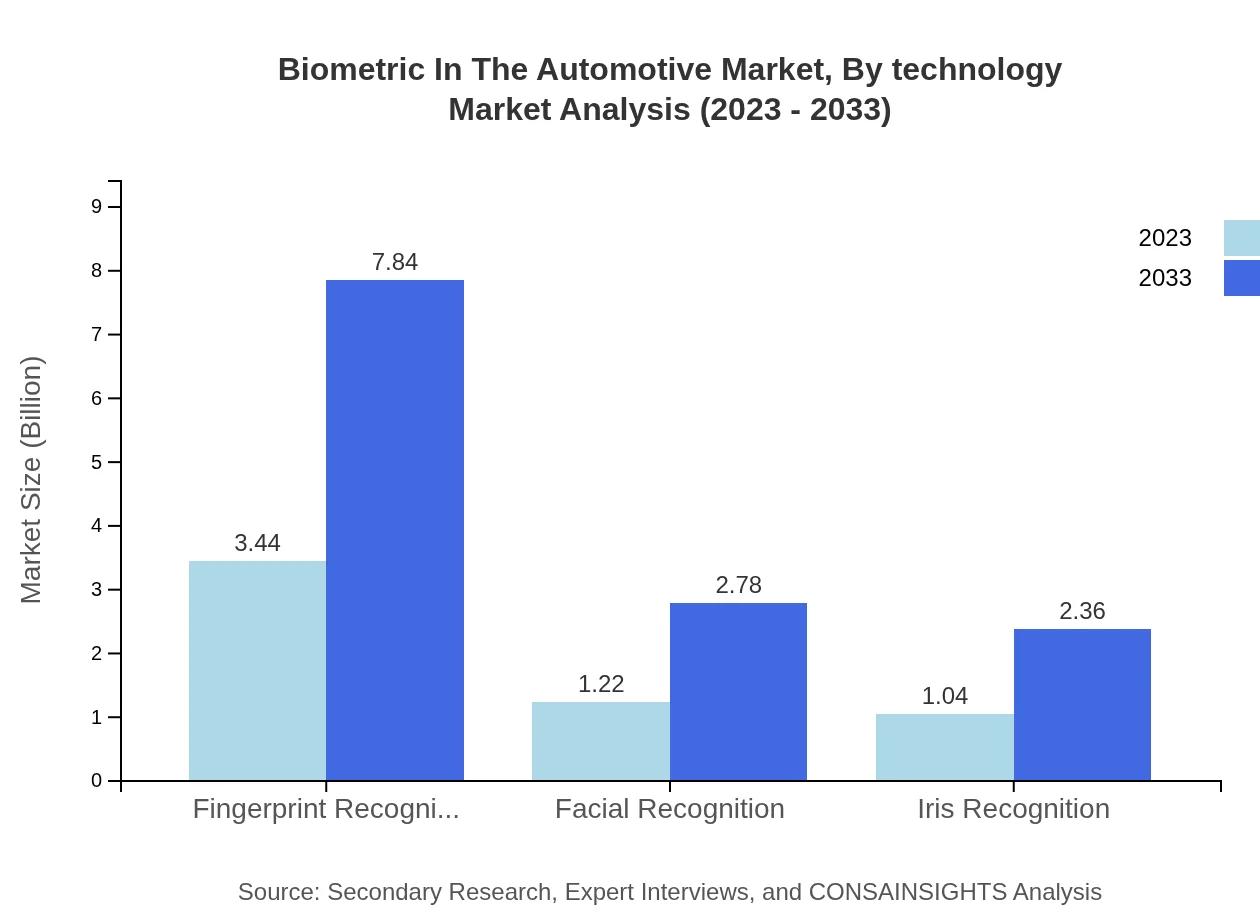

Biometric In The Automotive Market Analysis By Technology

In 2023, the market size for fingerprint recognition stands at $3.44 billion, projected to increase to $7.84 billion by 2033, capturing 60.41% of the market share. Facial recognition follows with a market size of $1.22 billion in 2023, expected to reach $2.78 billion and accounting for 21.43% share. Other technologies like iris recognition also show a healthy growth trajectory.

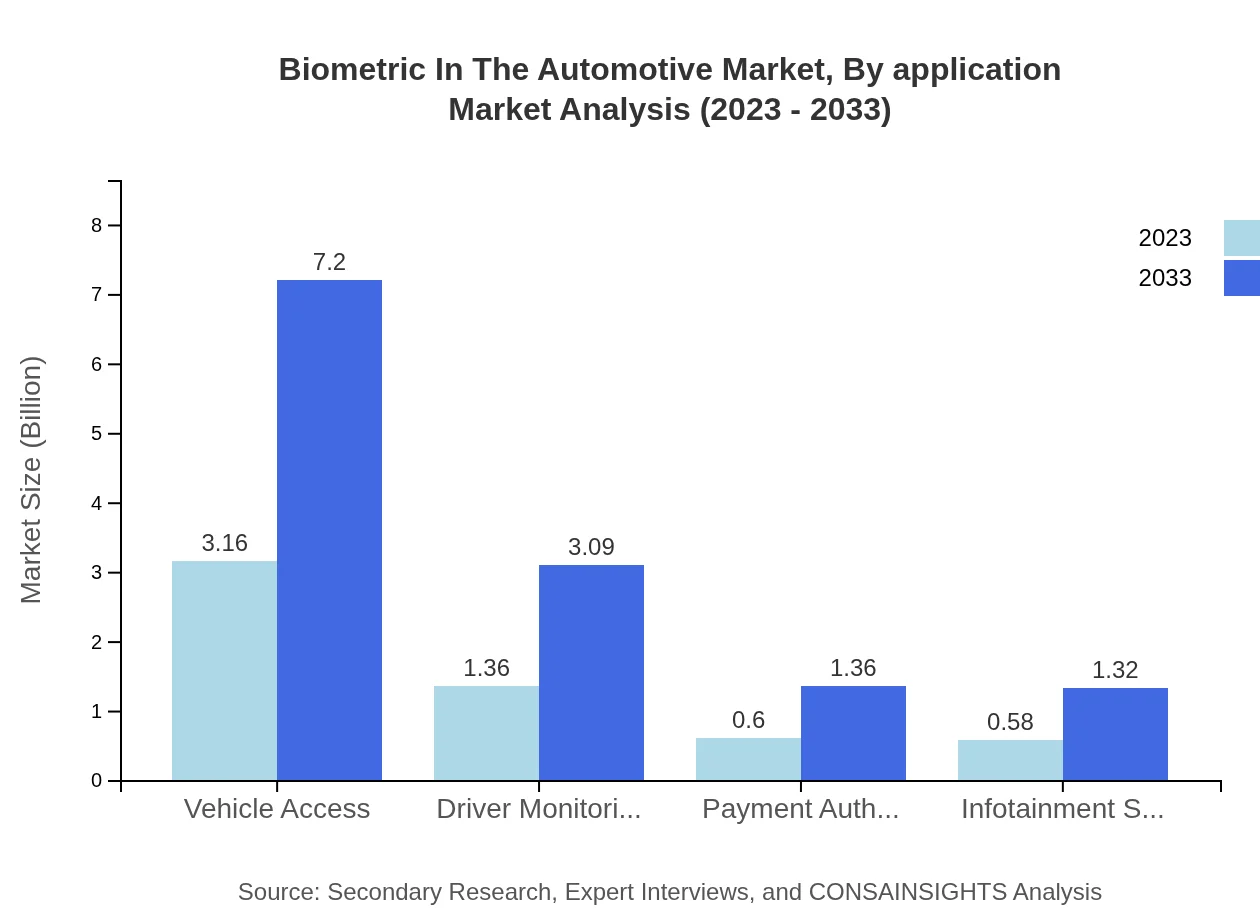

Biometric In The Automotive Market Analysis By Application

Vehicle access dominates the application segment with a market size of $3.16 billion in 2023, expected to grow to $7.20 billion by 2033. Driver monitoring applications, currently valued at $1.36 billion, anticipate reaching $3.09 billion, with a continuous demand for enhanced monitoring features driving this sector.

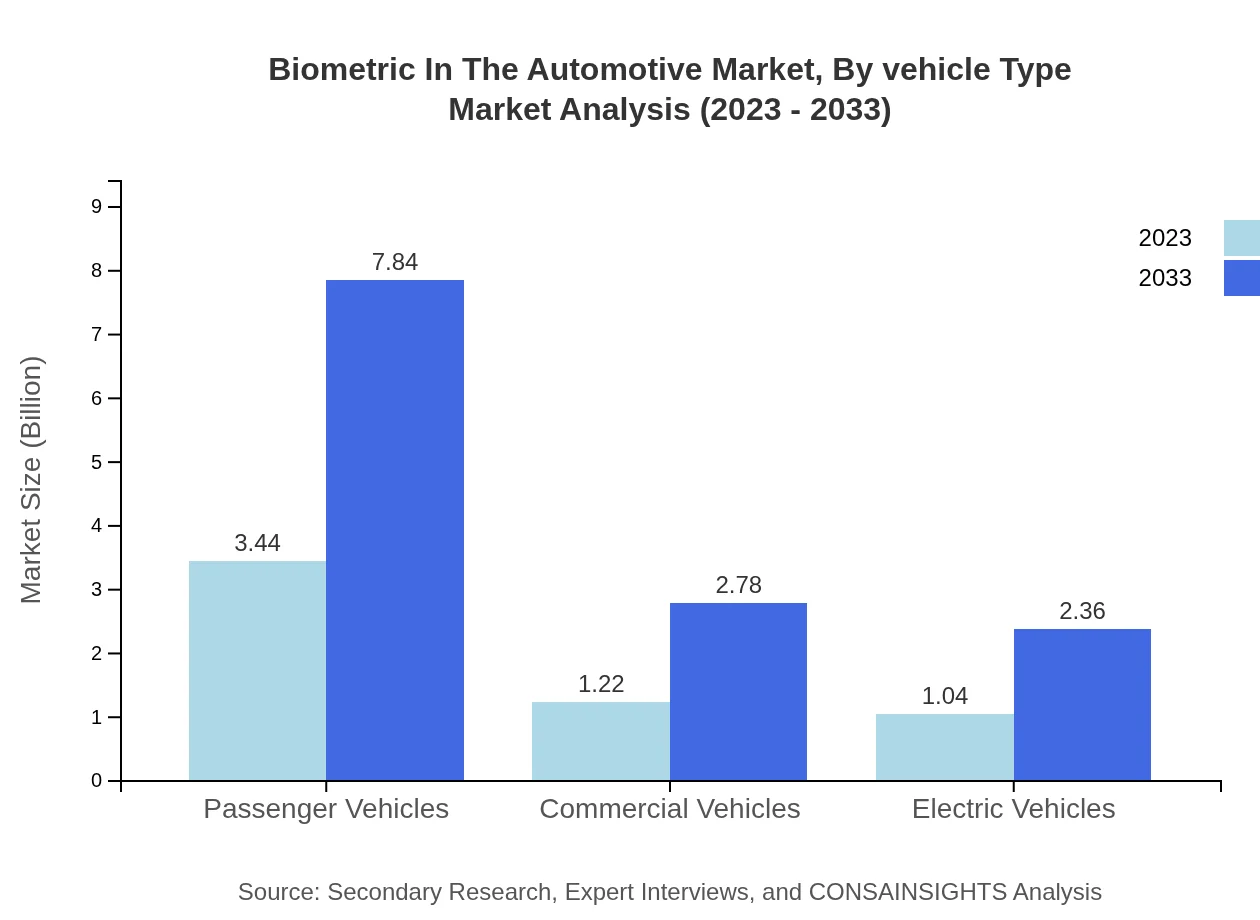

Biometric In The Automotive Market Analysis By Vehicle Type

Passenger vehicles lead the vehicle type segment, with a size of $3.44 billion projected to double to $7.84 billion by 2033, marking a 60.41% market share. Electric vehicles are also gaining traction, with an estimated size of $1.04 billion growing to $2.36 billion as they integrate advanced biometric features.

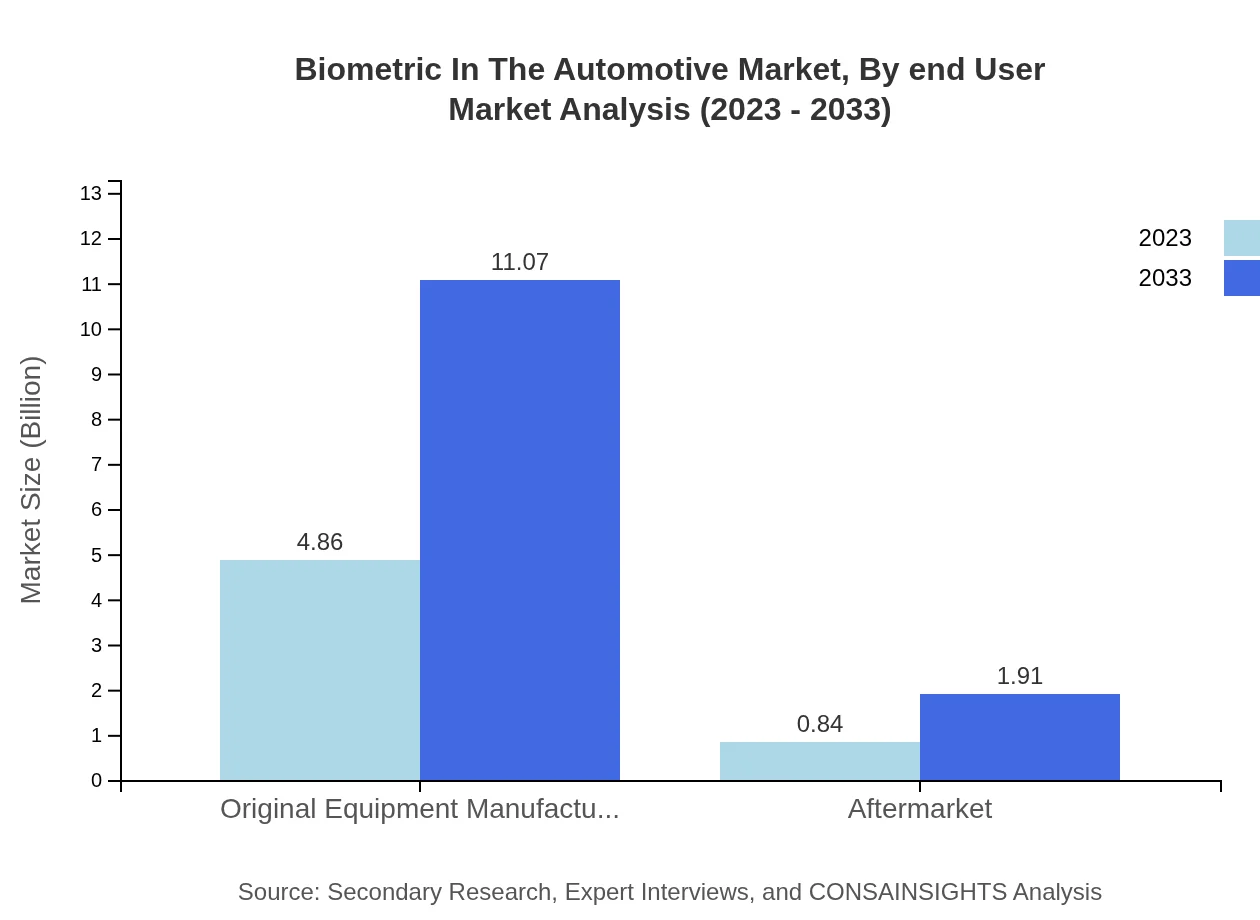

Biometric In The Automotive Market Analysis By End User

The Original Equipment Manufacturers (OEMs) segment leads the market size at $4.86 billion in 2023, driving robust growth to $11.07 billion by 2033, maintaining a steady market share of 85.3%. The aftermarket segment, valued at $0.84 billion, is also projected to grow significantly to $1.91 billion, capturing 14.7% market share.

Biometric In The Automotive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric In The Automotive Industry

Bosch:

A leading global supplier of technology and services, Bosch is at the forefront of advancing automotive safety and security solutions through biometric systems.Gentex Corporation:

An established player in the automotive technology space, Gentex is known for its innovations in electrochromic mirrors and biometric security systems, enhancing vehicle access and safety.Aware, Inc.:

Specializes in biometric software and solutions, Aware, Inc. provides advanced algorithms for facial and fingerprint recognition to drive automotive security applications.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric In The Automotive?

The biometric in the automotive market is projected to reach $5.7 billion by 2033, growing at a CAGR of 8.3%. This growth reflects the increasing integration of biometric technologies in vehicles for enhanced security and user convenience.

What are the key market players or companies in this biometric In The Automotive industry?

Key players in the biometric in the automotive industry include major automotive manufacturers and technology firms collaboratively working on biometric systems, security solutions, and integrated automotive technologies aiming to enhance vehicle safety and user interaction.

What are the primary factors driving the growth in the biometric In The Automotive industry?

Growth in this sector is driven by the rising demand for vehicle safety features, advancements in biometric technologies, and the increasing inclination towards personalized and secure user experiences in modern automobiles.

Which region is the fastest Growing in the biometric In The Automotive?

North America is currently the fastest-growing region in the biometric automotive sector, expected to expand from $1.85 billion in 2023 to $4.22 billion by 2033, indicating heightened adoption of these technologies in the region.

Does ConsaInsights provide customized market report data for the biometric In The Automotive industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs and insights for the biometric in the automotive sector, assisting clients in making informed decisions based on precise and relevant data.

What deliverables can I expect from this biometric In The Automotive market research project?

Expect comprehensive deliverables, including detailed market analysis, regional insights, competitive landscapes, growth forecasts, and sector-specific trends, all designed to support strategic planning and decision-making.

What are the market trends of biometric In The Automotive?

Current trends include an increasing emphasis on fingerprint and facial recognition technologies, growth in driver monitoring systems, and integration of biometrics in payment and infotainment systems, driving innovation in automotive technologies.