Blood Testing Market Report

Published Date: 31 January 2026 | Report Code: blood-testing

Blood Testing Market Size, Share, Industry Trends and Forecast to 2033

This market report on Blood Testing provides in-depth insights into the current market state, growth dynamics, and future projections from 2023 to 2033. It covers market size, industry analysis, segmentation details, regional insights, and leading players in the industry.

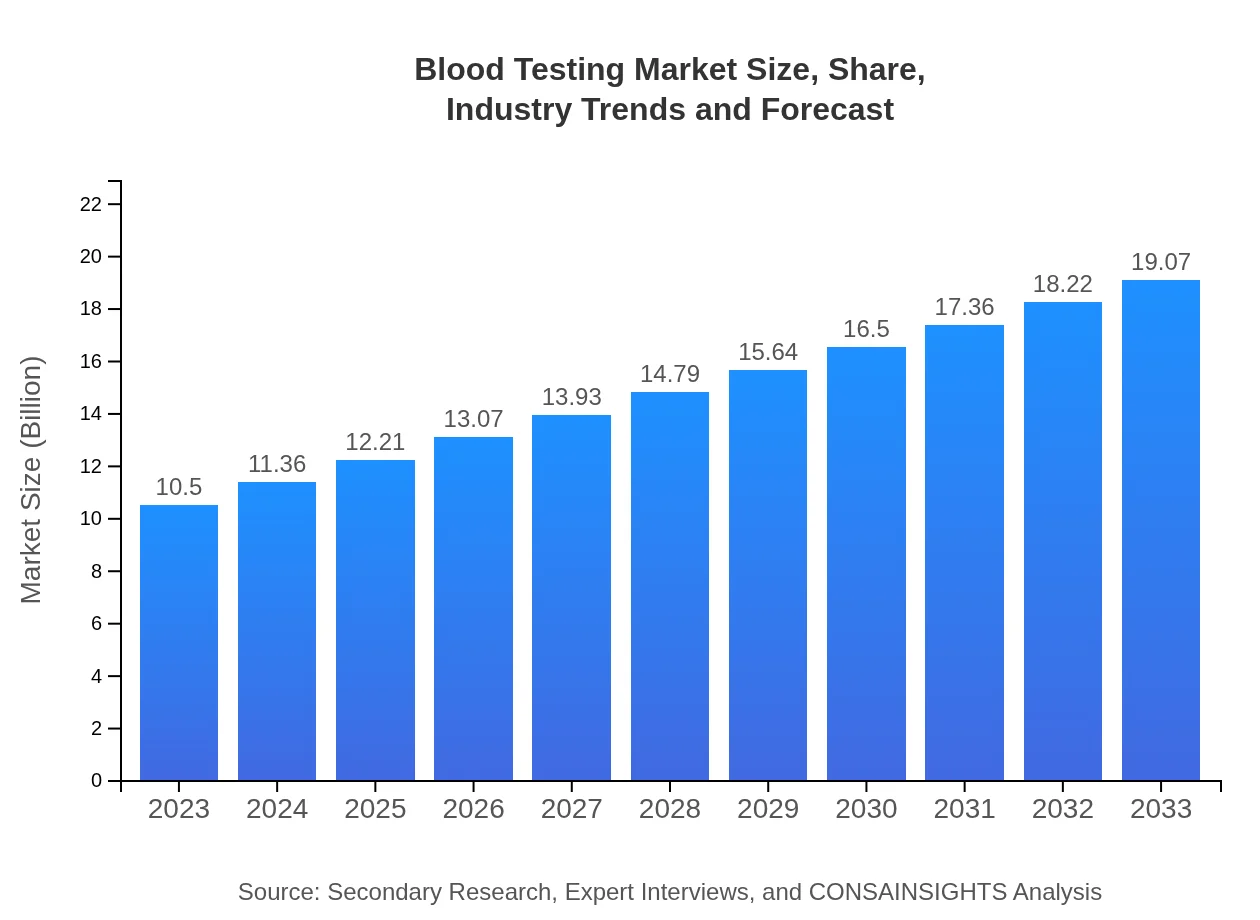

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $19.07 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Thermo Fisher Scientific, Becton, Dickinson and Company |

| Last Modified Date | 31 January 2026 |

Blood Testing Market Overview

Customize Blood Testing Market Report market research report

- ✔ Get in-depth analysis of Blood Testing market size, growth, and forecasts.

- ✔ Understand Blood Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blood Testing

What is the Market Size & CAGR of Blood Testing market in 2023?

Blood Testing Industry Analysis

Blood Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blood Testing Market Analysis Report by Region

Europe Blood Testing Market Report:

The European Blood Testing market is projected to grow from $2.95 billion in 2023 to $5.36 billion by 2033. Key factors include a robust healthcare infrastructure, stringent regulatory standards driving quality improvements, and increasing awareness regarding health monitoring and chronic disease management.Asia Pacific Blood Testing Market Report:

In the Asia Pacific region, the Blood Testing market was valued at $2.01 billion in 2023 and is projected to grow to $3.66 billion by 2033. The growth is driven by rising healthcare investments, an increasing prevalence of lifestyle diseases, and advancements in testing technology. Additionally, the growing emphasis on preventive healthcare and expanding health insurance coverage enhance market accessibility.North America Blood Testing Market Report:

North America, with a market size of $3.93 billion in 2023, is forecasted to reach $7.14 billion by 2033. This substantial growth is propelled by high healthcare spending, access to advanced technologies, and a strong emphasis on early diagnosis and preventive care practices, supported by extensive research and healthcare institutions.South America Blood Testing Market Report:

The Blood Testing market in South America is expected to grow from $0.74 billion in 2023 to $1.35 billion by 2033. Growth drivers include improving healthcare access, increased governmental healthcare spending, and rising public awareness regarding health issues, particularly infectious diseases and chronic conditions.Middle East & Africa Blood Testing Market Report:

The Middle East and Africa Blood Testing market was valued at $0.86 billion in 2023, with expectations to reach $1.56 billion by 2033. Growth is influenced by increasing investments in healthcare infrastructure, rising prevalence of communicable diseases, and government initiatives aimed at promoting diagnostic services across the region.Tell us your focus area and get a customized research report.

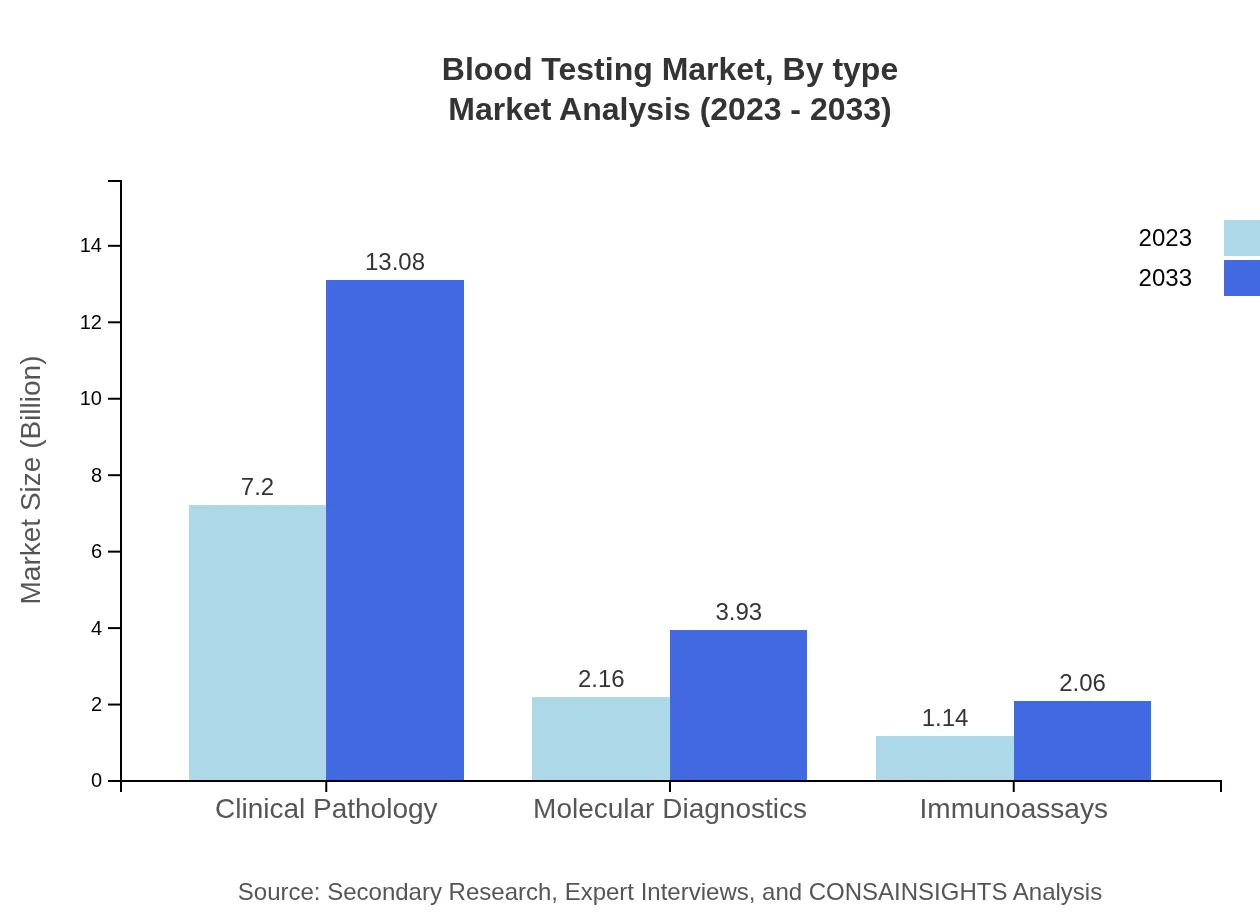

Blood Testing Market Analysis By Type

The Blood Testing market is primarily driven by several segments: Clinical Pathology, which holds a significant market size of $7.20 billion in 2023 and is projected to grow to $13.08 billion by 2033, reflecting a 68.57% market share. Molecular Diagnostics and Immunoassays are also essential segments, with expected sizes of $2.16 billion and $1.14 billion in 2023, respectively. Both segments are projected to witness similar growth trends, focusing on innovation and efficient diagnostics.

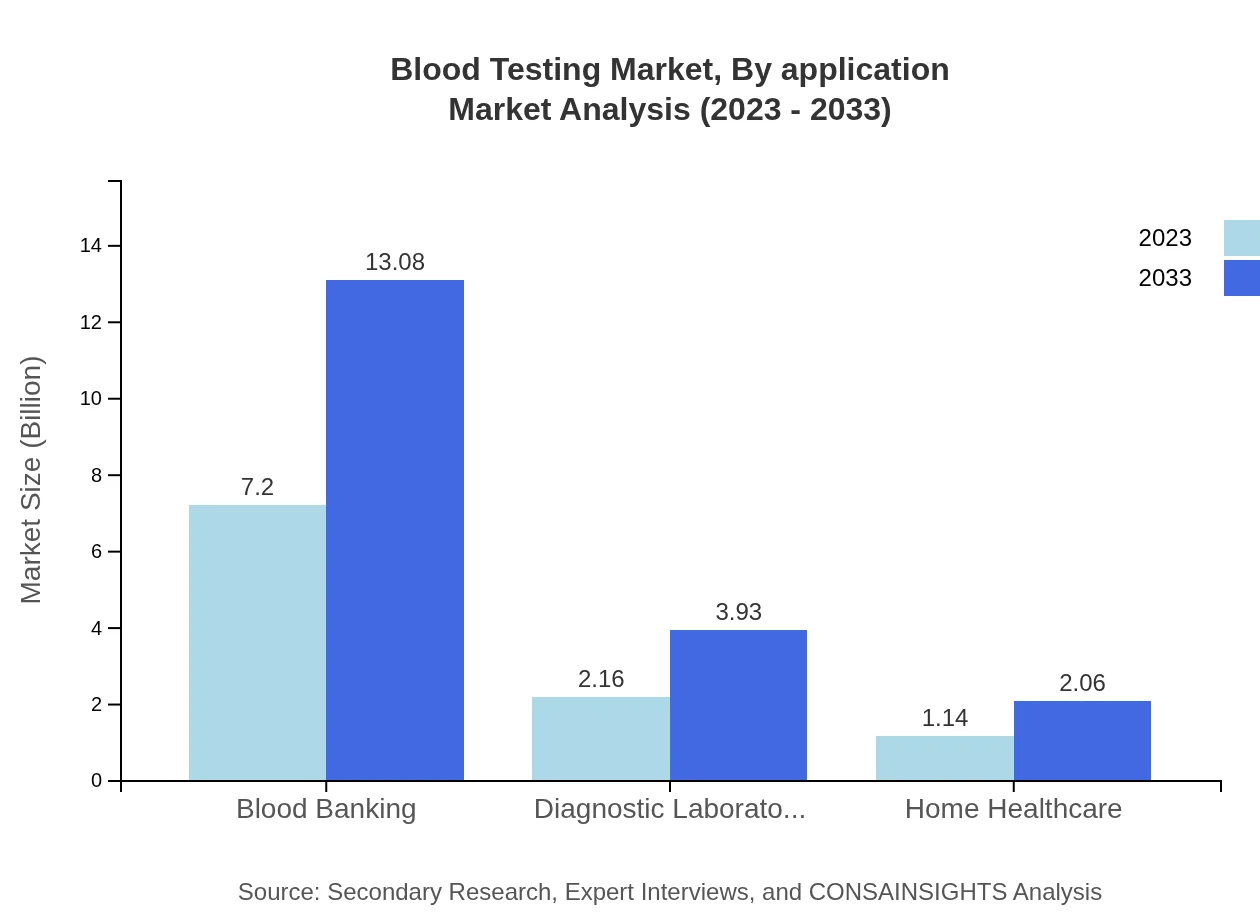

Blood Testing Market Analysis By Application

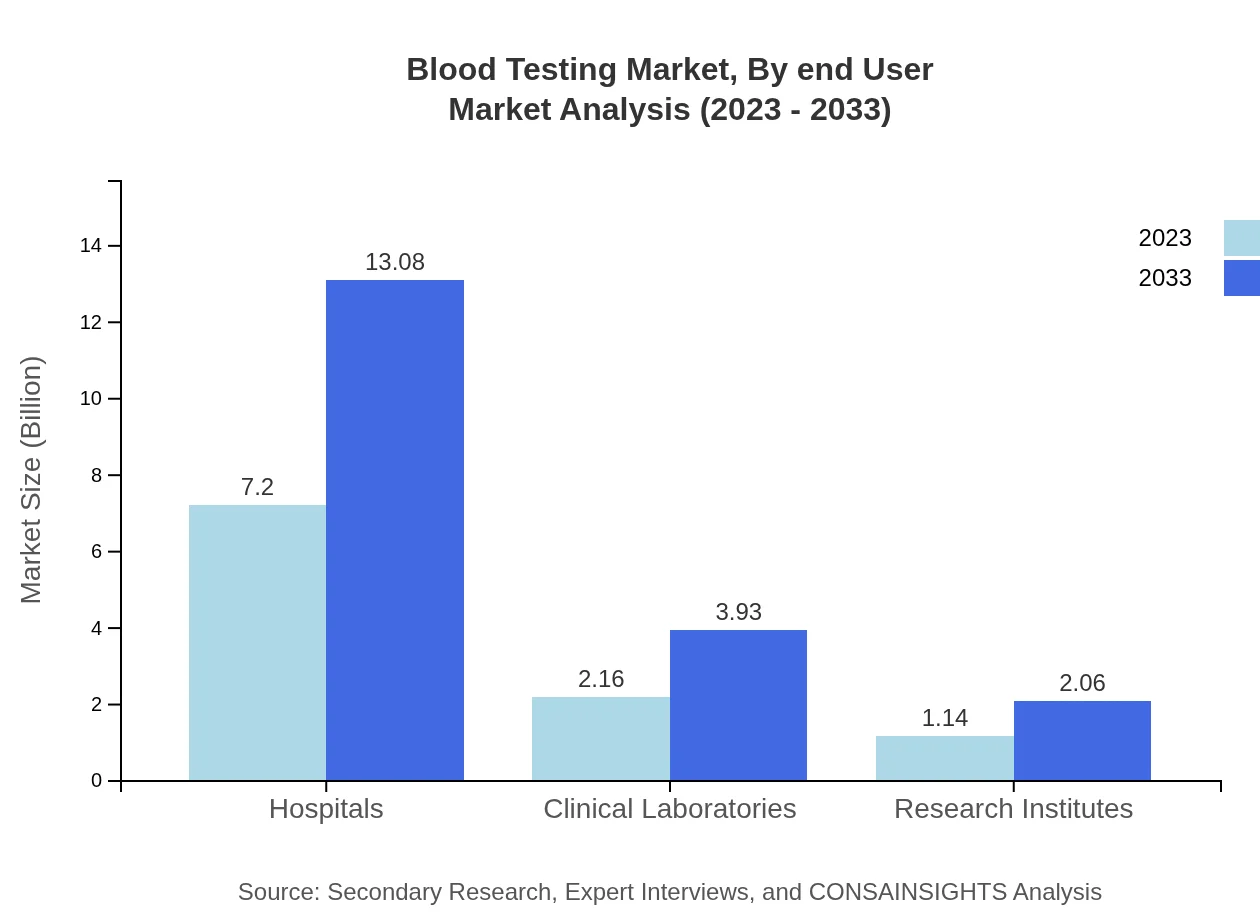

Applications of blood testing include Hospitals ($7.20 billion in 2023), Clinical Laboratories ($2.16 billion), and Research Institutes ($1.14 billion). Hospitals are anticipated to maintain the largest share with 68.57%, signaling the crucial role of in-patient diagnostics. Laboratories and research institutes focus on specialized testing and advanced research, contributing significantly to the growth and complexity of the sector.

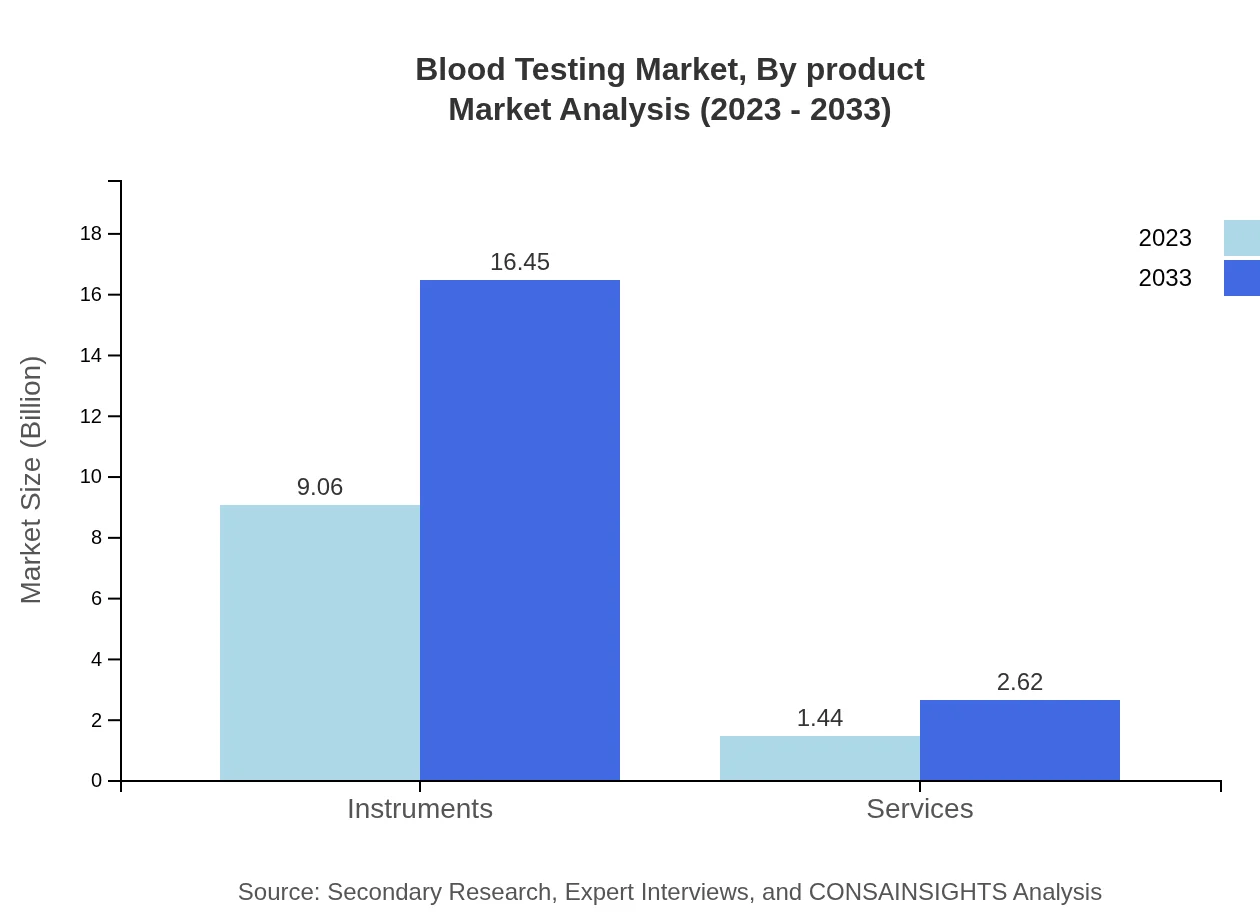

Blood Testing Market Analysis By Product

Product types in the Blood Testing market encompass Instruments ($9.06 billion in 2023) and Services ($1.44 billion). Instruments hold an impressive 86.25% share, bolstered by increasing automation and demand for reliable diagnostic equipment. The services segment also sees growth due to the demand for comprehensive diagnostic solutions and patient care services.

Blood Testing Market Analysis By End User

End-users of blood testing encompass Hospitals, Clinical Laboratories, Diagnostic Laboratories, and Home Healthcare. Hospitals dominate the landscape with a significant share, but Home Healthcare is emerging as a vital area of growth due to changing patient preferences and increased capabilities for monitoring health outside traditional setups.

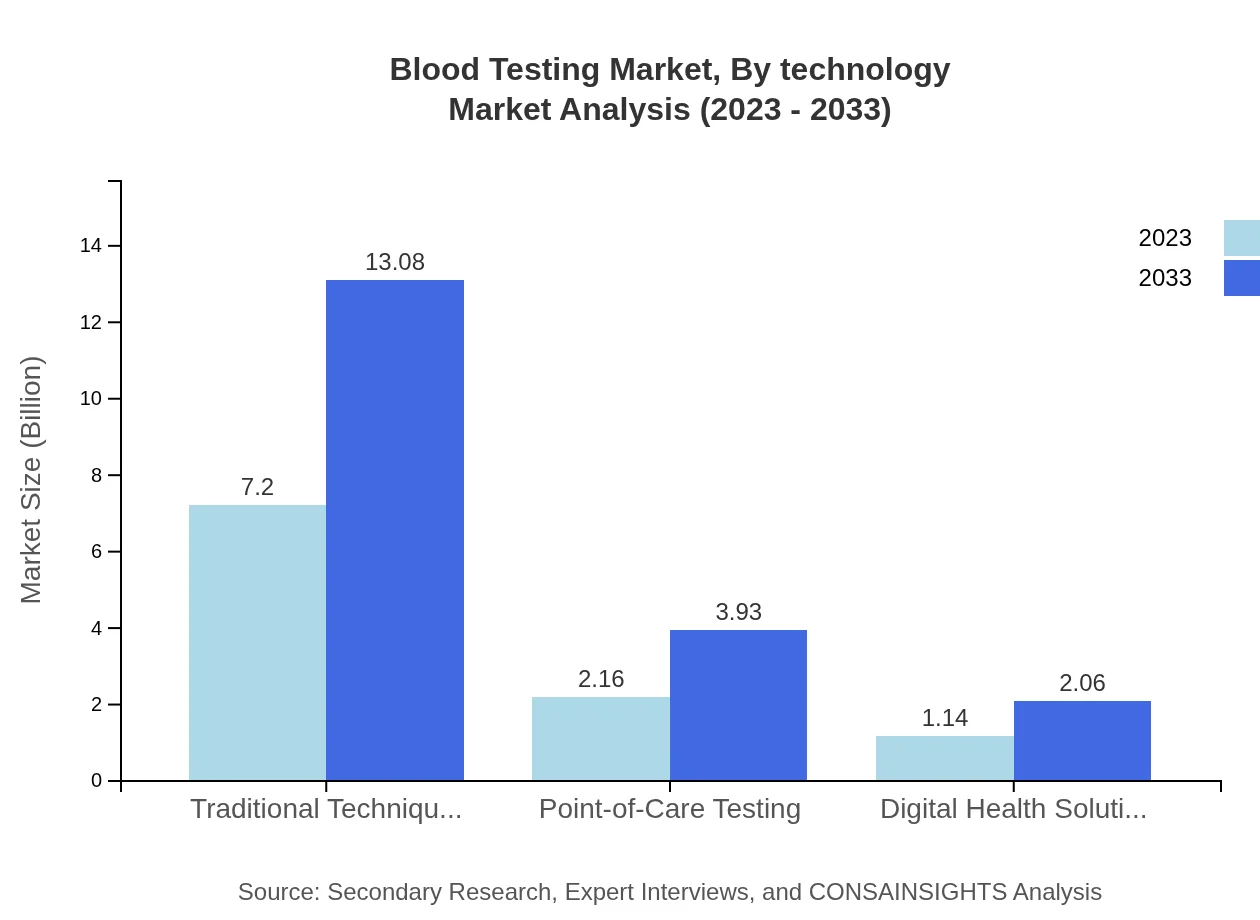

Blood Testing Market Analysis By Technology

Technological advancements, including Digital Health Solutions, Point-of-Care Testing, and traditional techniques, are reshaping the market. While traditional techniques account for a large market share, digital health solutions (projected at $1.14 billion in 2023) reflect a growing trend towards more accessible and efficient diagnostic capabilities. Innovations continue to drive market growth as new technologies enhance testing accuracy and speed.

Blood Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blood Testing Industry

Abbott Laboratories:

A leading global healthcare company specializing in a wide range of diagnostic tools and technologies, providing innovative blood testing solutions.Roche Diagnostics:

Renowned for its pioneering diagnostic technologies and extensive product portfolio in blood testing, focusing on molecular diagnostics and innovative testing.Siemens Healthineers:

Known for its advanced medical technology, particularly in laboratory diagnostics, Siemens Healthineers offers high-quality blood testing instruments and solutions.Thermo Fisher Scientific:

A leader in the field of scientific instrumentation and diagnostics, providing comprehensive blood testing solutions including molecular and immunodiagnostic testing.Becton, Dickinson and Company:

A global provider of medical technology, BD delivers advanced blood collection devices and diagnostic systems that enhance testing accuracy.We're grateful to work with incredible clients.

FAQs

What is the market size of blood Testing?

The blood testing market is forecasted to reach approximately $10.5 billion by 2033, growing at a CAGR of 6.0% from 2023. This significant growth reflects increasing demand for advanced diagnostic techniques and improved healthcare standards.

What are the key market players or companies in this blood Testing industry?

Key players in the blood-testing industry include Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. These companies lead through innovation and extensive product offerings, contributing significantly to the industry's overall growth.

What are the primary factors driving the growth in the blood Testing industry?

Growth drivers include technological advancements, increasing prevalence of chronic diseases, and rising awareness about early diagnosis. Additionally, the expansion of healthcare facilities and investment in research further boost market dynamics.

Which region is the fastest Growing in the blood Testing market?

North America is the fastest-growing region, projected to increase from $3.93 billion in 2023 to $7.14 billion in 2033. Factors include high healthcare expenditure, advancements in medical technology, and a robust infrastructure for diagnostics.

Does ConsaInsights provide customized market report data for the blood Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the blood-testing industry. This includes in-depth analysis, projections, and insights relevant to your business requirements.

What deliverables can I expect from this blood Testing market research project?

Deliverables include comprehensive market analytics, reports detailing market size, trends, and forecasts, segment analyses, and insights on competitive landscapes, ensuring you have detailed information to guide strategic decisions.

What are the market trends of blood Testing?

Current trends include increased adoption of digital health solutions, growth in point-of-care testing, and expansion of molecular diagnostics. These trends indicate a shift towards faster, more efficient testing methods with improved patient outcomes.