Bottled Water Market Report

Published Date: 02 February 2026 | Report Code: bottled-water

Bottled Water Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the bottled water market from 2023 to 2033, focusing on market dynamics, trends, and forecasts, along with comprehensive insights into regional performance and segmentation.

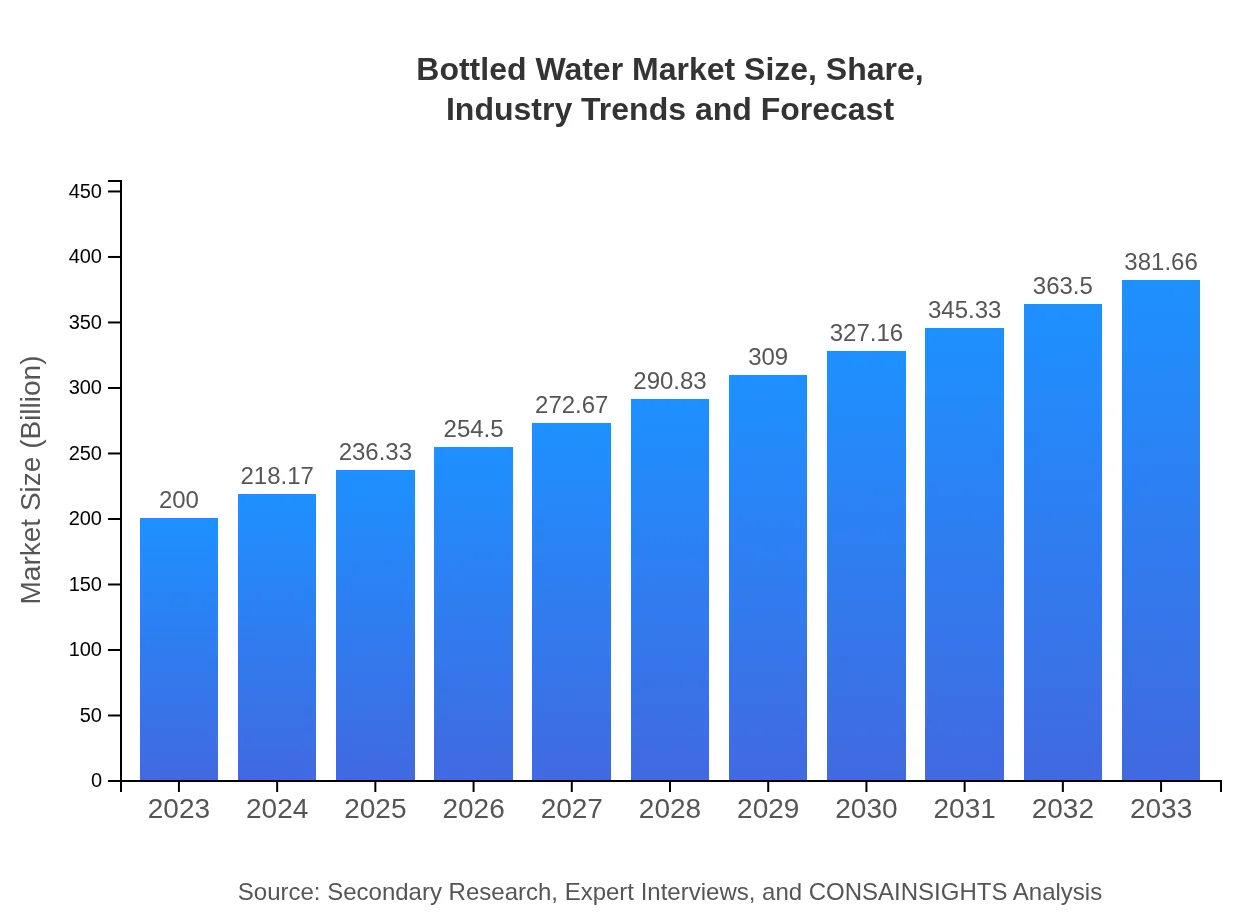

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $381.66 Billion |

| Top Companies | Nestlé Waters, Coca-Cola Company, PepsiCo, Danone |

| Last Modified Date | 02 February 2026 |

Bottled Water Market Overview

Customize Bottled Water Market Report market research report

- ✔ Get in-depth analysis of Bottled Water market size, growth, and forecasts.

- ✔ Understand Bottled Water's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bottled Water

What is the Market Size & CAGR of Bottled Water market in 2023 and 2033?

Bottled Water Industry Analysis

Bottled Water Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bottled Water Market Analysis Report by Region

Europe Bottled Water Market Report:

Europe's market size for bottled water is estimated to grow from $50.24 billion in 2023 to $95.87 billion by 2033. Stringent regulations on beverage packaging and sustainability are influencing market dynamics, pushing companies towards eco-friendly practices.Asia Pacific Bottled Water Market Report:

The Asia-Pacific region is witnessing robust growth, with market size projected to increase from $41.40 billion in 2023 to $79.00 billion by 2033. Factors include rising disposable incomes, urbanization, and a growing inclination towards healthier hydration options.North America Bottled Water Market Report:

North America's bottled water market is significant, with a projected increase from $76.94 billion in 2023 to $146.83 billion by 2033. The region shows a strong preference for bottled water driven by a growing health and wellness trend, alongside high consumption rates.South America Bottled Water Market Report:

In South America, the market is expected to grow from $19.76 billion in 2023 to $37.71 billion in 2033. Increased health consciousness and the popularity of bottled water are driving demand despite economic challenges faced in the region.Middle East & Africa Bottled Water Market Report:

In the Middle East and Africa, the market is forecasted to expand from $11.66 billion in 2023 to $22.25 billion by 2033. Water scarcity and increasing demand for quality drinking water significantly contribute to market growth in these regions.Tell us your focus area and get a customized research report.

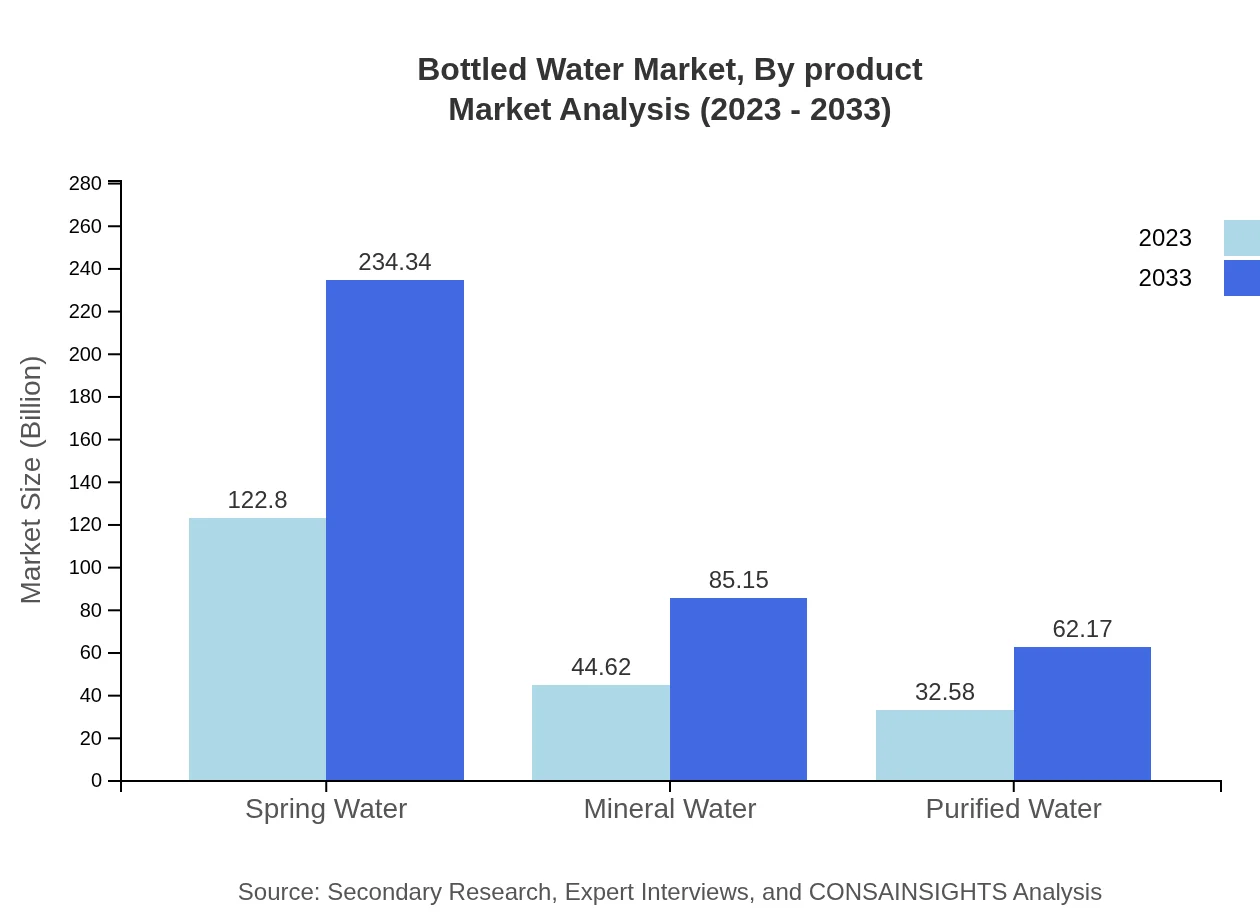

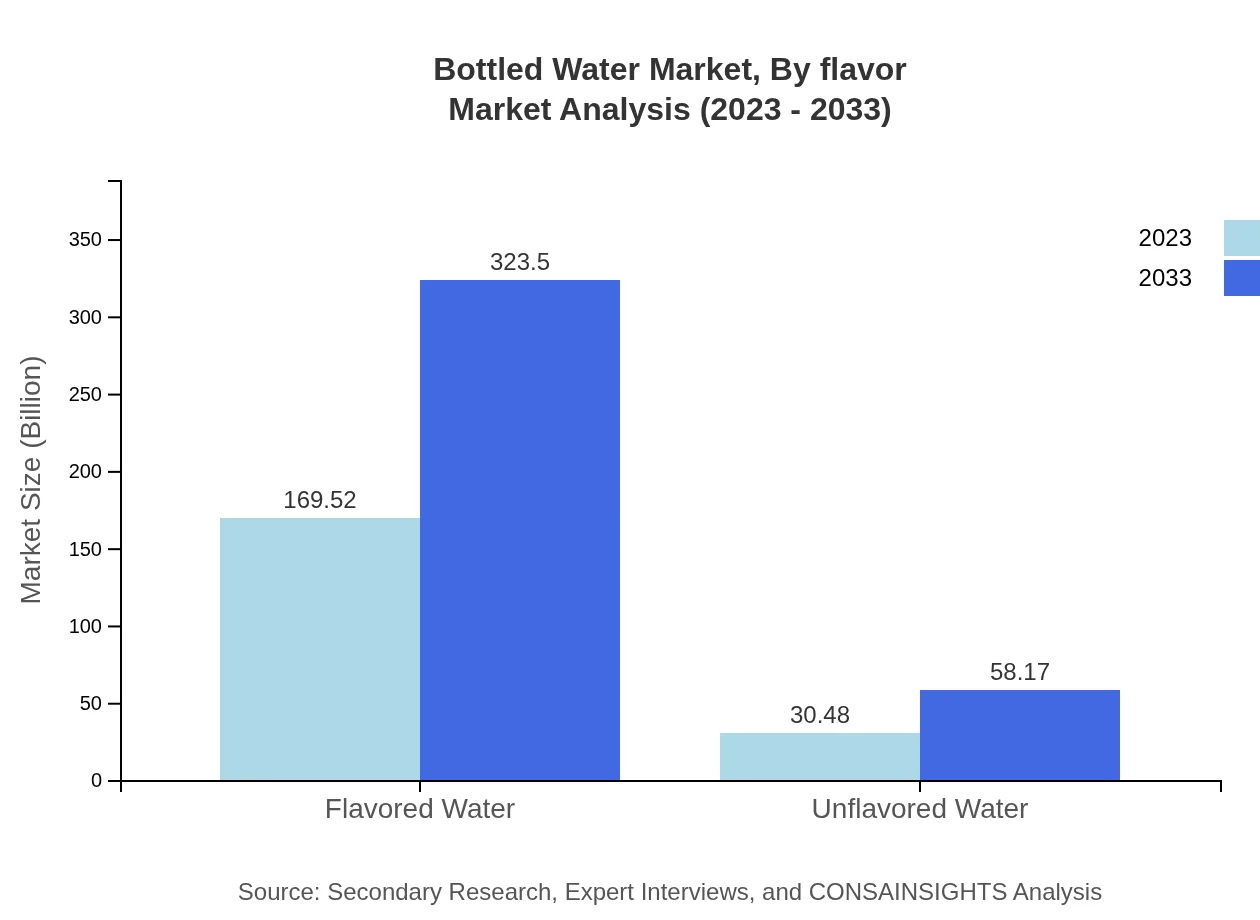

Bottled Water Market Analysis By Product

The bottled water market comprises various product types including flavored, unflavored, spring, mineral, and purified waters. Flavored water is anticipated to demonstrate the most substantial growth, increasing from $169.52 billion in 2023 to $323.50 billion in 2033. Meanwhile, spring and mineral waters hold significant market shares, making them essential segments amid rising consumer preferences.

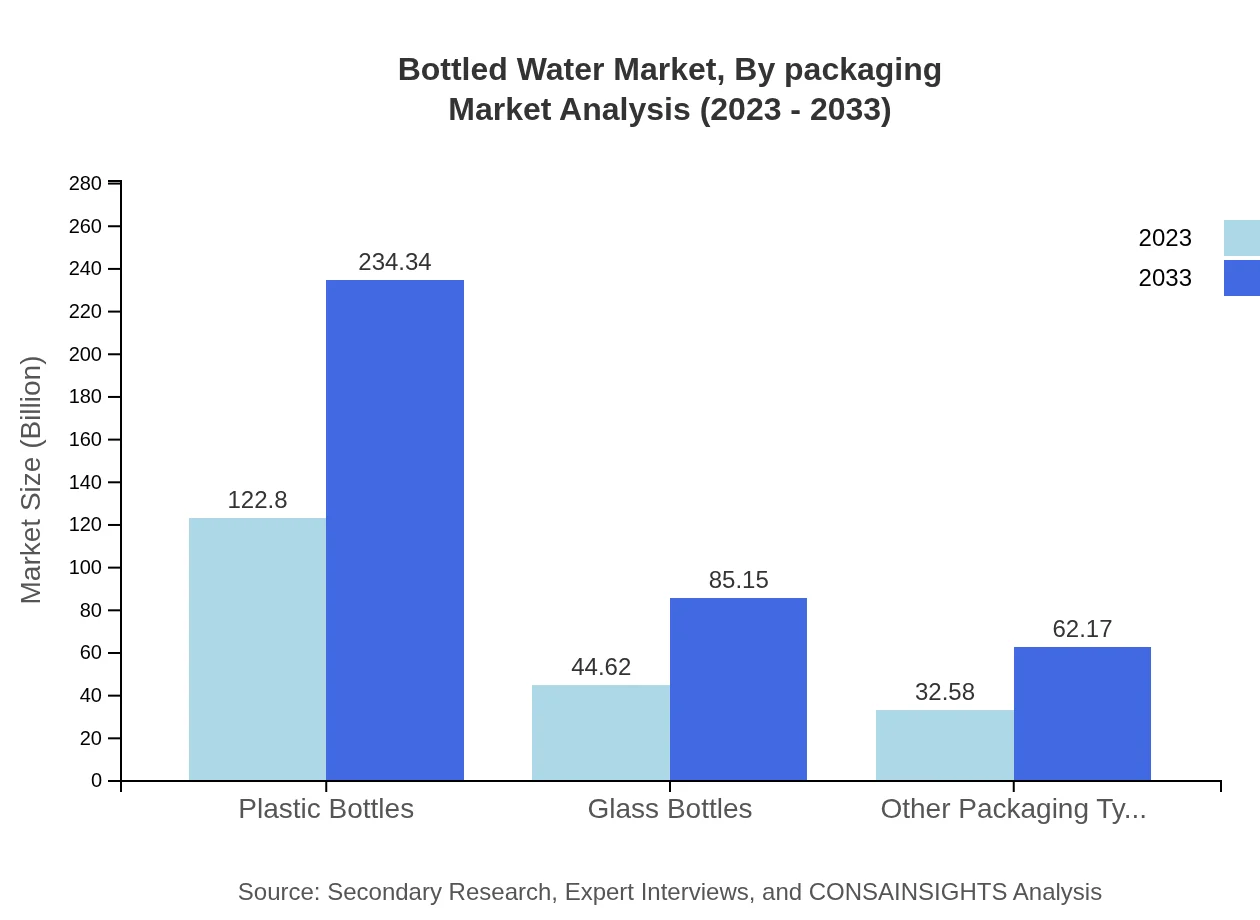

Bottled Water Market Analysis By Packaging

Packaging types are pivotal in the bottled water segment, with plastic bottles dominating the market due to convenience and cost-effectiveness, accounting for 61.4% of market share in 2023. Glass bottles follow, experiencing growth due to premiumization trends, while alternative packaging is gaining attention as sustainability becomes more crucial to consumers.

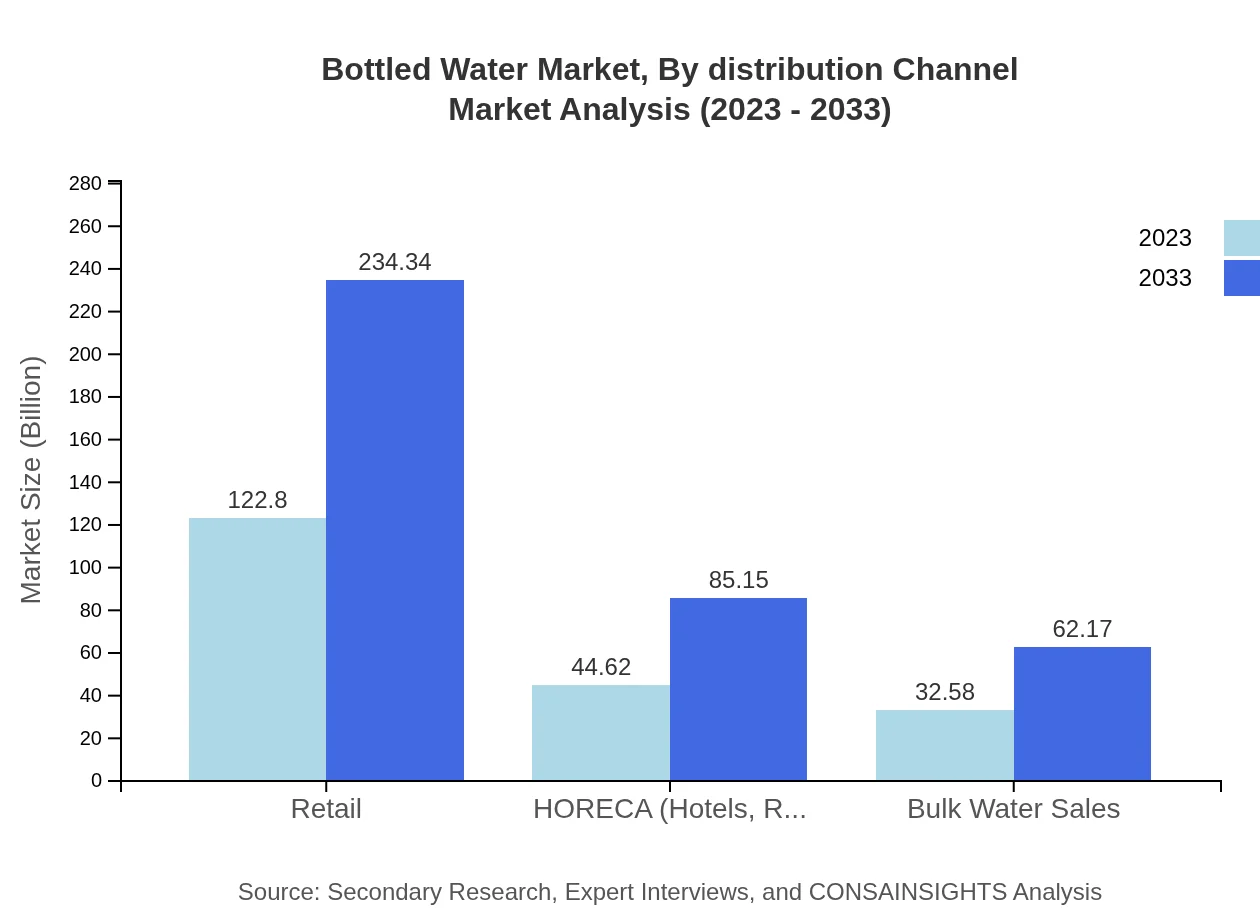

Bottled Water Market Analysis By Distribution Channel

The distribution of bottled water is segmented into retail, HORECA (Hotels, Restaurants, Cafés), and bulk water sales. Retail channels, encompassing supermarkets and convenience stores, command a large volume of sales, while HORECA services are also growing, catering to lifestyle and dining trends.

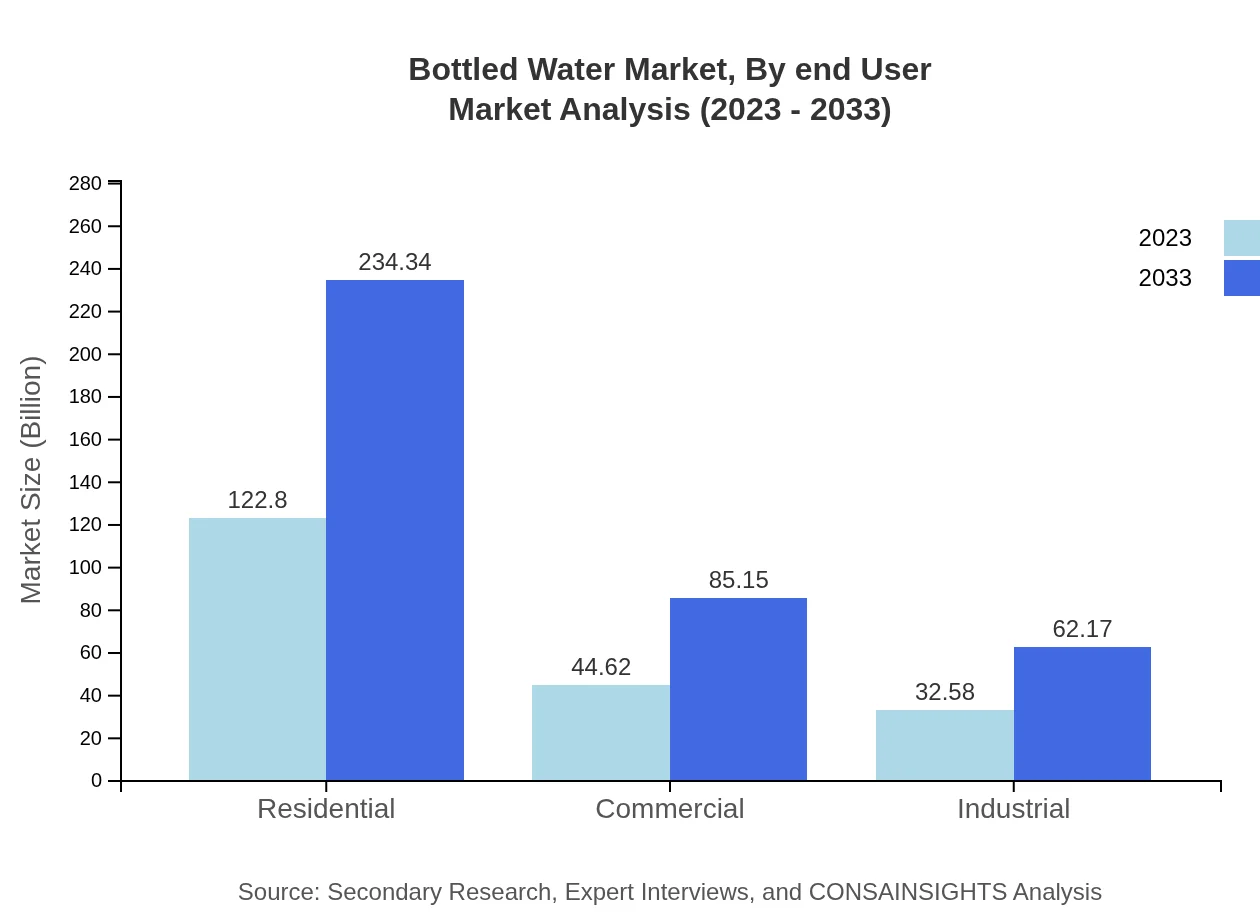

Bottled Water Market Analysis By End User

End-user segmentation reveals a diverse consumer base, with residential use constituting the largest market share. This segment benefits from increased health awareness, with consumers opting for bottled water as their primary source of hydration. Commercial and industrial uses are also significant, particularly in hospitality and corporate environments.

Bottled Water Market Analysis By Flavor

Flavored bottled waters are gaining traction, projected to grow significantly as consumers seek variety and enhanced hydration options. This segment is expected to solidify its dominance as new flavors are introduced, targeting specific consumer needs, such as energy and nutritional benefits.

Bottled Water Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bottled Water Industry

Nestlé Waters:

A leading player in the bottled water market, offering a diverse portfolio of brands, including Poland Spring and San Pellegrino. They prioritize sustainability and innovative packaging solutions.Coca-Cola Company:

Known for its popular Dasani and Smartwater brands, Coca-Cola emphasizes health and wellness in product formulations and invests heavily in environmental initiatives.PepsiCo:

PepsiCo owns Aquafina and Lifewtr, focusing on product innovation and expanding its health-conscious offerings to meet rising demand for bottled water.Danone:

With leading brands such as Evian and Volvic, Danone champions bottled water sourced from springs and is dedicated to promoting a sustainable water future.We're grateful to work with incredible clients.

FAQs

What is the market size of bottled Water?

The bottled water market is valued at approximately $200 billion in 2023, with a projected growth rate (CAGR) of 6.5% through 2033, highlighting its robust demand and essential role in the beverage industry.

What are the key market players or companies in this bottled Water industry?

Key players in the bottled water industry include Nestlé Waters, Coca-Cola, PepsiCo, Danone, and Suntory, among others, who dominate the market with a diverse range of products and extensive distribution networks.

What are the primary factors driving the growth in the bottled water industry?

Driving factors include increasing health consciousness, preference for convenient hydration options, and environmental concerns pushing brands towards sustainable packaging solutions. Moreover, growing urbanization and higher disposable incomes also contribute significantly.

Which region is the fastest Growing in the bottled water market?

Asia Pacific is the fastest-growing region for bottled water, expected to expand from $41.40 billion in 2023 to $79.00 billion by 2033. Europe and North America also show strong growth, yet Asia Pacific leads the charge.

Does ConsaInsights provide customized market report data for the bottled water industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs and interests within the bottled water industry, ensuring relevant market data, trends, and insights aligned with client requirements.

What deliverables can I expect from this bottled water market research project?

Expect detailed reports comprising market size analysis, competitive landscape, growth forecasts, regional insights, segment evaluations (including types and packaging), and comprehensive trend assessments in the bottled water market.

What are the market trends of bottled water?

Current trends in the bottled water market include rising demand for flavored and functional waters, shift towards eco-friendly packaging, and increased consumer interest in premium water products, reflecting evolving preferences in health and sustainability.