Cataract Market Report

Published Date: 31 January 2026 | Report Code: cataract

Cataract Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive examination of the cataract market from 2023 to 2033, encompassing market trends, segmentation, regional insights, and leading companies within the industry, aimed at delivering crucial data for stakeholders to make informed decisions.

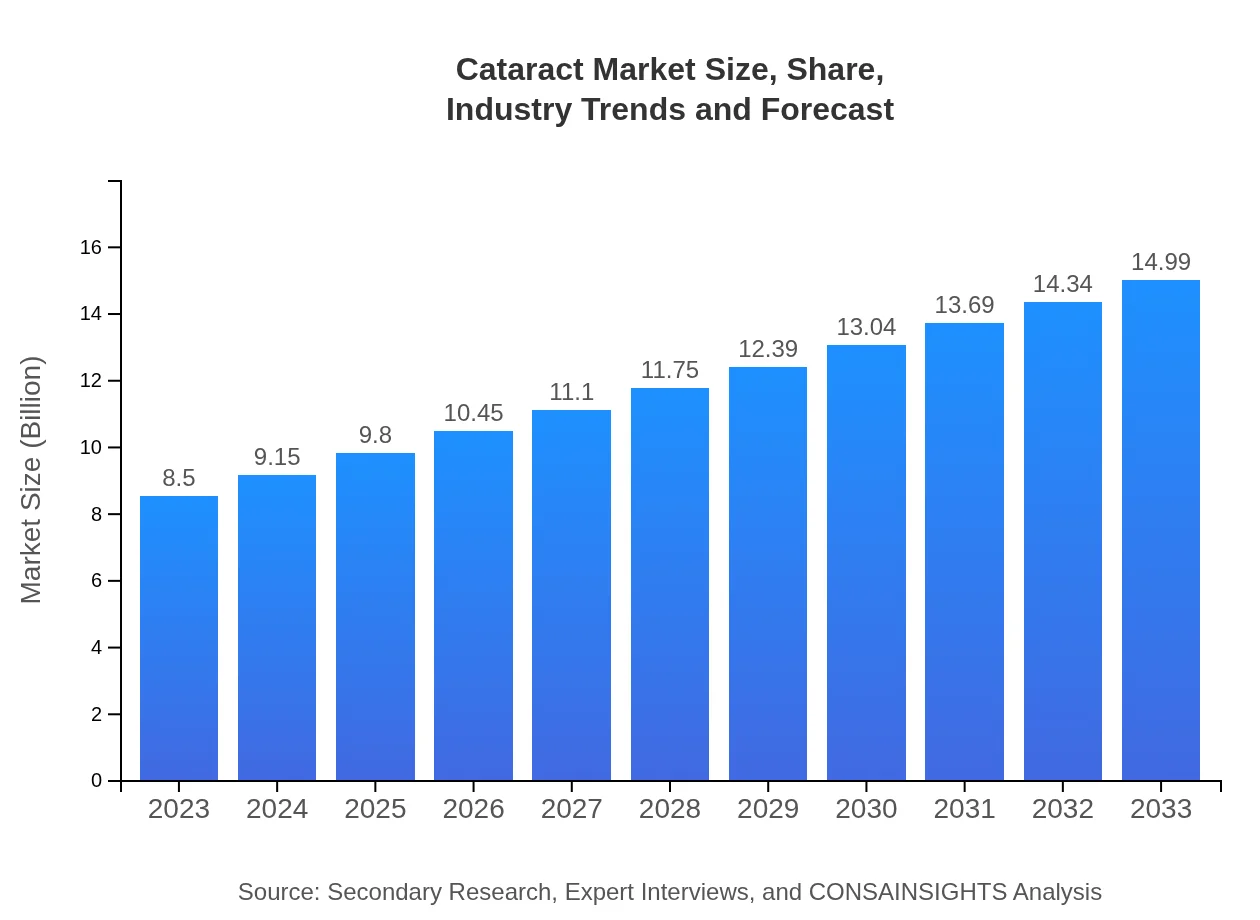

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $14.99 Billion |

| Top Companies | Alcon, Johnson & Johnson Vision, Bausch + Lomb, Zeiss |

| Last Modified Date | 31 January 2026 |

Cataract Market Overview

Customize Cataract Market Report market research report

- ✔ Get in-depth analysis of Cataract market size, growth, and forecasts.

- ✔ Understand Cataract's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cataract

What is the Market Size & CAGR of Cataract market in 2033?

Cataract Industry Analysis

Cataract Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cataract Market Analysis Report by Region

Europe Cataract Market Report:

With a market valuation of $2.67 billion in 2023, Europe is expected to see significant growth, reaching $4.71 billion by 2033. The region's robust healthcare systems and ongoing technological advancements in surgical techniques are driving market expansion.Asia Pacific Cataract Market Report:

In 2023, the cataract market in the Asia Pacific region is valued at $1.59 billion and is expected to reach $2.81 billion by 2033. The growing population and increasing incidence of cataract surgeries, along with rising healthcare investments, are key drivers of this growth in countries such as India and China.North America Cataract Market Report:

North America represents one of the largest markets for cataracts, valued at $2.98 billion in 2023 and projected to reach $5.26 billion by 2033. The region benefits from advanced healthcare infrastructure, a high percentage of elderly individuals, and numerous skilled ophthalmic surgeons.South America Cataract Market Report:

The South American cataract market is estimated to grow from $0.48 billion in 2023 to $0.84 billion by 2033. Factors contributing to this rise include increasing healthcare access and a surge in awareness about eye health among the population.Middle East & Africa Cataract Market Report:

In the Middle East and Africa, the cataract market stands at $0.78 billion in 2023 and is projected to reach $1.37 billion by 2033. The growing middle class and improvements in healthcare accessibility will propel market growth in this region.Tell us your focus area and get a customized research report.

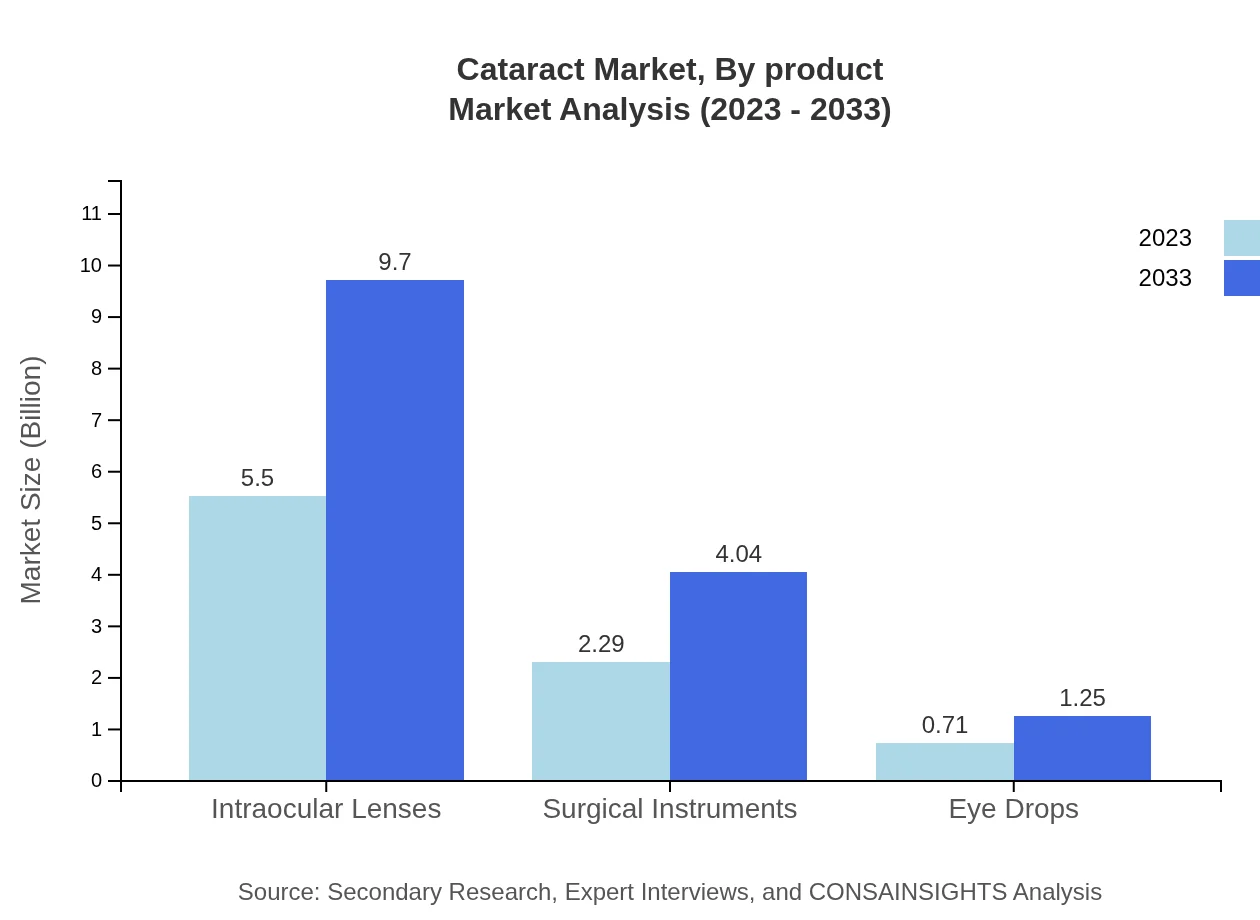

Cataract Market Analysis By Product

In 2023, the intraocular lenses segment holds a market size of $5.50 billion, expected to grow to $9.70 billion by 2033. These lenses account for 64.72% of overall market share due to their essential role in cataract surgeries. Surgical instruments follow, currently valued at $2.29 billion, growing to $4.04 billion, with a 26.93% market share. Eye drops represent a smaller but important segment, growing from $0.71 billion to $1.25 billion, maintaining an 8.35% share.

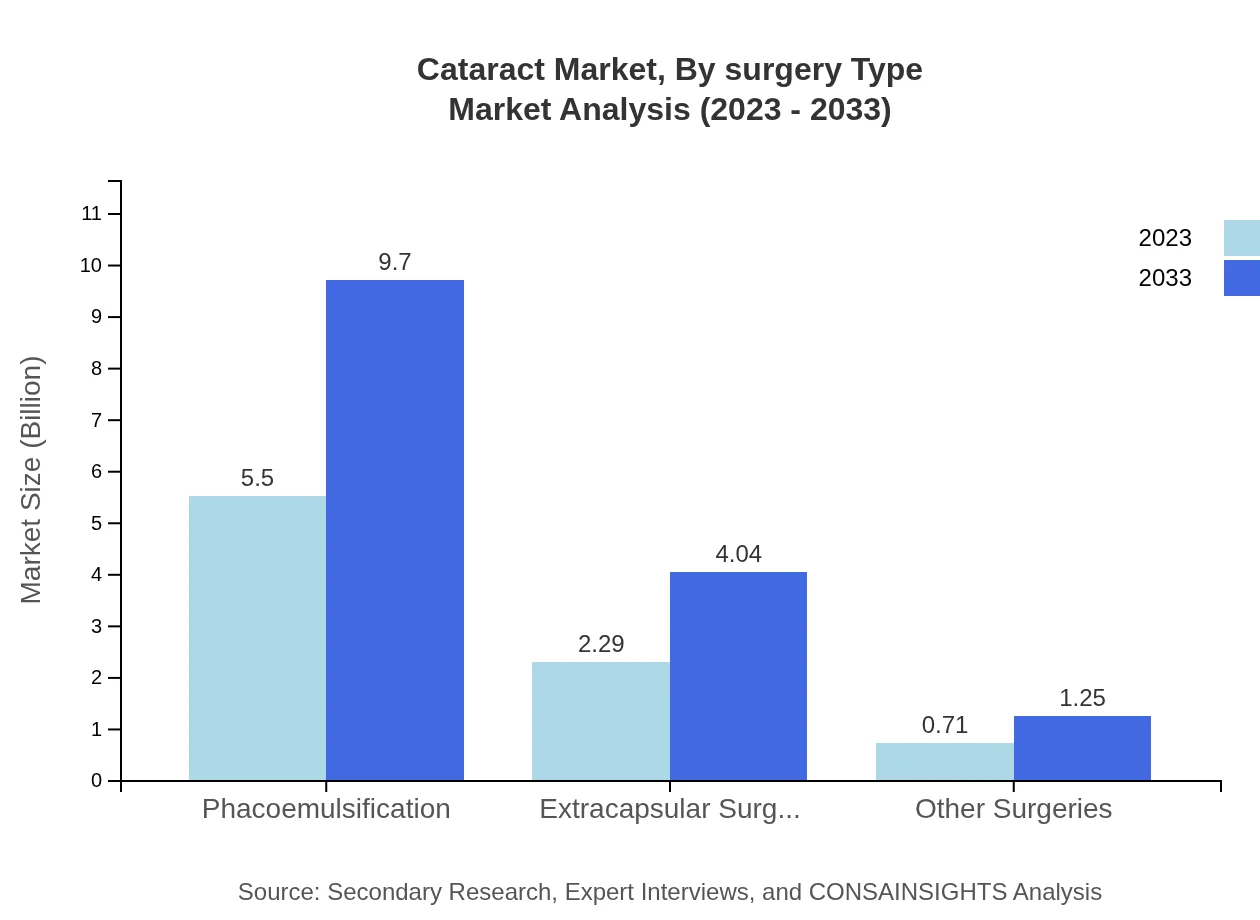

Cataract Market Analysis By Surgery Type

Phacoemulsification remains the dominant surgery type, valued at $5.50 billion in 2023 and anticipated to reach $9.70 billion by 2033, holding a market share of 64.72%. Extracapsular surgery follows, with a current market of $2.29 billion projected to grow to $4.04 billion, sharing 26.93%. Other surgical methods are also growing, moving from $0.71 billion to $1.25 billion, with an 8.35% share.

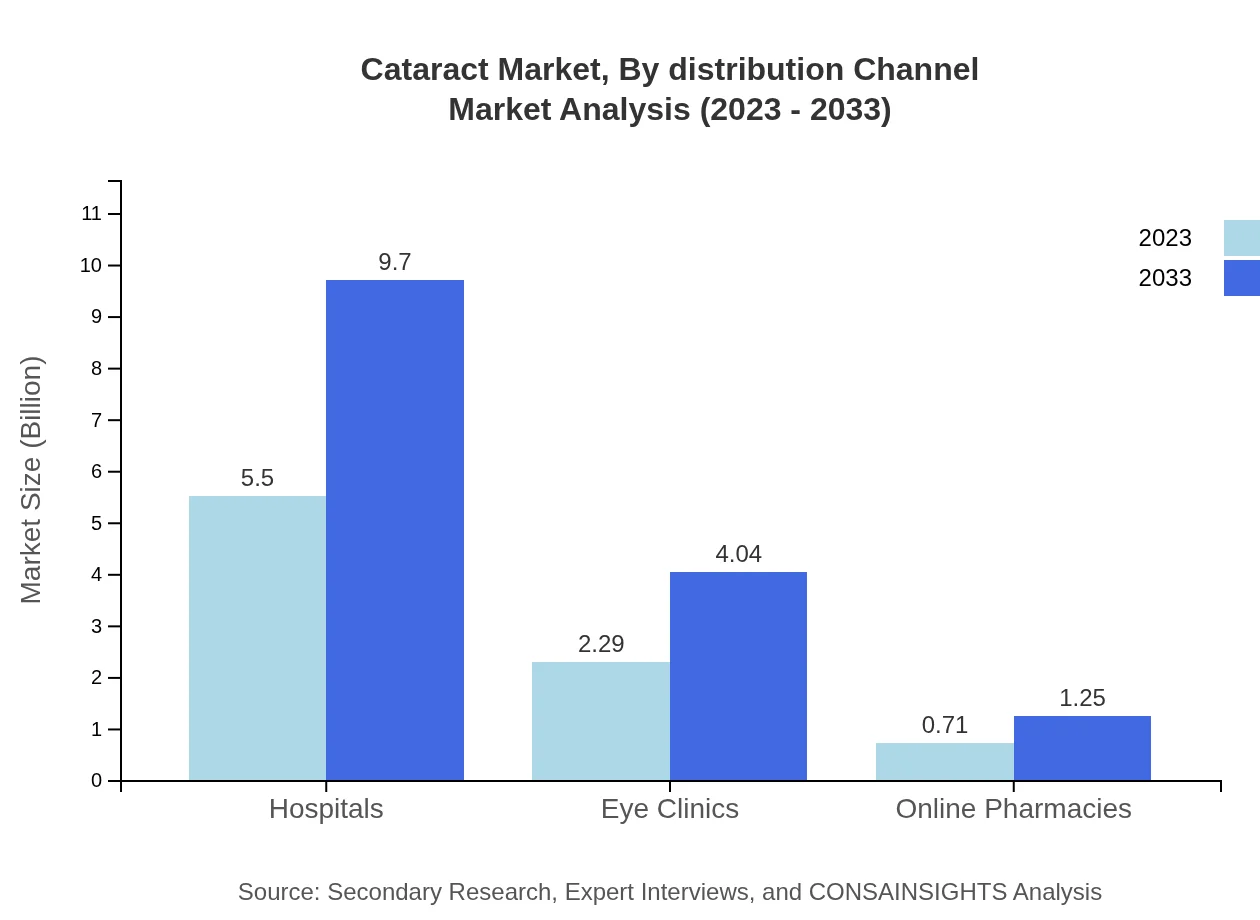

Cataract Market Analysis By Distribution Channel

Market access through hospitals is robust, currently at $5.50 billion and expected to grow to $9.70 billion. Eye clinics follow, with a market of $2.29 billion predicted to reach $4.04 billion. Online pharmacies are expanding significantly, growing from $0.71 billion to $1.25 billion, indicating a shift in how patients access treatment.

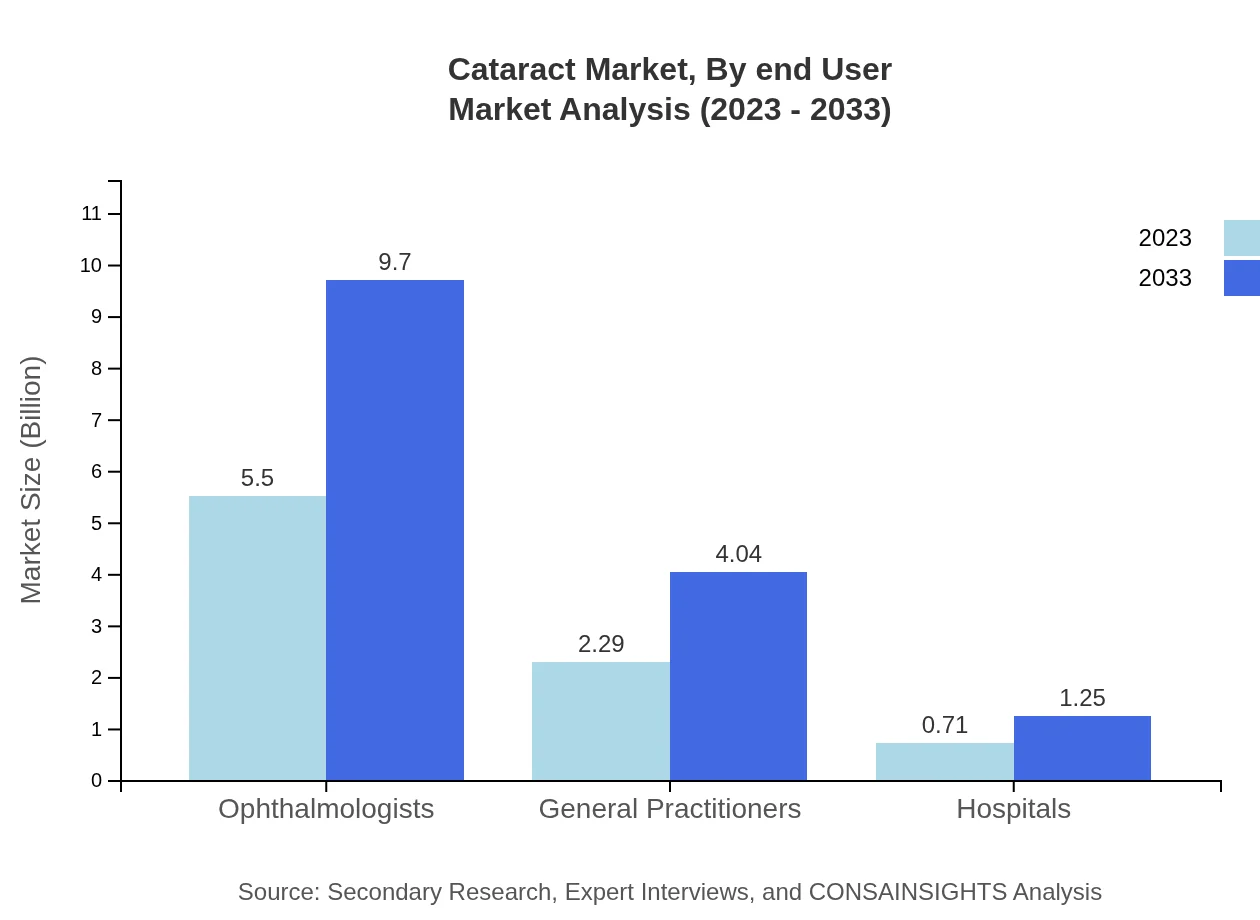

Cataract Market Analysis By End User

Hospitals dominate the end-user segment with a market size of $5.50 billion, expected to grow to $9.70 billion. Eye clinics and online pharmacies are also significant players, with sizes of $2.29 billion and $0.71 billion in 2023, respectively, indicating diverse access points for patients.

Cataract Market Analysis By Technology

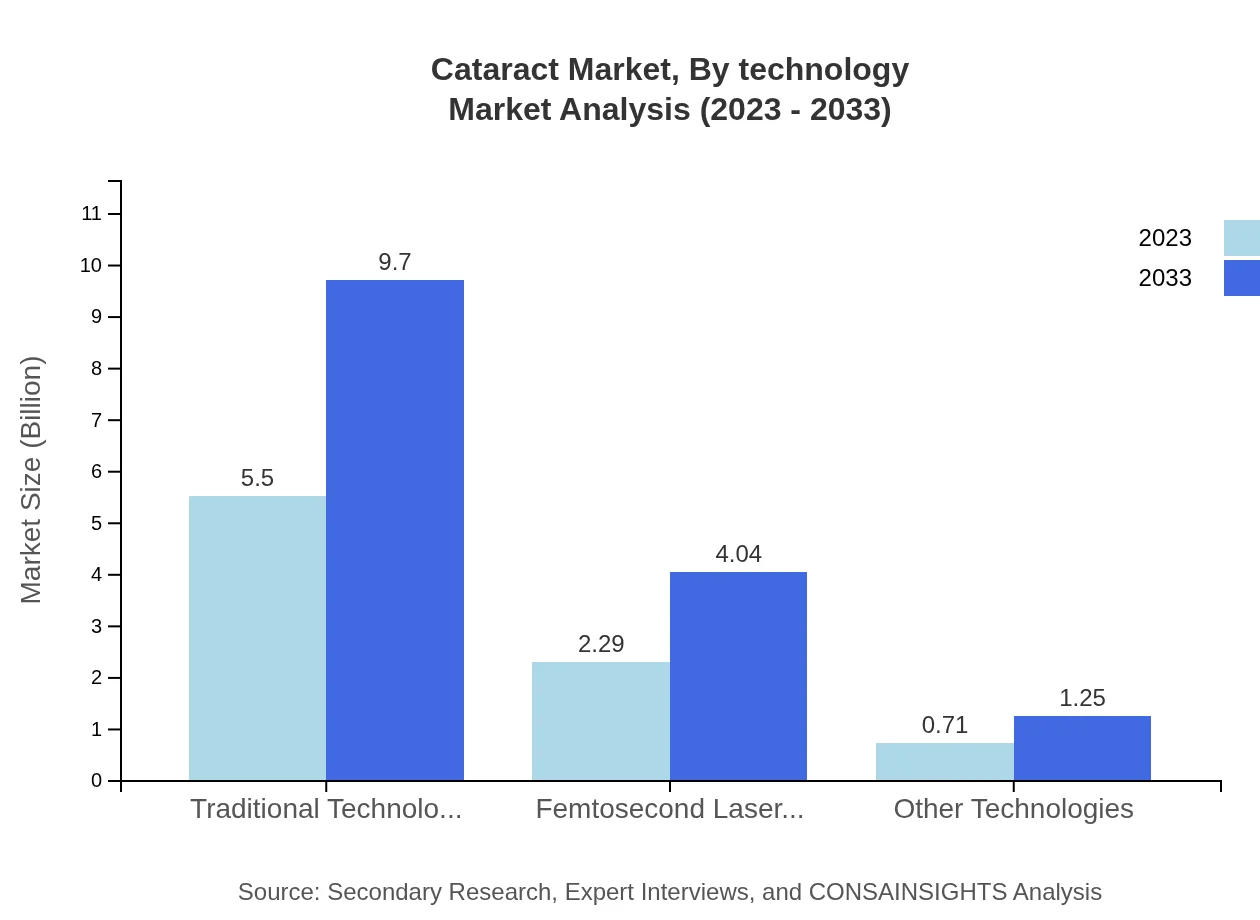

Traditional technology, including phacoemulsification, leads the technology segment at $5.50 billion in 2023, growing to $9.70 billion. Femtosecond laser technology ranks second with a market size of $2.29 billion and growth to $4.04 billion. Emerging technologies are driving innovations within the cataract market.

Cataract Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cataract Industry

Alcon:

A leading player specializing in eye care products with a strong focus on surgical and vision care, contributing greatly to technological advancements in cataract treatment.Johnson & Johnson Vision:

This company emphasizes innovation in surgical devices and intraocular lenses, focusing on improving surgical outcomes and patient care in cataract surgery.Bausch + Lomb:

Known for a comprehensive range of ophthalmic products and a robust portfolio in cataract treatment, Bausch + Lomb plays a pivotal role in education and advancement in eye care.Zeiss:

Prominent for its optical systems and surgical microscopes, Zeiss is a key technology partner in cataract surgeries providing precision solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of cataract?

The global cataract market is valued at approximately $8.5 billion in 2023, with a projected CAGR of 5.7% from 2023 to 2033. This growth is driven by increased demand for cataract surgeries and advancements in treatment technologies.

What are the key market players or companies in this cataract industry?

Key players in the cataract industry include Alcon, Bausch + Lomb, Johnson & Johnson Vision, Regeneron Pharmaceuticals, and Carl Zeiss Meditec, which are known for their innovative technologies and extensive product portfolios.

What are the primary factors driving the growth in the cataract industry?

Growth in the cataract market is primarily driven by the rising prevalence of cataracts linked with aging populations, advancements in minimally invasive surgical techniques, and increased awareness regarding eye health and regular eye examinations.

Which region is the fastest Growing in the cataract?

Asia Pacific is the fastest-growing region in the cataract market, projected to grow from $1.59 billion in 2023 to $2.81 billion by 2033, benefiting from improving healthcare access and rising patient awareness of eye health.

Does ConsaInsights provide customized market report data for the cataract industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and requirements of clients, ensuring a comprehensive understanding of the cataract market dynamics.

What deliverables can I expect from this cataract market research project?

Deliverables include an in-depth market analysis report featuring comprehensive data on market size, growth projections, competitive landscape, and insights on regional and segment trends for the cataract industry.

What are the market trends of cataract?

Market trends in the cataract industry include increasing adoption of advanced surgical technologies, rise in outpatient surgeries, a shift towards personalized treatment plans, and enhanced focus on post-operative care and technology integration.