Cloud Migration Market Report

Published Date: 31 January 2026 | Report Code: cloud-migration

Cloud Migration Market Size, Share, Industry Trends and Forecast to 2033

This report covers the insights and trends in the Cloud Migration market from 2023 to 2033, including market size estimates, industry analysis, segmentation, regional insights, and forecasts for growth and challenges ahead.

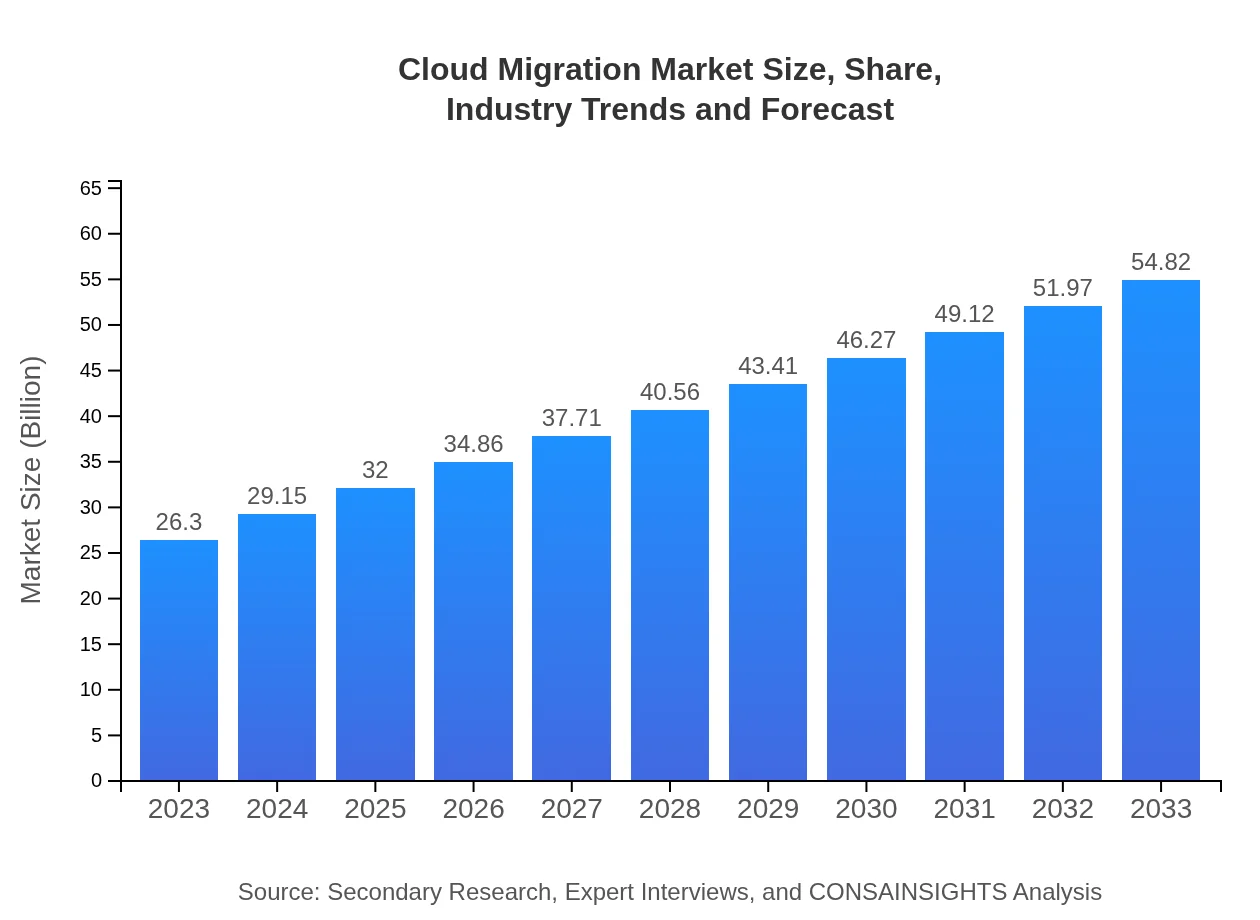

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $26.30 Billion |

| CAGR (2023-2033) | 7.4% |

| 2033 Market Size | $54.82 Billion |

| Top Companies | Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud |

| Last Modified Date | 31 January 2026 |

Cloud Migration Market Overview

Customize Cloud Migration Market Report market research report

- ✔ Get in-depth analysis of Cloud Migration market size, growth, and forecasts.

- ✔ Understand Cloud Migration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cloud Migration

What is the Market Size & CAGR of Cloud Migration market in 2023?

Cloud Migration Industry Analysis

Cloud Migration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cloud Migration Market Analysis Report by Region

Europe Cloud Migration Market Report:

Europe’s Cloud Migration market is set to grow from USD 7.22 billion in 2023 to USD 15.06 billion by 2033. Regulations like GDPR catalyze demand for secure cloud solutions. European businesses are migrating to remain competitive and leverage innovative technologies while ensuring compliance with stringent standards.Asia Pacific Cloud Migration Market Report:

The Asia-Pacific region is crucial for the Cloud Migration market, projected to grow from USD 5.04 billion in 2023 to USD 10.50 billion by 2033. Growing digital transformation initiatives, particularly in countries like India and China, alongside rising investments in cloud infrastructure, contribute to this growth. High levels of mobile adoption and internet connectivity further facilitate cloud migrations in this region.North America Cloud Migration Market Report:

North America is expected to dominate the Cloud Migration market, with projected growth from USD 9.81 billion in 2023 to USD 20.45 billion by 2033. The well-established technology infrastructure, coupled with advanced cloud adoption strategies, positions this region as a leader in cloud migration investments, with companies increasingly integrating complex cloud systems into their operations.South America Cloud Migration Market Report:

In South America, the Cloud Migration market is anticipated to expand from USD 2.24 billion in 2023 to USD 4.67 billion by 2033. Factors such as increasing cloud vendor options and rising remote work trends drive this growth, enabling enterprises to migrate more efficiently to cloud solutions and streamline operations amidst economic changes.Middle East & Africa Cloud Migration Market Report:

The Middle East and Africa Cloud Migration market is projected to grow from USD 1.99 billion in 2023 to USD 4.14 billion by 2033. Escalating investment from government initiatives and businesses aiming to improve operational efficiencies and digital capabilities largely drive this growth within the region.Tell us your focus area and get a customized research report.

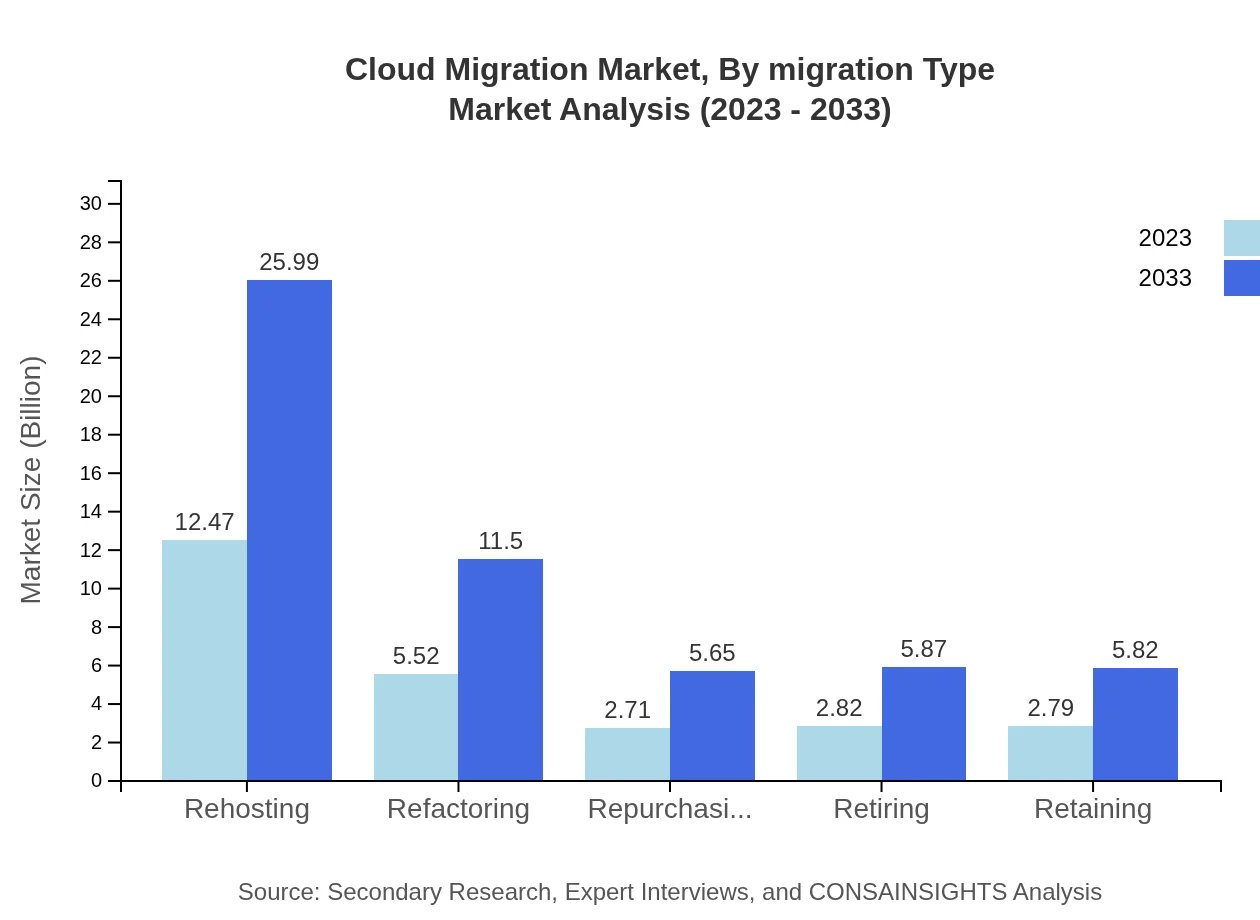

Cloud Migration Market Analysis By Migration Type

The migration types within the Cloud Migration market include: 1. **Rehosting**: Expected to grow from USD 12.47 billion in 2023 to USD 25.99 billion by 2033, making it a pivotal aspect of cloud migration strategies. 2. **Refactoring**: Anticipated to rise from USD 5.52 billion in 2023 to USD 11.50 billion by 2033, focusing on optimizing application performance in the cloud. 3. **Repurchasing**: This segment will see growth from USD 2.71 billion to USD 5.65 billion in the same timeframe, emphasizing cloud-ready solutions. 4. **Retiring**: With a market size increase from USD 2.82 billion to USD 5.87 billion, organizations will focus on ceasing support for legacy applications. 5. **Retaining**: Similarly, expected growth from USD 2.79 billion to USD 5.82 billion emphasizes maintaining some services in-house while moving others to the cloud.

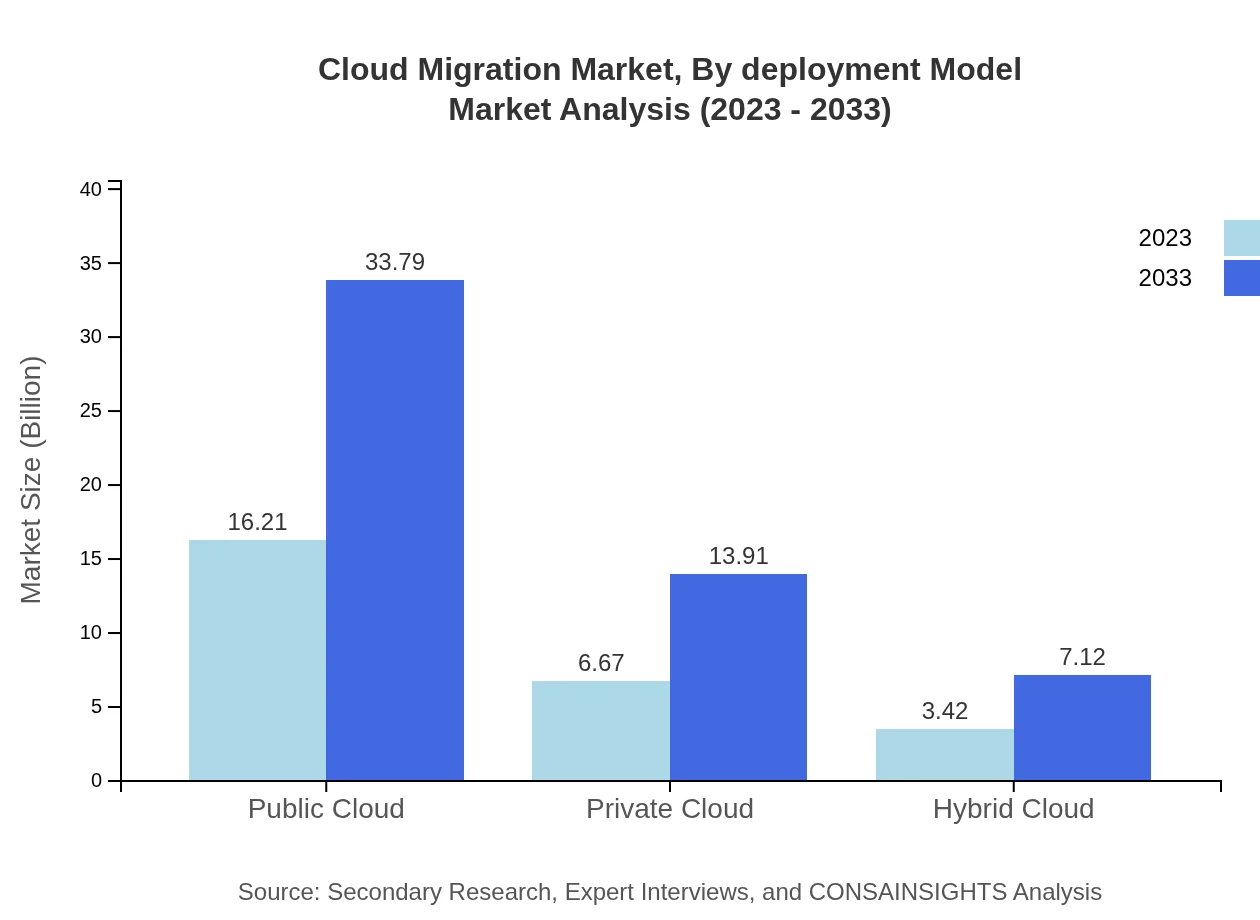

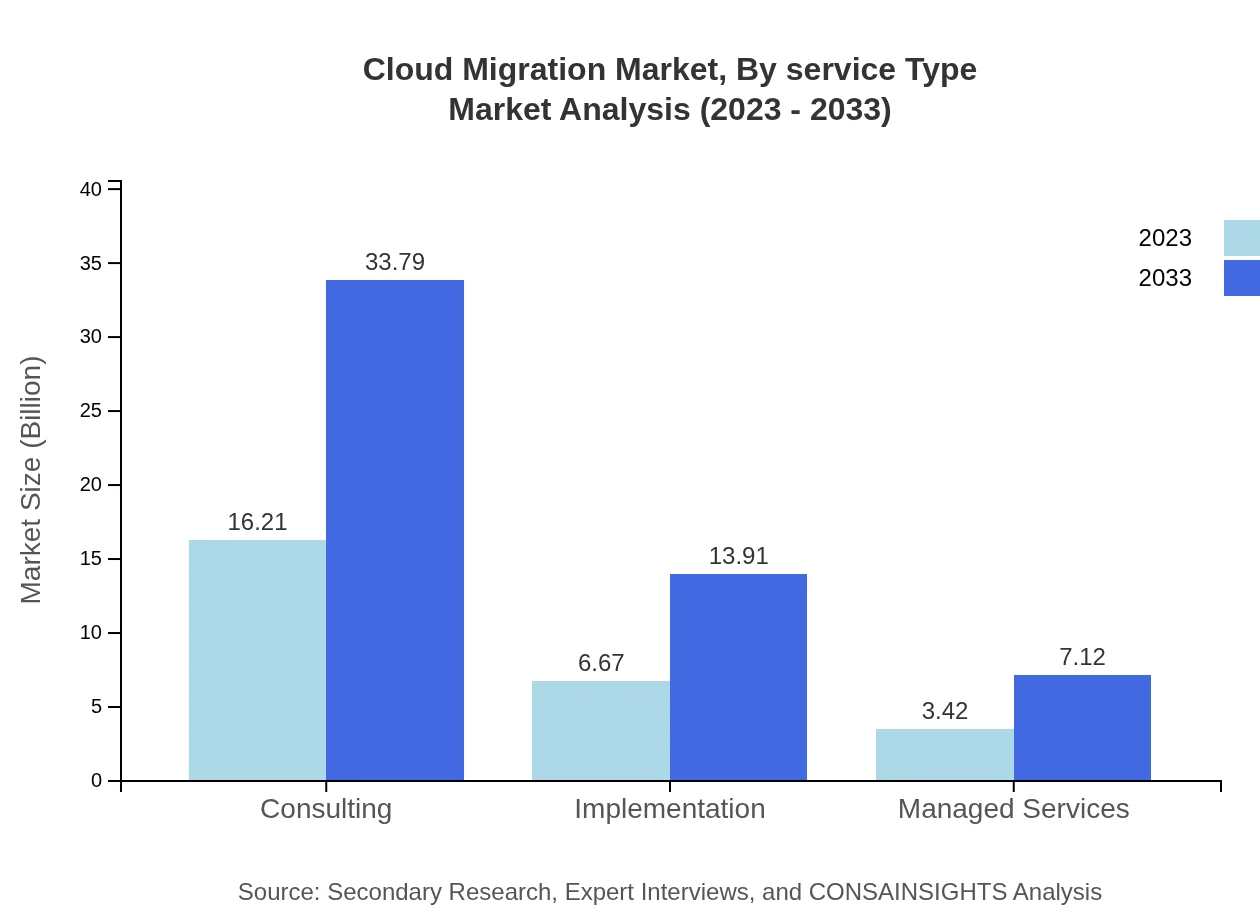

Cloud Migration Market Analysis By Deployment Model

The deployment model segmentation includes: 1. **Public Cloud**: Expected to dominate with significant growth from USD 16.21 billion to USD 33.79 billion, capturing the largest market share due to its cost-effectiveness and scalability. 2. **Private Cloud**: This segment will expand from USD 6.67 billion to USD 13.91 billion, primarily adopted by organizations needing stringent security and compliance. 3. **Hybrid Cloud**: Projected to increase from USD 3.42 billion to USD 7.12 billion as organizations seek a blend of public and private cloud advantages.

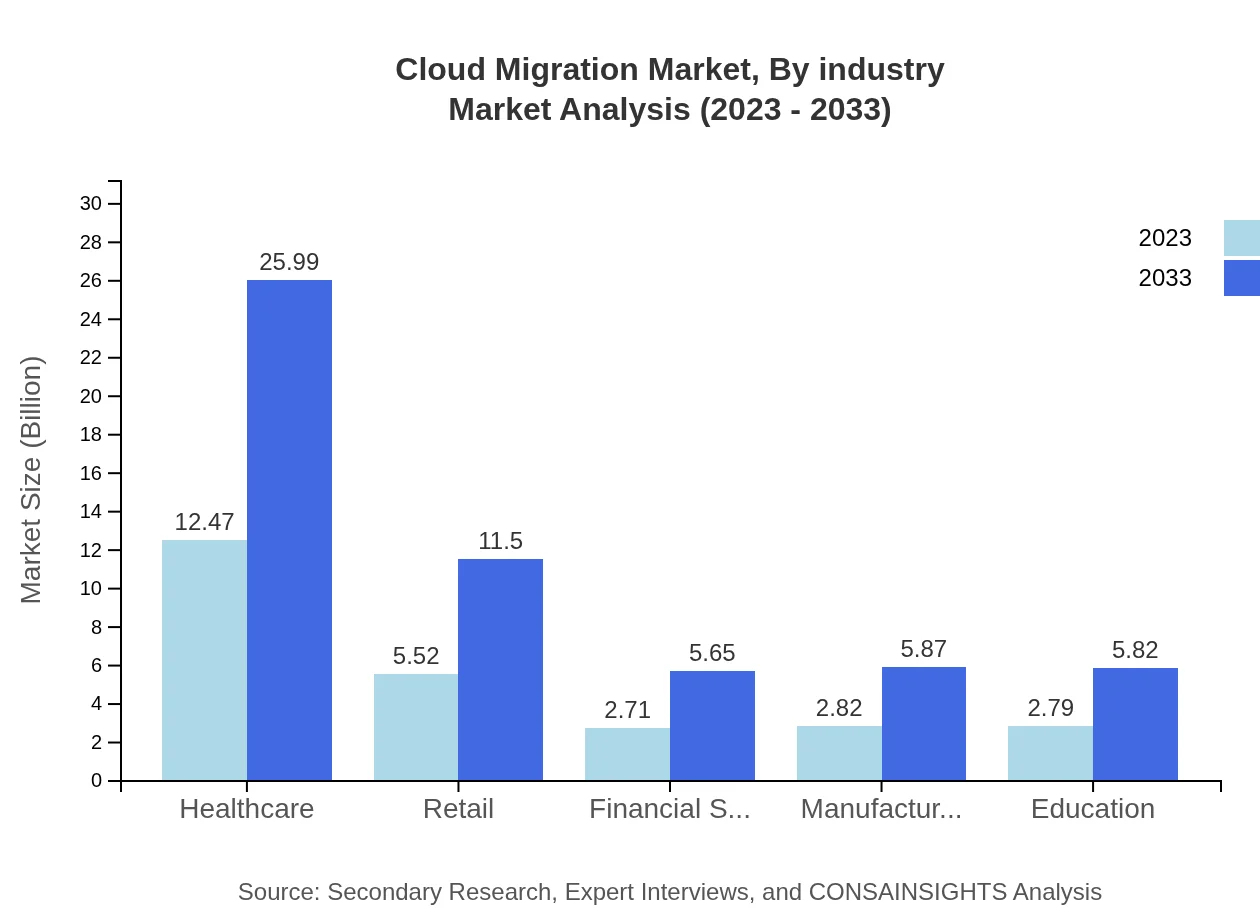

Cloud Migration Market Analysis By Industry

Market insights by industry reveal: 1. **Healthcare**: Anticipated to see substantial growth from USD 12.47 billion to USD 25.99 billion, driven by the need for efficient data management and compliance with health regulations. 2. **Retail**: Growth from USD 5.52 billion to USD 11.50 billion shows an increasing trend for better customer experience management. 3. **Financial Services**: Forecasted from USD 2.71 billion to USD 5.65 billion, primarily due to stringent data compliance and operational efficiency needs.

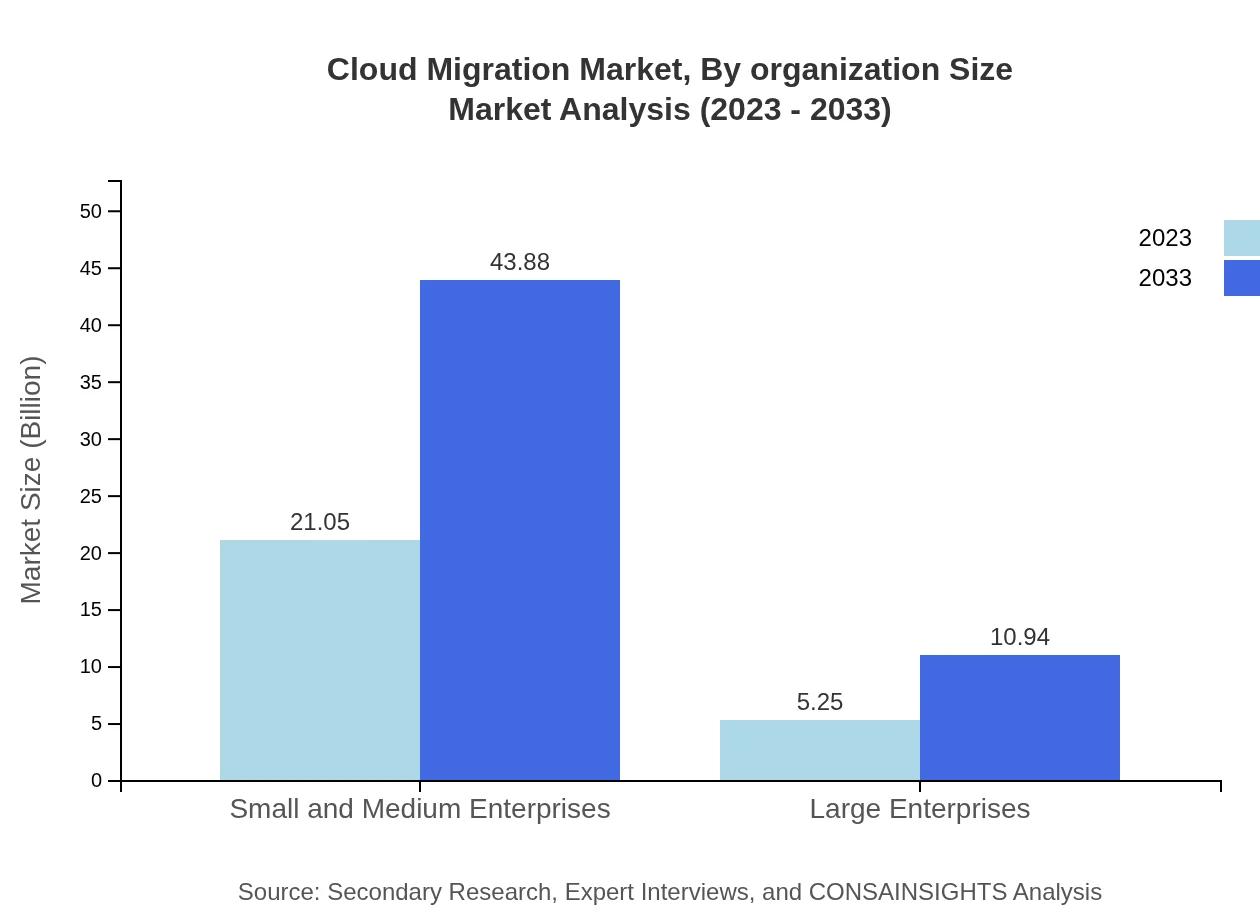

Cloud Migration Market Analysis By Organization Size

The organization size segment displays: 1. **Small and Medium Enterprises (SMEs)**: Growth from USD 21.05 billion to USD 43.88 billion showcasing SMEs' increasing adaptability towards cloud solutions. 2. **Large Enterprises**: Expected to shift from USD 5.25 billion to USD 10.94 billion, as larger firms effectively harness cloud strategies to enhance global operations.

Cloud Migration Market Analysis By Service Type

Service types within cloud migration include: 1. **Consulting**: Expected to dominate with growth from USD 16.21 billion to USD 33.79 billion, as organizations seek expertise for effective migration strategies. 2. **Implementation**: Growth anticipated from USD 6.67 billion to USD 13.91 billion, ensuring operational transition to cloud technologies.

Cloud Migration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cloud Migration Industry

Amazon Web Services (AWS):

As one of the leading cloud service providers, AWS offers a broad range of cloud migration tools and services to facilitate the seamless transition of enterprises into the cloud.Microsoft Azure:

Microsoft Azure provides extensive cloud services, enabling organizations to migrate applications and data swiftly with support and integration options.Google Cloud:

Google Cloud excels in providing cutting-edge tools and solutions that leverage AI and machine learning to enhance cloud migration strategies.IBM Cloud:

IBM Cloud supports various industries with specific cloud migration solutions, focusing on hybrid cloud technologies that offer flexibility and efficiency.Oracle Cloud:

Oracle Cloud specializes in providing innovative database migration solutions, particularly beneficial for enterprises needing enhanced data management.We're grateful to work with incredible clients.

FAQs

What is the market size of cloud Migration?

The global cloud migration market is valued at approximately $26.3 billion in 2023, with an expected CAGR of 7.4% from 2023 to 2033. This growth indicates increasing adoption of cloud services across various sectors.

What are the key market players or companies in this cloud Migration industry?

Key players in the cloud migration industry include major technology firms such as Amazon Web Services, Microsoft Azure, Google Cloud Platform, IBM, and Oracle. These companies continually innovate to provide effective cloud migration solutions.

What are the primary factors driving the growth in the cloud Migration industry?

Key drivers behind the growth in the cloud migration industry include increasing adoption of cloud-based solutions, the need for cost efficiency, advancement in cloud technologies, and businesses' desire for scalability and flexibility in operations.

Which region is the fastest Growing in the cloud Migration?

The North America region is leading the cloud migration market growth, projected to reach $20.45 billion by 2033. In contrast, Asia Pacific is also rapidly expanding, expecting growth from $5.04 billion in 2023 to $10.50 billion by 2033.

Does ConsaInsights provide customized market report data for the cloud Migration industry?

Yes, ConsaInsights offers tailored reports that cater to specific needs in the cloud migration industry. Clients can request insights particular to their market segment or regions for strategic planning purposes.

What deliverables can I expect from this cloud Migration market research project?

Deliverables from the cloud migration market research project include comprehensive market analysis reports, segment performance summaries, regional market insights, competitive landscape information, and forecasts tailored to your business objectives.

What are the market trends of cloud Migration?

Market trends in cloud migration include increased use of hybrid and public cloud services, evolving security measures, automation of migration processes, and a marked rise in cloud adoption among SMEs, indicating a shift in technology utilization.