Commercial Vehicle Telematics Software

Published Date: 31 January 2026 | Report Code: commercial-vehicle-telematics-software

Commercial Vehicle Telematics Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Commercial Vehicle Telematics Software market, offering detailed insights into market size, growth drivers, segmentation, regional analysis, and technological trends. Covering forecast data from 2024 to 2033, the report is designed to guide stakeholders by delivering comprehensive data, trend analysis, and future market projections.

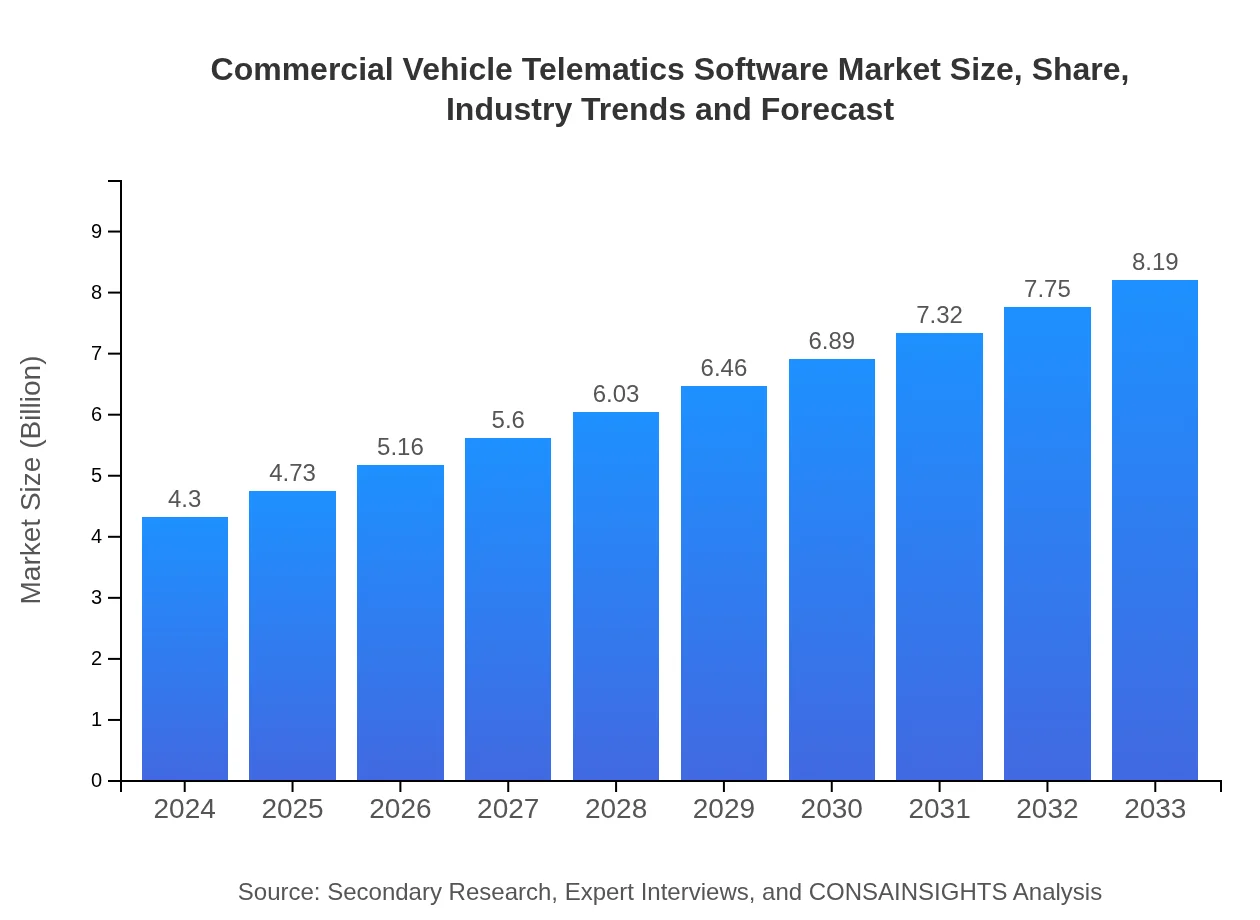

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $4.30 Billion |

| CAGR (2024-2033) | 7.2% |

| 2033 Market Size | $8.19 Billion |

| Top Companies | Telematics Global Inc., Fleet Solutions Ltd., SmartFleet Technologies, Navisys Innovations |

| Last Modified Date | 31 January 2026 |

Commercial Vehicle Telematics Software Market Overview

Customize Commercial Vehicle Telematics Software market research report

- ✔ Get in-depth analysis of Commercial Vehicle Telematics Software market size, growth, and forecasts.

- ✔ Understand Commercial Vehicle Telematics Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Commercial Vehicle Telematics Software

What is the Market Size & CAGR of Commercial Vehicle Telematics Software market in {Year}?

Commercial Vehicle Telematics Software Industry Analysis

Commercial Vehicle Telematics Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Commercial Vehicle Telematics Software Market Analysis Report by Region

Europe Commercial Vehicle Telematics Software:

Europe, with its mature automotive and technology sectors, is witnessing significant developments in telematics solutions. The market in this region is forecasted to expand from 1.08 in 2024 to 2.06 by 2033. The rapid adoption of smart mobility solutions, supported by stringent emission and safety regulations, and increasing collaborations across the technology and automotive sectors, are setting the stage for innovative telematics applications.Asia Pacific Commercial Vehicle Telematics Software:

In the Asia Pacific region, the market is poised for growth driven by rapid industrialization, urbanization, and significant investments in smart infrastructure. From a market size of 0.86 in 2024, projections indicate a rise to 1.64 by 2033, fueled by increasing adoption of telematics solutions among fleet operators and logistics companies. Countries in the region are rapidly modernizing their transport frameworks to incorporate these advanced systems, with government initiatives supporting digital transformation.North America Commercial Vehicle Telematics Software:

North America remains a strong market for Commercial Vehicle Telematics Software, characterized by high technology penetration and robust demand from the transportation and logistics sectors. The region’s market size is projected to grow from 1.44 in 2024 to 2.74 by 2033. Advanced regulatory frameworks, a widespread adoption of smart fleet management solutions, and continuous R&D initiatives in telematics technologies are key contributors to this steady growth.South America Commercial Vehicle Telematics Software:

South America shows promising potential as market conditions evolve with a focus on modernizing transportation networks and improving fleet management practices. The region’s market size is expected to expand from 0.39 in 2024 to 0.75 by 2033, driven by investments in digital technologies and the need to optimize operational efficiency in logistics. Economic growth and infrastructure development further support these projections.Middle East & Africa Commercial Vehicle Telematics Software:

The Middle East and Africa region, while in the early stages of telematics adoption, is gradually embracing advanced fleet management systems. The market indicators suggest an upward trend, with market size increasing from 0.53 in 2024 to 1.00 by 2033. With infrastructural improvements, enhanced digital connectivity, and the growing need for efficient transportation management, this region is expected to catch up rapidly with its global counterparts.Tell us your focus area and get a customized research report.

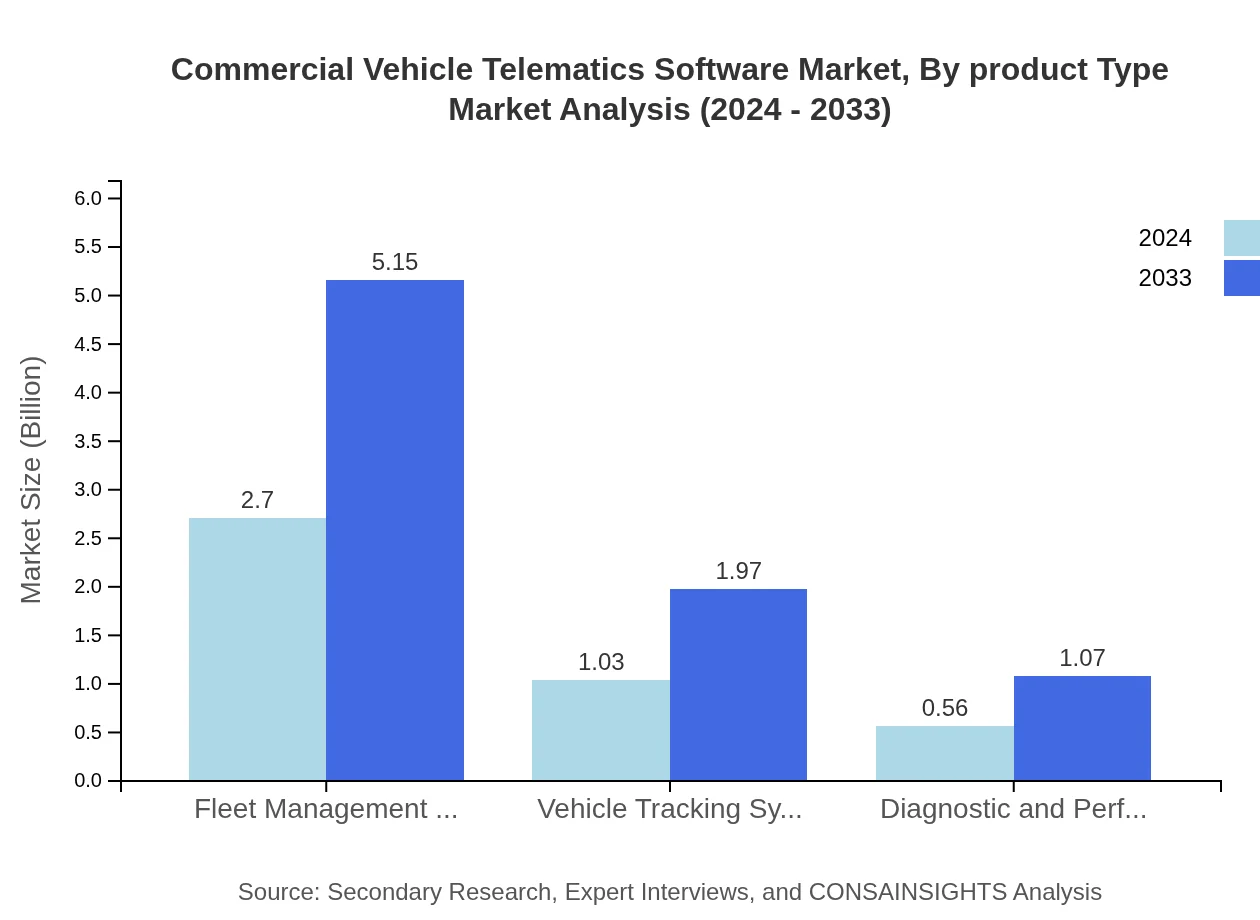

Commercial Vehicle Telematics Software Market Analysis By Product Type

In the by-product-type segment, the market is extensively segmented into key categories such as fleet management software, vehicle tracking systems, diagnostic and performance tools, and telematics communication modules. Fleet management solutions contribute significantly with a market size reaching 2.70 in 2024 and further expanding to 5.15 by 2033, representing an overwhelming 62.86% share. Vehicle tracking and diagnostic tools are crucial for performance monitoring and operational efficiency. Product innovation within this category is marked by enhanced user interfaces, real-time data analytics, and improved recall capabilities that offer a competitive edge to solution providers. Overall, the product type segment is expected to benefit from continuous technological advancements and a growing preference for integrated fleet management solutions.

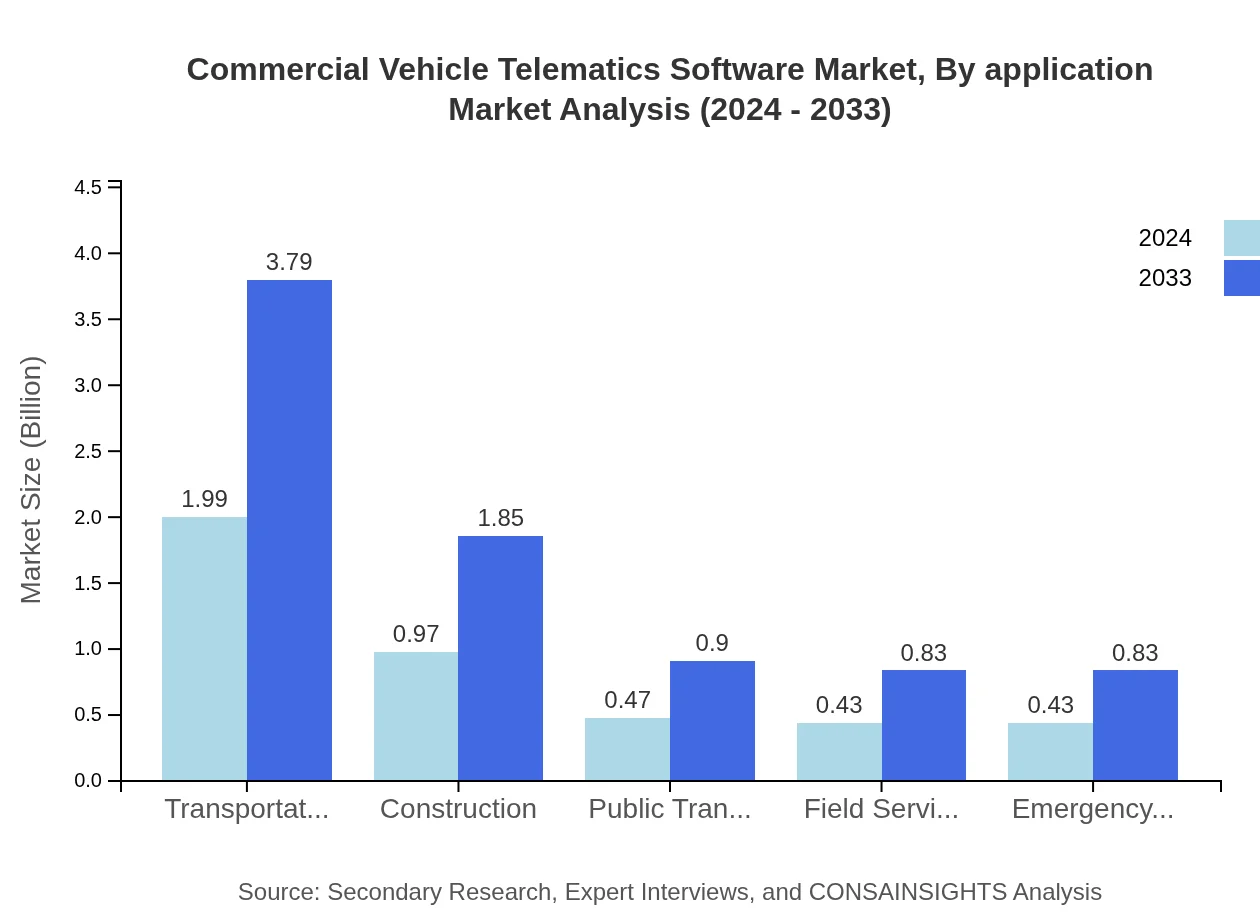

Commercial Vehicle Telematics Software Market Analysis By Application

The by-application segment is dominated by diverse use cases including transportation and logistics, construction, public transport, field service management, and emergency services. Transportation and logistics lead with a projected market size of 1.99 in 2024, growing to 3.79 by 2033 while capturing an impressive 46.31% share of the overall market. Construction and public transport similarly benefit from improved operational efficiencies and safety protocols provided by telematics software. Emergency services and field service management also see substantial gains in efficiency, paving the way for increased adoption. Innovations in this segment include the adaptation of real-time communication tools and enhanced analytical capabilities, allowing for optimized route planning and improved asset utilization among various applications.

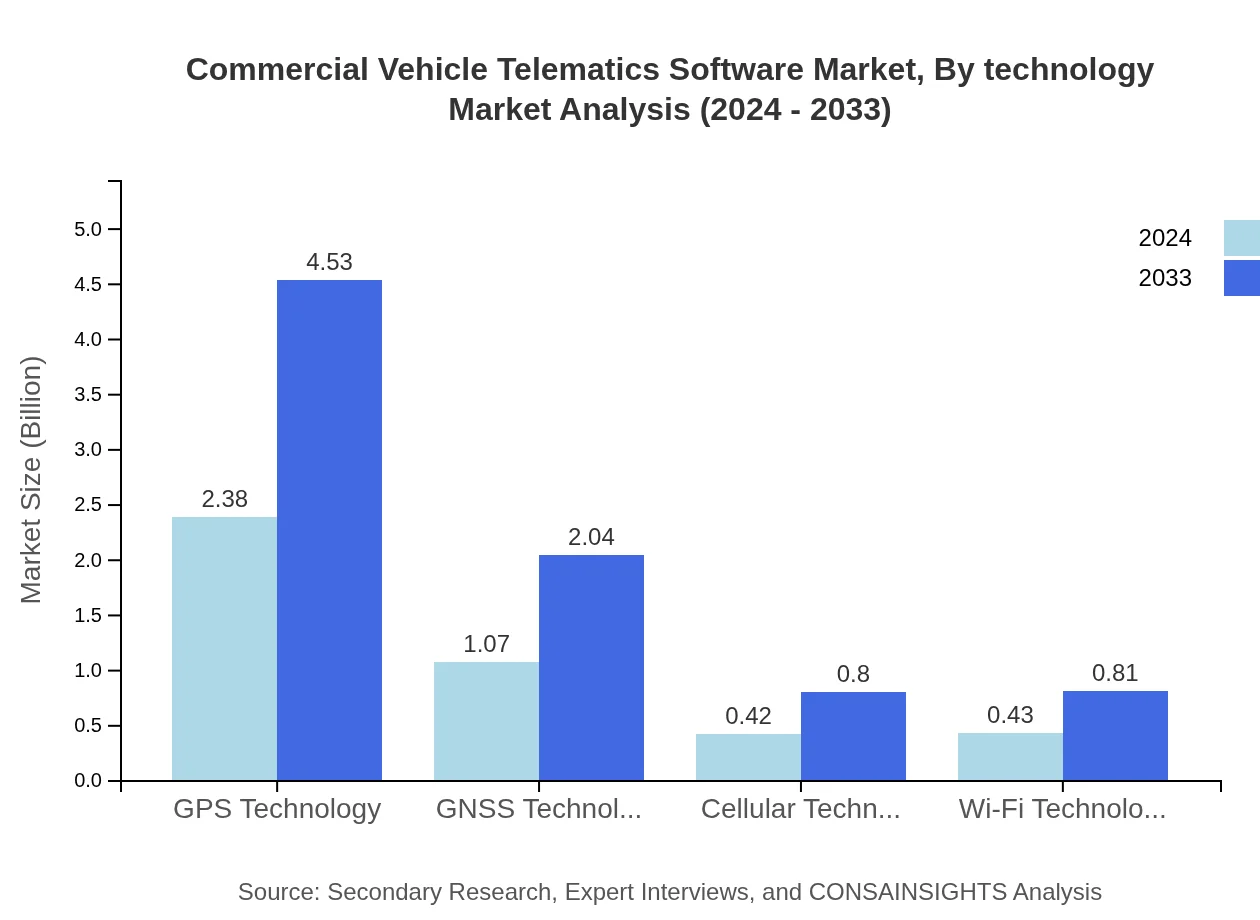

Commercial Vehicle Telematics Software Market Analysis By Technology

Technological innovation remains a major driver in the evolution of telematics software. The by-technology segment comprises key technologies such as GPS, GNSS, cellular, and Wi-Fi-based solutions. GPS technology, which represented a market size of 2.38 in 2024 with a 55.31% share, continues to dominate due to its widespread use and reliable tracking accuracy. Similarly, GNSS technology offers high precision and is increasingly adopted in regions requiring advanced navigation. Cellular and Wi-Fi technologies provide robust connectivity options, essential for real-time data transmission and monitoring. The ongoing development of hybrid systems that integrate multiple technological solutions is expected to further elevate the capabilities of telematics software, thus enhancing overall system performance and reliability.

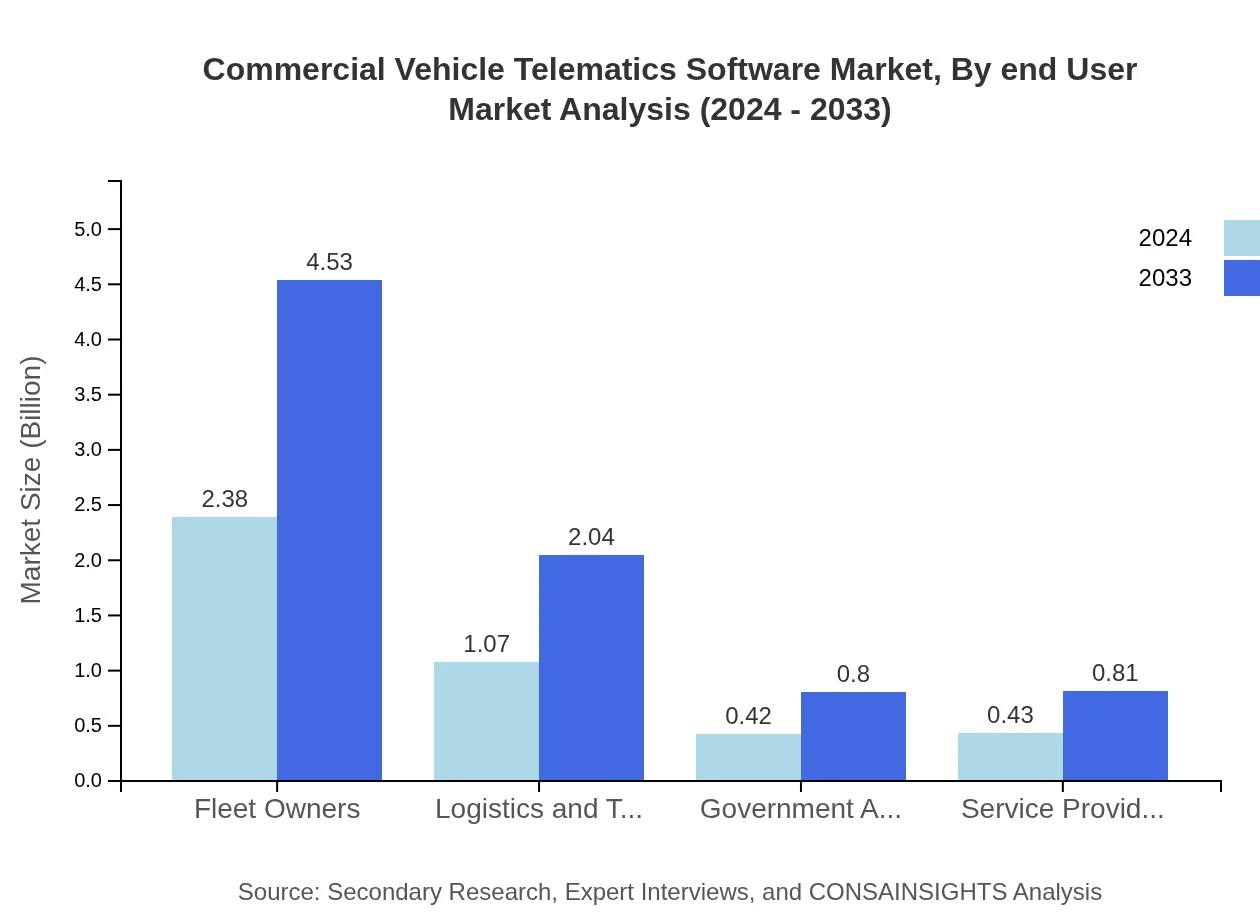

Commercial Vehicle Telematics Software Market Analysis By End User

The by-end-user analysis of the market focuses on key players such as fleet owners, logistics and transportation companies, government agencies, and service providers. Fleet owners constitute the largest share with a market size of 2.38 in 2024, maintaining a dominant share of 55.31% through 2033. Logistics and transportation companies follow closely with a significant share that underscores the need for comprehensive fleet management. Government agencies also invest in telematics systems to enforce regulatory compliance and enhance public safety, while service providers are harnessing these solutions to deliver value-added services. The diverse end-user landscape continues to drive demand for tailored telematics solutions that address distinct operational challenges and regulatory requirements.

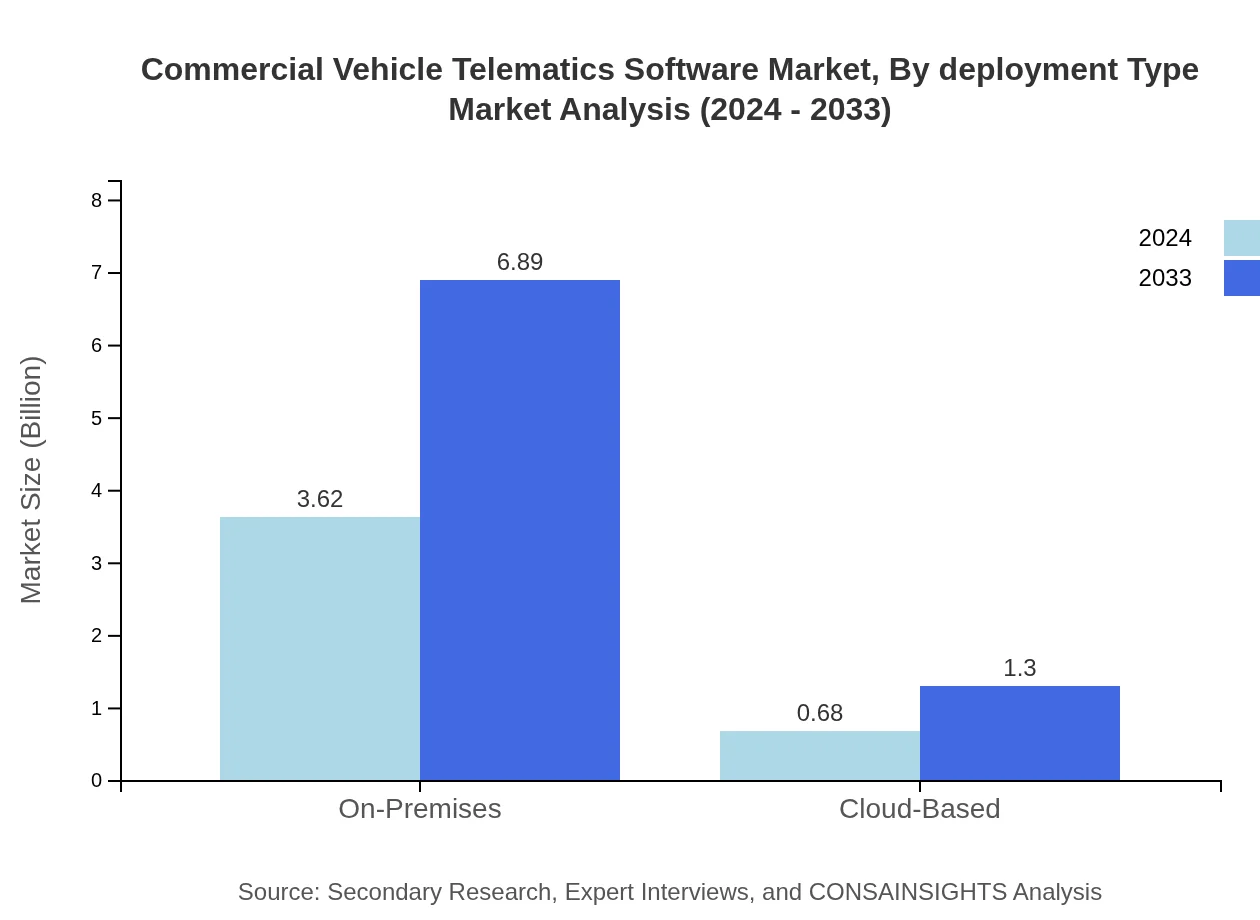

Commercial Vehicle Telematics Software Market Analysis By Deployment Type

Deployment type segmentation divides the market into on-premises and cloud-based solutions. On-premises deployments, which recorded a market size of 3.62 in 2024 with an 84.15% share, continue to be favored by organizations that require greater control over data security and system integration. In contrast, cloud-based solutions offer flexibility, scalability, and lower upfront costs, with a market size growing from 0.68 in 2024 to 1.30 by 2033 and accounting for a 15.85% share. The trend toward digital transformation and the need for real-time data accessibility are prompting businesses to reevaluate their deployment strategies, with many opting for hybrid solutions that merge the benefits of both deployment types.

Commercial Vehicle Telematics Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Commercial Vehicle Telematics Software Industry

Telematics Global Inc.:

Telematics Global Inc. is a leader in providing innovative fleet management solutions, integrating advanced sensor data, real-time tracking, and data analytics to optimize fleet operations across diverse sectors.Fleet Solutions Ltd.:

Fleet Solutions Ltd. specializes in end-to-end telematics solutions, offering cutting-edge technologies that improve vehicle tracking, diagnostic services, and performance management for global transportation fleets.SmartFleet Technologies:

SmartFleet Technologies leverages state-of-the-art software and IoT integration to deliver comprehensive fleet management and telematics solutions, enabling businesses to enhance efficiency and operational control.Navisys Innovations:

Navisys Innovations is renowned for its advanced navigation and telematics software, focusing on innovative data-driven strategies that empower fleet operators to achieve improved safety and cost efficiency.We're grateful to work with incredible clients.

FAQs

How can the Commercial Vehicle Telematics Software Report help align our marketing strategy with customer adoption trends?

The report provides insights into customer adoption trends, helping marketers identify target demographics and adjust marketing strategies accordingly. Analyzing trends aids in aligning campaigns that resonate with customer preferences, leading to enhanced engagement and increased conversions in a market projected to grow from $4.3 billion at a CAGR of 7.2%.

What product features are in highest demand according to the Commercial Vehicle Telematics Software trends?

Demand is highest for features like GPS tracking and fleet management capabilities. With fleet management software alone projected to grow from $2.70 billion to $5.15 billion by 2033, focusing on these areas can drive competitive advantage and align offerings with market needs.

Which regions offer the best market entry and expansion opportunities in the Commercial Vehicle Telematics Software industry?

North America and Europe offer the most significant opportunities, with expected market sizes of $2.74 billion and $2.06 billion respectively by 2033. Additionally, the Asia Pacific region is emerging as a growth area due to increasing logistic needs and infrastructure development.

What emerging technologies and innovations are shaping the Commercial Vehicle Telematics Software market?

Innovations in IoT and AI are transforming telematics software, enhancing vehicle tracking and analytics. Technologies like GNSS and cellular systems are becoming critical for real-time data processing, supporting the growth of a market anticipated to achieve a size of $4.3 billion by 2024.

Does the Commercial Vehicle Telematics Software Report include competitive landscape and market share analysis?

Yes, the report includes detailed competitive landscape analysis, showcasing market share data across major segments like fleet management and vehicle tracking systems. This information is crucial for understanding competitive positioning within a rapidly evolving $4.3 billion market.

How can executives use the Commercial Vehicle Telematics Software Report to evaluate investment risks and ROI?

Executives can leverage the report's insights into market trends, customer demands, and competitive dynamics to assess potential risks and return on investment. Understanding market size projections and segment performance helps inform strategic decisions that mitigate risks and optimize ROI.

What is the market size of Commercial Vehicle Telematics Software and forecast growth?

The Commercial Vehicle Telematics Software market is valued at $4.3 billion in 2024 and is expected to grow at a CAGR of 7.2%, indicating a robust growth trend over the next decade.

Can you provide regional market size projections for Commercial Vehicle Telematics Software?

Sure! In 2024, North America is expected to reach $1.44 billion, Europe $1.08 billion, Asia Pacific $0.86 billion, Latin America $0.39 billion, and the Middle East & Africa $0.53 billion. By 2033, these figures will increase to $2.74 billion, $2.06 billion, $1.64 billion, $0.75 billion, and $1.00 billion, respectively.

What are the projected market sizes for different segments in Telemetry Software?

By 2033, Fleet Owners will dominate with $4.53 billion, followed by Transportation and Logistics at $3.79 billion. Other segments such as Construction and Public Transport will also see substantial growth, reinforcing the diverse applications of telematics.