Corneal Pachymetry Market Report

Published Date: 31 January 2026 | Report Code: corneal-pachymetry

Corneal Pachymetry Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Corneal Pachymetry market, covering insights, trends, and forecasts for the years 2023 to 2033, focusing on market size, growth rates, regional developments, and leading companies.

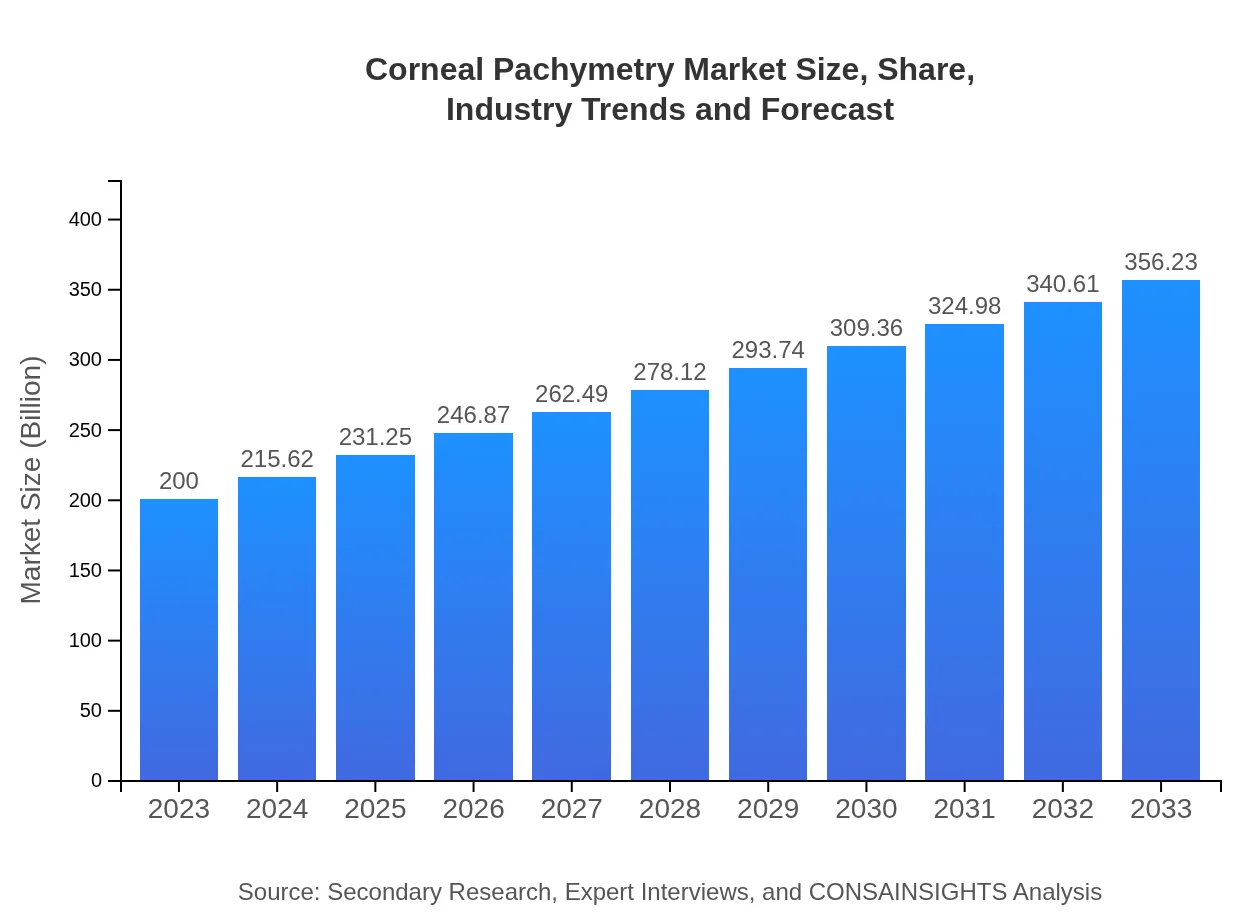

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Million |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $356.23 Million |

| Top Companies | Carl Zeiss AG, Topcon Corporation, Nidek Co., Ltd., Heidelberg Engineering |

| Last Modified Date | 31 January 2026 |

Corneal Pachymetry Market Overview

Customize Corneal Pachymetry Market Report market research report

- ✔ Get in-depth analysis of Corneal Pachymetry market size, growth, and forecasts.

- ✔ Understand Corneal Pachymetry's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Corneal Pachymetry

What is the Market Size & CAGR of Corneal Pachymetry market in 2023?

Corneal Pachymetry Industry Analysis

Corneal Pachymetry Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Corneal Pachymetry Market Analysis Report by Region

Europe Corneal Pachymetry Market Report:

The European market is anticipated to grow from USD 59.18 million in 2023 to USD 105.41 million by 2033. Stringent regulations regarding eye health and a growing elderly population contribute to the rising demand for Corneal Pachymetry.Asia Pacific Corneal Pachymetry Market Report:

The Asia-Pacific region, valued at USD 38.30 million in 2023 and expected to reach USD 68.22 million by 2033, is witnessing significant growth due to advancements in healthcare infrastructure and rising investments in ophthalmic technologies.North America Corneal Pachymetry Market Report:

North America leads the global market, with a size of USD 72.46 million in 2023, projected to reach USD 129.06 million by 2033. Factors such as high healthcare expenditure, advanced technology adoption, and a significant prevalence of eye diseases bolster market growth.South America Corneal Pachymetry Market Report:

In South America, the market size is projected to grow from USD 18.04 million in 2023 to USD 32.13 million by 2033. Increased healthcare awareness and rising patient population needing eye care services are primary growth drivers.Middle East & Africa Corneal Pachymetry Market Report:

The Middle East and Africa region is expected to grow from USD 12.02 million in 2023 to USD 21.41 million by 2033, driven by the increasing prevalence of ocular diseases and improvements in medical facilities.Tell us your focus area and get a customized research report.

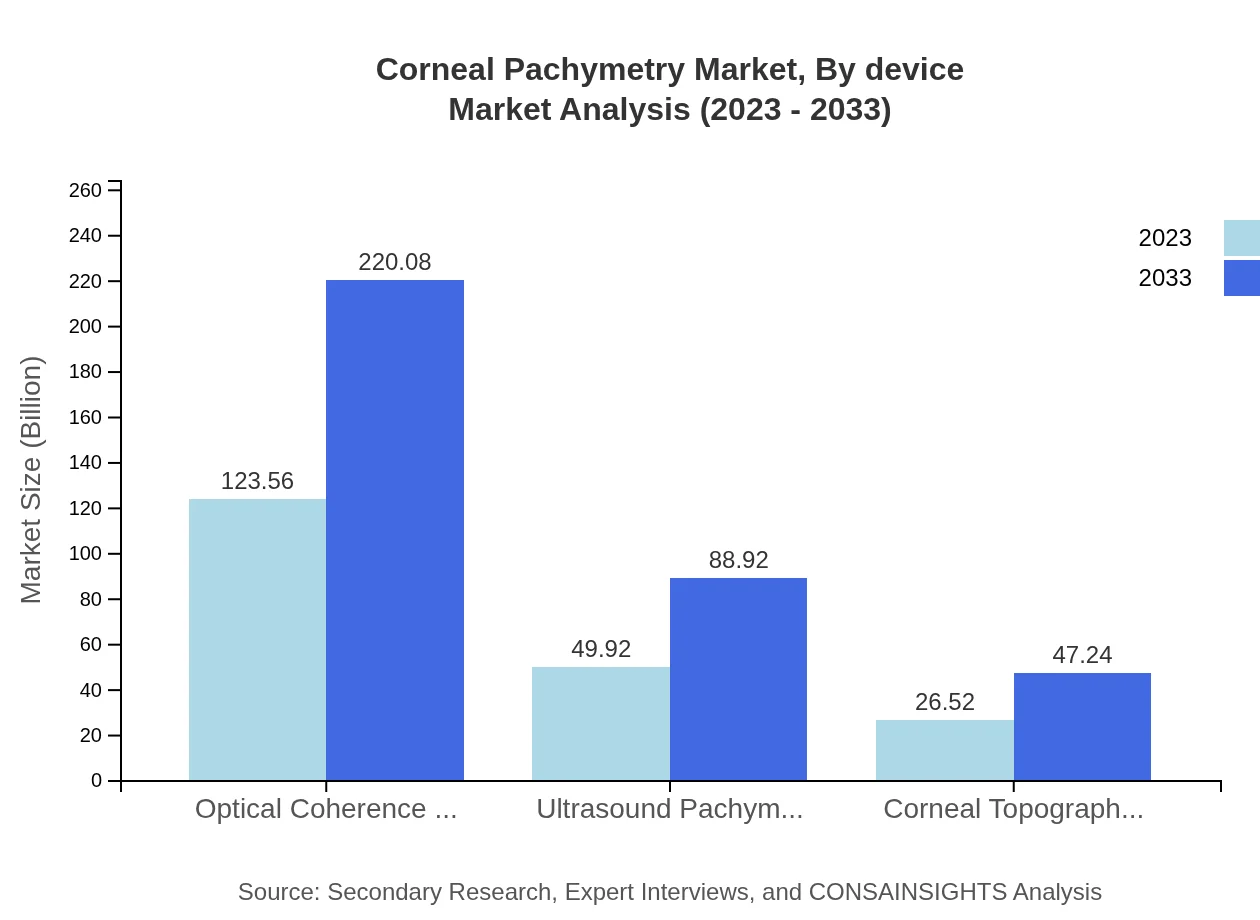

Corneal Pachymetry Market Analysis By Device

The major devices include Optical Coherence Tomography (OCT), which dominates the market with a size of USD 123.56 million in 2023 and expected to grow to USD 220.08 million by 2033. Ultrasound Pachymeters follow, growing from USD 49.92 million to USD 88.92 million within the same timeframe. Lastly, Corneal Topographers, starting at USD 26.52 million, are projected to reach USD 47.24 million, highlighting their increasing utilization in diagnostics.

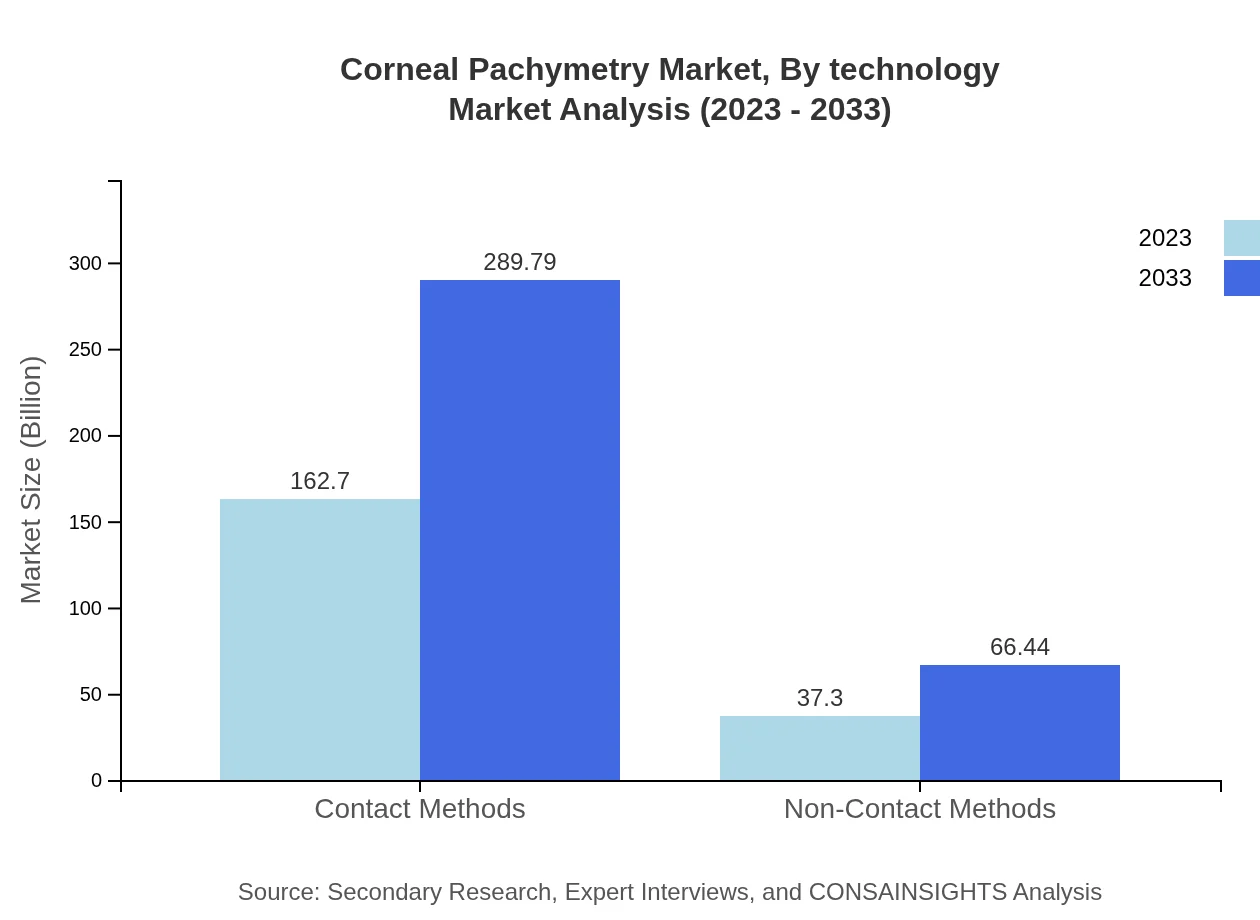

Corneal Pachymetry Market Analysis By Technology

The segment is classified into contact and non-contact methods. Contact methods represent a significant market share, achieving USD 162.70 million in 2023, projected to grow to USD 289.79 million by 2033. In contrast, non-contact methods are also expanding from USD 37.30 million to USD 66.44 million, reflecting growing preferences for patient comfort during diagnostics.

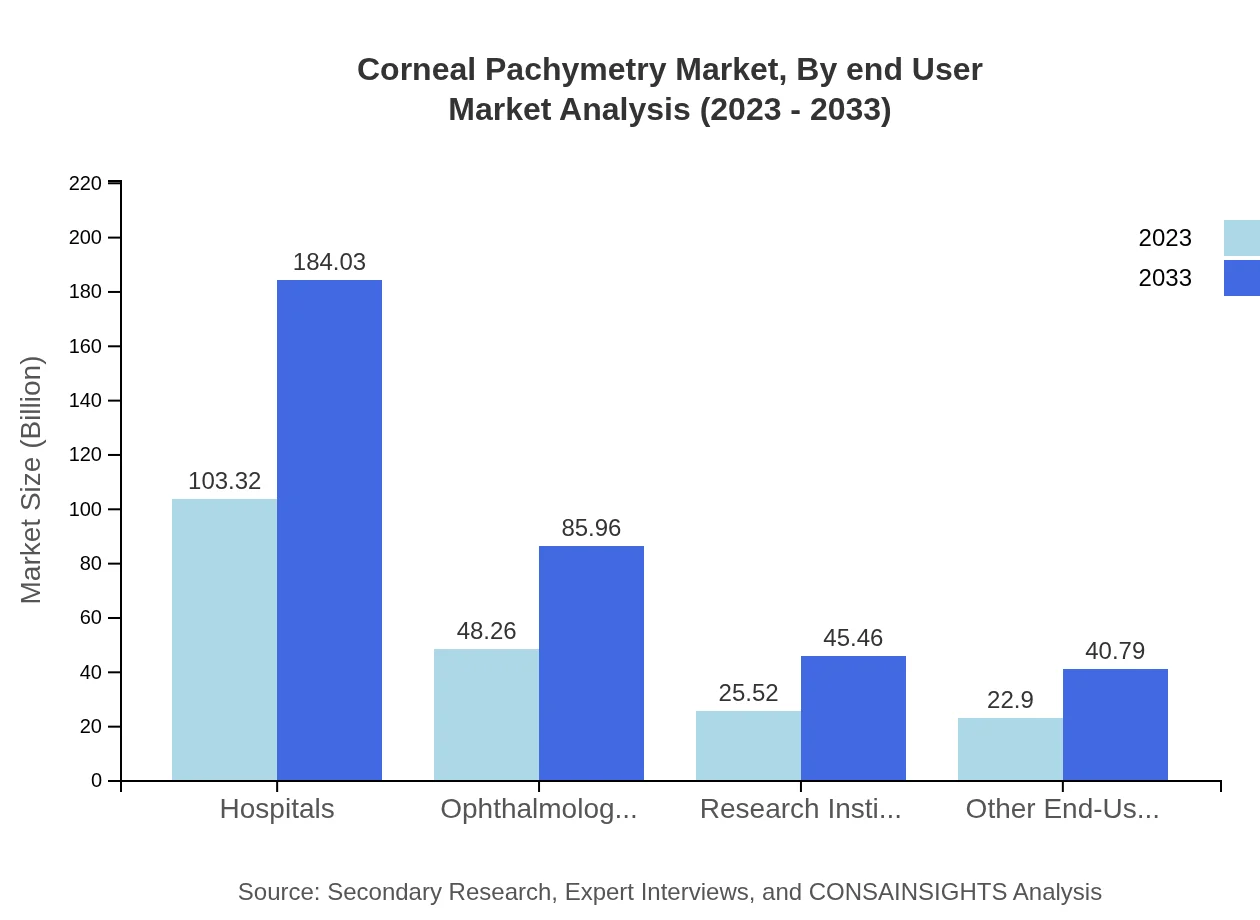

Corneal Pachymetry Market Analysis By End User

Hospitals are the largest end-users, with a market size of USD 103.32 million anticipated to expand to USD 184.03 million by 2033. Ophthalmology clinics follow at USD 48.26 million, expected to grow to USD 85.96 million. Research institutions will also see growth from USD 25.52 million to USD 45.46 million as research on ocular diseases continues.

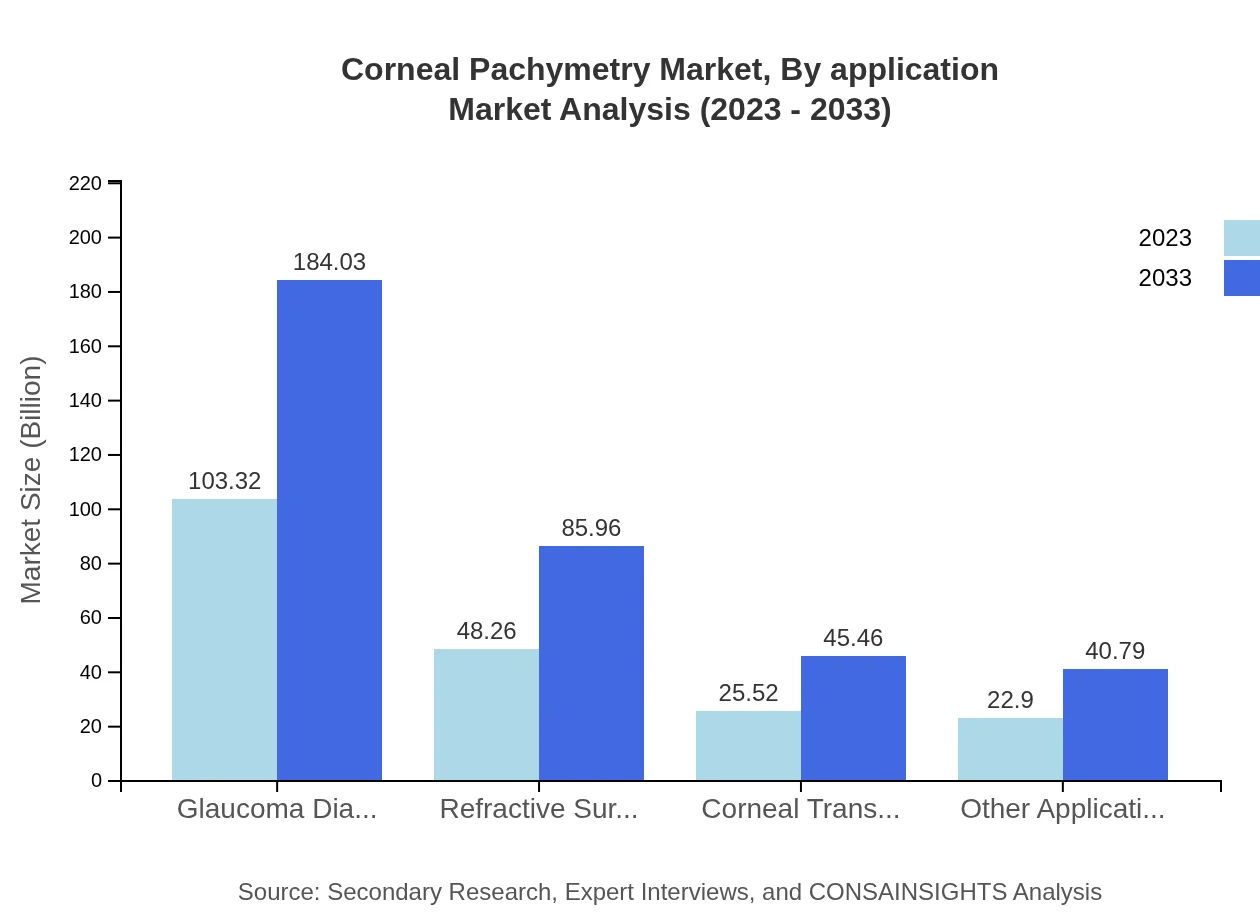

Corneal Pachymetry Market Analysis By Application

Applications include glaucoma diagnosis, refractive surgery, corneal transplantation, and other treatments. The glaucoma diagnosis segment leads with a size of USD 103.32 million in 2023, expected to reach USD 184.03 million. Refractive surgery follows at USD 48.26 million, with projections of USD 85.96 million, indicating a growing market for corrective procedures.

Corneal Pachymetry Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Corneal Pachymetry Industry

Carl Zeiss AG:

A leader in optical systems, Carl Zeiss AG offers advanced diagnostic equipment, including high-resolution OCT systems for corneal analysis.Topcon Corporation:

Topcon is renowned for its comprehensive line of ophthalmic equipment, providing innovative solutions for Corneal Pachymetry with cutting-edge technology.Nidek Co., Ltd.:

Nidek specializes in diagnostic and surgical ophthalmic devices and is known for its commitment to research and excellence in corneal imaging.Heidelberg Engineering:

This company offers state-of-the-art imaging systems specifically for ophthalmology, bolstering diagnostic efficiency and accuracy in Corneal Pachymetry.We're grateful to work with incredible clients.

FAQs

What is the market size of corneal Pachymetry?

The corneal pachymetry market size is estimated at $200 million in 2023, with a projected CAGR of 5.8% from 2023 to 2033. This growth reflects increasing awareness and advancements in corneal measurement technologies.

What are the key market players or companies in the corneal Pachymetry industry?

Key players in the corneal pachymetry market include renowned medical device companies focused on ophthalmology. These companies design innovative instruments and contribute to research, which enhances market competition and technology development.

What are the primary factors driving the growth in the corneal Pachymetry industry?

Driving factors include the rising prevalence of eye diseases, enhanced healthcare infrastructure, technological advancements in diagnostic equipment, and growing demand for non-invasive measurement techniques in ophthalmology.

Which region is the fastest Growing in the corneal Pachymetry?

North America is the fastest-growing region in the corneal pachymetry market, expected to increase from $72.46 million in 2023 to $129.06 million by 2033, driven by innovation and high healthcare spending.

Does ConsaInsights provide customized market report data for the corneal Pachymetry industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the corneal pachymetry industry. Clients can request detailed analyses on market trends, forecasts, and competitive landscapes.

What deliverables can I expect from this corneal Pachymetry market research project?

Clients can expect comprehensive reports, including market size, growth forecasts, competitive analysis, regional insights, and detailed segment data, ensuring a deep understanding of the corneal pachymetry market landscape.

What are the market trends of corneal Pachymetry?

Market trends in corneal pachymetry show a shift towards advanced imaging techniques, increased adoption of optical coherence tomography, and enhanced focus on glaucoma diagnosis, reflecting evolving healthcare needs and technology.