Cyclosporine Market Report

Published Date: 31 January 2026 | Report Code: cyclosporine

Cyclosporine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cyclosporine market, encompassing market size, growth forecasts, industry dynamics, regional insights, and competitive landscape from 2023 to 2033.

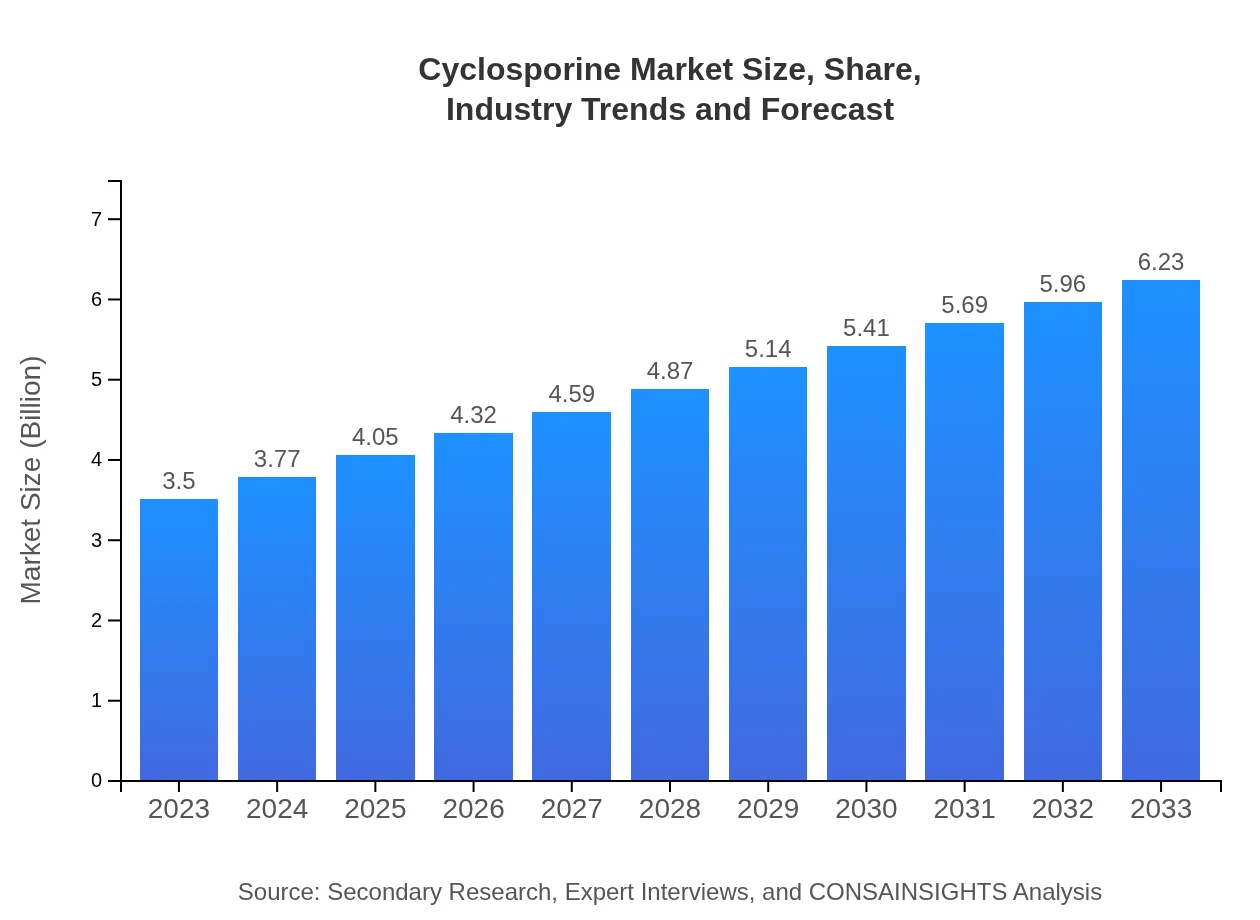

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $6.23 Billion |

| Top Companies | Novartis, Roche, Mylan, Teva Pharmaceutical Industries, Sandoz |

| Last Modified Date | 31 January 2026 |

Cyclosporine Market Overview

Customize Cyclosporine Market Report market research report

- ✔ Get in-depth analysis of Cyclosporine market size, growth, and forecasts.

- ✔ Understand Cyclosporine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cyclosporine

What is the Market Size & CAGR of the Cyclosporine market in 2023 and 2033?

Cyclosporine Industry Analysis

Cyclosporine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cyclosporine Market Analysis Report by Region

Europe Cyclosporine Market Report:

In Europe, the Cyclosporine market is forecasted to expand from $0.89 billion in 2023 to $1.59 billion by 2033. The growth is attributed to increasing cases of autoimmune diseases, alongside favorable reimbursement policies for organ transplants.Asia Pacific Cyclosporine Market Report:

In the Asia Pacific region, the Cyclosporine market is projected to grow from $0.74 billion in 2023 to $1.32 billion by 2033. This growth is driven by increasing healthcare investments, an expanding population, and rising awareness regarding organ transplantation and autoimmune treatments.North America Cyclosporine Market Report:

North America is a significant market for Cyclosporine, expected to increase from $1.33 billion in 2023 to $2.37 billion by 2033. The region benefits from advanced healthcare infrastructure, high disposable incomes, and a growing awareness of organ transplantation.South America Cyclosporine Market Report:

The South American market for Cyclosporine is estimated to grow from $0.12 billion in 2023 to $0.22 billion by 2033. Factors such as rising healthcare expenditure and improved access to medications are expected to drive market growth in this region.Middle East & Africa Cyclosporine Market Report:

The Middle East and Africa market is expected to rise from $0.42 billion in 2023 to $0.74 billion by 2033. Growth will be fueled by increasing investments in the healthcare sector and rising incidences of chronic diseases requiring immunosuppressive therapies.Tell us your focus area and get a customized research report.

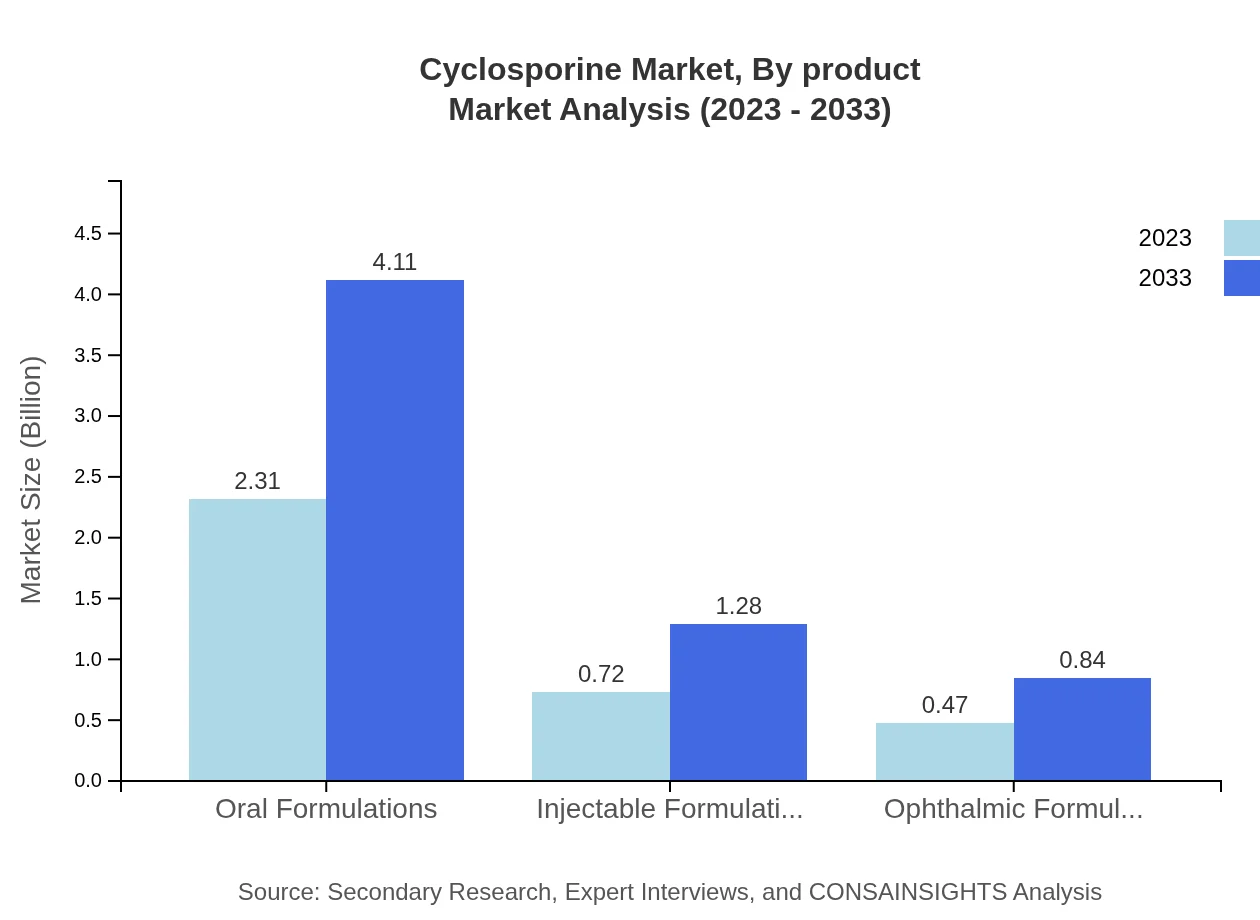

Cyclosporine Market Analysis By Product

The Cyclosporine market is primarily segmented into oral, injectable, and ophthalmic formulations. Oral formulations lead the segment, expected to grow from $2.31 billion in 2023 to $4.11 billion by 2033, constituting 65.93% of the market share. Injectable formulations are projected to expand from $0.72 billion in 2023 to $1.28 billion by 2033, making up 20.57% of the market. Lastly, ophthalmic formulations, while smaller, are set to increase from $0.47 billion to $0.84 billion.

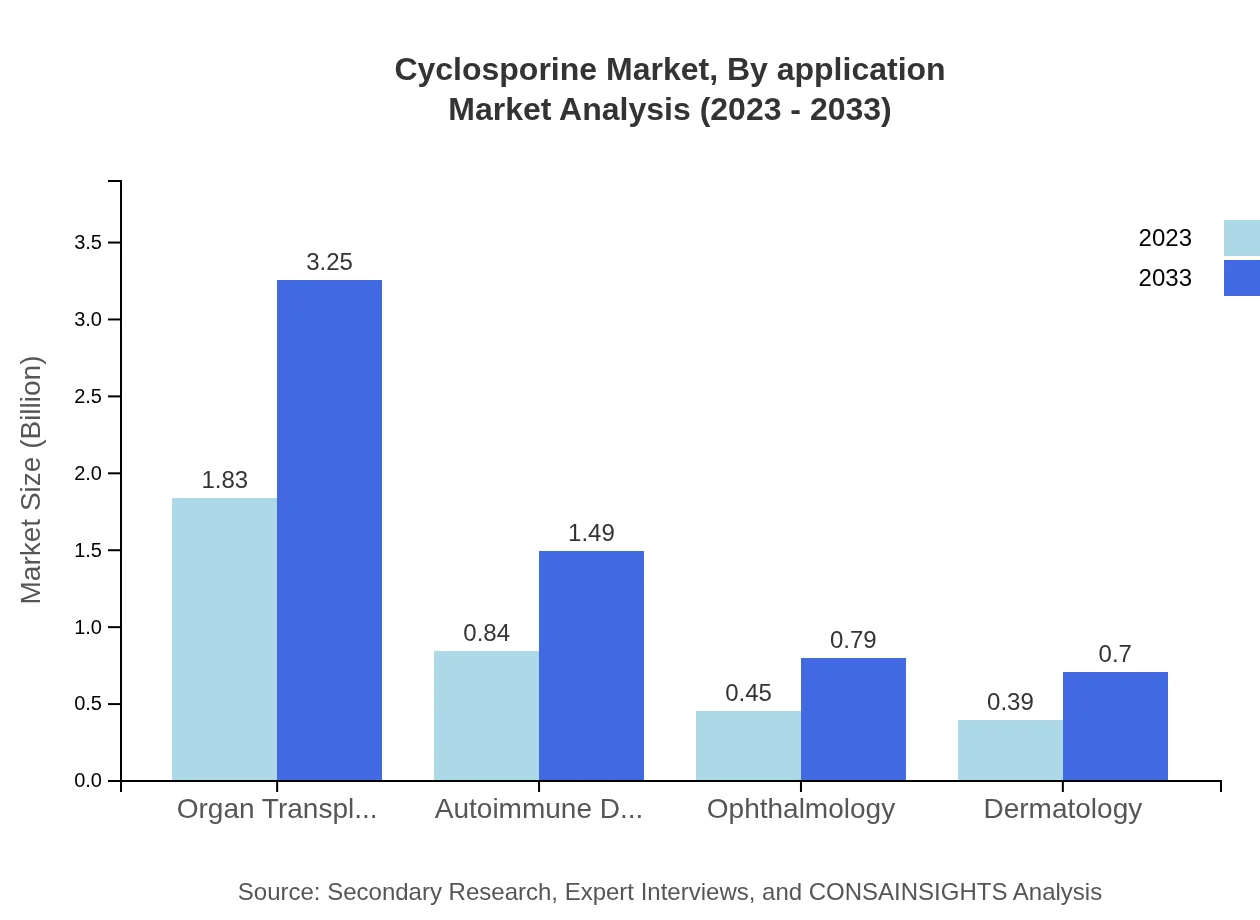

Cyclosporine Market Analysis By Application

The primary applications of Cyclosporine include organ transplantation and autoimmune disorders. The organ transplantation segment is expected to dominate, with a size increase from $1.83 billion in 2023 to $3.25 billion by 2033, holding 52.21% of the market share. Autoimmune disorder applications will also see significant growth from $0.84 billion to $1.49 billion, capturing around 23.86% of the market.

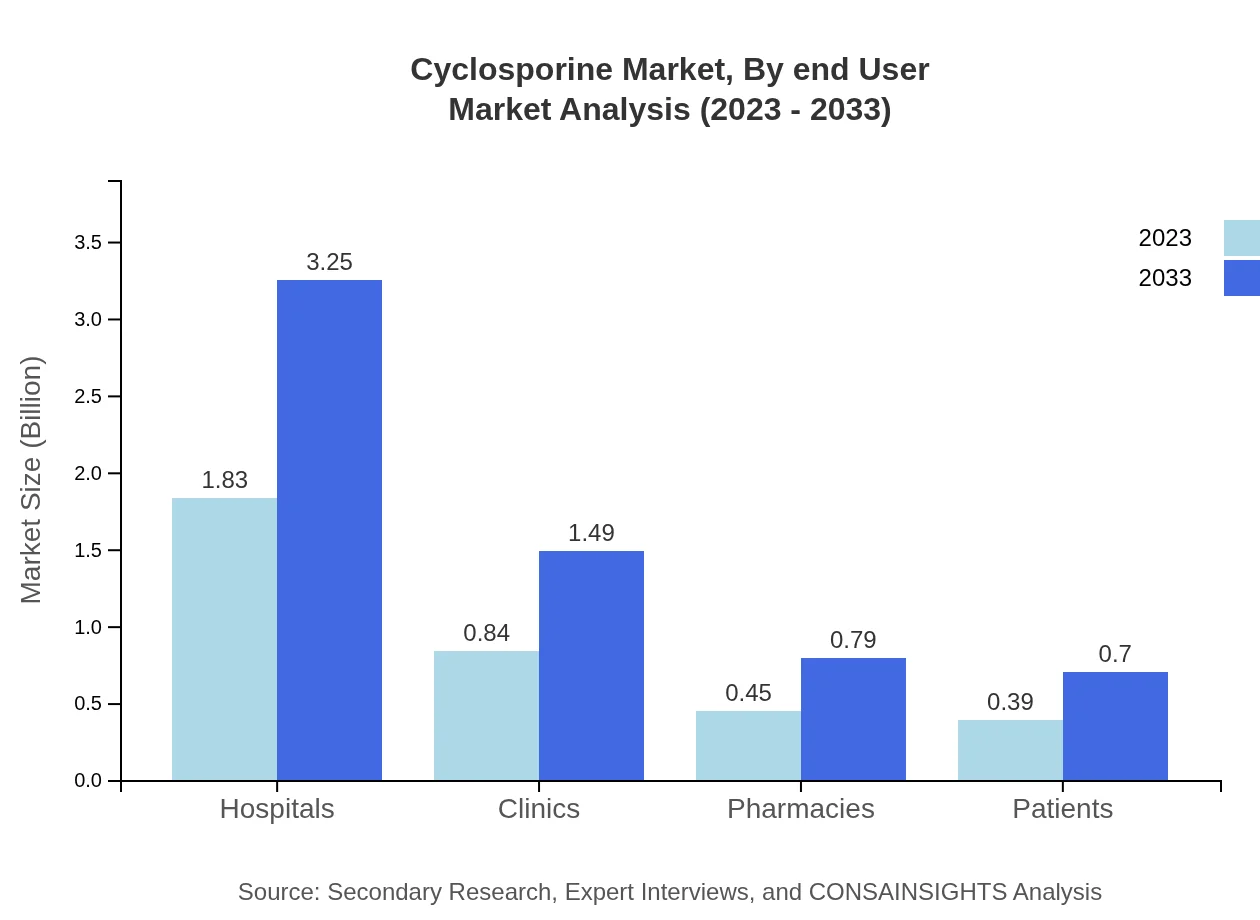

Cyclosporine Market Analysis By End User

End-users of Cyclosporine mainly consist of hospitals, clinics, and pharmacies. Hospitals make up the largest share, expected to grow from $1.83 billion in 2023 to $3.25 billion by 2033, representing 52.21% of the market. Clinics will increase from $0.84 billion to $1.49 billion, holding 23.86%, and pharmacies from $0.45 billion to $0.79 billion, accounting for 12.75%.

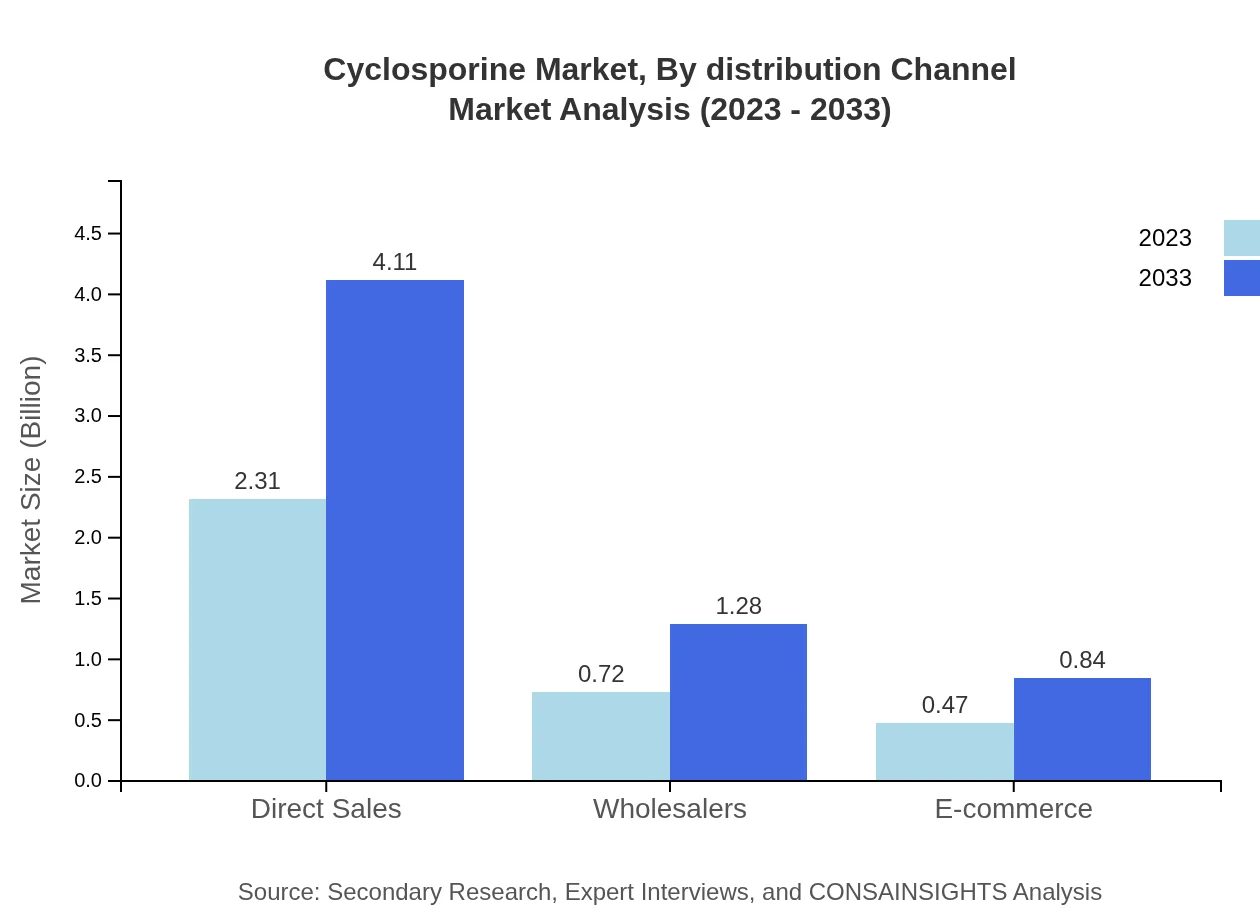

Cyclosporine Market Analysis By Distribution Channel

Distribution channels for Cyclosporine include direct sales, wholesalers, and e-commerce. Direct sales emerge as the most significant channel, projected to grow from $2.31 billion in 2023 to $4.11 billion by 2033, constituting 65.93%. Wholesalers will rise from $0.72 billion to $1.28 billion, while e-commerce will also see growth from $0.47 billion to $0.84 billion.

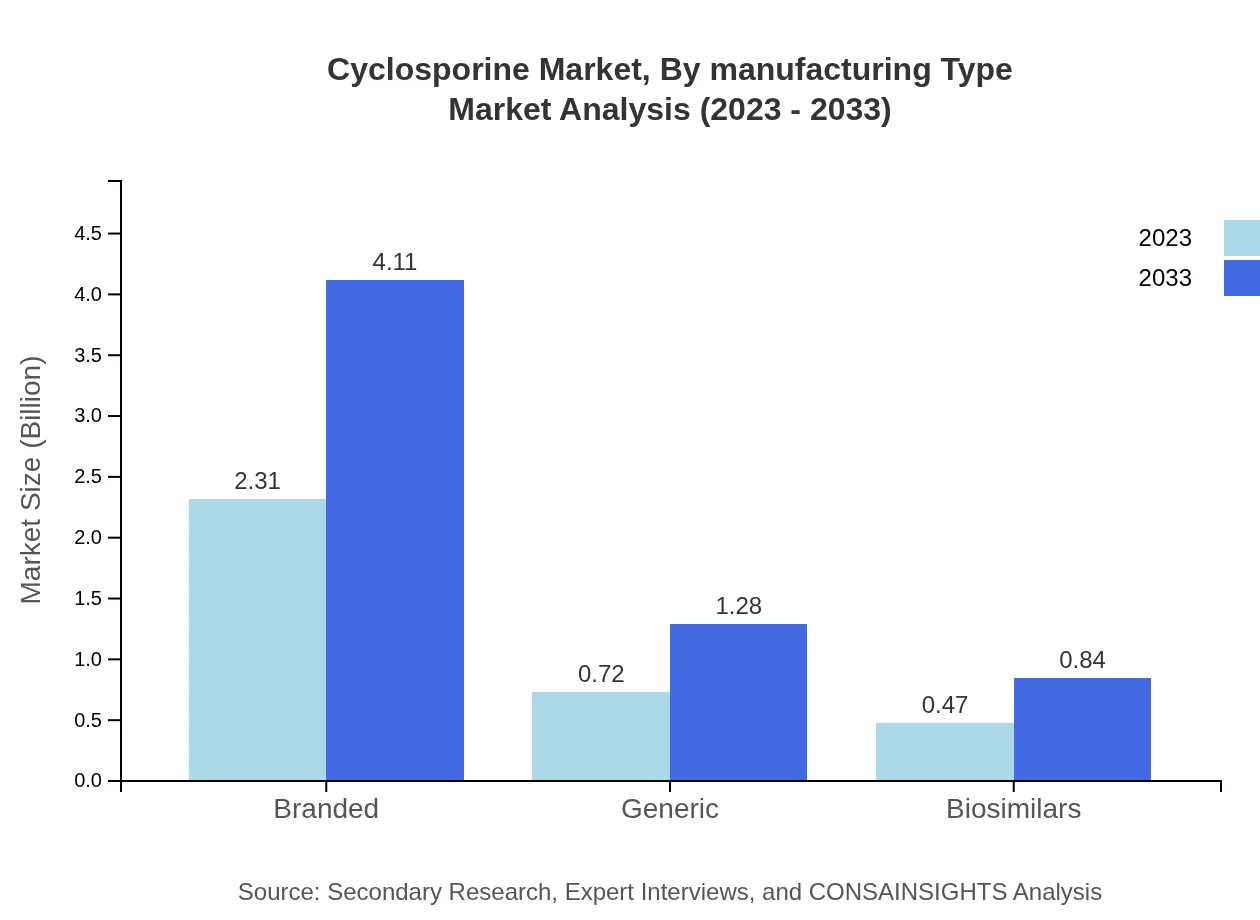

Cyclosporine Market Analysis By Manufacturing Type

Cyclosporine is segmented based on manufacturing type into branded, generic, and biosimilars. Branded formulations dominate with a market size projected to grow from $2.31 billion to $4.11 billion by 2033, holding a steady 65.93%. Generic products are expected to increase from $0.72 billion to $1.28 billion, accounting for 20.57%, while biosimilars will rise from $0.47 billion to $0.84 billion.

Cyclosporine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cyclosporine Industry

Novartis:

A leading global healthcare company that develops innovative medicines, including the market-leading branded Cyclosporine product, Sandimmune.Roche:

A major player in the pharmaceutical and diagnostics sector that contributes through its Cyclosporine formulations aimed at organ transplantation.Mylan:

A global generic pharmaceuticals company that offers cost-effective alternatives to branded Cyclosporine, enhancing patient access to treatment.Teva Pharmaceutical Industries:

A key manufacturer of generic drugs, including various formulations of Cyclosporine, focusing on affordability and accessibility.Sandoz:

A division of Novartis known for its biosimilar products and a strong presence in the Cyclosporine generics market.We're grateful to work with incredible clients.

FAQs

What is the market size of cyclosporine?

The global cyclosporine market is valued at approximately $3.5 billion in 2023 and is projected to grow at a CAGR of 5.8%, reaching significant milestones by 2033.

What are the key market players or companies in the cyclosporine industry?

The cyclosporine market features leading companies including Novartis, Roche, Teva Pharmaceuticals, and AbbVie which contribute significantly to product development and distribution.

What are the primary factors driving the growth in the cyclosporine industry?

Key growth drivers include the increasing prevalence of organ transplantation, rising autoimmune diseases, advancements in drug formulations, and heightened patient awareness towards immunosuppressants.

Which region is the fastest Growing in the cyclosporine?

The Asia Pacific region is the fastest-growing market for cyclosporine, with a projected growth from $0.74 billion in 2023 to $1.32 billion by 2033, fostering significant development opportunities.

Does ConsaInsights provide customized market report data for the cyclosporine industry?

Yes, ConsaInsights offers tailored market reports for the cyclosporine industry, catering to specific research needs and providing deep insights into market dynamics.

What deliverables can I expect from this cyclosporine market research project?

Deliverables include comprehensive market analyses, regional and segment data insights, competitive landscape evaluations, and future growth predictions for informed decision-making.

What are the market trends of cyclosporine?

Current trends in the cyclosporine market include increasing demand for oral formulations, rising adoption of biosimilars, and expansion of distribution channels through e-commerce.