Data Center Colocation Market Report

Published Date: 31 January 2026 | Report Code: data-center-colocation

Data Center Colocation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Data Center Colocation market, covering market size, regional insights, industry trends, and forecasts from 2023 to 2033. It aims to offer actionable insights and data for stakeholders to make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

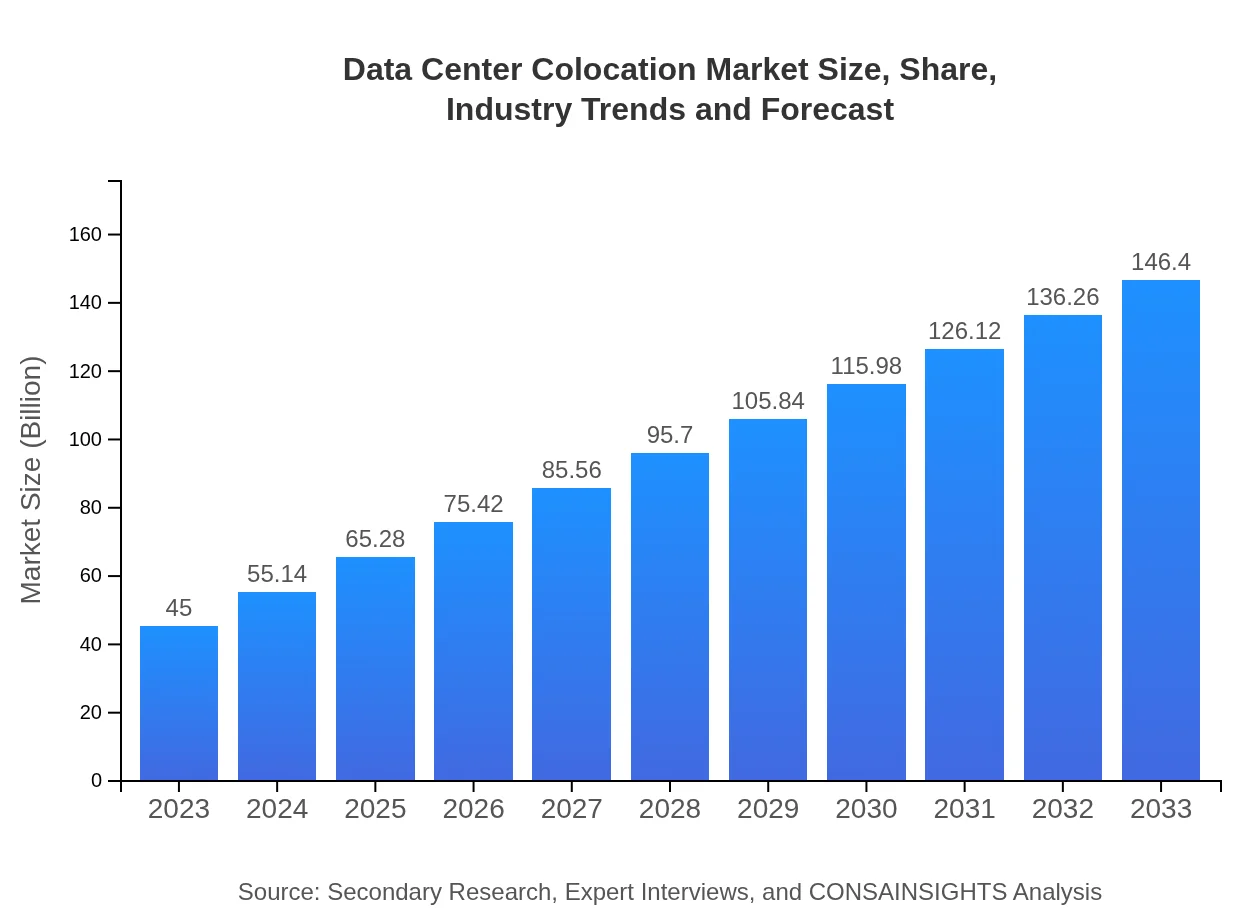

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $146.40 Billion |

| Top Companies | Equinix , Digital Realty, Cyxtera, CyrusOne |

| Last Modified Date | 31 January 2026 |

Data Center Colocation Market Overview

Customize Data Center Colocation Market Report market research report

- ✔ Get in-depth analysis of Data Center Colocation market size, growth, and forecasts.

- ✔ Understand Data Center Colocation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Data Center Colocation

What is the Market Size & CAGR of Data Center Colocation market in 2023?

Data Center Colocation Industry Analysis

Data Center Colocation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Data Center Colocation Market Analysis Report by Region

Europe Data Center Colocation Market Report:

Europe's market, estimated at USD 14.90 billion in 2023, is set to grow to USD 48.47 billion by 2033, boosted by an emphasis on energy efficiency, data protection regulations like GDPR, and an expanding fintech sector demanding secure storage solutions.Asia Pacific Data Center Colocation Market Report:

The Data Center Colocation market in Asia Pacific is projected to grow from USD 8.50 billion in 2023 to USD 27.65 billion by 2033. Factors driving this include rising internet penetration, mobile connectivity, and government initiatives promoting cloud adoption. Countries like China and India are significant contributors to this growth demand.North America Data Center Colocation Market Report:

North America dominates the global Data Center Colocation market, expected to escalate from USD 15.12 billion in 2023 to USD 49.19 billion by 2033, driven by the high concentration of data centers, advanced facility construction methods, and significant investments from technology companies.South America Data Center Colocation Market Report:

In South America, the colocation market shows promising signs, with a projected growth from USD 0.92 billion in 2023 to USD 2.99 billion by 2033. Increased IT spending and advancements in infrastructure will help facilitate a better colocation environment throughout the region.Middle East & Africa Data Center Colocation Market Report:

The Middle East and Africa market is likely to progress from USD 5.56 billion in 2023 to USD 18.09 billion by 2033, largely due to infrastructural investments and an increasing number of tech-savvy consumers in the region, enhancing data demands.Tell us your focus area and get a customized research report.

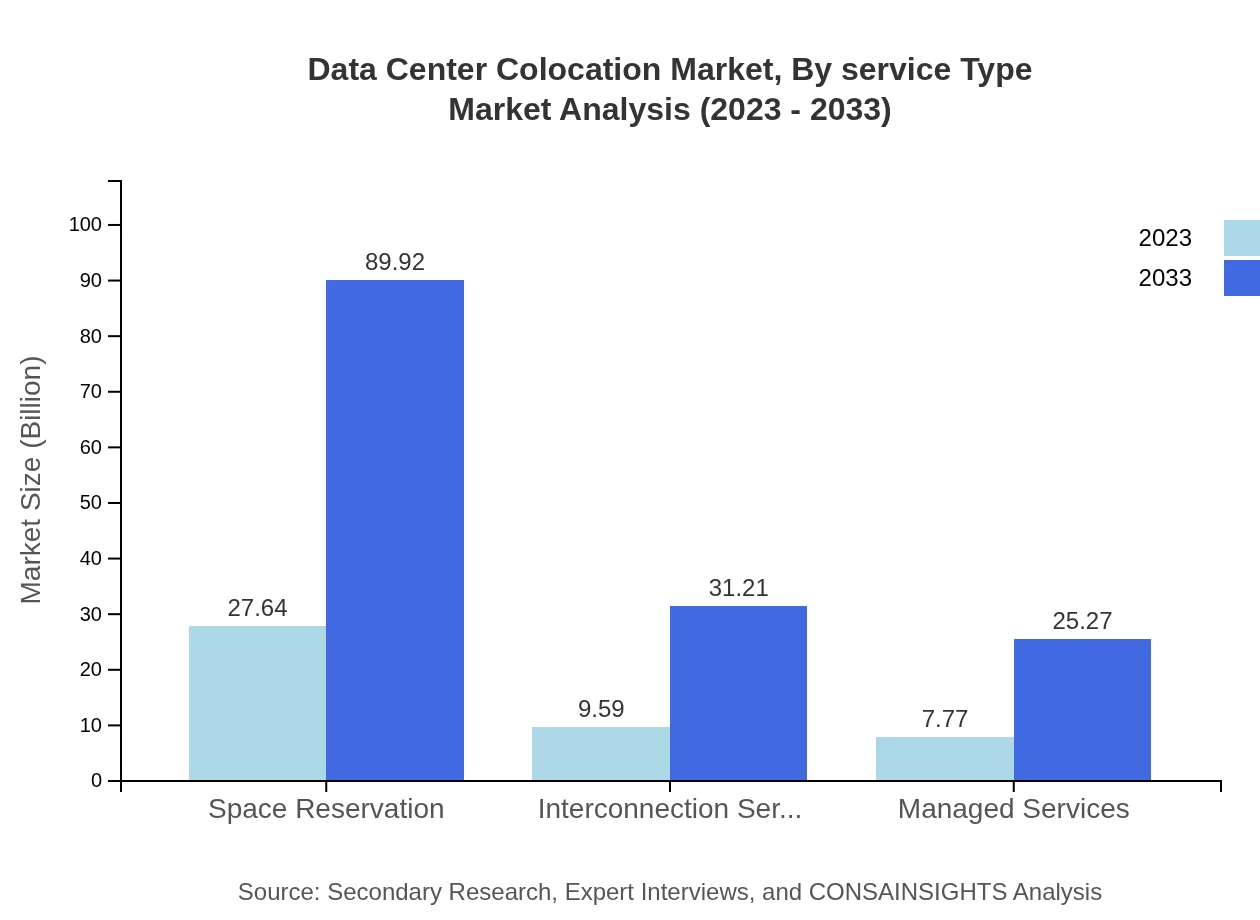

Data Center Colocation Market Analysis By Service Type

The service type segment comprises various offerings that play a critical role in the colocation market. Interconnection services are forecasted to grow from USD 9.59 billion in 2023 to USD 31.21 billion by 2033, capitalizing on the increasing need for direct connectivity. Managed services also show a growth potential, expanding from USD 7.77 billion to USD 25.27 billion over the same period, as companies prioritize optimizing their operations while outsourcing infrastructure management.

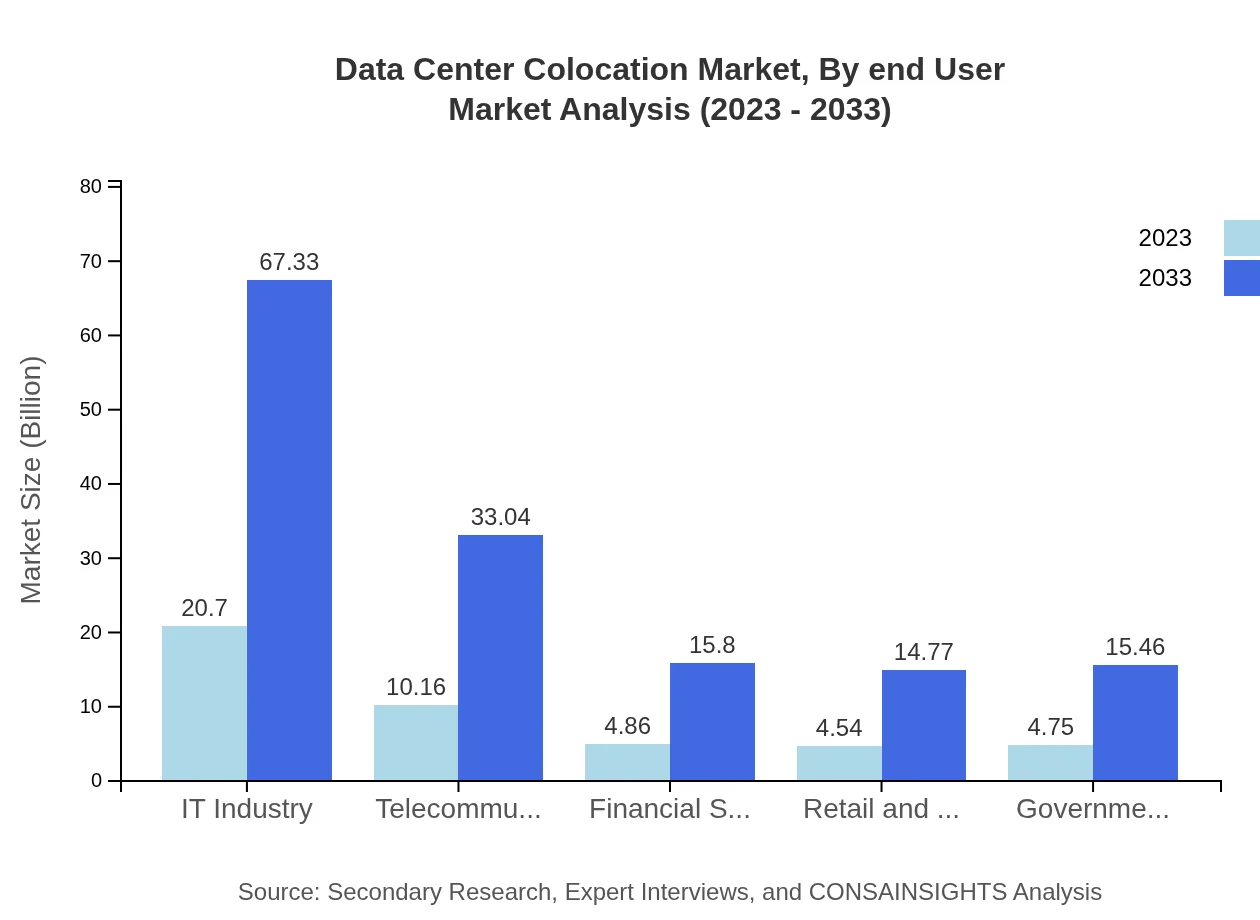

Data Center Colocation Market Analysis By End User

The end-user segment reveals substantial insights; the IT industry leads with an estimated market size of USD 20.70 billion in 2023, rising to USD 67.33 billion by 2033. Telecommunications follows, marking growth from USD 10.16 billion to USD 33.04 billion, driven largely by the use of colocation services to support extensive network functions. Financial services and healthcare are also significant end-users, emphasizing the need for effective data storage and processing due to compliance requirements.

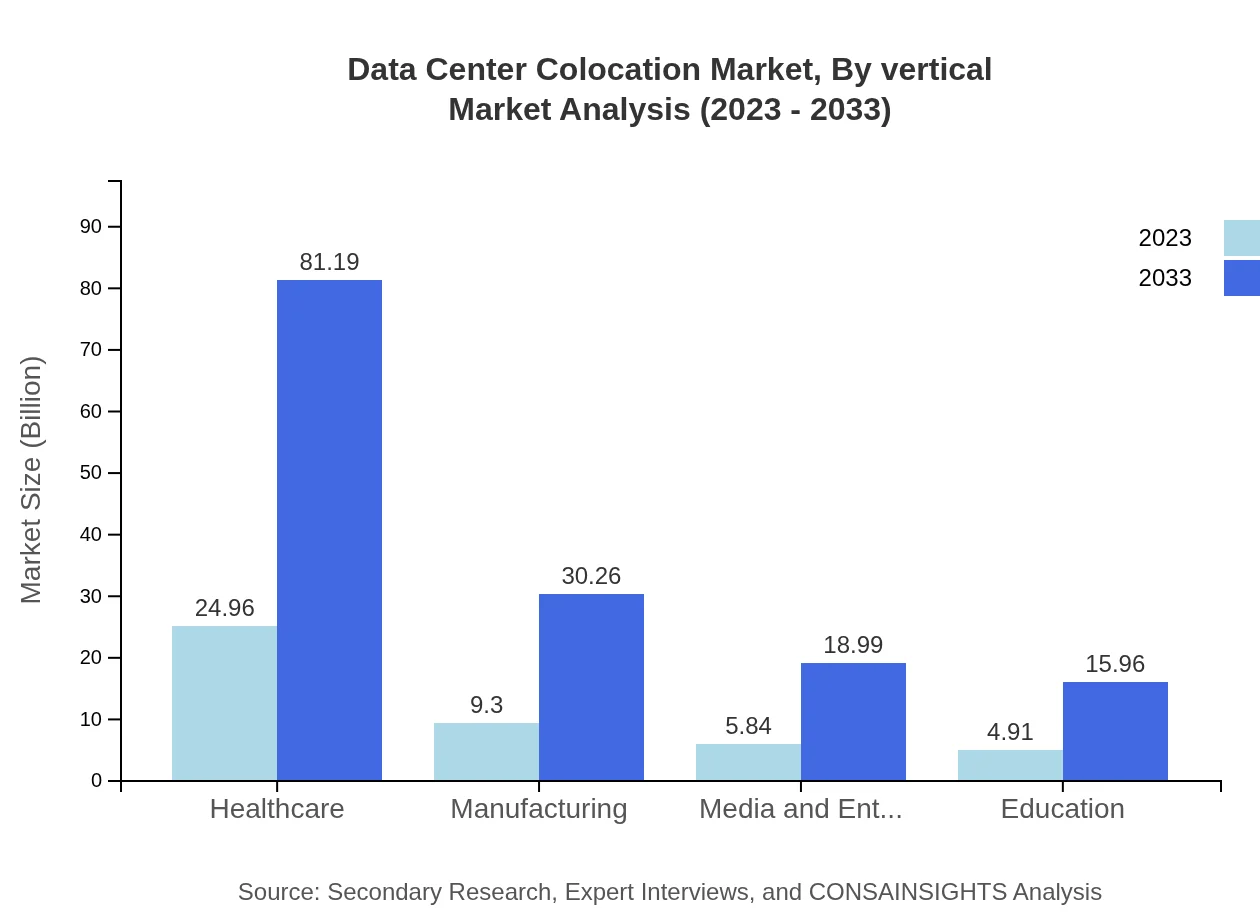

Data Center Colocation Market Analysis By Vertical

The vertical segment highlights critical areas with varying market shares; healthcare is the largest contributor with a market size of USD 24.96 billion in 2023, expanding towards USD 81.19 billion by 2033, influenced by the upsurge in telemedicine and electronic health records. Financial services continue to hold a notable market share of USD 4.86 billion today, projected to grow to USD 15.80 billion, necessitating stringent data management solutions.

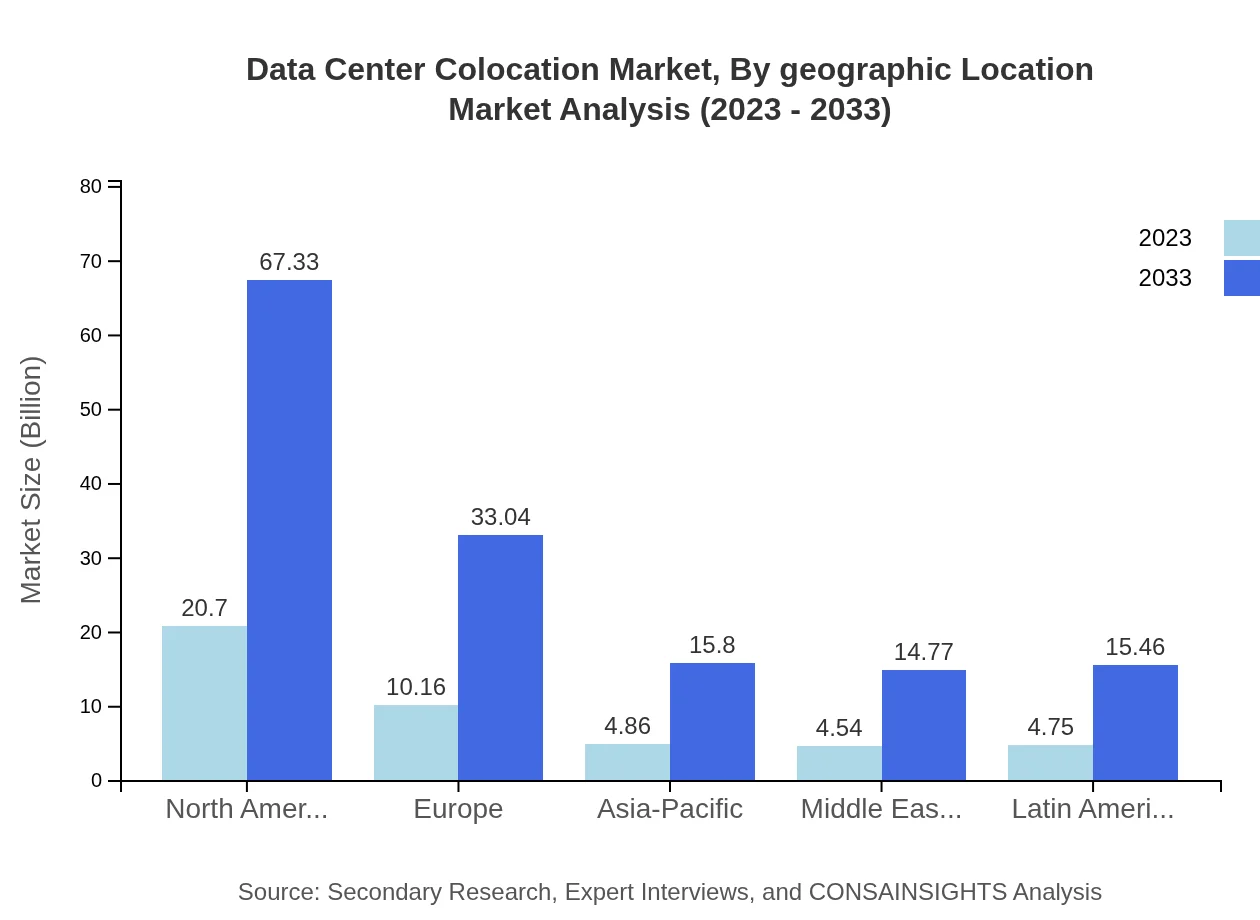

Data Center Colocation Market Analysis By Geographic Location

Geographically, the colocation market is experiencing varying growth trends; North America continues to maintain the largest share due to high investment and technological advancements. Following closely is Europe, which, while growing steadily, faces unique regulations around data. Emerging markets, particularly Asia-Pacific, are quickly catching up, driven by rising digital infrastructure and data generation needs.

Data Center Colocation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Data Center Colocation Industry

Equinix :

Equinix is a leading global interconnection and data center provider, connecting businesses and networks across the world with over 200 data centers.Digital Realty:

Digital Realty co-location solutions allow enterprises and service providers to access key markets and deploy globally across an extensive network of data centers.Cyxtera:

Cyxtera is a global leader in data center colocation offering security-rich, high-performance environments with flexible and scalable infrastructure solutions.CyrusOne:

CyrusOne provides premium, carrier-neutral data center services focused on high-performance and operational excellence.We're grateful to work with incredible clients.

FAQs

What is the market size of data Center Colocation?

The global data center colocation market is valued at approximately $45 billion in 2023, with a robust CAGR of 12% expected through 2033. This growth reflects increasing demand for cloud services and efficient data management.

What are the key market players or companies in this data Center Colocation industry?

Key players in the data center colocation market include major companies like Equinix, Digital Realty, NTT Communications, and CyrusOne, along with emerging firms that offer specialized services in cloud storage and data management.

What are the primary factors driving the growth in the data Center Colocation industry?

Growth drivers for the data center colocation industry include rising data traffic, increased internet penetration, the shift to cloud solutions, and regulatory compliance necessitating enhanced data storage and security options.

Which region is the fastest Growing in the data Center Colocation?

The Asia-Pacific region is the fastest-growing market for data center colocation, projected to expand from $8.50 billion in 2023 to $27.65 billion by 2033, driven by rapid urbanization and digital transformation initiatives.

Does ConsaInsights provide customized market report data for the data Center Colocation industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the data center colocation industry. Clients can get detailed insights that align with their strategic objectives and market dynamics.

What deliverables can I expect from this data Center Colocation market research project?

Deliverables for the data center colocation market research project may include comprehensive reports, market forecasts, competitor analysis, key trends, and tailored insights, all designed to assist strategic decision-making.

What are the market trends of data Center Colocation?

Current market trends in data center colocation include a focus on sustainability, increased adoption of edge computing, rising demand for interconnection services, and the implementation of advanced technologies for enhanced security and efficiency.