Wireless Sensors Market Report

Published Date: 31 January 2026 | Report Code: wireless-sensors

Wireless Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the wireless sensors market, highlighting the trends, forecasts, and growth opportunities from 2023 to 2033. Insights on industry dynamics, regional performance, and competitive landscape are included.

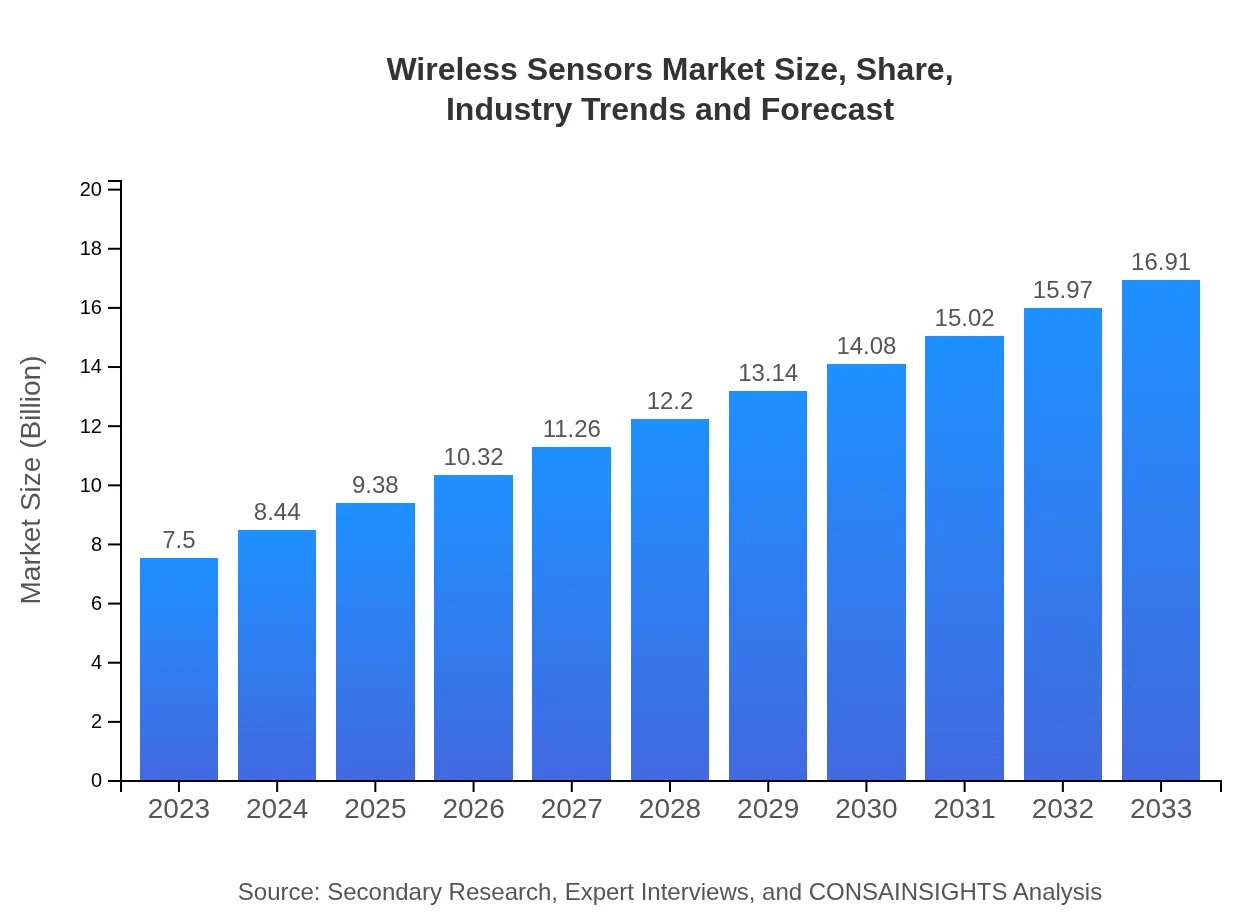

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $16.91 Billion |

| Top Companies | Honeywell International Inc., Texas Instruments, Siemens AG, Bosch Sensortec |

| Last Modified Date | 31 January 2026 |

Wireless Sensors Market Overview

Customize Wireless Sensors Market Report market research report

- ✔ Get in-depth analysis of Wireless Sensors market size, growth, and forecasts.

- ✔ Understand Wireless Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Wireless Sensors

What is the Market Size & CAGR of Wireless Sensors market in 2023?

Wireless Sensors Industry Analysis

Wireless Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Wireless Sensors Market Analysis Report by Region

Europe Wireless Sensors Market Report:

The European market is projected to rise from $2.12 billion in 2023 to $4.79 billion by 2033, representing a CAGR of 8.51%. Stricter environmental regulations and a push towards smart building technologies are significant contributors to this growth.Asia Pacific Wireless Sensors Market Report:

In the Asia Pacific region, the wireless sensors market is expected to grow from $1.44 billion in 2023 to $3.25 billion by 2033, at a CAGR of 8.71%. The growth is attributed to increasing industrialization, the rise of smart agriculture, and government initiatives promoting smart cities.North America Wireless Sensors Market Report:

North America leads the wireless sensors market, with a growth from $2.72 billion in 2023 to $6.14 billion by 2033, achieving a CAGR of 8.49%. Factors such as advanced technological infrastructure and a strong focus on industrial automation are key drivers.South America Wireless Sensors Market Report:

The South American market is anticipated to increase from $0.19 billion in 2023 to $0.44 billion by 2033, growing at a CAGR of 9.02%. The demand for environmental monitoring solutions is driving this growth, especially in agriculture and resource management.Middle East & Africa Wireless Sensors Market Report:

In the Middle East and Africa, the market is set to grow from $1.02 billion in 2023 to $2.29 billion by 2033, at a CAGR of 8.34%. The growth will be driven by increasing investments in infrastructure and smart technology deployment.Tell us your focus area and get a customized research report.

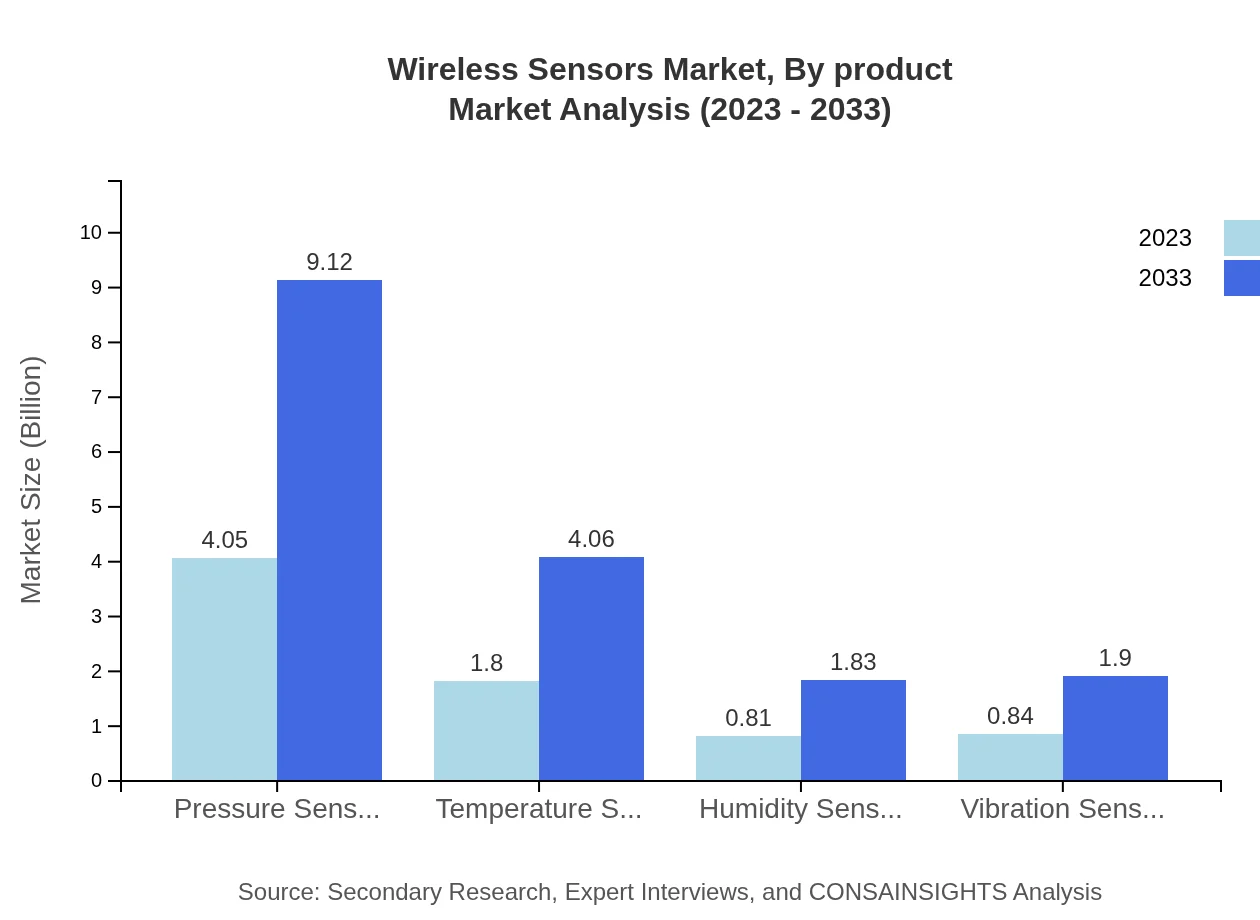

Wireless Sensors Market Analysis By Product

The wireless sensors market is dominated by pressure sensors, projected to grow from $4.05 billion in 2023 to $9.12 billion in 2033, maintaining a 53.95% market share throughout the period. Temperature sensors follow with a growth from $1.80 billion to $4.06 billion, holding a consistent 23.99%. Other significant sensors include humidity sensors and vibration sensors, which are expected to capitalize on the expanding industrial applications.

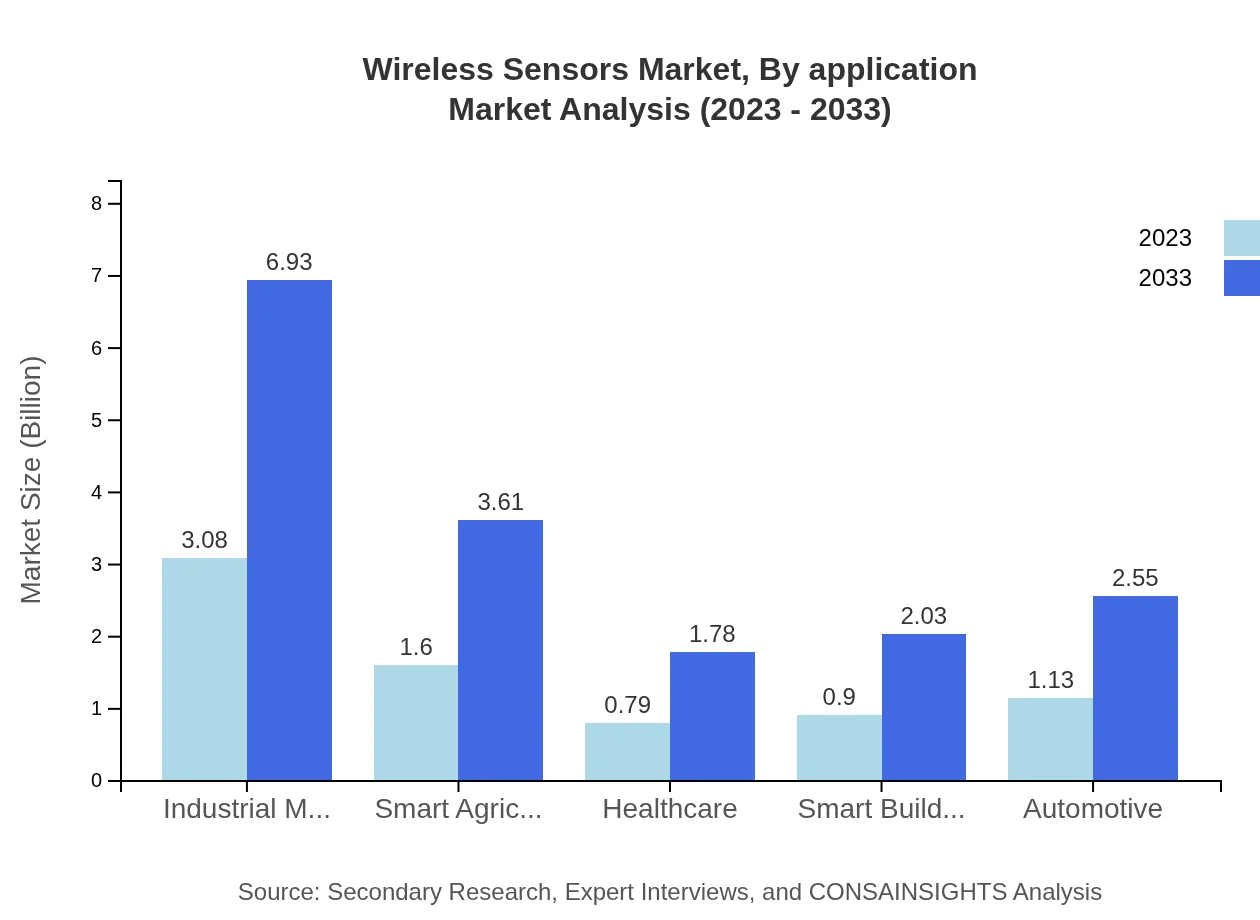

Wireless Sensors Market Analysis By Application

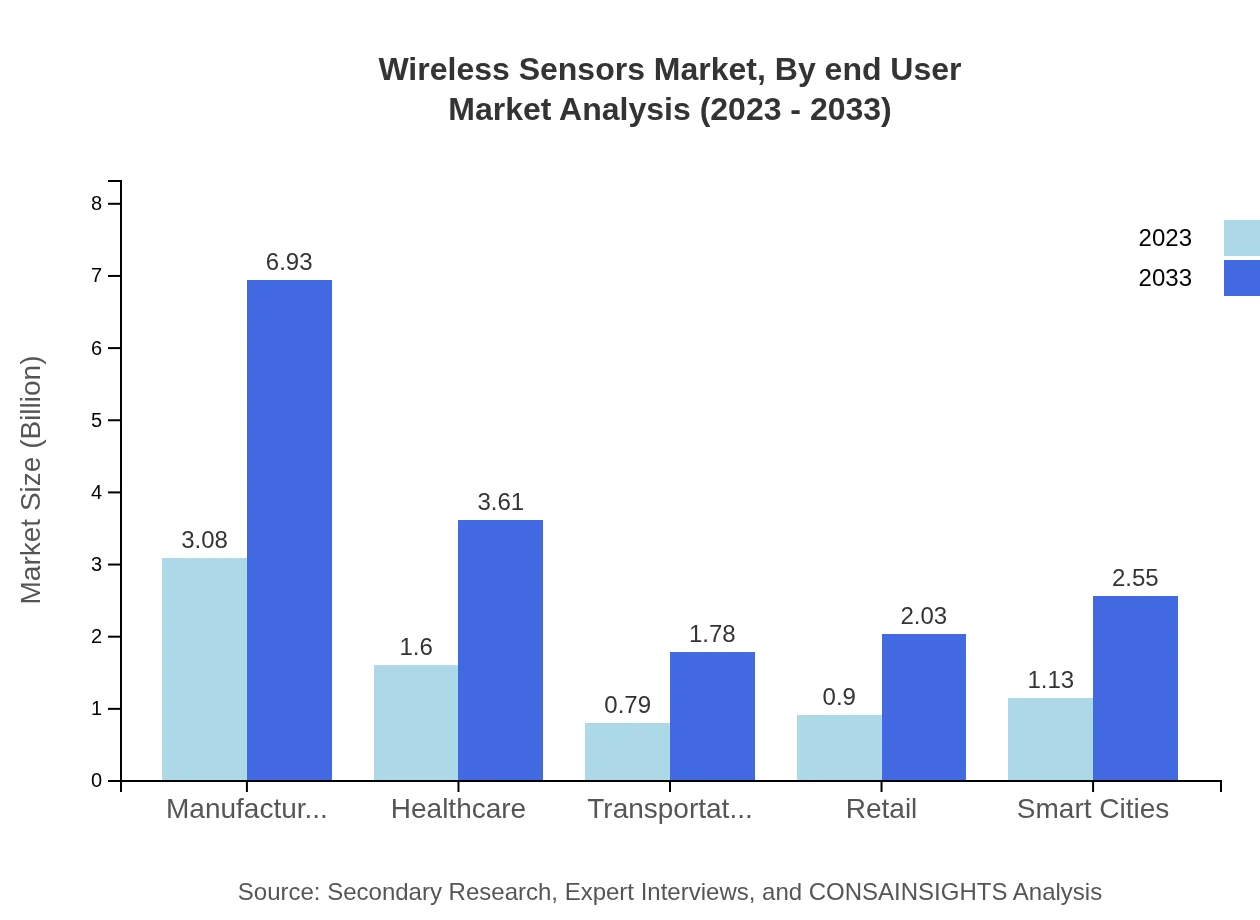

Manufacturing is the leading application segment, forecasted to grow from $3.08 billion in 2023 to $6.93 billion in 2033, retaining a 41.02% share. Healthcare is another critical sector, anticipated to rise from $1.60 billion to $3.61 billion, indicating the growing importance of real-time monitoring in patient care.

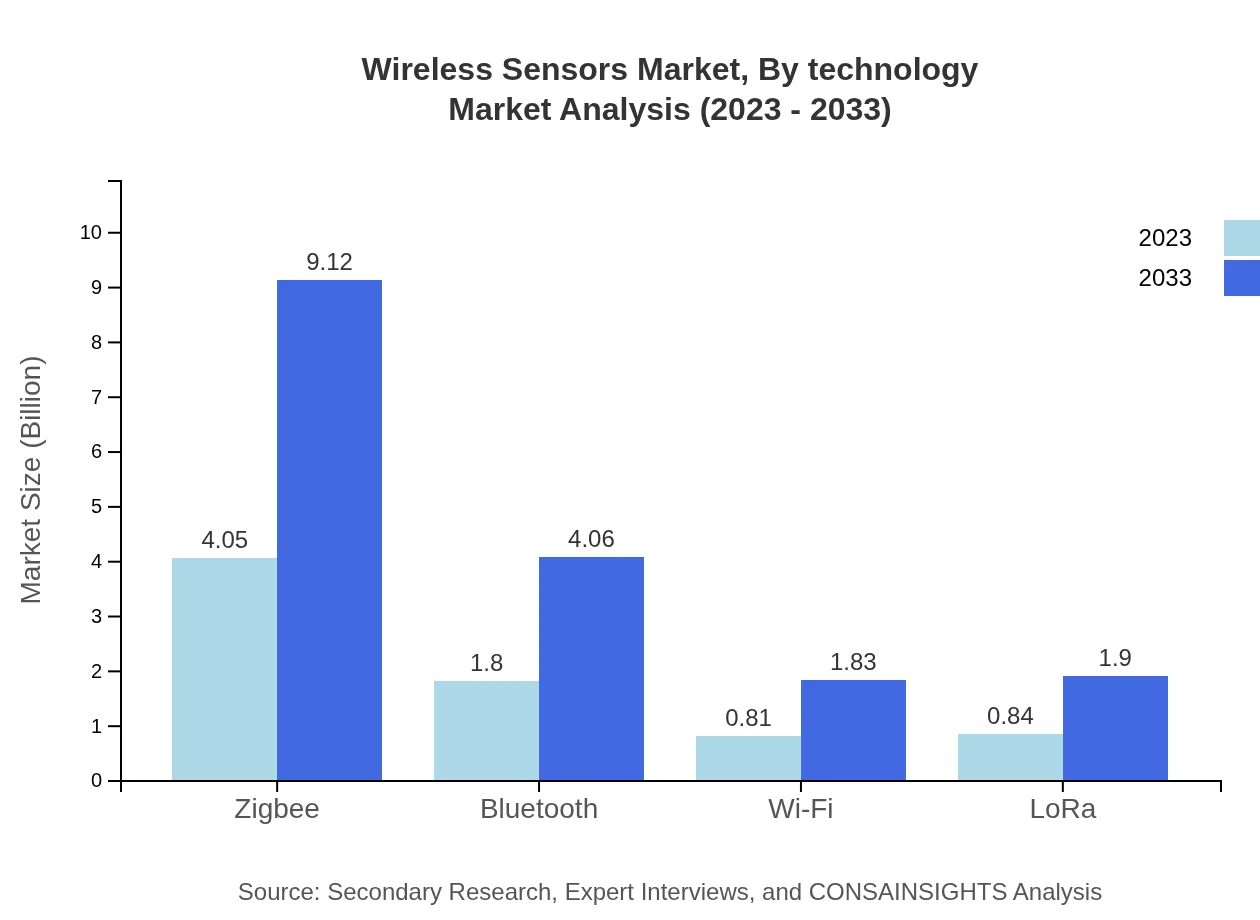

Wireless Sensors Market Analysis By Technology

Zigbee technology is leading the market, projected to grow from $4.05 billion in 2023 to $9.12 billion by 2033. Bluetooth technology follows, growing from $1.80 billion to $4.06 billion, showing its relevance in consumer electronics and smart applications.

Wireless Sensors Market Analysis By End User

Industrial monitoring remains the primary end-user industry, with an expected increase from $3.08 billion in 2023 to $6.93 billion by 2033, keeping a significant market share. Additionally, the smart agriculture segment is projected to grow from $1.60 billion to $3.61 billion, highlighting advancements in precision farming.

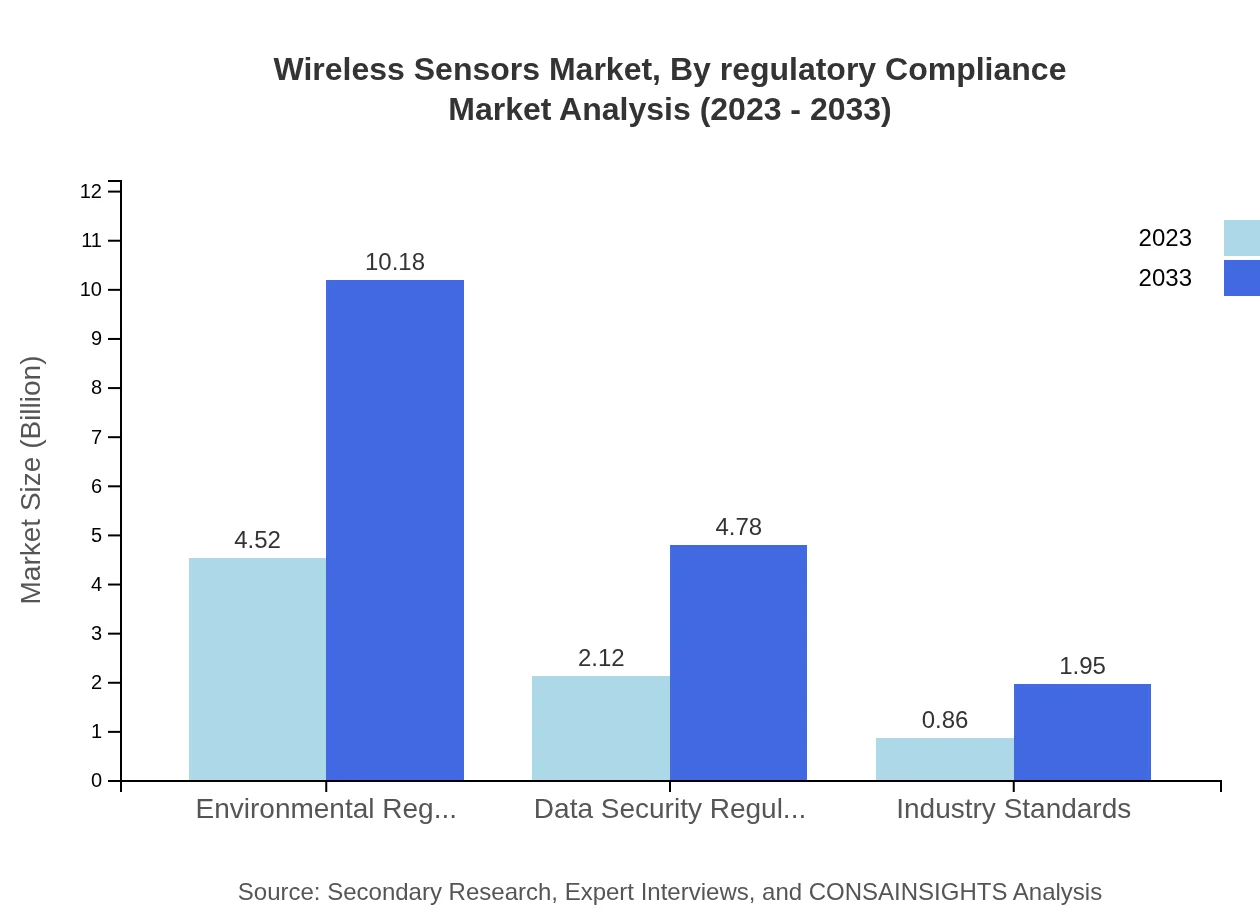

Wireless Sensors Market Analysis By Regulatory Compliance

Market growth is increasingly influenced by regulatory compliance requirements, particularly regarding environmental regulations which are projected to rise significantly. The market segment associated with environmental compliance is expected to grow from $4.52 billion to $10.18 billion by 2033, reflecting the increasing demand for compliance in various industries.

Wireless Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Wireless Sensors Industry

Honeywell International Inc.:

A global leader in aerospace and building technologies, Honeywell manufactures a range of sensors offering innovative solutions for enhanced operational efficiency.Texas Instruments:

Known for its expertise in semiconductor manufacturing, Texas Instruments provides advanced wireless sensors that power a variety of applications across multiple industries.Siemens AG:

Siemens provides cutting-edge wireless sensor solutions tailored for industrial automation, healthcare, and smart infrastructure advancements.Bosch Sensortec:

Part of the Bosch Group, Bosch Sensortec develops high-performance sensors aimed at Smartphones and IoT devices, facilitating seamless connectivity.We're grateful to work with incredible clients.

FAQs

What is the market size of wireless sensors?

The global wireless sensors market size is estimated at $7.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 8.2% through 2033, indicating robust growth driven by demand across various sectors.

What are the key market players or companies in this wireless sensors industry?

Key players in the wireless sensors industry include Honeywell, Siemens, Bosch, Texas Instruments, and Analog Devices. These companies are pivotal in driving innovation and market expansion through advanced sensing technologies.

What are the primary factors driving the growth in the wireless sensors industry?

Growth drivers include the increased demand for automation in industries, the rise of IoT applications, advancements in wireless technology, and the need for real-time data across various sectors such as healthcare and manufacturing.

Which region is the fastest Growing in the wireless sensors market?

The Asia Pacific region is poised to be the fastest-growing market for wireless sensors, expanding from $1.44 billion in 2023 to $3.25 billion by 2033, fueled by rapid industrialization and technological advancements.

Does ConsaInsights provide customized market report data for the wireless sensors industry?

Yes, ConsaInsights offers customized market research reports tailored to specific business needs within the wireless sensors industry, providing in-depth insights and data analysis to inform strategic decision-making.

What deliverables can I expect from this wireless sensors market research project?

Deliverables from the wireless sensors market research project include detailed market analysis, trend forecasts, competitive landscape assessments, and segmented data insights, equipping stakeholders with actionable intelligence.

What are the market trends of wireless sensors?

Market trends in wireless sensors highlight increased adoption of IoT solutions, growth in smart city initiatives, advancements in sensor technology, and heightened emphasis on data security regulations, shaping the future landscape.