Digital Twin In Finance

Published Date: 31 January 2026 | Report Code: digital-twin-in-finance

Digital Twin In Finance Market Size, Share, Industry Trends and Forecast to 2033

This report on Digital Twin In Finance provides a comprehensive snapshot of the market landscape from 2024 to 2033. It outlines key insights, forecasts, and detailed analyses of market size, technological advancements, product performance, and regional distinctions. Readers will gain valuable data-driven perspectives and strategic recommendations to navigate this emerging digital ecosystem.

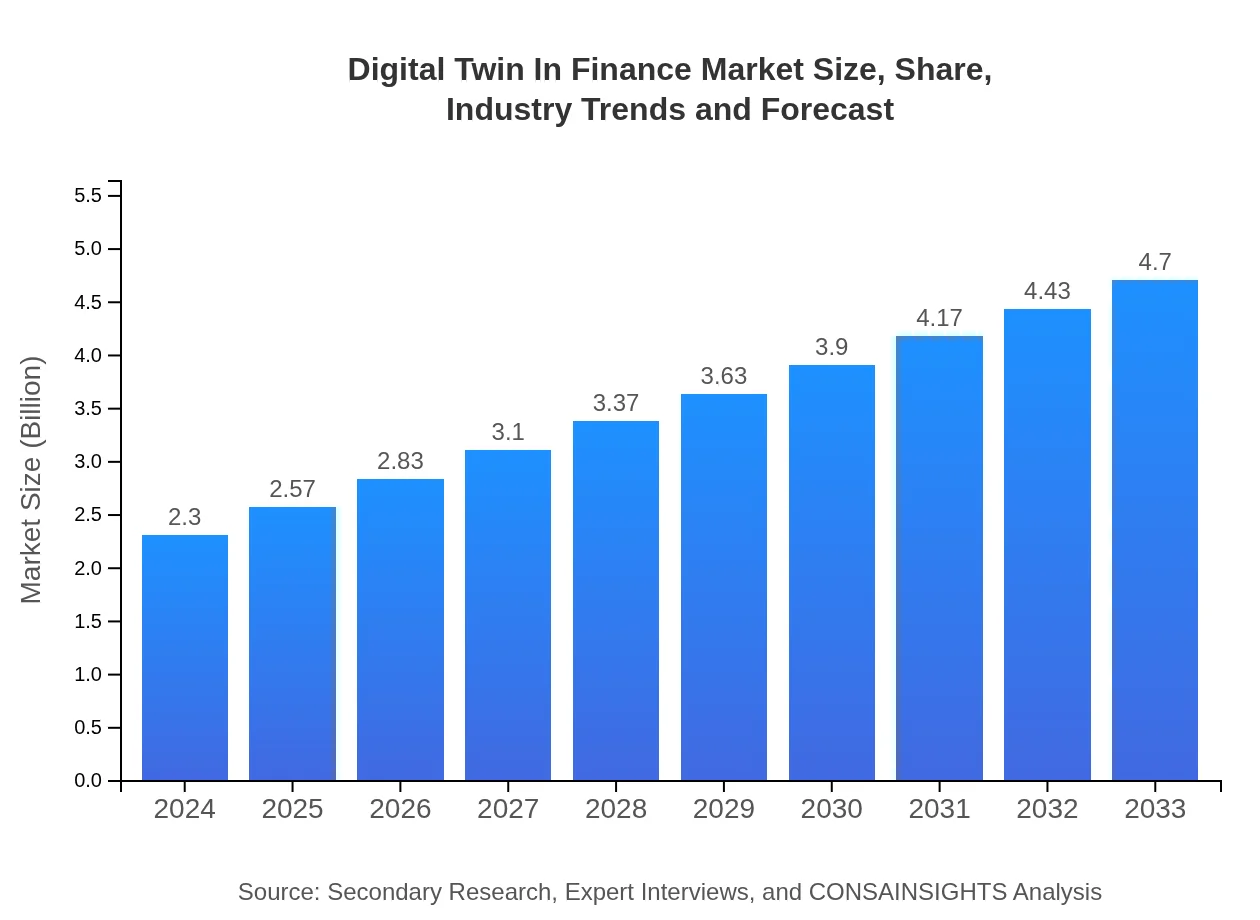

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.30 Billion |

| CAGR (2024-2033) | 8.0% |

| 2033 Market Size | $4.70 Billion |

| Top Companies | FinTech Innovators Inc., Digital Sim Solutions, TwinTech Financial, Secure Finance Dynamics |

| Last Modified Date | 31 January 2026 |

Digital Twin In Finance Market Overview

Customize Digital Twin In Finance market research report

- ✔ Get in-depth analysis of Digital Twin In Finance market size, growth, and forecasts.

- ✔ Understand Digital Twin In Finance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Digital Twin In Finance

What is the Market Size & CAGR of Digital Twin In Finance market in Year 2024?

Digital Twin In Finance Industry Analysis

Digital Twin In Finance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Digital Twin In Finance Market Analysis Report by Region

Europe Digital Twin In Finance:

Europe’s market demonstrates strong potential, advancing from 0.70 in 2024 to 1.43 by 2033. Progressive regulatory frameworks, innovation in fintech, and strategic investments in simulation tools drive growth, reinforcing digital twin technology as a centerpiece in modern financial services.Asia Pacific Digital Twin In Finance:

In the Asia Pacific region, digital twin adoption is gaining momentum with a market size forecast growing from 0.45 in 2024 to 0.92 by 2033. Factors include rapid digital transformation, government support for fintech innovation, and a strong emphasis on technology-led modernization across banking and insurance sectors.North America Digital Twin In Finance:

North America has emerged as a leader in the Digital Twin In Finance space, with market estimates rising from 0.78 in 2024 to 1.58 in 2033. The region benefits from a mature technological ecosystem, robust cybersecurity practices, and a high adoption rate of cloud computing and data-driven solutions.South America Digital Twin In Finance:

The South American market, reflecting a smaller yet significant footprint, is expected to expand from 0.20 in 2024 to 0.42 by 2033. Increased investments in digital infrastructure and a rising demand for advanced risk management solutions underpin market growth in this region.Middle East & Africa Digital Twin In Finance:

In the Middle East and Africa region, market growth is forecast to move from 0.17 in 2024 to 0.35 by 2033. Despite challenges such as varied digital infrastructure, increasing awareness, and targeted governmental initiatives promise gradual but steady adoption of digital twin solutions.Tell us your focus area and get a customized research report.

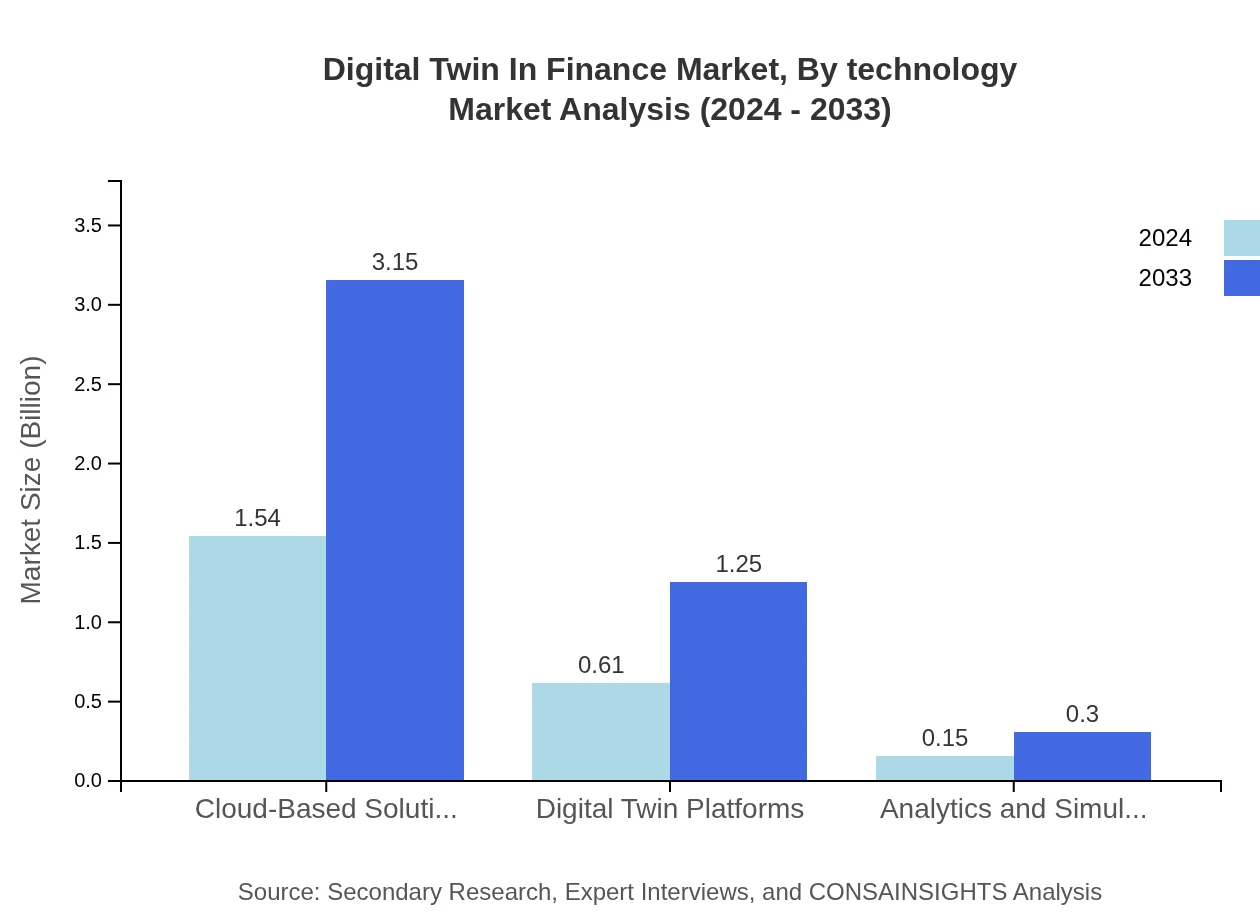

Digital Twin In Finance Market Analysis By Technology

The technology segment in the Digital Twin In Finance market is driven by innovations in cloud computing, big data analytics, and digital simulation. Financial institutions are increasingly relying on cloud-based solutions to enable scalable and flexible digital twin implementations. These technologies provide real-time insights and advanced predictive analytics, which are critical for risk assessment and decision-making. Additionally, digital twin platforms are evolving to support complex financial models, integrating simulation tools that enhance operational accuracy. Industry players are investing substantially in R&D to develop proprietary technologies that reduce implementation time and improve integration capabilities with existing legacy systems.

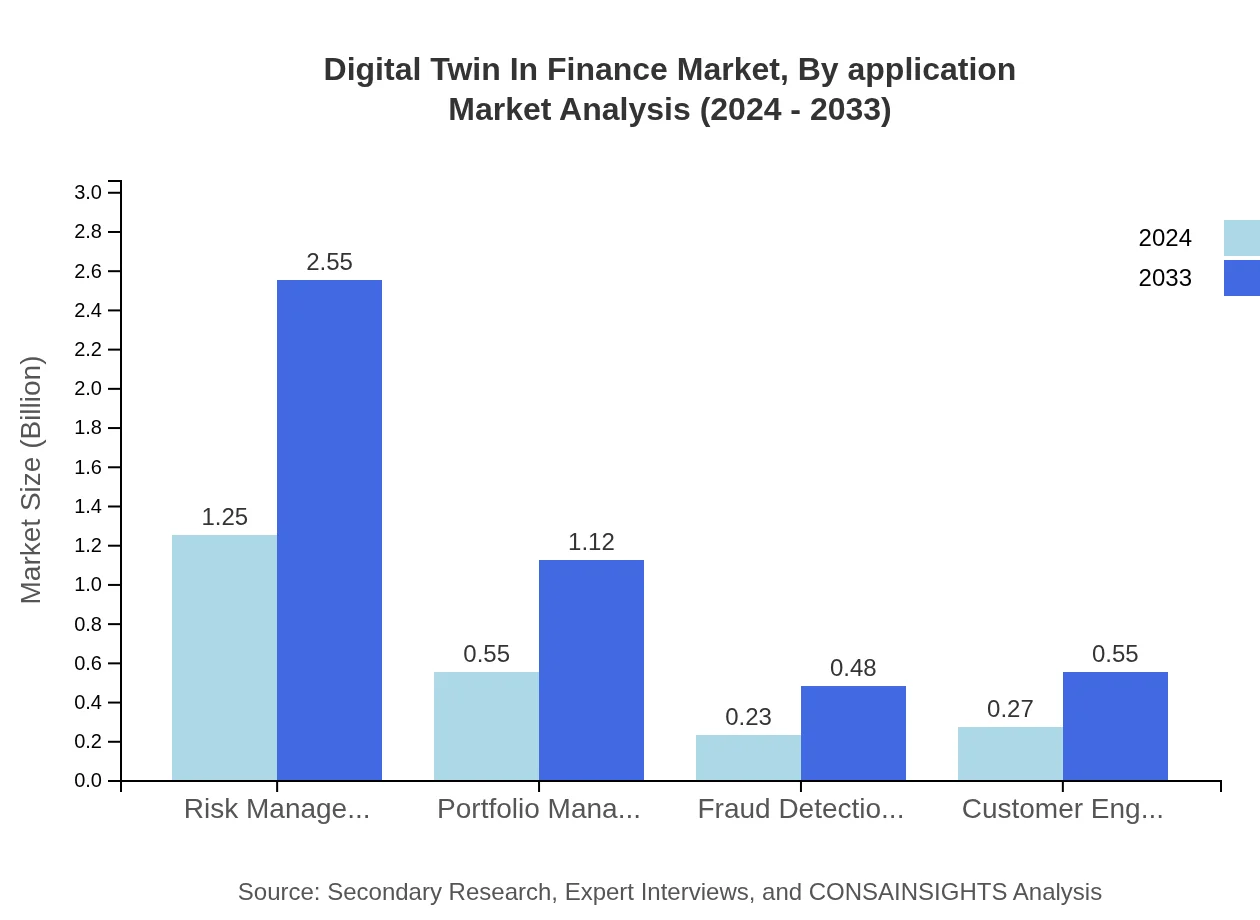

Digital Twin In Finance Market Analysis By Application

In the application segment, digital twin technology is applied across several key financial domains including portfolio management, fraud detection, and risk management. Banks and insurance companies use these applications to simulate market scenarios, optimize asset allocation, and enhance customer service. Advanced analytics and simulation tools enable financial firms to predict market fluctuations more accurately, allowing for informed decision-making. The growing complexity of financial products necessitates tailored solutions that are both dynamic and secure. Such applications are instrumental in reducing operational risks while providing a competitive edge. As customer expectations evolve, the emphasis on personalized financial services further drives application-specific innovations.

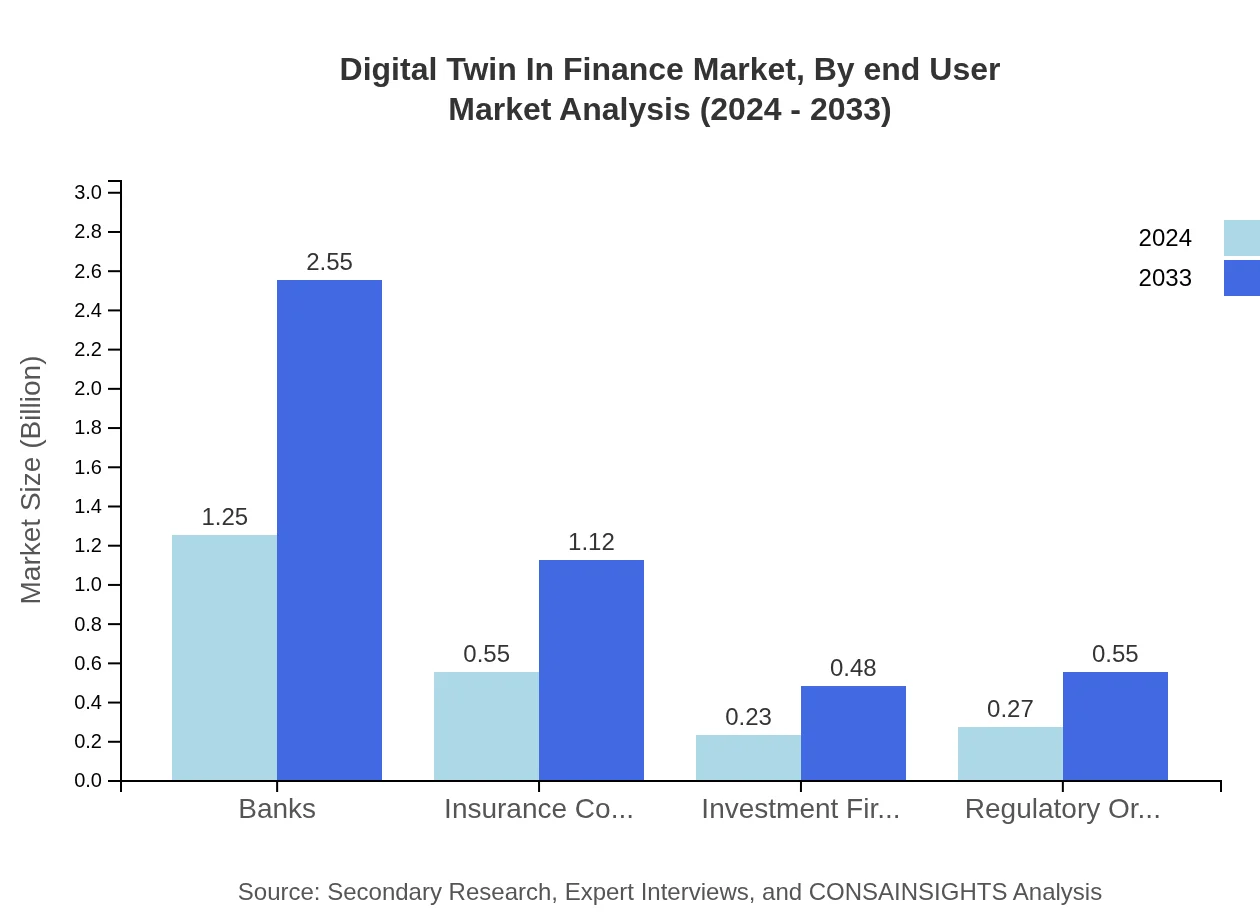

Digital Twin In Finance Market Analysis By End User

End-users of digital twin technology in finance span across banks, insurance companies, investment firms, and regulatory agencies. Each end-user segment benefits uniquely from the detailed simulation capabilities and real-time data analytics offered by digital twins. For instance, banks leverage these tools to optimize asset management and enhance fraud prevention measures, while investment firms use them for predictive portfolio analysis. Regulatory organizations find value in improved oversight and compliance monitoring. The growing adoption across these varying end-user categories underscores the flexibility and scalability of digital twin solutions, ensuring that the technology meets the specific needs of diverse financial stakeholders.

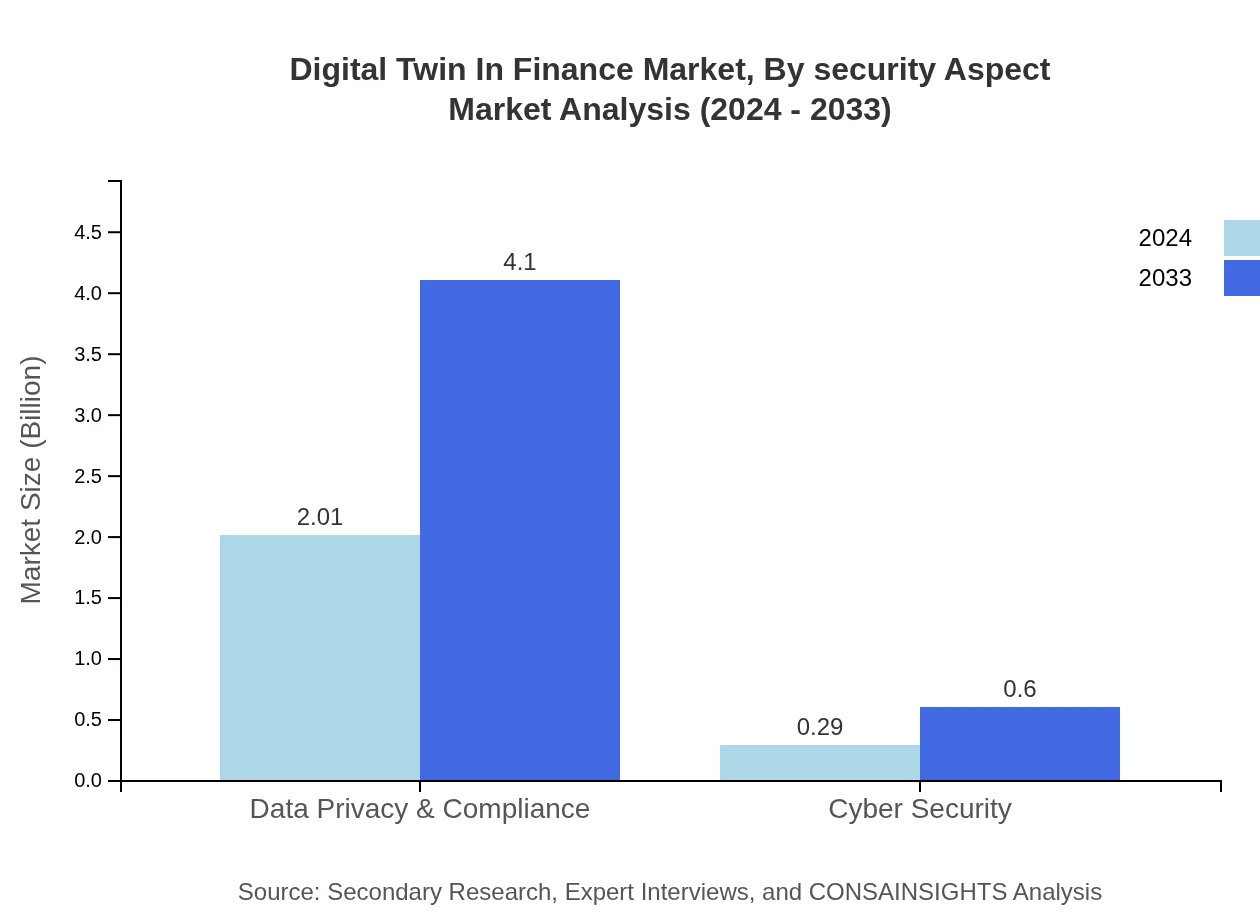

Digital Twin In Finance Market Analysis By Security Aspect

Security remains a paramount concern within the Digital Twin In Finance market. This segment focuses on ensuring robust cybersecurity frameworks, data privacy measures, and compliance with international regulations. Banks and financial institutions are implementing advanced security protocols to protect sensitive data as they integrate digital twin solutions. Fraud detection and prevention systems are continuously evolving to counteract emerging cyber threats, while data privacy initiatives ensure consumer trust and regulatory adherence. By investing in innovative security technologies, market players safeguard critical financial operations, enabling a secure digital ecosystem that supports both innovation and operational resilience.

Digital Twin In Finance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Digital Twin In Finance Industry

FinTech Innovators Inc.:

A leader in integrating digital twin technology with financial services, FinTech Innovators Inc. has developed advanced simulation tools and cloud-based analytics that support risk management and operational efficiency across global markets.Digital Sim Solutions:

Specializing in digital twin platforms and cybersecurity, Digital Sim Solutions offers cutting-edge simulation software that enhances fraud detection, data privacy compliance, and real-time decision-making in finance.TwinTech Financial:

TwinTech Financial excels in delivering comprehensive digital twin applications tailored for portfolio management and investment analysis, driving digital transformation for banks and insurance companies worldwide.Secure Finance Dynamics:

Focused on cybersecurity and risk management, Secure Finance Dynamics leverages innovative digital twin strategies to provide secure, efficient, and reliable financial solutions, ensuring regulatory compliance and high operational integrity.We're grateful to work with incredible clients.

FAQs

How can the Digital Twin in Finance Report help align our marketing strategy with customer adoption trends?

The Digital Twin in Finance Report provides insights into customer preferences and adoption trends, enabling tailored marketing strategies. The current market size is $2.3 billion with a CAGR of 8.0%, highlighting the need for timely responses to market changes and consumer expectations.

What product features are in highest demand according to the Digital Twin in Finance trends?

The demand is rising for cloud-based solutions and risk management tools, accounting for 67.11% and 54.25% market share respectively by 2024. These features facilitate enhanced customer engagement, fraud detection, and analytics, significantly benefiting users in finance.

Which regions offer the best market entry and expansion opportunities in the Digital Twin in Finance industry?

North America leads with a market size of $0.78 billion in 2024, growing to $1.58 billion by 2033. Europe, Asia Pacific, Latin America, and MEA also display promising prospects, especially given their projected sustained growth throughout the decade.

What emerging technologies and innovations are shaping the Digital Twin in Finance market?

Cloud computing and AI-driven analytics are pivotal in shaping the Digital Twin in Finance market. The integration of these technologies enhances risk management and customer personalization, facilitating innovative solutions as adoption widens in financial services.

Does the Digital Twin in Finance Report include competitive landscape and market share analysis?

Yes, the report covers the competitive landscape thoroughly, showcasing market shares such as 67.11% for cloud-based solutions and 54.25% for risk management in the segment analysis, crucial for strategic positioning against competitors.

How can executives use the Digital Twin in Finance Report to evaluate investment risks and ROI?

Executives can assess market size of $2.3 billion and projected CAGR of 8.0% to gauge potential ROI. Analyzing segments like data privacy with an 87.18% market share helps identify secure investment opportunities in rapidly growing areas.

What is the market size of digital Twin In Finance?

The Digital Twin in Finance market is valued at $2.3 billion in 2024, poised for growth with an 8.0% CAGR, suggesting lucrative opportunities as the financial sector increasingly adopts these innovative technologies.

What are the projected market sizes for the Digital Twin in Finance by region from 2024 to 2033?

Projected market sizes by region include North America: $0.78B (2024) to $1.58B (2033), Europe: $0.70B to $1.43B, Asia Pacific: $0.45B to $0.92B, Latin America: $0.20B to $0.42B, and MEA: $0.17B to $0.35B.

What segments are contributing to the Digital Twin in Finance market's growth?

Key segments include Banks ($1.25B in 2024, 54.25% share) and Cloud-Based Solutions ($1.54B and 67.11% share). Insurance and investment firms also contribute significantly, driving overall market development in diverse financial operations.