Disposable Medical Sensors Market Report

Published Date: 31 January 2026 | Report Code: disposable-medical-sensors

Disposable Medical Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Disposable Medical Sensors market, highlighting insights on market size, trends, and forecasts from 2023 to 2033. It examines regional dynamics, technological advancements, segment performance, and key market players, offering valuable data for stakeholders across the healthcare sector.

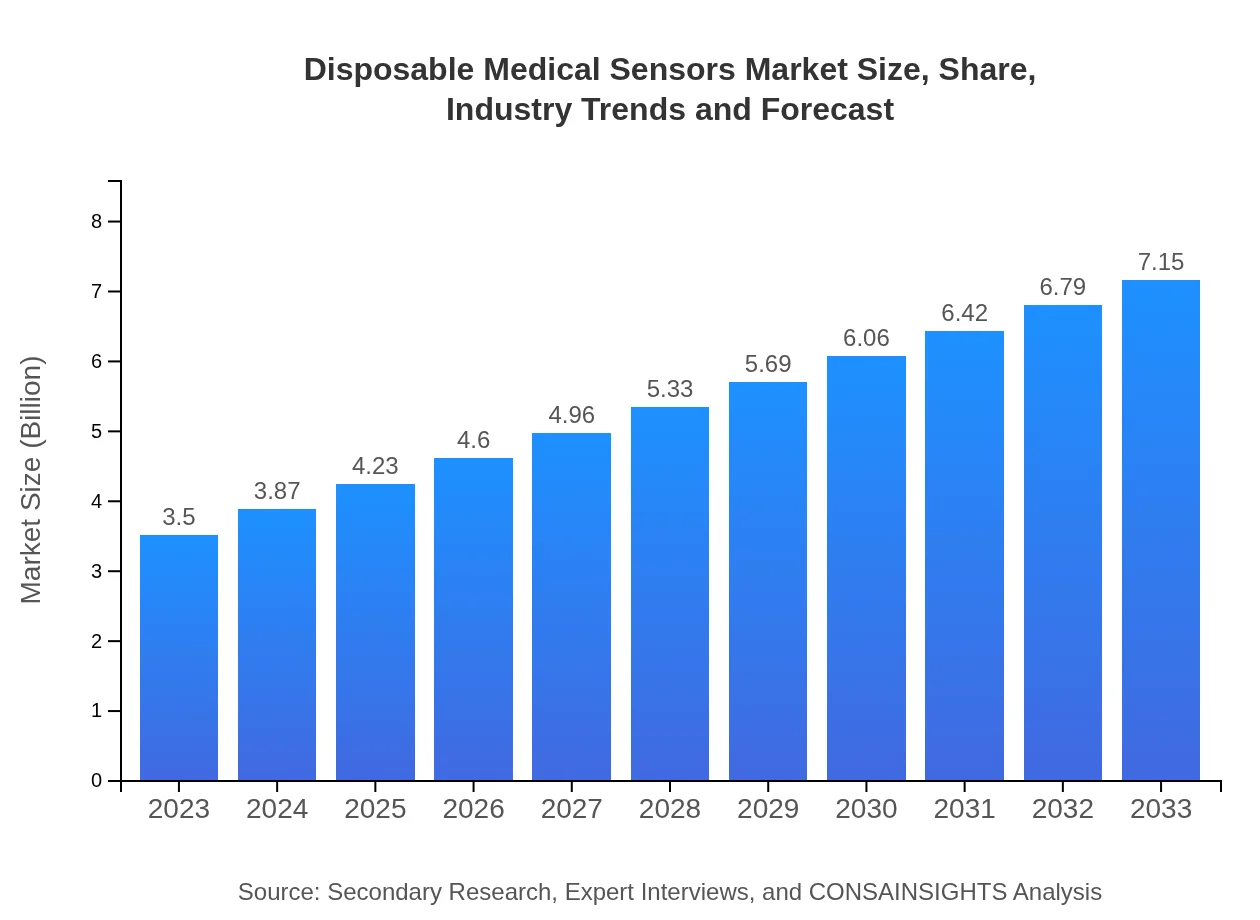

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | Medtronic , Abbott Laboratories, Roche Diagnostics, Philips Healthcare, Honeywell |

| Last Modified Date | 31 January 2026 |

Disposable Medical Sensors Market Overview

Customize Disposable Medical Sensors Market Report market research report

- ✔ Get in-depth analysis of Disposable Medical Sensors market size, growth, and forecasts.

- ✔ Understand Disposable Medical Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Disposable Medical Sensors

What is the Market Size & CAGR of Disposable Medical Sensors market in 2023 and 2033?

Disposable Medical Sensors Industry Analysis

Disposable Medical Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Disposable Medical Sensors Market Analysis Report by Region

Europe Disposable Medical Sensors Market Report:

Europe's market is estimated to reach $1.03 billion in 2023 and is expected to grow to $2.11 billion by 2033. This growth trajectory is largely influenced by stringent regulations pertaining to patient safety and hygiene, along with a well-established medical device market seeking disposable solutions.Asia Pacific Disposable Medical Sensors Market Report:

In the Asia Pacific region, the Disposable Medical Sensors market is estimated to be $0.64 billion in 2023 and is projected to grow to $1.31 billion by 2033. The growth is driven by increasing healthcare infrastructure investments and a rising aging population needing advanced healthcare solutions, alongside a shift toward disposable technologies.North America Disposable Medical Sensors Market Report:

The North American market for Disposable Medical Sensors is projected to grow from $1.32 billion in 2023 to $2.71 billion by 2033. This region leads in technological adoption and innovation, supported by high healthcare expenditure and a robust healthcare system emphasizing patient safety and infection control.South America Disposable Medical Sensors Market Report:

South America presents a developing market for Disposable Medical Sensors, with the market valued at $0.17 billion in 2023, anticipated to increase to $0.36 billion by 2033. The expansion is encouraged by rising government healthcare initiatives and improvements in medical accessibility across the region.Middle East & Africa Disposable Medical Sensors Market Report:

In the Middle East and Africa, the market for Disposable Medical Sensors is valued at $0.32 billion in 2023 and is projected to reach $0.66 billion by 2033. The region is witnessing improvements in healthcare access and investment in healthcare technology, driving demand for single-use medical sensors.Tell us your focus area and get a customized research report.

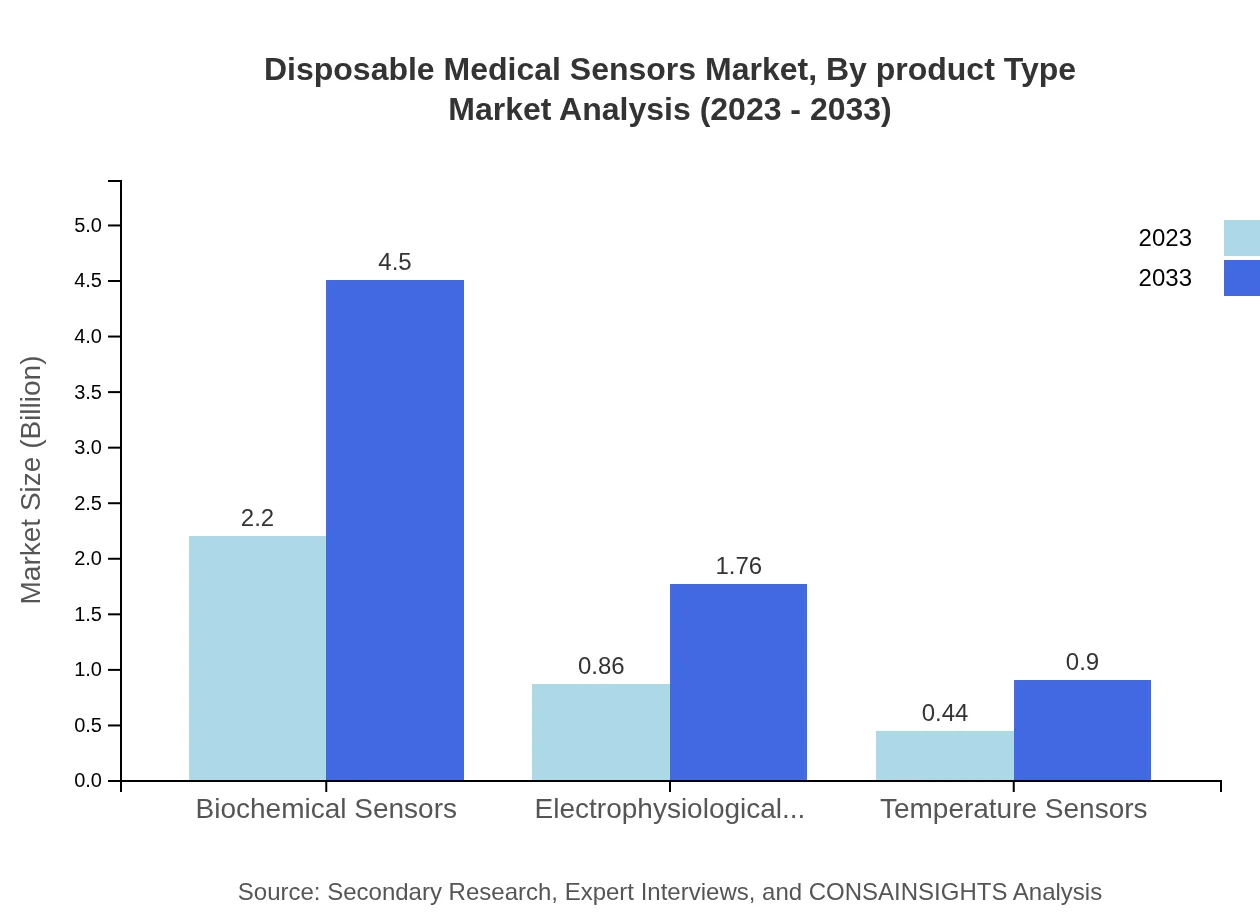

Disposable Medical Sensors Market Analysis By Product Type

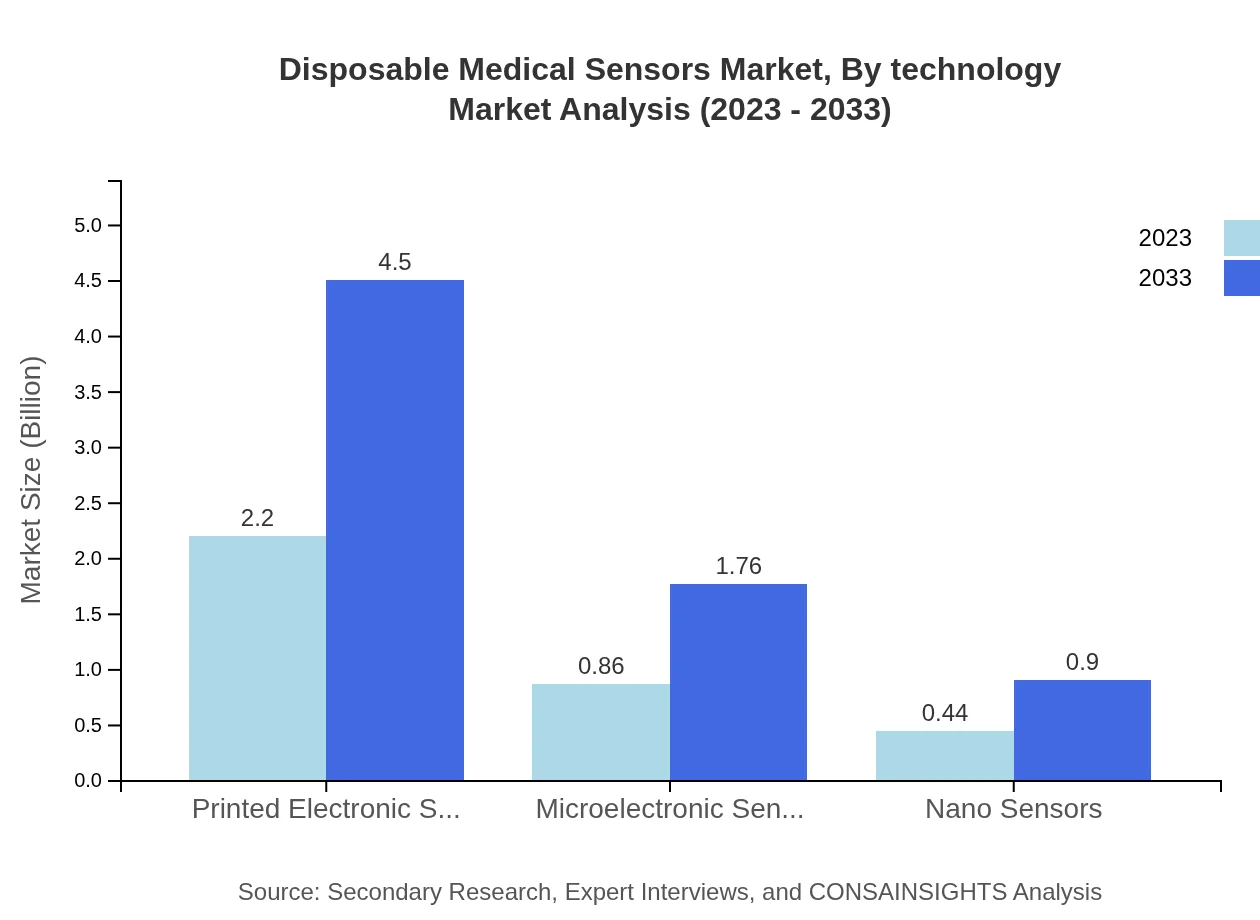

The market for Disposable Medical Sensors by product type reflects varied growth patterns. Printed Electronic Sensors dominate the market with a size of $2.20 billion in 2023, expecting to grow to $4.50 billion by 2033, accounting for approximately 62.83% of the market share. Microelectronic Sensors and Nano Sensors also show considerable growth, with market sizes expected to increase to $1.76 billion and $0.90 billion, respectively, by 2033.

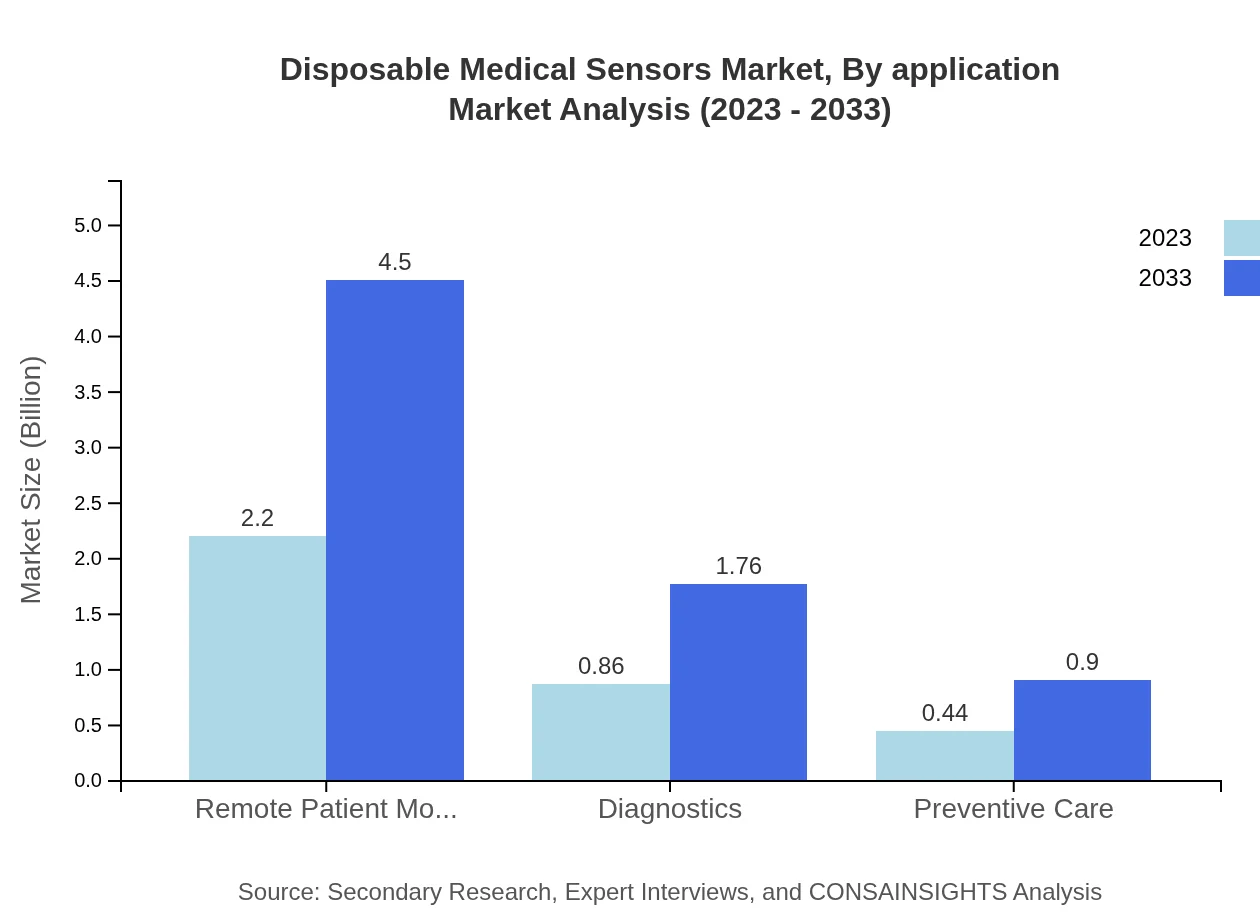

Disposable Medical Sensors Market Analysis By Application

In terms of application, the Diagnostics segment holds a significant market, projected to grow from $0.86 billion in 2023 to $1.76 billion by 2033. Preventive Care and Remote Patient Monitoring are also critical segments that continue to gain traction, showcasing the versatility of disposable sensors across different healthcare scenarios.

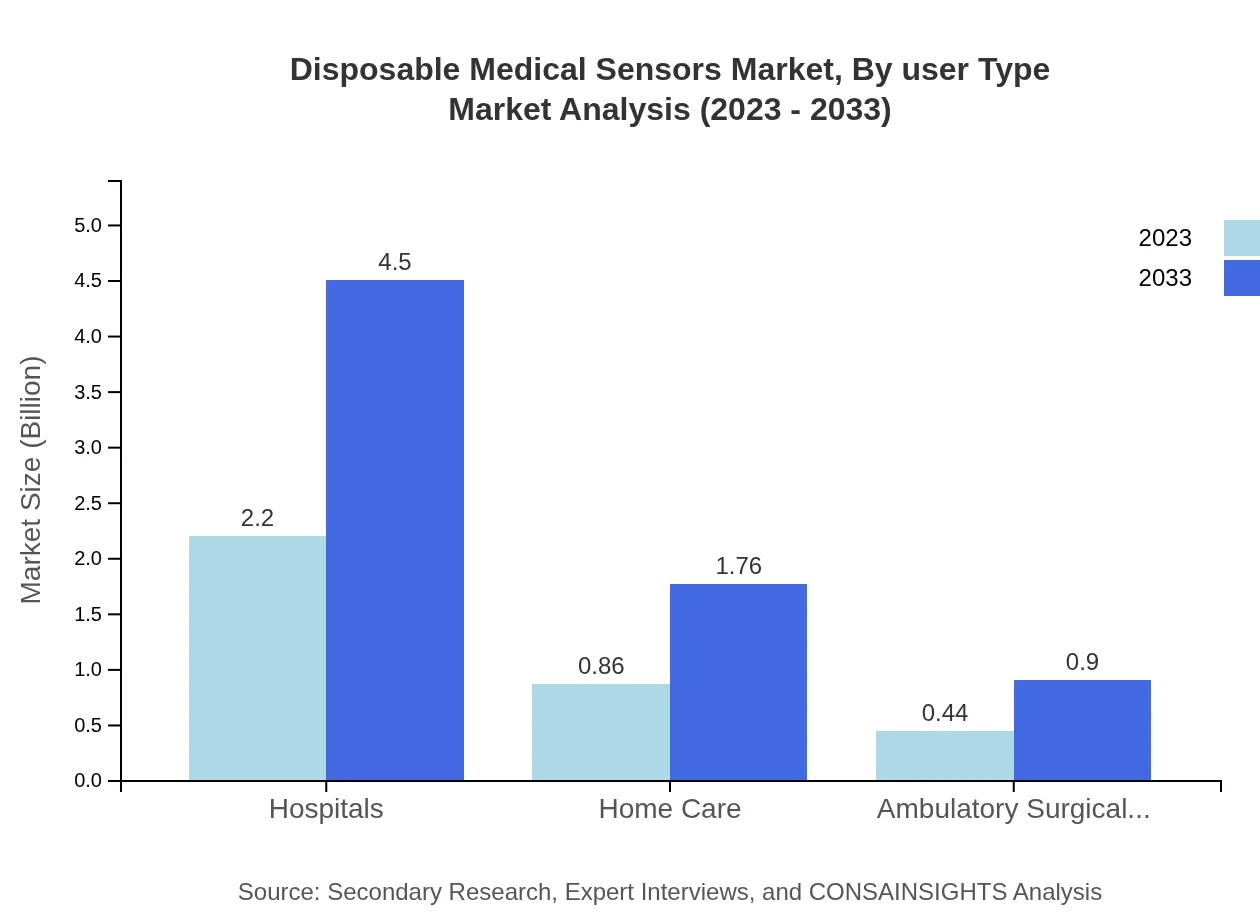

Disposable Medical Sensors Market Analysis By User Type

Hospitals are the largest user segment, currently holding a market size of $2.20 billion, expected to rise to $4.50 billion by 2033, capturing 62.83% market share. Home care providers follow with substantial growth potential, underscoring the shift towards more personalized healthcare solutions.

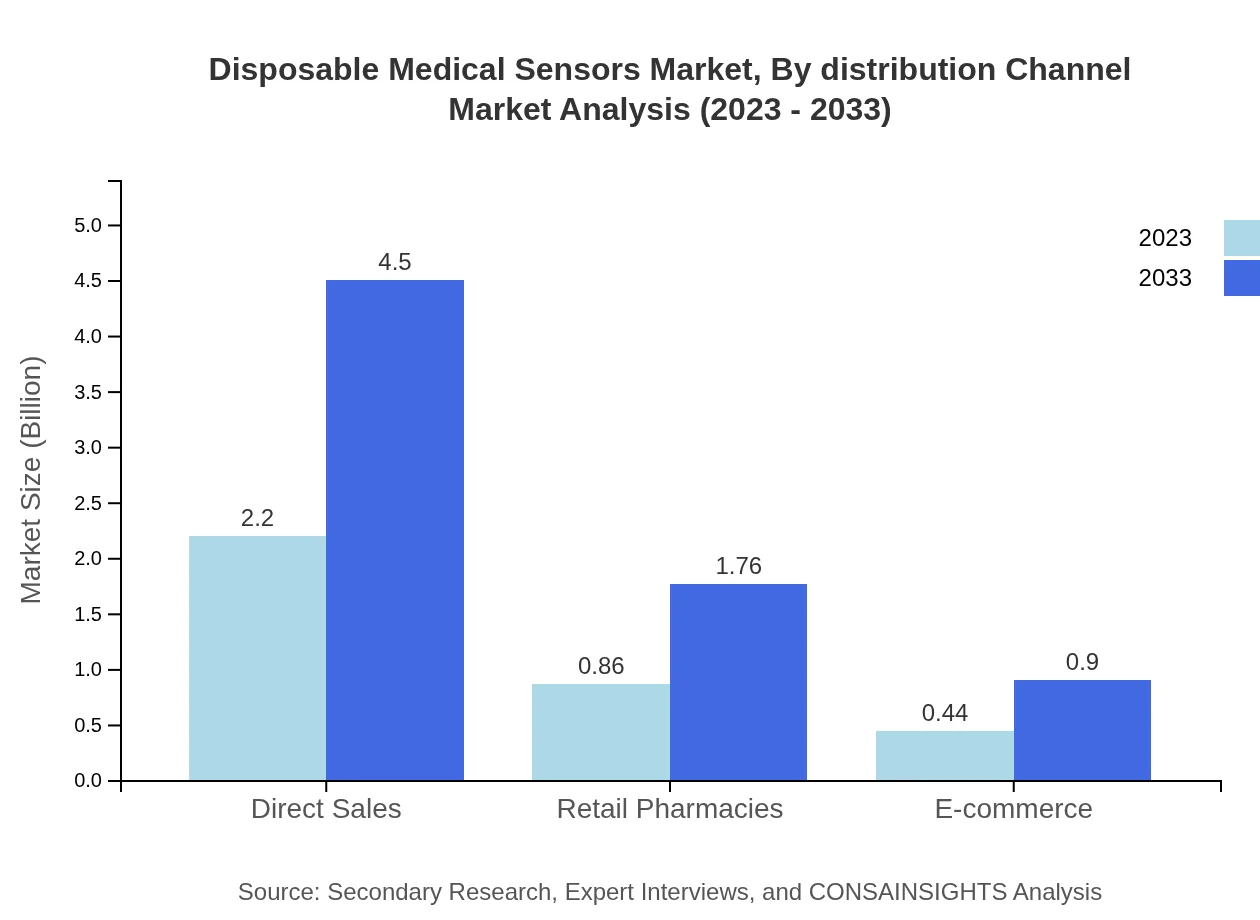

Disposable Medical Sensors Market Analysis By Distribution Channel

Direct sales continue to lead as the primary distribution channel, currently valued at $2.20 billion with expectations to reach $4.50 billion by 2033. E-commerce and retail pharmacies are also growing distribution channels, reflecting the changing dynamics of how healthcare products are accessed by consumers.

Disposable Medical Sensors Market Analysis By Technology

Technological advancements significantly impact the Disposable Medical Sensors market. Emerging technologies in sensor design and connectivity, such as IoT-enabled devices, enhance remote monitoring capabilities and data analytics in clinical settings, revolutionizing patient care.

Disposable Medical Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Disposable Medical Sensors Industry

Medtronic :

A leading global healthcare solutions company, Medtronic focuses on innovative solutions in medical devices, including a diverse range of disposable sensors utilized in patient monitoring and diagnostics.Abbott Laboratories:

Abbott specializes in diagnostics and health technologies, gaining prominence with its robust portfolio of disposable sensors designed for fast and efficient medical assessments.Roche Diagnostics:

Roche leads the development of diagnostic solutions, integrating disposable sensor technologies to enhance its product line and improve patient outcomes.Philips Healthcare:

Philips Healthcare specializes in innovative health technology solutions, including disposable sensors that aim to improve patient monitoring and clinical effectiveness.Honeywell :

Honeywell is a key player in sensor technology, offering a range of disposable sensors for industrial and medical applications, enhancing efficiency and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of disposable Medical Sensors?

The global disposable medical sensors market is valued at approximately $3.5 billion in 2023, with an expected compound annual growth rate (CAGR) of 7.2%. This significant growth highlights the increasing demand for these sensors in healthcare.

What are the key market players or companies in this disposable Medical Sensors industry?

The disposable medical sensors market features key players such as Medtronic, Philips Healthcare, and Abbott Laboratories. These companies are pivotal in driving innovation and enhancing competitiveness through technological advancements and strategic partnerships in the industry.

What are the primary factors driving the growth in the disposable Medical Sensors industry?

Growth in the disposable medical sensors market is driven by advancements in telemedicine and remote patient monitoring technologies, increasing healthcare expenditures, and the rising prevalence of chronic diseases that necessitate constant monitoring and timely interventions for patients.

Which region is the fastest Growing in the disposable Medical Sensors?

North America is currently the fastest-growing region for disposable medical sensors, projected to grow from $1.32 billion in 2023 to $2.71 billion by 2033, reflecting the region's advanced healthcare infrastructure and increased adoption of digital health solutions.

Does ConsaInsights provide customized market report data for the disposable Medical Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients. This includes detailed analysis, market forecasts, and strategic insights applicable to the disposable medical sensors industry and its various segments.

What deliverables can I expect from this disposable Medical Sensors market research project?

From the disposable medical sensors market research project, you can expect comprehensive reports that include market trends, segment analysis, competitive landscapes, regional insights, along with tailored recommendations for strategic planning and decision-making purposes.

What are the market trends of disposable Medical Sensors?

Key trends in the disposable medical sensors market include a growing focus on miniaturization of sensors, the integration of IoT connectivity for real-time monitoring, and the shift towards home care settings, highlighting the evolving landscape of healthcare technology.