Embedded Finance

Published Date: 31 January 2026 | Report Code: embedded-finance

Embedded Finance Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on Embedded Finance delves into the market dynamics and projected trends from 2024 to 2033. It offers detailed insights, including market size, growth drivers, industry analysis, segmentation, regional assessments, technological innovations, and leading players. The analysis provides valuable perspectives for stakeholders and industry decision-makers.

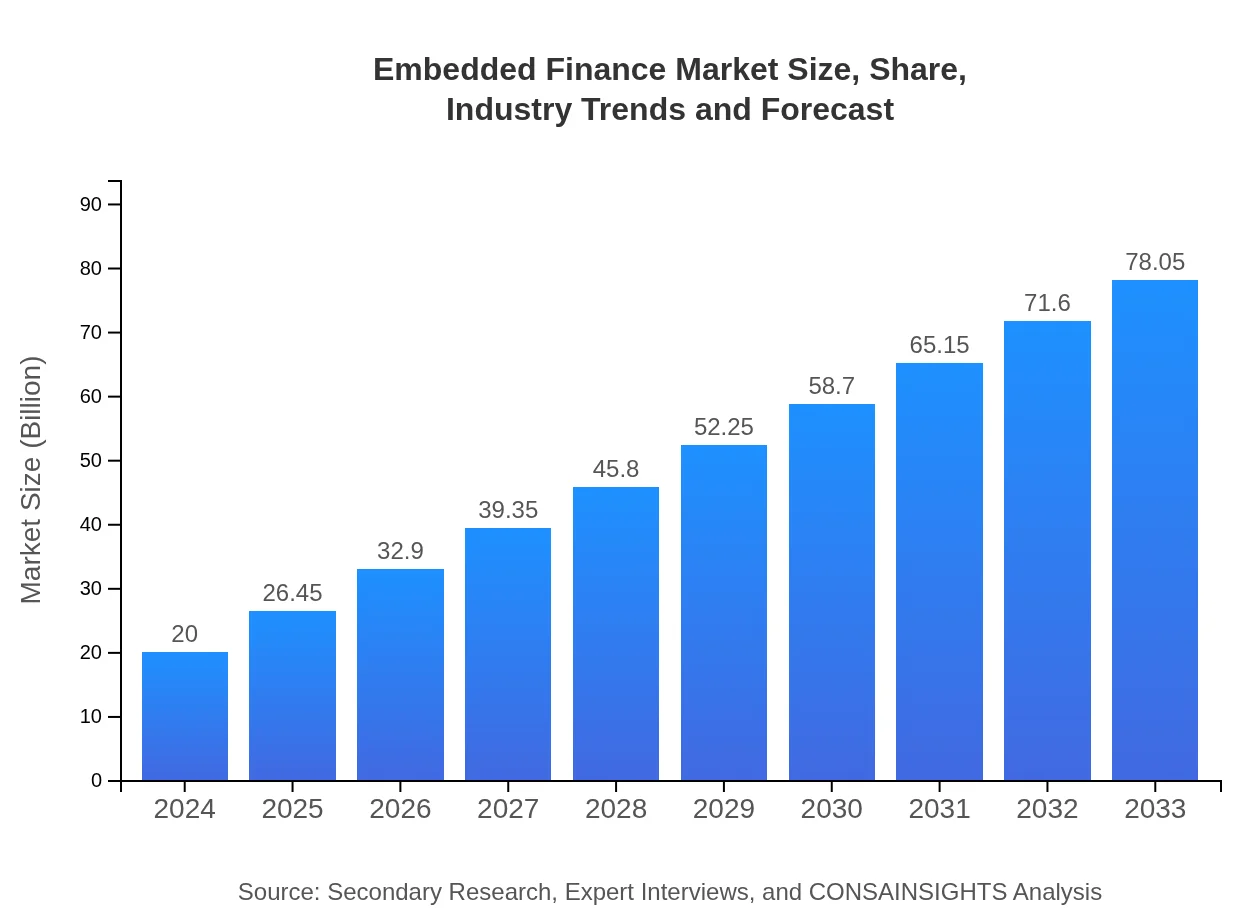

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $20.00 Billion |

| CAGR (2024-2033) | 15.5% |

| 2033 Market Size | $78.05 Billion |

| Top Companies | FinTech Innovators Inc., Digital Payments Global, Embedded Solutions Ltd., SecurePay Technologies |

| Last Modified Date | 31 January 2026 |

Embedded Finance Market Overview

Customize Embedded Finance market research report

- ✔ Get in-depth analysis of Embedded Finance market size, growth, and forecasts.

- ✔ Understand Embedded Finance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Embedded Finance

What is the Market Size & CAGR of Embedded Finance market in 2024?

Embedded Finance Industry Analysis

Embedded Finance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Embedded Finance Market Analysis Report by Region

Europe Embedded Finance:

Europe demonstrates substantial market stability and growth with evolving regulatory frameworks and increased consumer interest in digital financial solutions. Investments in infrastructure and strong collaboration between banks and tech firms enhance the region's overall market strength.Asia Pacific Embedded Finance:

Asia Pacific is experiencing strong growth due to rapid digital transformation and increasing mobile penetration. With diverse economies embracing fintech innovations, the region is set to witness a steady expansion in embedded financial services, supported by government initiatives and cross-border collaborations.North America Embedded Finance:

North America remains a leading market with advanced technological adoption and a mature financial ecosystem. The presence of major fintech hubs, innovation centers, and strict regulatory environments contributes to sustainable growth and high consumer trust.South America Embedded Finance:

South America is gradually catching up with the global trend, with governments and private players investing heavily in digital infrastructures. Consumers are increasingly shifting to integrated financial services, making the market more vibrant and competitive in the region.Middle East & Africa Embedded Finance:

In the Middle East and Africa, rapid smartphone adoption and initiatives to improve financial inclusion are fueling market expansion. This region is witnessing progressive regulatory reforms and a surge in innovative digital payment platforms that are integrating financial services.Tell us your focus area and get a customized research report.

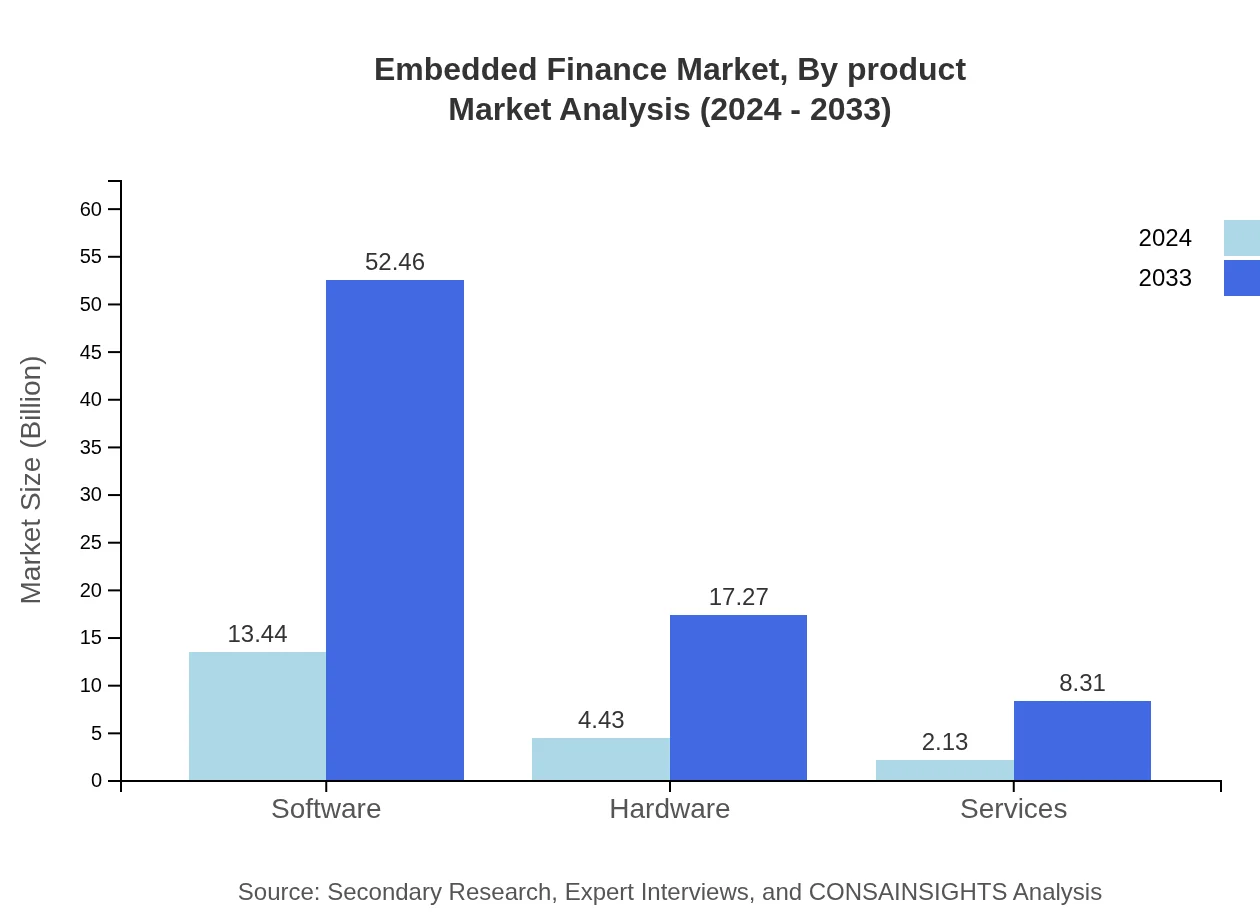

Embedded Finance Market Analysis By Product

The product segmentation of the Embedded Finance market includes software, hardware, and services. Software solutions, accounting for a significant share in both market size and share, are pivotal in delivering streamlined, efficient digital financial services. Hardware components ensure secure transactions while supporting underlying infrastructures. Complementary service offerings enhance user experiences and maintain system reliability. Together, these components create a symbiotic ecosystem driving innovation and performance within the industry.

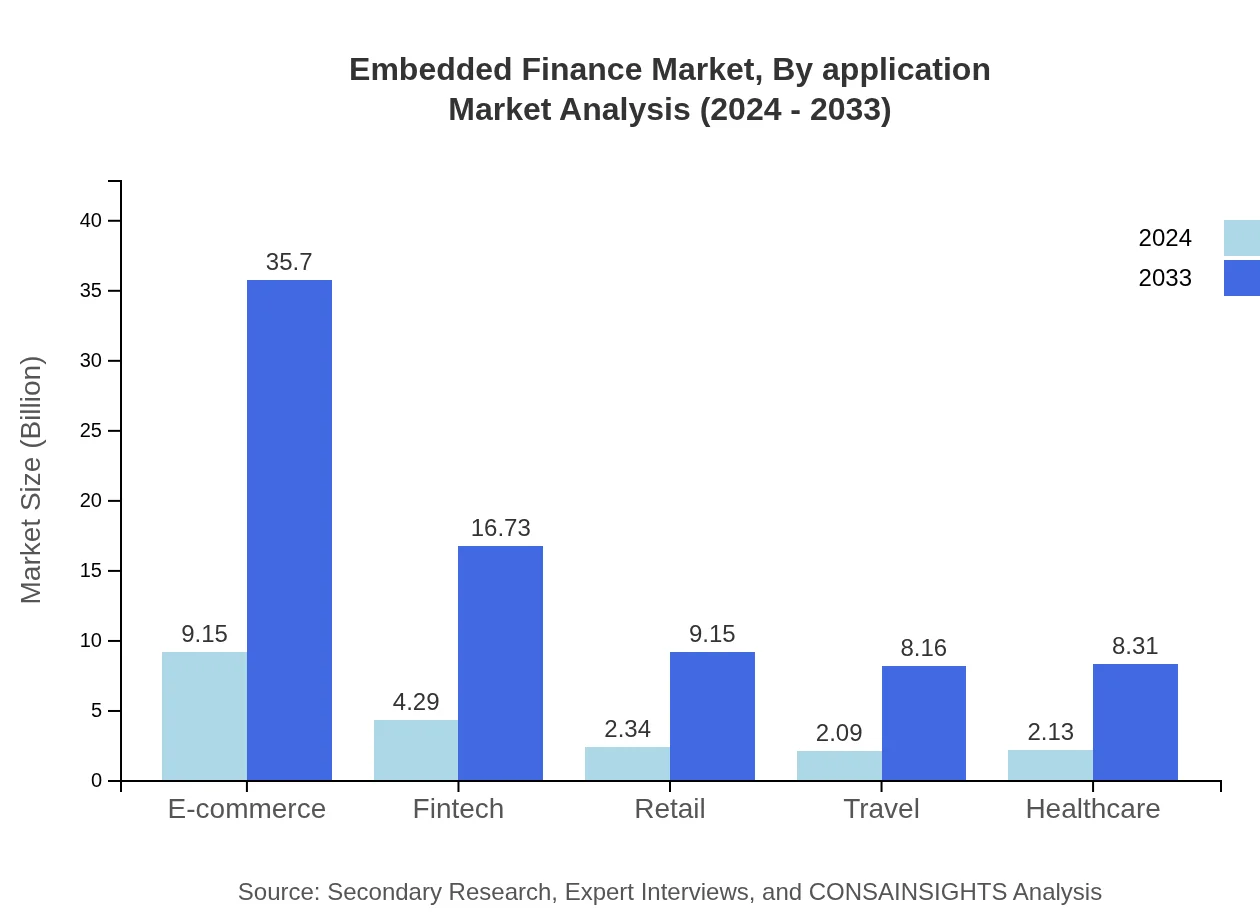

Embedded Finance Market Analysis By Application

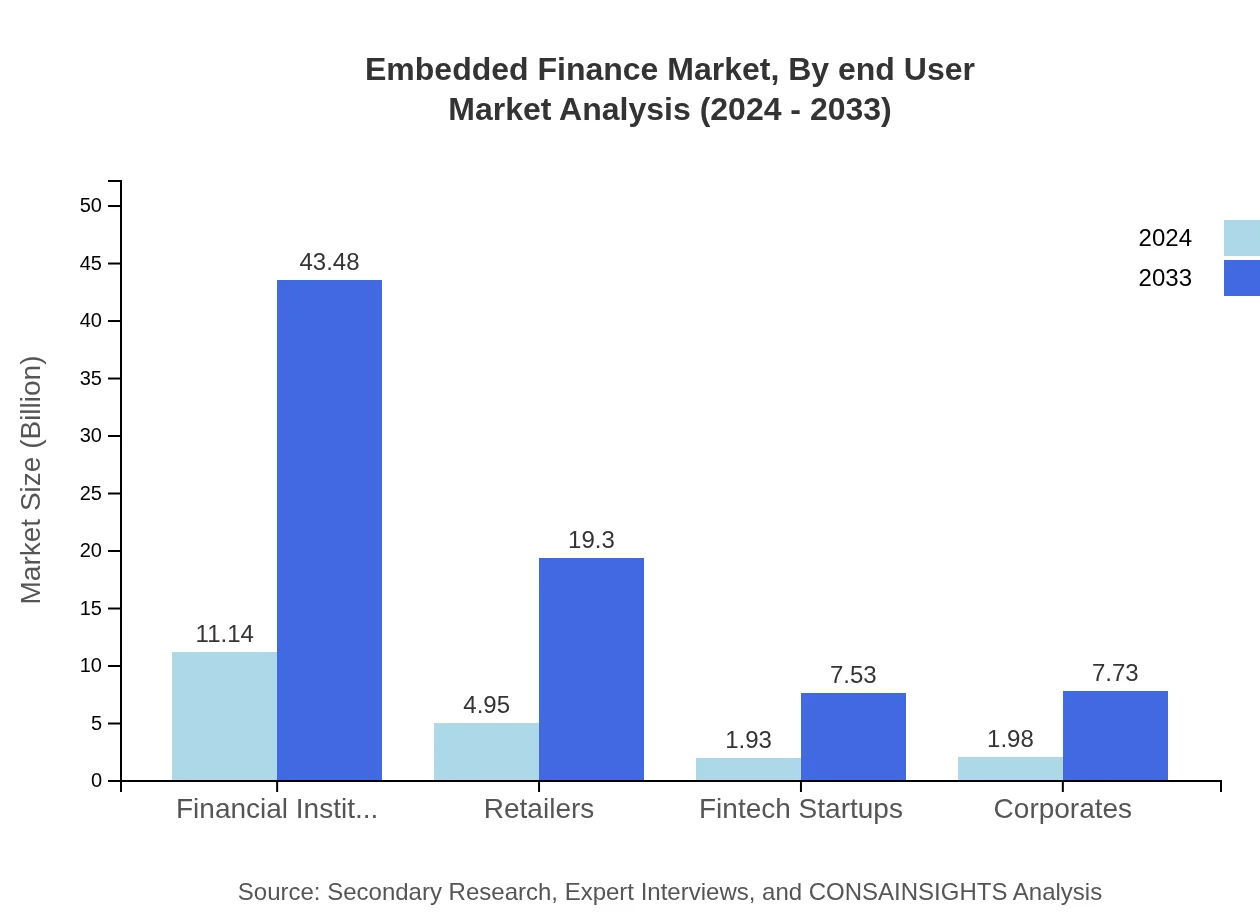

Application segmentation involves various sectors such as financial institutions, retailers, fintech startups, and corporates. Financial institutions and retailers dominate the market through large-scale integration of embedded services. Fintech startups offer disruptive models that challenge traditional approaches, while corporates leverage these solutions to enhance customer engagement and operational efficiencies. Each application segment has unique drivers, competitive dynamics, and regulatory considerations that collectively contribute to market resilience and widespread adoption.

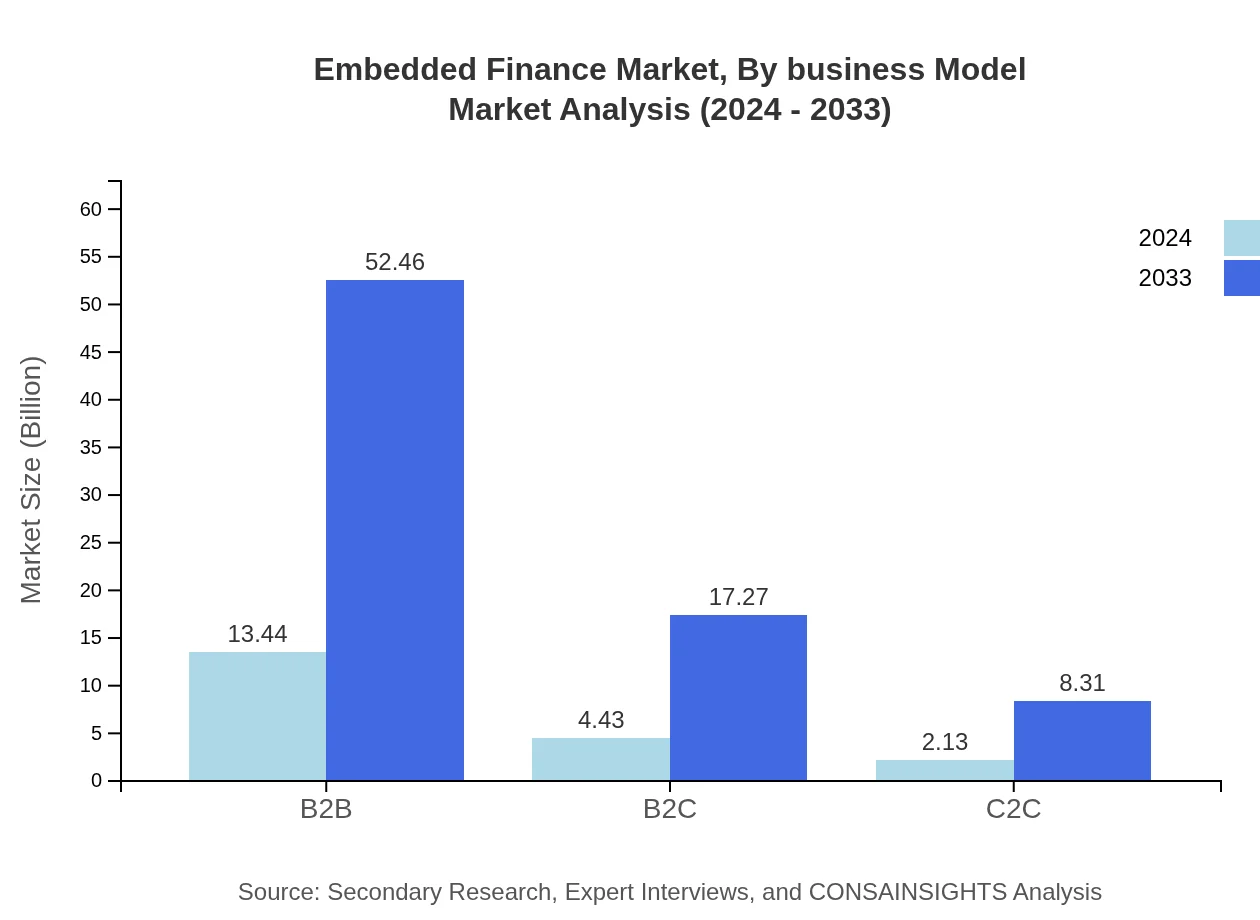

Embedded Finance Market Analysis By Business Model

The business model segmentation explores models like API integration and blockchain technology. API integration is central to the seamless incorporation of financial services into varied platforms and holds the largest share. The blockchain segment adds value by enhancing transaction security and transparency, appealing to a growing base of security-conscious consumers. With compelling value propositions, these business models are instrumental in defining the commercial dynamics and operational efficiencies of the Embedded Finance market.

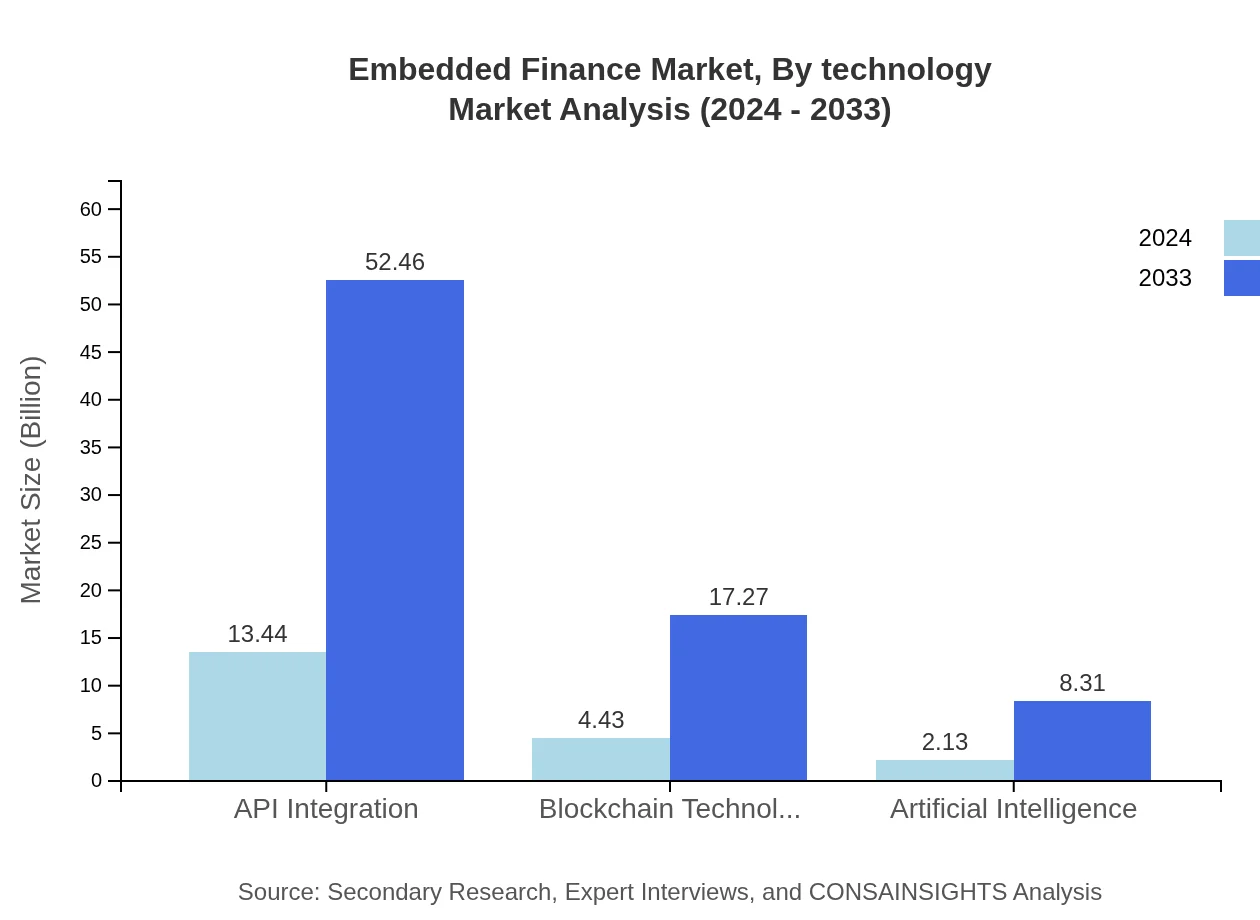

Embedded Finance Market Analysis By Technology

Technology remains a cornerstone for progress in the Embedded Finance industry. Advances in artificial intelligence and blockchain technology are revolutionizing embedded solutions. AI algorithms optimize customer interactions, fraud detection, and personalization, while blockchain facilitates secure, transparent transaction processes. These technologies foster a reliable environment for service delivery and are essential for scaling operations. Additionally, continuous innovations in API development and data analytics are expanding the technology’s role, thereby deepening market penetration and competitive advantage.

Embedded Finance Market Analysis By End User

End-user segmentation divides the market into B2B, B2C, and C2C sectors. The B2B segment leads with a substantial market share due to the adoption of embedded financial services by enterprises seeking operational efficiency and enhanced service delivery. In contrast, the B2C and C2C segments are marked by personalized financial solutions enabled through digital platforms. Each end-user segment demands unique features tailored to specific needs, which has resulted in diverse product offerings and competitive advancements in the market.

Embedded Finance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Embedded Finance Industry

FinTech Innovators Inc.:

FinTech Innovators Inc. is at the forefront of integrating embedded payment solutions across multiple platforms, driving significant advancements in API integration and secure digital transactions.Digital Payments Global:

Digital Payments Global is renowned for its cutting-edge technologies that enhance user experiences and streamline financial operations. Their strategic partnerships and continuous R&D have positioned them as a market leader.Embedded Solutions Ltd.:

Embedded Solutions Ltd. leverages its deep industry expertise to offer comprehensive embedded financial services, propelling digital transformation in key markets around the world.SecurePay Technologies:

SecurePay Technologies provides robust security frameworks and innovative payment integration solutions, ensuring trust and efficiency across digital financial transactions.We're grateful to work with incredible clients.

FAQs

How can the report help align our marketing strategy with customer adoption trends?

The report on embedded finance indicates a market size of approximately $20 billion, growing at a CAGR of 15.5%. Understanding these metrics aligns your marketing efforts with customer adoption trends, allowing strategies to target growth areas effectively.

What product features are in highest demand according to the report trends?

According to the embedded finance trends, features like API integration, with a 67.22% market share by 2033, and AI, growing to 10.65% share by 2033, are critical. Prioritizing these can drive adoption and meet market expectations.

Which regions offer the best market entry and expansion opportunities in the embedded finance industry?

North America leads with a market size projected to reach $28.18 billion by 2033. Europe and Asia Pacific follow with notable growth, reaching $19.45 billion and $16.15 billion respectively, indicating strong opportunities for expansion.

What emerging technologies and innovations are shaping the embedded finance market?

Key innovations in embedded finance include API integration and blockchain technology. API integration forecasts a 67.22% market share by 2033, revolutionizing transactional capabilities, while blockchain technology grows to 22.13% share, enhancing security and transparency.

Does the report include competitive landscape and market share analysis?

Yes, the report provides a detailed competitive landscape, including market share analysis. It highlights key players in various segments like financial institutions, which maintain a 55.71% share, enabling strategic insights for competitive positioning.

How can executives use the report to evaluate investment risks and ROI?

Executives can leverage insights from the report, which predicts a $20 billion market size and a 15.5% CAGR. This data helps gauge investment viability and potential ROI against emerging market trends and regional growth opportunities.

What is the market size of embedded finance?

The embedded finance market is valued at approximately $20 billion, projected to grow at a CAGR of 15.5%, indicating substantial growth opportunities in the coming years across various sectors and regions.