Enterprise Networking

Published Date: 31 January 2026 | Report Code: enterprise-networking

Enterprise Networking Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Enterprise Networking market, offering detailed insights into market size, CAGR, segmentation, industry trends, and regional dynamics over the forecast period 2024 to 2033. It examines technological innovations, product performance, and competitive strategies to provide a holistic view that assists stakeholders in making informed decisions.

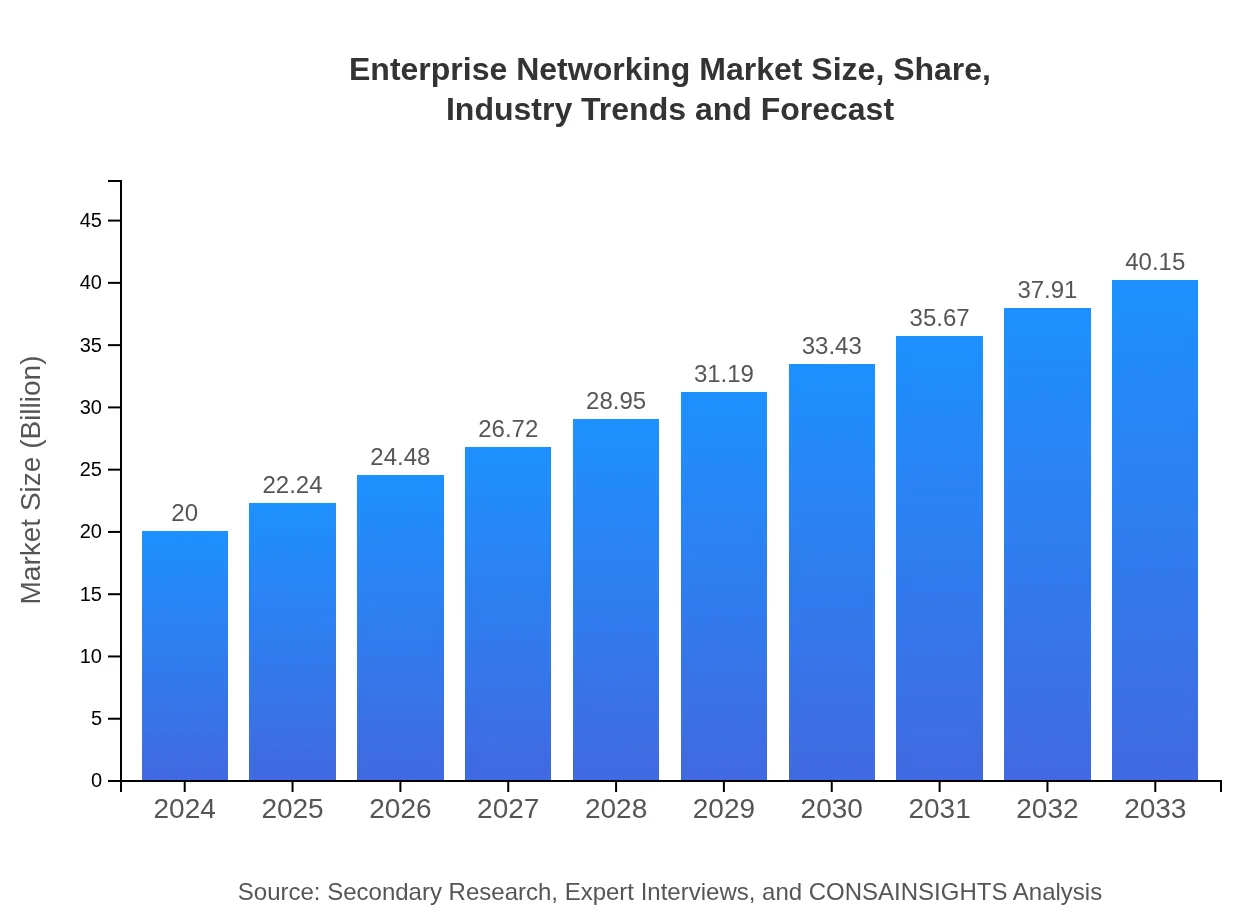

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $20.00 Billion |

| CAGR (2024-2033) | 7.8% |

| 2033 Market Size | $40.15 Billion |

| Top Companies | Cisco Systems, Huawei Technologies |

| Last Modified Date | 31 January 2026 |

Enterprise Networking Market Overview

Customize Enterprise Networking market research report

- ✔ Get in-depth analysis of Enterprise Networking market size, growth, and forecasts.

- ✔ Understand Enterprise Networking's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Enterprise Networking

What is the Market Size & CAGR of Enterprise Networking market in 2024?

Enterprise Networking Industry Analysis

Enterprise Networking Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Enterprise Networking Market Analysis Report by Region

Europe Enterprise Networking:

Europe’s market is marked by steady growth and high regulatory standards that ensure robust digital security and data privacy. With a market value of 5.13 in 2024 growing to an anticipated 10.29 by 2033, European enterprises are accelerating their transition to next-generation networking solutions. The emphasis on digital sovereignty and the integration of advanced wireless and fiber-optic technologies contribute significantly to this growth.Asia Pacific Enterprise Networking:

In the Asia Pacific region, the Enterprise Networking market is witnessing robust growth due to rapid digital adoption and significant investments in digital and communication infrastructure. With a market value of approximately 4.04 in 2024, it is projected to nearly double to around 8.10 by 2033. The region’s focus on technology innovation, increasing mobile penetration, and modernization of existing networks are key drivers for this expansion.North America Enterprise Networking:

North America remains a mature and technologically advanced market, with its market size recorded at 7.67 in 2024 and projected to grow to 15.39 by 2033. This growth is underpinned by high investments in innovative network technologies, strong R&D efforts, and the prioritization of cybersecurity. The region's early adoption of emerging trends, coupled with robust consumer demand for cutting-edge network integration, continues to drive market leadership.South America Enterprise Networking:

South America is experiencing steady market growth, with the market size moving from an estimated 1.20 in 2024 to about 2.40 by 2033. Government initiatives aimed at enhancing digital connectivity and geopolitical reforms enhance investment in advanced networking solutions. The region’s evolving business landscape continues to fuel demand for secure and scalable networking infrastructure.Middle East & Africa Enterprise Networking:

The Middle East and Africa region is steadily emerging as an important market segment, with its value growing from 1.97 in 2024 to around 3.96 by 2033. Strategic initiatives to enhance digital connectivity, bolstered by investments in urban and rural infrastructure, are spurring growth. This region is gradually adopting high-speed networking technologies as part of broader governmental and commercial efforts aimed at comprehensive digital transformation.Tell us your focus area and get a customized research report.

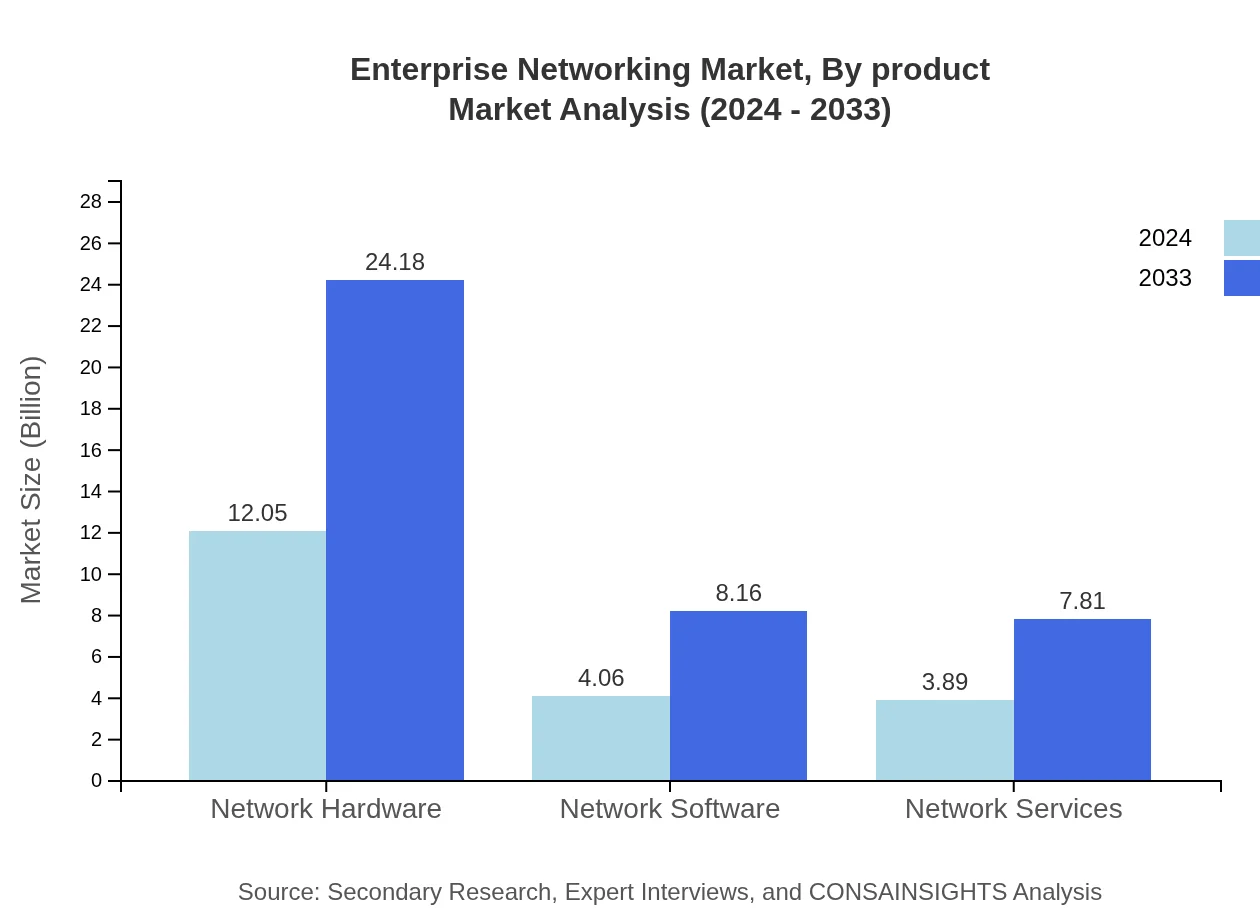

Enterprise Networking Market Analysis By Product

This segment focuses on the detailed analysis of network hardware, network software, and network services. Network hardware plays a critical role, with its market size growing from 12.05 in 2024 to 24.18 in 2033, maintaining a dominant share of 60.23% throughout the period. A similar growth trend is observed for network software and services, reflecting a strong demand driven by increased digitalization, innovation, and the need for integrated solutions that ensure reliable connectivity and efficient data management.

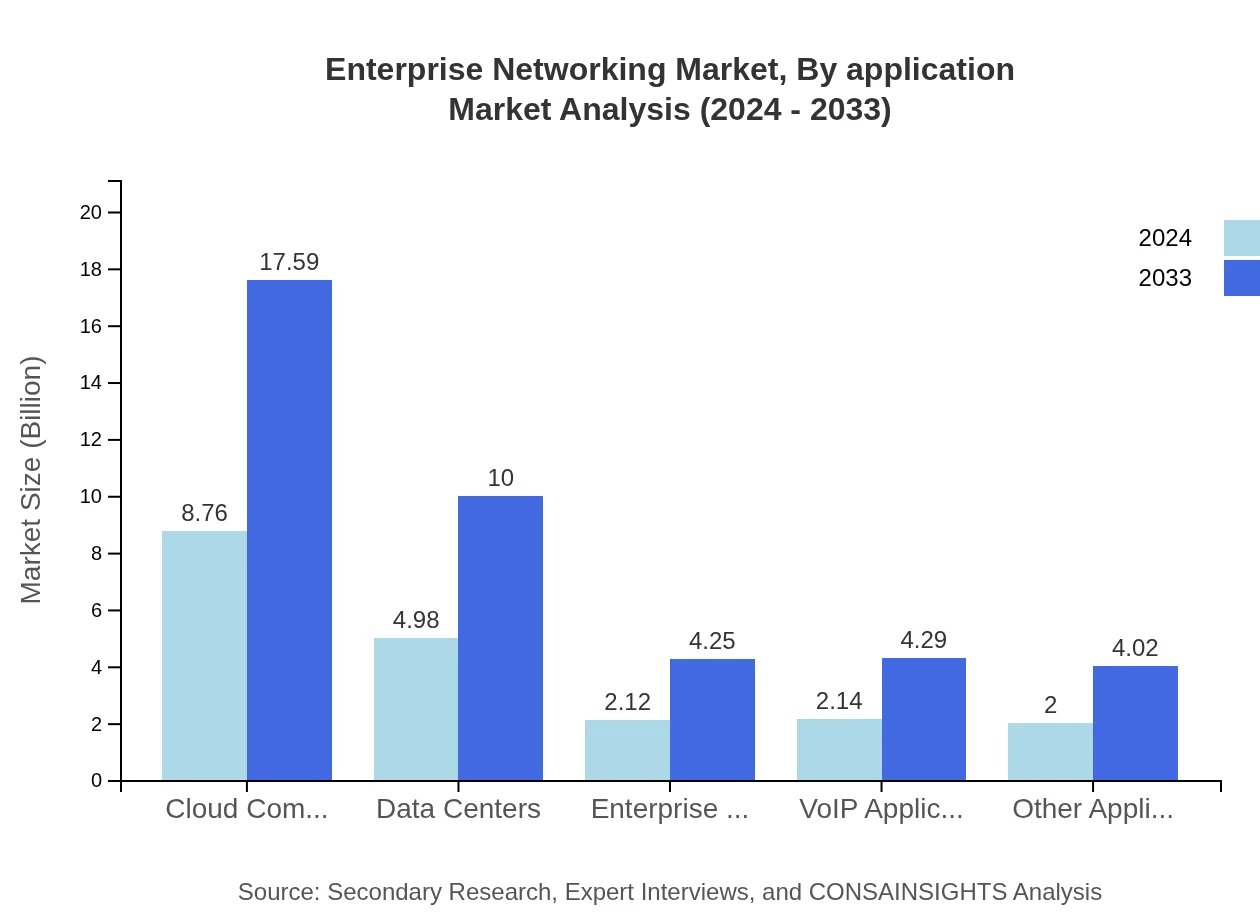

Enterprise Networking Market Analysis By Application

The application segment examines cloud computing, data centers, enterprise security, VoIP applications, and other applications. Cloud computing, in particular, stands out as a major growth driver, with its market size expected to increase from 8.76 in 2024 to 17.59 in 2033, while retaining a stable market share of 43.81%. Data centers and enterprise security also show robust performance, underscoring the growing emphasis on secure, scalable, and efficient data management practices across industries.

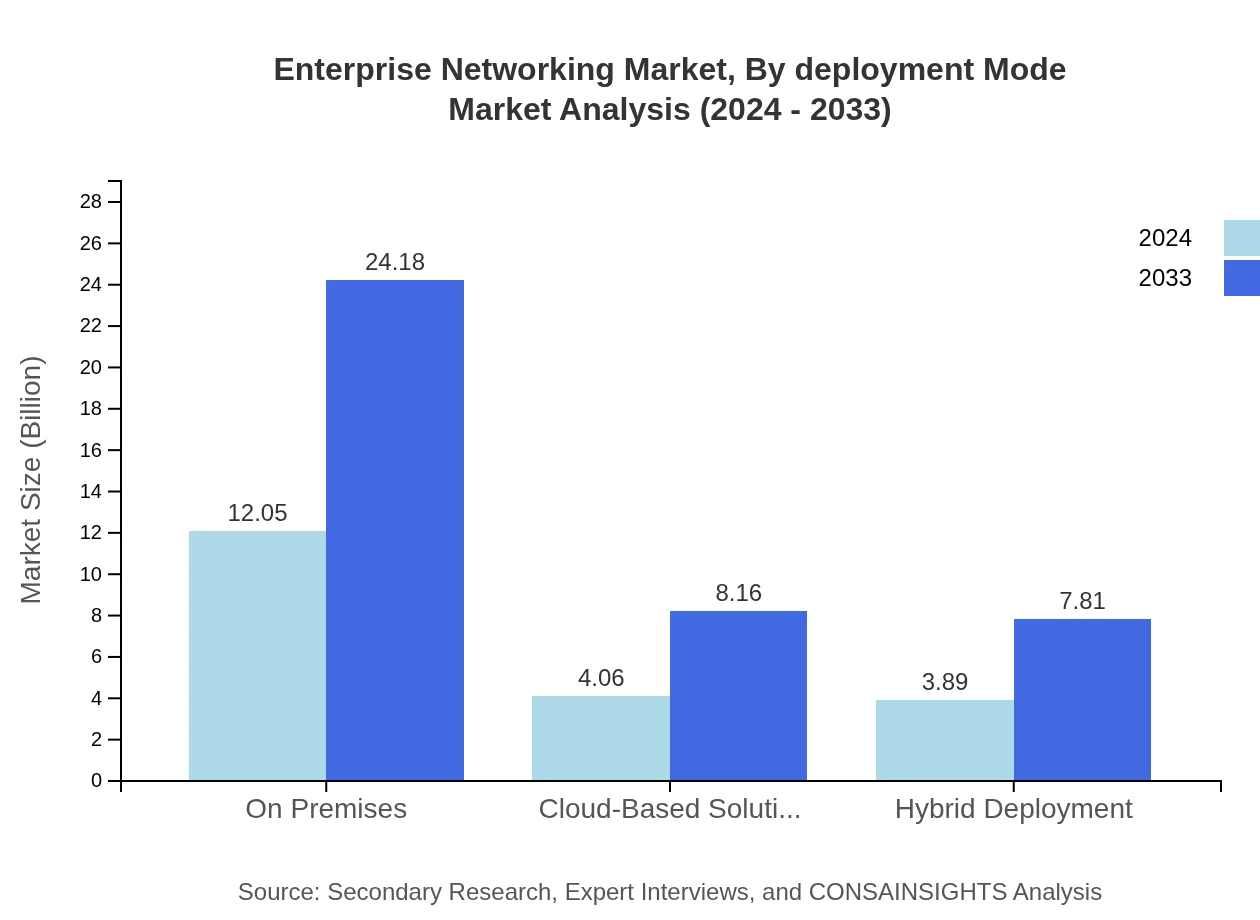

Enterprise Networking Market Analysis By Deployment Mode

This segmentation categorizes the market into on-premises, cloud-based solutions, and hybrid deployment modes. On-premises deployment remains the largest segment, with market sizes growing from 12.05 in 2024 to 24.18 in 2033 and consistently capturing 60.23% of the market share. In parallel, cloud-based solutions and hybrid deployments are steadily gaining traction as they offer increased agility, cost efficiency, and scalability, enabling businesses to adopt flexible networking infrastructures that are responsive to dynamic market needs.

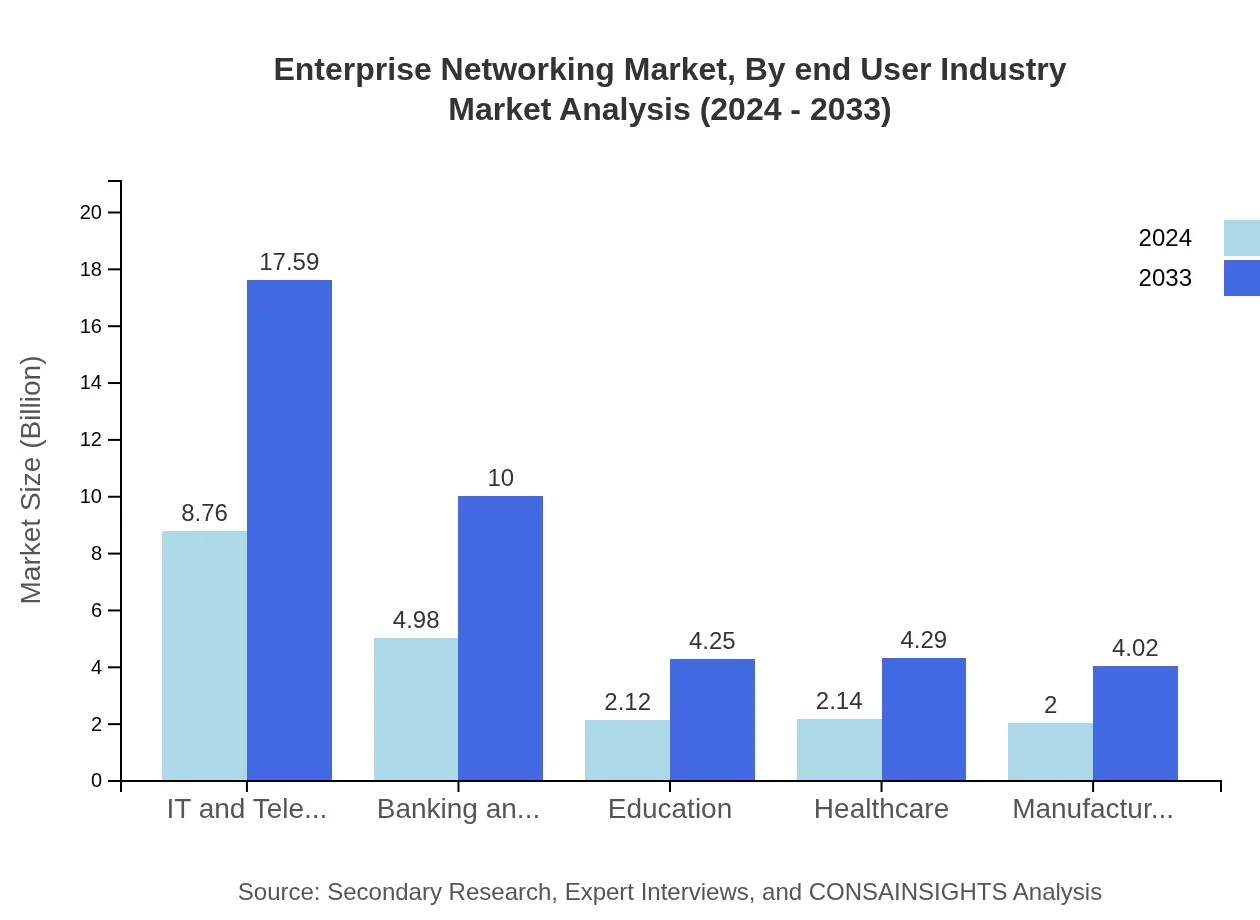

Enterprise Networking Market Analysis By End User Industry

This segment delves into the end-user industries including IT and telecom, banking and financial services, education, healthcare, and manufacturing. IT and telecom lead the market with significant growth from 8.76 in 2024 to 17.59 in 2033, reflecting the critical importance of networking infrastructure in driving digital innovation and service delivery. Additionally, sectors such as banking, education, and healthcare are increasingly investing in advanced networking solutions to meet regulatory, security, and operational challenges, thereby promoting sustained market growth.

Enterprise Networking Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Enterprise Networking Industry

Cisco Systems:

A global leader in networking solutions, Cisco Systems is known for its innovative product portfolio and extensive R&D initiatives. The company consistently drives advances in network security, virtualization, and cloud integration, positioning it as a key player in the evolving Enterprise Networking landscape.Huawei Technologies:

Huawei Technologies has emerged as a significant contributor to the Enterprise Networking market, offering a broad range of solutions that span from traditional hardware to advanced software-defined networking. Their focus on research and innovation has enabled them to capture considerable market share globally.We're grateful to work with incredible clients.

FAQs

How can the Enterprise Networking market report help align our marketing strategy with customer adoption trends?

Understanding customer adoption trends can help fine-tune marketing strategies. With a $20 billion market and a CAGR of 7.8%, marketing efforts can focus on key segments driving growth and innovate based on real-time data reflections from customer preferences.

What product features are in highest demand according to the Enterprise Networking trends?

Demand trends highlight Network Hardware, projected to grow from $12.05 billion in 2024 to $24.18 billion in 2033, as the most sought-after feature alongside Cloud Computing, indicative of a shift towards more accessible and flexible networking solutions.

Which regions offer the best market entry and expansion opportunities in the Enterprise Networking industry?

Key regions for growth include North America, with market potential increasing from $7.67 billion in 2024 to $15.39 billion by 2033, followed by Europe, where the market is poised to grow from $5.13 billion to $10.29 billion over the same period.

What emerging technologies and innovations are shaping the Enterprise Networking market?

Emerging innovations like cloud computing and advanced security technologies are pivotal. The sector is evolving rapidly, with innovations expected to drive demand and growth, notably with cloud solutions projected to expand significantly within the next decade.

Does the Enterprise Networking Report include competitive landscape and market share analysis?

Yes, the report encompasses a thorough competitive landscape analysis, detailing market shares across segments like Network Hardware, Software, and Cloud Solutions, which collectively inform strategic positioning amid competitive dynamics.

How can executives use the Enterprise Networking Report to evaluate investment risks and ROI?

Executives can leverage the report's in-depth market analysis and forecasts to assess potential risks, guided by insights on market size growth, segment performance, and geographical opportunities, aiding informed decision-making for ROI-oriented investments.

What is the market size of enterprise networking?

The enterprise networking market is valued at $20 billion currently and is expected to grow at a CAGR of 7.8%. This growth indicates robust future potential as industries increasingly adopt advanced networking technologies.

What are the key segments in the enterprise networking market?

Segments include Network Hardware, expected to grow to $24.18 billion by 2033, Cloud Computing at approximately $17.59 billion, and Network Services, each contributing to the overall market expansion alongside emerging tech trends.