Food Grade Lubricants Market Report

Published Date: 02 February 2026 | Report Code: food-grade-lubricants

Food Grade Lubricants Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Food Grade Lubricants market from 2023 to 2033, detailing market trends, size, segmentation, regional insights, and forecasts, along with competitive landscapes to aid stakeholders in making informed decisions.

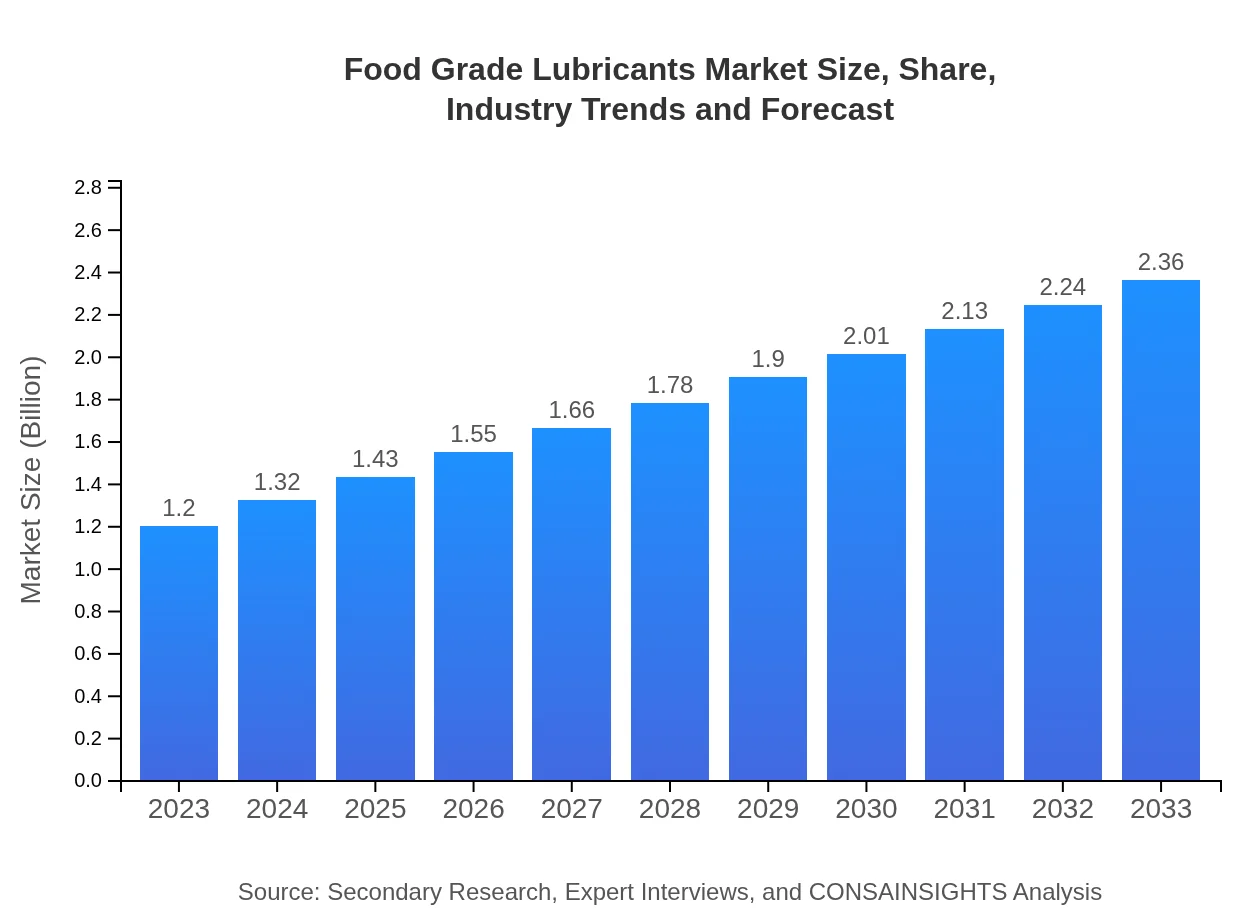

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.36 Billion |

| Top Companies | Henkel AG & Co. KGaA, Houghton International, Inc., Fuchs Petrolub SE, ExxonMobil Corporation |

| Last Modified Date | 02 February 2026 |

Food Grade Lubricants Market Overview

Customize Food Grade Lubricants Market Report market research report

- ✔ Get in-depth analysis of Food Grade Lubricants market size, growth, and forecasts.

- ✔ Understand Food Grade Lubricants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Food Grade Lubricants

What is the Market Size & CAGR of Food Grade Lubricants market in 2033?

Food Grade Lubricants Industry Analysis

Food Grade Lubricants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Food Grade Lubricants Market Analysis Report by Region

Europe Food Grade Lubricants Market Report:

Europe is witnessing a substantial rise in demand for food grade lubricants, expected to reach USD 0.61 billion by 2033 from USD 0.31 billion in 2023, as European countries enforce strict compliance regulations and prioritize food safety.Asia Pacific Food Grade Lubricants Market Report:

The Asia Pacific region is projected to grow significantly, with the market size expected to increase from USD 0.24 billion in 2023 to USD 0.47 billion by 2033 due to the expanding food and beverage industry and rising disposable income in emerging economies.North America Food Grade Lubricants Market Report:

North America holds a significant share of the Food Grade Lubricants market, projected to grow from USD 0.44 billion in 2023 to USD 0.86 billion by 2033, supported by stringent regulations on food safety and a highly developed food processing sector.South America Food Grade Lubricants Market Report:

In South America, the market for food grade lubricants is expected to grow steadily, reaching USD 0.15 billion by 2033 from USD 0.08 billion in 2023, driven by growth in food processing industries and an emphasis on food safety.Middle East & Africa Food Grade Lubricants Market Report:

The Middle East and Africa market for food grade lubricants is anticipated to increase from USD 0.13 billion in 2023 to USD 0.26 billion by 2033, backed by a growing food industry and logistical improvements in food supply chains.Tell us your focus area and get a customized research report.

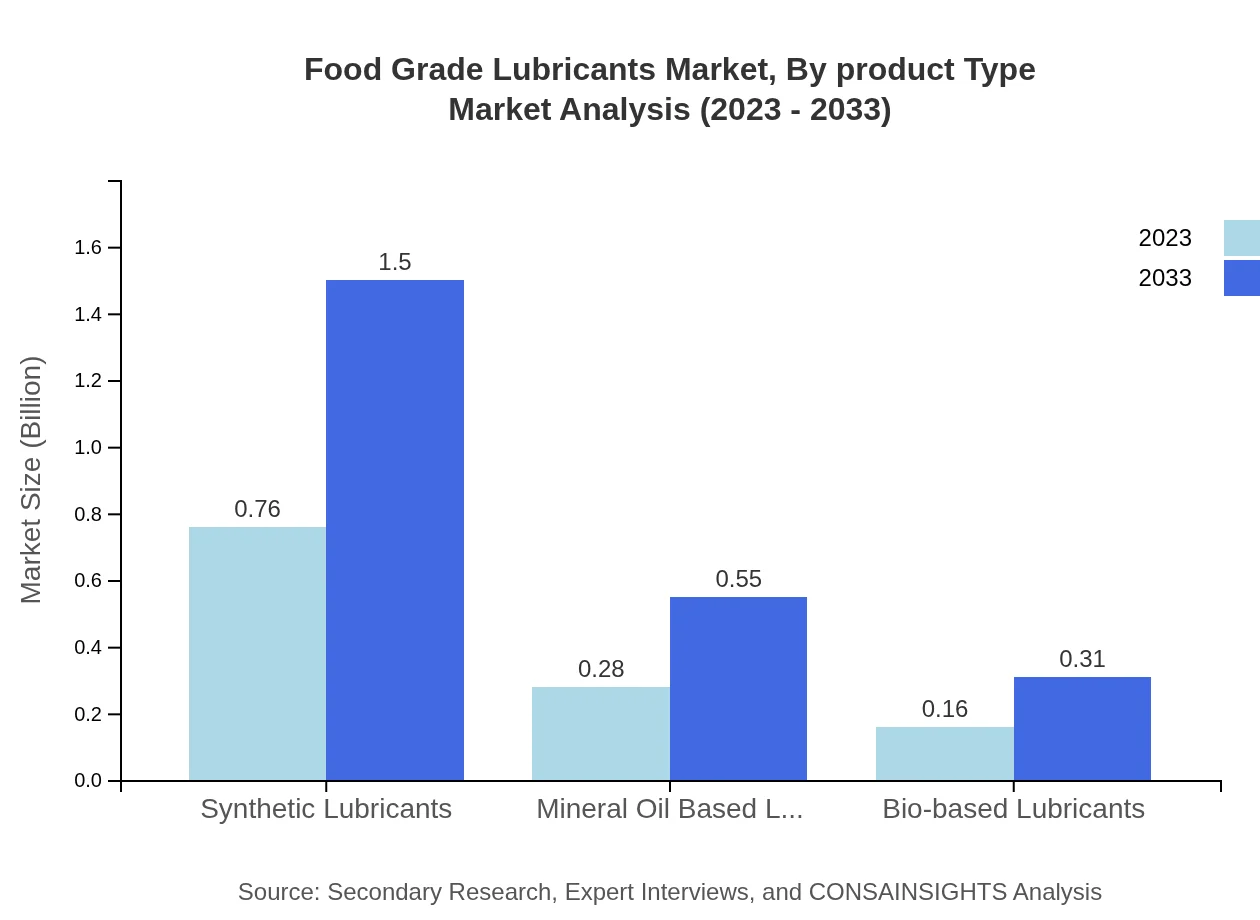

Food Grade Lubricants Market Analysis By Product Type

In the Food Grade Lubricants market, greases lead in size with USD 0.76 billion expected in 2023, growing to USD 1.50 billion by 2033. Synthetic lubricants also contribute significantly, demonstrating a marked preference for performance and safety in food applications.

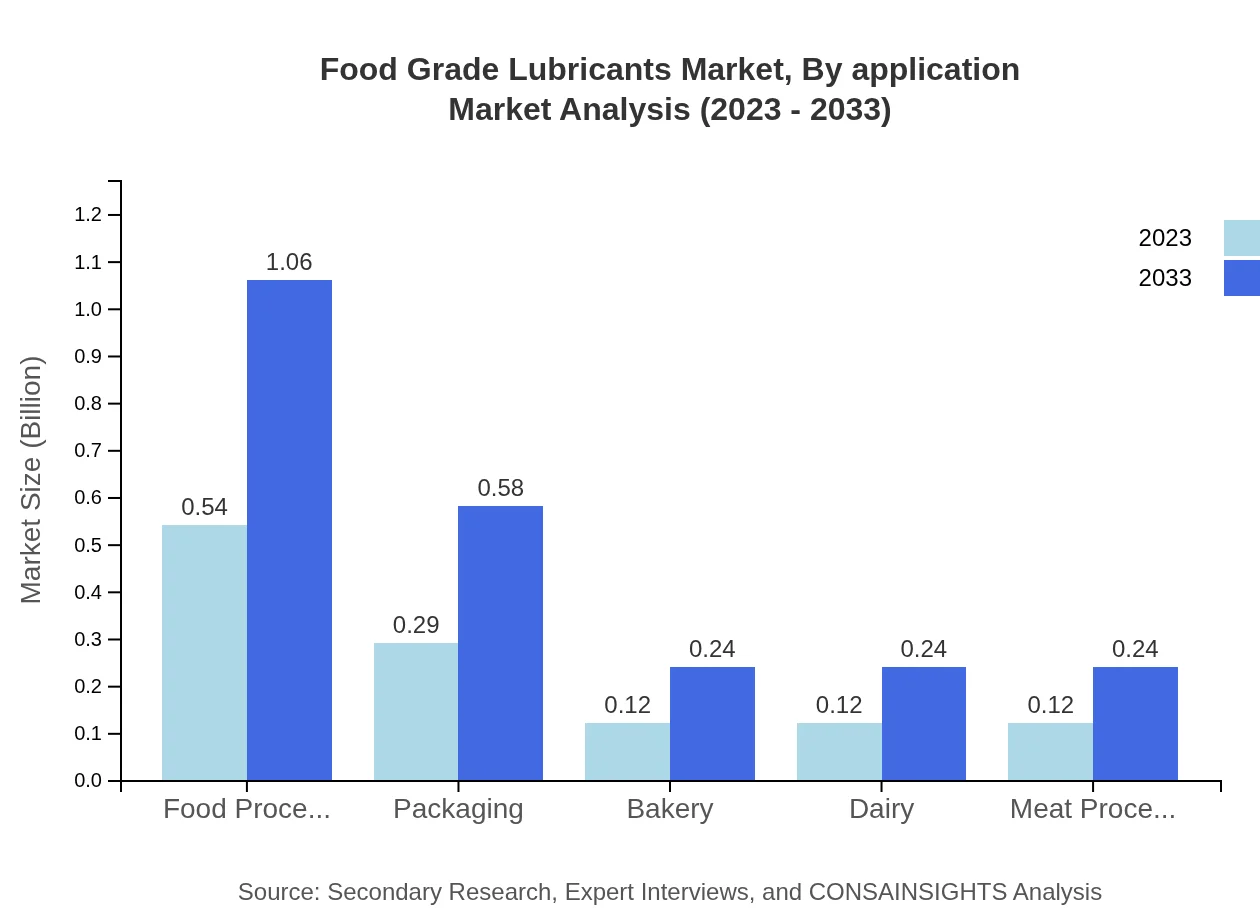

Food Grade Lubricants Market Analysis By Application

Applications of food grade lubricants are diverse, with food manufacturers accounting for approximately 45.08% of market share in 2023. The growth of the food processing sector underscores this segment’s prominence, further aided by rising demands from food packaging companies.

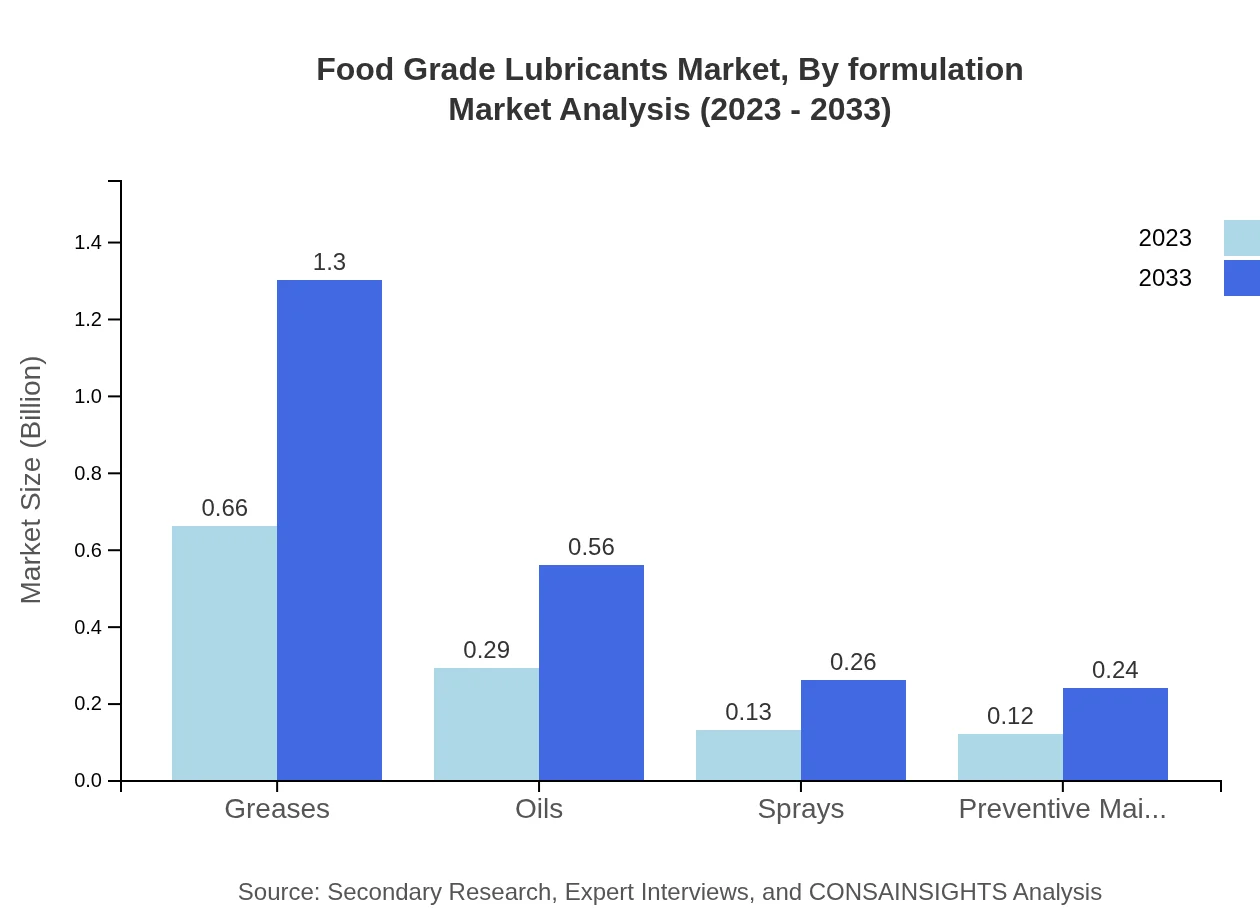

Food Grade Lubricants Market Analysis By Formulation

The market is also segmented by formulation types such as bio-based, synthetic, and mineral oil-based lubricants, each presenting unique benefits. Synthetic oils have a prominent market share of 63.62% driven by their superior performance characteristics.

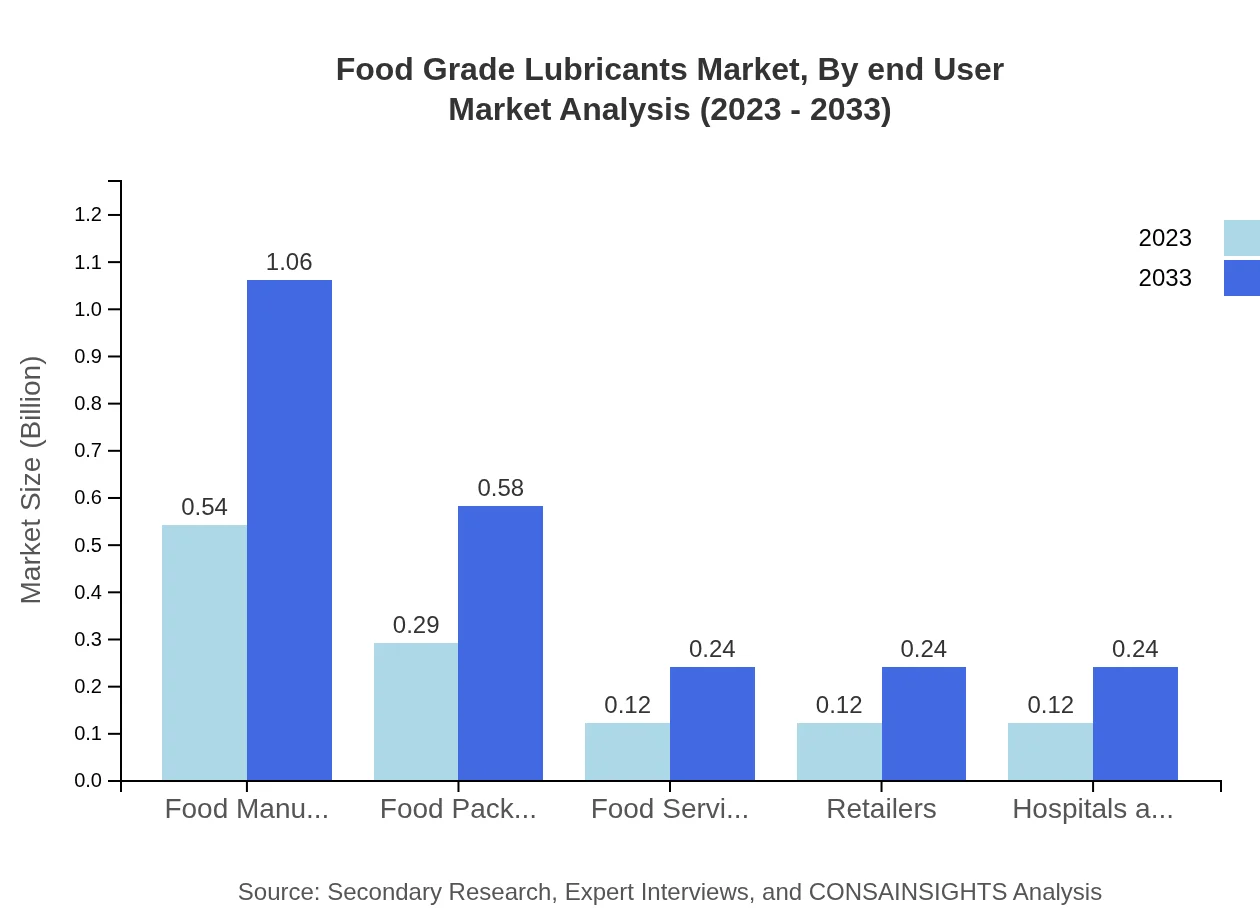

Food Grade Lubricants Market Analysis By End User

End-user analysis reveals significant contributions from food processing operations, including specialized markets such as meat processing and dairy. Each sector emphasizes compliance and safety, necessitating the use of certified food grade lubricants.

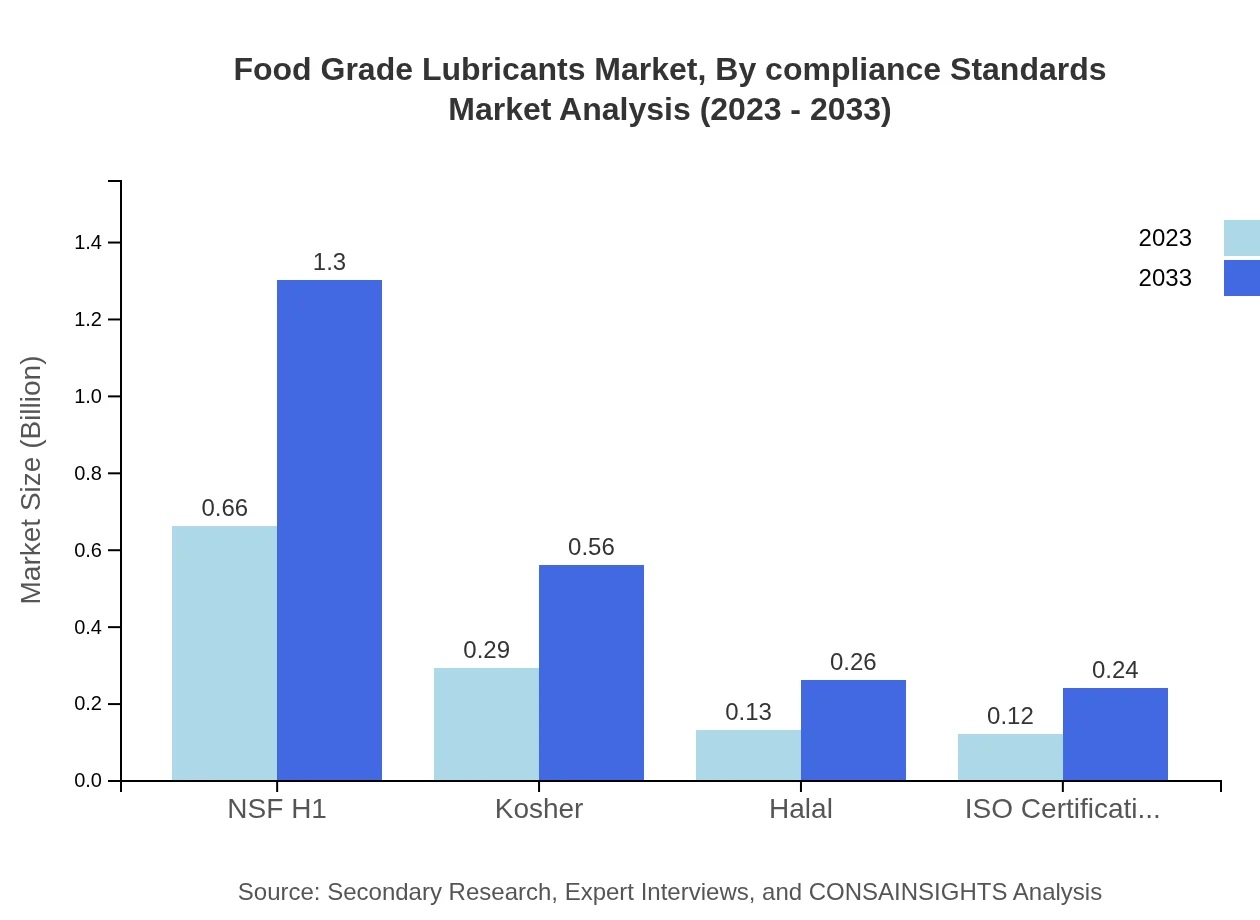

Food Grade Lubricants Market Analysis By Compliance Standards

Compliance with standards such as NSF H1, Halal, and Kosher is critical for market players. The NSF H1 certified lubricants are projected to dominate, capturing 55.11% of market share, reflecting growing awareness and demand for safe food contact materials.

Food Grade Lubricants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Food Grade Lubricants Industry

Henkel AG & Co. KGaA:

Henkel provides a range of innovative food grade lubricants designed for safe use in food processing environments, ensuring compliance with international safety standards.Houghton International, Inc.:

Houghton specializes in providing high-quality specialty lubricants, including food grade options that cater to various food sectors, ensuring efficient operations and safety.Fuchs Petrolub SE:

Fuchs is a key player in the food grade lubricants market, known for its extensive product portfolio and commitment to sustainable and safe lubricant solutions.ExxonMobil Corporation:

ExxonMobil offers a comprehensive range of food grade lubricants that meet stringent regulatory requirements, supporting efficiency in food and beverage processing.We're grateful to work with incredible clients.

FAQs

What is the market size of food Grade Lubricants?

The food-grade lubricants market is projected to reach $1.2 billion by 2033, growing at a CAGR of 6.8%. This growth indicates increasing demand across various food processing and manufacturing segments.

What are the key market players or companies in the food Grade Lubricants industry?

Key players in the food-grade lubricants market include major lubricant manufacturers and suppliers who focus on compliant products for the food industry. Leading companies leverage innovative formulations and certifications to ensure safety and efficiency in food production.

What are the primary factors driving the growth in the food Grade lubricants industry?

Growth in the food-grade lubricants sector is primarily driven by stringent safety regulations, increased consumer awareness regarding food safety, and the expanding food processing industries worldwide. These factors necessitate high-quality lubricants that meet health standards.

Which region is the fastest Growing in the food Grade lubricants market?

The Asia-Pacific region is experiencing rapid growth in the food-grade lubricants market, projected to grow from $0.24 billion in 2023 to $0.47 billion by 2033. This growth is driven by rising food production and processing activities.

Does ConsaInsights provide customized market report data for the food Grade Lubricants industry?

Yes, ConsaInsights provides customized market reports tailored to specific needs in the food-grade lubricants industry. Clients can obtain insights that cater to particular segments, regions, or market dynamics.

What deliverables can I expect from this food Grade Lubricants market research project?

From the food-grade lubricants market research project, you can expect detailed reports that include market size, growth forecasts, competitive analysis, regional breakdowns, and key trends that impact the industry.

What are the market trends of food Grade lubricants?

Current trends in the food-grade lubricants market include a shift towards bio-based alternatives, increased adoption of synthetic lubricants, and heightened emphasis on certification standards such as NSF H1, reflecting industry standards in food safety.