Freight Transport Management Market Report

Published Date: 31 January 2026 | Report Code: freight-transport-management

Freight Transport Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Freight Transport Management market, covering market size, segmentation, regional insights, industry analysis, and forecasts up to 2033, alongside technology trends and key players.

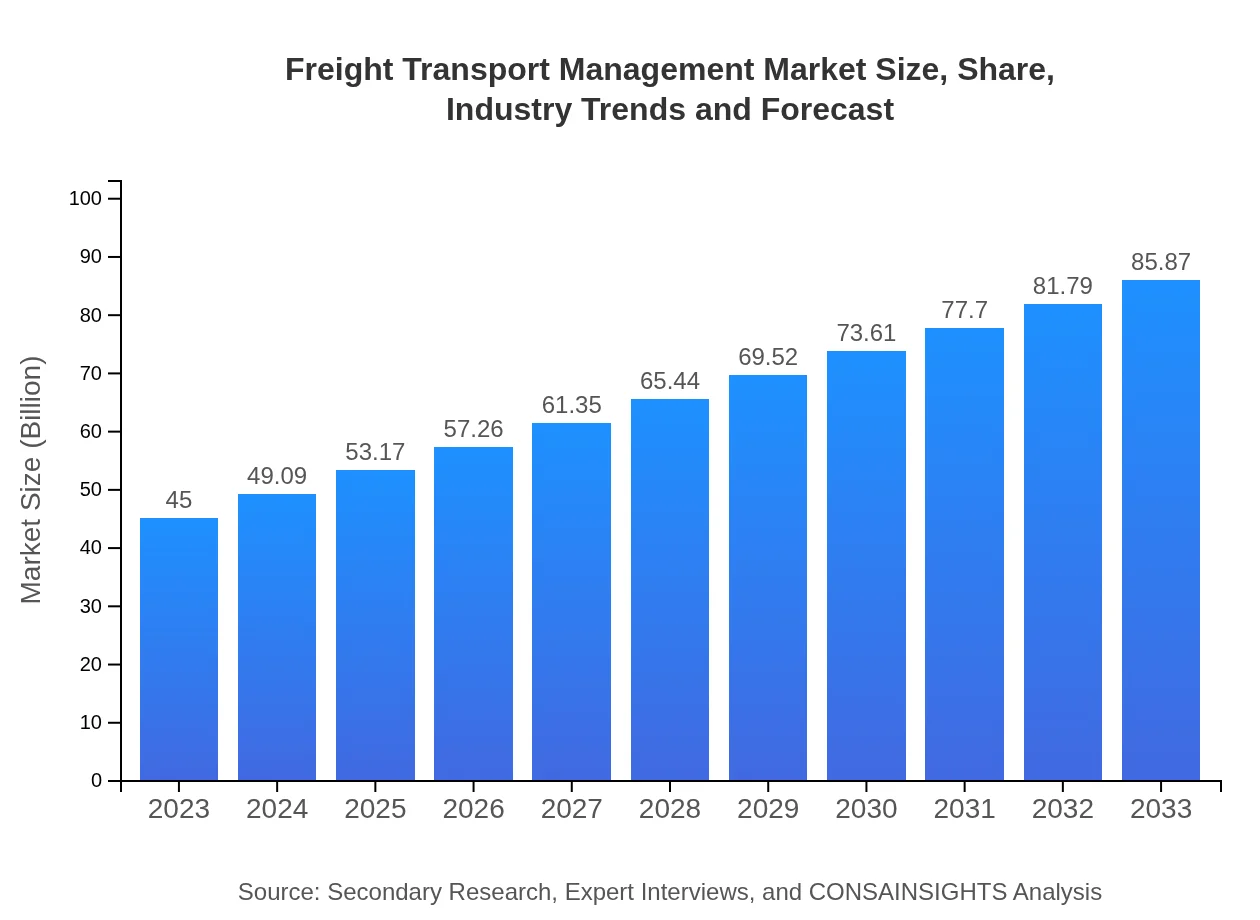

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $85.87 Billion |

| Top Companies | DHL Supply Chain, FedEx Corporation, UPS Supply Chain Solutions, XPO Logistics, C.H. Robinson |

| Last Modified Date | 31 January 2026 |

Freight Transport Management Market Overview

Customize Freight Transport Management Market Report market research report

- ✔ Get in-depth analysis of Freight Transport Management market size, growth, and forecasts.

- ✔ Understand Freight Transport Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Freight Transport Management

What is the Market Size & CAGR of Freight Transport Management market in 2023?

Freight Transport Management Industry Analysis

Freight Transport Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Freight Transport Management Market Analysis Report by Region

Europe Freight Transport Management Market Report:

Europe is anticipated to grow from a market size of USD 12.16 billion in 2023 to USD 23.21 billion by 2033. The European Freight Transport Management market benefits from stringent regulatory measures for safety and environmental standards along with a commitment to sustainability, driving technological innovations.Asia Pacific Freight Transport Management Market Report:

In 2023, the Asia Pacific region holds a market size of USD 9.62 billion, with projections to reach USD 18.36 billion by 2033. Rapid urbanization and industrialization are fuelling demand for freight transport solutions, particularly in countries like China and India, where enhanced infrastructure is facilitating smoother logistics operations.North America Freight Transport Management Market Report:

North America is projected to experience robust growth from USD 16.18 billion in 2023 to USD 30.87 billion in 2033. The region's market expansion is propelled by advanced technology adoption for supply chain management and extensive investment in freight transport systems to meet rising consumer demands.South America Freight Transport Management Market Report:

The South American market, valued at USD 2.60 billion in 2023, is expected to grow to USD 4.95 billion by 2033. The growth is driven by increasing trade agreements within the continent and investments in logistics infrastructure that enhance connectivity and efficiency.Middle East & Africa Freight Transport Management Market Report:

The Middle East and Africa market is expected to increase from USD 4.44 billion in 2023 to USD 8.48 billion by 2033. The region witnesses growth with substantial investments in logistics and infrastructure development aimed at boosting trade efficiency.Tell us your focus area and get a customized research report.

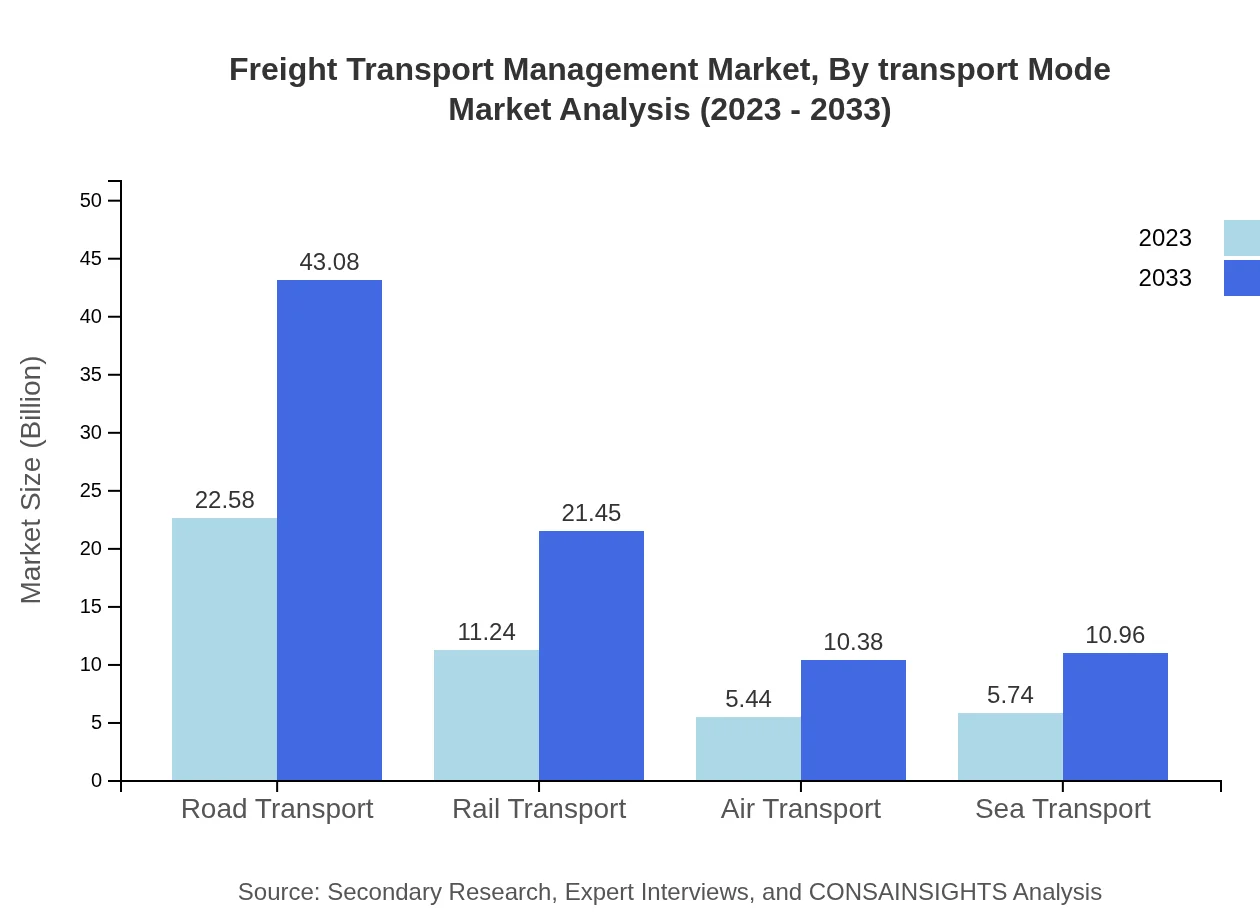

Freight Transport Management Market Analysis By Transport Mode

The segment analysis indicates that Road Transport is the largest segment at USD 22.58 billion in 2023, forecasted to reach USD 43.08 billion by 2033. Rail Transport follows, projected to grow from USD 11.24 billion to USD 21.45 billion. Air and Sea Transport also demonstrate growth, with sizes of USD 5.44 billion and USD 5.74 billion in 2023, respectively.

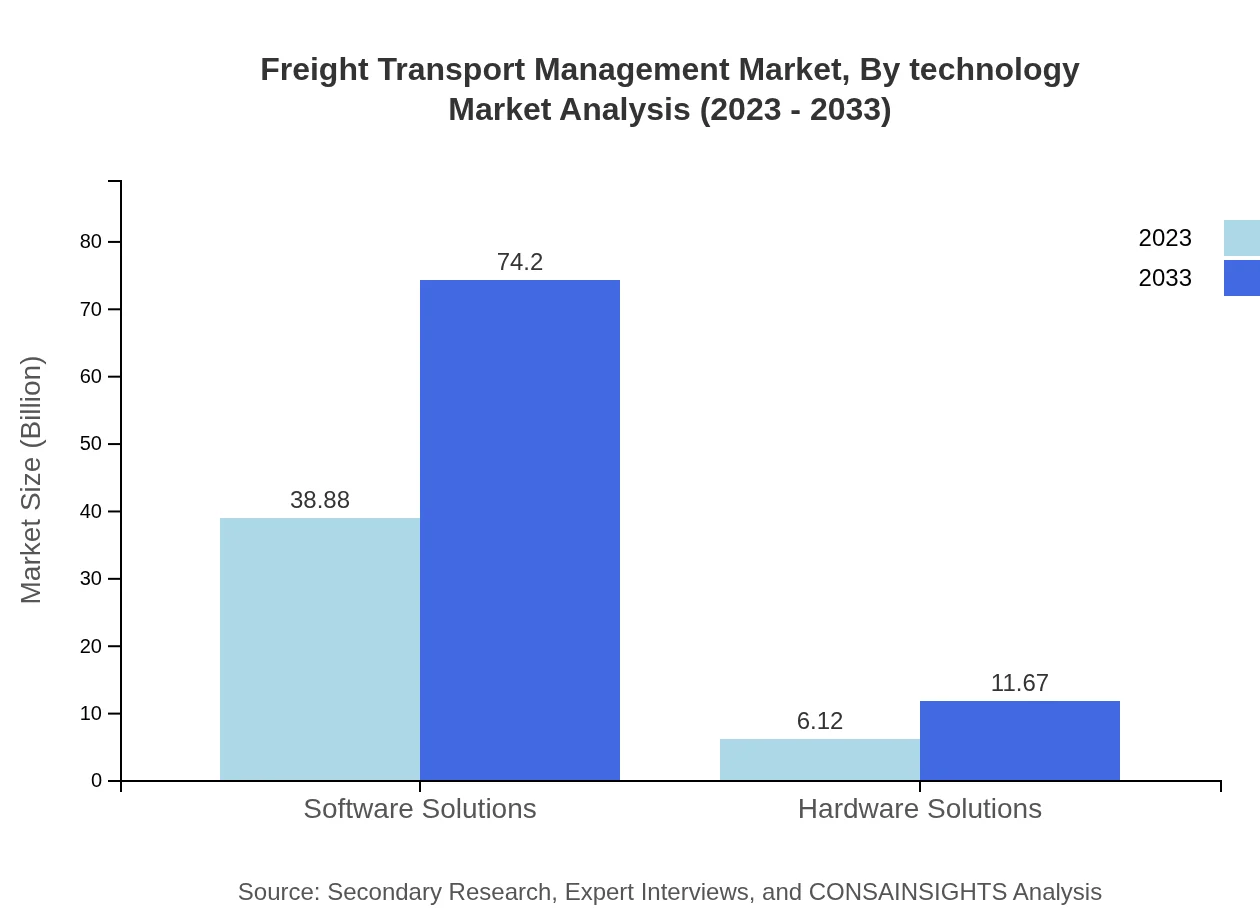

Freight Transport Management Market Analysis By Technology

Software solutions dominate the Freight Transport Management market, accounting for USD 38.88 billion in 2023, expected to double to USD 74.20 billion by 2033. Hardware solutions, while smaller, are also gaining traction in the market as businesses seek comprehensive solutions that integrate software and physical technologies.

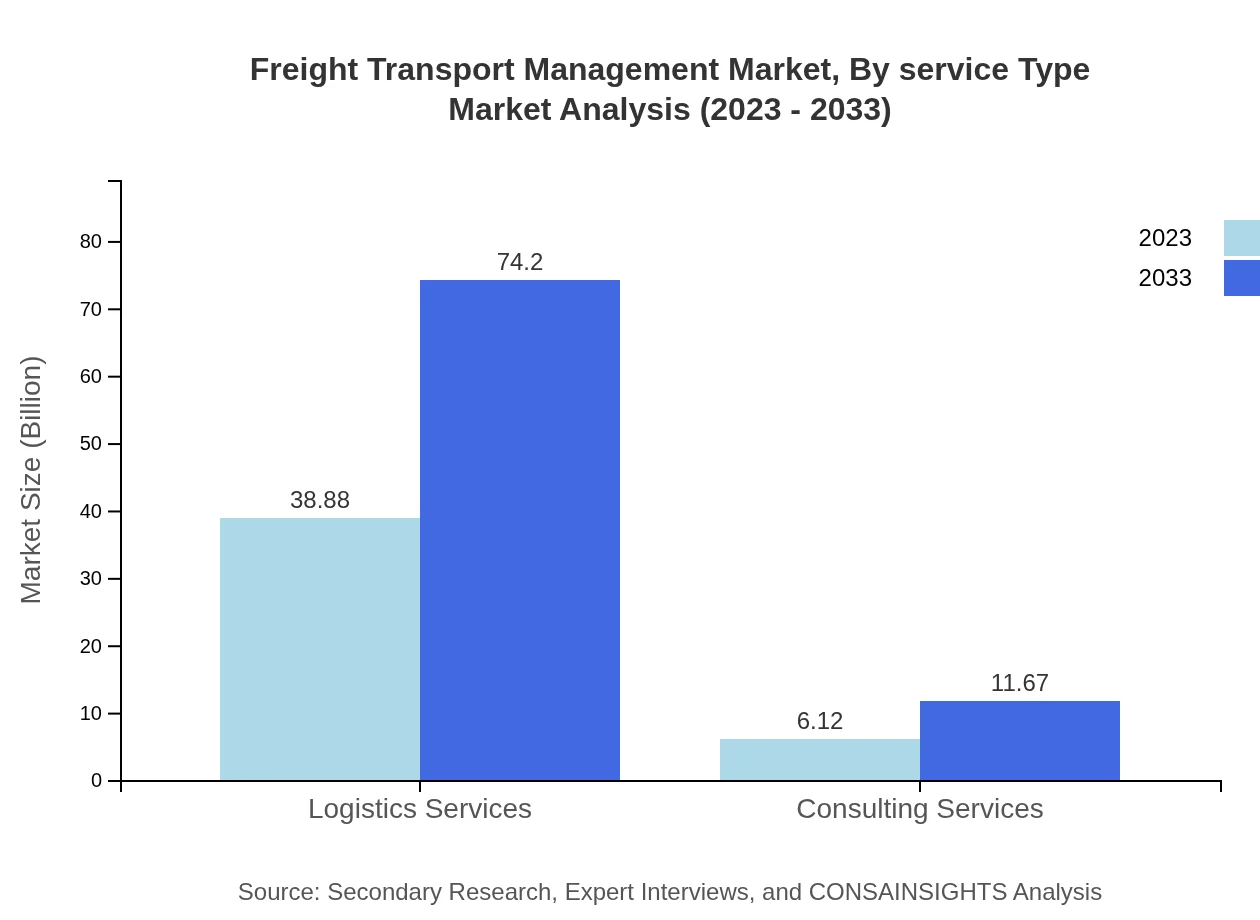

Freight Transport Management Market Analysis By Service Type

Logistics services capture a significant share of the market, expected to grow from USD 38.88 billion in 2023 to USD 74.20 billion by 2033. Consulting services and software solutions also contribute significantly, ensuring businesses adapt efficiently to changing market dynamics.

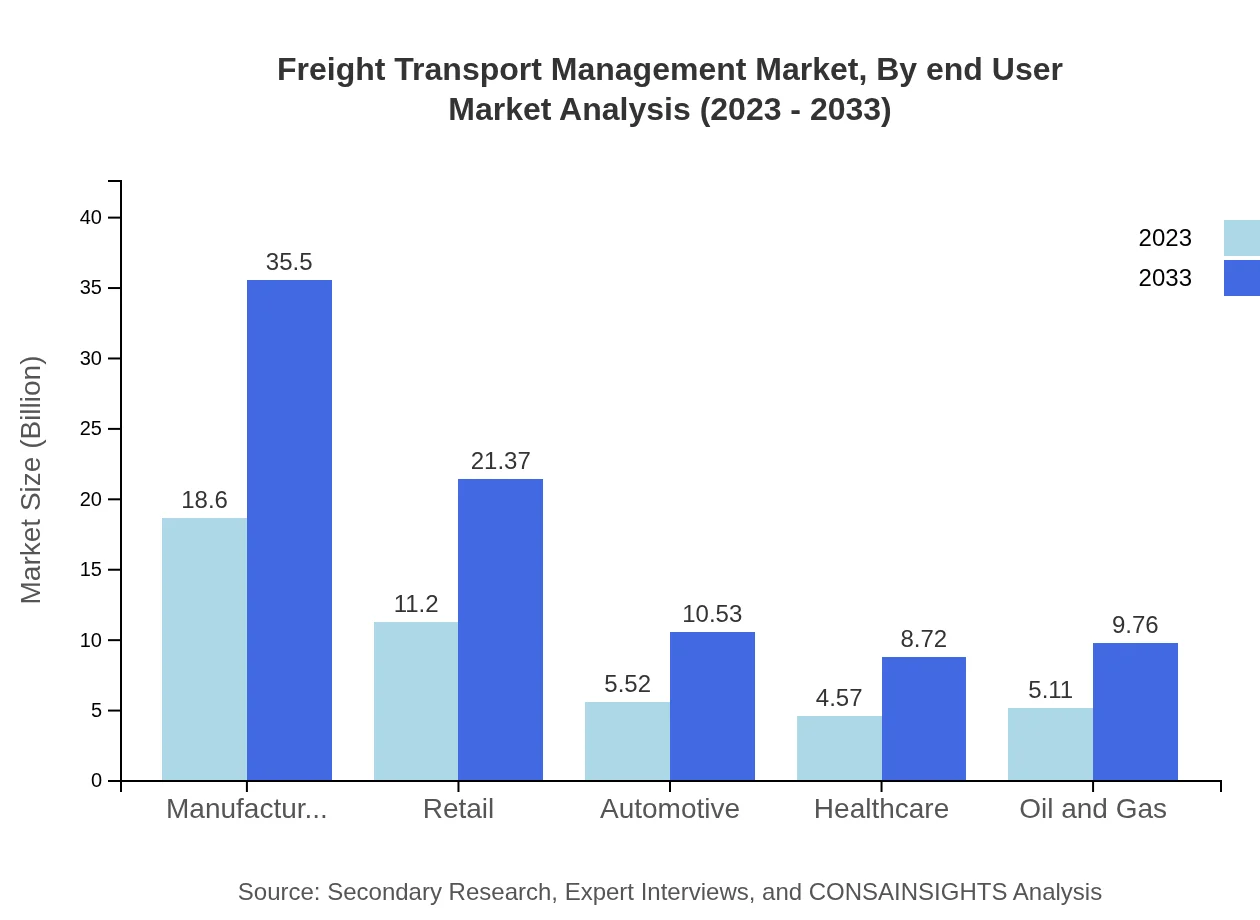

Freight Transport Management Market Analysis By End User

Manufacturing leads the market with an expected size of USD 18.60 billion in 2023, growing to USD 35.50 billion by 2033. Retail, automotive, and healthcare sectors also show substantial growth, indicating the essential role of freight transport management across various industries.

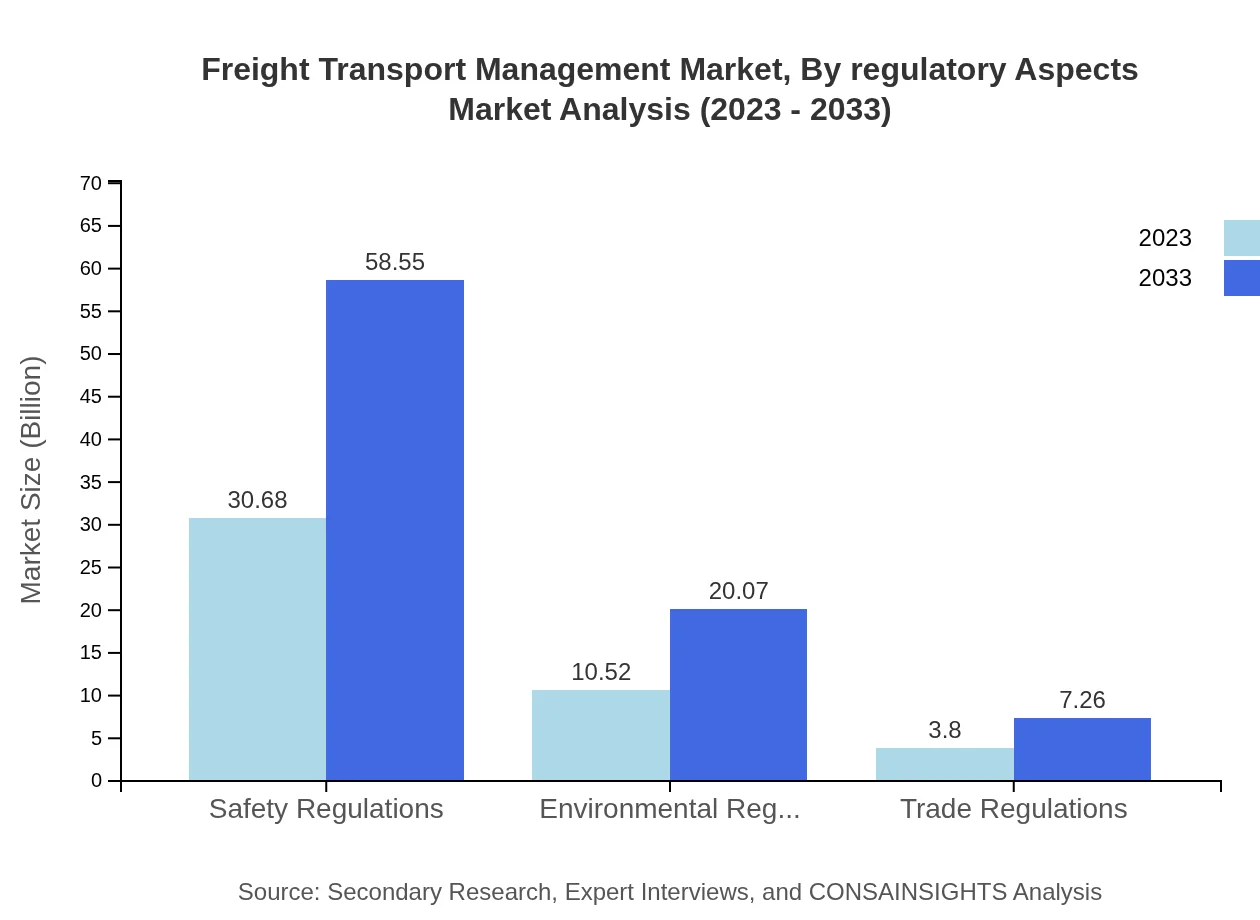

Freight Transport Management Market Analysis By Regulatory Aspects

Regulatory aspects play a crucial role in shaping the Freight Transport Management market with safety, environmental, and trade regulations influencing market dynamics. Safety regulations alone expected to grow from USD 30.68 billion in 2023 to USD 58.55 billion by 2033 reflect the increased focus on safe logistics operations.

Freight Transport Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Freight Transport Management Industry

DHL Supply Chain:

A leading provider of contract logistics solutions, known for extensive logistics operations and technology integration.FedEx Corporation:

A global courier delivery services company offering reliable shipping solutions and freight management services.UPS Supply Chain Solutions:

United Parcel Service specializes in logistics and supply chain management, providing innovative solutions to optimize freight transport.XPO Logistics:

An innovative provider of supply chain solutions, recognized for leveraging technology to enhance logistics efficiency.C.H. Robinson:

A leader in logistics with a focus on integrated services ensuring customers benefit from customized freight transport solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of freight Transport Management?

The freight transport management market is estimated to reach a size of $45 billion by 2033 with a CAGR of 6.5%. In 2023, the market is valued at $45 billion, indicating robust growth prospects over the decade.

What are the key market players or companies in this freight Transport Management industry?

Key players in the freight transport management industry include major logistics firms, technology solution providers, and transportation companies. Their contributions span software solutions, logistics services, and consulting, playing vital roles in shaping the market.

What are the primary factors driving the growth in the freight Transport Management industry?

Growth drivers in the freight transport management sector are increased e-commerce activities, globalization of trade, technological advancements in logistics, and the need for efficiency. Additionally, regulatory frameworks are pushing firms to adopt better management practices.

Which region is the fastest Growing in the freight Transport Management?

The North America region is the fastest-growing for freight transport management, projected to expand from $16.18 billion in 2023 to $30.87 billion by 2033. This growth is attributed to advanced infrastructure and high demand for logistics services.

Does ConsaInsights provide customized market report data for the freight Transport Management industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the freight transport management industry. These tailored reports provide in-depth insights, analyses, and forecasts adjusted for unique market conditions.

What deliverables can I expect from this freight Transport Management market research project?

Anticipated deliverables include comprehensive market reports with analysis of trends, forecasts, competitive landscape assessments, and segmented data. Additionally, insights into regulatory impacts and growth opportunities will be provided.

What are the market trends of freight Transport Management?

Current market trends in freight transport management include rising adoption of software solutions, increased focus on sustainability, and integration of IoT technologies. Additionally, a noticeable shift towards multimodal transport strategies is evident.