Gas Analyzer Market Report

Published Date: 31 January 2026 | Report Code: gas-analyzer

Gas Analyzer Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Gas Analyzer market from 2023 to 2033, including insights on market trends, regional breakdowns, technological advancements, and key players.

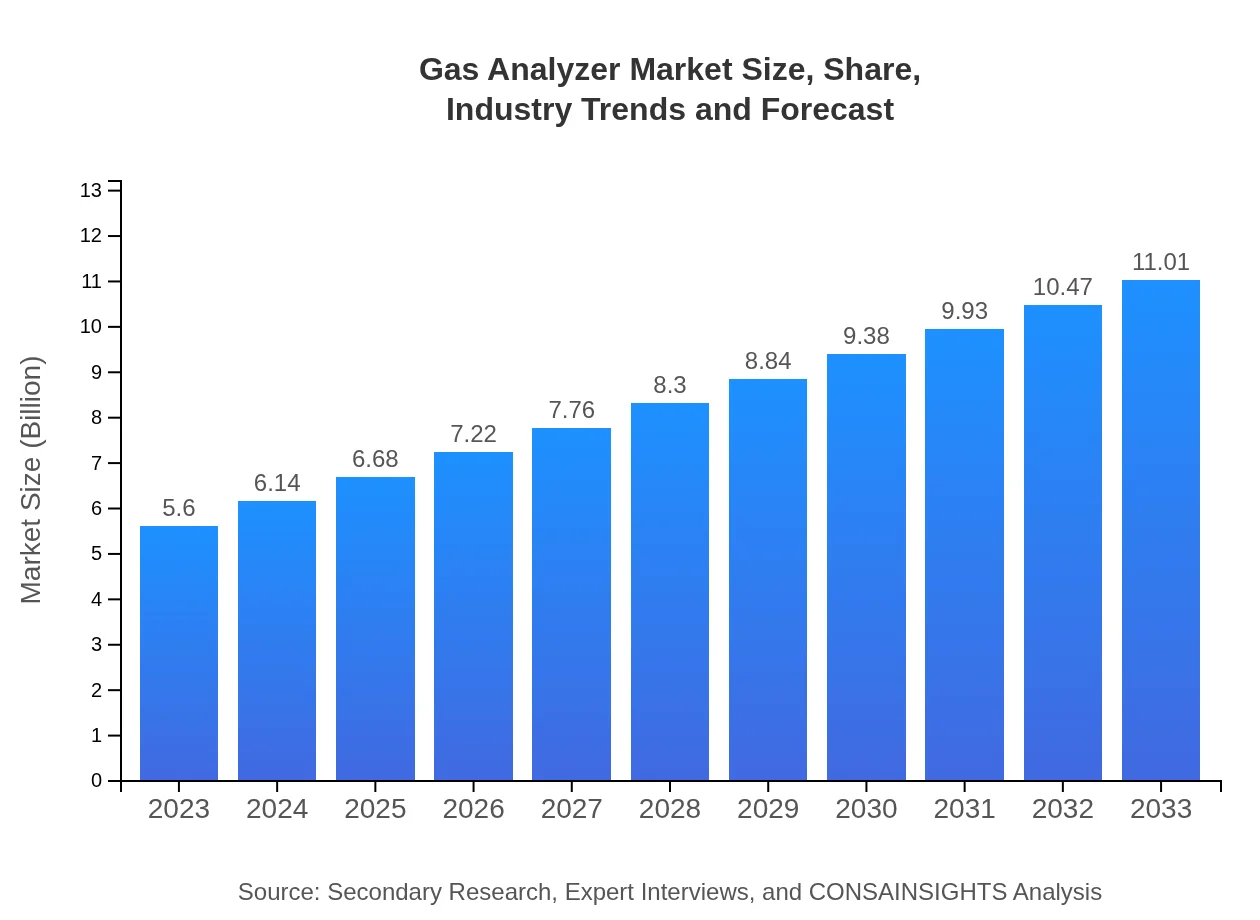

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Thermo Fisher Scientific, ABB Ltd., Emerson Electric Co., Horiba Ltd., Teledyne Technologies |

| Last Modified Date | 31 January 2026 |

Gas Analyzer Market Overview

Customize Gas Analyzer Market Report market research report

- ✔ Get in-depth analysis of Gas Analyzer market size, growth, and forecasts.

- ✔ Understand Gas Analyzer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Gas Analyzer

What is the Market Size & CAGR of Gas Analyzer market in 2023?

Gas Analyzer Industry Analysis

Gas Analyzer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Gas Analyzer Market Analysis Report by Region

Europe Gas Analyzer Market Report:

The European market, at $1.84 billion in 2023, is forecasted to grow to $3.62 billion by 2033. Strong regulatory frameworks related to emissions and an emphasis on air quality control contribute to this steady growth.Asia Pacific Gas Analyzer Market Report:

In 2023, the Asia Pacific Gas Analyzer market is valued at $1.01 billion, expected to grow to $1.99 billion by 2033. Factors such as industrial growth in developing countries, increased environmental awareness, and investments in air quality monitoring are driving this growth.North America Gas Analyzer Market Report:

North America, valued at $1.91 billion in 2023, is anticipated to reach $3.76 billion by 2033. This growth is attributed to stringent regulations and technological innovations in the gas analyzer sector, particularly in industrial applications.South America Gas Analyzer Market Report:

The South American market, starting at $0.28 billion in 2023, is projected to double to $0.56 billion by 2033. The growth is supported by sectors such as mining and oil that emphasize environmental compliance.Middle East & Africa Gas Analyzer Market Report:

Valued at $0.55 billion in 2023, the Middle East and Africa market is expected to reach $1.08 billion by 2033. Growth will be driven by the oil and gas sector's increasing adoption of gas analyzers for safety monitoring.Tell us your focus area and get a customized research report.

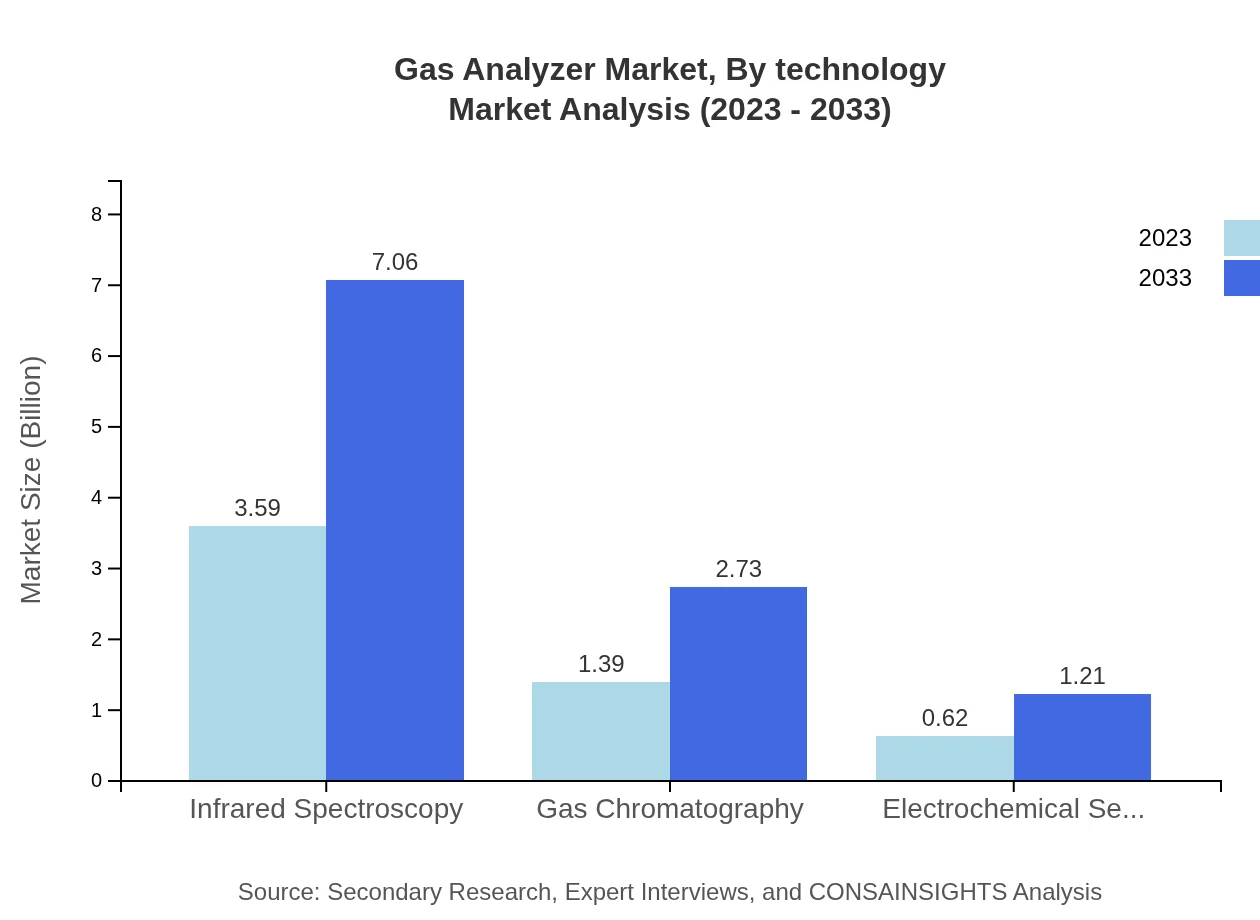

Gas Analyzer Market Analysis By Technology

The technology segment includes: - **Infrared Spectroscopy**: Valued at $3.59 billion in 2023, projected to grow to $7.06 billion by 2033 (64.18% market share). - **Gas Chromatography**: Starting at $1.39 billion, growing to $2.73 billion (24.83% market share). - **Electrochemical Sensors**: Increasing from $0.62 billion to $1.21 billion (10.99% market share). The emphasis on precision in applications drives demand for these technologies.

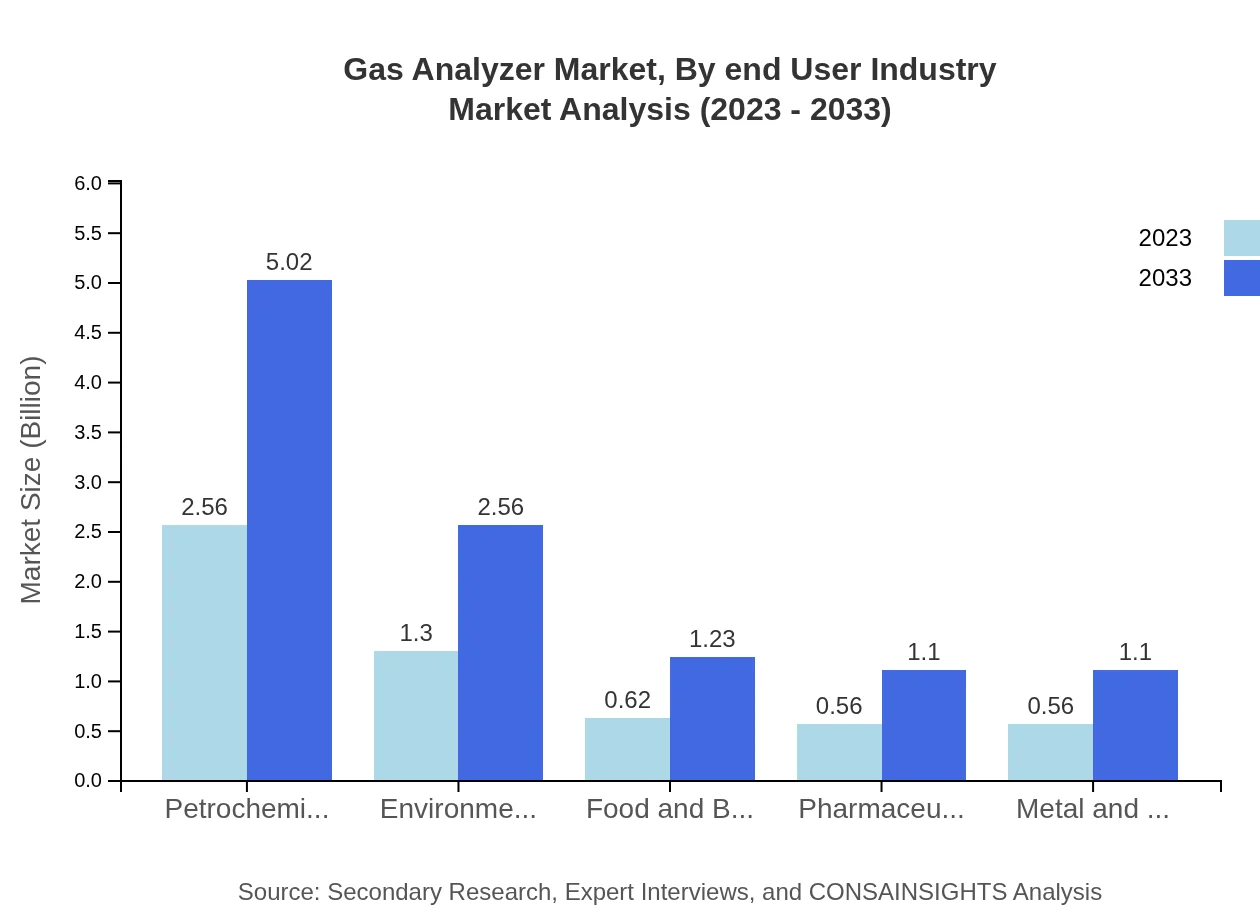

Gas Analyzer Market Analysis By End User Industry

Segments include: - **Petrochemical**: Dominates at $2.56 billion, reaching $5.02 billion by 2033 (45.63% share). - **Environmental Monitoring**: Expected to grow from $1.30 billion to $2.56 billion (23.22% share). - **Food and Beverage**: Will increase from $0.62 billion to $1.23 billion (11.14% share). These sectors contribute significantly to market growth, driven by compliance and safety mandates.

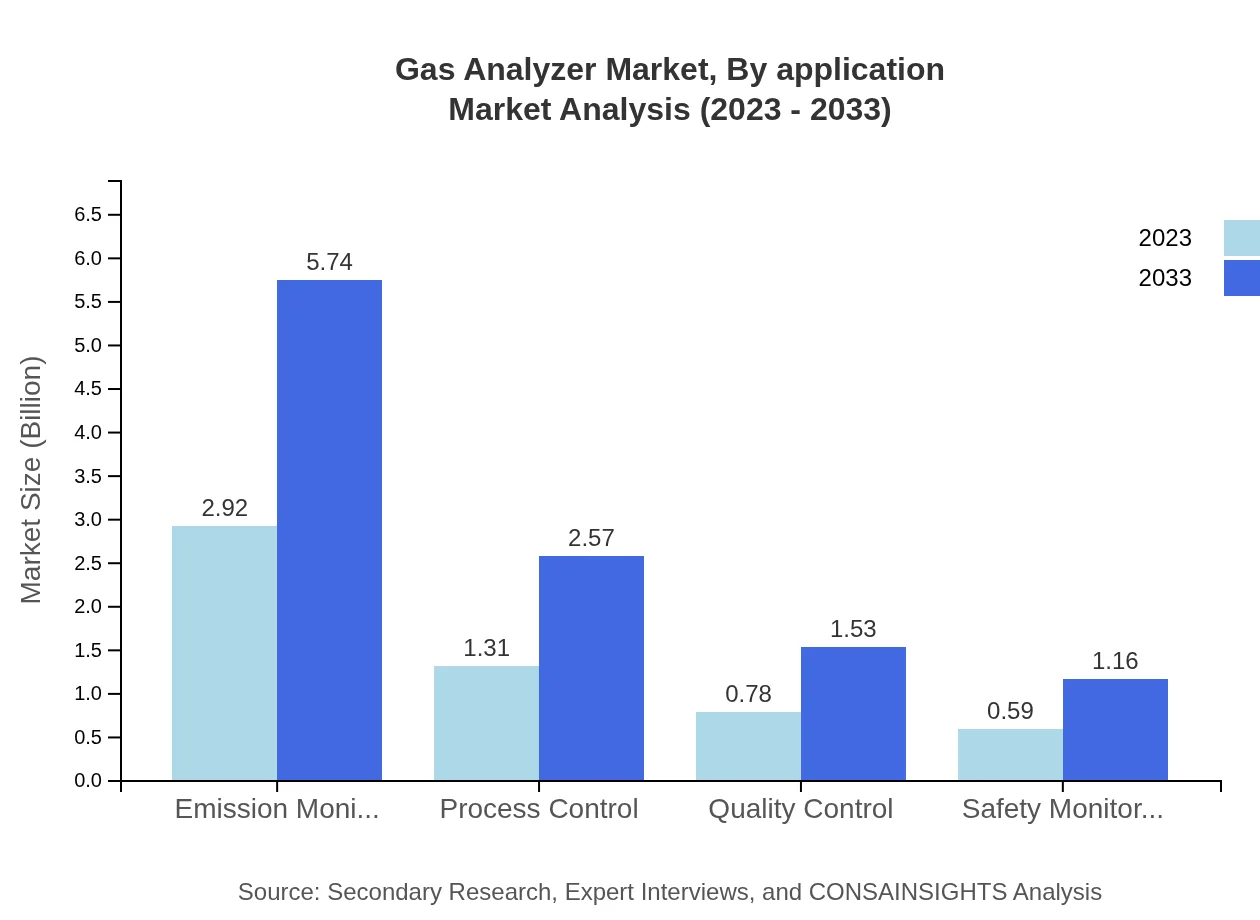

Gas Analyzer Market Analysis By Application

Application segments include: - **Emission Monitoring**: Largest at $2.92 billion in 2023, growing to $5.74 billion (52.19% share). - **Process Control**: From $1.31 billion to $2.57 billion (23.34% share). - **Quality Control**: Increasing from $0.78 billion to $1.53 billion (13.94% share). - **Safety Monitoring**: Growth from $0.59 billion to $1.16 billion (10.53% share). Overall, emission monitoring remains a top priority across industries.

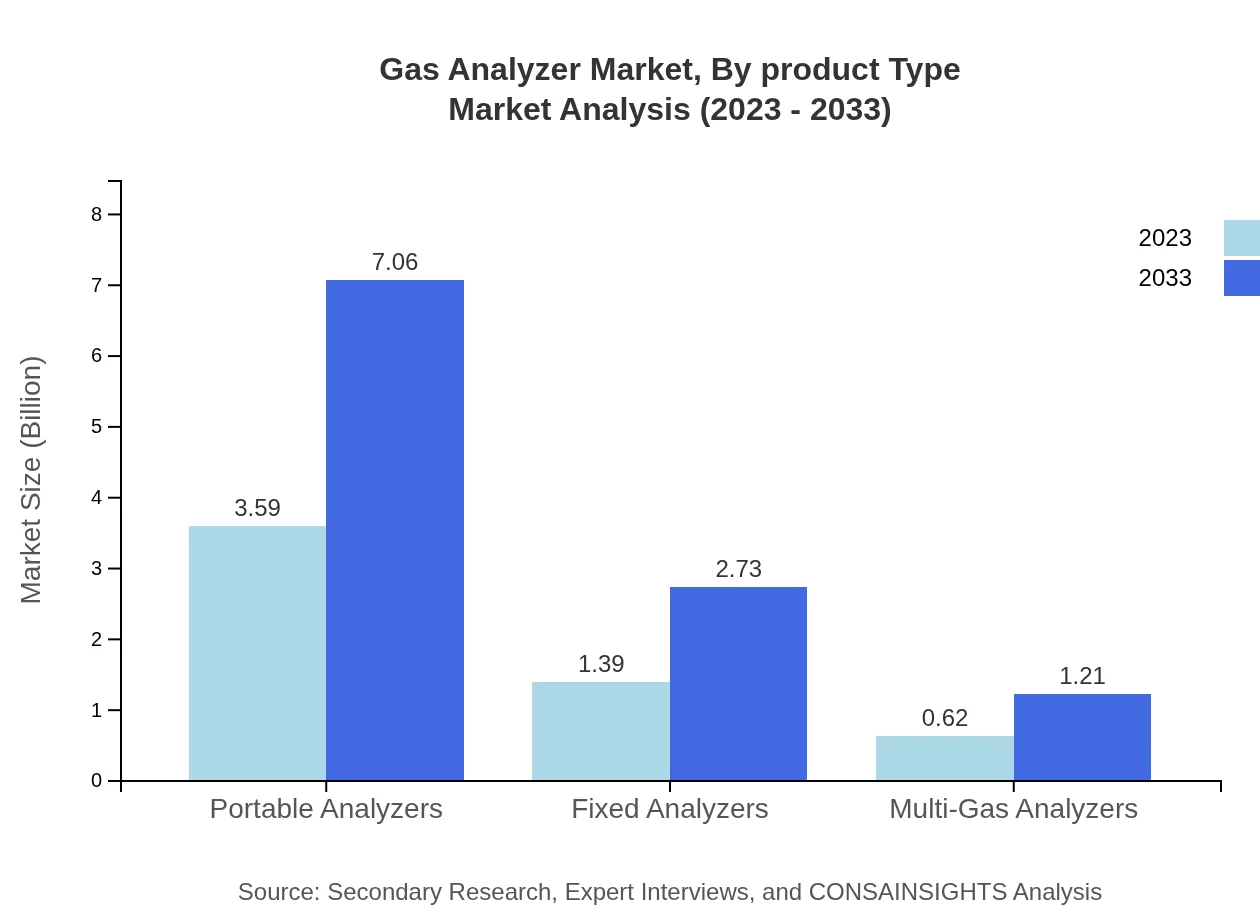

Gas Analyzer Market Analysis By Product Type

Product types: - **Portable Analyzers**: Leading with $3.59 billion and projected to grow to $7.06 billion (64.18% share). - **Fixed Analyzers**: From $1.39 billion to $2.73 billion (24.83% share). - **Multi-Gas Analyzers**: Expected growth from $0.62 billion to $1.21 billion (10.99% share). The mobility of portable analyzers is a critical factor driving their market presence.

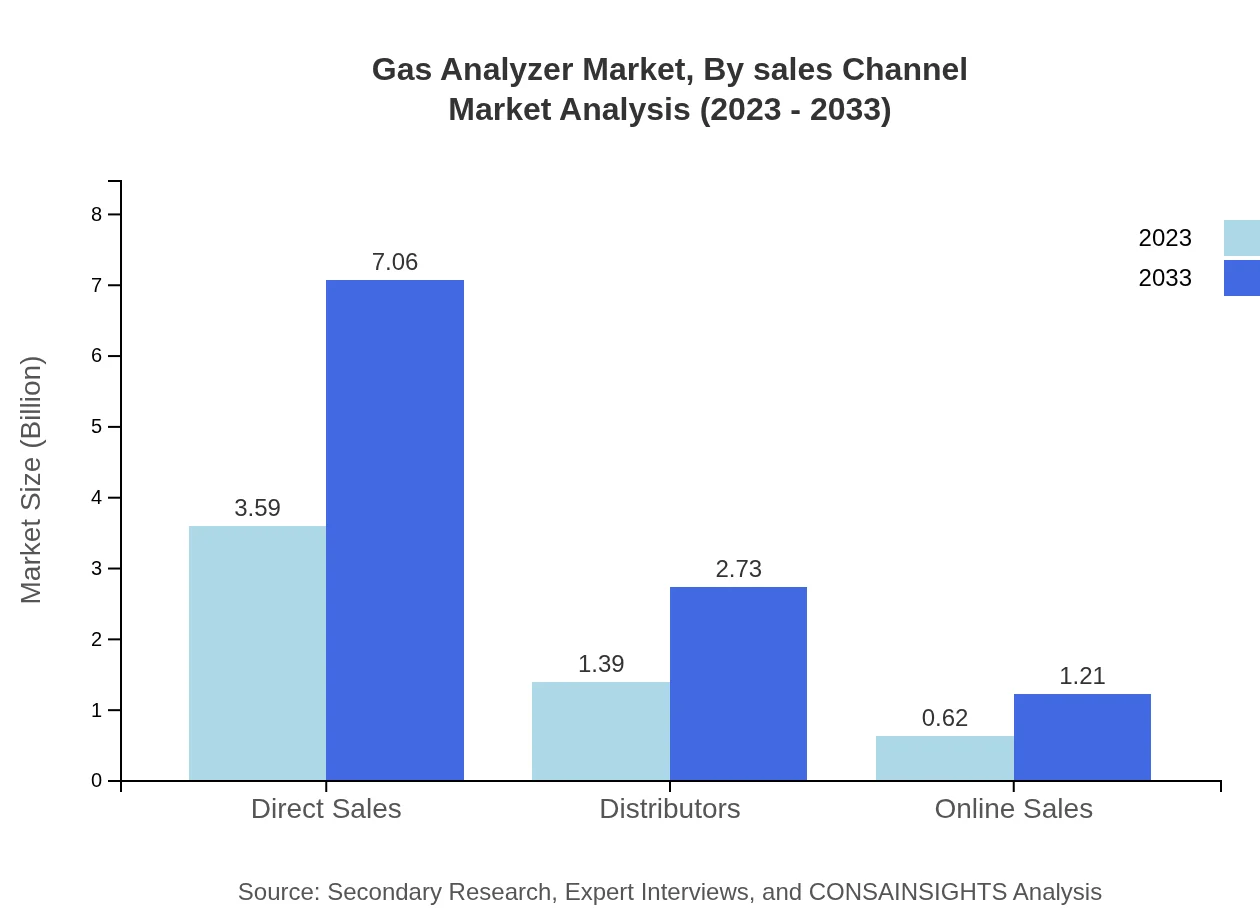

Gas Analyzer Market Analysis By Sales Channel

Sales channels: - **Direct Sales**: Leading channel valued at $3.59 billion, growing to $7.06 billion (64.18% share). - **Distributors**: Projected rise from $1.39 billion to $2.73 billion (24.83% share). - **Online Sales**: From $0.62 billion to $1.21 billion (10.99% share). The shift toward online sales channels is notable, reflecting broader industry trends.

Gas Analyzer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Gas Analyzer Industry

Thermo Fisher Scientific:

A leading player offering a wide range of gas analyzers focusing on advanced detection and monitoring solutions.ABB Ltd.:

Known for industrial automation and power technologies, ABB provides robust gas analyzers for various industrial applications.Emerson Electric Co.:

A prominent name in technical solutions, Emerson manufactures gas analyzers tailored for the oil and gas industry.Horiba Ltd.:

Focuses on automotive and environmental measurements, providing innovative gas analysis solutions across sectors.Teledyne Technologies:

Specializes in sophisticated analytical instruments, including gas analyzers for environmental monitoring.We're grateful to work with incredible clients.

FAQs

What is the market size of gas Analyzer?

The global gas analyzer market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in this gas Analyzer industry?

Key players in the gas analyzer market include major corporations such as Siemens, ABB, and Emerson, specializing in various segments like emission monitoring, process control, and environmental monitoring.

What are the primary factors driving the growth in the gas Analyzer industry?

Factors driving growth include increased environmental regulations, heightened demand for air quality monitoring, and advancements in sensor technologies to enhance accuracy and functionality in gas analysis.

Which region is the fastest Growing in the gas Analyzer?

The fastest-growing region in the gas analyzer market is Europe, expected to grow from $1.84 billion in 2023 to $3.62 billion by 2033, indicating strong regional demand and investment.

Does ConsaInsights provide customized market report data for the gas Analyzer industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the gas analyzer industry, ensuring clients receive the most relevant insights.

What deliverables can I expect from this gas Analyzer market research project?

Deliverables include comprehensive market analysis reports, insights on trends, competitive landscape assessments, and detailed forecasts segmented by region and market type.

What are the market trends of gas Analyzer?

Market trends include the rise of portable analyzers, advancements in infrared spectroscopy, and increased utilization in environmental monitoring within the gas analyzer sector.