Geofencing Service Providers

Published Date: 02 February 2026 | Report Code: geofencing-service-providers

Geofencing Service Providers Market Size, Share, Industry Trends and Forecast to 2033

This report presents a comprehensive analysis of the Geofencing Service Providers market from 2024 to 2033. It outlines key insights and data trends, explores market size, growth rate, industry dynamics, segmentation details, regional performance, technological innovations, and product analyses. The forecast and strategic recommendations provide valuable guidance for stakeholders.

| Metric | Value |

|---|---|

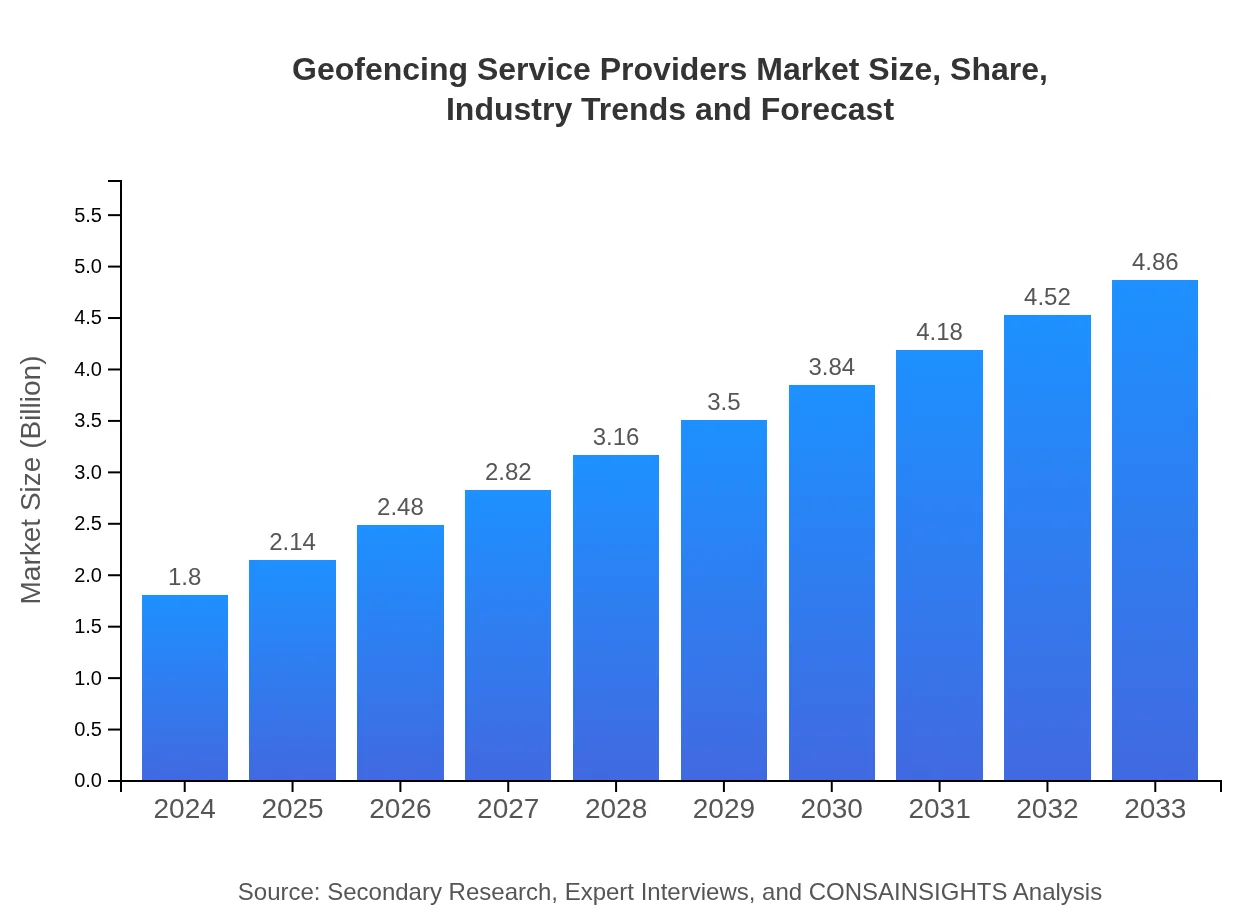

| Study Period | 2024 - 2033 |

| 2024 Market Size | $1.80 Billion |

| CAGR (2024-2033) | 11.2% |

| 2033 Market Size | $4.86 Billion |

| Top Companies | GeoTech Innovations, LocateX Solutions |

| Last Modified Date | 02 February 2026 |

Geofencing Service Providers Market Overview

Customize Geofencing Service Providers market research report

- ✔ Get in-depth analysis of Geofencing Service Providers market size, growth, and forecasts.

- ✔ Understand Geofencing Service Providers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Geofencing Service Providers

What is the Market Size & CAGR of Geofencing Service Providers market in 2024?

Geofencing Service Providers Industry Analysis

Geofencing Service Providers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Geofencing Service Providers Market Analysis Report by Region

Europe Geofencing Service Providers:

Europe is projected to see a substantial increase in market size from 0.46 in 2024 to 1.23 by 2033. The region’s growth is driven by advanced technological infrastructure, regulatory support for data privacy, and a thriving e-commerce sector. European companies are increasingly leveraging geofencing to enhance customer engagement and improve operational efficiency.Asia Pacific Geofencing Service Providers:

In the Asia Pacific region, the market is set to grow from a size of 0.37 in 2024 to approximately 1.00 by 2033. This growth is fueled by rapid urbanization, increased smartphone penetration, and significant investments in digital infrastructure. The regional market benefits from technological innovation and a growing middle class, which drives demand for location-based marketing and smart city initiatives.North America Geofencing Service Providers:

In North America, the market demonstrates a strong performance with figures growing from 0.59 in 2024 to 1.61 by 2033. This region benefits from early adoption of innovative technologies, robust infrastructure, and a mature digital ecosystem. High consumer demand for personalized services further distinguishes North America as a leading market for geofencing solutions.South America Geofencing Service Providers:

South America’s geofencing market is witnessing gradual expansion, with market sizes expected to progress from 0.16 in 2024 to 0.42 by 2033. Although the economic volatility in parts of the region poses challenges, an increasing shift towards digital transformation in retail and logistics is fueling steady growth.Middle East & Africa Geofencing Service Providers:

The Middle East and Africa region is expected to witness moderate growth, with market sizes rising from 0.22 in 2024 to 0.60 by 2033. Emerging economies in this region, coupled with increasing investments in smart city projects and mobile commerce, are stimulating the demand for innovative geofencing applications.Tell us your focus area and get a customized research report.

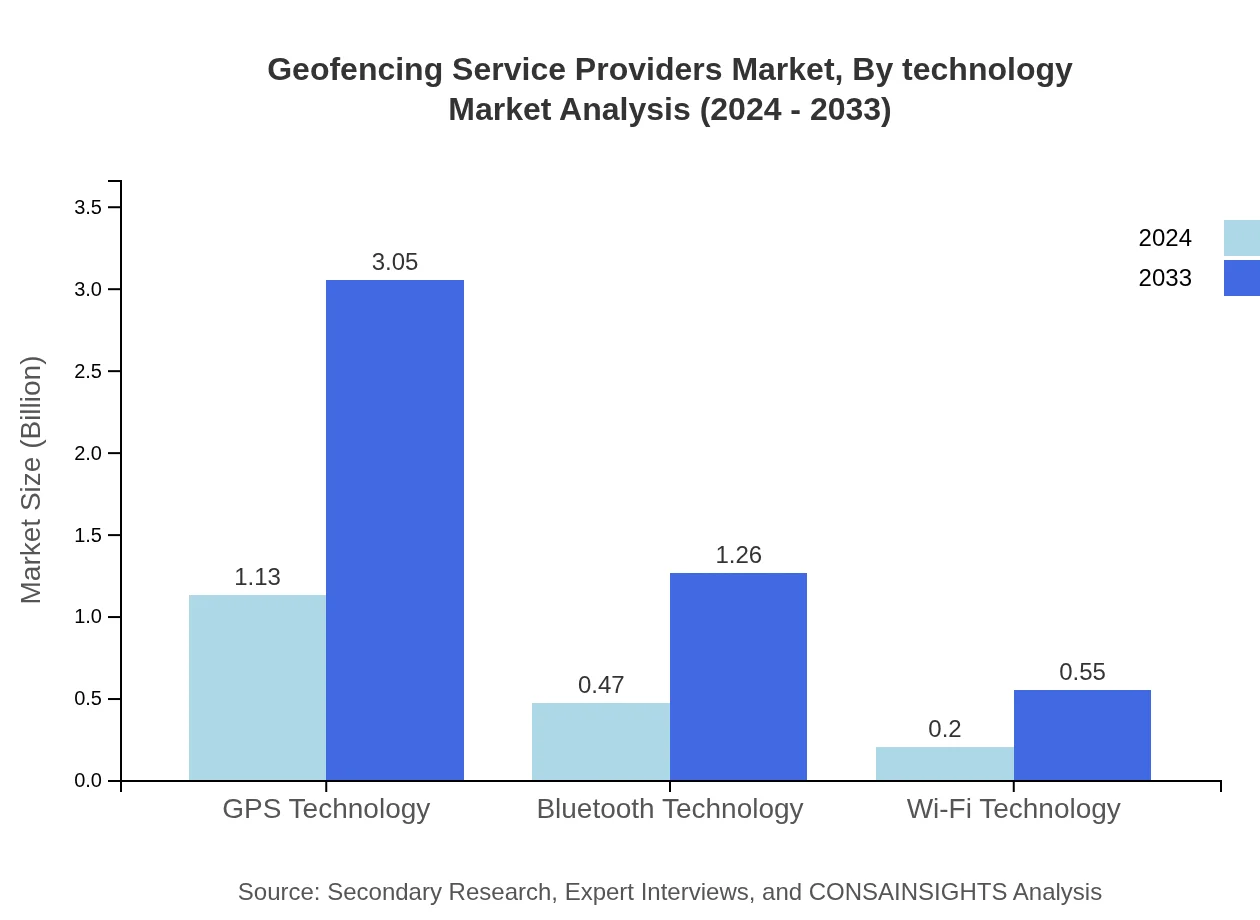

Geofencing Service Providers Market Analysis By Technology

The technology segment of the geofencing market encapsulates various innovations that drive location-based services. Mobile platforms remain the dominant technology, with market size projections indicating significant growth driven by enhanced GPS accuracy and sensor integration. In addition, web platforms and IoT devices are reshaping the way geofencing services are deployed. Emerging trends in GPS technology, Bluetooth, and Wi-Fi further enhance connectivity and precision. As these technologies evolve, they not only improve the overall user experience but also open up new avenues for data collection and analytics, helping businesses achieve better operational insights and customer targeting.

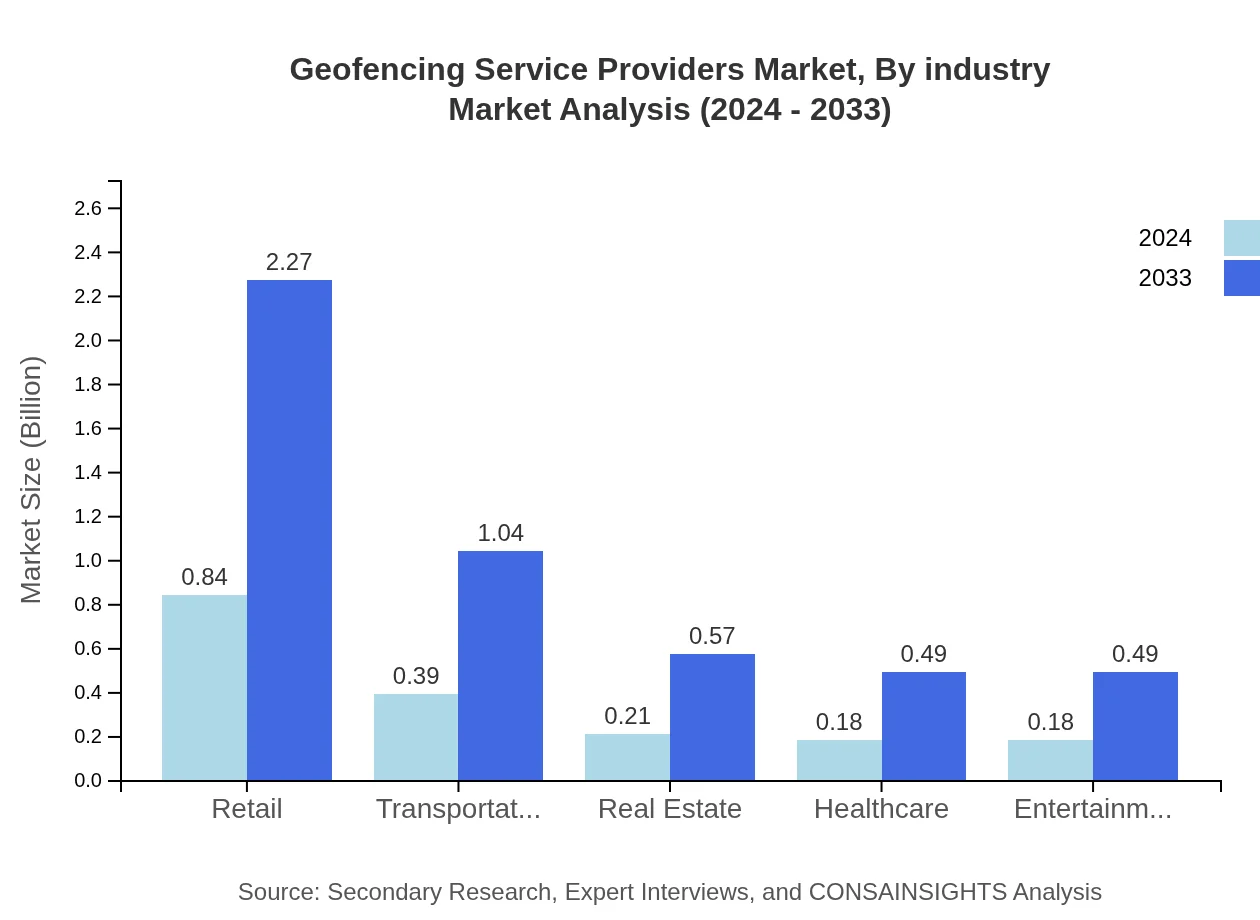

Geofencing Service Providers Market Analysis By Industry

Industry segmentation within the geofencing market highlights diverse applications across sectors. Retail is a key driver, using geofencing to offer targeted promotions, with market size advancements from 0.84 in 2024 to 2.27 by 2033 and a consistent 46.74% share. The transportation and logistics sector leverages these services for fleet management and route optimization, while real estate uses location data to enhance property management. Additionally, the healthcare sector has begun integrating geofencing protocols for patient tracking and facility management. Entertainment and events also capitalize on these technologies to enhance customer experiences and crowd management during live events.

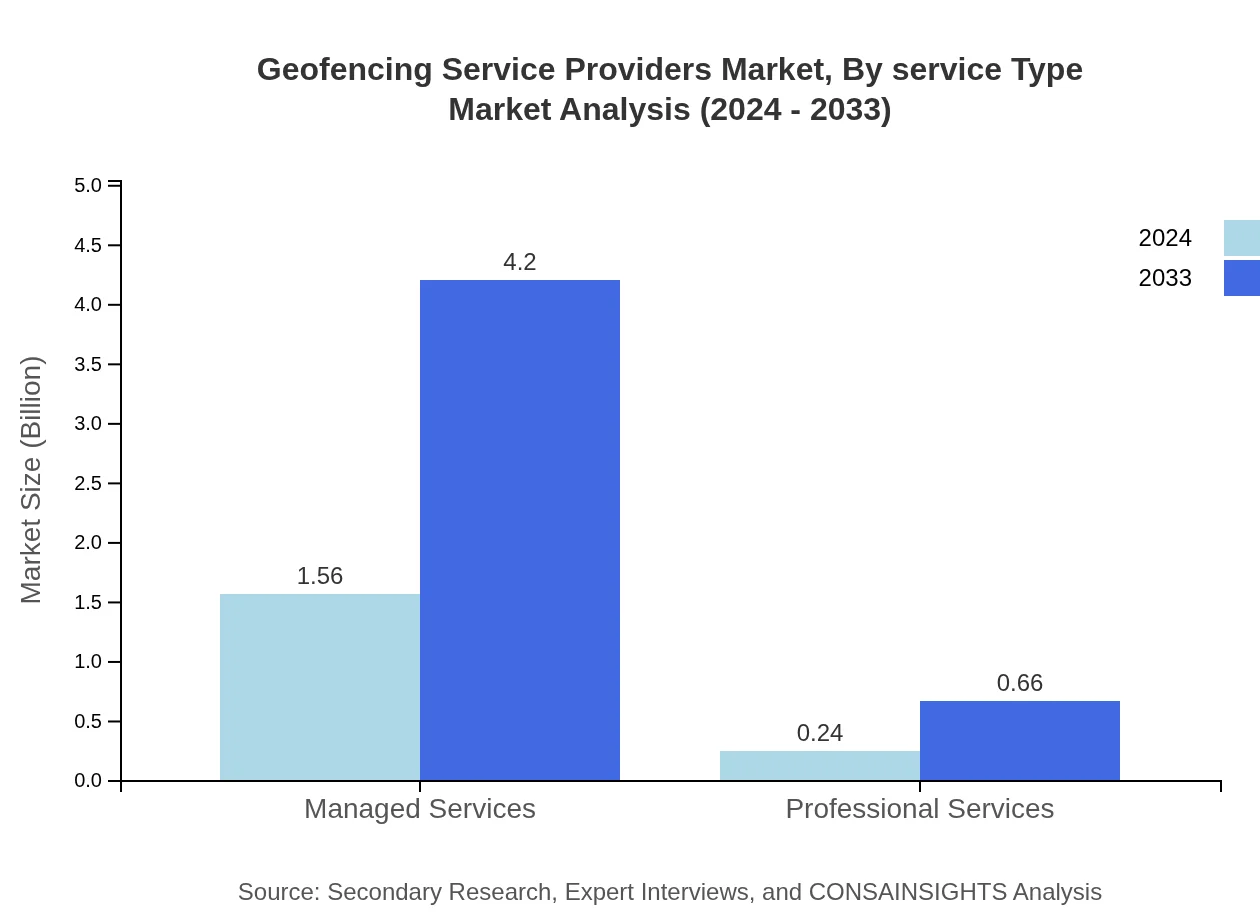

Geofencing Service Providers Market Analysis By Service Type

Within the service type segmentation, managed services and professional services play pivotal roles. Managed services, which boast a market size of 1.56 in 2024 growing to 4.20 by 2033 along with an 86.46% share, are favored by many organizations for their reliability and comprehensive support. Professional services, while representing a smaller segment with a market size of 0.24 in 2024 expanding to 0.66 by 2033, provide specialized expertise in implementation and custom integration. These service models help businesses tailor geofencing solutions to fit unique operational requirements, ensuring scalability and effective resource utilization.

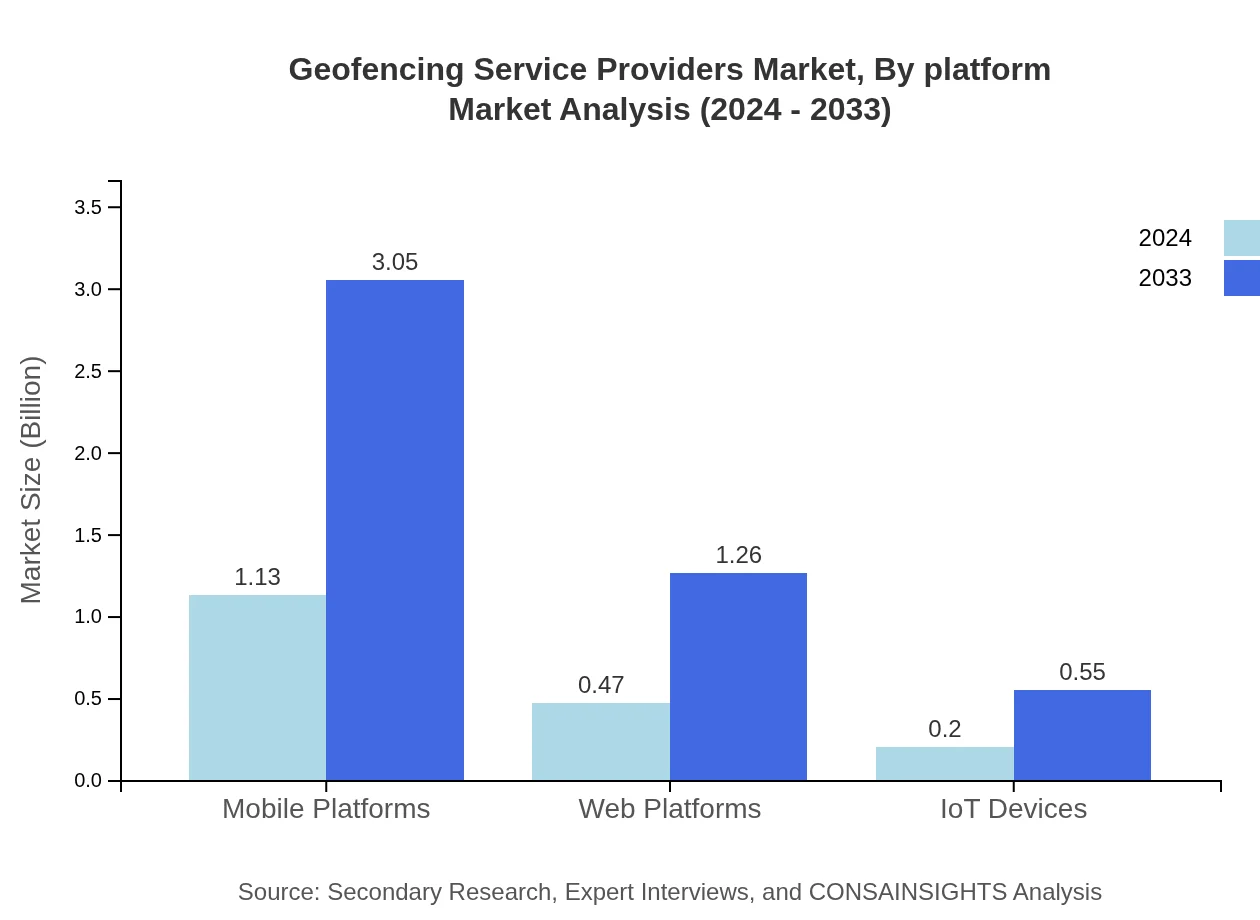

Geofencing Service Providers Market Analysis By Platform

Platform analysis in the geofencing market distinguishes between mobile and web-based platforms, both of which have shown significant traction. Mobile platforms, with a market size of 1.13 in 2024 growing to 3.05 by 2033, lead the sector with a dominant 62.77% share. Web platforms also represent an important channel for geofencing applications, showing steady growth and a corresponding share of 25.93%. The competitive landscape in this segment is marked by continuous innovation, where improved interface designs and enhanced real-time capabilities are critical to capturing consumer and business interest alike. These developments facilitate seamless integration of geofencing capabilities across multiple digital touchpoints.

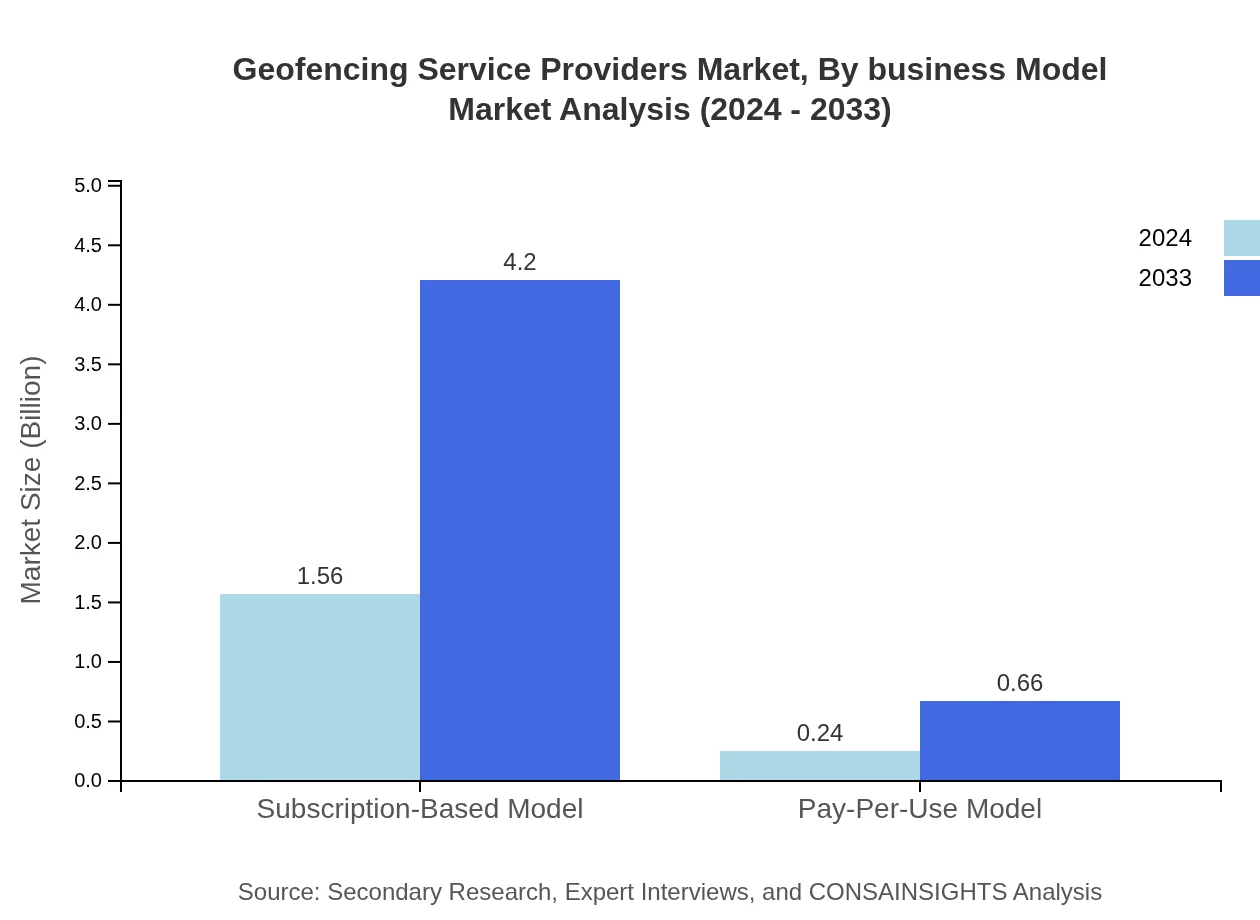

Geofencing Service Providers Market Analysis By Business Model

The business model segmentation of the geofencing market is predominantly shaped by subscription-based and pay-per-use models. The subscription-based model has seen considerable success, with market sizes increasing from 1.56 in 2024 to 4.20 by 2033 and maintaining an 86.46% share, offering predictable revenue streams and enhanced customer retention. On the other hand, the pay-per-use model, despite representing a smaller slice of the market with a size of 0.24 in 2024 growing to 0.66 by 2033, allows for flexibility and cost-effectiveness for smaller businesses and test pilots. These models enable providers to adapt to varying customer needs, aligning pricing strategies with usage patterns and market demands.

Geofencing Service Providers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Geofencing Service Providers Industry

GeoTech Innovations:

GeoTech Innovations is a market leader known for its cutting-edge geofencing solutions that integrate AI and IoT. The company consistently pioneers advanced analytics and location-based innovations, catering to a global clientele across multiple industries.LocateX Solutions:

LocateX Solutions excels in delivering comprehensive geofencing services with a focus on mobile platform integration and data-driven insights. Their robust offerings and strategic partnerships position them as one of the foremost leaders in the market.We're grateful to work with incredible clients.

FAQs

What is the market size of geofencing service providers?

The global geofencing service providers market is projected to reach $1.8 billion by 2024, with a compound annual growth rate (CAGR) of 11.2% until 2033. Significant growth in mobile technologies and location-based services are key drivers of this expansion.

What are the key market players or companies in the geofencing service providers industry?

Key market players in the geofencing service providers industry include prominent technology firms and startups specializing in location-based services. These companies are continuously innovating, which significantly influences market dynamics and competition.

What are the primary factors driving the growth in the geofencing service providers industry?

Key factors driving growth include increasing penetration of smartphones, advancements in GPS technology, and the growing demand for location-based marketing. Businesses are leveraging geofencing tools to enhance customer engagement and targeted advertising.

Which region is the fastest Growing in the geofencing service providers market?

The Asia Pacific region is poised for significant growth in the geofencing service providers market, rising from $0.37 billion in 2024 to $1.00 billion by 2033, indicating a rapid adoption of mobile technology and location-based strategies.

Does ConsaInsights provide customized market report data for the geofencing service providers industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications. This includes in-depth analysis, regional insights, and segmentation data to support strategic decision-making in the geofencing service providers industry.

What deliverables can I expect from this geofencing service providers market research project?

Deliverables typically include a comprehensive report featuring market size estimates, growth forecasts, segment analysis, and regional data. Additional insights into competitive landscape and key trends will also be provided.

What are the market trends of geofencing service providers?

Current market trends in geofencing include increased use of managed services, the rise of subscription-based models, and significant investment in mobile and web platforms. The integration of IoT devices is also shaping future developments.