High Performance Computing As A Service

Published Date: 31 January 2026 | Report Code: high-performance-computing-as-a-service

High Performance Computing As A Service Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report delves into the High Performance Computing As A Service market, offering a detailed analysis of market size, growth trajectories, segmentation, regional performance, technological innovations, and future trends. Covering the forecast period from 2024 to 2033, the report presents vital insights, substantiated data, and strategic guidance for stakeholders seeking to understand and capitalize on this dynamic market.

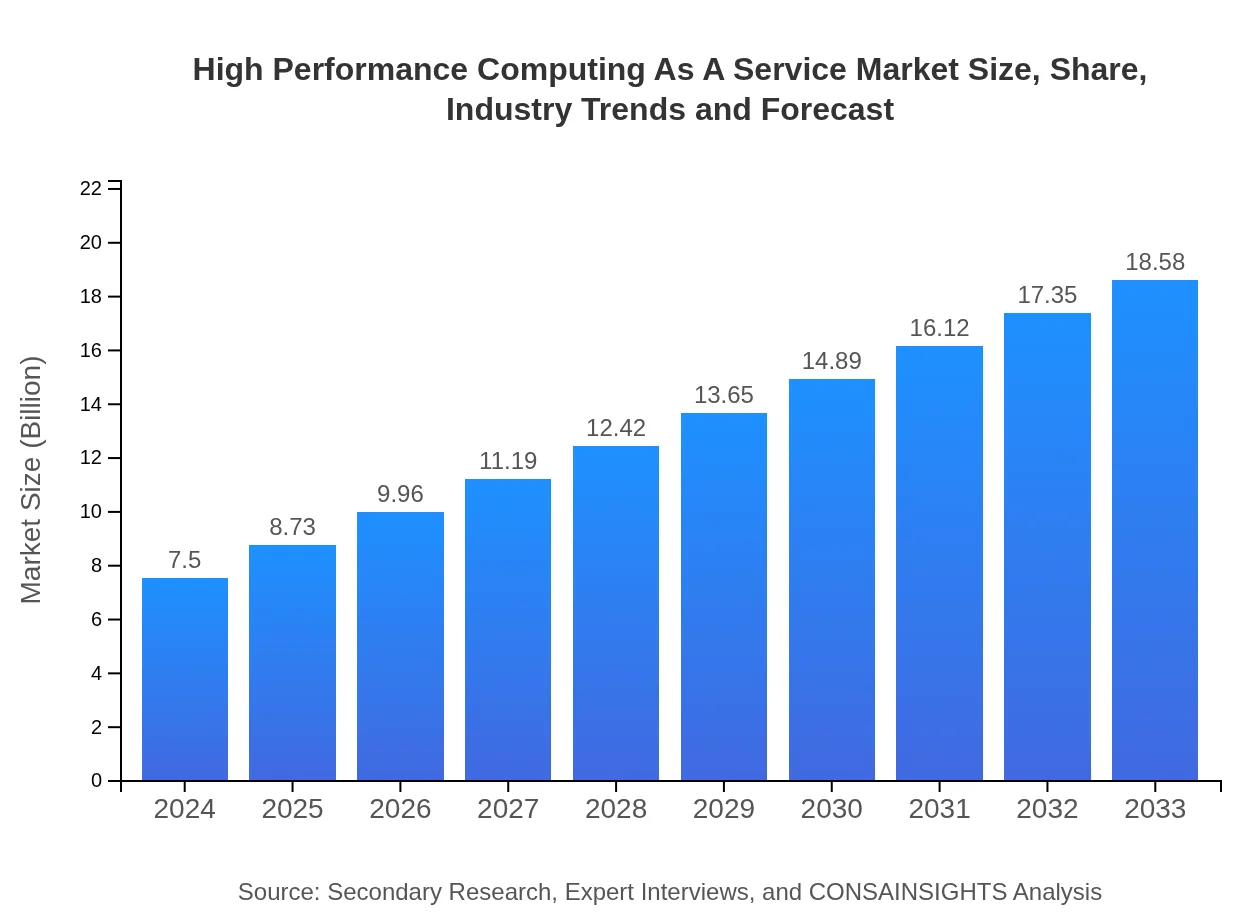

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $7.50 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $18.58 Billion |

| Top Companies | TechCompute Innovations, NextGen Cloud Systems, ComputeX Global |

| Last Modified Date | 31 January 2026 |

High Performance Computing As A Service Market Overview

Customize High Performance Computing As A Service market research report

- ✔ Get in-depth analysis of High Performance Computing As A Service market size, growth, and forecasts.

- ✔ Understand High Performance Computing As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in High Performance Computing As A Service

What is the Market Size & CAGR of High Performance Computing As A Service market in 2024?

High Performance Computing As A Service Industry Analysis

High Performance Computing As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

High Performance Computing As A Service Market Analysis Report by Region

Europe High Performance Computing As A Service:

Europe is characterized by a healthy competitive landscape, with market sizes anticipated to expand from 2.10 in 2024 to 5.21 in 2033. Investments in digital innovation, research collaborations, and substantial public-private partnerships have created a dynamic environment. European countries continue to invest in infrastructure modernization and regulatory enhancements that foster competitive advantage and efficient service delivery.Asia Pacific High Performance Computing As A Service:

In Asia Pacific, the market is witnessing robust growth driven by rising investments in IT infrastructure, expanding digital economies, and strong government initiatives for research and innovation. With market sizes projected to move from 1.42 in 2024 to 3.52 in 2033, countries in this region are focusing on developing advanced computing capabilities to support industries such as manufacturing, healthcare, and education. The region’s strategic emphasis on digital transformation has attracted global technology players, further intensifying competitive dynamics.North America High Performance Computing As A Service:

North America remains a dominant force in the high performance computing as a service market with market sizes increasing from 2.85 in 2024 to 7.06 in 2033. Strong technological integration, substantial investments in R&D, and the presence of major players drive innovation and service delivery in this region. The demand for advanced computing capabilities in industries such as finance, defense, healthcare, and academia further bolsters market growth.South America High Performance Computing As A Service:

South America is emerging as a promising market for high performance computing services, despite relatively modest initial market sizes. The region’s market is set to increase from 0.62 in 2024 to 1.55 by 2033, powered by growing investments in technology and a surge in academic and research activities. Initiatives towards digital infrastructure modernization present opportunities for both local and international service providers.Middle East & Africa High Performance Computing As A Service:

The Middle East and Africa market, though currently smaller with a market size of 0.50 in 2024, is expected to grow significantly to 1.24 by 2033. Rapid urbanization, digital transformation initiatives, and investments in IT infrastructure are key drivers in this region. Enhanced connectivity, government support, and strategic partnerships are paving the way for accelerated adoption of high performance computing services in emerging markets.Tell us your focus area and get a customized research report.

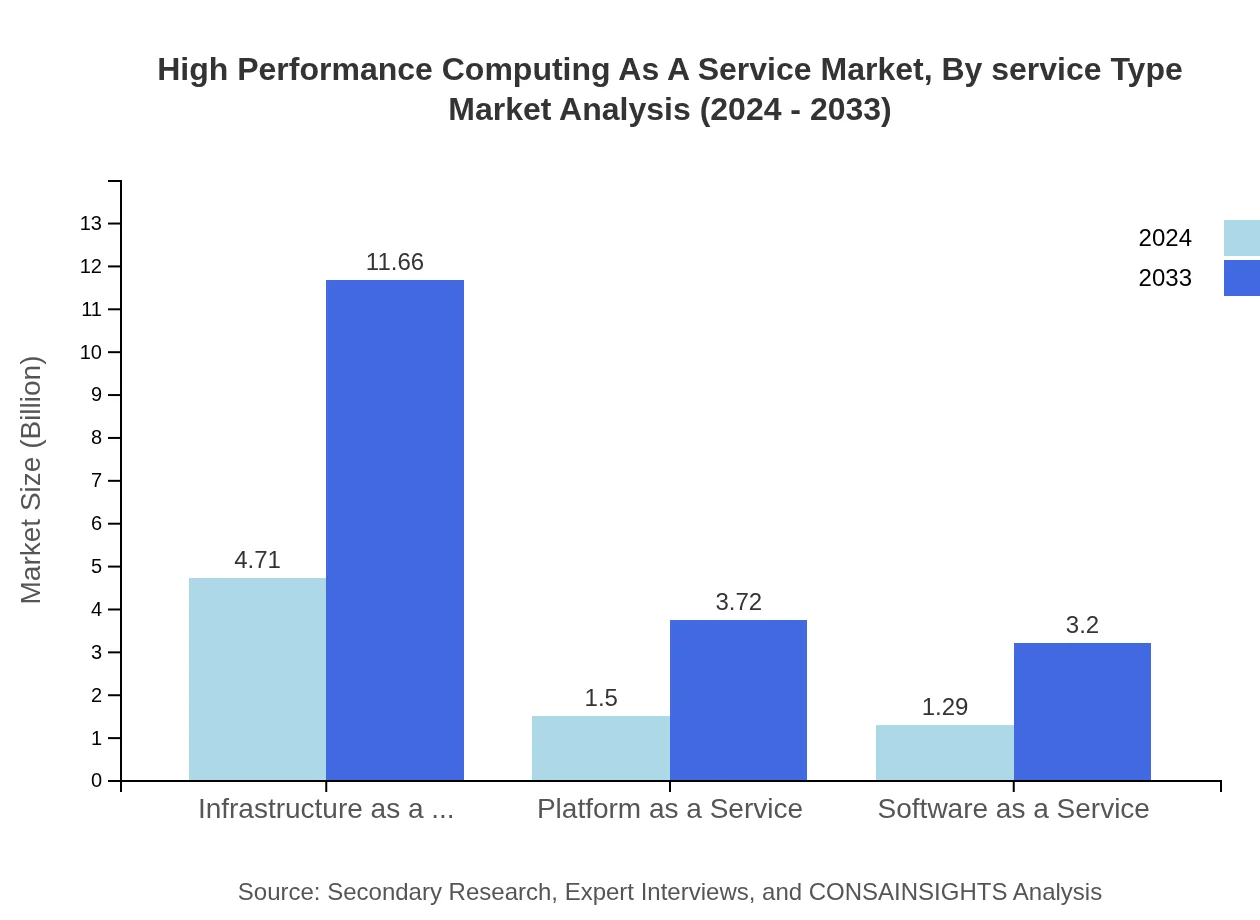

High Performance Computing As A Service Market Analysis By Service Type

The by-service-type segment analyzes the varying needs of different organizational players. Research institutions, for instance, command a significant share owing to their reliance on advanced computing resources to drive scientific advancements. Academic institutions also contribute robustly, due to the increasing integration of computational research within educational frameworks. Additionally, enterprises and government agencies have demonstrated steady growth as they adopt digital solutions to improve operational efficiencies. The 'Others' category represents niche market segments with specialized requirements. Data indicates consistent market sizes and shares from 2024 to 2033, reinforcing the significance of tailored service delivery.

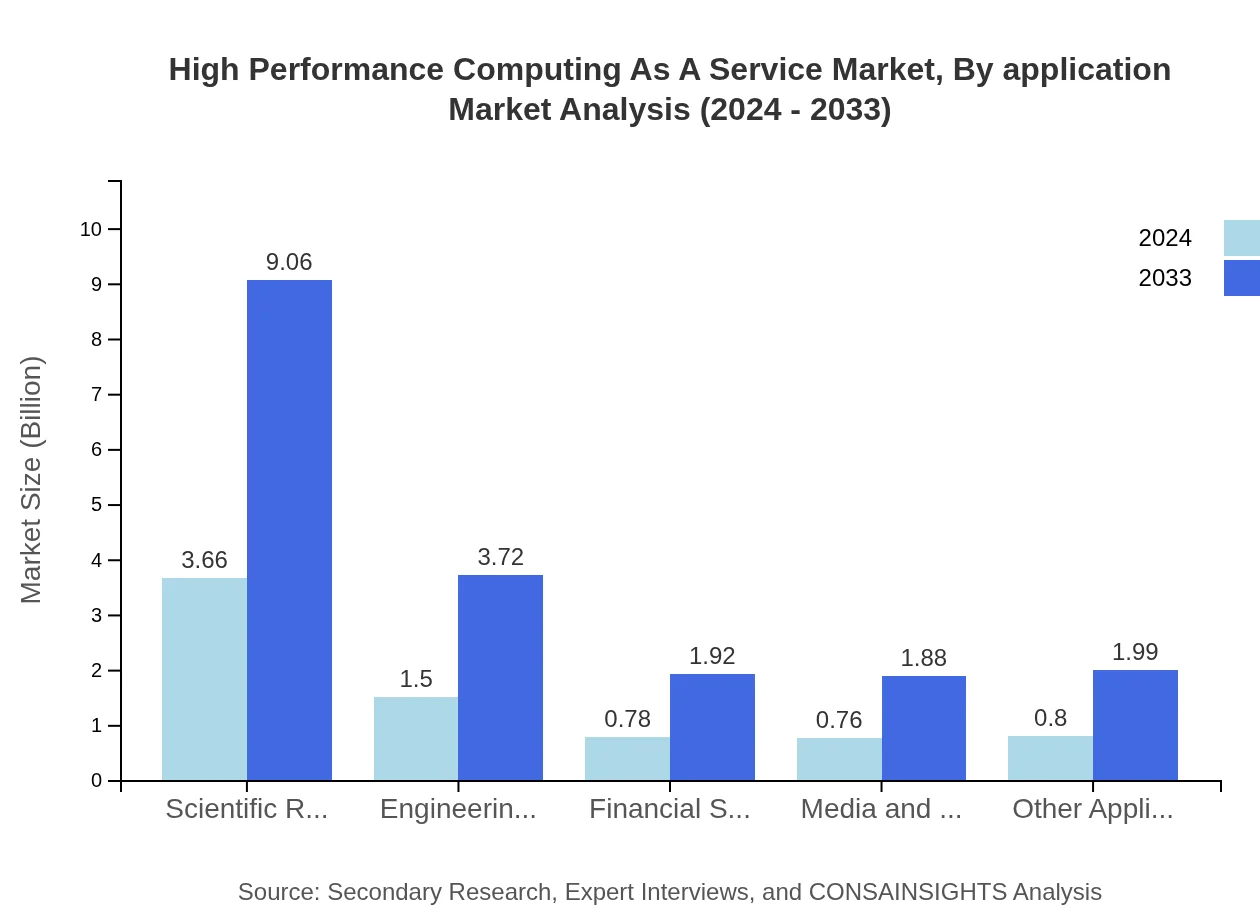

High Performance Computing As A Service Market Analysis By Application

Application segmentation offers a deep dive into sectors such as scientific research, engineering and design, financial services, media and entertainment, and other specialized areas. For example, scientific research drives nearly half of the market share, accentuating the importance of high throughput computing in experimental and simulation studies. Engineering and design benefit from faster computations and model validations, enhancing product development cycles. Financial services and media applications also harness these services for risk assessments and high-definition content processing. The stability in market shares over the forecast period further illustrates the maturity and diverse applicability of high performance computing in fulfilling specialized industry requirements.

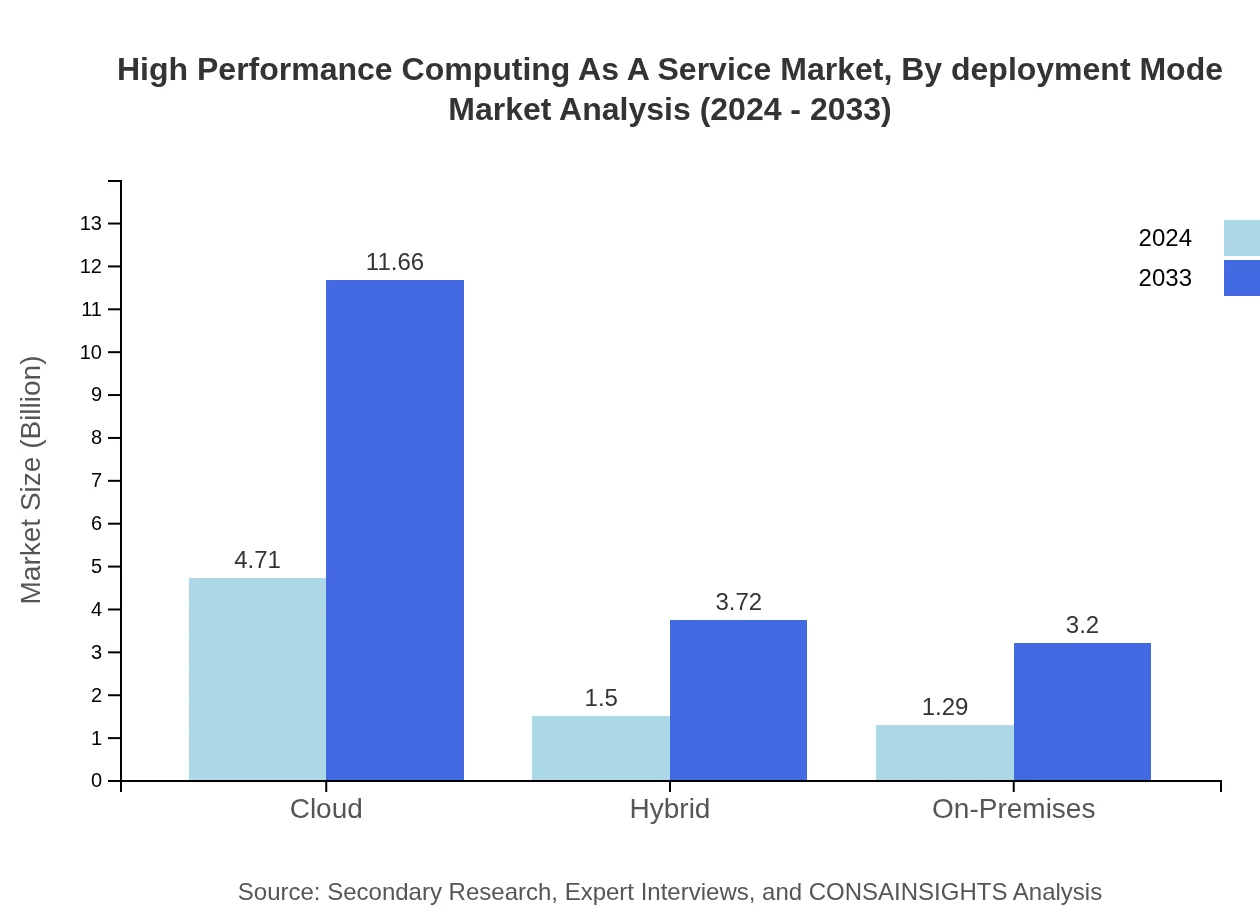

High Performance Computing As A Service Market Analysis By Deployment Mode

Analysis of deployment modes reveals three prominent categories: Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, IaaS dominates with high market sizes and favorable growth due to its scalable and customizable infrastructure. PaaS, offering integrated solutions for app development and deployment, provides agility with moderate market share. SaaS, while representing a smaller portion, serves workload-specific needs with focused application software delivery. These deployment strategies are evaluated based on cost-effectiveness, ease of implementation, and reliability, ensuring that service providers can meet the varied demands of different customer segments effectively.

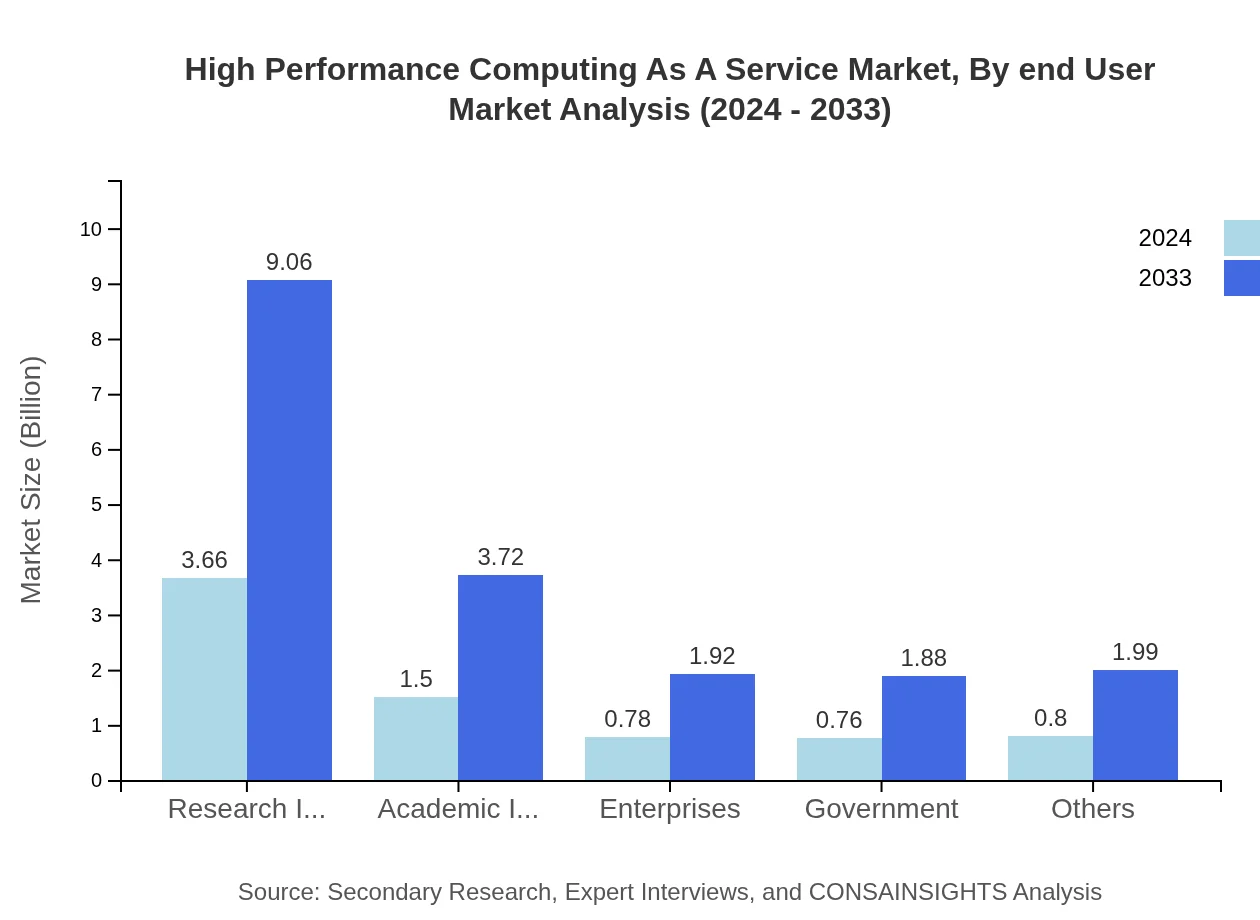

High Performance Computing As A Service Market Analysis By End User

The by-end-user segmentation explores the diverse industries that rely on high performance computing services. End-users range from large-scale research organizations and academic institutions to government bodies and private enterprises. Each end-user category exhibits unique requirements—from high throughput and precise computational capabilities in scientific research to robust security and compliance measures in government projects. The analysis highlights the growing adoption of HPC services to drive innovation, operational efficiency, and decision-making processes. The sustained importance of these segments is evidenced by consistent market shares and continuous investments in technological advancements.

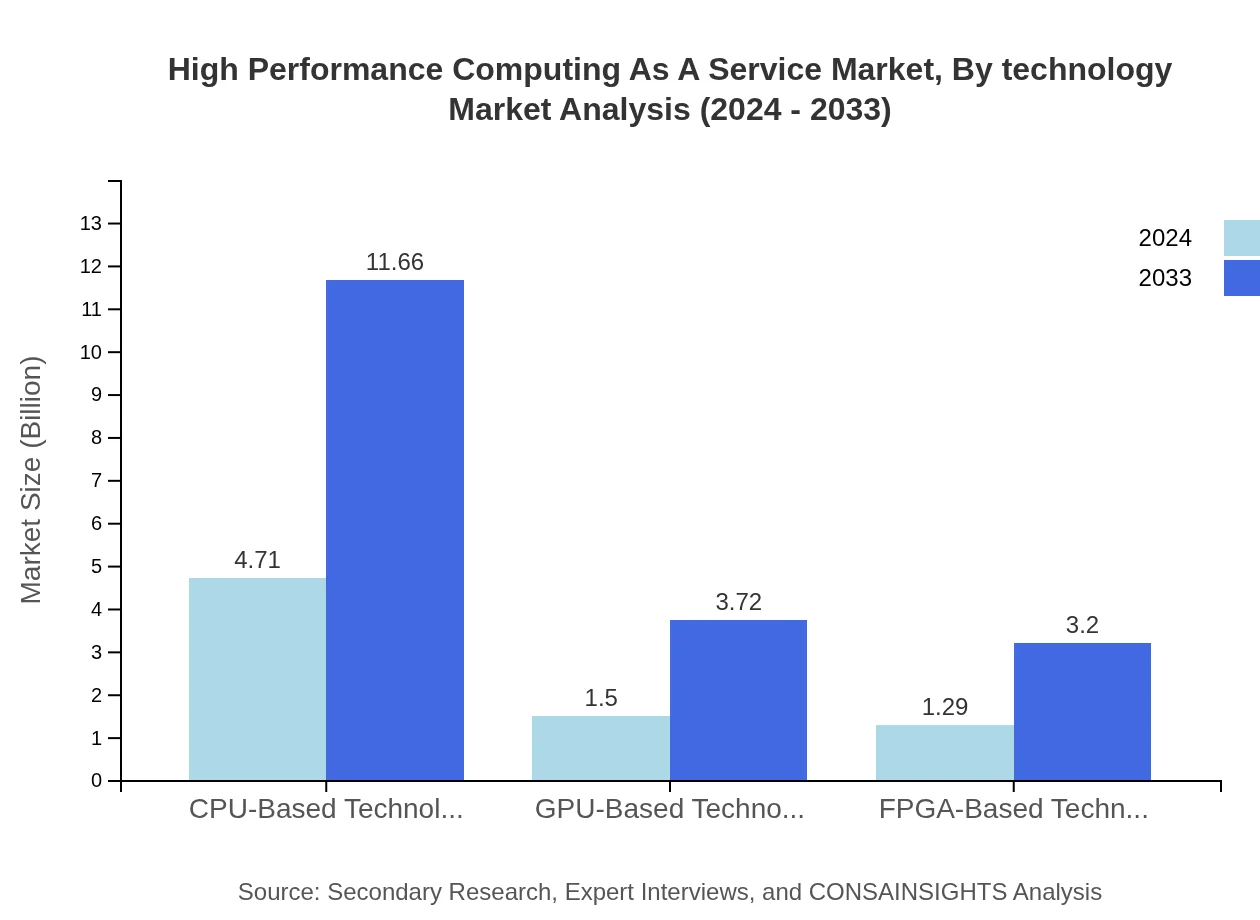

High Performance Computing As A Service Market Analysis By Technology

Technology analysis within the high performance computing market focuses on the evolution of hardware and software innovations. Key technological segments include CPU-based, GPU-based, and FPGA-based solutions. CPU-based technology remains a cornerstone due to its widespread compatibility and established market dominance, holding a significant share. In contrast, GPU-based solutions offer accelerated processing for parallel tasks, making them ideal for data-intensive workloads, while FPGA-based systems provide customizable performance benefits. The technological segmentation underscores ongoing R&D efforts aimed at enhancing performance, reducing power consumption, and optimizing cost-efficiency, ultimately driving the next wave of innovation within the industry.

High Performance Computing As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in High Performance Computing As A Service Industry

TechCompute Innovations:

A market leader renowned for its cutting-edge HPC solutions, TechCompute Innovations offers scalable infrastructures and advanced cloud services tailored to research, government, and enterprise applications.NextGen Cloud Systems:

NextGen Cloud Systems specializes in delivering high performance computing through cloud-based platforms, ensuring high-speed data processing and reliability for customers in diverse industries.ComputeX Global:

ComputeX Global integrates advanced hardware technologies with innovative software solutions, driving efficiency in scientific research, big data analytics, and engineering simulation services across the globe.We're grateful to work with incredible clients.

FAQs

How can the High-Performance Computing as a Service report help align our marketing strategy with customer adoption trends?

The report identifies that the High-Performance Computing as a Service market is projected to reach a size of $7.5 billion with a CAGR of 10.2%. This data helps businesses tailor marketing strategies to customer demand patterns, ensuring alignment with adoption trends.

What product features are in highest demand according to the High-Performance Computing as a Service report trends?

The demand for Infrastructure as a Service (62.76% market share), along with flexible cloud solutions, leads the trends in high-performance computing services. These insights guide product development and marketing, focusing on high-demand features.

Which regions offer the best market entry and expansion opportunities in the High-Performance Computing as a Service industry?

North America is projected to grow to $7.06 billion by 2033, while Europe will reach $5.21 billion, making these regions prime for expansion. Asia Pacific is also promising, with expected growth to $3.52 billion.

What emerging technologies and innovations are shaping the High-Performance Computing as a Service market?

Innovations in CPU-based (62.76% market share), GPU-based, and FPGA technologies are pivotal. These advancements drive the high-performance capabilities in computing services, providing enhanced processing power for demanding applications.

Does the High-Performance Computing as a Service report include competitive landscape and market share analysis?

Yes, the report includes comprehensive competitive landscape analysis, detailing market shares by segments such as Research Institutions (48.78%) and other segments, offering crucial insights into industry positioning and competitive strategies.

How can executives use the High-Performance Computing as a Service report to evaluate investment risks and ROI?

The report provides critical growth data, like the $7.5 billion market size forecasted at a 10.2% CAGR, enabling executives to assess ROI effectively. Such insights into market growth trends facilitate informed investment decisions.

What is the market size of high Performance computing as a service?

The high-performance computing as a service market currently stands at $7.5 billion, with a robust expected growth rate of 10.2% CAGR through 2033, reflecting strong demand and increasing adoption in various sectors.