Hysteroscopy Instruments Market Report

Published Date: 31 January 2026 | Report Code: hysteroscopy-instruments

Hysteroscopy Instruments Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Hysteroscopy Instruments market, covering market size, trends, segmentation, and regional analysis from 2023 to 2033.

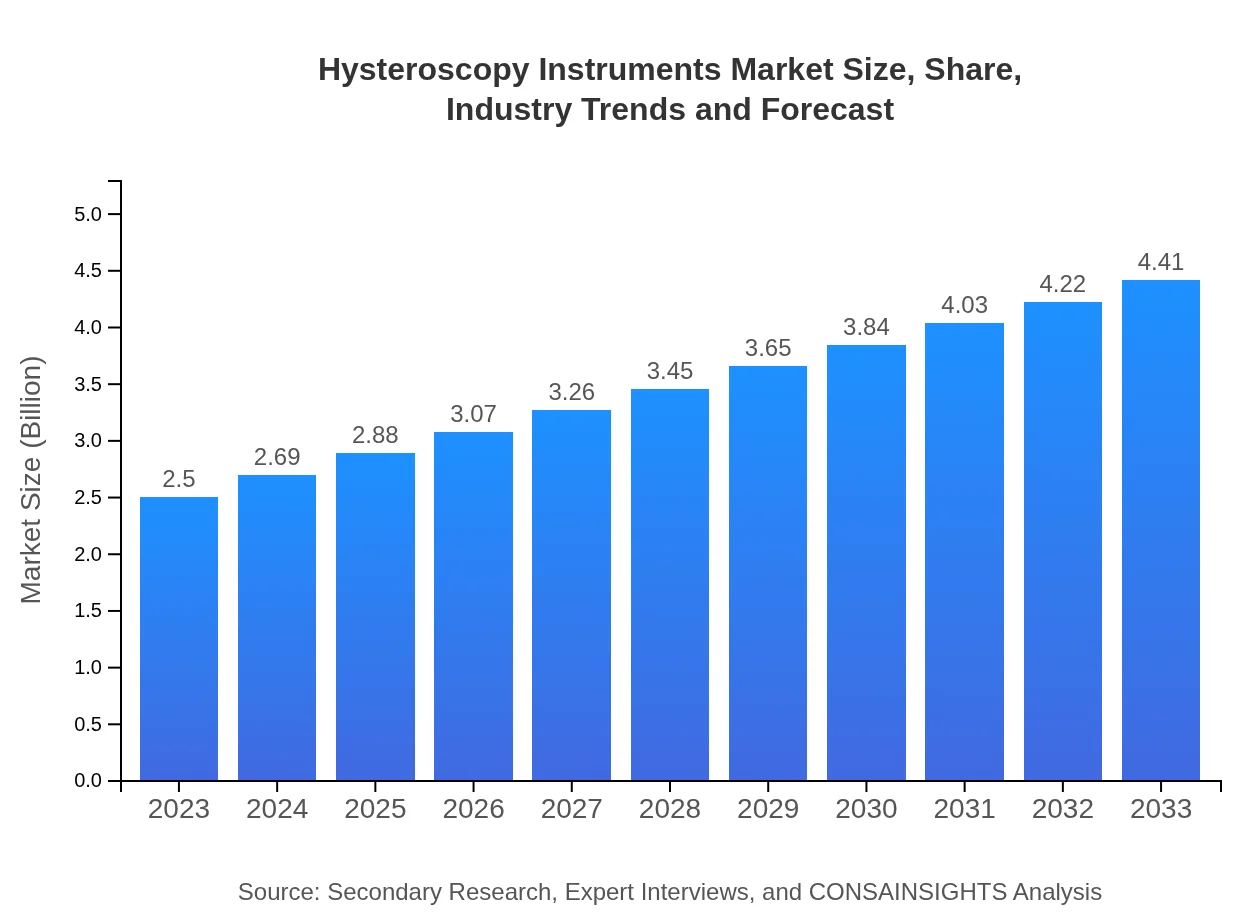

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $4.41 Billion |

| Top Companies | Karl Storz, Medtronic , Hologic, CooperSurgical |

| Last Modified Date | 31 January 2026 |

Hysteroscopy Instruments Market Overview

Customize Hysteroscopy Instruments Market Report market research report

- ✔ Get in-depth analysis of Hysteroscopy Instruments market size, growth, and forecasts.

- ✔ Understand Hysteroscopy Instruments's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Hysteroscopy Instruments

What is the Market Size & CAGR of Hysteroscopy Instruments market in 2023?

Hysteroscopy Instruments Industry Analysis

Hysteroscopy Instruments Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Hysteroscopy Instruments Market Analysis Report by Region

Europe Hysteroscopy Instruments Market Report:

The European market is set to grow from $0.73 billion in 2023 to $1.30 billion by 2033. The emphasis on minimally invasive surgical procedures supplemented by strong regulatory support enhances its growth prospects.Asia Pacific Hysteroscopy Instruments Market Report:

In the Asia-Pacific region, the Hysteroscopy Instruments market is projected to grow from $0.44 billion in 2023 to $0.78 billion by 2033. Growth is driven by rising healthcare infrastructure investments and increased awareness regarding reproductive health issues.North America Hysteroscopy Instruments Market Report:

North America leads the Hysteroscopy Instruments market, expected to expand from $0.97 billion in 2023 to $1.70 billion by 2033. A rise in gynecological surgeries in the US, high adoption of advanced medical technologies, and increasing healthcare expenditures drive this growth.South America Hysteroscopy Instruments Market Report:

The South American Hysteroscopy Instruments market is estimated to increase from $0.06 billion in 2023 to $0.11 billion by 2033. Although the market is slower than in other regions, there is a growing emphasis on women's health and increased access to modern medical technologies.Middle East & Africa Hysteroscopy Instruments Market Report:

The Middle East and Africa's market size is expected to grow from $0.30 billion in 2023 to $0.53 billion by 2033. Initiatives to enhance women's healthcare services across the region provide significant growth opportunities.Tell us your focus area and get a customized research report.

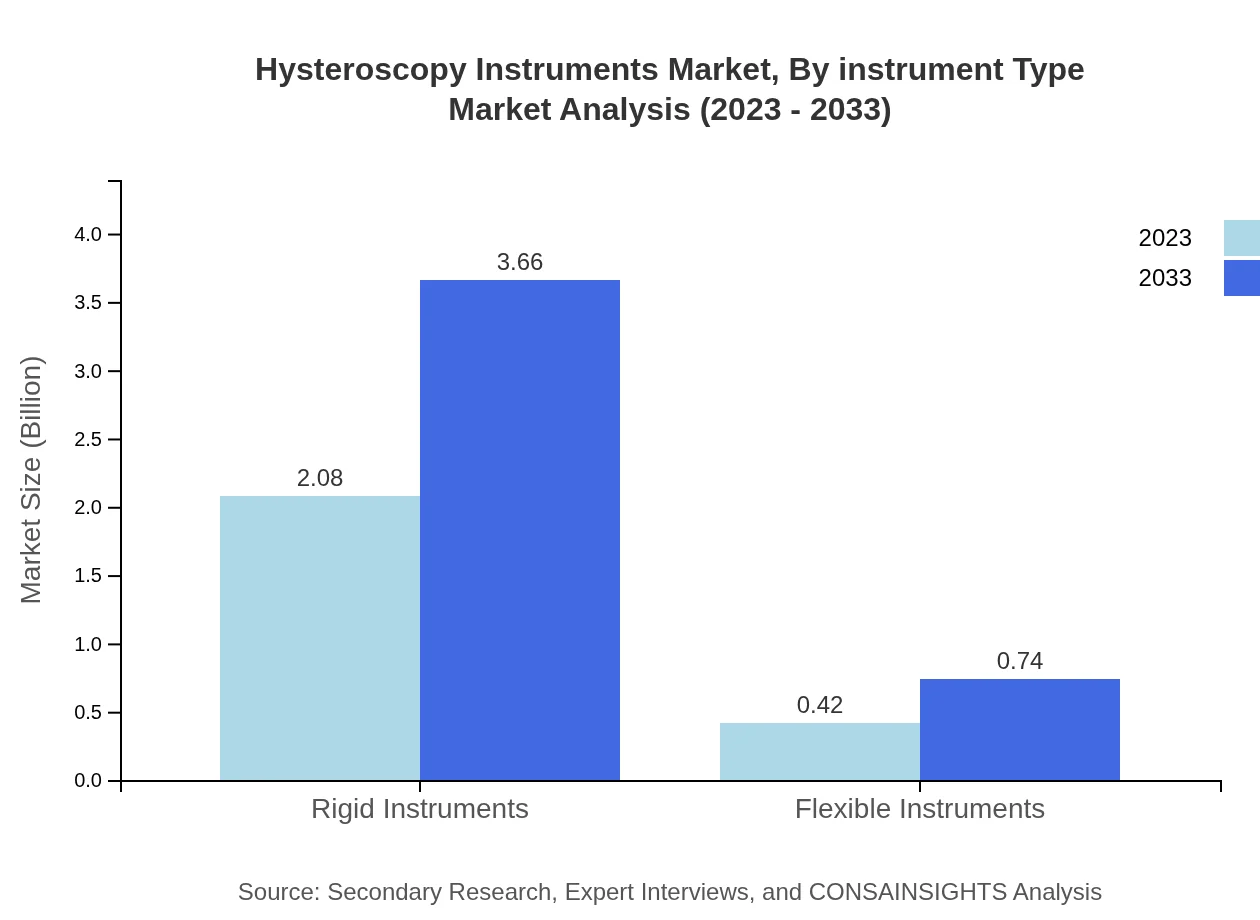

Hysteroscopy Instruments Market Analysis By Instrument Type

The Hysteroscopy Instruments market by instrument type consists of diagnostic and operative hysteroscopes, with demand greatly skewed towards diagnostic instruments due to their non-invasive nature. Rigid instruments dominate the market due to their ease of use and affordability, while flexible instruments are gaining traction due to their maneuverability. In 2023, diagnostic hysteroscopy is anticipated to hold an 83.12% market share, expected to maintain that position through 2033.

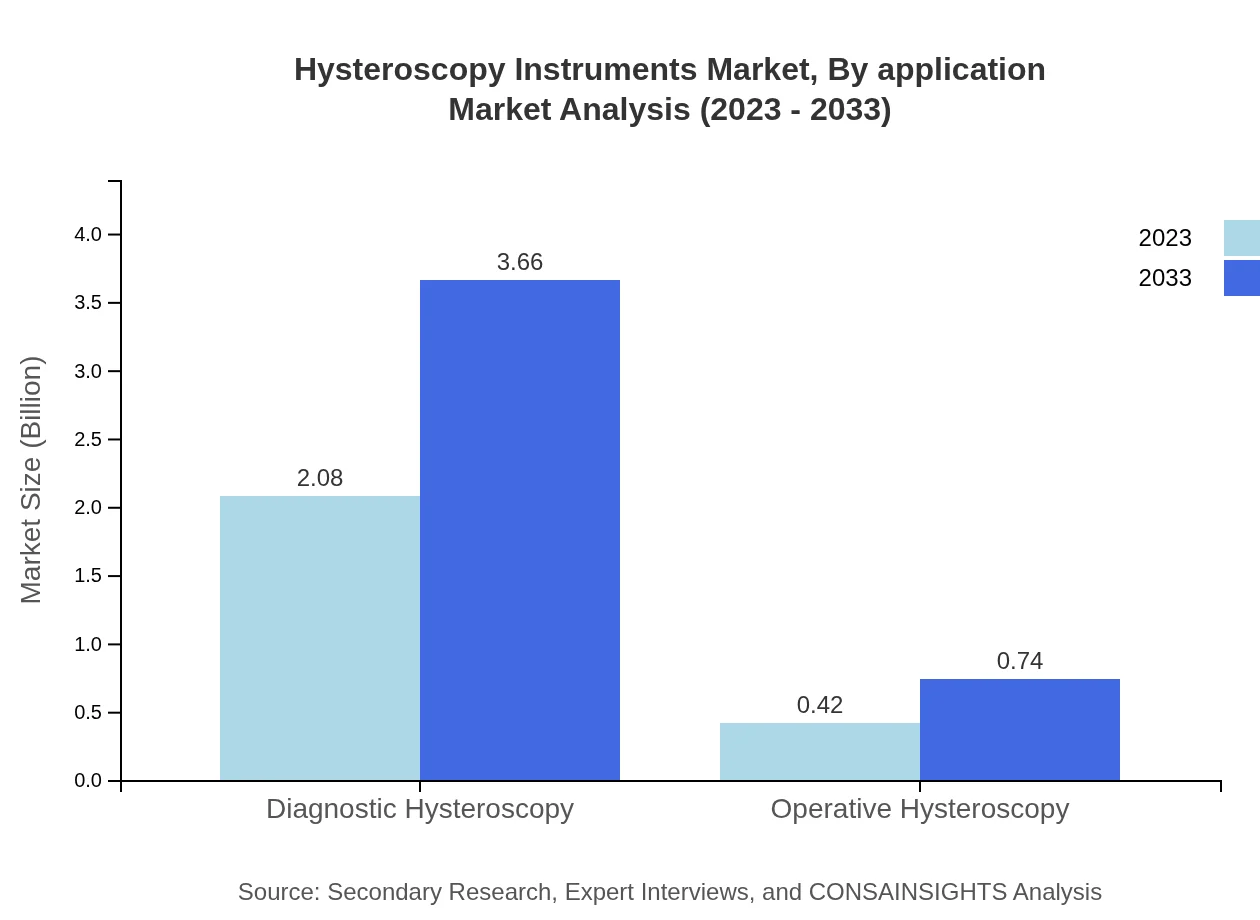

Hysteroscopy Instruments Market Analysis By Application

The Hysteroscopy Instruments market is broadly segmented into diagnostic and operative applications. Diagnostic hysteroscopy accounts for a significant share owing to its utility in evaluating endometrial abnormalities. Operative hysteroscopy shows growth potential as it enables both diagnostic and procedure-based treatments, anticipating growth from $0.42 billion in 2023 to $0.74 billion by 2033.

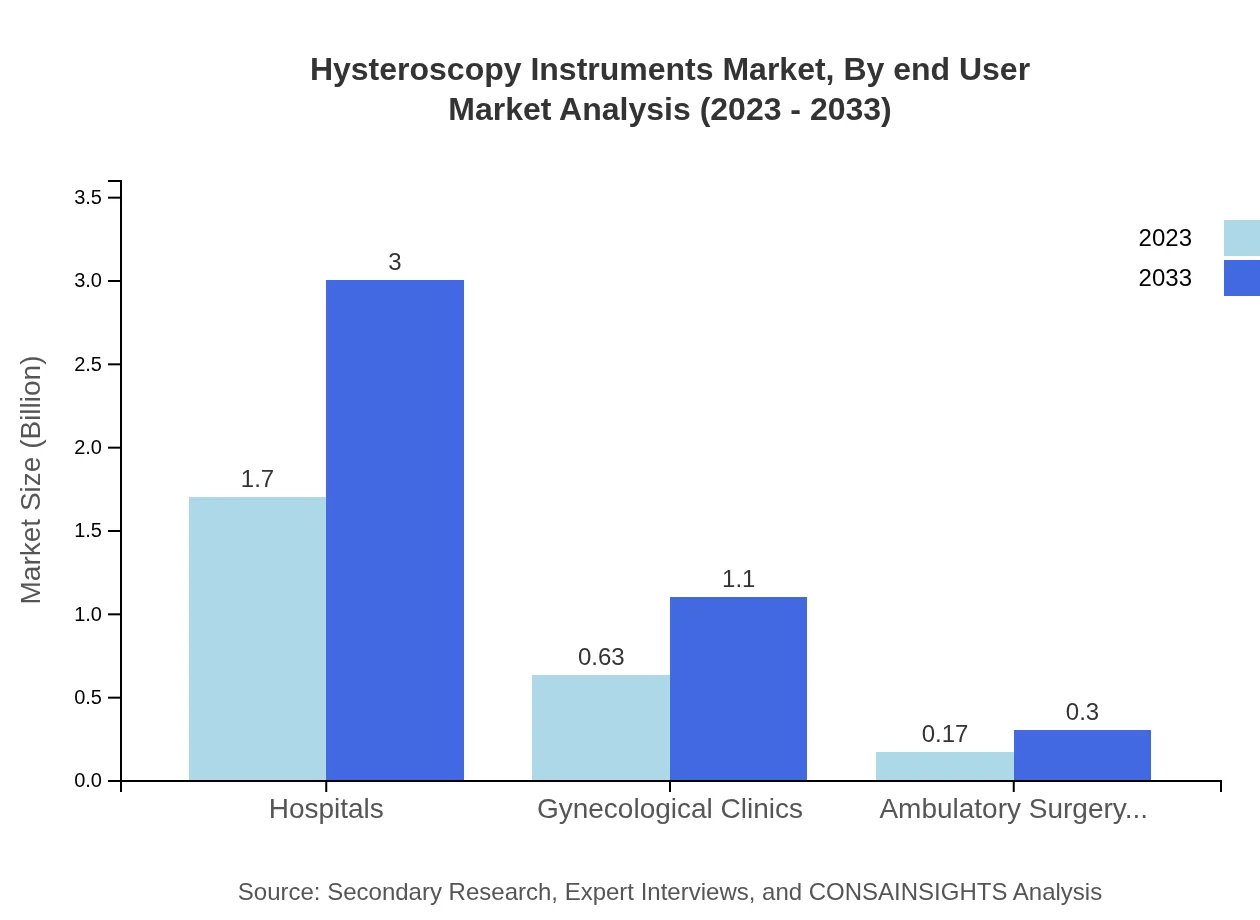

Hysteroscopy Instruments Market Analysis By End User

The market by end-user is primarily segmented into hospitals, gynecological clinics, and ambulatory surgery centers. Hospitals are expected to dominate, capturing approximately 68.15% market share in 2023 and maintaining this grip through 2033, driven by a comprehensive range of services and patient volume.

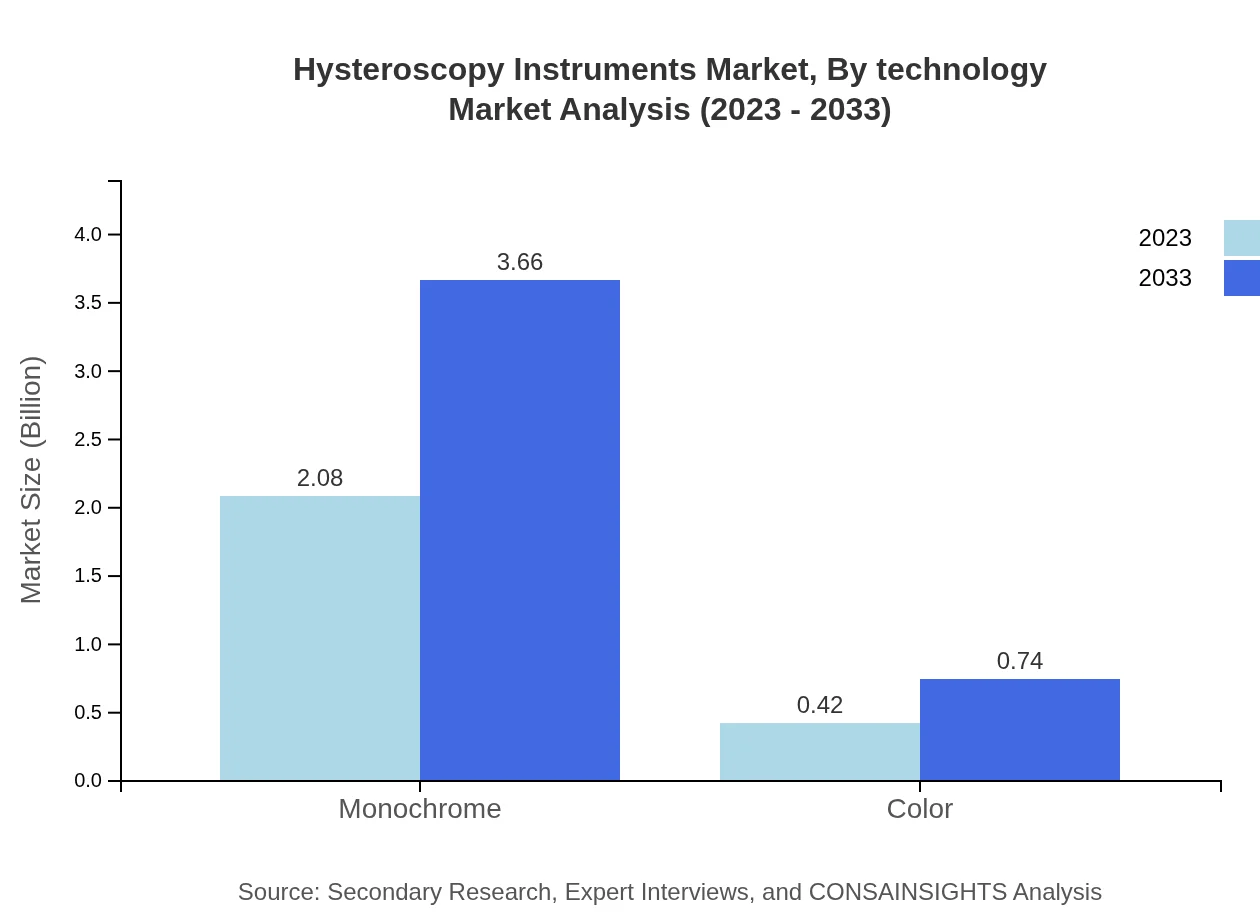

Hysteroscopy Instruments Market Analysis By Technology

Technological advancements are key to the Hysteroscopy Instruments market, which includes monochrome and color imaging systems. Monochrome systems dominate the market as they provide better visualization, capturing an 83.12% share in 2023. However, color technologies are projected to grow as they offer enhanced capabilities in diagnostics and treatment.

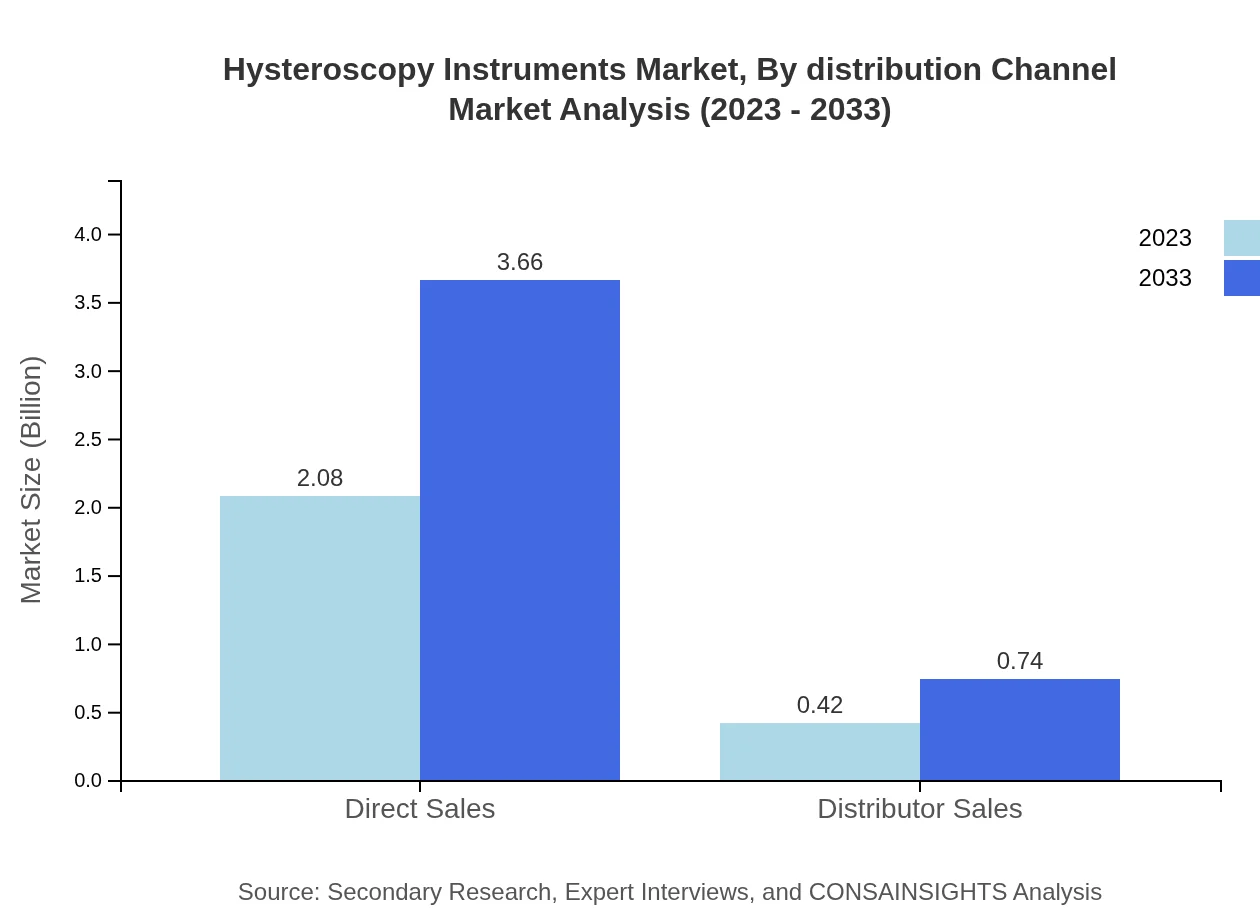

Hysteroscopy Instruments Market Analysis By Distribution Channel

Distribution channels for Hysteroscopy Instruments include direct sales and distributor sales. Direct sales are expected to maintain dominance with an 83.12% market share in 2023 due to the direct engagement of manufacturers with end-users, ensuring better service and product availability.

Hysteroscopy Instruments Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Hysteroscopy Instruments Industry

Karl Storz:

Karl Storz is an established leader in endoscopy equipment, offering a wide range of hysteroscopes and instruments that emphasize quality and innovation. Their products are widely used globally in both diagnostic and operative hysteroscopy.Medtronic :

Medtronic focuses on providing advanced minimally invasive technology and solutions for various surgical procedures, including hysteroscopy, and is committed to enhancing surgical outcomes with innovative designs.Hologic:

Hologic leads in women's health technology, with specialized products in hysteroscopy that prioritize patient safety and procedural efficiency, contributing significantly to the market.CooperSurgical:

Known for its focus on gynecologic health, CooperSurgical offers diverse hysteroscopy solutions that streamline the process and support healthcare providers effectively.We're grateful to work with incredible clients.

FAQs

What is the market size of hysteroscopy Instruments?

The global hysteroscopy instruments market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.7% till 2033, forecasting significant growth driven by advancements and increased demand for minimally invasive procedures.

What are the key market players or companies in this hysteroscopy Instruments industry?

Key players in the hysteroscopy instruments market include market leaders like Medtronic, Karl Storz, Hologic, and Olympus Corp. These companies are noted for their innovative technologies, high-quality products, and strategic collaborations.

What are the primary factors driving the growth in the hysteroscopy instruments industry?

Growth in the hysteroscopy instruments industry is primarily propelled by rising incidences of gynecological disorders, advancements in technology, and the growing preference for minimally invasive surgical procedures that enhance patient recovery times.

Which region is the fastest Growing in the hysteroscopy instruments market?

The Asia Pacific region is the fastest-growing in the hysteroscopy instruments market, projected to grow from $0.44 billion in 2023 to $0.78 billion by 2033, as healthcare infrastructure and awareness improve in emerging economies.

Does ConsaInsights provide customized market report data for the hysteroscopy instruments industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific needs within the hysteroscopy instruments industry, ensuring insights that align with unique business requirements and strategic goals.

What deliverables can I expect from this hysteroscopy instruments market research project?

Deliverables from the hysteroscopy instruments market research project typically include comprehensive market analysis, detailed competitive landscape, segment data, key trends, and actionable insights aimed at guiding strategic decisions.

What are the market trends of hysteroscopy instruments?

Emerging trends in the hysteroscopy instruments market include increased adoption of robotic-assisted procedures, rising demand for outpatient surgeries, and the integration of advanced imaging technologies enhancing diagnostic accuracy and operational efficiency.