India Data Center

Published Date: 31 January 2026 | Report Code: india-data-center

India Data Center Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report analyzes the India Data Center market, providing a deep dive into various segments including technology, product offerings, and regional influences. Covering forecast details from 2024 to 2033, the report presents key market insights, size assessments, CAGR statistics, and competitive overviews to support strategic decision-making.

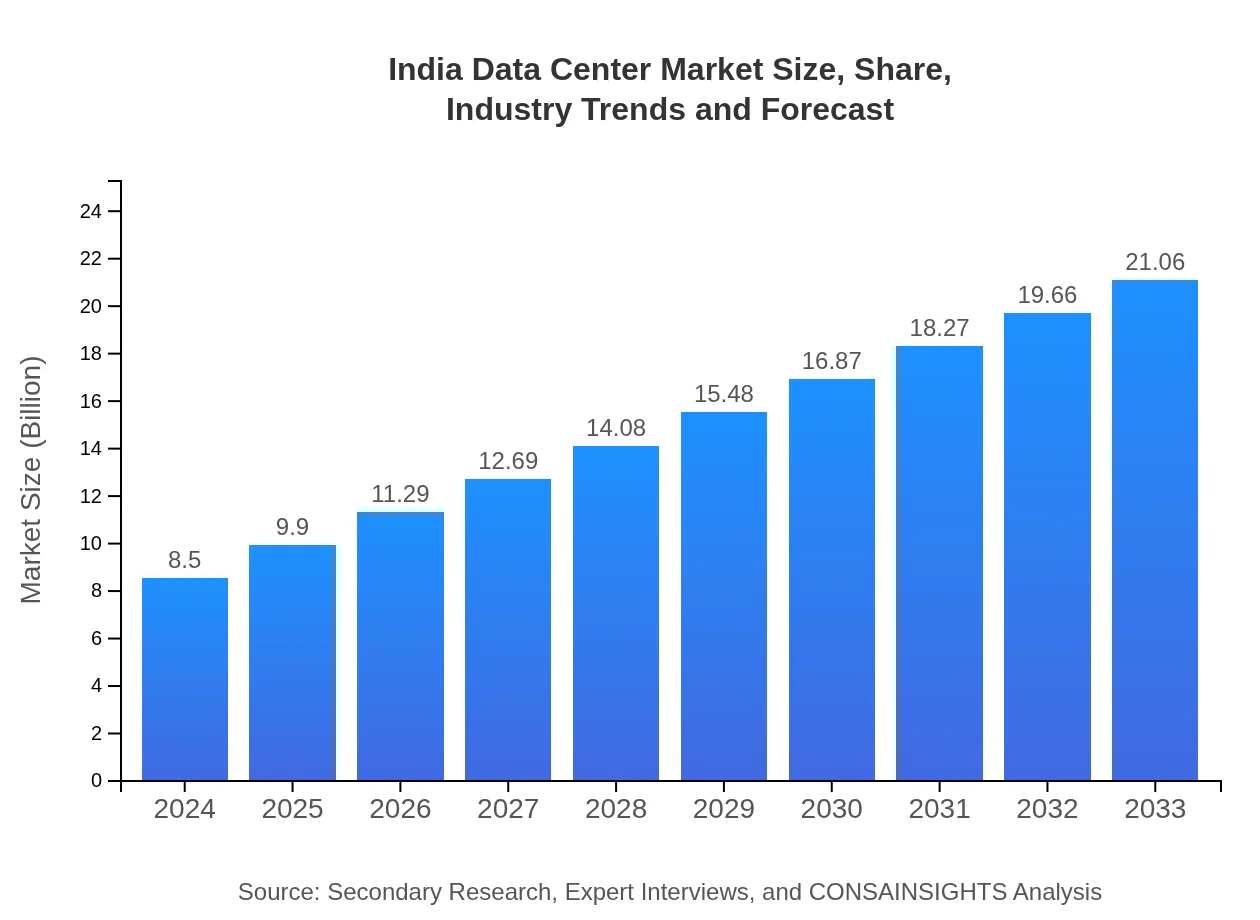

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $8.50 Billion |

| CAGR (2024-2033) | 10.2% |

| 2033 Market Size | $21.06 Billion |

| Top Companies | Tata Communications, CtrlS Datacenters, Sify Technologies |

| Last Modified Date | 31 January 2026 |

India Data Center Market Overview

Customize India Data Center market research report

- ✔ Get in-depth analysis of India Data Center market size, growth, and forecasts.

- ✔ Understand India Data Center's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in India Data Center

What is the Market Size & CAGR of India Data Center market in 2024?

India Data Center Industry Analysis

India Data Center Market Segmentation and Scope

Tell us your focus area and get a customized research report.

India Data Center Market Analysis Report by Region

Europe India Data Center:

Europe presents a vibrant Data Center market with considerable expansion potential. With an estimated increase in market value from 2.29 billion USD in 2024 to 5.69 billion USD in 2033, the region benefits from stringent data protection regulations and significant technological investments. European markets are characterized by strategic initiatives to enhance data localization norms, which have spurred several state-of-the-art data center projects. The focus on sustainability, energy efficiency, and compliance with EU data regulations creates a competitive edge while also attracting foreign investments, thereby driving market dynamism.Asia Pacific India Data Center:

In the Asia Pacific region, the India Data Center market is witnessing vigorous expansion, with projections indicating significant growth from a market value of 1.77 billion USD in 2024 to 4.38 billion USD in 2033. This robust increase is driven by rapid industrialization, technological adoption, and the rising demand for cloud-based services. Innovative infrastructural developments coupled with increasing investments in digital connectivity further enhance the region’s competitive stance. The market here benefits from strong government support and the emergence of new data hubs that provide localized services while fostering economies of scale.North America India Data Center:

North America continues to be a frontrunner in the Data Center industry, with significant market momentum owing to a mature technological ecosystem and high demand for advanced data processing capabilities. The market is projected to escalate notably from a starting point of 2.77 billion USD in 2024 to an anticipated 6.85 billion USD in 2033. Key drivers include robust infrastructure investments, sustained innovation, and a focus on energy-efficient practices. The region’s leadership in technology and continuous developments in cloud computing have reinforced its dominant position in the global market.South America India Data Center:

South America is emerging as an influential player in the Data Center landscape, reflecting steady progress in data management capabilities and technological infrastructure investments. Though the current market size remains modest, the growing reliance on advanced computing and heightened digital connectivity is expected to drive market expansion. Strategic investments in modern infrastructure and regional partnerships have paved the way for improved service delivery and enhanced competitive advantages. The gradual transition from traditional systems to modern, scalable facilities underscores the market’s latent potential.Middle East & Africa India Data Center:

The Middle East and Africa region is witnessing progressive developments in the data infrastructure sector, where market size is projected to grow from 0.84 billion USD in 2024 to 2.07 billion USD in 2033. Economic diversification, rising digital transformation initiatives, and increasing internet penetration are driving demand for state-of-the-art data center services. The region has seen improvements in connectivity, investments in renewable energy for powering data centers, and an overall boost in technological innovations, ensuring these markets emerge as significant contributors to regional and global data ecosystems.Tell us your focus area and get a customized research report.

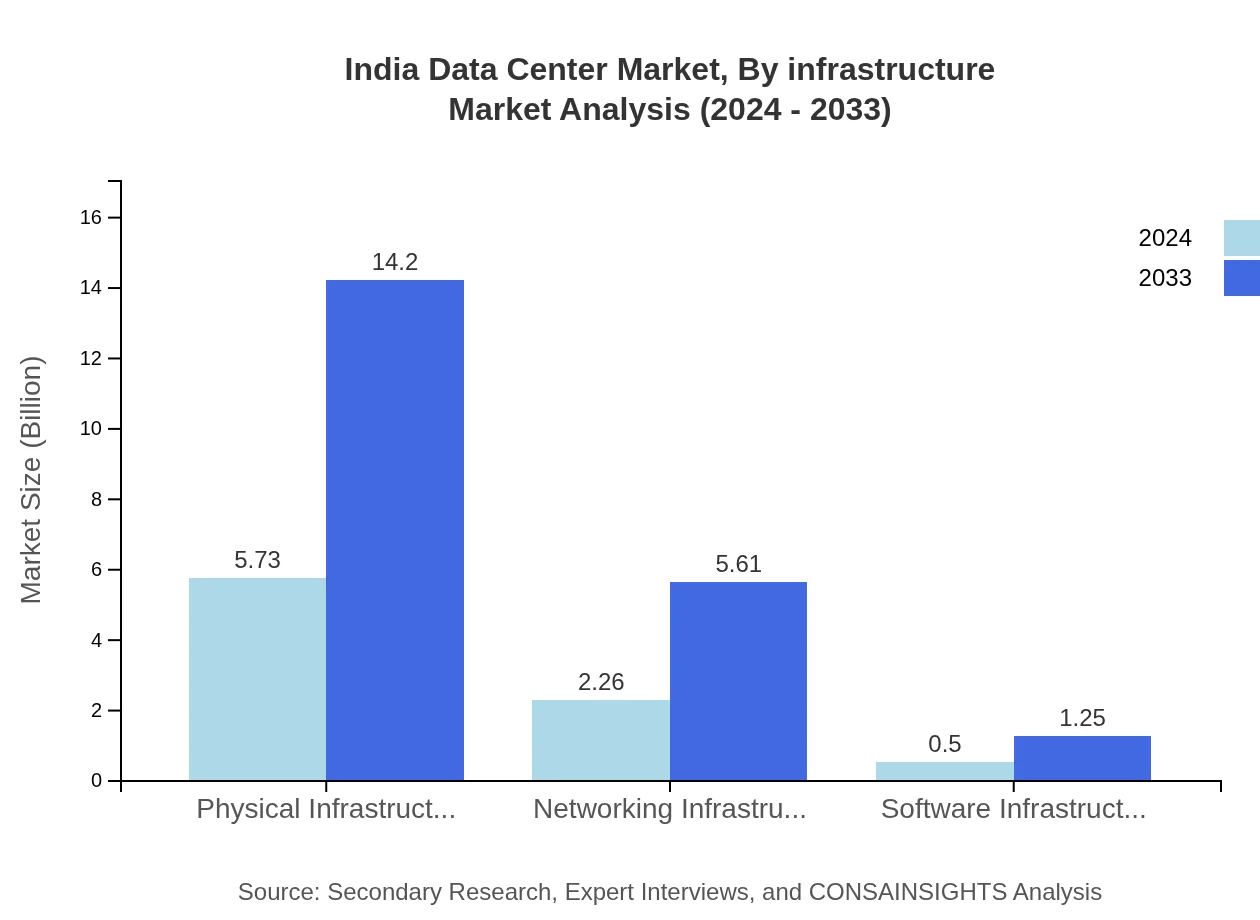

India Data Center Market Analysis By Infrastructure

The infrastructure segment of the India Data Center market explores components such as physical, networking, and software infrastructures. Physical infrastructure, comprising data halls, cooling systems, and power management, has undergone significant enhancements aimed at boosting energy efficiency and reliability. Networking infrastructure emphasizes robust connectivity solutions that ensure seamless data transmission across extensive digital networks. In contrast, the software infrastructure component focuses on platforms and management systems that facilitate data center operations and performance monitoring. These elements collectively enable the market to address rising data demands, implement disaster recovery systems, and maintain high operational uptime, thus reinforcing the infrastructure framework.

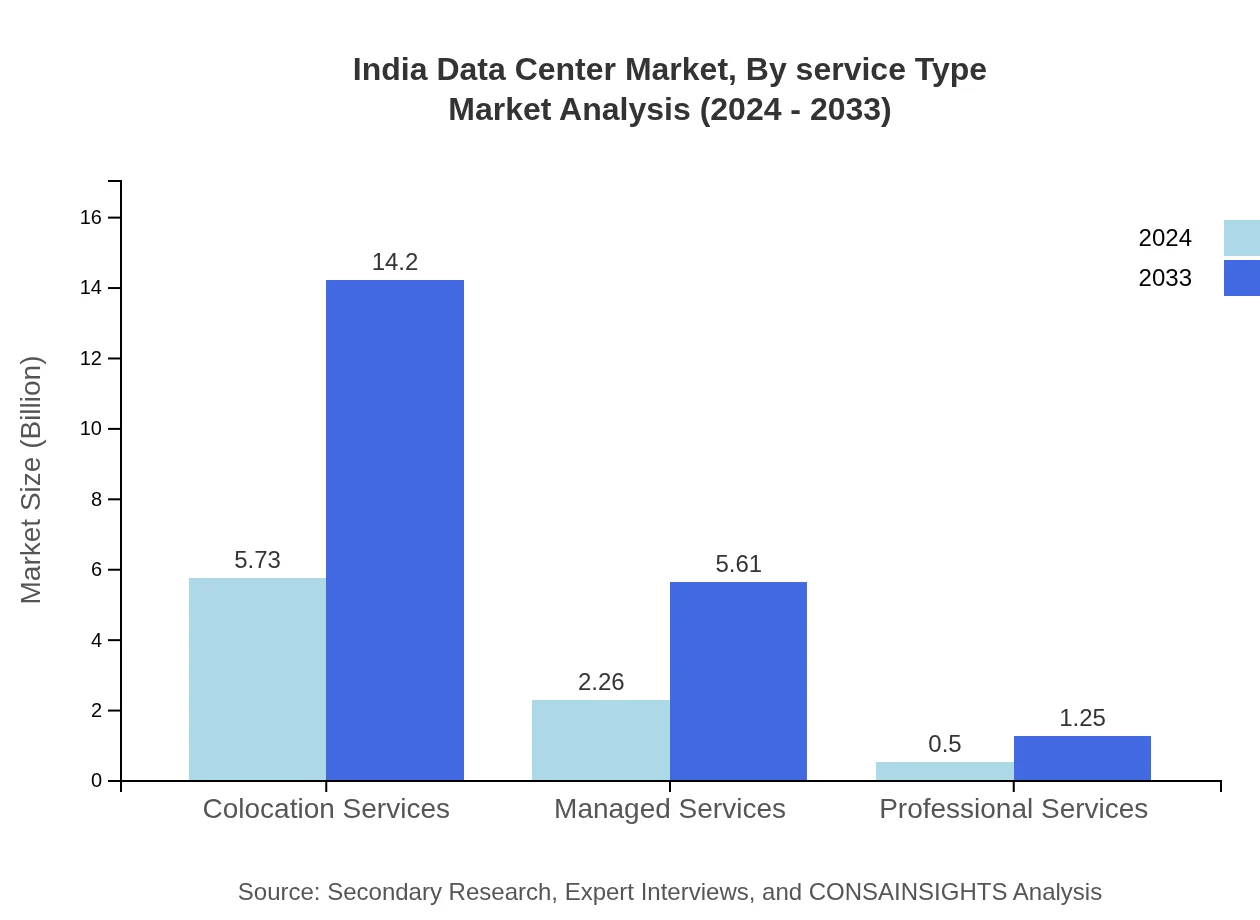

India Data Center Market Analysis By Service Type

Service type segmentation divides the market into colocation services, managed services, and professional services. Colocation services, which command a major share, offer dedicated spaces within data centers where enterprises can house their servers with enhanced security and operational efficiency. Managed services provide comprehensive management solutions, including maintenance, support, and infrastructure planning, allowing businesses to optimize operational performance without significant capital investments. Meanwhile, professional services offer consultancy and strategic advisory roles that support the deployment and integration of data center solutions. Each service type is tailored to meet specific customer requirements, thereby creating a diverse ecosystem that drives competitive differentiation and market resilience.

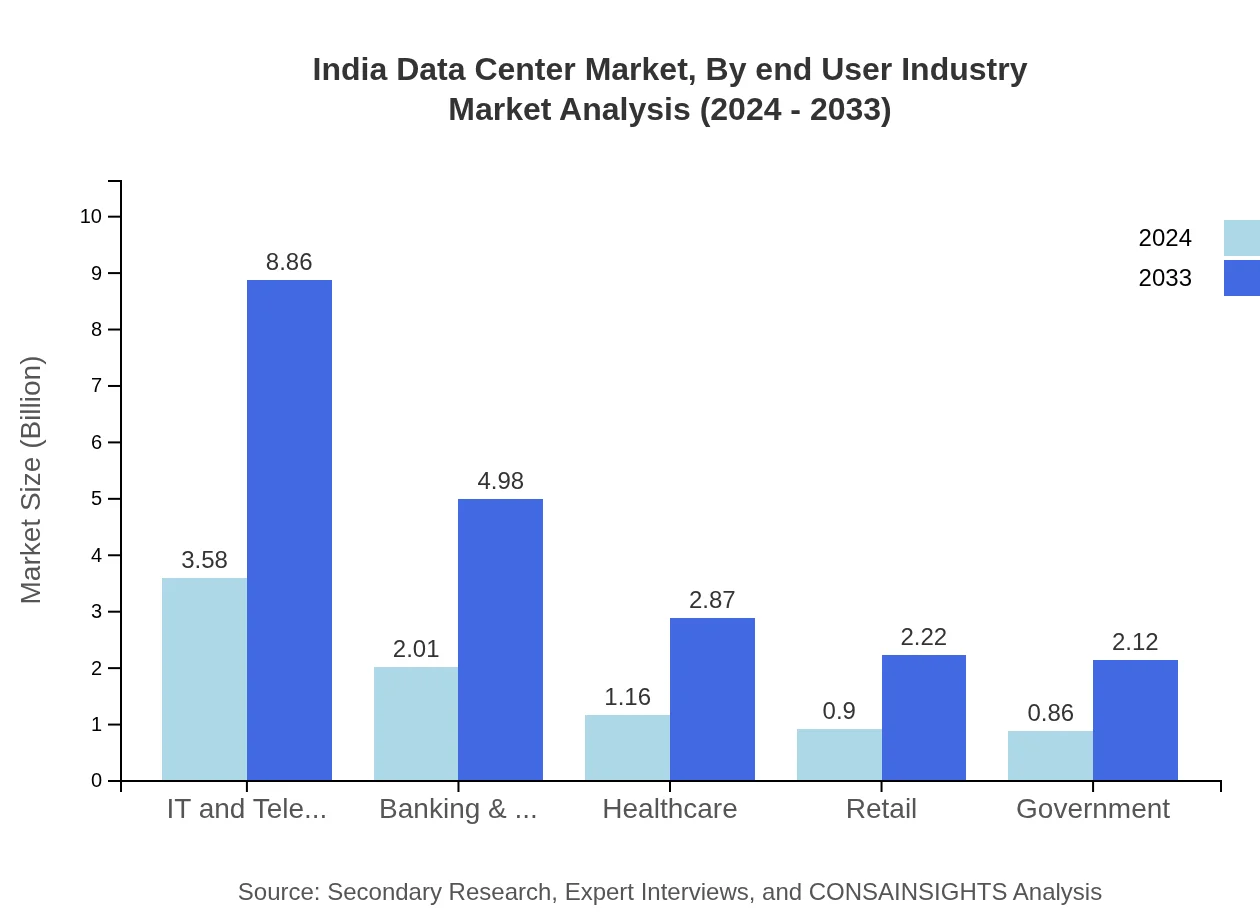

India Data Center Market Analysis By End User Industry

The end-user industry segmentation prioritizes sectors such as IT and Telecom, Banking & Finance, Healthcare, Retail, and Government. IT and Telecom continue to dominate the market, driven by a surge in digital communications and the rapid deployment of 5G networks. The Banking & Finance sector has witnessed evolving data needs due to increased cybersecurity requirements and operational automation. Similarly, the Healthcare industry is leveraging data centers for improved data management and telemedicine services. Retail organizations focus on enhancing their digital presence while safeguarding customer data, and governmental agencies invest in modern, secure facilities to ensure data integrity and regulatory compliance. This detailed segmentation highlights the customized demands and exponential potential inherent in each sector, paving the way for specialized service offerings.

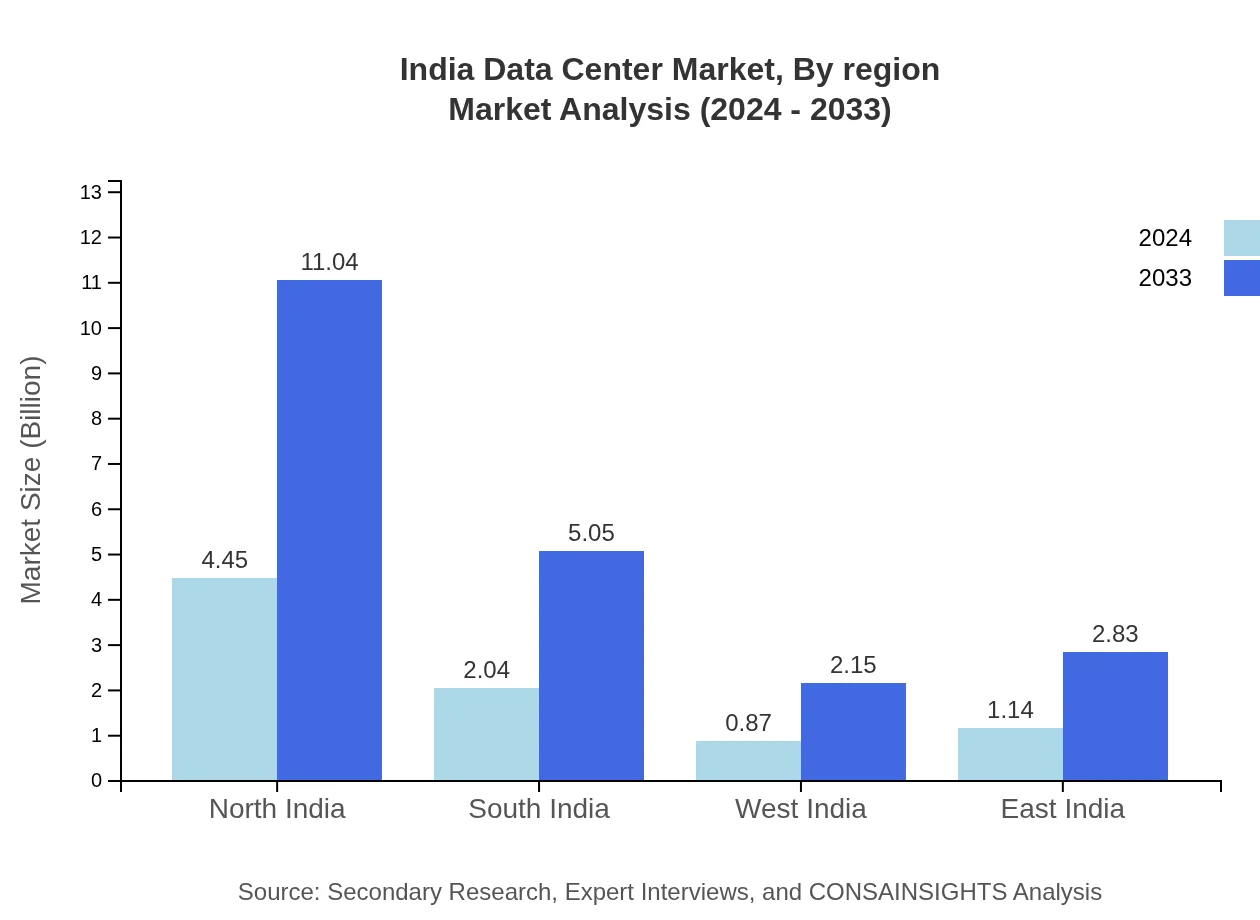

India Data Center Market Analysis By Region

Regional segmentation in the India Data Center market involves analyzing performance across North, South, West, and East India. The Northern region demonstrates the highest market share, benefiting from robust economic clusters and advanced urban infrastructure. South India and West India are emerging markets with significant investments in technology and data connectivity, while East India showcases steady growth, supported by government incentives and regional partnerships. Each geographic segment plays a critical role in shaping national market trends by providing localized services, tailoring customer-specific solutions, and enabling broader strategic expansions across the country.

India Data Center Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in India Data Center Industry

Tata Communications:

Tata Communications is a leading player in the global data center market, renowned for its innovative infrastructure solutions, extensive network connectivity, and adherence to international data security standards. The company continuously invests in state-of-the-art technology and has a significant presence in both India and global markets.CtrlS Datacenters:

CtrlS Datacenters is recognized for its high-availability data center facilities, efficient energy management practices, and robust service delivery in the India Data Center market. With its expansive network of state-of-the-art facilities, the company sets benchmarks for operational excellence and reliability.Sify Technologies:

Sify Technologies offers a comprehensive suite of data center services including colocation, managed services, and cloud solutions. Its continued focus on innovation and customer-centric solutions has positioned it as a significant contributor to the rapid evolution of the India Data Center space.We're grateful to work with incredible clients.

FAQs

How can the report topic help align our marketing strategy with customer adoption trends?

The India Data Center Report reveals that the market is projected to grow from $8.5 billion in 2024, with a CAGR of 10.2%. Understanding customer adoption trends allows businesses to tailor marketing strategies effectively to increase engagement and drive growth.

What product features are in highest demand according to the report topic trends?

According to trends analyzed in the report, features related to colocation services are in high demand, accounting for 67.44% market share in 2024. Other features, such as managed services and networking infrastructure, are also gaining traction as businesses prioritize efficiency.

Which regions offer the best market entry and expansion opportunities in the report topic industry?

The best markets for expansion in the India Data Center industry include North India, expected to grow from $4.45 billion in 2024 to $11.04 billion by 2033, and South India, which will increase from $2.04 billion in 2024 to $5.05 billion by 2033, indicating significant growth potential.

What emerging technologies and innovations are shaping the report topic market?

Emerging technologies like AI, IoT, and advanced cloud solutions are significantly impacting the India Data Center market. Their integration is expected to enhance operational efficiency, improve customer experiences, and drive substantial market growth, aligning with the projected CAGR of 10.2%.

Does the report name include competitive landscape and market share analysis?

Yes, the India Data Center Report includes a comprehensive competitive landscape analysis, detailing market shares, segment performance, and growth projections, allowing stakeholders to assess the competitive environment and identify strategic opportunities for investment.

How can executives use the report name to evaluate investment risks and ROI?

Executives can leverage the insights from the India Data Center Report to conduct risk assessments based on market dynamics, growth trends, and competitive parameters. This aids in formulating strategies to optimize ROI, supported by the forecasted 10.2% CAGR.

What is the market size of India data center?

The India Data Center market is projected to reach $8.5 billion in 2024, with an impressive CAGR of 10.2% anticipated until 2033, underscoring the sector's robust growth trajectory and investment potential.

What regional data can you provide for the India data center market?

In 2024, North India will account for $4.45 billion, while South India will be at $2.04 billion. By 2033, North India will grow to $11.04 billion, indicating strong regional expansion opportunities.

What segment data is available for the India data center market?

Colocation services lead with a market size of $5.73 billion in 2024, while IT and telecom segments contribute significantly with $3.58 billion. This segmentation highlights areas where investment and innovation can drive business growth.