India Hcm

Published Date: 31 January 2026 | Report Code: india-hcm

India Hcm Market Size, Share, Industry Trends and Forecast to 2033

This comprehensive report on the India Hcm market delivers a detailed overview of key market trends, segmentation, and regional dynamics. It offers insights on market size, growth, and competitive landscape from 2024 to 2033. The report also highlights technological advancements and future opportunities, ensuring a holistic understanding of the evolving India Hcm ecosystem.

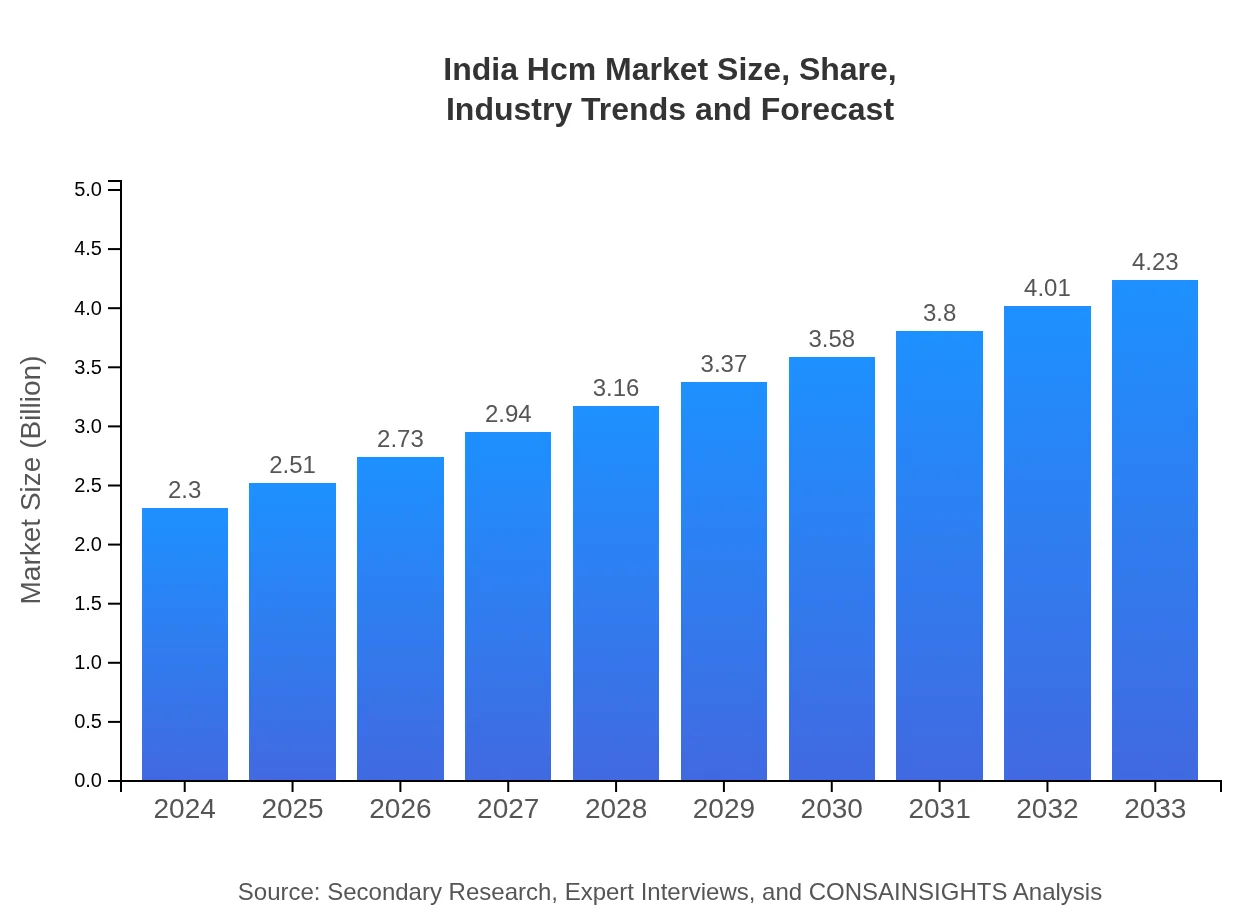

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $2.30 Billion |

| CAGR (2024-2033) | 6.8% |

| 2033 Market Size | $4.23 Billion |

| Top Companies | Oracle, SAP |

| Last Modified Date | 31 January 2026 |

India Hcm Market Overview

Customize India Hcm market research report

- ✔ Get in-depth analysis of India Hcm market size, growth, and forecasts.

- ✔ Understand India Hcm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in India Hcm

What is the Market Size & CAGR of India Hcm market in {Year}?

India Hcm Industry Analysis

India Hcm Market Segmentation and Scope

Tell us your focus area and get a customized research report.

India Hcm Market Analysis Report by Region

Europe India Hcm:

Europe shows promising growth patterns, with the market size projected to increase from 0.68 in 2024 to 1.24 in 2033. The region benefits from mature economies and advanced digital infrastructures that favor the adoption of integrated HR solutions. Regulatory mandates and a focus on workforce diversity further accentuate growth in this sector.Asia Pacific India Hcm:

In Asia Pacific, the India Hcm market is witnessing moderate yet steady growth with market size increasing from 0.46 in 2024 to 0.85 in 2033. The improvement is driven by rapid digital transformation initiatives, increased investment in HR technologies, and evolving labor market dynamics. Regional players are leveraging technology to improve employee management and operational efficiencies.North America India Hcm:

North America remains a significant market driver for Hcm technologies, with market size expanding from 0.82 in 2024 to 1.50 in 2033. High adoption rates of cloud-based services, comprehensive HR solutions, and strong investment in innovation underpin its growth. The market is characterized by a robust competitive landscape and steady enhancements in system efficiencies.South America India Hcm:

South America, reflecting insights from Latin America, is a smaller yet emerging segment with market size growing from 0.07 in 2024 to 0.12 in 2033. Despite its modest scale, the region is gradually adapting modern Hcm practices, with governments and businesses beginning to embrace digital solutions to optimize workforce management.Middle East & Africa India Hcm:

The Middle East and Africa region is gradually emerging with market size projections rising from 0.28 in 2024 to 0.51 in 2033. The growth is fostered by increasing investments in human capital and the adoption of digital transformation strategies, along with targeted government initiatives aimed at modernizing traditional HR processes.Tell us your focus area and get a customized research report.

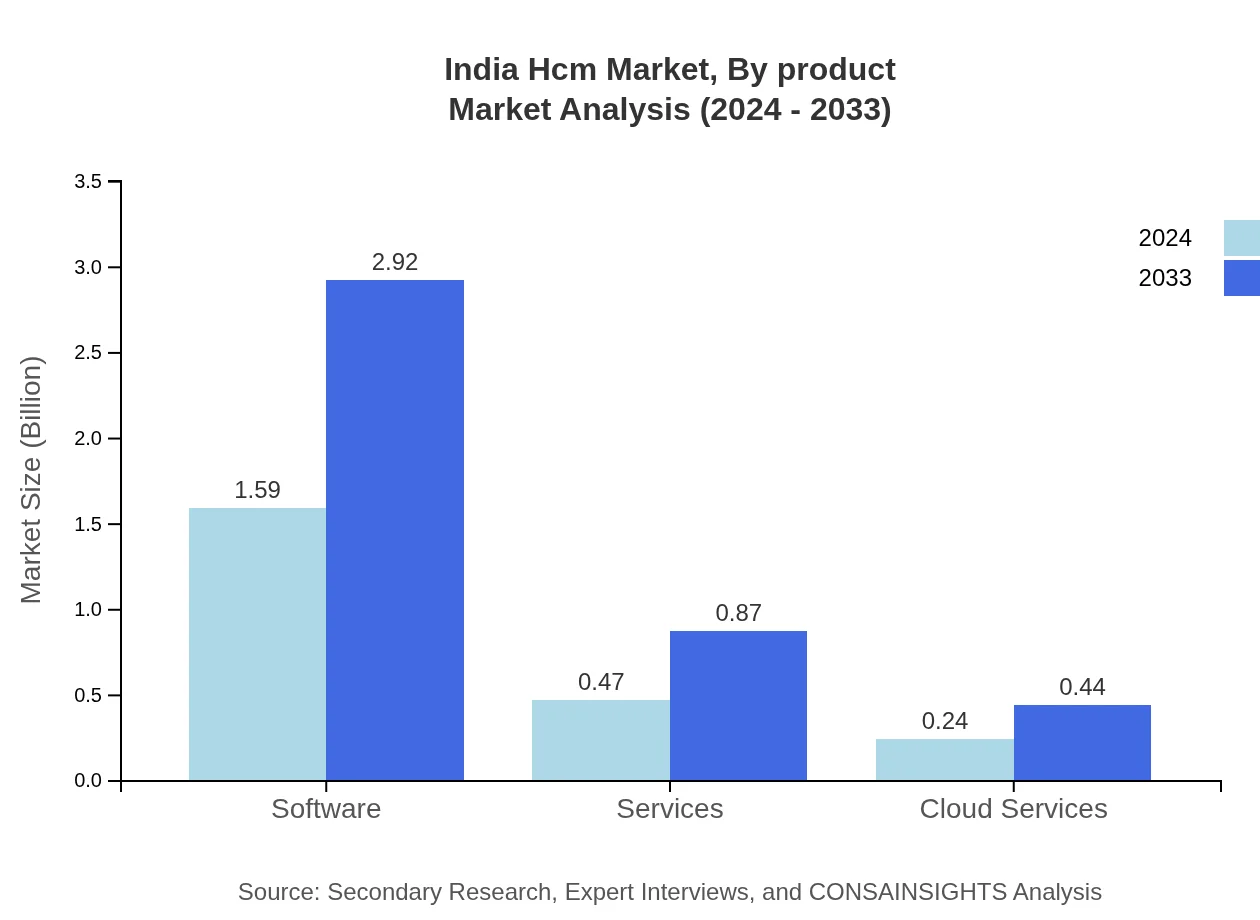

India Hcm Market Analysis By Product

The by-product segmentation of the India HCM market primarily focuses on software solutions, services, and cloud services. Software solutions lead the segment with robust adoption and account for a major share in market size, reflecting investments in innovative HR management systems. Complementary services and cloud offerings further enhance operational flexibility and cost efficiency. These products are continuously evolving to integrate analytics and real-time decision-making features, ensuring a substantial growth trajectory over the forecast period.

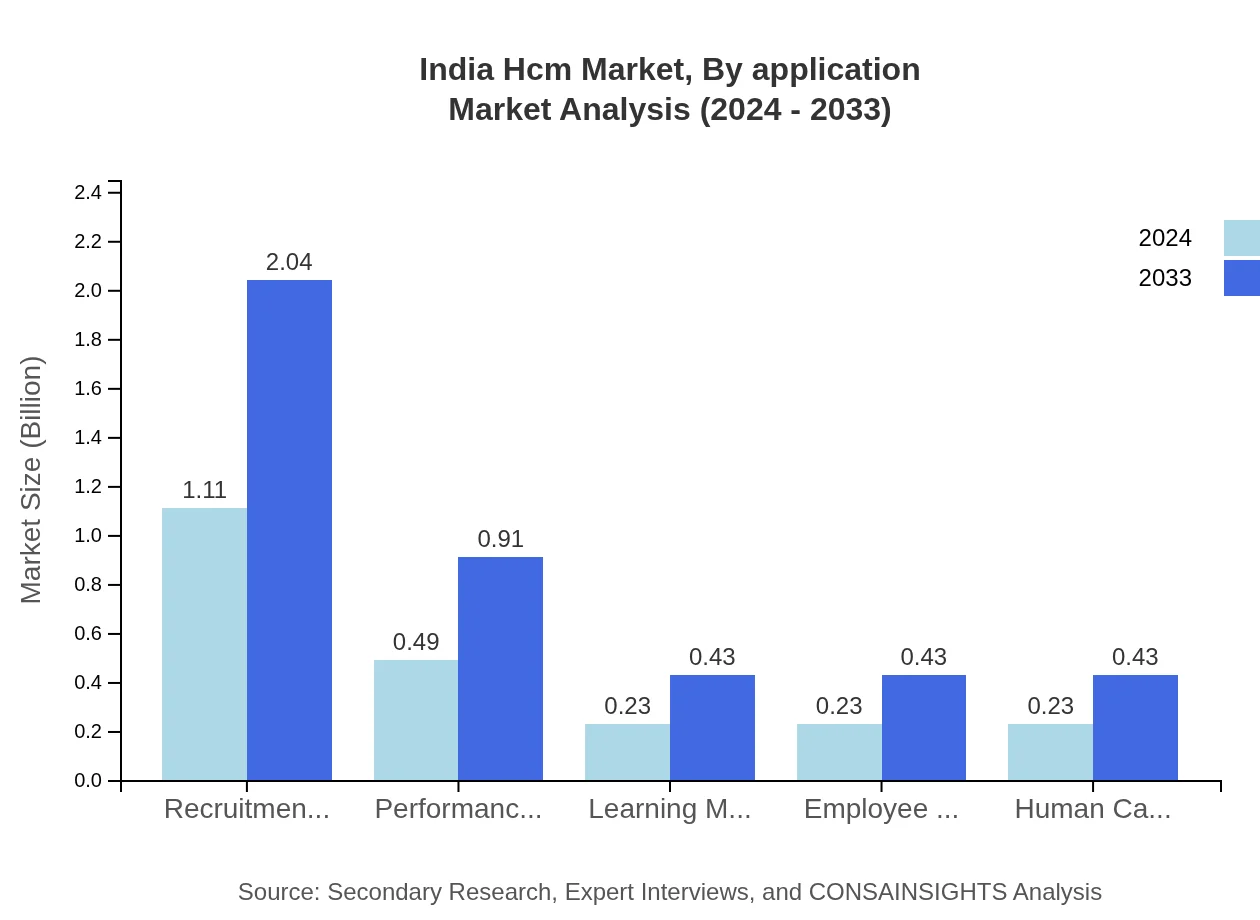

India Hcm Market Analysis By Application

In the by-application category, the market is segmented into various functional areas such as IT and Telecom, manufacturing, healthcare, retail, and financial services. Each application segment showcases distinct performance metrics and growth drivers. For instance, IT and Telecom demonstrate higher adoption rates due to the early integration of digital tools, while sectors like healthcare and retail are progressively investing in employee management systems. This diversified application landscape ensures that tailored solutions meet the specific needs of different industries, driving efficiency and competitive advantage.

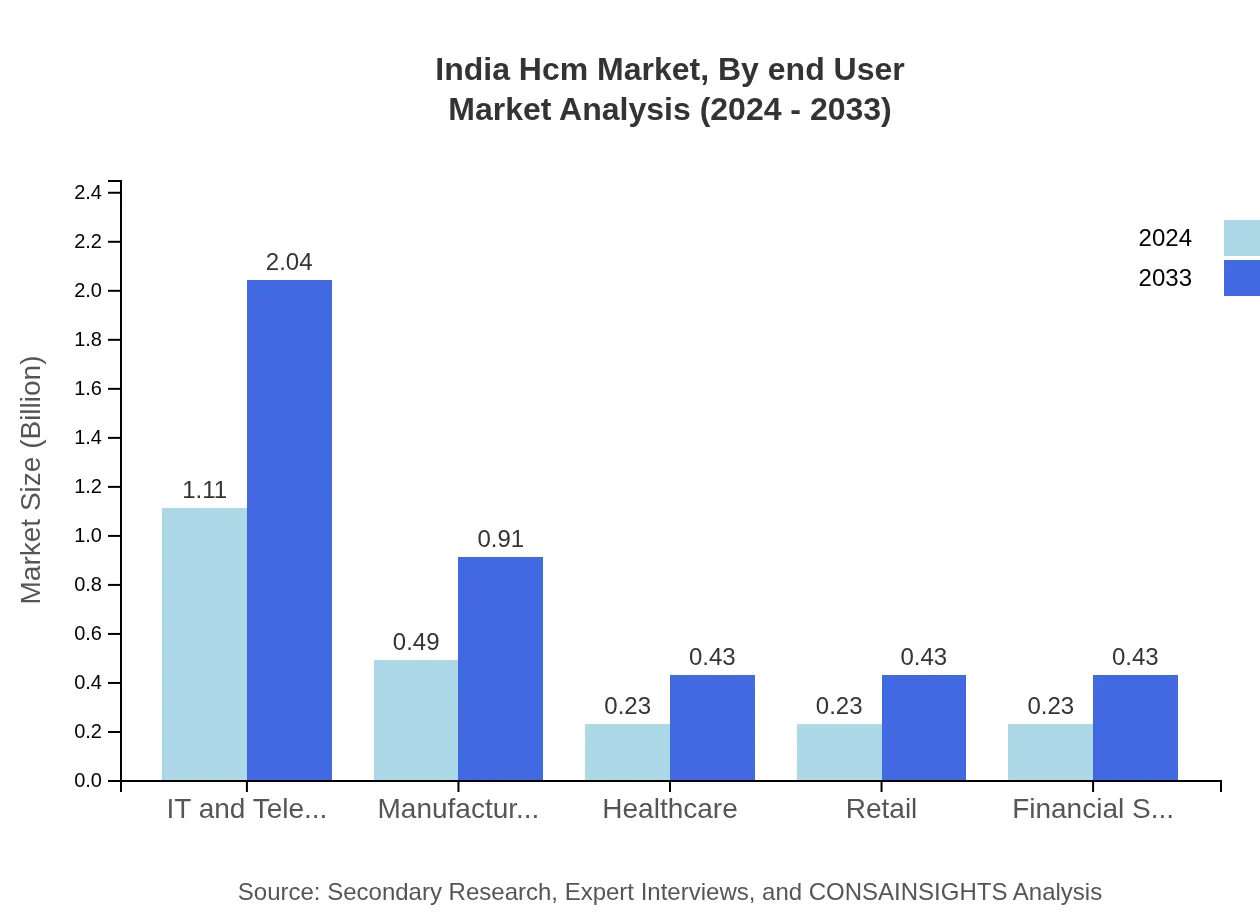

India Hcm Market Analysis By End User

The by-end-user segmentation details the diverse industries utilizing HCM technologies. End users span from large multinational corporations to small and medium-sized enterprises across sectors like manufacturing, healthcare, financial services, and retail. These organizations are increasingly relying on data-driven insights to enhance workforce productivity, streamline recruitment, and improve overall employee engagement. By addressing unique operational challenges, the HCM solutions provide end users with customized functionalities that support strategic growth and improved human capital management.

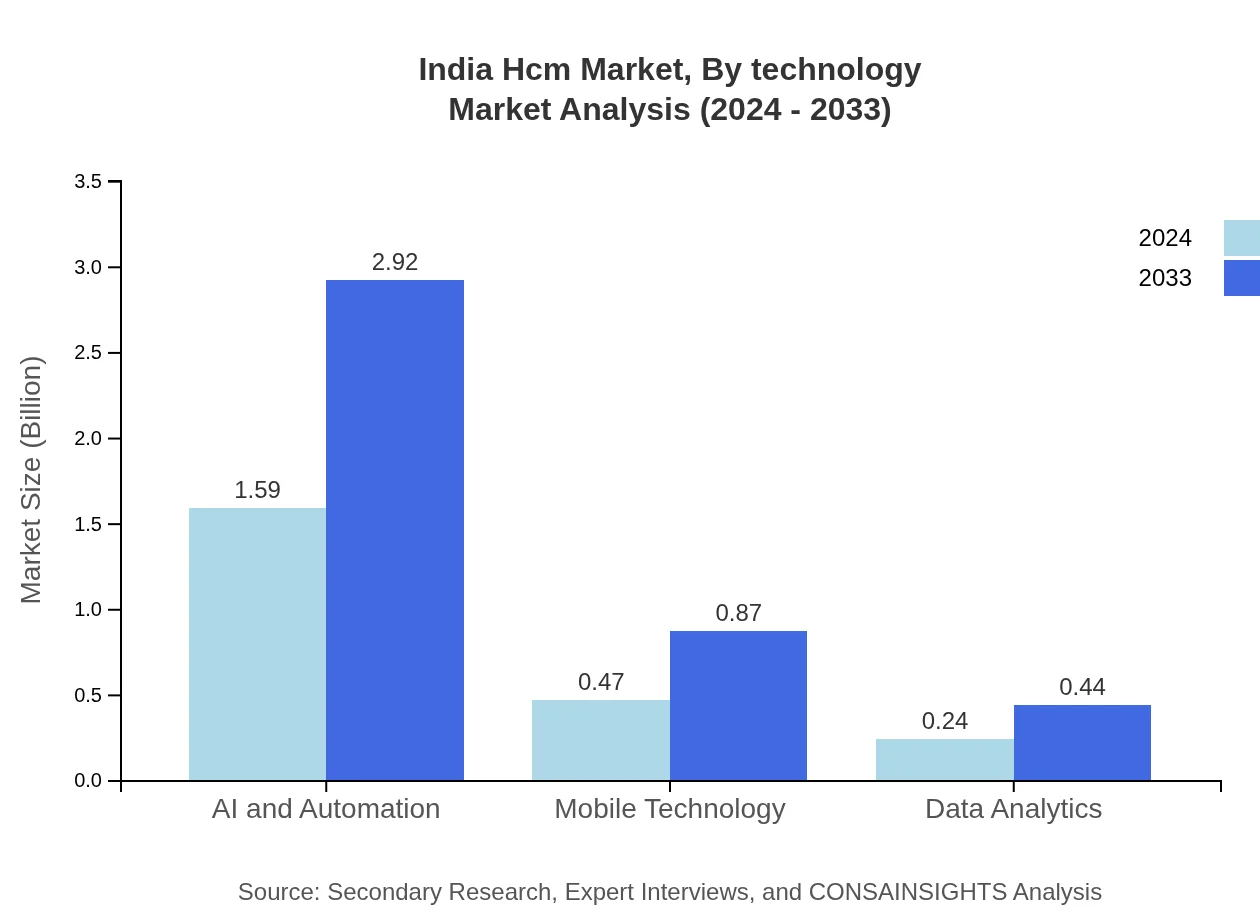

India Hcm Market Analysis By Technology

The by-technology segment encapsulates innovations in AI and automation, mobile technology, data analytics, and recruitment management, among others. These technological enhancements are pivotal in transforming traditional HR processes into dynamic, agile operations. Advanced tools facilitate real-time monitoring, predictive analytics, and automated workflows, reducing manual interventions and bolstering decision-making capabilities. This focus on cutting-edge technology ensures that the market remains competitive, addresses emerging challenges, and continues to drive efficiency and scalability in human capital management.

India Hcm Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in India Hcm Industry

Oracle:

Oracle is a renowned global leader in enterprise software and Hcm solutions. The company continuously innovates its cloud-based HR platforms to deliver comprehensive, secure, and scalable workforce management solutions, empowering organizations to streamline operations and enhance employee engagement.SAP:

SAP stands as a major player in the Hcm industry, offering integrated solutions that combine traditional HR functions with modern analytics and digital transformation tools. Its robust suite of products facilitates efficient data management, strategic planning, and real-time workforce insights for enterprises worldwide.We're grateful to work with incredible clients.

FAQs

How can the India HCM report help align our marketing strategy with customer adoption trends?

The India HCM report, with a market size of $2.3 billion and a CAGR of 6.8%, provides insights into customer preferences and adoption patterns. This data allows marketers to tailor their strategies, ensuring alignment with evolving demands and maximizing customer engagement.

What product features are in highest demand according to the India HCM trends?

Currently, features such as AI and Automation, and Recruitment Management are in high demand. The software segment is projected to grow from $1.59 billion in 2024 to $2.92 billion by 2033, emphasizing the importance of robust functionality and advanced capabilities.

Which regions offer the best market entry and expansion opportunities in the India HCM industry?

Regions like North America and Europe are promising, with North American market size expected to reach $1.50 billion by 2033. The European market also shows potential, growing from $0.68 billion in 2024 to $1.24 billion, highlighting a need for localized strategies in these areas.

What emerging technologies and innovations are shaping the India HCM market?

Technologies such as AI, Data Analytics, and Cloud Services are revolutionizing the India HCM market. Their growing importance is reflected in segment data, with AI alone projected to reach $2.92 billion by 2033, greatly enhancing automation and recruitment efficiency.

Does the India HCM report include competitive landscape and market share analysis?

Yes, the report provides a detailed competitive landscape, showcasing market shares of distinct segments. Notably, IT and Telecom services dominate with a 48.15% share, indicating significant competition and opportunities within that sector.

How can executives use the India HCM report to evaluate investment risks and ROI?

Executives can leverage the insights on market size and growth rates—such as the projected $2.3 billion and a CAGR of 6.8%—to assess potential ROI. Understanding regional growth prospects helps mitigate risks linked to market entry and expansion.

What is the market size of India HCM?

As of 2024, the India HCM market is valued at $2.3 billion and is expected to grow at a CAGR of 6.8% through 2033. This growth signals robust opportunities for stakeholders within this evolving sector.