Industrial Water Pump Market Report

Published Date: 22 January 2026 | Report Code: industrial-water-pump

Industrial Water Pump Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Industrial Water Pump market, covering market size, growth forecasts, regional trends, and key players from 2023 to 2033. It aims to deliver insights to stakeholders for informed decision-making.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

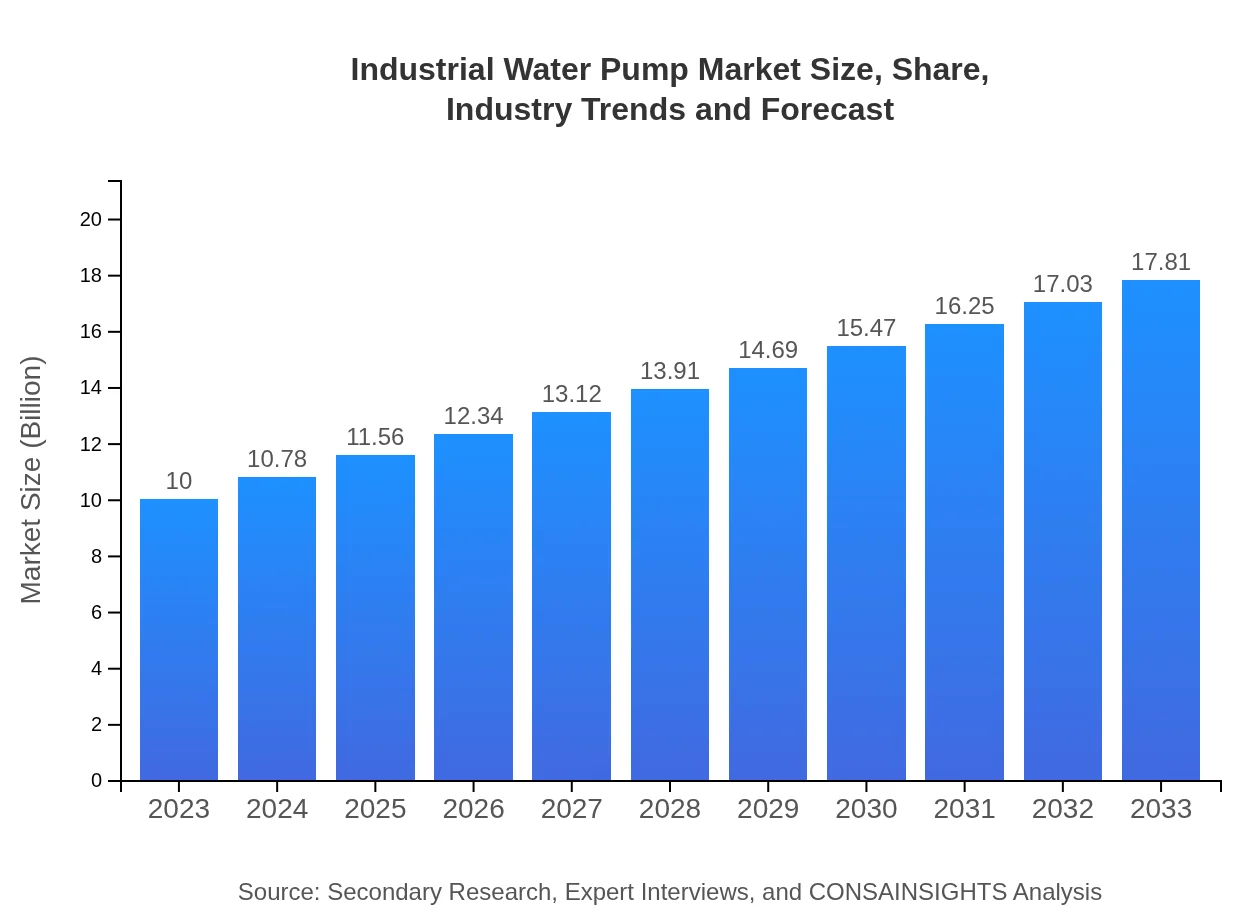

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $17.81 Billion |

| Top Companies | Grundfos, Xylem, KSB Aktiengesellschaft, Flowserve Corporation, Tsurumi Manufacturing Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Industrial Water Pump Market Overview

Customize Industrial Water Pump Market Report market research report

- ✔ Get in-depth analysis of Industrial Water Pump market size, growth, and forecasts.

- ✔ Understand Industrial Water Pump's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Water Pump

What is the Market Size & CAGR of the Industrial Water Pump market in 2023?

Industrial Water Pump Industry Analysis

Industrial Water Pump Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Water Pump Market Analysis Report by Region

Europe Industrial Water Pump Market Report:

Europe's Industrial Water Pump market is estimated at $2.58 billion in 2023, growing to $4.60 billion by 2033. The region is witnessing robust investment in renewable energy and eco-friendly practices, aiding in the adoption of advanced pumping technologies.Asia Pacific Industrial Water Pump Market Report:

The Asia Pacific region, valued at approximately $2.04 billion in 2023, is projected to grow to $3.64 billion by 2033. Growing economies, agricultural investments, and urban development drive demand here, coupled with increasing government emphasis on sustainable water management.North America Industrial Water Pump Market Report:

North America represents one of the largest markets, with a size of $3.63 billion in 2023, projected to reach $6.47 billion by 2033. Key drivers include significant investment in infrastructure, industrial expansion, and regulations promoting efficient water use.South America Industrial Water Pump Market Report:

In South America, the market size is expected to rise from $0.69 billion in 2023 to $1.23 billion by 2033. This growth is fueled by investment in water infrastructure and the expanding agricultural sector, particularly in countries like Brazil and Argentina.Middle East & Africa Industrial Water Pump Market Report:

In the Middle East and Africa, the market is projected to grow from $1.04 billion in 2023 to $1.86 billion by 2033. Water scarcity and infrastructure challenges motivate investment in reliable water solutions, especially in arid regions.Tell us your focus area and get a customized research report.

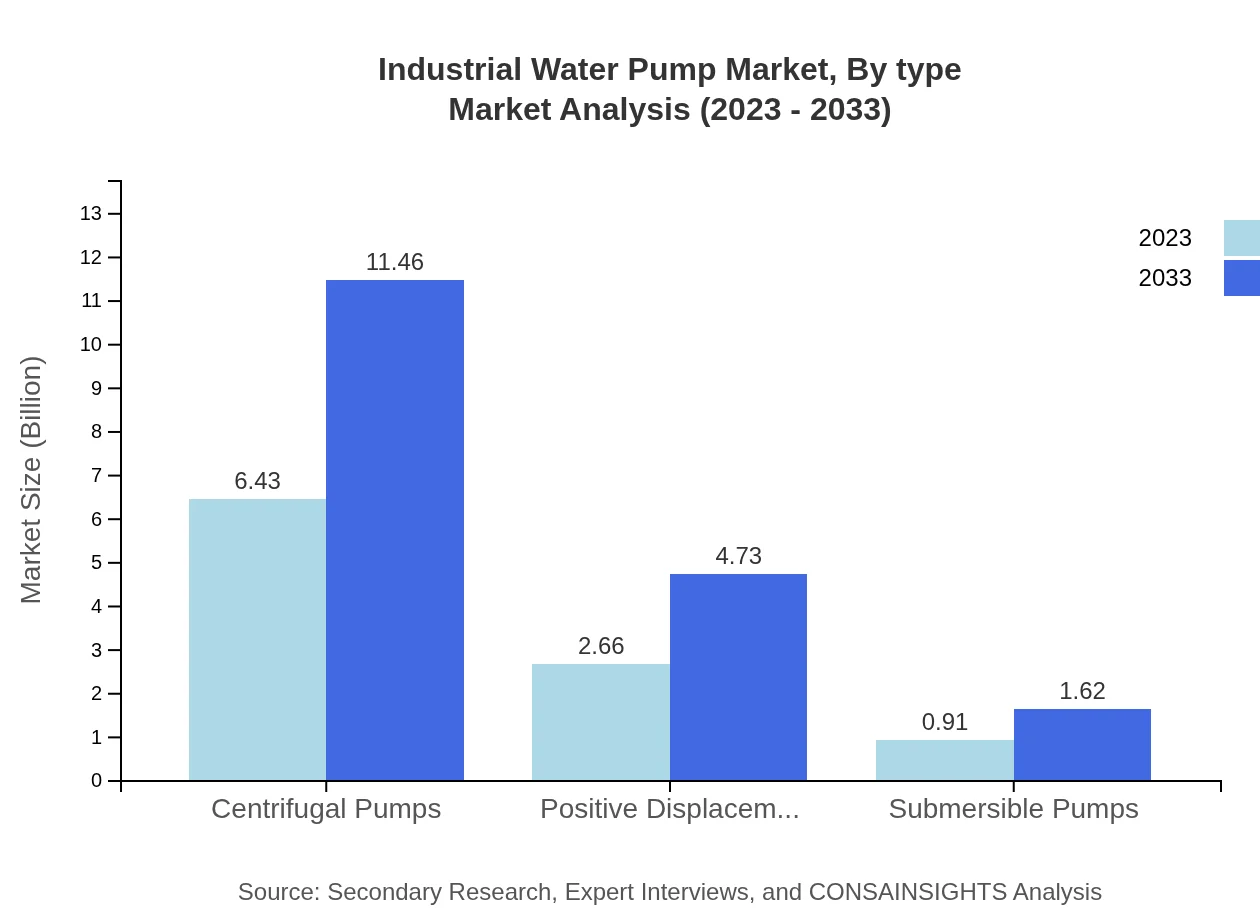

Industrial Water Pump Market Analysis By Type

Centrifugal pumps dominate with a market size of $6.43 billion in 2023 and expected growth to $11.46 billion by 2033, holding a 64.35% market share. Positive displacement pumps follow, starting at $2.66 billion and growing to $4.73 billion, which confirms their critical function in various applications. Submersible pumps account for $0.91 billion in 2023 with a projected increase to $1.62 billion.

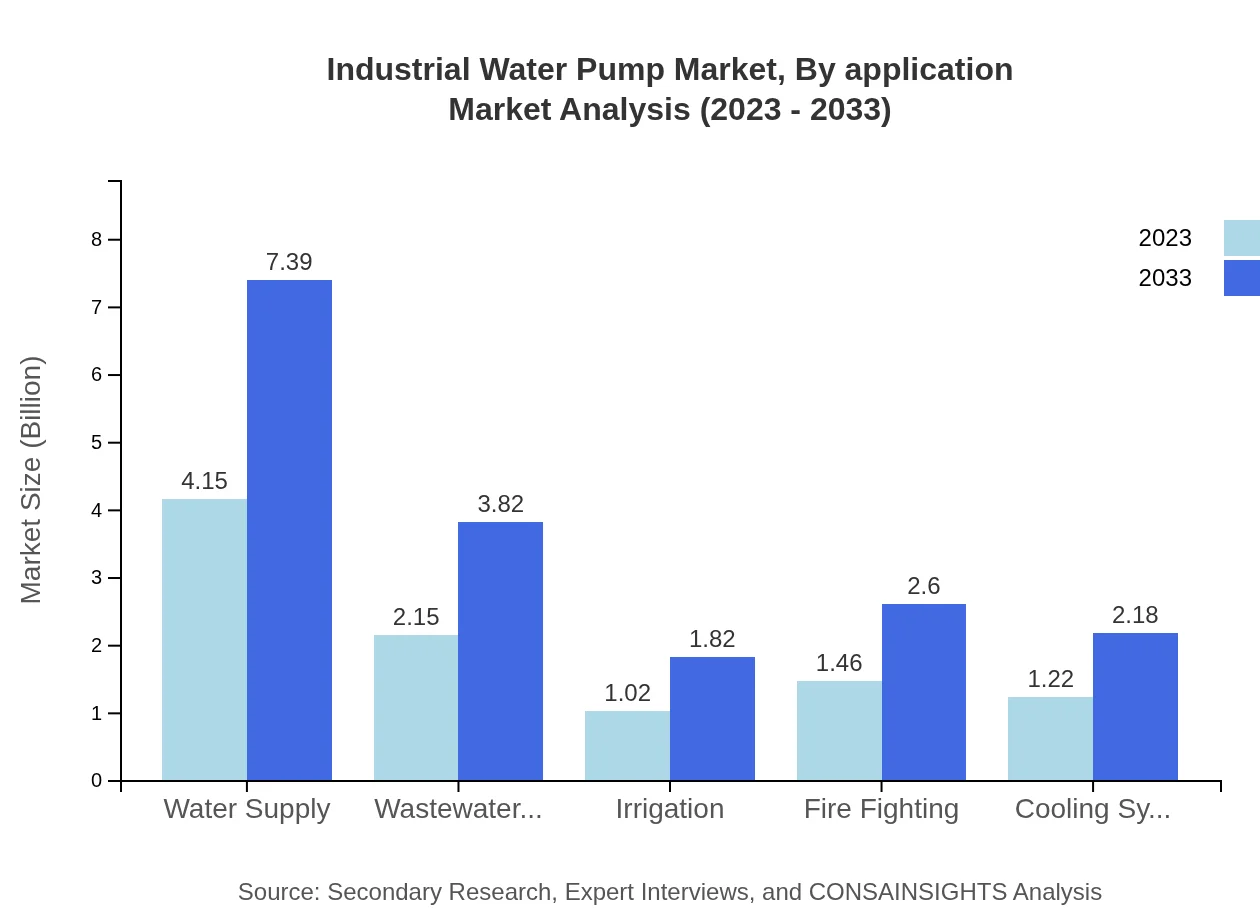

Industrial Water Pump Market Analysis By Application

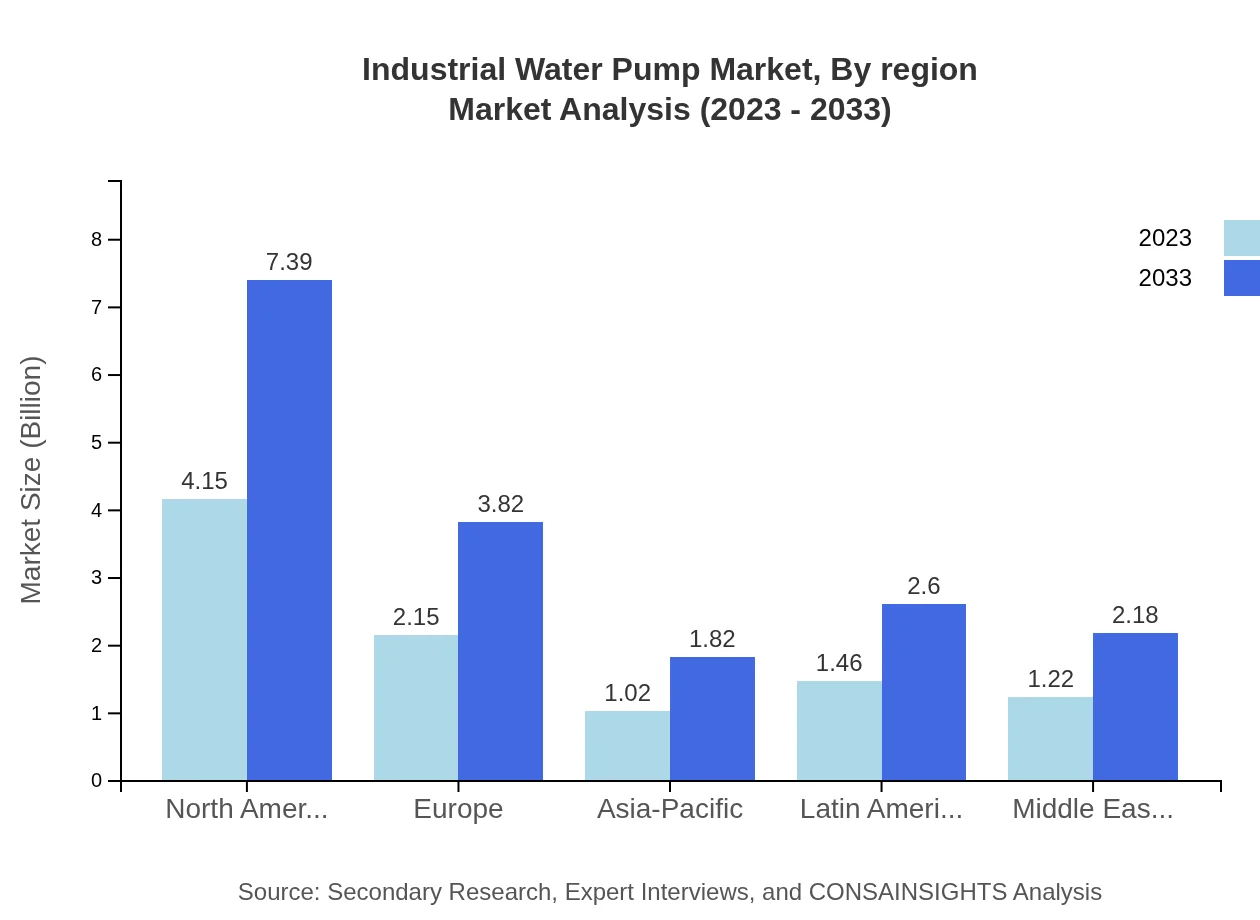

Water supply leads with a sizeable market of $4.15 billion in 2023, with projections hitting $7.39 billion by 2033. Wastewater treatment is also significant, initially at $2.15 billion and estimated to rise to $3.82 billion, highlighting the critical nature of effective waste management. Irrigation applications also hold considerable share, affirming the demand in agriculture.

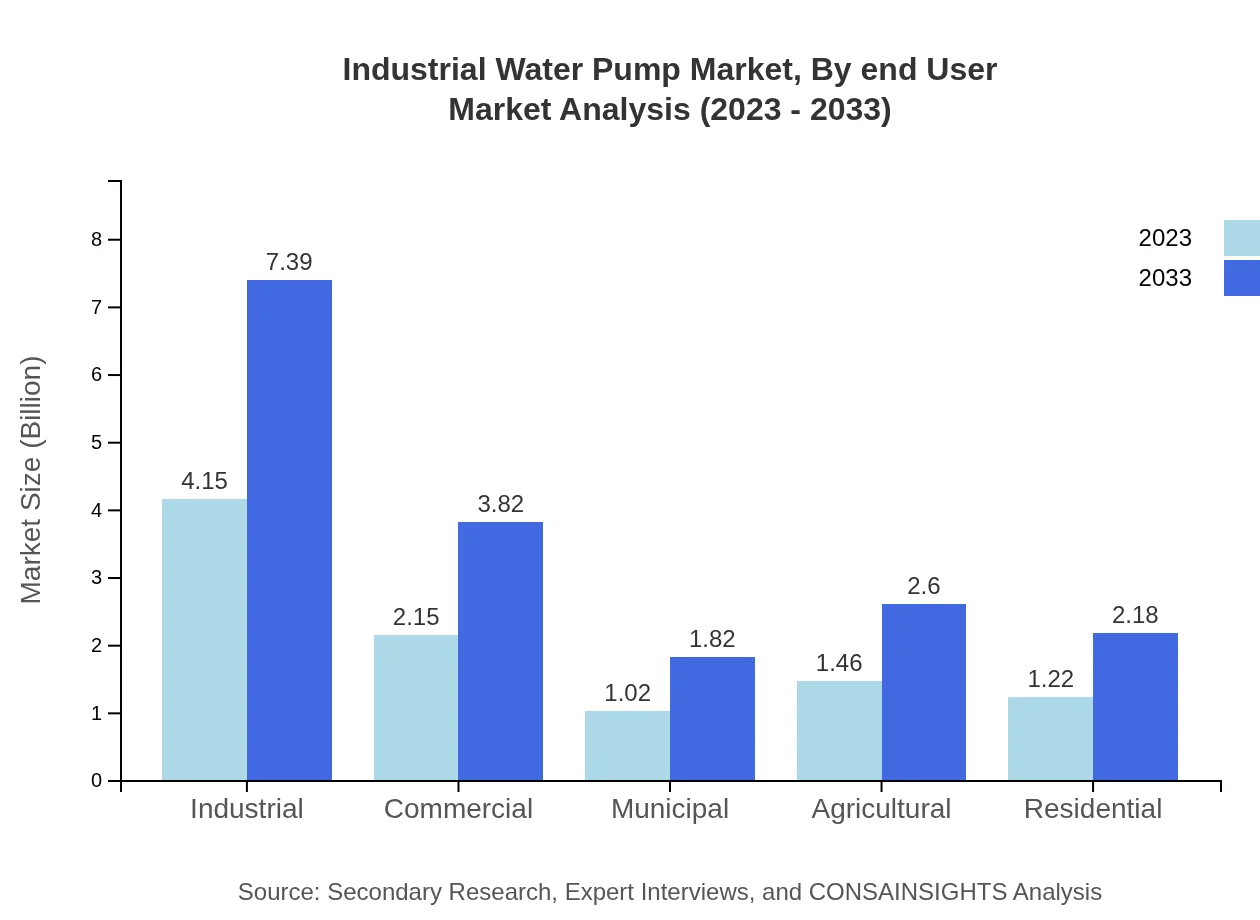

Industrial Water Pump Market Analysis By End User

Key end-users of the Industrial Water Pump market include industrial operations, commercial entities, municipalities, and agriculture. The industrial segment is pegged at $4.15 billion in 2023, headed to $7.39 billion, showcasing its substantial impact on market trends. Agriculture is also noteworthy, with an increase from $1.46 billion to $2.60 billion, underlining the essential nature of irrigation.

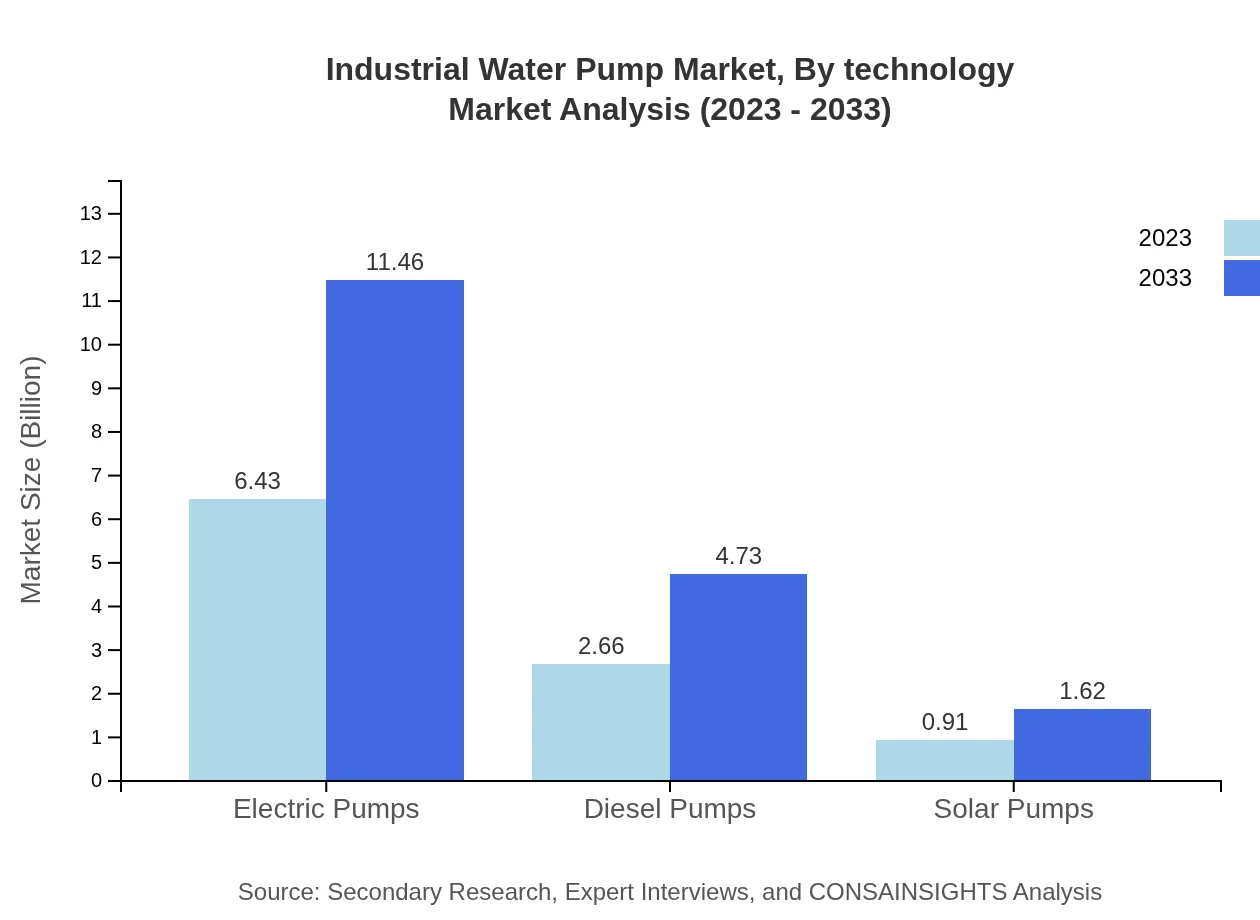

Industrial Water Pump Market Analysis By Technology

Electric pumps represent the largest segment, valued at $6.43 billion in 2023, anticipated to rise to $11.46 billion by 2033. Following closely are diesel pumps, starting at $2.66 billion with a future value of $4.73 billion, revealing an adaptive market responsive to varying energy needs. Solar pumps, although a smaller segment at $0.91 billion, reflect innovation trends and sustainable technology adoption.

Industrial Water Pump Market Analysis By Region

Each region presents unique dynamics. North America leads with size and growth, while Asia Pacific's rapid urbanization fuels its rate of advancement. Europe is focused on sustainability, reflected in broader investment patterns, whereas the Middle East faces water scarcity challenges driving innovation and efficiency. South America is slowly adopting advanced technologies, benefiting from improved infrastructure investments.

Industrial Water Pump Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Water Pump Industry

Grundfos:

A leading manufacturer specializing in high-efficiency pumps and systems, contributing significantly to water management solutions globally.Xylem:

A prominent water technology company known for its innovative water solutions and extensive range of pumping products.KSB Aktiengesellschaft:

Renowned for its comprehensive range of pumps and valves, KSB focuses on optimizing performance in the water industry.Flowserve Corporation:

Offers a wide range of flow control products, recognized for its engineering expertise and commitment to sustainability.Tsurumi Manufacturing Co., Ltd.:

A leading Japanese manufacturer of submersible pumps, noted for durability and reliability in challenging environments.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial Water Pump?

The industrial water pump market size is projected to reach approximately $10 billion by 2033, growing at a compound annual growth rate (CAGR) of 5.8%. With increasing industrial demands and technological advancements, this sector is expected to witness significant growth in the coming years.

What are the key market players or companies in this industry?

Key players in the industrial water pump market include leading manufacturers such as Grundfos, Xylem Inc., and KSB AG, among others. These companies significantly contribute to market innovations and cater to growing demands across various industrial sectors.

What are the primary factors driving the growth in the industrial water pump industry?

Growth in the industrial water pump industry is primarily driven by rising infrastructure development, increased oil and gas production, and expanding wastewater treatment facilities. Additionally, technological advancements in pump efficiency play a crucial role in market expansion.

Which region is the fastest Growing in the industrial water pump market?

The fastest-growing region in the industrial water pump market is North America, projected to grow from $3.63 billion in 2023 to $6.47 billion by 2033. This growth is supported by a robust industrial base and increasing investments in environmental sustainability.

Does ConsaInsights provide customized market report data for the industrial water pump industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs of clients in the industrial water pump sector. We offer detailed insights, market forecasts, and analytical reports to help understand market dynamics.

What deliverables can I expect from this industrial water pump market research project?

Deliverables from the industrial water pump market research project include comprehensive market reports, analysis of trends by segments and regions, forecasts up to 2033, and data on key players including market shares and competitive landscape insights.

What are the market trends of industrial water pump?

Current market trends in the industrial water pump sector include increasing adoption of energy-efficient electric pumps, growing utilization in wastewater treatment applications, and rise in demand for smart pumps integrated with IoT technology for enhanced performance.