Industrial Wearables Market Report

Published Date: 01 February 2026 | Report Code: industrial-wearables

Industrial Wearables Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Industrial Wearables market from 2023 to 2033, focusing on market size, trends, segmentation, and regional insights to guide stakeholders in strategic decision-making.

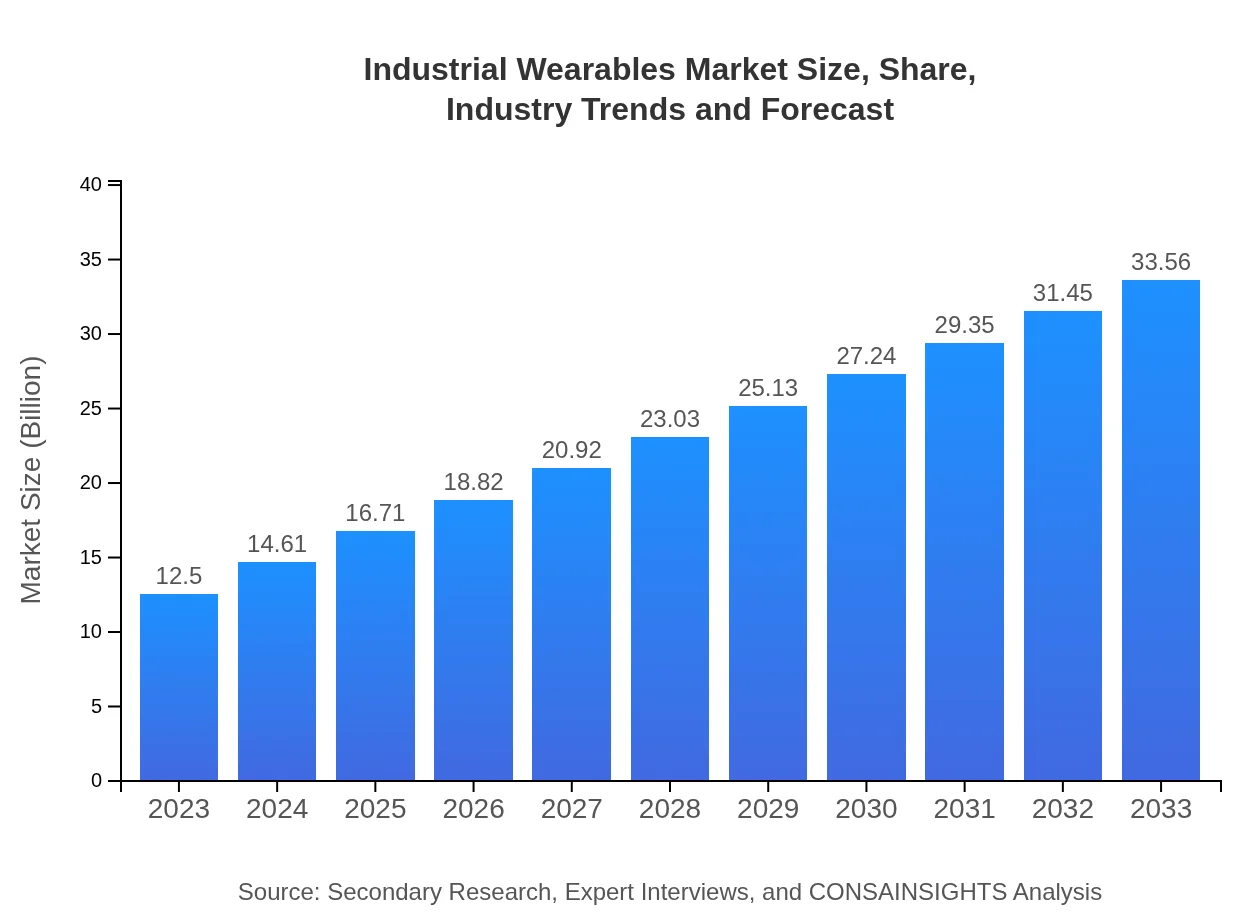

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $33.56 Billion |

| Top Companies | Google, Microsoft, Siemens , Vuzix |

| Last Modified Date | 01 February 2026 |

Industrial Wearables Market Overview

Customize Industrial Wearables Market Report market research report

- ✔ Get in-depth analysis of Industrial Wearables market size, growth, and forecasts.

- ✔ Understand Industrial Wearables's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Industrial Wearables

What is the Market Size & CAGR of Industrial Wearables market in 2023?

Industrial Wearables Industry Analysis

Industrial Wearables Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Industrial Wearables Market Analysis Report by Region

Europe Industrial Wearables Market Report:

The European market for Industrial Wearables is valued at $3.98 billion in 2023, with expectations to grow to $10.68 billion by 2033. Strict safety regulations and advancements in digital technologies bolster this market.Asia Pacific Industrial Wearables Market Report:

In 2023, the market size for Industrial Wearables in the Asia Pacific stands at $2.45 billion, expected to grow to $6.59 billion by 2033. The region's growth is driven by rapid industrialization, technology adoption, and government initiatives emphasizing safety and productivity.North America Industrial Wearables Market Report:

North America holds a significant market position with a size of $4.19 billion in 2023, anticipated to reach $11.24 billion by 2033. Major drivers include the concentration of advanced manufacturing facilities and a strong focus on integrating new technologies.South America Industrial Wearables Market Report:

The South American market for Industrial Wearables is estimated at $0.51 billion in 2023, with projections of $1.38 billion by 2033. This growth is largely supported by increasing investments in manufacturing and mining sectors.Middle East & Africa Industrial Wearables Market Report:

In the Middle East and Africa, the Industrial Wearables market is currently valued at $1.37 billion and is projected to rise to $3.67 billion by 2033, driven by increased mining activities and safety compliance in various industries.Tell us your focus area and get a customized research report.

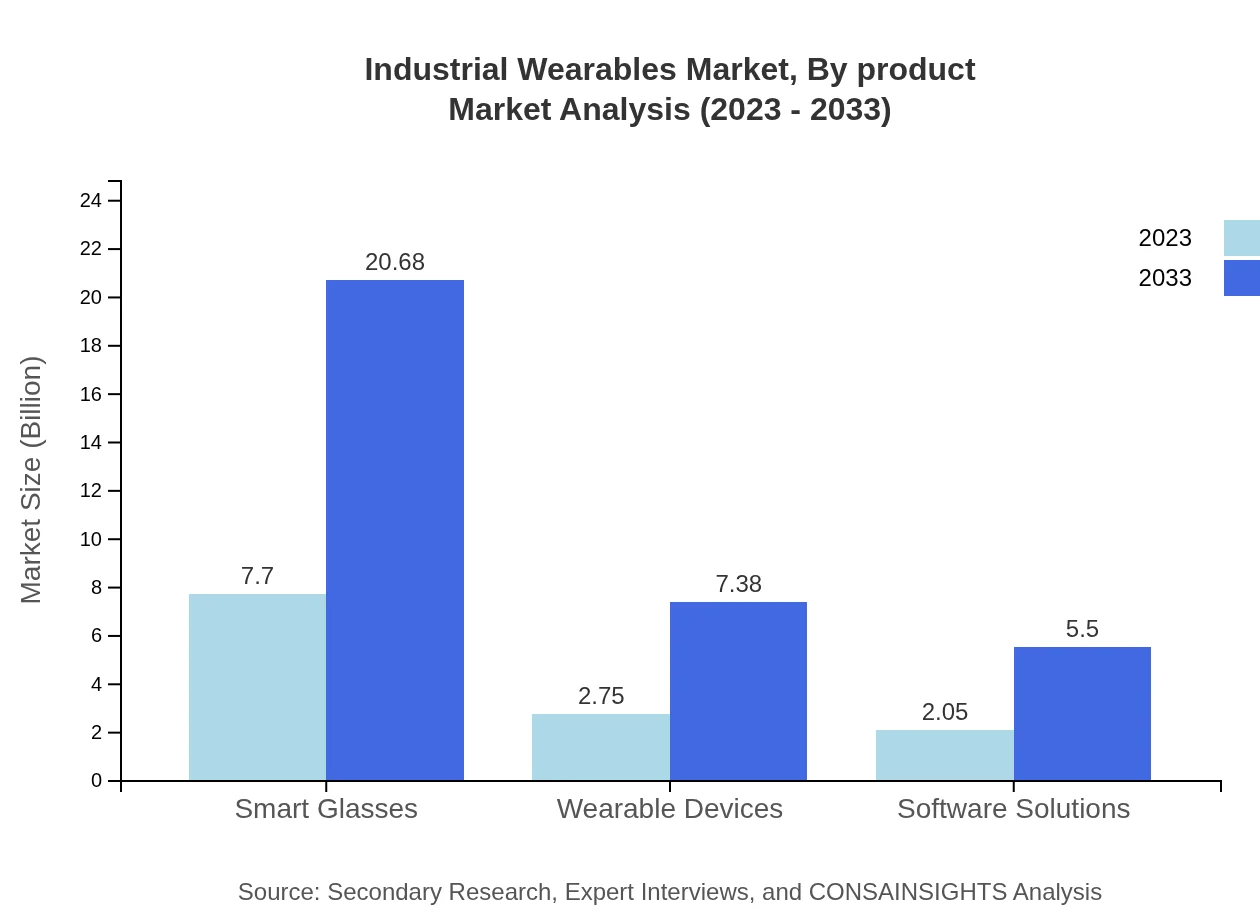

Industrial Wearables Market Analysis By Product

The Industrial Wearables market's product segment illustrates significant growth trajectories, primarily driven by smart glasses, which dominate with a market size of $7.70 billion in 2023, increasing to $20.68 billion by 2033. Wearable devices and software solutions also contribute robustly, highlighting a diversification of industrial applications.

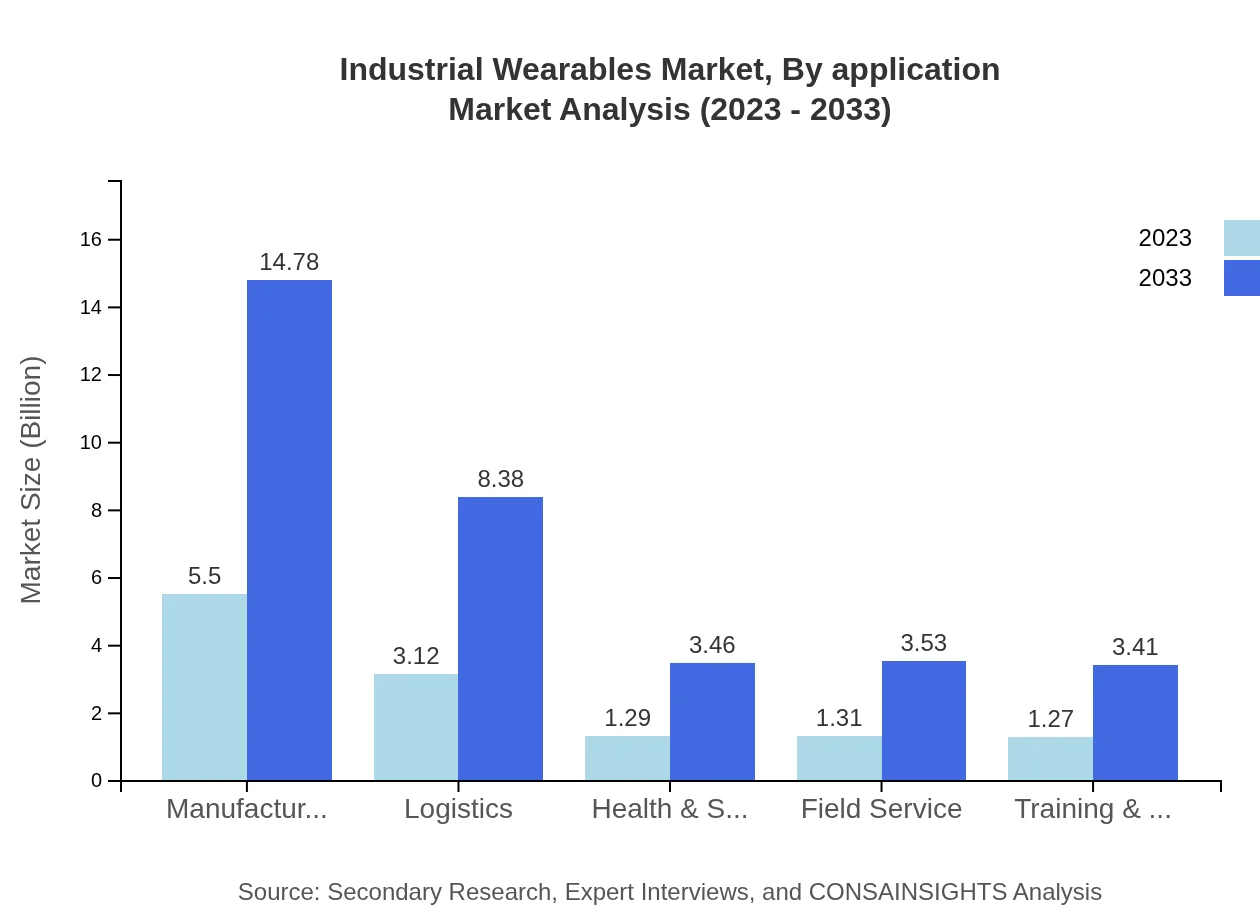

Industrial Wearables Market Analysis By Application

Applications across manufacturing, construction, healthcare, and logistics sectors are crucial. The manufacturing sector accounts for about 44% of the market in both 2023 and 2033, indicating its foundational role in adopting wearables for productivity enhancements.

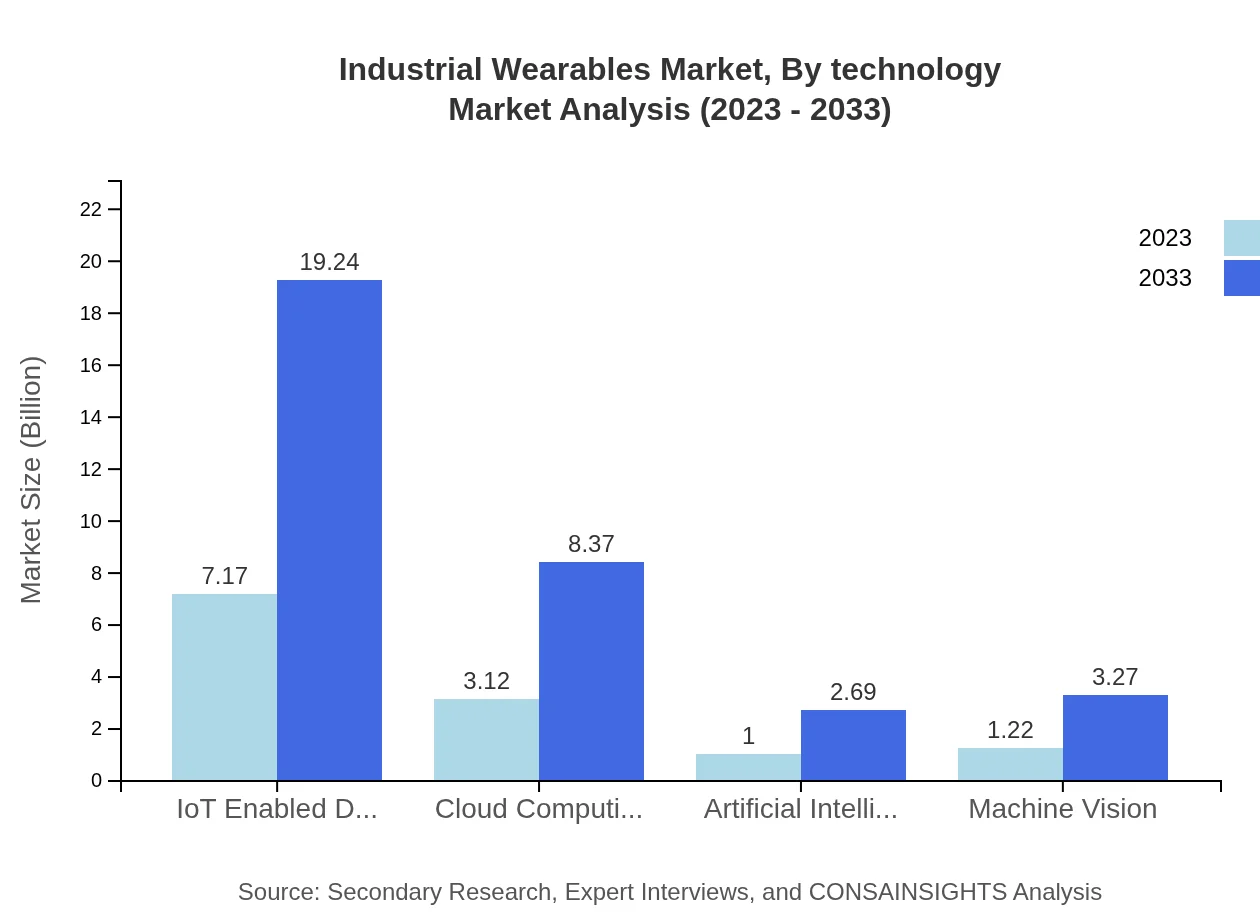

Industrial Wearables Market Analysis By Technology

Technological advancements such as IoT, AI, and machine learning are at the core of the Industrial Wearables market. As of 2023, IoT-enabled devices dominate with 57.32% market share, forecasted to stay stable through 2033, while AI technology adoption increases significantly.

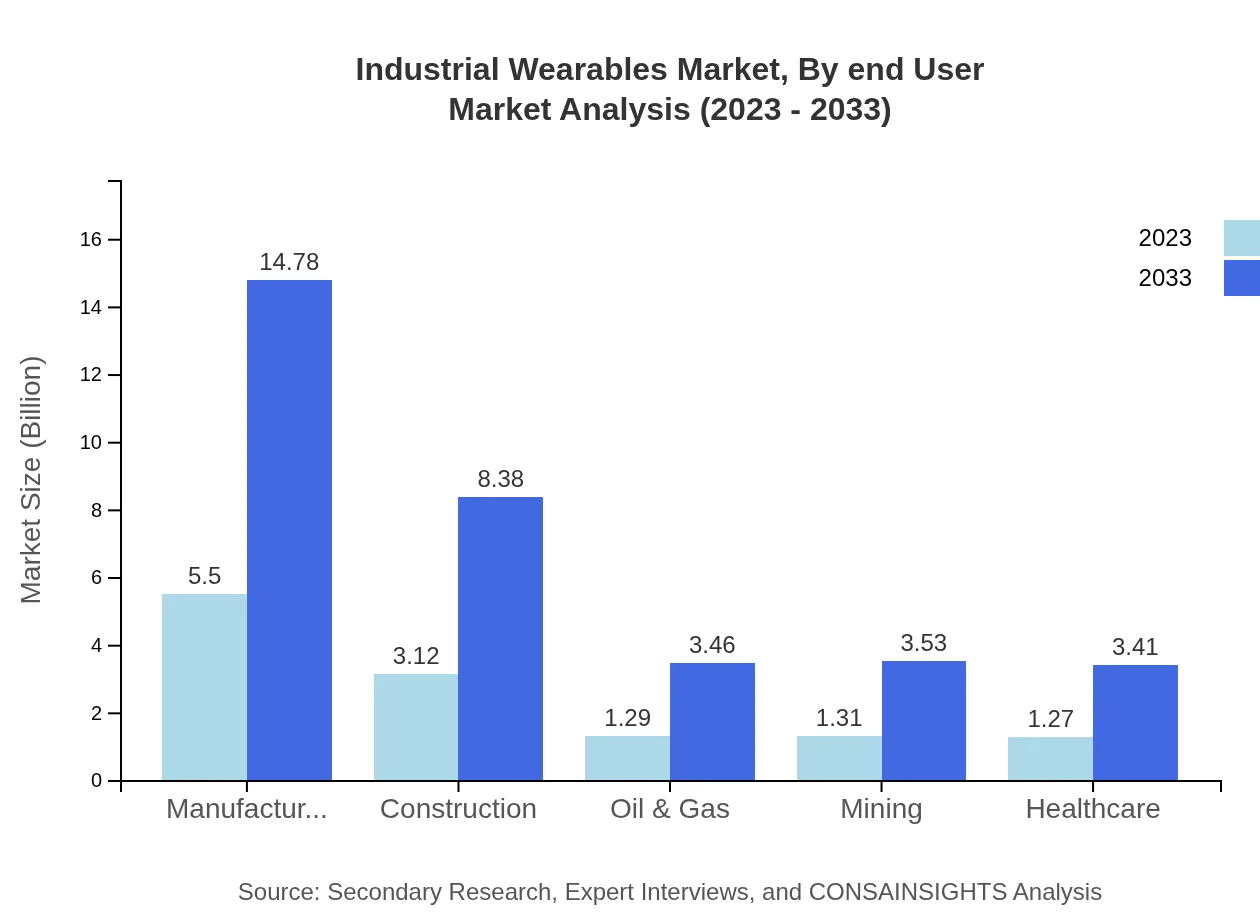

Industrial Wearables Market Analysis By End User

End-user industries like manufacturing, logistics, and healthcare see increased demand for wearables. Manufacturing holds a strong share, around 44% in 2023, followed by logistics and health & safety applications.

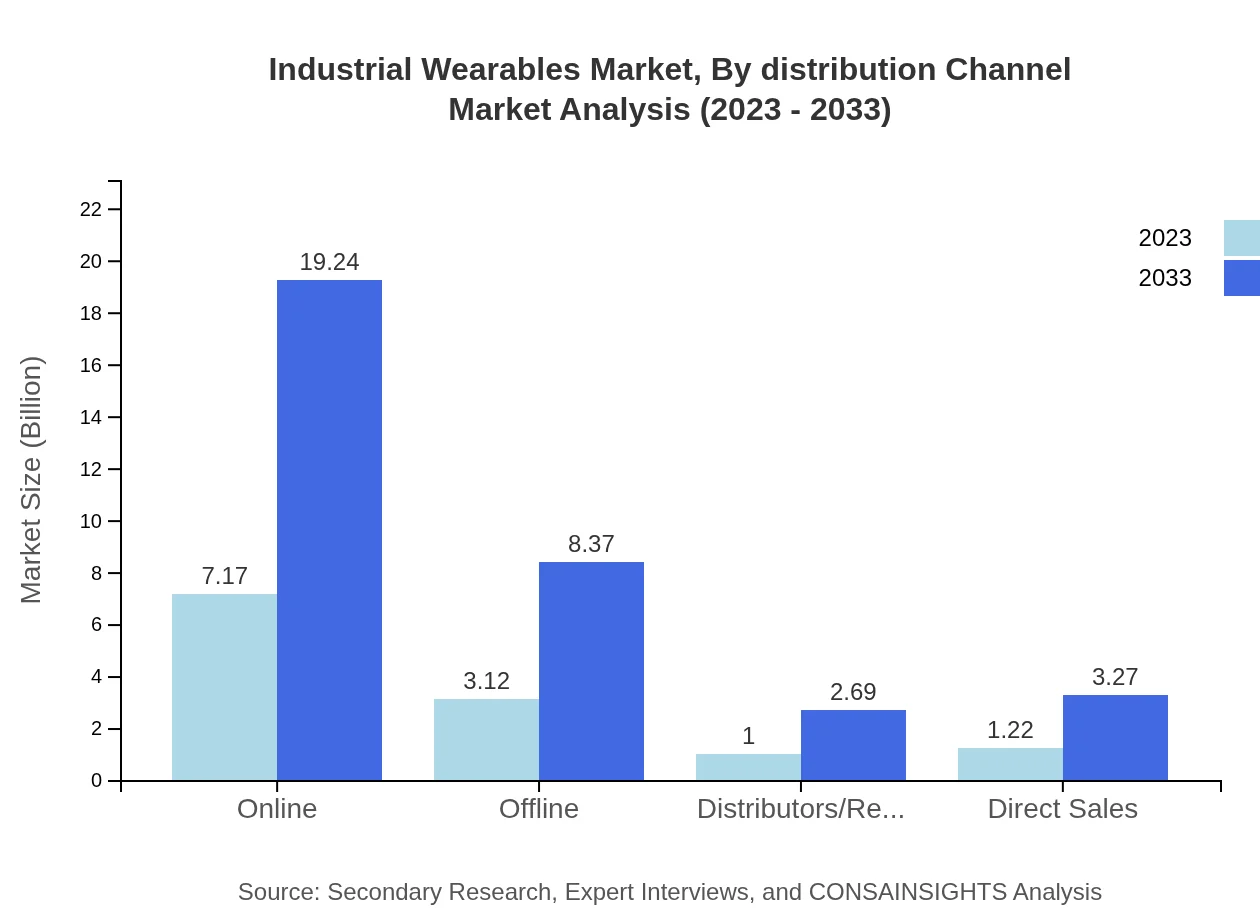

Industrial Wearables Market Analysis By Distribution Channel

Distribution channels crucially impacting the market include online and offline sales. Online channels have a substantial market share of 57.32% in 2023, with projections indicating continued preference as digital platforms improve.

Industrial Wearables Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Industrial Wearables Industry

Google:

Through its Google Glass project, the company is a pioneer in the market, providing innovative wearable solutions for industrial applications.Microsoft:

With its HoloLens, Microsoft provides cutting-edge augmented reality solutions that enhance productivity and safety for industrial workers.Siemens :

Siemens offers comprehensive digital solutions in industrial wearables, focusing on improving efficiency and safety in various operations.Vuzix:

A leader in the smart glasses field, Vuzix cultivates applications in manufacturing and enterprise sectors, enhancing workflow efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of industrial wearables?

The industrial wearables market size is projected to reach approximately $12.5 billion by the year 2033, with a CAGR of 10%. This significant growth reflects the rising adoption of wearable technology across various sectors.

What are the key market players or companies in this industrial wearables industry?

Key players in the industrial wearables industry include robust tech companies specializing in smart glasses, wearable devices, and software solutions. Their innovations drive significant advancements, enhancing productivity and safety in various industrial applications.

What are the primary factors driving the growth in the industrial wearables industry?

Key growth drivers include heightened demand for safety equipment, technological advancements in IoT and AI, and increased focus on employee productivity. These factors collectively foster innovation and investment within the industrial wearables market.

Which region is the fastest Growing in the industrial wearables?

North America is currently the fastest-growing region in the industrial wearables market, projected to grow from $4.19 billion in 2023 to $11.24 billion by 2033, highlighting a significant increase in demand and investment in this technology.

Does ConsaInsights provide customized market report data for the industrial wearables industry?

Yes, ConsaInsights offers tailored market report data for the industrial wearables industry, allowing clients to access personalized insights that cater to specific business requirements and enhance strategic decision-making processes.

What deliverables can I expect from this industrial wearables market research project?

Deliverables from the industrial wearables market research project typically include detailed market analysis, segmentation data, regional forecasts, and competitive landscape evaluations, providing comprehensive insights necessary for informed strategic planning.

What are the market trends of industrial wearables?

Emergent trends in the industrial wearables market include enhanced integration of AI and IoT, growing emphasis on health and safety solutions, and a shift towards cloud-based applications, signifying a trend towards increased automation and data analytics.