Integrated Marine Automation System Market Report

Published Date: 02 February 2026 | Report Code: integrated-marine-automation-system

Integrated Marine Automation System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Integrated Marine Automation System market for the forecast period from 2023 to 2033. It includes insights on market sizes, trends, regional performances, technological advancements, and key players shaping the industry.

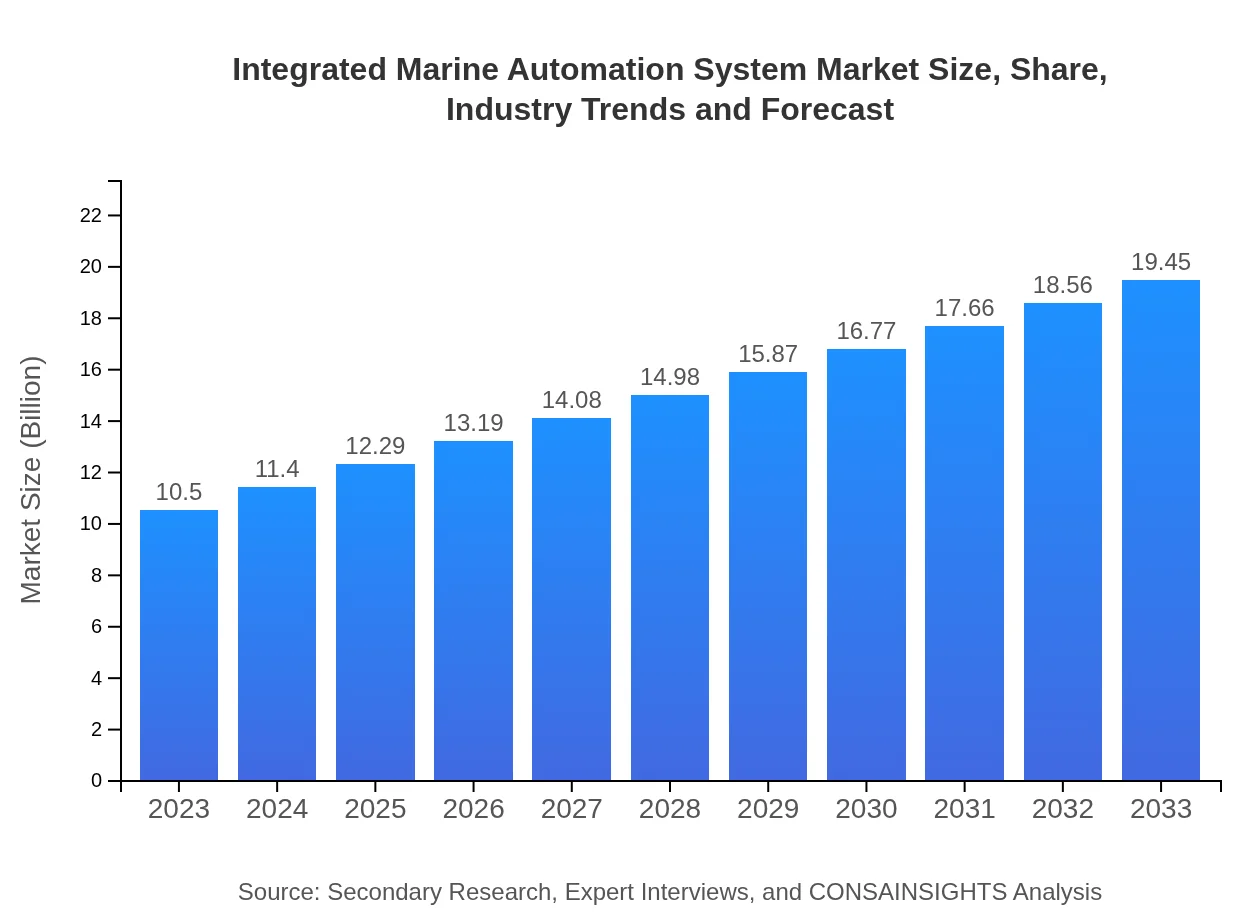

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $19.45 Billion |

| Top Companies | ABB, Rolls-Royce, Siemens , Kongsberg Gruppen |

| Last Modified Date | 02 February 2026 |

Integrated Marine Automation System Market Overview

Customize Integrated Marine Automation System Market Report market research report

- ✔ Get in-depth analysis of Integrated Marine Automation System market size, growth, and forecasts.

- ✔ Understand Integrated Marine Automation System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Integrated Marine Automation System

What is the Market Size & CAGR of Integrated Marine Automation System market in 2023?

Integrated Marine Automation System Industry Analysis

Integrated Marine Automation System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Integrated Marine Automation System Market Analysis Report by Region

Europe Integrated Marine Automation System Market Report:

The European market, with a size of $3.10 billion in 2023, is anticipated to grow to $5.75 billion by 2033. The region benefits from advanced maritime regulations and a significant presence of established shipping companies.Asia Pacific Integrated Marine Automation System Market Report:

In 2023, Asia Pacific holds a market size of $1.94 billion, expected to grow to $3.60 billion by 2033. This growth is driven by the rapid expansion of shipping activities and increased investment in maritime infrastructure.North America Integrated Marine Automation System Market Report:

In North America, the market size of $3.95 billion in 2023 is expected to grow to $7.31 billion by 2033, supported by stringent safety regulations and a strong focus on technology upgrades.South America Integrated Marine Automation System Market Report:

South America currently represents a market of $0.69 billion, projected to reach $1.28 billion by 2033, reflecting the rising need for modernization in maritime services.Middle East & Africa Integrated Marine Automation System Market Report:

Middle East and Africa have a market of $0.82 billion in 2023, projected to grow to $1.52 billion by 2033. The region's investments in marine technology and expanding shipping activities are key growth drivers.Tell us your focus area and get a customized research report.

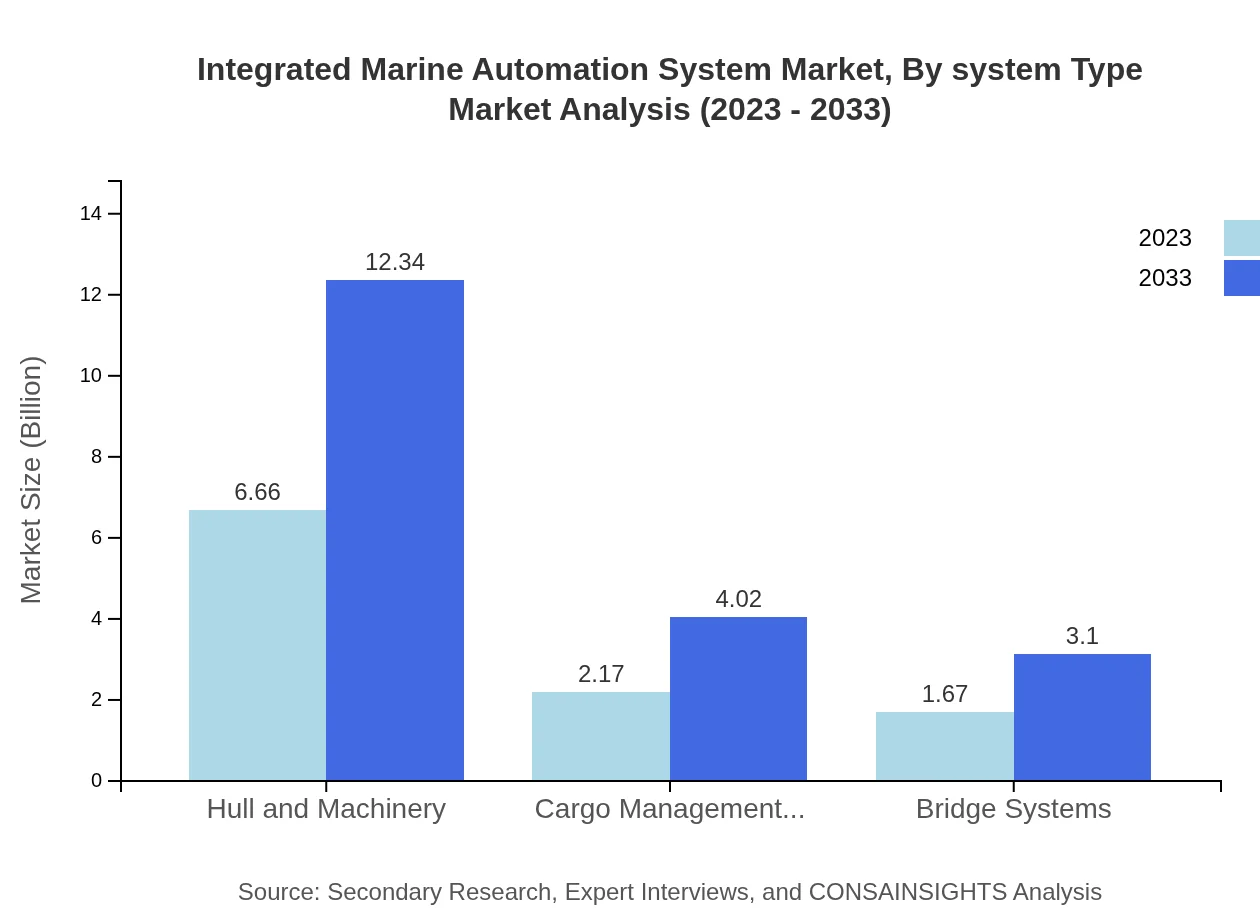

Integrated Marine Automation System Market Analysis By System Type

In 2023, Hull and Machinery dominate the market with a share of approximately 63.41%, estimated at $6.66 billion, and projected to reach $12.34 billion by 2033. Cargo Management Systems and Bridge Systems capture 20.68% and 15.91%, reflecting their critical roles in integrated maritime operations.

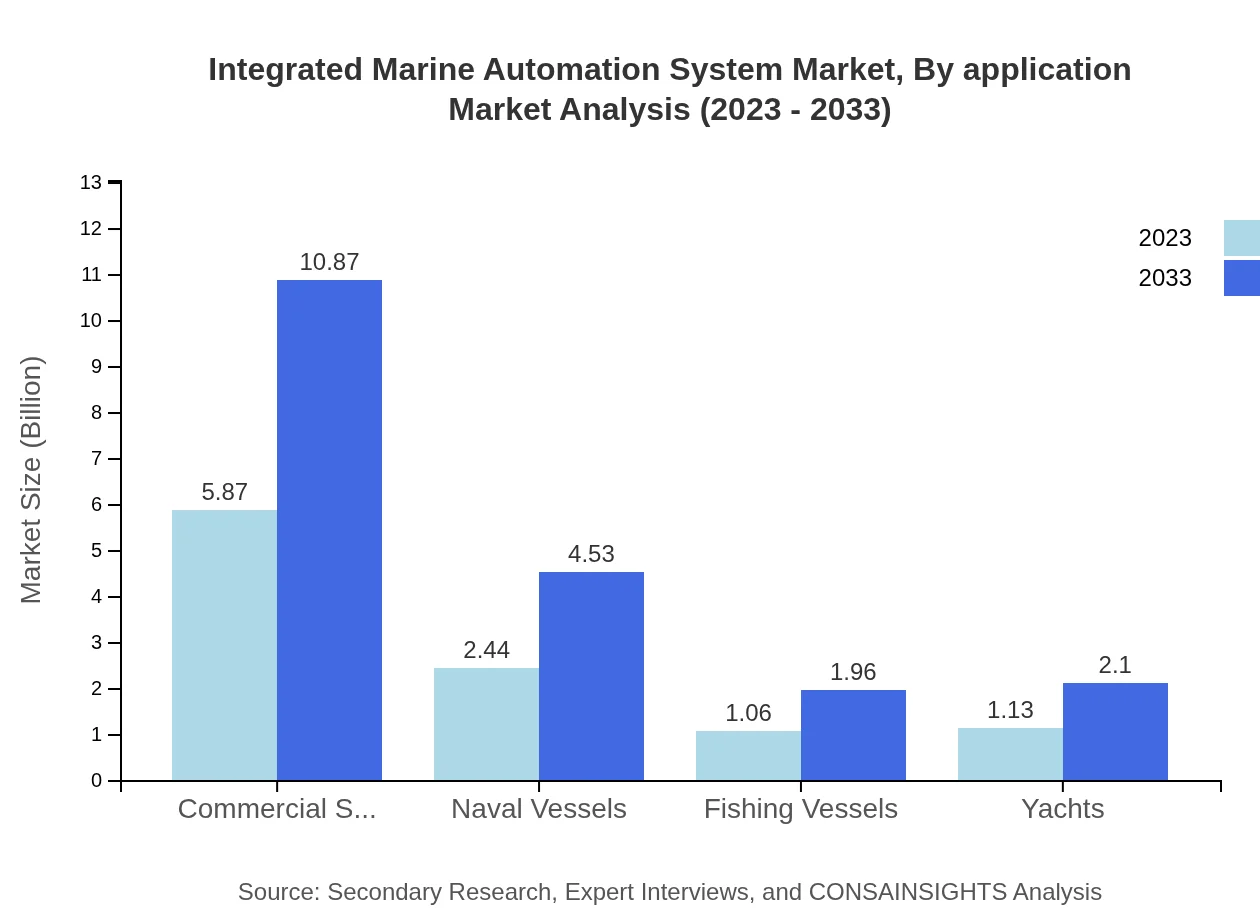

Integrated Marine Automation System Market Analysis By Application

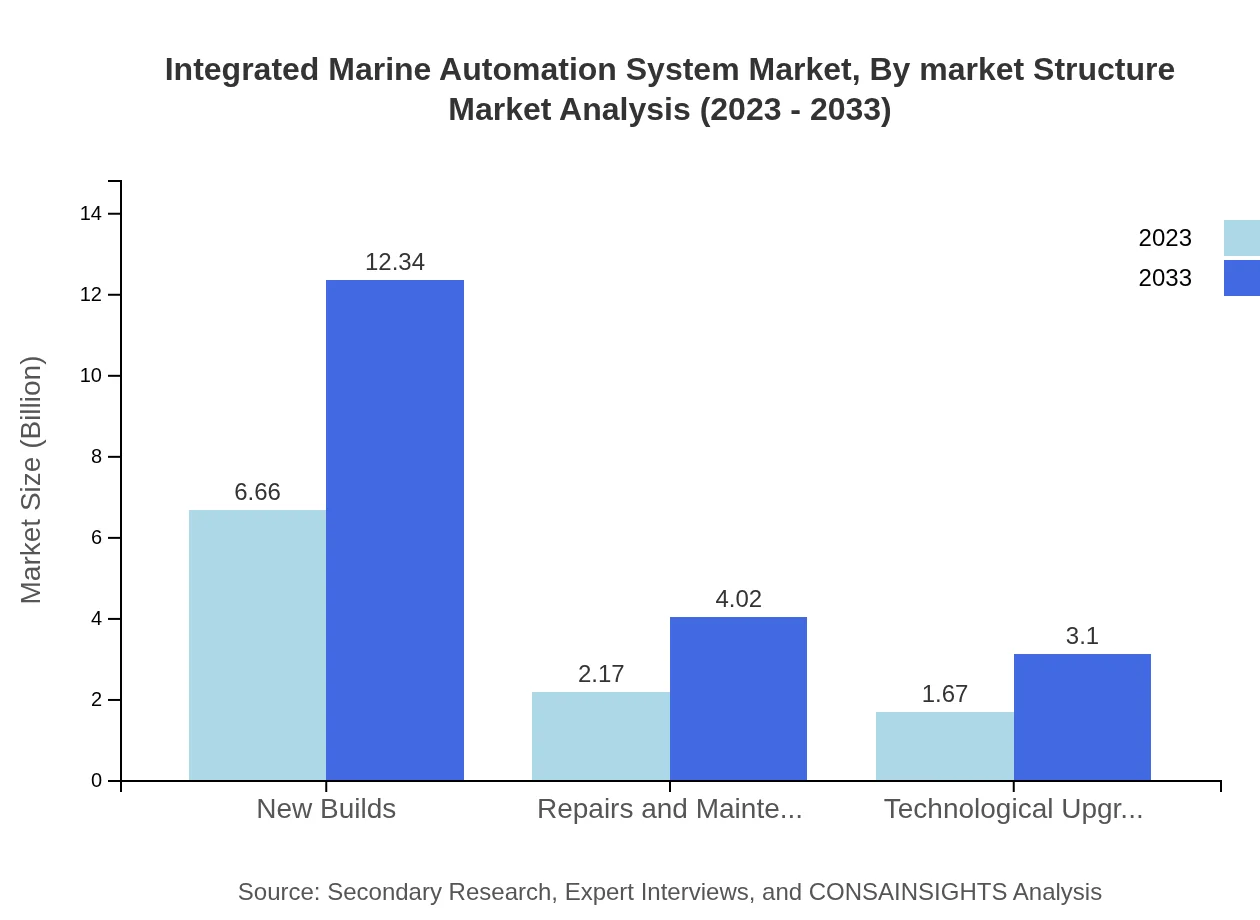

For the application segment, New Builds hold the majority with a size of $6.66 billion (63.41%) in 2023, expected to grow to $12.34 billion by 2033. Continued demand for modern vessel construction drives this growth, alongside services for Repairs and Maintenance and Technological Upgrades.

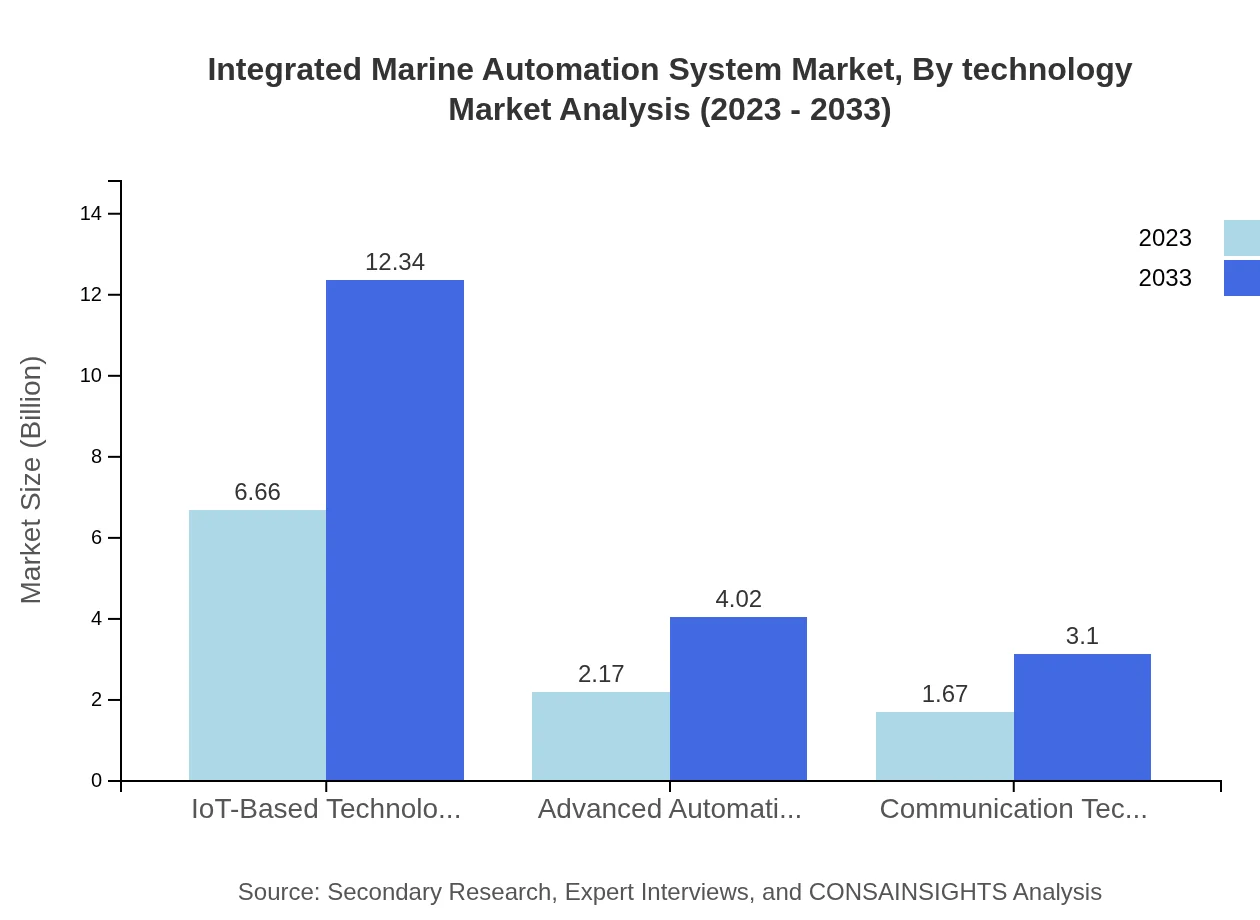

Integrated Marine Automation System Market Analysis By Technology

IoT-Based Technologies lead the market, holding a size of $6.66 billion in 2023, maintaining a share of 63.41% and expected to grow significantly. Advanced Automation Technologies and Communication Technologies are also gaining traction with notable market shares.

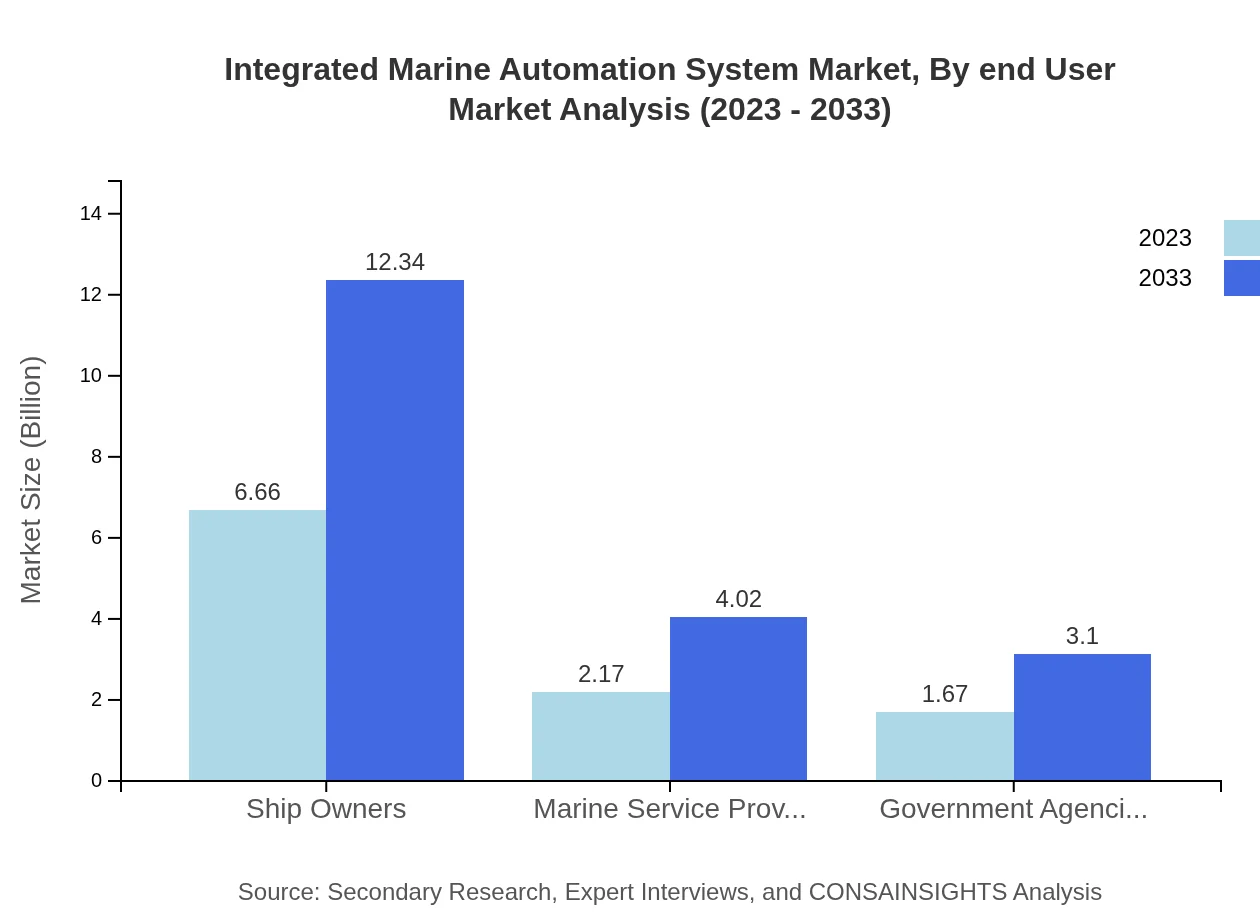

Integrated Marine Automation System Market Analysis By End User

Ship Owners represent the largest segment, with a market size of $6.66 billion (63.41%) in 2023 and projected growth through 2033. Marine Service Providers and Government Agencies together contribute significantly, reflecting the increasing reliance on integrated automation solutions across the industry.

Integrated Marine Automation System Market Analysis By Market Structure

The market structure is increasingly characterized by competitive dynamics, with leading players developing integrated systems and modular components that facilitate easier updates and enhancements, thus attracting diverse customer bases.

Integrated Marine Automation System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Integrated Marine Automation System Industry

ABB:

ABB is a pioneer in marine automation, delivering state-of-the-art solutions that enhance operational efficiency and safety in maritime environments.Rolls-Royce:

Rolls-Royce offers innovative integrated systems for marine applications, focusing on smart shipping technologies that reduce emissions and improve performance.Siemens :

Siemens is a leader in maritime automation, providing advanced systems that optimize ship performance across the global shipping industry.Kongsberg Gruppen:

Kongsberg is an expert in marine technology, offering critical automation solutions that improve safety and efficiency for ship operators worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of Integrated Marine Automation System?

The Integrated Marine Automation System market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.2%, indicating steady growth and increasing demand in the coming years.

What are the key market players or companies in this Integrated Marine Automation System industry?

Key market players in the Integrated Marine Automation System industry include notable companies that specialize in marine electronics, automation technologies, and systems integration. These companies are continuously innovating and expanding their product offerings to stay competitive.

What are the primary factors driving the growth in the Integrated Marine Automation System industry?

Growth in the Integrated Marine Automation System industry is primarily driven by advancements in automation technology, increasing demand for efficient vessel operations, regulatory compliance, and the need for enhanced safety measures on maritime vessels.

Which region is the fastest Growing in the Integrated Marine Automation System?

The fastest-growing region in the Integrated Marine Automation System market is North America, projected to grow from $3.95 billion in 2023 to $7.31 billion by 2033, fueled by high adoption rates of advanced marine technologies.

Does ConsaInsights provide customized market report data for the Integrated Marine Automation System industry?

Yes, ConsaInsights provides customized market report data tailored to the specific needs of clients in the Integrated Marine Automation System industry, allowing for detailed insights and strategic analysis.

What deliverables can I expect from this Integrated Marine Automation System market research project?

Expect deliverables such as comprehensive market reports detailing market size, trends, competitive analysis, regional insights, and segmentation, all designed to inform strategic decision-making in the Integrated Marine Automation System sector.

What are the market trends of Integrated Marine Automation System?

Key market trends include the increasing integration of IoT-based technologies for enhanced monitoring, the rise of automation in new builds, and growing investments in advanced communication and safety systems across diverse marine applications.