Interconnects And Passive Components Market Report

Published Date: 31 January 2026 | Report Code: interconnects-and-passive-components

Interconnects And Passive Components Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Interconnects and Passive Components market, covering current trends, industry insights, and forecasts from 2023 to 2033, including market size, segmentation, and regional dynamics.

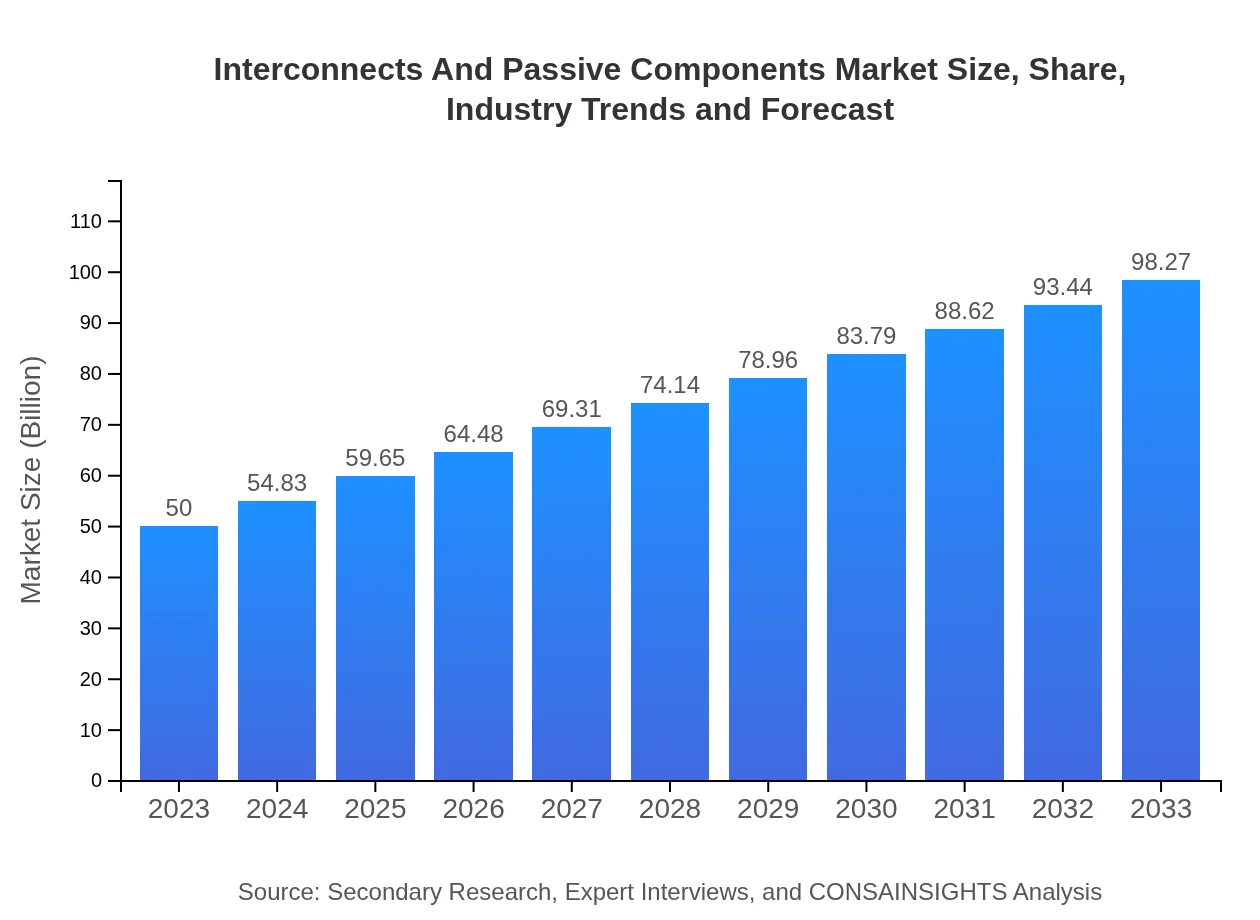

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $98.27 Billion |

| Top Companies | TE Connectivity, Molex, Amphenol Corporation, Rohm Semiconductor |

| Last Modified Date | 31 January 2026 |

Interconnects And Passive Components Market Overview

Customize Interconnects And Passive Components Market Report market research report

- ✔ Get in-depth analysis of Interconnects And Passive Components market size, growth, and forecasts.

- ✔ Understand Interconnects And Passive Components's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Interconnects And Passive Components

What is the Market Size & CAGR of Interconnects And Passive Components market in 2023?

Interconnects And Passive Components Industry Analysis

Interconnects And Passive Components Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Interconnects And Passive Components Market Analysis Report by Region

Europe Interconnects And Passive Components Market Report:

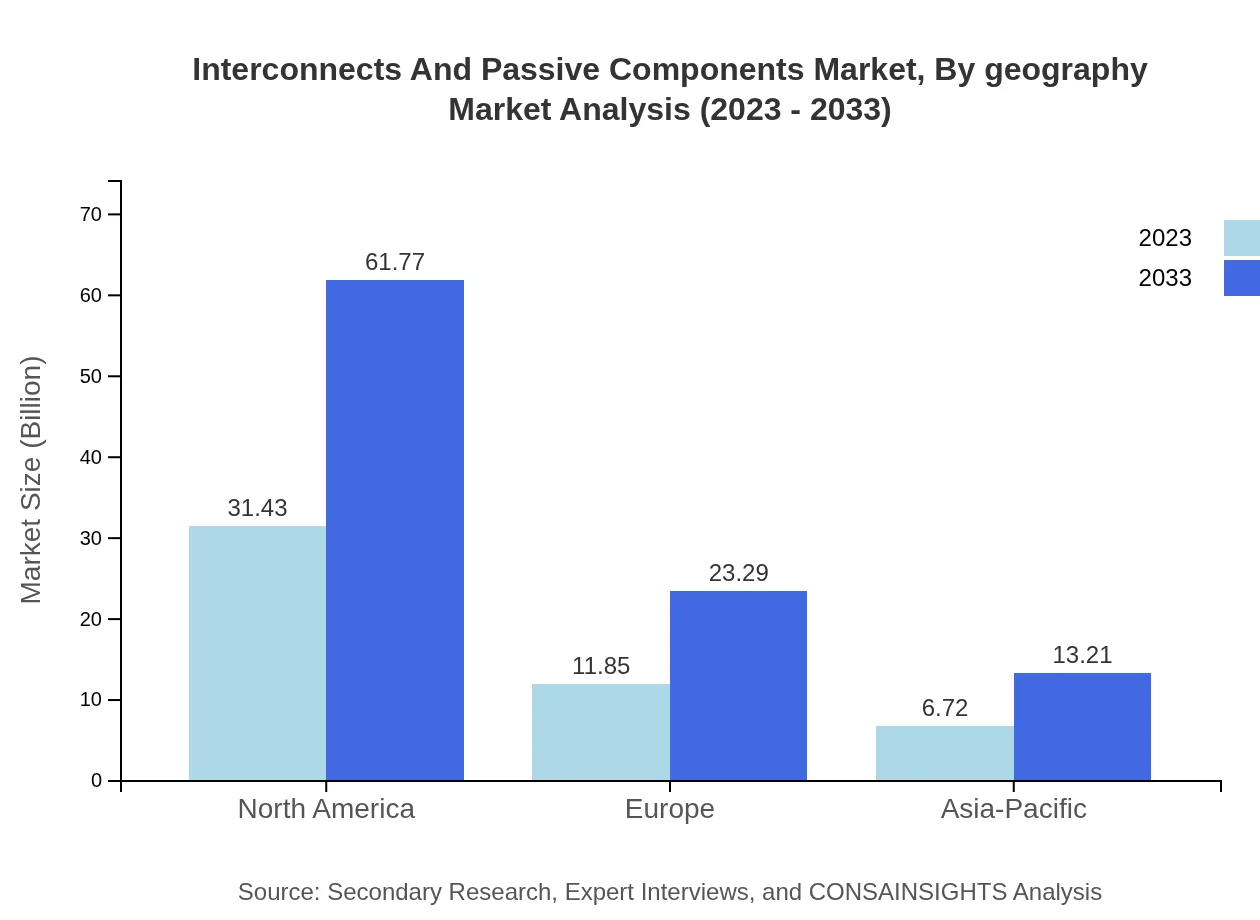

Europe's market is set to grow significantly, from $14.41 billion in 2023 to $28.32 billion by 2033. Growth is fueled by investments in smart infrastructure and sustainable energy solutions.Asia Pacific Interconnects And Passive Components Market Report:

The Asia Pacific region is expected to witness robust growth, with the market size projected to reach $18.65 billion by 2033 from $9.49 billion in 2023. This surge is driven by rapid industrialization and increased manufacturing of electronics in countries like China and Japan.North America Interconnects And Passive Components Market Report:

North America remains a leading market, projected to expand from $19.25 billion in 2023 to $37.84 billion by 2033. The growth is primarily due to developments in the automotive sector and advancements in networking technologies.South America Interconnects And Passive Components Market Report:

In South America, the market for Interconnects and Passive Components is anticipated to grow from $1.95 billion in 2023 to $3.82 billion by 2033, supported by increasing demand for telecommunications and consumer electronics.Middle East & Africa Interconnects And Passive Components Market Report:

The Middle East and Africa region is also noting growth, with the market expected to rise from $4.90 billion in 2023 to $9.63 billion by 2033, driven by infrastructure developments and telecommunications enhancements.Tell us your focus area and get a customized research report.

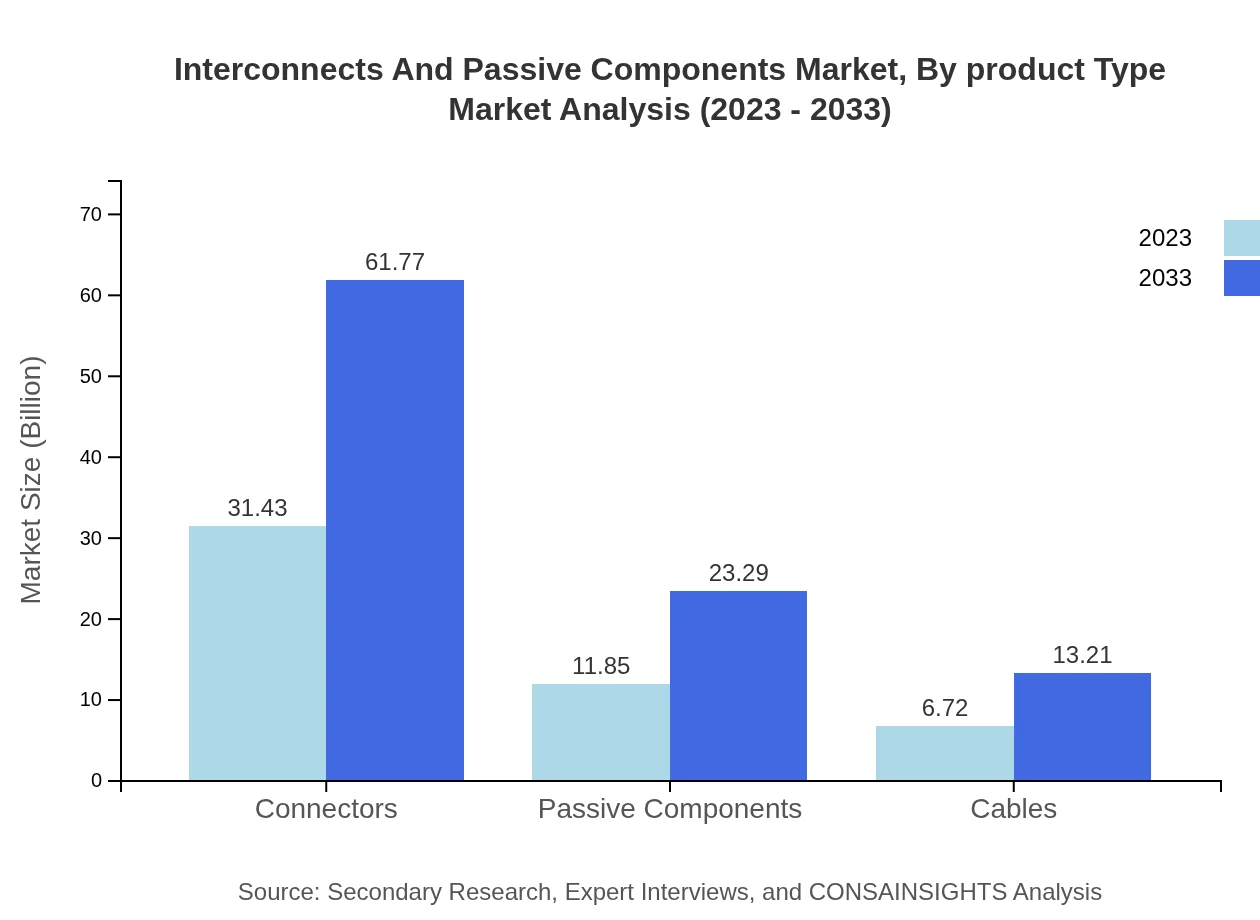

Interconnects And Passive Components Market Analysis By Product Type

The product type segmentation shows that connectors dominate the market, with an expected growth from $31.43 billion in 2023 to $61.77 billion by 2033. Passive components like resistors and capacitors are also significant, growing from $11.85 billion to $23.29 billion during the same period.

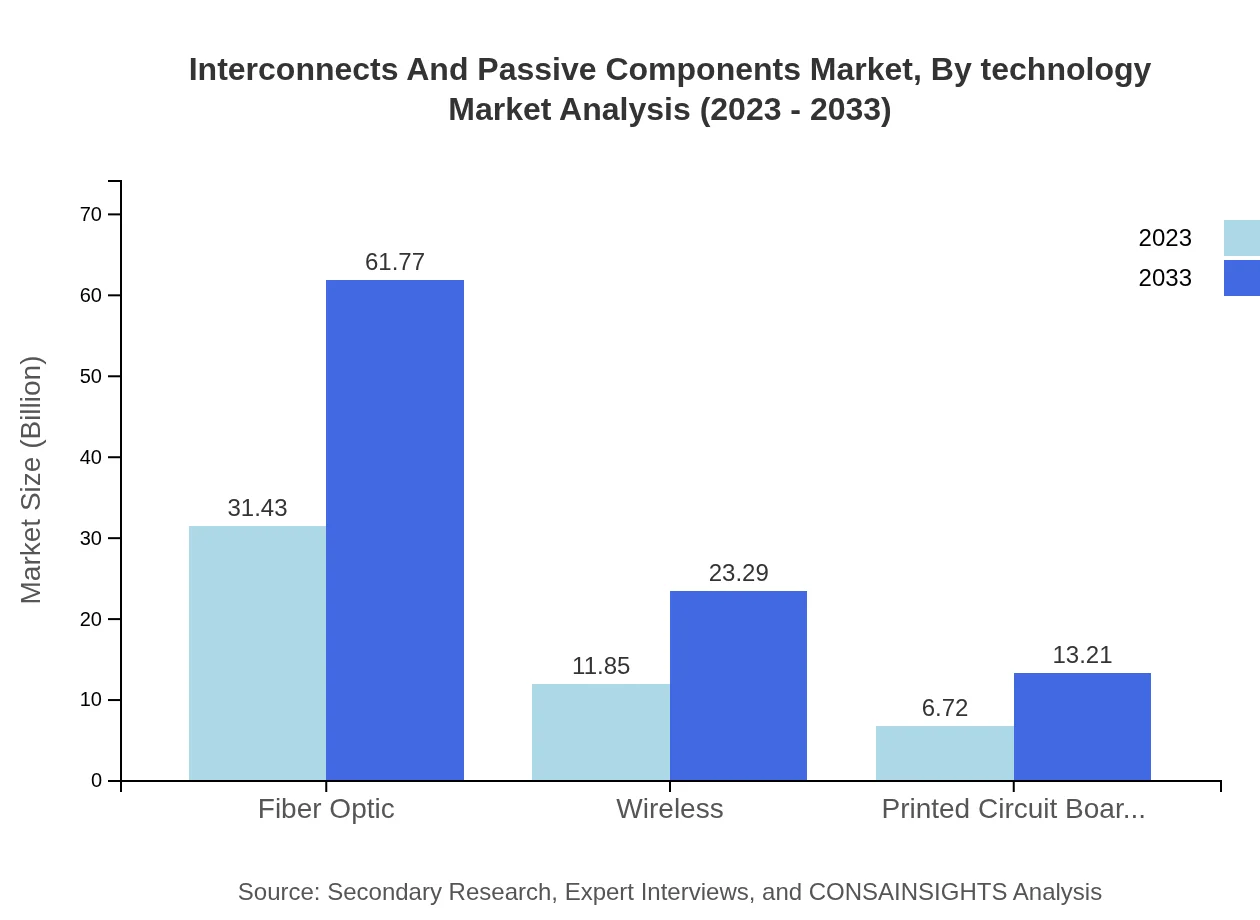

Interconnects And Passive Components Market Analysis By Technology

Technological advancements in fiber optics and wireless interconnections are at the forefront, reflecting a size increase from $31.43 billion in 2023 to $61.77 billion in 2033. This reflects growing trends in data centers and high-speed internet.

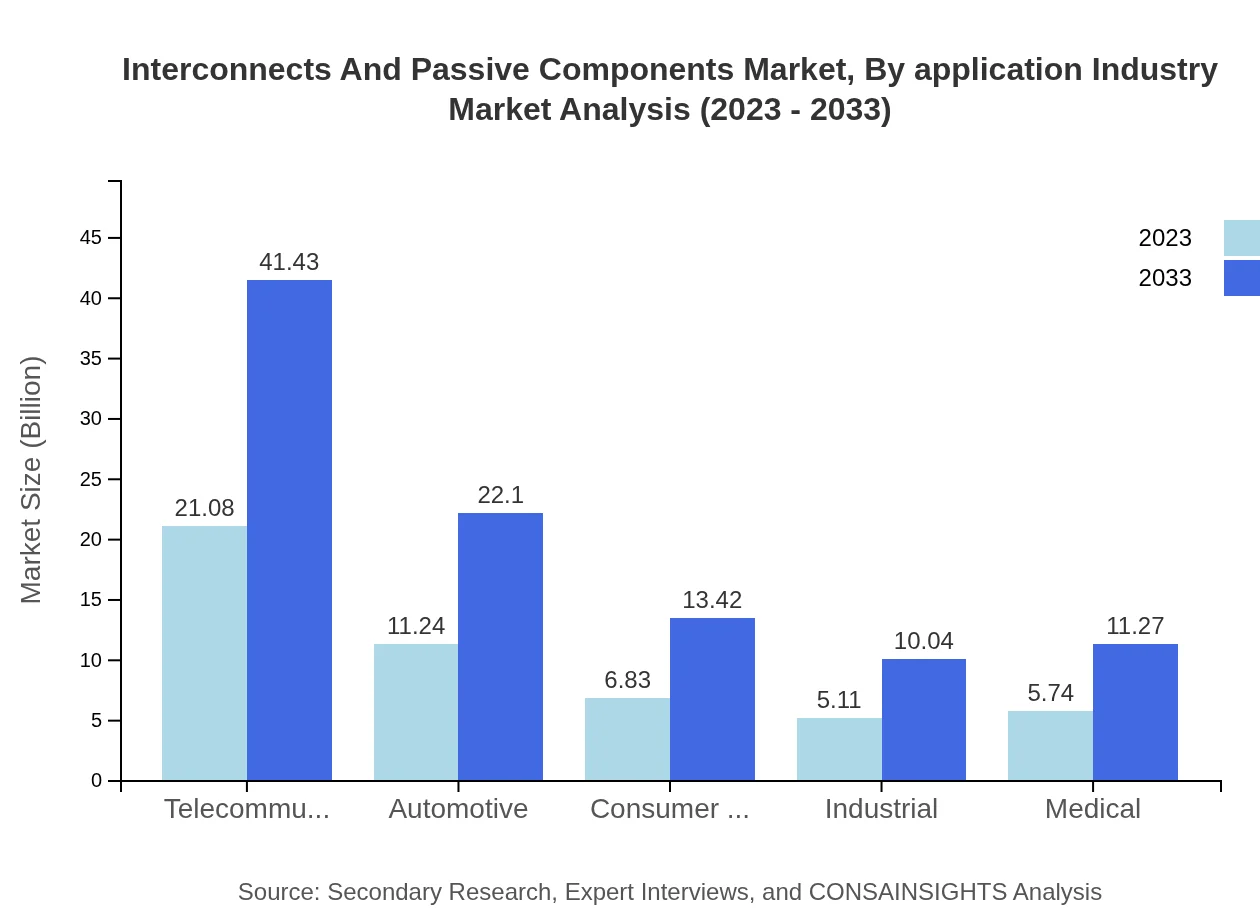

Interconnects And Passive Components Market Analysis By Application Industry

The telecommunications sector is the largest application industry, projected to grow from $21.08 billion in 2023 to $41.43 billion in 2033, highlighting the importance of reliable connectivity solutions in modern communication systems.

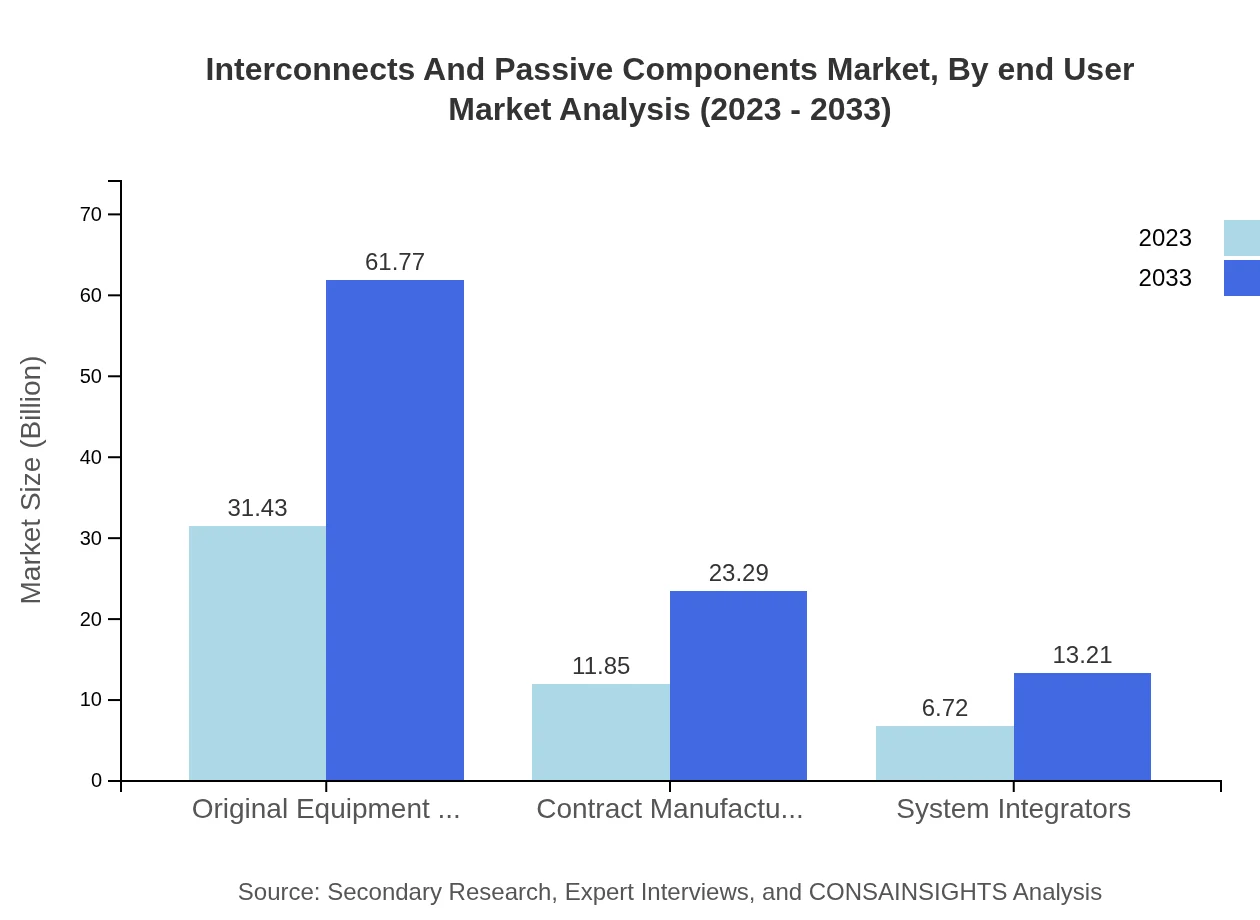

Interconnects And Passive Components Market Analysis By End User

Key end-users include automotive and consumer electronics, with the automotive industry expected to grow from $11.24 billion in 2023 to $22.10 billion by 2033, indicating the increasing reliance on electronic components in vehicles.

Interconnects And Passive Components Market Analysis By Geography

Geographical segmentation reveals that North America and Europe are leading markets. North America is set to maintain its position with substantial investments across high-tech sectors, while Asia-Pacific gains traction due to rapid market expansions.

Interconnects And Passive Components Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Interconnects And Passive Components Industry

TE Connectivity:

A global leader in engineered electronic components and connectors, TE Connectivity caters to various industries with innovative solutions that enhance connectivity and power management.Molex:

Molex is renowned for its comprehensive product portfolio of connectors and interconnect technology. The company focuses on developing cutting-edge solutions to improve connectivity in electronics.Amphenol Corporation:

Amphenol is one of the largest manufacturers of electronic connectors, offering innovative technologies that ensure reliable interconnections across multiple sectors including aerospace, automotive, and telecommunications.Rohm Semiconductor:

Rohm is recognized for its passive components and semiconductor solutions, providing advanced technologies for improving energy efficiency in electronic applications.We're grateful to work with incredible clients.

FAQs

What is the market size of interconnects And Passive Components?

As of 2023, the interconnects and passive components market is valued at approximately $50 billion, with expectations for growth at a CAGR of 6.8%. This trend positions the market to expand significantly through 2033.

What are the key market players or companies in this interconnects And Passive Components industry?

Key players in the interconnects and passive components industry include major manufacturers and suppliers focused on innovation and technological advancements, such as TE Connectivity, Molex, and Vishay Intertechnology, which lead in both product quality and market share.

What are the primary factors driving the growth in the interconnects And Passive Components industry?

Growth in the interconnects and passive components industry is driven by increasing demand from telecommunications, automotive, and consumer electronics sectors, alongside advancements in technology, leading to new applications and product development.

Which region is the fastest Growing in the interconnects And Passive Components?

The North American region is currently the fastest-growing market for interconnects and passive components, projected to expand from $19.25 billion in 2023 to $37.84 billion by 2033, reflecting substantial growth opportunities embedded in the region.

Does ConsaInsights provide customized market report data for the interconnects And Passive Components industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications in the interconnects and passive components field, ensuring that clients receive insights that meet their unique business requirements and strategic objectives.

What deliverables can I expect from this interconnects And Passive Components market research project?

Deliverables from an interconnects and passive components market research project typically include comprehensive reports detailing market size, growth rates, competitive analysis, regional insights, and segmented data to inform strategic planning.

What are the market trends of interconnects And Passive Components?

Current market trends in interconnects and passive components include increased demand for energy-efficient solutions, advancements in automation and smart technologies, and a shift towards miniaturization of components, indicating a transformative period ahead.