Isoflavones Market Report

Published Date: 02 February 2026 | Report Code: isoflavones

Isoflavones Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Isoflavones market, covering key trends, insights, and projected growth from 2023 to 2033. It includes detailed assessments of market size, regional dynamics, industry competition, and forecasts shaping the future of this sector.

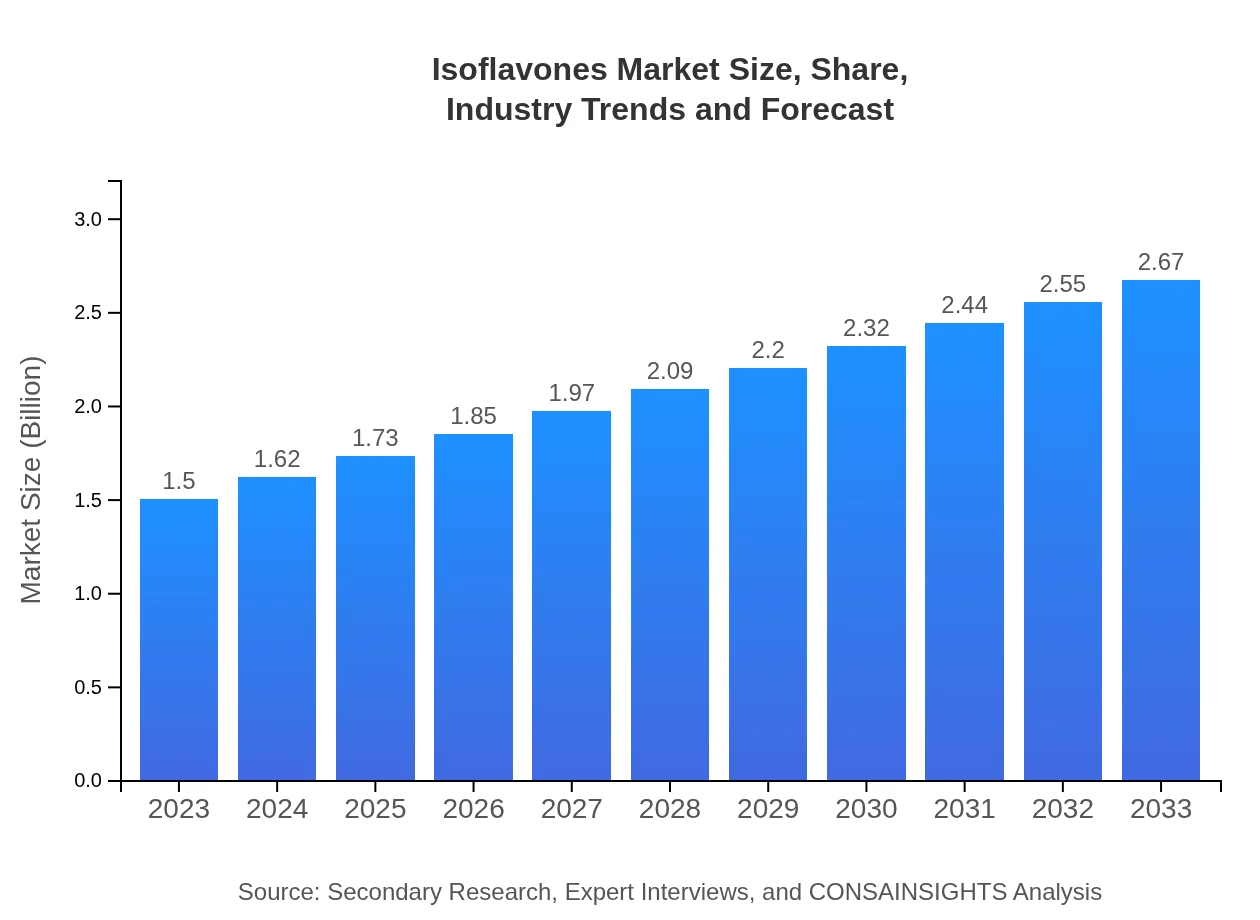

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.67 Billion |

| Top Companies | DSM Nutritional Products, Solae LLC (DuPont), Fujifilm Diosynth Biotechnologies, NutraScience Labs, Herbalife Nutrition |

| Last Modified Date | 02 February 2026 |

Isoflavones Market Overview

Customize Isoflavones Market Report market research report

- ✔ Get in-depth analysis of Isoflavones market size, growth, and forecasts.

- ✔ Understand Isoflavones's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Isoflavones

What is the Market Size & CAGR of Isoflavones market in 2023?

Isoflavones Industry Analysis

Isoflavones Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Isoflavones Market Analysis Report by Region

Europe Isoflavones Market Report:

The Isoflavones market in Europe was valued at 0.53 billion USD in 2023 and is projected to grow to 0.94 billion USD by 2033. The rising trend of health-conscious consumers and the incorporation of Isoflavones in functional foods and supplements drive this growth, amidst a robust regulatory environment.Asia Pacific Isoflavones Market Report:

In the Asia Pacific region, the Isoflavones market size reached approximately 0.27 billion USD in 2023, projected to grow to around 0.48 billion USD by 2033. The demand is primarily driven by increased consumption of soy-based products, rising health awareness, and supportive government policies promoting functional foods.North America Isoflavones Market Report:

North America is a leading market for Isoflavones, with a size of 0.49 billion USD in 2023, expected to reach 0.87 billion USD by 2033. The region's growth is fueled by an increasing preference for natural health products and ongoing research supporting the health benefits of Isoflavones, particularly amongst aging populations.South America Isoflavones Market Report:

The South American Isoflavones market, valued at 0.11 billion USD in 2023, is expected to rise to 0.19 billion USD by 2033. Growing consumer interest in plant-based dietary supplements and increased production of soy products contribute to this region's market expansion.Middle East & Africa Isoflavones Market Report:

The Middle East and Africa market, starting at 0.11 billion USD in 2023 and expanding to 0.19 billion USD by 2033, is bolstered by increasing investment in wellness products and rising popularity of herbal supplements, highlighting the health benefits of Isoflavones.Tell us your focus area and get a customized research report.

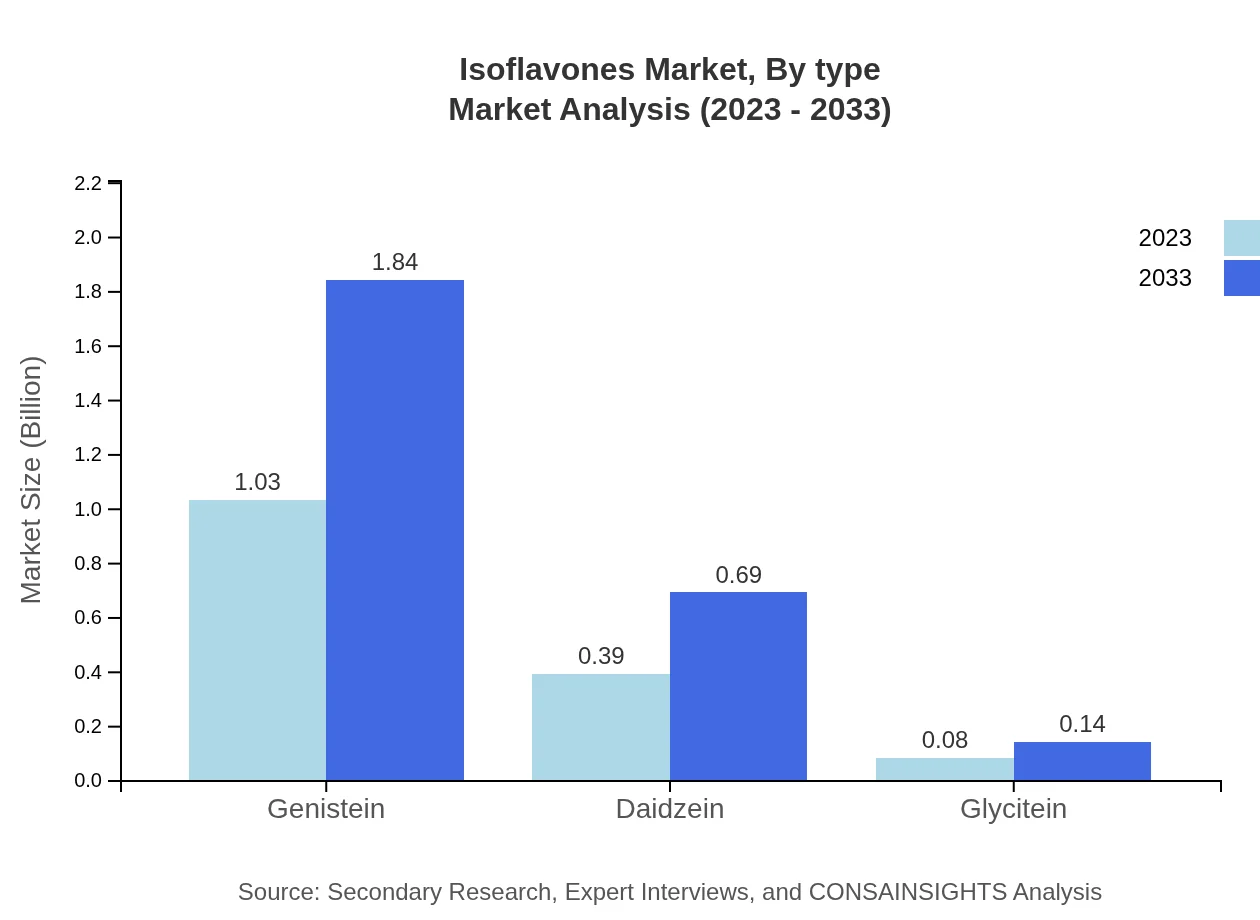

Isoflavones Market Analysis By Type

The Isoflavones market is primarily segmented by type into Genistein, Daidzein, and Glycitein. Genistein leads the market, showcasing a size of 1.03 billion USD in 2023, growing to 1.84 billion USD by 2033. Daidzein accounts for 0.39 billion USD initially, expected to reach 0.69 billion USD, while Glycitein, although smaller, represents a stable segment with values of 0.08 billion USD growing to 0.14 billion USD.

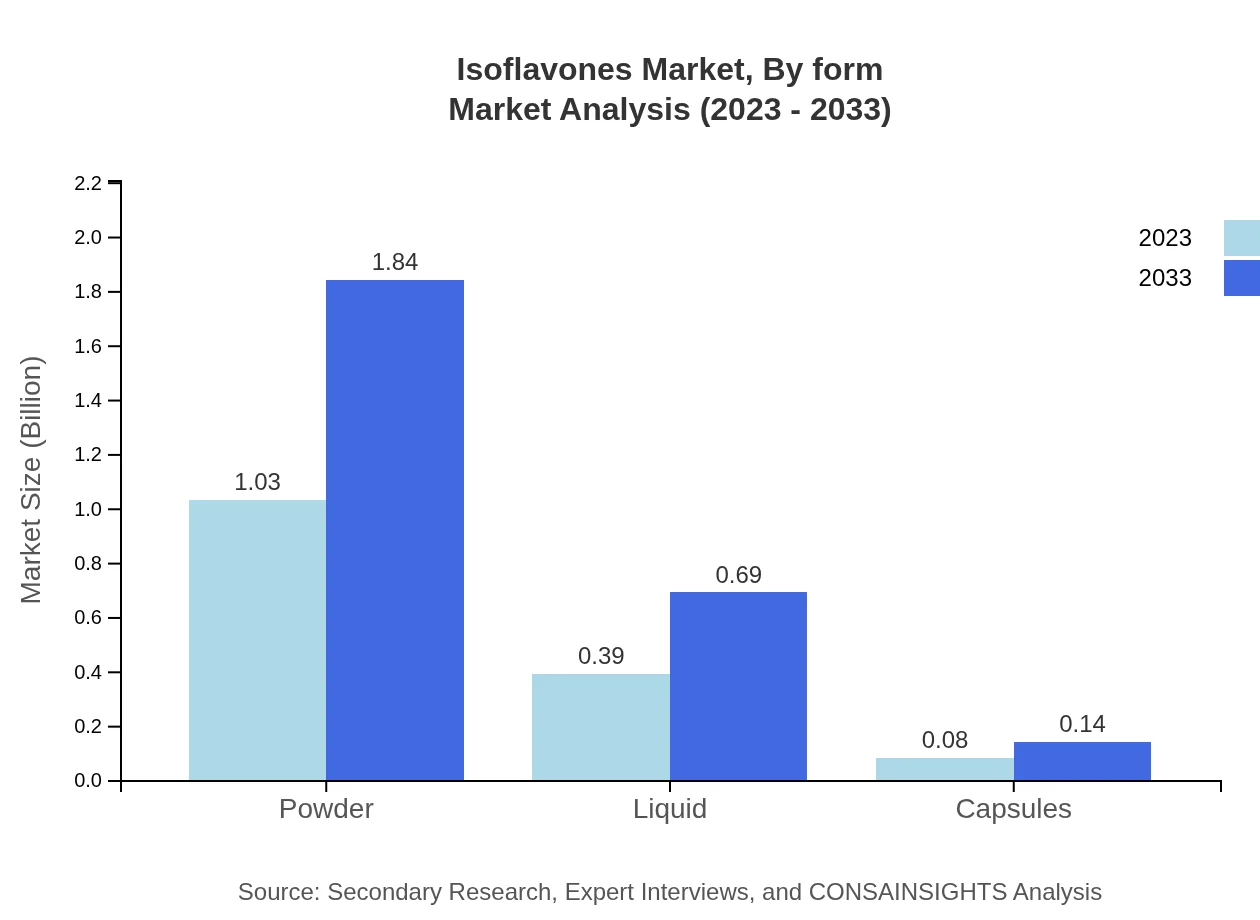

Isoflavones Market Analysis By Form

The market is categorized by form, including Powder, Liquid, and Capsules. Powder form dominates the market, growing from 1.03 billion USD in 2023 to 1.84 billion USD in 2033. Liquid Isoflavones also capture a significant market share, moving from 0.39 billion USD to 0.69 billion USD. Capsules, while smaller, are expected to see growth from 0.08 billion USD to 0.14 billion USD.

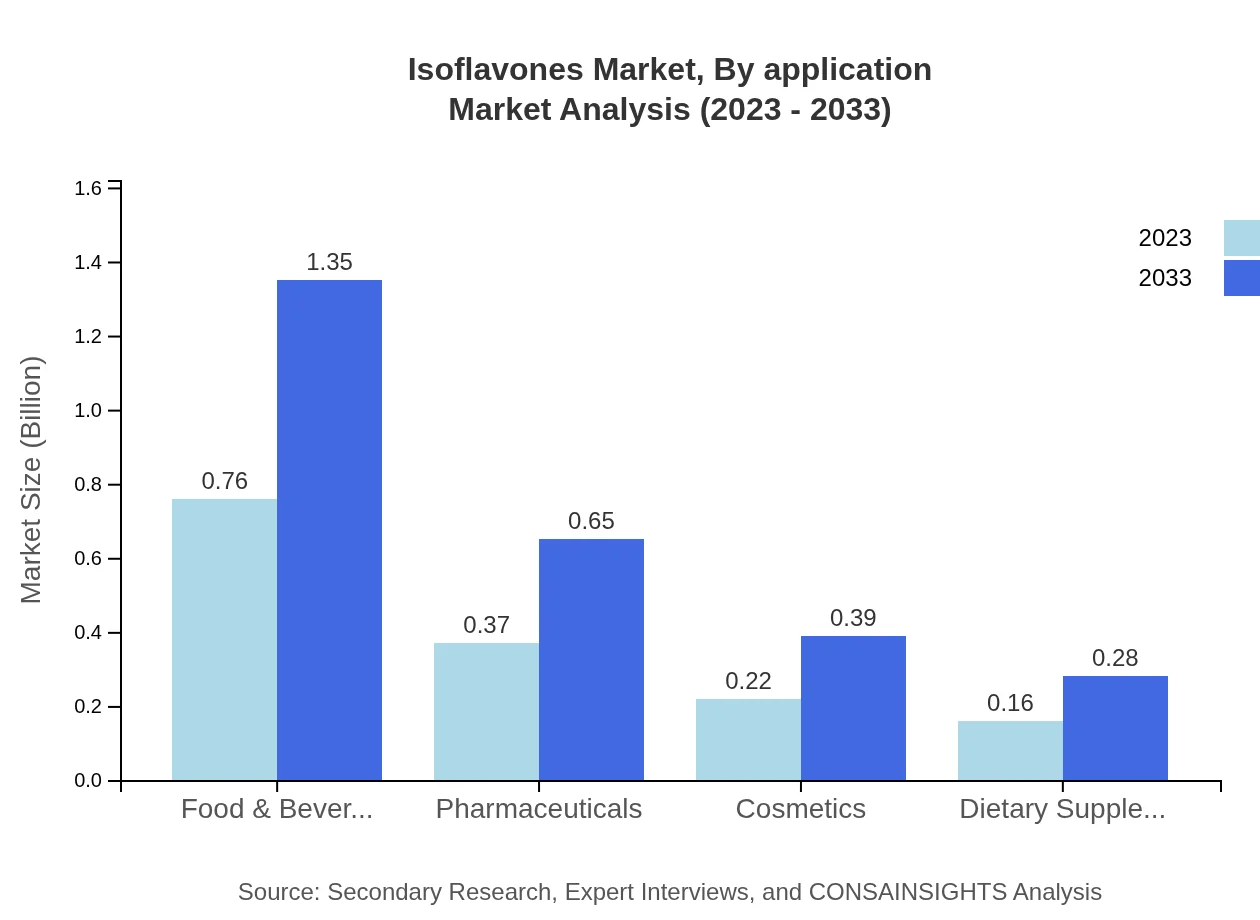

Isoflavones Market Analysis By Application

By application, the Isoflavones market serves sectors like Healthcare, Food & Beverages, Pharmaceuticals, and Cosmetics. The healthcare sector, valued at 1.03 billion USD in 2023, is projected to expand significantly. Food & Beverages hold a market share of 0.76 billion USD and are expected to reach 1.35 billion USD by 2033, illustrating extensive use in functional foods.

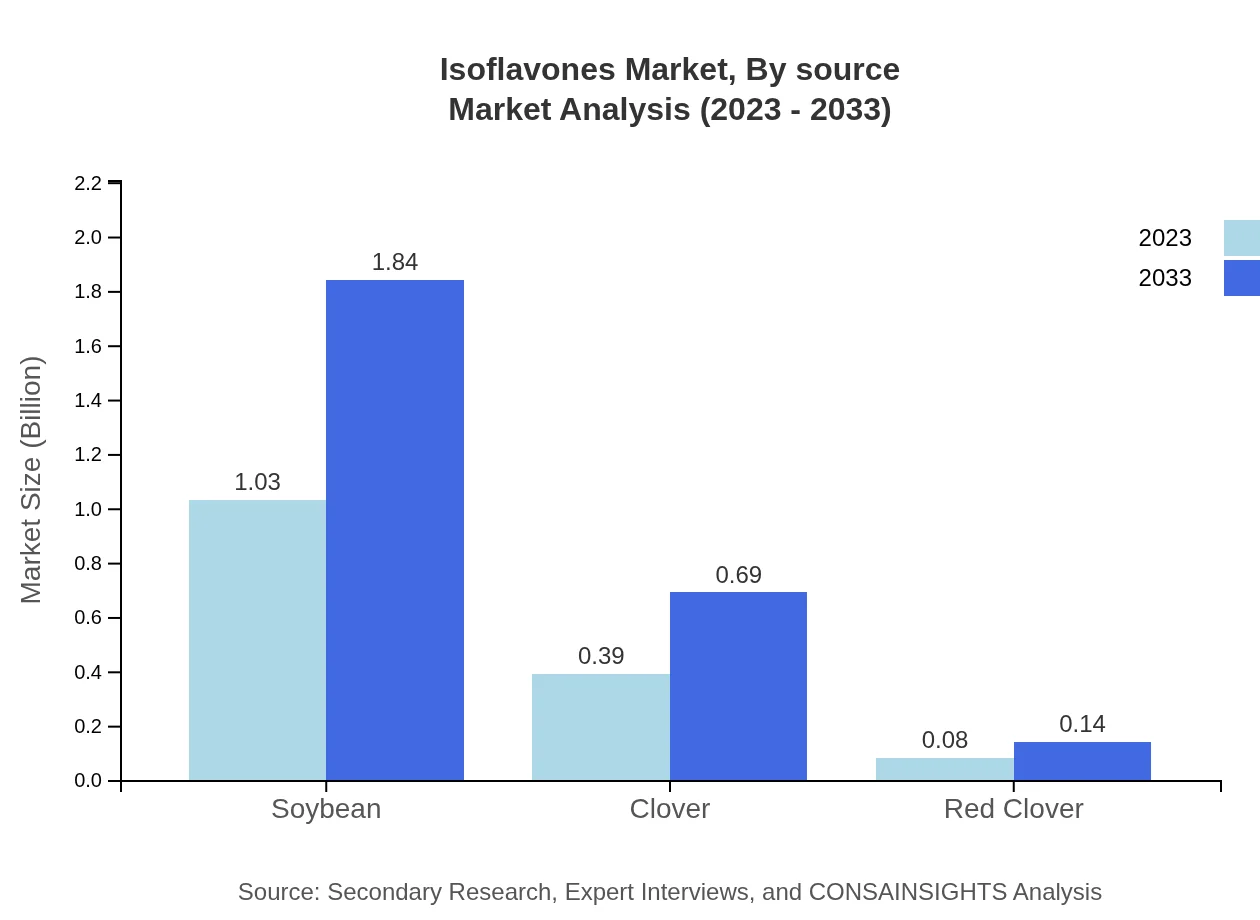

Isoflavones Market Analysis By Source

The dominant source of Isoflavones is Soybean, leading the market with a projection from 1.03 billion USD to 1.84 billion USD. Additionally, Clover and Red Clover are significant contributors, showcasing growth aligned with increasing demand for plant sources of Isoflavones.

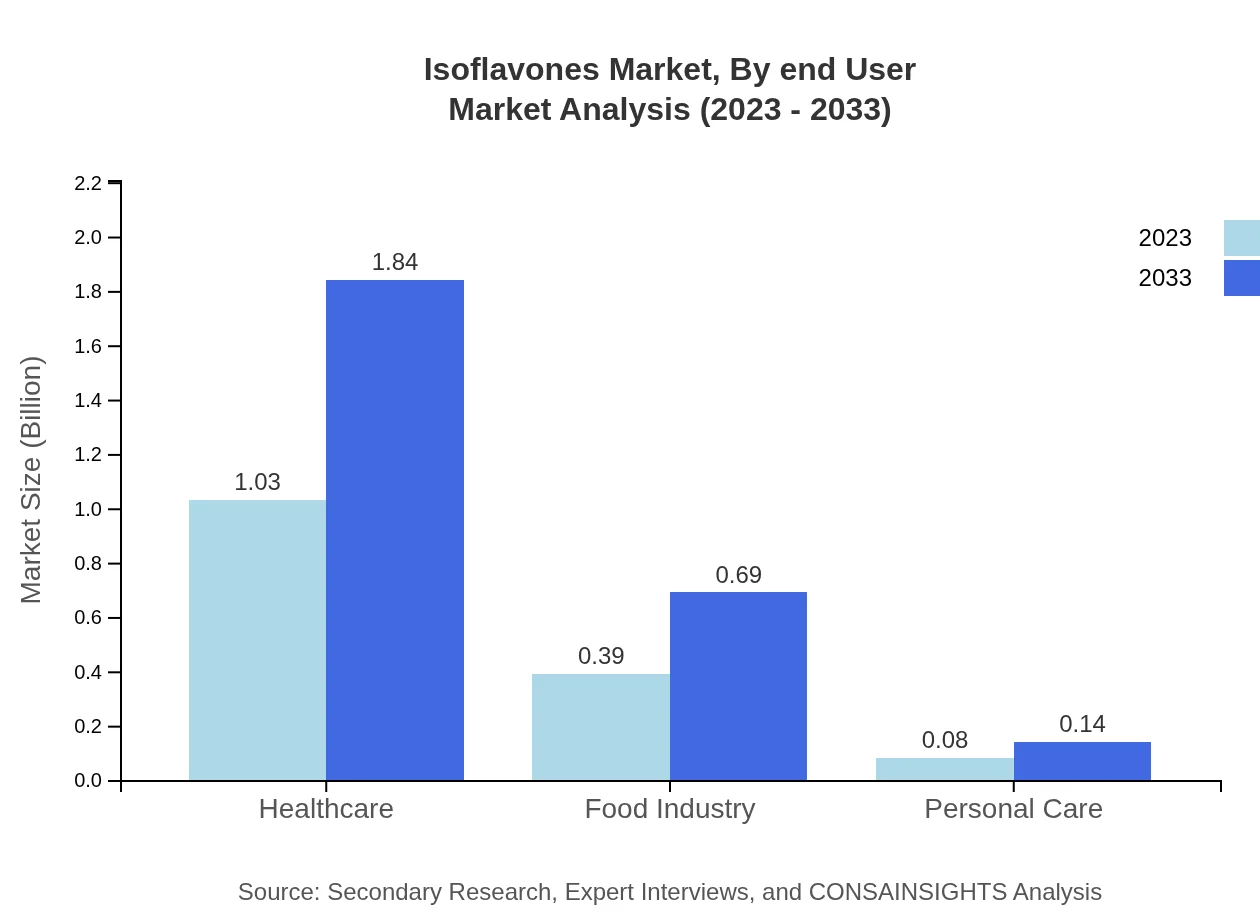

Isoflavones Market Analysis By End User

End-users of Isoflavones spread across healthcare, food, and cosmetics. The healthcare sector remains the largest user, with a steady market size, while dietary supplements and functional foods gain traction, indicating a shift toward preventive health measures.

Isoflavones Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Isoflavones Industry

DSM Nutritional Products:

A major player in the nutritional supplement sector, DSM focuses on developing high-quality Isoflavones for health applications, leveraging their R&D capabilities.Solae LLC (DuPont):

Solae specializes in soy protein and Isoflavones, providing innovative solutions catering to the health and wellness industry, positioning itself as a leader in plant-derived ingredients.Fujifilm Diosynth Biotechnologies:

Known for its biopharmaceuticals, Fujifilm employs cutting-edge technology to produce Isoflavones, emphasizing sustainability and efficiency in production.NutraScience Labs:

NutraScience specializes in dietary supplements, providing a wide range of Isoflavones-derived products aimed at health-conscious consumers and leveraging strong distribution networks.Herbalife Nutrition:

A well-known brand in the nutritional sector, Herbalife integrates Isoflavones into its product lines, focusing on weight management and fitness.We're grateful to work with incredible clients.

FAQs

What is the market size of isoflavones?

The isoflavones market is currently valued at approximately $1.5 billion, with a projected growth rate of 5.8% CAGR from 2023 to 2033.

What are the key market players or companies in the isoflavones industry?

Key players in the isoflavones market include major nutraceutical companies and producers focused on soy isoflavones, healthcare supplements, and functional foods.

What are the primary factors driving the growth in the isoflavones industry?

Growth in the isoflavones market is driven by increasing health awareness, a rising demand for natural supplements, and the growing popularity of plant-based diets.

Which region is the fastest Growing in the isoflavones?

The fastest-growing region in the isoflavones market is Europe, expanding from $0.53 billion in 2023 to $0.94 billion by 2033.

Does ConsaInsights provide customized market report data for the isoflavones industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and interests of clients in the isoflavones industry.

What deliverables can I expect from this isoflavones market research project?

Deliverables include comprehensive market analysis, segment insights, regional data, competitor analysis, and key trends in the isoflavones market.

What are the market trends of isoflavones?

Current trends include a rising interest in plant-based nutrition, increased use of isoflavones in functional foods, and growing integration in personal care products.