Led Packaging Market Report

Published Date: 31 January 2026 | Report Code: led-packaging

Led Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the LED Packaging market, including market size, growth potential, segmentation, regional insights, and forecast trends from 2023 to 2033. It aims to equip stakeholders with relevant data and analyses to make informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

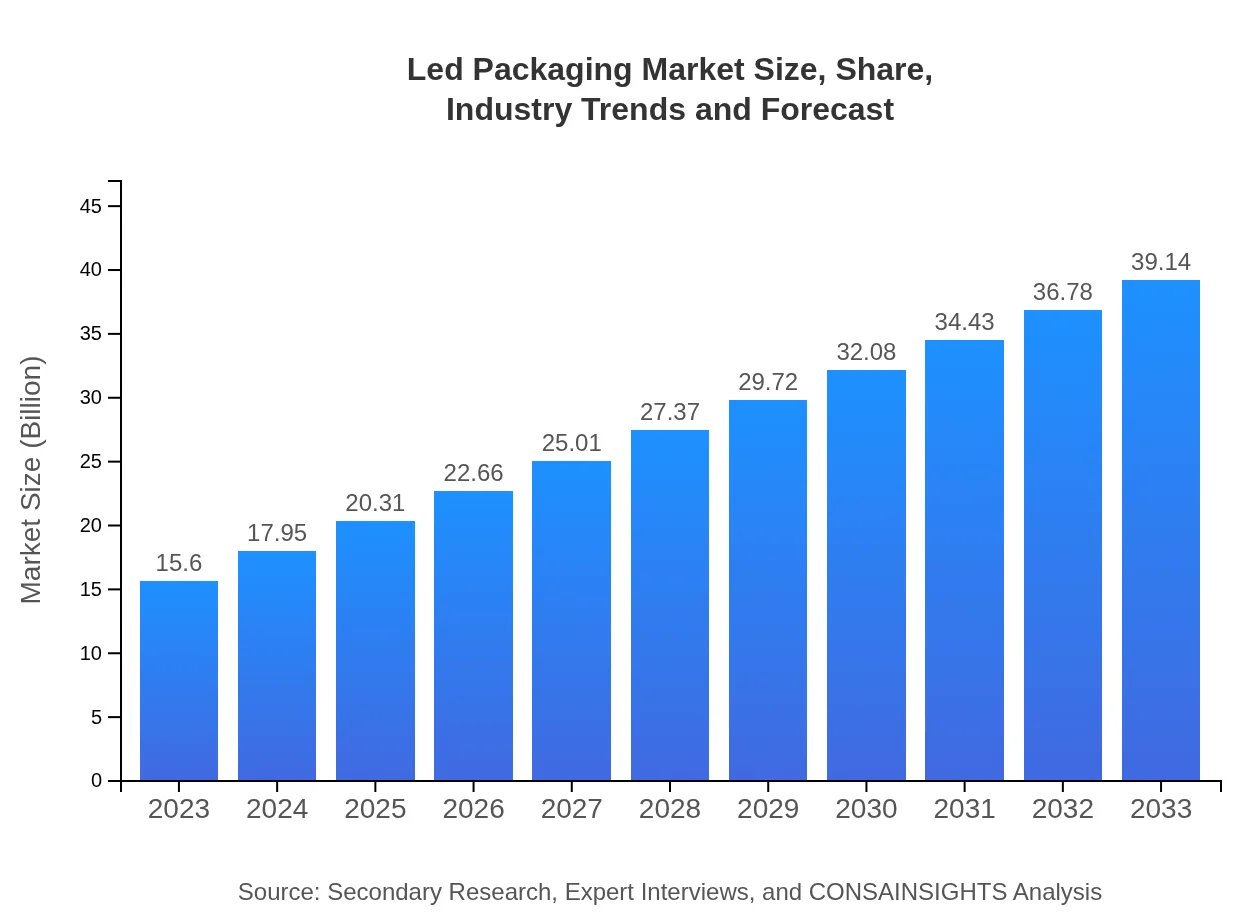

| 2023 Market Size | $15.60 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $39.14 Billion |

| Top Companies | Nichia Corporation, Osram, Samsung Electronics, Cree, Inc., Philips Lighting |

| Last Modified Date | 31 January 2026 |

LED Packaging Market Overview

Customize Led Packaging Market Report market research report

- ✔ Get in-depth analysis of Led Packaging market size, growth, and forecasts.

- ✔ Understand Led Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Led Packaging

What is the Market Size & CAGR of LED Packaging market in 2023?

LED Packaging Industry Analysis

LED Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

LED Packaging Market Analysis Report by Region

Europe Led Packaging Market Report:

Europe's LED Packaging market was valued at $4.90 billion in 2023, forecasted to grow to $12.29 billion by 2033. The European market benefits from stringent regulations that push for energy-efficient lighting solutions, with countries like Germany and the UK leading the charge.Asia Pacific Led Packaging Market Report:

In 2023, the Asia Pacific region accounted for a market size of approximately $3.08 billion, expected to rise to $7.73 billion by 2033. This region is a hotspot for manufacturing and innovation in LED technologies due to the presence of major electronics manufacturers and robust infrastructure for adopting new technologies.North America Led Packaging Market Report:

North America, particularly the U.S., held a market size of $5.11 billion in 2023, projected to expand to $12.82 billion by 2033. The demand is primarily fueled by government incentives for energy-efficient solutions and the growing consumer preference for LED lighting.South America Led Packaging Market Report:

The Latin American LED Packaging market was valued at $1.26 billion in 2023, growing to $3.15 billion by 2033. The growth is driven by energy efficiency initiatives and increasing investments in infrastructure development, particularly in Brazil and Mexico.Middle East & Africa Led Packaging Market Report:

The Middle East and Africa region recorded a market size of $1.25 billion in 2023, expected to reach $3.14 billion by 2033. Growth in this region is supported by rapid urbanization and a focus on sustainability in building projects.Tell us your focus area and get a customized research report.

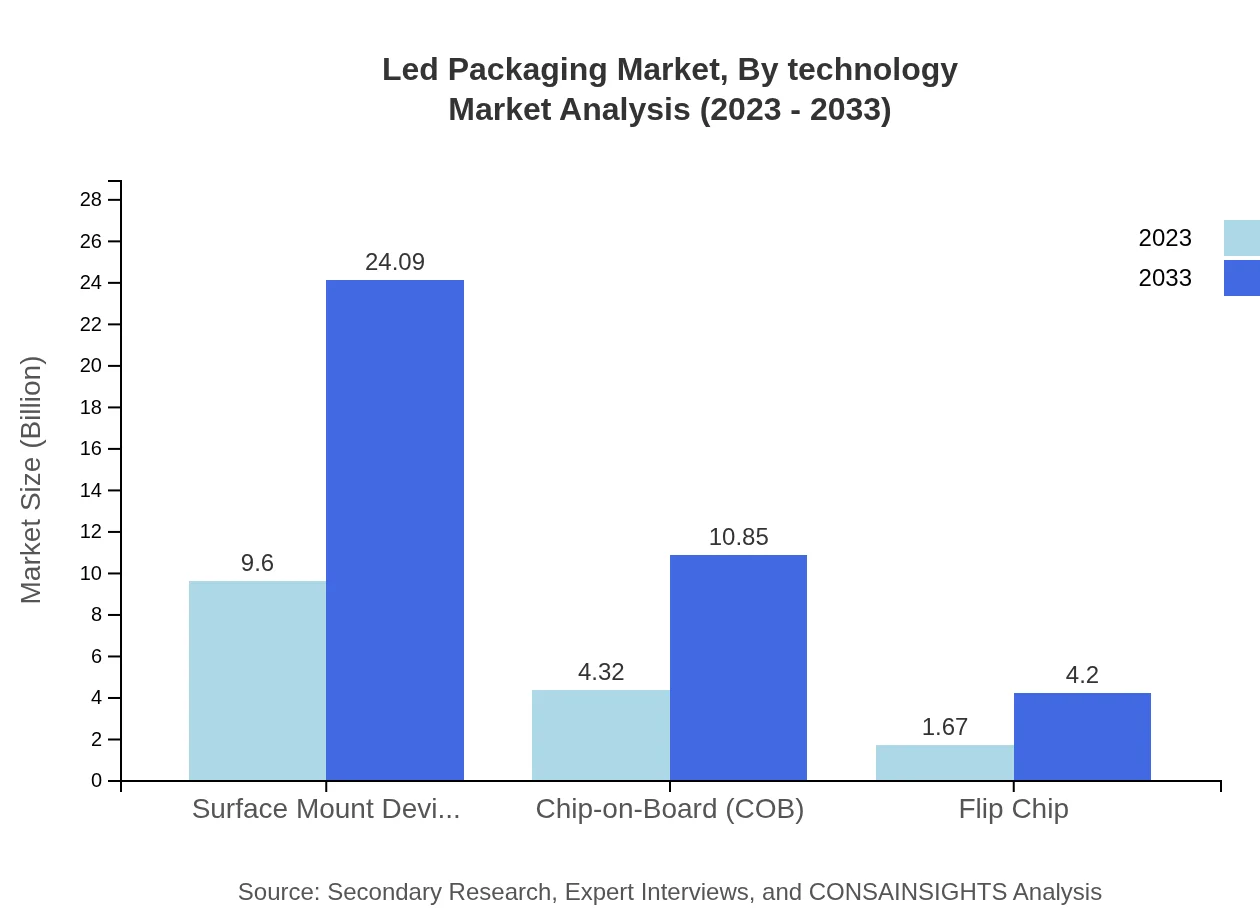

Led Packaging Market Analysis By Technology

The LED Packaging market is segmented into different technologies, including Surface Mount Device (SMD), Chip-on-Board (COB), and Flip Chip. SMD dominates the market with a share of approximately 61.55% in 2023, attributed to its compact design and efficiency in high-density applications.

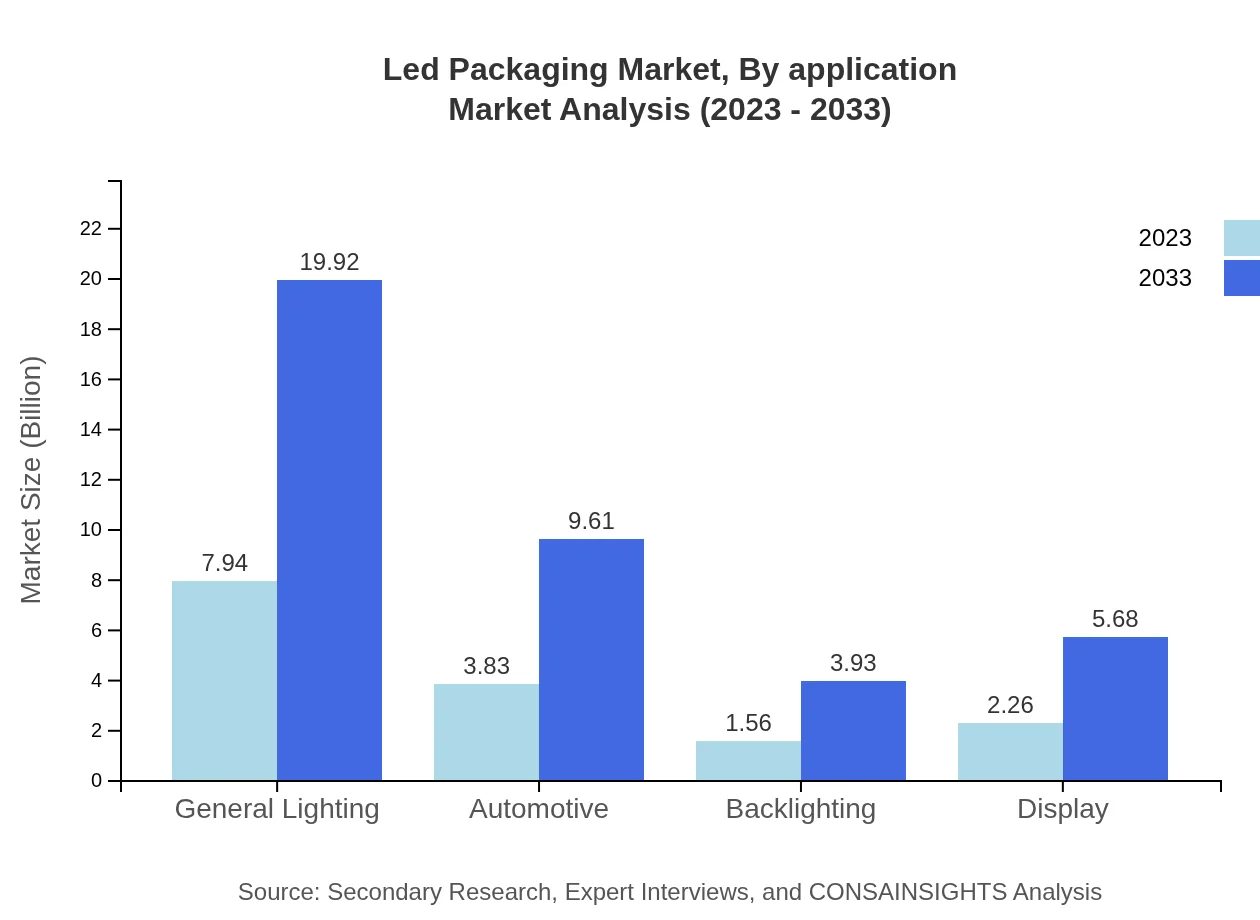

Led Packaging Market Analysis By Application

Applications of LED Packaging are diverse, with general lighting leading, accounting for around 50.9% of the market share in 2023. Other notable applications include automotive and display, which are also experiencing significant growth due to advancements in automotive lighting and consumer electronics.

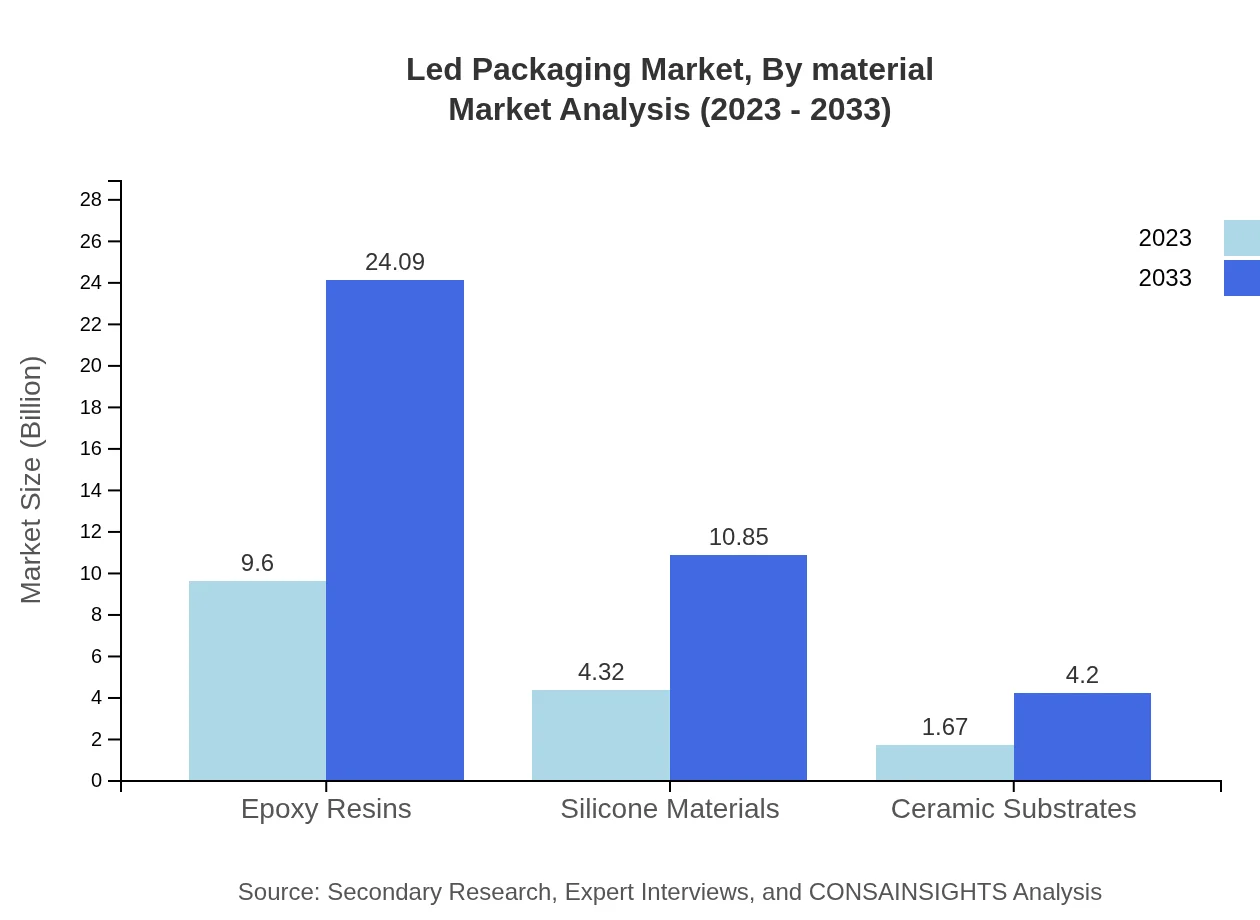

Led Packaging Market Analysis By Material

Materials used in the LED Packaging market include epoxy resins, silicone materials, and ceramic substrates. Epoxy resins comprise approximately 61.55% share due to their excellent thermal management properties, while silicone materials account for 27.72%.

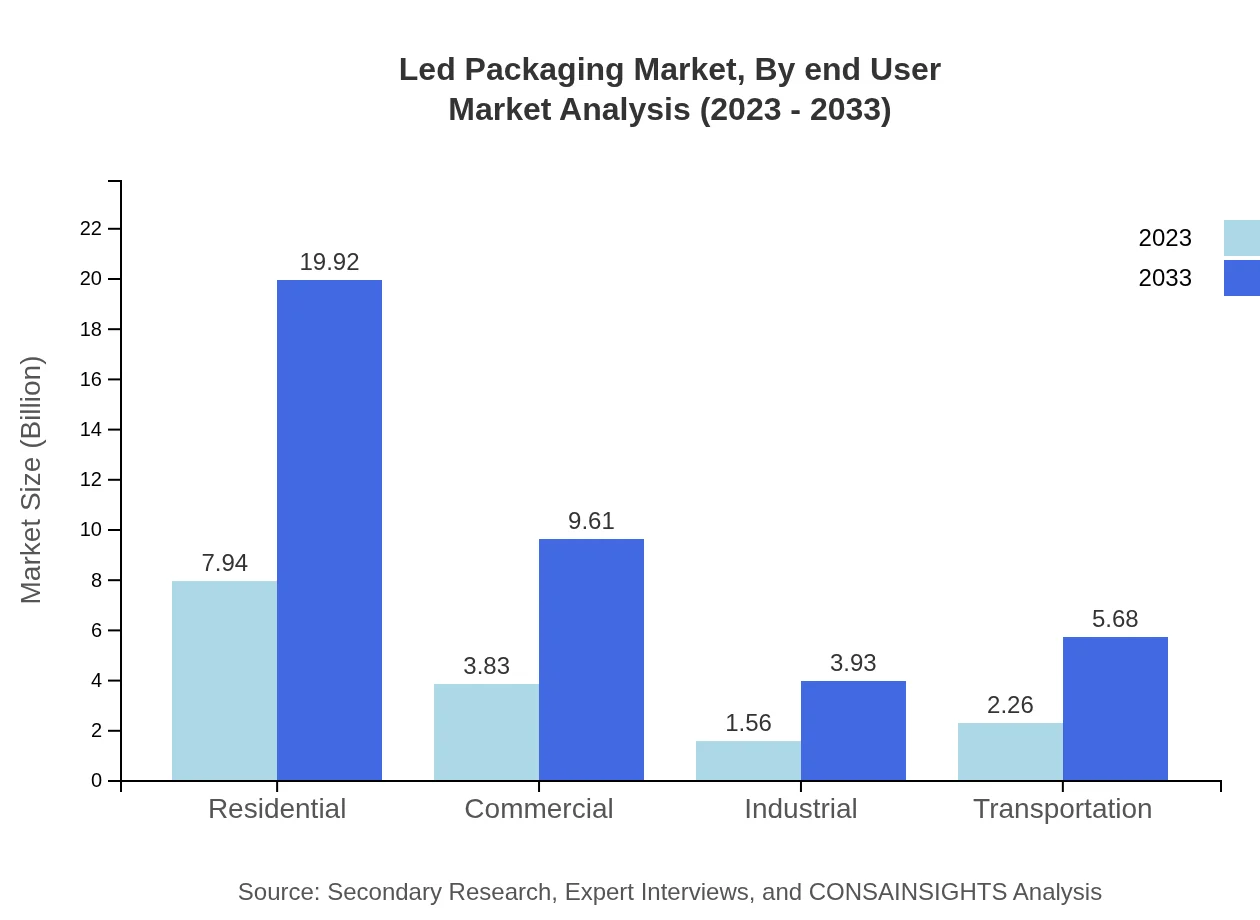

Led Packaging Market Analysis By End User

End-users of the LED Packaging market can be segmented into residential, commercial, industrial, and transportation sectors. The residential segment is significant, holding over 50.9% market share in 2023, driven by widespread adoption of energy-efficient lighting solutions.

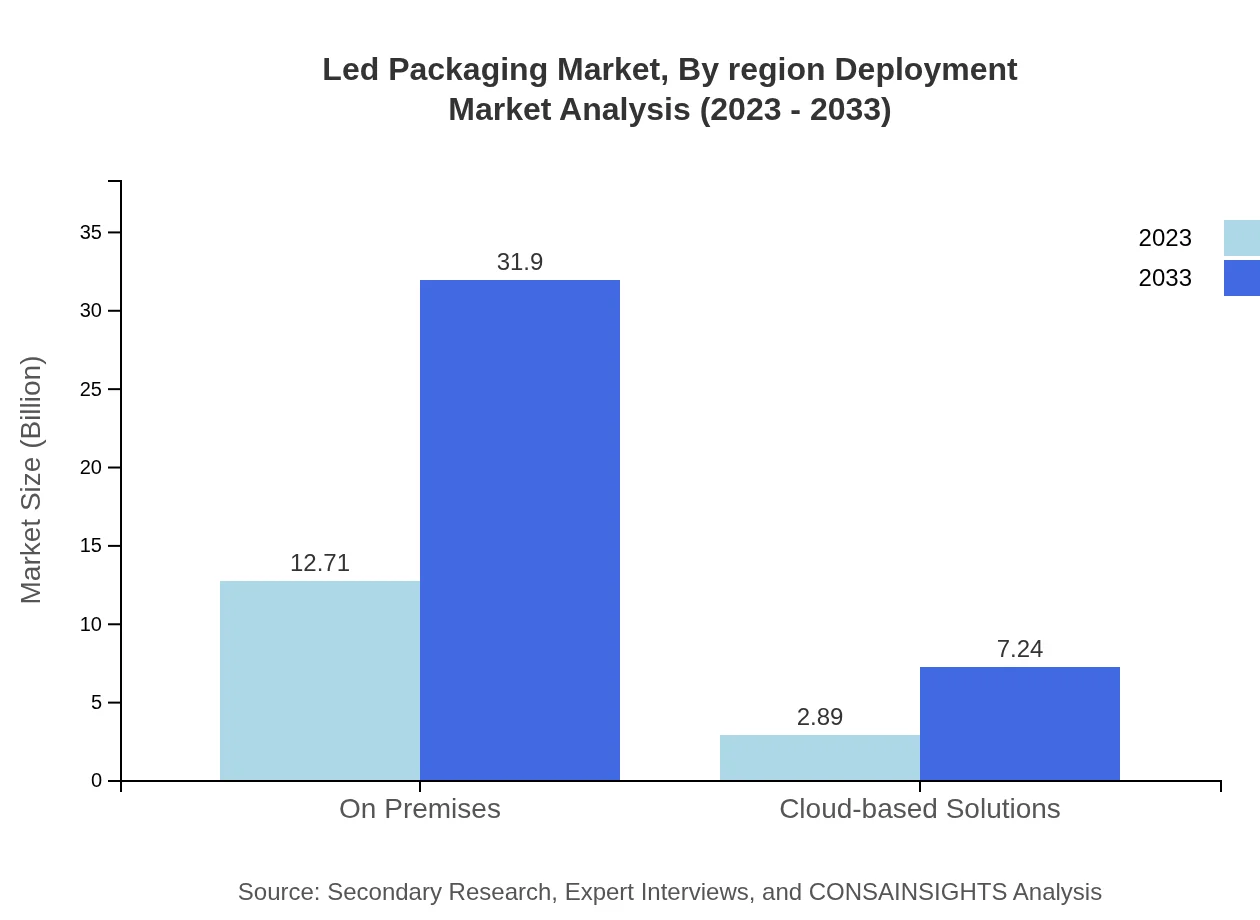

Led Packaging Market Analysis By Region Deployment

Regionally, the deployment of LED packaging varies, with strong growth in Asia-Pacific and North America, where initiatives for smart cities and sustainable development are heavily influencing market dynamics.

LED Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in LED Packaging Industry

Nichia Corporation:

Nichia is a leading manufacturer of LED chip technology contributing to innovative LED packaging solutions, known for their high efficiency and longevity.Osram:

Osram is global leader in lighting solutions, with a strong portfolio in LED packaging that emphasizes energy efficiency and environmental sustainability.Samsung Electronics:

Samsung is a significant player in the LED market, with a focus on cutting-edge technology in LED packaging that enhances performance and reliability.Cree, Inc.:

Cree, Inc. specializes in LED technology and is recognized for its role in developing efficient LED lighting solutions and packaging innovations.Philips Lighting:

Philips Lighting has made substantial contributions to LED packaging technology advancements, impacting both consumer and professional markets worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of led Packaging?

The market size of the LED Packaging industry is estimated at $15.6 billion in 2023, with a substantial compound annual growth rate (CAGR) of 9.3%. By 2033, the market is projected to experience significant expansion, confirming the industry's growth trajectory.

What are the key market players or companies in this led Packaging industry?

Key players in the LED Packaging industry include major semiconductor manufacturers, LED technology firms, and packaging solution providers. Notable companies focus on innovation in materials, sustainability practices, and advanced manufacturing processes to maintain a competitive edge in the market.

What are the primary factors driving the growth in the led Packaging industry?

Growth in the LED Packaging industry is primarily driven by increasing demand for energy-efficient lighting solutions, advancements in LED technology, and rising investments in smart lighting systems. Additionally, regulatory incentives promoting LED adoption and focus on sustainable practices significantly contribute to market expansion.

Which region is the fastest Growing in the led Packaging?

The fastest-growing region in the LED Packaging industry is Europe, with its market expected to grow from $4.90 billion in 2023 to $12.29 billion by 2033. Increased demand for energy-efficient lighting solutions and government initiatives drive this substantial growth.

Does ConsaInsights provide customized market report data for the led Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the LED Packaging industry. Clients can request specialized insights that focus on particular segments, regions, or variables to support strategic decision-making.

What deliverables can I expect from this led Packaging market research project?

From the LED Packaging market research project, clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitor insights, segmentation analysis, and strategic recommendations to guide market positioning and investment decisions.

What are the market trends of led Packaging?

Current market trends in the LED Packaging sector include the rise of smart lighting solutions, increased focus on sustainability, and innovations in packaging materials. These trends reflect a shift towards more efficient, environmentally friendly, and versatile lighting solutions in various applications.