Light Sport Aircraft Market Report

Published Date: 03 February 2026 | Report Code: light-sport-aircraft

Light Sport Aircraft Market Size, Share, Industry Trends and Forecast to 2033

This report provides an overview of the Light Sport Aircraft market from 2023 to 2033, analyzing market size, industry trends, regional performance, and leading manufacturers, offering valuable insights for stakeholders.

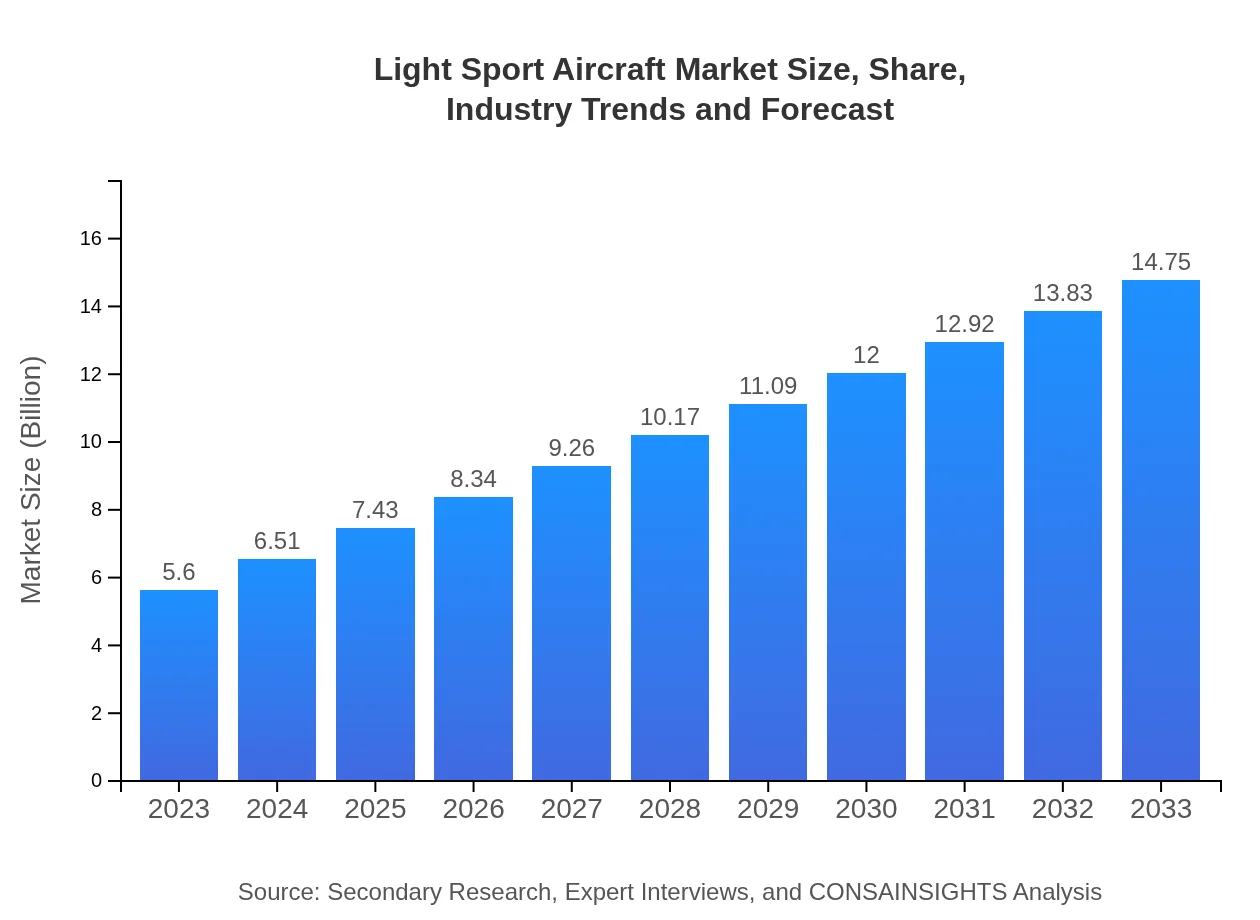

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $14.75 Billion |

| Top Companies | Flight Design GmbH, CubCrafters, Inc., Aerospool s.r.o., Textron Aviation |

| Last Modified Date | 03 February 2026 |

Light Sport Aircraft Market Overview

Customize Light Sport Aircraft Market Report market research report

- ✔ Get in-depth analysis of Light Sport Aircraft market size, growth, and forecasts.

- ✔ Understand Light Sport Aircraft's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Light Sport Aircraft

What is the Market Size & CAGR of Light Sport Aircraft market in 2023 and 2033?

Light Sport Aircraft Industry Analysis

Light Sport Aircraft Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Light Sport Aircraft Market Analysis Report by Region

Europe Light Sport Aircraft Market Report:

In Europe, the market dynamics are compelling, with growth expected from $1.71 billion in 2023 to $4.51 billion in 2033. Key drivers include an emphasis on sustainable aviation, increasing disposable income, and an influx of aviation enthusiasts. European regulations around LSAs are maturing, fostering a conducive environment for market expansion.Asia Pacific Light Sport Aircraft Market Report:

In the Asia-Pacific region, the Light Sport Aircraft market is projected to expand from $1.02 billion in 2023 to $2.69 billion in 2033. Growing interest in recreational flying, supported by rising income levels and a burgeoning pilot population, is driving this growth. Additionally, regional governments are enhancing aviation regulations to promote safety and encourage LSA usage.North America Light Sport Aircraft Market Report:

North America remains a dominant player in the Light Sport Aircraft market, expected to grow from $2.13 billion in 2023 to $5.61 billion in 2033. The region is a hub for pilot training institutions and recreational flying, spurred by a favorable regulatory landscape and robust consumer interest in aviation. Innovations in aircraft technology also play a pivotal role in enhancing market prospects.South America Light Sport Aircraft Market Report:

South America showcases a growing potential for Light Sport Aircraft, with market size anticipated to increase from $0.45 billion in 2023 to $1.17 billion by 2033. The region's focus on tourism and adventure sports fuels demand for LSAs, while ongoing improvement in regional aviation infrastructure will further support market growth.Middle East & Africa Light Sport Aircraft Market Report:

The Middle East and Africa regions are expected to see incremental growth in the Light Sport Aircraft market, increasing from $0.29 billion in 2023 to $0.76 billion by 2033. The regions' growing interest in pilot training and recreational flying represents emerging opportunities, though challenges such as regulatory compliance and market education remain.Tell us your focus area and get a customized research report.

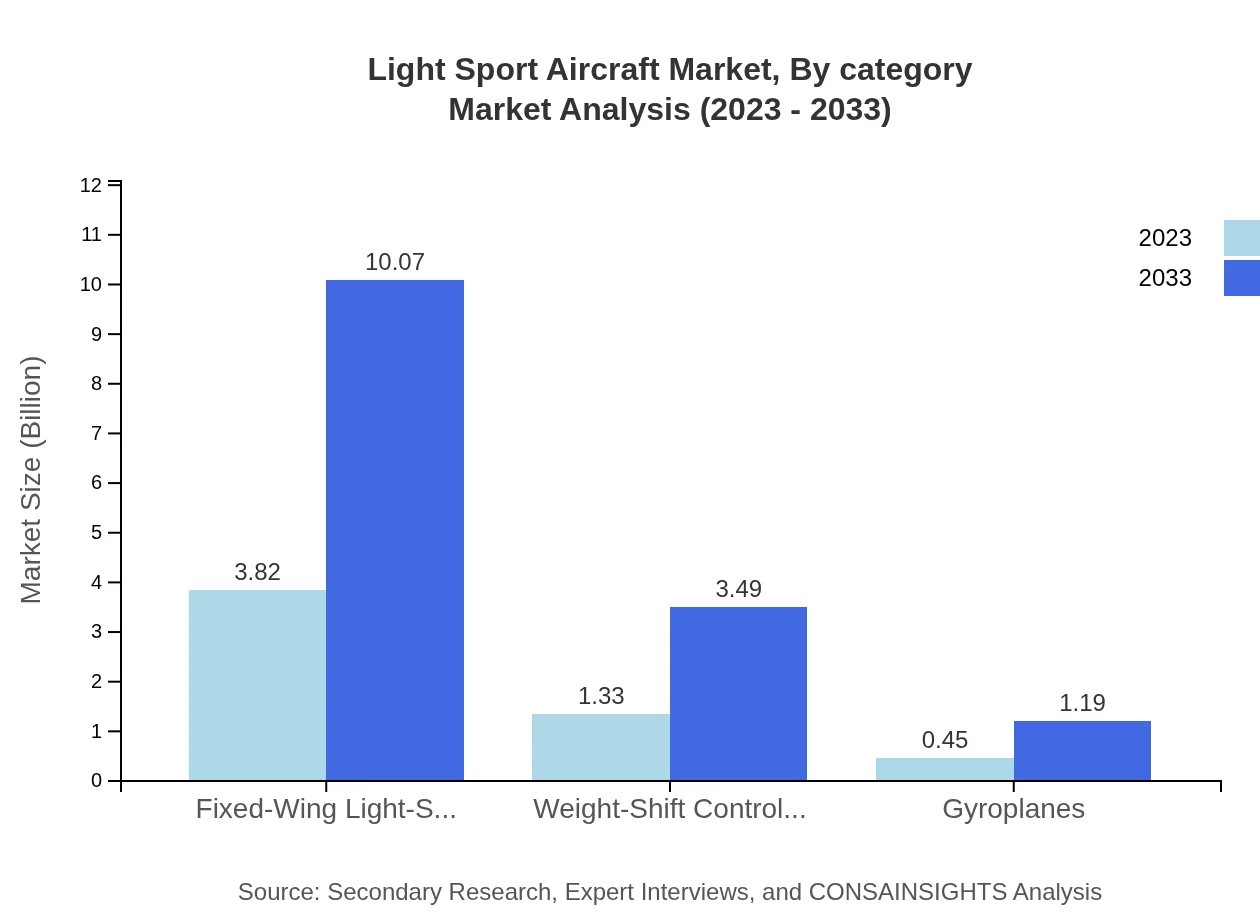

Light Sport Aircraft Market Analysis By Category

In terms of category segmentation, the market for recreational flying leads substantially, valued at $3.82 billion in 2023 and projected to reach $10.07 billion by 2033, capturing a share of 68.28%. Training purposes account for $1.33 billion currently, with expected growth to $3.49 billion and a consistent share of 23.67%. Commercial usage, although smaller, is anticipated to grow from $0.45 billion to $1.19 billion.

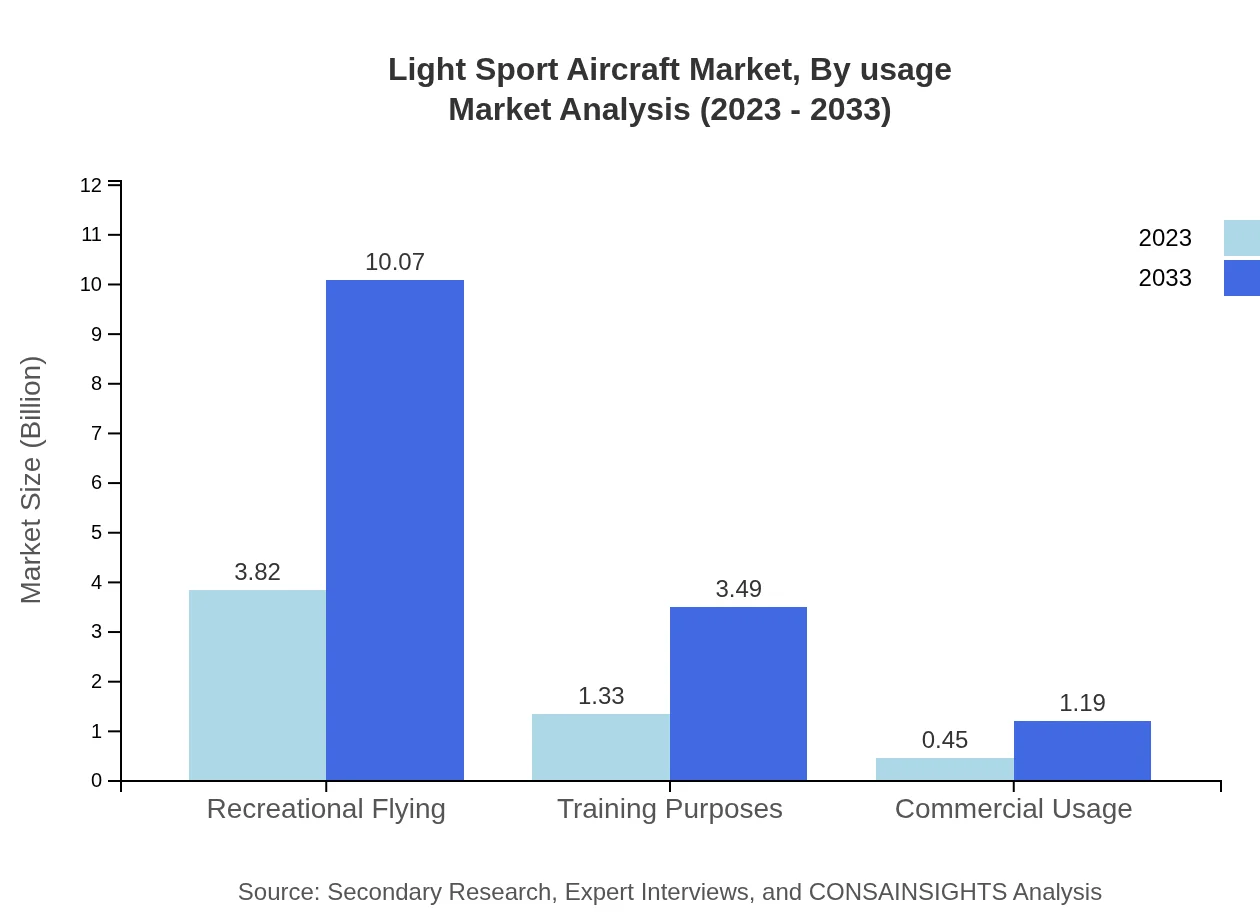

Light Sport Aircraft Market Analysis By Usage

Based on usage, the market is predominantly driven by recreational flying, contributing to a significant market share. The shift towards using LSAs for training and potential commercial applications is evident, demonstrating a diversification that can support industry growth in the coming years.

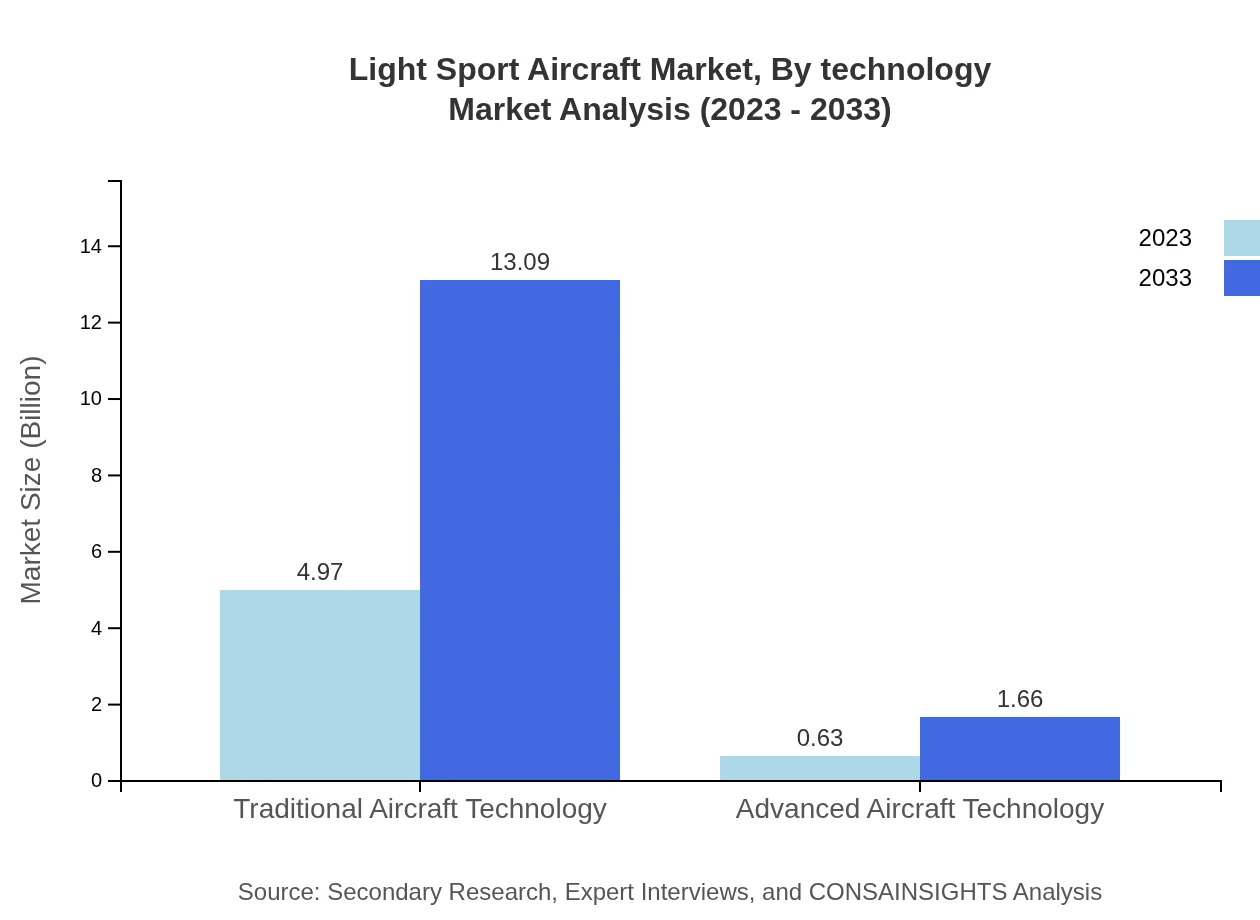

Light Sport Aircraft Market Analysis By Technology

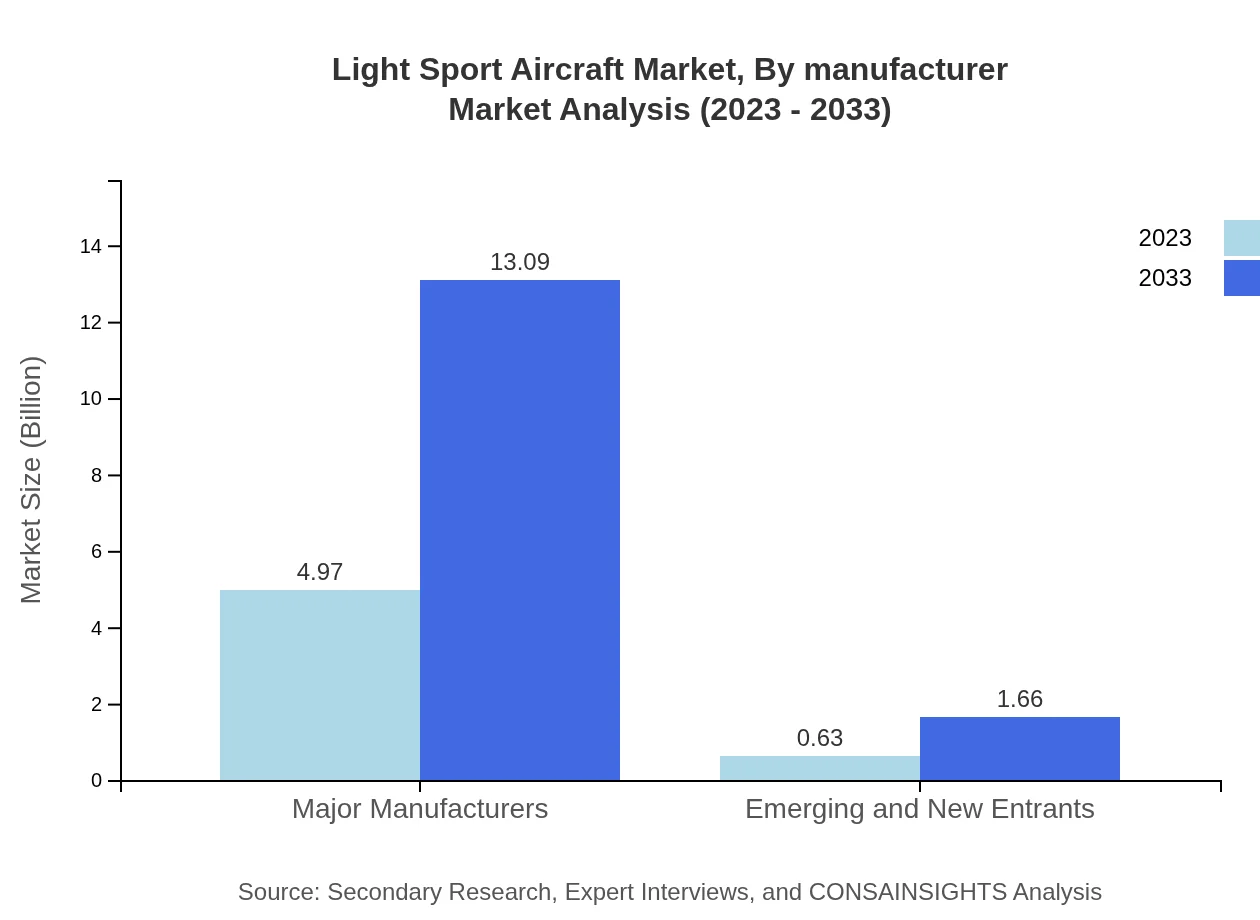

The technological segmentation reflects a shift towards advanced aircraft technology, with traditional aircraft technology dominating the market size. Market sizes reflect $4.97 billion in 2023 for traditional technologies, projected to reach $13.09 billion by 2033, while advanced technologies initially valued at $0.63 billion will grow to $1.66 billion.

Light Sport Aircraft Market Analysis By Manufacturer

Major manufacturers currently hold a significant market share valued at $4.97 billion, and this segment is expected to grow to $13.09 billion by 2033, comprising 88.74% of the market share. Emerging manufacturers represent a smaller portion, yet they are innovating and driving competition, increasing their footprint from $0.63 billion to $1.66 billion.

Light Sport Aircraft Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Light Sport Aircraft Industry

Flight Design GmbH:

A pioneer in LSA manufacturing, known for their advanced design and efficiency, significantly impacting global market dynamics.CubCrafters, Inc.:

Specializes in high-performance LSAs and training aircraft, renowned for their technology and performance-oriented designs.Aerospool s.r.o.:

An innovative member of the LSA market, focusing on expanding their product offerings and increasing their competitive edge.Textron Aviation:

A major player with a diverse portfolio in aviation, driving advancements in the LSA segment through innovation and robust supply chains.We're grateful to work with incredible clients.

FAQs

What is the market size of light Sport Aircraft?

The global light sport aircraft market is valued at $5.6 billion in 2023, with a projected CAGR of 9.8% through 2033, reflecting significant growth opportunities in the sector.

What are the key market players or companies in this light Sport Aircraft industry?

Key players in the light sport aircraft market include major manufacturers and new entrants focusing on both traditional and advanced aircraft technology to cater to diverse consumer needs.

What are the primary factors driving the growth in the light Sport Aircraft industry?

Factors driving growth in the light sport aircraft industry include increasing demand for recreational flying, advancements in technology, and rising awareness of aviation as a viable transportation option.

Which region is the fastest Growing in the light Sport Aircraft?

The fastest-growing region in the light sport aircraft market is Europe, expected to grow from $1.71 billion in 2023 to $4.51 billion by 2033, showcasing strong demand and investment.

Does ConsaInsights provide customized market report data for the light Sport Aircraft industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the light sport aircraft industry, ensuring relevant and comprehensive data.

What deliverables can I expect from this light Sport Aircraft market research project?

Expect comprehensive deliverables including detailed market analysis, segment insights, regional breakdowns, and forecasts that provide strategic guidance for stakeholders in the light sport aircraft market.

What are the market trends of light Sport Aircraft?

Current market trends include a focus on recreational flying, innovations in aircraft technology, an increase in training activities, and a rising interest in environmentally sustainable aviation solutions.